Académique Documents

Professionnel Documents

Culture Documents

CP EOQ Calculation

Transféré par

Saidi GwauDescription originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

CP EOQ Calculation

Transféré par

Saidi GwauDroits d'auteur :

Formats disponibles

Client Packet, Economic Order Quantity (EOQ) Calculation

Tony Polito

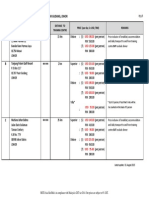

If you were buying steering wheels for an automobile manufacturing company, how many would you order at a time? If you order a large quantity each time you order, youll end up holding some steering wheels in inventory for a longer time than if you had ordered a smaller quantity. With a higher quantity, inventory cost goes high. If you order a small quantity, youll end up paying any setup and/or fixed costs more frequently. For example, the driver of the truck delivering the steering wheels is paid the same, whether the truck is loaded with 500 steering wheels or 5 steering wheels. If you order only 5 steering wheels at a time, youll have to pay the driver 100 times more than if you had ordered 500 steering wheels at a time. With a smaller quantity, setup and/or fixed cost goes high. Since a higher quantity is not best and a lower quantity is not best there must be some middle quantity where the total cost (inventory cost PLUS setup and/or fixed cost) is least expensive. Below is a chart that illustrates the relationship:

Total Cost

C o s t

Inventory Cost

Setup Cost Quantity

The point of lowest total cost can be seen to be at the very bottom of the Total Cost curve. The quantity associated with that point just also happens to be the same quantity at which the two other lines intersect. To calculate the quantity at that point, use the formula below: _______________________________________ EOQ = [ 2 (Demand) (Setup Cost) ] / (Inventory Cost) (That formula results from using calculus to take the derivative of the Total Cost function at zero just in case you were wondering.) When this formula is used to calculate how many to MAKE at a time (instead of how many to BUY at a time), it is sometimes called the Economic Manufacturing Quantity or EMQ.

Client Packet, Economic Order Quantity (EOQ) Calculation

Tony Polito

1) Manatee Computers

Manatee uses EOQ logic to determine the order quantity for its various computer components and is planning its Avatar chip orders. Forecasted annual demand is 10,000 Avatar chips. The setup costs associated with placing and receiving each Avatar chip order is $9.25. It is estimated that the cost to carry an Avatar chip in inventory for a year is $5.00. Manatee calculates the order quantity as follows: _______________________________________ EOQ = [ 2 (Demand) (Setup Cost) ] / (Inventory Cost) ______________________ EOQ = [ 2 (10,000) (9.25) ] / (5) _____________ EOQ = [ 185,000 ] / 5 _______ EOQ = 37,000 Answer:

192.35

The economic order quantity is 192.35 Avatar chips.

2) Daytona Jewelry Daytona uses EOQ logic to determine the order quantity for its retail stock and is planning its annual diamond ring orders. Forecasted annual demand is for 16,900 diamond rings. The setup costs associated with placing and receiving each diamond ring order is $312.50. It is estimated that the cost to carry a diamond ring in inventory for a year is $100.00. Calculate the diamond ring EOQ for Daytona.

Answer:

In order to receive full credit, your answer must fully show your mathematical work, it must be in the form of a complete sentence and it must reference the correct unit of measure.

Client Packet, Economic Order Quantity (EOQ) Calculation

Tony Polito

3) Marina Flags Marina uses EOQ logic to determine the order quantity for the nylon fabric its uses in the manufacturing of its flags. Forecasted annual demand for nylon fabric is for 100,000 yards. The setup costs associated with placing and receiving each nylon fabric order is $50.00. It is estimated that the cost to carry a yard of nylon fabric in inventory for a year is $10.00. Calculate the nylon fabric EOQ for Daytona.

Answer:

The economic order quantity is 1,000 yards.

