Académique Documents

Professionnel Documents

Culture Documents

Bill French

Transféré par

Mark Jourdan H. CaparasDescription originale:

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Bill French

Transféré par

Mark Jourdan H. CaparasDroits d'auteur :

Formats disponibles

RESTRICTED INTERNAL USE ONLY

BILL FRENCH

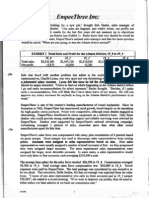

Bill French picked up the phone and called his boss, Wes Davidson, controller of Duo-Products Corporation. Wes, Im all set for the meeting this afternoon. Ive put together a set of break-even statements that should really make people sit up and take notice and I think theyll be able to understand them, too. After a brief conversation, French concluded the call and turned to his charts for one last checkout before the meeting. French had been hired six months earlier as a staff accountant. He was directly responsible to Davidson and had been doing routine types of analytical work. French was a business school graduate and was considered by his associates to be quite capable and unusually conscientious. It was this later characteristic that had apparently caused him to rub some of the working folks the wrong way, as one of his coworkers put it. French was well aware of his capabilities and took advantage of every opportunity that arose to try to educate those around him. Davidsons invitation for French to attend an informal managers meeting had come as a surprise to others in the accounting group. However, when French requested permission to make a presentation of some break-even data, Davidson acquiesced. Duo-Products had not been making use of this type of analysis in its planning procedures. Basically, what French had done was to determine the level at which the company must operate in order to break even. As he put it, The company must be able at least to sell a sufficient volume of goods so that it will cover all the variable costs of producing and selling the goods. Further, it will not make a profit unless it covers the fixed costs as well. The level of operation at which total costs are just covered is the break-even volume. This should be the lower limit in all our planning. The accounting records had provided the following information that French used in constructing his chart: Plant capacity 2 million units per year Past years level of operations 1.5 million units Average unit selling price - $7.20 Total fixed costs - $2,970,000 Average unit variable cost - $4.50 From this information French observed that each unit contributed $2.70 to fixed costs after covering its variable costs. Given total fixed costs of $2,970,000, he calculated that 1,100,000 units must be sold in order to break even. He verified this conclusion by calculating the dollar sales volume that was required to break even. Since the variable costs per unit were 62.5

(bill french: p. 1/5)

RESTRICTED INTERNAL USE ONLY

percent of the selling price, French reasoned that 37.5 percent of every sales dollar was left available to cover fixed costs. Thus, fixed costs of $2,970,000 required sales of $7,920,000 in order to break even. When he constructed a breakeven chart, his conclusions were further verified. The chart also made it clear that the firm was operating at a fair margin above break-even, and that the pretax profits accruing (at the rate of 37.5 percent of every sales dollar over break even) increased rapidly as volume increased (see Exhibit 1 at p. 2). Shortly after lunch, French and Davidson left for the meeting. Several representatives of the manufacturing departments were present, as well as the general sales manager, two assistant sales managers, the purchasing officer, and two people from the product engineering office. Davidson introduced French to the few

people whom he had not already met, and then the meeting got under way. Frenchs presentation was the last item on the agenda. In due time the controller introduced French, explaining his interest in cost control and analysis. French had prepared copies of his chart and supporting calculations for everyone at the meeting. He described carefully what he had done and explained how the chart pointed to a profitable year, dependent on meeting the sales volume that had been maintained in the past. It soon became apparent that some of the participants had known in advance what French planned to discuss; they had come prepared to challenge him and soon had taken control of the meeting. The following exchange ensued (see Exhibit 2 for a list of participants and their titles):

Exhibit 1. Break-Even Chart Total Business

(bill french: p. 2/5)

RESTRICTED INTERNAL USE ONLY

Exhibit 2. List of Participants in the Meeting Bill French................................. Wes Davidson........................... John Cooper.............................. Fred Williams............................ Ray Bradshaw........................... Arnie Winetki............................. Anne Fraser.............................. Staff Accountant Controller Production Control Manufacturing Assistant Sales Manager General Sales Manager Administrative Assistant to President

John Cooper: You know, Bill, Im really concerned that you havent allowed for our planned changes in volume next year. It seems to me that you should have allowed for the sales departments guess that well boost unit sales by 20 percent. Well be pushing 90 percent of capacity then. It sure seems that this would make quite a difference in your figuring.