When you are administered this quiz, you will NOT be provided with the formula. The EOQ formula was first developed around 1915. Unfortunately, as the latter half of the 20 Century progressed, operations professionals found that the formula simply has too many underlying, impractical assumptions to actually be useful in practice. Here are just a VERY FEW of those assumptions: Demand is known Full inventory cost, full setup costs are known Steady (level, non-seasonal) demand Steady inventory cost Steady setup cost No quantity discounts No stockouts, shortages or backorders Discrete (versus continuous) receiving Quantity ordered has no effect on quality, delivery, operations, processes or competitive position Local optimizing of each order quantity leads to global optimizing of ALL order quantities

th

Over the years, mathematical-types have devoted a lot of effort toward modifying the EOQ formula to account for such things, but, in the end, there really isnt any way to anticipate, include or mathematicize all the factors that would be important in such a decision. To make matters worse, Western accountants historically underestimated inventory cost quite a bit, basing their estimate upon only those costs in inventory-related accounts (ie, cost to carry/finance inventory) and overlooking other costs that were caused by inventory but not posted in inventory accounts (ie, cost if excess inventory turns obsolete, cost to receive/track/count inventory). As a result, the EOQ the formula would usually yield a quantity that was much, much too high. In other words, its pretty well known that the EOQ formula just doesnt work at all. Nevertheless and unfortunately most textbooks still usually contain it (often 5 to 10 pages worth of it) and most students are still usually expected to learn it. 1994, 2003, 2006. All rights reserved.

Vous aimerez peut-être aussi

- Inventory Management A Complete Guide - 2021 EditionD'EverandInventory Management A Complete Guide - 2021 EditionPas encore d'évaluation

- A Research Project On The Economic Order Quantity of Retail OutletsDocument21 pagesA Research Project On The Economic Order Quantity of Retail Outletsaavinash3182% (11)

- Productivity and Reliability-Based Maintenance Management, Second EditionD'EverandProductivity and Reliability-Based Maintenance Management, Second EditionPas encore d'évaluation

- In Search of Management Accounting TheoryDocument25 pagesIn Search of Management Accounting TheoryDua Bibi100% (1)

- An Operational Application of System Dynamics in The Automotive Industry: Inventory Management at BMWDocument10 pagesAn Operational Application of System Dynamics in The Automotive Industry: Inventory Management at BMWGourav DebPas encore d'évaluation

- Unit 6 Waiting Lines/ Queuing Theory OutlineDocument17 pagesUnit 6 Waiting Lines/ Queuing Theory OutlineHadiBiesPas encore d'évaluation

- Boiler Fuel Savings by Heat Recovery and Reduced Standby Losses B. GrabsDocument7 pagesBoiler Fuel Savings by Heat Recovery and Reduced Standby Losses B. GrabsPhilip ShihPas encore d'évaluation

- Advanced Operation Management: Name: Amar Verma Roll: 13P119 American Lighting ProductsDocument7 pagesAdvanced Operation Management: Name: Amar Verma Roll: 13P119 American Lighting ProductsArchit AroraPas encore d'évaluation

- Federal Procurement Ethics: The Complete Legal GuideD'EverandFederal Procurement Ethics: The Complete Legal GuidePas encore d'évaluation

- BootstrapDocument8 pagesBootstrapmisko007Pas encore d'évaluation

- Total Cost Of Ownership A Complete Guide - 2020 EditionD'EverandTotal Cost Of Ownership A Complete Guide - 2020 EditionPas encore d'évaluation

- Inventory and Risk Management-AbstractDocument2 pagesInventory and Risk Management-AbstractSaritha ReddyPas encore d'évaluation

- Reliability Analysis and Plans for Successive Testing: Start-up Demonstration Tests and ApplicationsD'EverandReliability Analysis and Plans for Successive Testing: Start-up Demonstration Tests and ApplicationsPas encore d'évaluation

- The Bullwhip EffectDocument16 pagesThe Bullwhip EffectHargobind Coach100% (1)

- Design For LogisticsDocument22 pagesDesign For LogisticsBarun BhardwajPas encore d'évaluation

- Planning And Inventory Management A Complete Guide - 2020 EditionD'EverandPlanning And Inventory Management A Complete Guide - 2020 EditionPas encore d'évaluation

- Dynamic Response of An Overhead Cam Valve TrainDocument6 pagesDynamic Response of An Overhead Cam Valve TraindarkrusePas encore d'évaluation

- Supply Chain Execution Predictive Analytics Second EditionD'EverandSupply Chain Execution Predictive Analytics Second EditionPas encore d'évaluation

- Inventory ManagementDocument51 pagesInventory ManagementPrakhar RatheePas encore d'évaluation

- Cost Capacity Planning A Complete Guide - 2021 EditionD'EverandCost Capacity Planning A Complete Guide - 2021 EditionPas encore d'évaluation

- MCl756 SCM Dossier Feb 2019Document8 pagesMCl756 SCM Dossier Feb 2019parth100% (1)

- Remanfacturing The Ultimate Form of Recycling 1Document27 pagesRemanfacturing The Ultimate Form of Recycling 1Roshan Khedkar100% (1)

- The General Principles of Value Chain ManagementDocument8 pagesThe General Principles of Value Chain ManagementAamir Khan SwatiPas encore d'évaluation

- Inventory Optimization Produces Operational and Cost EfficiencyDocument2 pagesInventory Optimization Produces Operational and Cost EfficiencyfyfyPas encore d'évaluation

- Abreviation22 AutoDocument26 pagesAbreviation22 AutoNuno RodriguesPas encore d'évaluation

- CostDocument1 pageCostvishwanath cPas encore d'évaluation

- Kimberly-Clark Company Case Assign4Document3 pagesKimberly-Clark Company Case Assign4Ahmad Elsayed MohammedPas encore d'évaluation

- 1898 Ford Operations ManagementDocument8 pages1898 Ford Operations ManagementSanthoshAnvekarPas encore d'évaluation

- 7.chapter 5 Capacity PlanningDocument16 pages7.chapter 5 Capacity Planningopio jamesPas encore d'évaluation

- The Influence of Collaboration and Decision - Making in Sustainable Supply Chain Management - A Case Study Analysis On Skechers USA Inc.Document96 pagesThe Influence of Collaboration and Decision - Making in Sustainable Supply Chain Management - A Case Study Analysis On Skechers USA Inc.Angelica ChavesPas encore d'évaluation

- Spare Parts Inventory Management 1Document2 pagesSpare Parts Inventory Management 1stanleyPas encore d'évaluation

- Inventory ControlDocument41 pagesInventory ControlantoniobhPas encore d'évaluation

- Warehousing DesignDocument34 pagesWarehousing DesignRamneek Singh KhalsaPas encore d'évaluation

- Multi Echelon Inventory EOQDocument4 pagesMulti Echelon Inventory EOQLazyLundPas encore d'évaluation

- Capacity PlanningDocument4 pagesCapacity Planningmayankganatra123Pas encore d'évaluation

- TENTEC Hydraulic Ancillary Data Sheet R7 A4Document4 pagesTENTEC Hydraulic Ancillary Data Sheet R7 A4Juliyan PujakesumaPas encore d'évaluation

- Braun Ma4 SM 09Document55 pagesBraun Ma4 SM 09nobleverma100% (1)

- CHT 6 InventoryDocument33 pagesCHT 6 InventoryJay PatelPas encore d'évaluation

- Fundamentals of Engineering Thermodynamics 5thDocument187 pagesFundamentals of Engineering Thermodynamics 5thHaralambos TsivicosPas encore d'évaluation

- 1) Effect of Engine Speed On Intake Valve Flow Characteristics of A Diesel EngineDocument6 pages1) Effect of Engine Speed On Intake Valve Flow Characteristics of A Diesel EnginefitriasyrafPas encore d'évaluation

- Mechanically Operated Wheelchair Convertible StretcherDocument5 pagesMechanically Operated Wheelchair Convertible StretcherIAEME PublicationPas encore d'évaluation

- Calculating What It Costs To Run A MotorDocument6 pagesCalculating What It Costs To Run A MotorDamian100% (1)

- Lect 12 EOQ SCMDocument38 pagesLect 12 EOQ SCMApporva MalikPas encore d'évaluation

- A Minimum Cost Design For An Automated WarehouseDocument284 pagesA Minimum Cost Design For An Automated Warehousekutsay100% (1)