Bill French: That might be true, but as you can see, all you have to do is read the cost and profit relationship right off the chart for the new volume. Lets see at a million eight-hundred-thousand units wed Fred Williams: Wait a minute, now! If youre going to talk in terms of 90 percent of capacity, and it looks like thats what it will

(bill french: p. 3/5)

RESTRICTED INTERNAL USE ONLY

be, you had better note that well be shelling out some more for the plant. Weve already got approval on investments that will boost fixed costs by at least $60,000 a month. And that may not be all. We may call it 90 percent of plant capacity, but there are a lot of places where were just full up and we cant pull things up any tighter. John Cooper: Fred is right, but Im not finished on this bit about volume changes. According to the information that Ive got here and it came from your office Im not sure that your break-even chart can really be used even if there were to be no changes next

year. It looks to me like youve got average figures that dont allow for the fact that were dealing with three basic products. Your report on each product lines costs last year (see Exhibit 3) makes it pretty clear that the average is way out of line. How would the break-even point look if we took this on an individual product basis? Bill French: Well, Im not sure. It seems to me that there is only one break-even point for the firm. Whether we take it product by product or in total, weve got to hit that point. Ill be glad to check for you if you want, but

Exhibit 3 Product Class Cost Analysis, Normal Year Aggregate

Sales at full capacity (units) Actual sales volume Unit sales price Total sales revenue Variable cost per unit Total variable cost Fixed costs Profit Ratios: Variable cost to sales Unit contribution to sales Utilization of capacity 2,000,000 1,500,000 $7.20 10,800,000 4.50 6,750,000 2,970,000 1,080,000 0.625 0.375 75%

A

600,000 $10.00 6,000,000 7.50 4,500,000 960,000 540,000 0.75 0.25 30%

B

400,000 $9.00 3,600,000 3.75 1,500,000 1,560,000 540,000 0.42 0.58 20%

C

500,000 $2.40 1,200,000 1.50 750,000 450,000 0 0.625 0.375 25%

Ray Bradshaw: Guess I may as well get in on this one, Bill. If youre going to do anything with individual products, you ought to know that were looking for a big shift in our product mix. The A line is really losing out, and I imagine that well be lucky to hold two-thirds of its volume next year. Wouldnt you buy that, Arnie?

(Agreement from the general sales manager.) Thats not too bad, though, because we expect that we should pick up the 200,000 that we lose, plus about a quarter million units more, in C production. We dont see anything that shows much of a change in B. Thats been solid

(bill french: p. 4/5)

RESTRICTED INTERNAL USE ONLY

for years and shouldnt change much now. Arnie Winetki: Bradshaws called it about as we figure it, but theres something else here. Weve talked about our pricing on C enough, and now Im really going to push our side of it. Rays estimate of maybe half a million units 450,000 I guess it was increase on C for next year is on the basis of doubling the price with no change in cost. Weve been priced so low on this item that its been a crime weve got to raise it for two reasons. First, for our reputation: the price is out of line with other products in its class and is completely inconsistent with our quality reputation. Second, if we dont raise the price, well be swamped, and we cant handle it. You heard what Williams said about capacity. The way the whole C field is exploding well have to deal with another half-million units in unsatisfied orders if we dont jack the price up. We cant afford to expand that much for this product. At this point, Anne Fraser walked toward the front of the room from where she had been standing near the rear door. The discussion broke for a minute, and she took advantage of the lull to interject a few comments. Anne Fraser: This certainly has been a helpful discussion. As long as youre going to try to get all the things together for next year, lets see what I can add to help you: Number One: Lets remember that everything that shows in the profit area here on Bills chart is divided

almost evenly between the government and us. Now, for last year we can read a profit of about $900,000. Thats right; but we were left with half of that, and then paid out dividends of $300,000 to the stockholders. Since weve got an anniversary year coming up, wed like to put out a special dividend of about 50 percent extra. We ought to retain $150,000 in the business, too. This means that wed like to hit $600,000 profit after taxes. Number Two: From where I sit, it looks as if were going to have negotiations with the union again, and this time its likely to cost us. All the indications are and this isnt public that we may have to meet demands that will boost our production costs what do you call them here, Bill variable costs by 10 percent across the board. This may kill the bonusdividend plans, but weve got to hold the line on past profits. This means that we can give that much to the union only if we can make it in added revenues. I guess youd say that raises your break-even point, Bill and for that one Id consider the companys profit to be a fixed cost. Number Three: Maybe this is the time to think about switching our product emphasis. Arnie may know better than I which of the products is more profitable. You check me out on this Arnie and it might be a good idea for you and Bill to get together on this one, too. These figures that I have (Exhibit 3) make it look like the percentage contribution on line A is the lowest of the bunch. If were losing volume there as

(bill french: p. 5/5)

RESTRICTED INTERNAL USE ONLY

rapidly as you sales folks say, and if were as hard pressed for space as Fred has indicated, maybe wed be better off grabbing some of that big demand for C by shifting some of the assets from A to C. Wes Davidson: Thanks, Anne. I sort of figured that wed wind up here as soon as Bill brought out his charts. This is an approach that weve barely touched on, but, as you can see, youve all got ideas that have to be made to fit here somewhere. Let me suggest this: Bill, you rework your chart and try to bring into it some of the points that were made here today. Ill see if I can summarize what everyone seems to be looking for. First of all, I have the idea that your presentation is based on a rather important series of assumptions. Most of the questions that were raised were really about those assumptions. It might help us all if you try to set the assumptions down in black and white so that we can see just how they influence the analysis. Then, I think that John would like to see the unit sales increase

factored in, and hed also like to see whether theres any difference if you base the calculations on an analysis of individual product lines. Also, as Ray suggested, since the product mix is bound to change, why not see how things look if the shift materializes as he has forecast? Arnie would like to see the influence of a price increase in the C line; Fred looks toward an increase in fixed manufacturing costs of $60,000 a month; and Anne has suggested that we should consider taxes, dividends, expected union demands, and the question of product emphasis. I think that ties it all together. Lets hold off on our next meeting until Bill has had time to work some more on this. With that, the meeting disbanded. French and Davidson headed back to their offices and French, in a tone of concern, asked Davidson, Why didnt you warn me about the hornets nest I was walking into? Bill, you didnt ask!

Questions 1. What are the assumptions implicit in Bill Frenchs determination of his companys break-even point? 2. On the basis of Frenchs revised information, what does next year look like: a. What is the break-even point?

(bill french: p. 6/5)

RESTRICTED INTERNAL USE ONLY

b. What level of operations must be achieved to pay the extra dividend, ignoring union demands? c. What level of operations must be achieved to meet the union demands, ignoring bonus dividends? d. What level of operations must be achieved to meet both dividends and expected union requirements? 3. Calculate each of the three products break-even points using the data in Exhibit 3. Why is the sum of these three volumes not equal to the 1,100,000 units aggregated break-even volume? 4. Is this type of analysis of any value? For what can it be used?

(bill french: p. 7/5)

Vous aimerez peut-être aussi

- Steps On How To Start Your BusinessDocument65 pagesSteps On How To Start Your BusinessAnna Rose T. MarcelinoPas encore d'évaluation

- Bill FrenchDocument5 pagesBill FrenchqaqhuwipqlkwpaPas encore d'évaluation

- RBI Guidelines Mapping With COBIT 5 Res Eng 1013Document194 pagesRBI Guidelines Mapping With COBIT 5 Res Eng 1013KenChenPas encore d'évaluation

- Digital Wealth: An Automatic Way to Invest SuccessfullyD'EverandDigital Wealth: An Automatic Way to Invest SuccessfullyÉvaluation : 4.5 sur 5 étoiles4.5/5 (3)