- PSR Jet SystemDocument9 pagesPSR Jet SystemMiroslav JebavýPas encore d'évaluation

- Module 1 - Introduction and Management Decision Making - Homework SolutionsDocument4 pagesModule 1 - Introduction and Management Decision Making - Homework SolutionsAbelPas encore d'évaluation

- Abstract Precision Gear Boxes and Geared Motors ReportDocument2 pagesAbstract Precision Gear Boxes and Geared Motors Reportsandy17377Pas encore d'évaluation

- PR ARTS Data Warehouse V2 20110707Document75 pagesPR ARTS Data Warehouse V2 20110707dangerossPas encore d'évaluation

- BottleneckDocument5 pagesBottleneckcpl_09Pas encore d'évaluation

- Inventory Management of Spare Parts in An Energy Company PDFDocument32 pagesInventory Management of Spare Parts in An Energy Company PDFsaeedalemvePas encore d'évaluation

- Customer Profitability Case - Management AccountingDocument6 pagesCustomer Profitability Case - Management AccountingTina FluxPas encore d'évaluation

- Spark Ignition and Pre-Chamber Turbulent Jet Ignition Combustion VisualizationDocument16 pagesSpark Ignition and Pre-Chamber Turbulent Jet Ignition Combustion VisualizationKaiser IqbalPas encore d'évaluation

- Jet Propulsion BasicsDocument11 pagesJet Propulsion BasicsHeather CarsonPas encore d'évaluation

- Dixon and Poli Method IIT MadrasDocument17 pagesDixon and Poli Method IIT Madraschandra shekarPas encore d'évaluation

- Saipa Family 111 131 132 141 Owner ManualDocument197 pagesSaipa Family 111 131 132 141 Owner ManualMike PascualPas encore d'évaluation

- CashlessGarage Motor MultiBrandDocument46 pagesCashlessGarage Motor MultiBrandMunish KumarPas encore d'évaluation

- Bajaj Maxima Z & WB LPG, CNG SPCDocument78 pagesBajaj Maxima Z & WB LPG, CNG SPCjai arora100% (2)

- Komatsu Truck 930-4 Shop Manual CEBM017904Document1 027 pagesKomatsu Truck 930-4 Shop Manual CEBM017904Ravinder Singh80% (5)

- MS0401C0291-V00.C - (Bearing-Plate-&-Steel-Plate-for-Moving-Walk-&-Escalator) PDFDocument18 pagesMS0401C0291-V00.C - (Bearing-Plate-&-Steel-Plate-for-Moving-Walk-&-Escalator) PDFnoufalPas encore d'évaluation

- JF015E Calibration Parte3Document4 pagesJF015E Calibration Parte3EdgarditoPas encore d'évaluation

- Infographic ACI World Airport Traffic Forecasts 2017-2040Document1 pageInfographic ACI World Airport Traffic Forecasts 2017-2040Robith Basyarul AlamPas encore d'évaluation

- Twin Clutch TransmissionDocument237 pagesTwin Clutch TransmissionAkash Mankar100% (1)

- Dholera Industrial City Overview PDFDocument65 pagesDholera Industrial City Overview PDFzaheeruddin_mohdPas encore d'évaluation

- Ali CVDocument1 pageAli CVAli EidPas encore d'évaluation

- Manual Pruebas y Ajustes MotorDocument71 pagesManual Pruebas y Ajustes MotorJonathan VazquezPas encore d'évaluation

- Pengertian Recount TextDocument2 pagesPengertian Recount Textdede heryadiPas encore d'évaluation

- Pace Bus Schedule 422Document2 pagesPace Bus Schedule 422drjohnckim100% (1)

- Heritage ISIDocument1 pageHeritage ISISebastian AguileraPas encore d'évaluation

- Comparitive Study of Modular Structure Techniques Between Precast Elements and Cast-In-Situ ElementsDocument1 pageComparitive Study of Modular Structure Techniques Between Precast Elements and Cast-In-Situ ElementsKitrc CIVIL DEPARTMENTPas encore d'évaluation

- Gantrail Welded Base Fixing: SpecificationsDocument2 pagesGantrail Welded Base Fixing: SpecificationstobiasPas encore d'évaluation

- SIRE 2.0 Question Library - Question Programming Attributes - Version 1.0 (January 2022)Document86 pagesSIRE 2.0 Question Library - Question Programming Attributes - Version 1.0 (January 2022)Caner DoguPas encore d'évaluation

- Piping Design Tank FarmDocument36 pagesPiping Design Tank Farmkemo10100% (1)

- Stormwater Best Management Practices: Reference GuideDocument216 pagesStormwater Best Management Practices: Reference GuideSaydahmadPas encore d'évaluation

- ValPark Drainage ProjectDocument19 pagesValPark Drainage Projectjonathan_guthrie_5Pas encore d'évaluation

- Information On Pick Up Services & Hotel-Msts Johor (Pasir Gudang) (Wef 01.08.2015)Document5 pagesInformation On Pick Up Services & Hotel-Msts Johor (Pasir Gudang) (Wef 01.08.2015)bebulalaPas encore d'évaluation

- Steel Crash Barriers: Current ProvisionDocument9 pagesSteel Crash Barriers: Current ProvisionNIBEDITA DEYPas encore d'évaluation

- Private & Confidential Page 1 of 34Document34 pagesPrivate & Confidential Page 1 of 34Er. Rajesh ChatterjeePas encore d'évaluation

- EPS-18th Draft PDFDocument41 pagesEPS-18th Draft PDFbhuvaneswaraneeePas encore d'évaluation

- Mohad Sharef Mohad-CholaDocument2 pagesMohad Sharef Mohad-CholaVara PrasadPas encore d'évaluation

- Faller Car System 2014 enDocument23 pagesFaller Car System 2014 endavorp1402100% (1)

- Checklist For Inspection of Bridges by Bridge Line UnitsDocument3 pagesChecklist For Inspection of Bridges by Bridge Line UnitsSSE Bridge SSBPas encore d'évaluation

- Powertronic V5Document38 pagesPowertronic V5ARDELTPas encore d'évaluation

- How To Setup gp2Document8 pagesHow To Setup gp2Aniello IaccarinoPas encore d'évaluation

- Rizal'S Visit To The United States (1888Document2 pagesRizal'S Visit To The United States (1888banned napudPas encore d'évaluation

- The Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindD'EverandThe Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindÉvaluation : 5 sur 5 étoiles5/5 (231)

- I Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)D'EverandI Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)Évaluation : 4.5 sur 5 étoiles4.5/5 (13)

- Getting to Yes: How to Negotiate Agreement Without Giving InD'EverandGetting to Yes: How to Negotiate Agreement Without Giving InÉvaluation : 4 sur 5 étoiles4/5 (652)

- Purchasing, Inventory, and Cash Disbursements: Common Frauds and Internal ControlsD'EverandPurchasing, Inventory, and Cash Disbursements: Common Frauds and Internal ControlsÉvaluation : 5 sur 5 étoiles5/5 (1)

- How to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)D'EverandHow to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)Évaluation : 4.5 sur 5 étoiles4.5/5 (5)

- Warren Buffett and the Interpretation of Financial Statements: The Search for the Company with a Durable Competitive AdvantageD'EverandWarren Buffett and the Interpretation of Financial Statements: The Search for the Company with a Durable Competitive AdvantageÉvaluation : 4.5 sur 5 étoiles4.5/5 (109)

- Tax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesD'EverandTax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesPas encore d'évaluation

- The E-Myth Chief Financial Officer: Why Most Small Businesses Run Out of Money and What to Do About ItD'EverandThe E-Myth Chief Financial Officer: Why Most Small Businesses Run Out of Money and What to Do About ItÉvaluation : 5 sur 5 étoiles5/5 (13)

- The Credit Formula: The Guide To Building and Rebuilding Lendable CreditD'EverandThe Credit Formula: The Guide To Building and Rebuilding Lendable CreditÉvaluation : 5 sur 5 étoiles5/5 (1)

- Finance Basics (HBR 20-Minute Manager Series)D'EverandFinance Basics (HBR 20-Minute Manager Series)Évaluation : 4.5 sur 5 étoiles4.5/5 (32)