- Unknown Market Wizards (paperback): The best traders you've never heard ofD'EverandUnknown Market Wizards (paperback): The best traders you've never heard ofPas encore d'évaluation

- Unit 5 - Management AccountingDocument37 pagesUnit 5 - Management Accountingdangthanhhd79100% (4)

- Introduction to Business English (Words and Their Secrets)D'EverandIntroduction to Business English (Words and Their Secrets)Pas encore d'évaluation

- How Would Have a Low-Cost Index Fund Approach Worked During the Great Depression?D'EverandHow Would Have a Low-Cost Index Fund Approach Worked During the Great Depression?Pas encore d'évaluation

- IT Budget Template ExcelDocument6 pagesIT Budget Template ExcelJosé Manuel Montero OrtegaPas encore d'évaluation

- Asset Valuation: Basic Bond Andstock Valuation ModelsDocument23 pagesAsset Valuation: Basic Bond Andstock Valuation ModelsMa Via Bordon SalemPas encore d'évaluation

- Victor ChangDocument11 pagesVictor ChangIgor DautovicPas encore d'évaluation

- Marketing Research NotesDocument8 pagesMarketing Research NotesEmily100% (1)

- Statement 05-APR-23 AC 20312789 07043628 PDFDocument4 pagesStatement 05-APR-23 AC 20312789 07043628 PDFBakhter Jabarkhil0% (1)

- PrelimA2 - CVP AnalysisDocument8 pagesPrelimA2 - CVP AnalysishppddlPas encore d'évaluation

- Case Study 16-3 Bill FrenchDocument28 pagesCase Study 16-3 Bill FrenchShah 6020% (2)

- Notes CapsimDocument6 pagesNotes CapsimElinorWang0% (1)

- Filling Penalties and Remedies CparDocument7 pagesFilling Penalties and Remedies CparGelyn CruzPas encore d'évaluation

- Bill French - Eve - Version 2Document28 pagesBill French - Eve - Version 2Joanne LazaretoPas encore d'évaluation

- Feasibility StudyDocument28 pagesFeasibility StudyEdnelle Joyce Leal AgusPas encore d'évaluation

- Universal LimitedDocument6 pagesUniversal Limitedabhilash.mandal.mePas encore d'évaluation

- 03 Bill French - Accountant - StudentsDocument23 pages03 Bill French - Accountant - StudentsFiroz AhmadPas encore d'évaluation

- Case Study Analysis: Bill French Based On Break Even Point: Presented ByDocument11 pagesCase Study Analysis: Bill French Based On Break Even Point: Presented ByPRANAV KAKKARPas encore d'évaluation

- Research and AnalysisDocument6 pagesResearch and Analysisbawangb210% (1)

- Exam3 SolDocument18 pagesExam3 SolKalen CarneyPas encore d'évaluation

- CVP AnalysisDocument6 pagesCVP AnalysisMystica BayaniPas encore d'évaluation

- Small Business ProjectDocument2 pagesSmall Business ProjectSang ĐoànPas encore d'évaluation

- National Income AccountingDocument10 pagesNational Income Accountingadi221006Pas encore d'évaluation

- 4.you Are Going To Hear Three Telephone Calls About The Itinerary Below. Listen and Make Any Necessary ChangesDocument3 pages4.you Are Going To Hear Three Telephone Calls About The Itinerary Below. Listen and Make Any Necessary ChangesEsto HuyPas encore d'évaluation

- Em Pee Three Inc.Document5 pagesEm Pee Three Inc.Febrini ElviraPas encore d'évaluation

- Mas HW1Document19 pagesMas HW1anncabrito29Pas encore d'évaluation

- CH 6Document51 pagesCH 6anjo hosmerPas encore d'évaluation

- Lesson 10 (Printer-Friendly Version)Document8 pagesLesson 10 (Printer-Friendly Version)gretatamaraPas encore d'évaluation