- The Accounting Game: Learn the Basics of Financial Accounting - As Easy as Running a Lemonade Stand (Basics for Entrepreneurs and Small Business Owners)D'EverandThe Accounting Game: Learn the Basics of Financial Accounting - As Easy as Running a Lemonade Stand (Basics for Entrepreneurs and Small Business Owners)Évaluation : 4 sur 5 étoiles4/5 (33)

- Accounting 101: From Calculating Revenues and Profits to Determining Assets and Liabilities, an Essential Guide to Accounting BasicsD'EverandAccounting 101: From Calculating Revenues and Profits to Determining Assets and Liabilities, an Essential Guide to Accounting BasicsÉvaluation : 4 sur 5 étoiles4/5 (7)

- The ZERO Percent: Secrets of the United States, the Power of Trust, Nationality, Banking and ZERO TAXES!D'EverandThe ZERO Percent: Secrets of the United States, the Power of Trust, Nationality, Banking and ZERO TAXES!Évaluation : 4.5 sur 5 étoiles4.5/5 (14)

- The One-Page Financial Plan: A Simple Way to Be Smart About Your MoneyD'EverandThe One-Page Financial Plan: A Simple Way to Be Smart About Your MoneyÉvaluation : 4.5 sur 5 étoiles4.5/5 (37)

- A Beginners Guide to QuickBooks Online 2023: A Step-by-Step Guide and Quick Reference for Small Business Owners, Churches, & Nonprofits to Track their Finances and Master QuickBooks OnlineD'EverandA Beginners Guide to QuickBooks Online 2023: A Step-by-Step Guide and Quick Reference for Small Business Owners, Churches, & Nonprofits to Track their Finances and Master QuickBooks OnlinePas encore d'évaluation

- Accounting For Small Businesses QuickStart Guide: Understanding Accounting For Your Sole Proprietorship, Startup, & LLCD'EverandAccounting For Small Businesses QuickStart Guide: Understanding Accounting For Your Sole Proprietorship, Startup, & LLCÉvaluation : 5 sur 5 étoiles5/5 (1)

- Excel for Beginners 2023: A Step-by-Step and Quick Reference Guide to Master the Fundamentals, Formulas, Functions, & Charts in Excel with Practical Examples | A Complete Excel Shortcuts Cheat SheetD'EverandExcel for Beginners 2023: A Step-by-Step and Quick Reference Guide to Master the Fundamentals, Formulas, Functions, & Charts in Excel with Practical Examples | A Complete Excel Shortcuts Cheat SheetPas encore d'évaluation

- I'll Make You an Offer You Can't Refuse: Insider Business Tips from a Former Mob Boss (NelsonFree)D'EverandI'll Make You an Offer You Can't Refuse: Insider Business Tips from a Former Mob Boss (NelsonFree)Évaluation : 4.5 sur 5 étoiles4.5/5 (24)

- Financial Intelligence: A Manager's Guide to Knowing What the Numbers Really MeanD'EverandFinancial Intelligence: A Manager's Guide to Knowing What the Numbers Really MeanÉvaluation : 4.5 sur 5 étoiles4.5/5 (79)

- SAP Foreign Currency Revaluation: FAS 52 and GAAP RequirementsD'EverandSAP Foreign Currency Revaluation: FAS 52 and GAAP RequirementsPas encore d'évaluation

- LLC Beginner's Guide: The Most Updated Guide on How to Start, Grow, and Run your Single-Member Limited Liability CompanyD'EverandLLC Beginner's Guide: The Most Updated Guide on How to Start, Grow, and Run your Single-Member Limited Liability CompanyÉvaluation : 5 sur 5 étoiles5/5 (1)

- Overcoming Underearning(TM): A Simple Guide to a Richer LifeD'EverandOvercoming Underearning(TM): A Simple Guide to a Richer LifeÉvaluation : 4 sur 5 étoiles4/5 (21)

- Love Your Life Not Theirs: 7 Money Habits for Living the Life You WantD'EverandLove Your Life Not Theirs: 7 Money Habits for Living the Life You WantÉvaluation : 4.5 sur 5 étoiles4.5/5 (146)