- ProblemsDocument6 pagesProblemsVivek SuranaPas encore d'évaluation

- Unit 1: Used With The Present Perfect Used With The Past SimpleDocument6 pagesUnit 1: Used With The Present Perfect Used With The Past Simplejulieta loveraPas encore d'évaluation

- Sales Mix VarianceDocument6 pagesSales Mix Variance'Qy Qizwa Andini'Pas encore d'évaluation

- Case 123Document5 pagesCase 123jhanzabPas encore d'évaluation

- Before Listening: Business NewsDocument3 pagesBefore Listening: Business NewsThùy LêPas encore d'évaluation

- Man Acc Qs 1Document6 pagesMan Acc Qs 1Tehniat Zafar0% (1)

- Unit 3 - CoiDocument68 pagesUnit 3 - CoipaulaPas encore d'évaluation

- CVP AssignmentDocument2 pagesCVP AssignmentMichael CayabyabPas encore d'évaluation

- SubtitleDocument2 pagesSubtitleBlack LotusPas encore d'évaluation

- Business Listening.Document44 pagesBusiness Listening.Esto HuyPas encore d'évaluation

- Conversation With F&FDocument4 pagesConversation With F&Fthe mindbenderPas encore d'évaluation

- Tài LiệuDocument6 pagesTài LiệuThị Thanh Viên CaoPas encore d'évaluation

- Pro Forma InstructionsDocument10 pagesPro Forma InstructionsAsnakech YimamPas encore d'évaluation

- Three Ways M A Vallue Part TwoDocument5 pagesThree Ways M A Vallue Part TwoBhuwanPas encore d'évaluation

- Teodoro M. Luansing College of Rosario: Senior High School DepartmentDocument7 pagesTeodoro M. Luansing College of Rosario: Senior High School DepartmentSamantha Alice LysanderPas encore d'évaluation

- 12 Myths of Trade v3Document41 pages12 Myths of Trade v3Thanos DrakidisPas encore d'évaluation

- IB Pre Audio ScriptDocument15 pagesIB Pre Audio ScripthugoPas encore d'évaluation

- Lecture. Line GraphDocument21 pagesLecture. Line Graphtotoroc4tPas encore d'évaluation

- AC415 - Management Accounting Coursework 1Document8 pagesAC415 - Management Accounting Coursework 1jppresaPas encore d'évaluation

- Reading Text 2 U1Document2 pagesReading Text 2 U1NHI HUỲNH XUÂNPas encore d'évaluation

- Key To Chapter 09 End of Chapter QuestionsDocument7 pagesKey To Chapter 09 End of Chapter QuestionsmeaningbehindclosedPas encore d'évaluation

- C9 - Company ResultsDocument7 pagesC9 - Company Resultsmyaaa94Pas encore d'évaluation

- I B H E A F: Exercises in Cost - Volume - Profit Analysis Ex. 1Document4 pagesI B H E A F: Exercises in Cost - Volume - Profit Analysis Ex. 1I am JacobPas encore d'évaluation

- Relevant Costs 4Document6 pagesRelevant Costs 4Franklin Evan PerezPas encore d'évaluation

- BASF Q3-2023 Transcript QA by TopicDocument10 pagesBASF Q3-2023 Transcript QA by TopicTorres LondonPas encore d'évaluation

- BookmarkDocument3 pagesBookmarkRohit ChitalePas encore d'évaluation

- 3.9 International MarketsDocument7 pages3.9 International MarketsVũ Như NgọcPas encore d'évaluation

- Wat Is BEP?: InvestingDocument7 pagesWat Is BEP?: InvestingRCPas encore d'évaluation

- Customer Solutions ModelDocument8 pagesCustomer Solutions ModelInvestingSidekick0% (1)

- Practice Quiz Gross Domestic ProductDocument5 pagesPractice Quiz Gross Domestic ProducttheplumberPas encore d'évaluation

- When Market Fail - ConspectDocument40 pagesWhen Market Fail - ConspectvasyaPas encore d'évaluation

- AFDM Evening Winter 2020 Quiz 2Document5 pagesAFDM Evening Winter 2020 Quiz 2AUPas encore d'évaluation

- Practice MidtermDocument8 pagesPractice MidtermforadonlyPas encore d'évaluation

- GMROIDocument3 pagesGMROIlimaquicaPas encore d'évaluation

- LEARNERS COPY FABM2 CHAPTER 2 Statement of Comprehensive IncomeDocument10 pagesLEARNERS COPY FABM2 CHAPTER 2 Statement of Comprehensive IncomeAliyha MendozaPas encore d'évaluation

- Managerial Accounting Exam CHDocument17 pagesManagerial Accounting Exam CH808kailuaPas encore d'évaluation

- Introduction To Kanban Boards: @proofhubDocument20 pagesIntroduction To Kanban Boards: @proofhubZia UddinPas encore d'évaluation

- KingfisherDocument28 pagesKingfisherJeevan DassPas encore d'évaluation

- Teleworking Tips by SlidesgoDocument48 pagesTeleworking Tips by SlidesgoDIANA CAROLINA RINCON VANEGASPas encore d'évaluation

- GeraDocument2 pagesGeraAnonymousPas encore d'évaluation

- Work History: M MEI 2017 PT. Batamec Shipyard, Batam - IndonesiaDocument1 pageWork History: M MEI 2017 PT. Batamec Shipyard, Batam - Indonesiasyahrim eka putraPas encore d'évaluation

- Trainee Evaluation FormDocument6 pagesTrainee Evaluation FormIndranilGhoshPas encore d'évaluation

- Analisi Perusahaan PT AsahimasDocument14 pagesAnalisi Perusahaan PT AsahimasLutfi UmyrahPas encore d'évaluation

- Global Premium Office Rent Tracker Q4 2016Document6 pagesGlobal Premium Office Rent Tracker Q4 2016Hoi MunPas encore d'évaluation

- Ratio Analysis of GodrejDocument6 pagesRatio Analysis of GodrejAshutosh GadhavePas encore d'évaluation

- Heidelbergcement India Limited: Two Lakh Sixty Three Thousand Nine Hundred Fifty Three RupeesDocument1 pageHeidelbergcement India Limited: Two Lakh Sixty Three Thousand Nine Hundred Fifty Three RupeesPankaj PandeyPas encore d'évaluation

- Amazon-Redshift-Case-Study-Brightcove - CopieDocument4 pagesAmazon-Redshift-Case-Study-Brightcove - CopieAbelBabelPas encore d'évaluation

- Aa CH15Document41 pagesAa CH15Thuỳ DươngPas encore d'évaluation

- Module I: Assessment of Inherent RiskDocument8 pagesModule I: Assessment of Inherent RiskbtstanPas encore d'évaluation

- Student Handouts For BananaDocument8 pagesStudent Handouts For Bananaapi-271596792Pas encore d'évaluation

- Jamal Din Wali Sugar Mills ProjectDocument9 pagesJamal Din Wali Sugar Mills ProjectWaqas CheemaPas encore d'évaluation

- English Preparation Guide PDPF 202011Document16 pagesEnglish Preparation Guide PDPF 202011vichox525Pas encore d'évaluation

- Theory of Production Production Function Through Iso-Quant AnalysisDocument34 pagesTheory of Production Production Function Through Iso-Quant AnalysisAnit Jacob PhilipPas encore d'évaluation

- HCL ProjectDocument130 pagesHCL ProjectAbhishek Tiku100% (1)

- Fundamentals of Corporate Finance 12th Edition Ross Test BankDocument35 pagesFundamentals of Corporate Finance 12th Edition Ross Test Bankadeliahue1q9kl100% (19)

- Market-Tables (6) - Nov 29, 2018Document20 pagesMarket-Tables (6) - Nov 29, 2018allegrePas encore d'évaluation

- Sample of Field Research AssignmentDocument15 pagesSample of Field Research AssignmentKamarulazwa Muhammad100% (2)

- 603-Article Text-1225-1-10-20200203Document16 pages603-Article Text-1225-1-10-20200203ABAYNEGETAHUN getahunPas encore d'évaluation