Académique Documents

Professionnel Documents

Culture Documents

TaxGuide2011 12

Transféré par

dhavalg_2Description originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

TaxGuide2011 12

Transféré par

dhavalg_2Droits d'auteur :

Formats disponibles

www.Personal FN.

com

Preface

All of us engage in some economic activity and work hard to make a living. But as you start doing so you tend to attract the attention of the Income Tax Department, as they too are doing their economic activity of taxing your income, as you earn. And thus as we work hard to make a living, it becomes imperative for us to work a little more harder and smarter to save our taxes (the legal way) too, so that we can make our dreams come true - A dream of buying a better car, bigger house etc. But, remember in the quest of attaining the same, if you keep your tax planning exercise pending till the eleventh hour, then it would be merely a tax saving exercise leading to sub optimal gains. This guide on Tax Planning has been written with the purpose of helping you plan your taxes smartly. If one incorporates the financial planning aspects such as your age, income, ability to take risk and financial goals to tax planning exercise, then one can wisely complement tax planning to investment planning as well. Also, realisation will dawn on you that theres more to tax planning than the mere Rs 1 lakh limit under Section 80C, of the Income Tax Act, 1961. There are many other provisions that can provide you tax benefits. A simple thing like taking a loan for buying a house can make you eligible to get tax benefits. So, read on and wish you all VERY HAPPY TAX PLANNING!!

Team Personal FN

www.Personal FN.com

Disclaimer

Quantum Information Services Private Limited (PersonalFN) is enrolled as AMFI Registered Mutual Fund Advisor (ARMFA) under AMFI Registration No. ARN- 1022 and adheres to AMFI Guidelines and Norms for Intermediaries (AGNI), and all its employees engaged in distribution of Mutual Fund products have passed the prescribed AMFI certification examination. This is a generalized Service, provided on an "As Is" basis by PersonalFN. PersonalFN and its affiliates disclaim any warranty of any kind, imputed by the laws of any jurisdiction whether in or outside India, whether express or implied, as to any matter whatsoever relating to the Service, including without limitation the implied warranties of merchantability, fitness for a particular purpose. PersonalFN will and its subsidiaries / affiliates / sponsors / trustee or their officers, employees, personnel, directors will not be responsible for any direct/indirect loss or liability incurred to the user or any other person as a consequence of his or any other person on his behalf taking any investment decisions based on the above recommendation. This is not a specific advisory service to meet the requirements of a specific client. Use of the Service is at any persons, including a Client's, own risk. The investments discussed or recommended under this service may not be suitable for all investors. Investors must make their own investment decisions based on their specific investment objectives and financial position and using such independent advisors as they believe necessary. Information herein is believed to be reliable but PersonalFN does not warrant its completeness or accuracy. The Service should not be construed to be an advertisement for solicitation for buying or selling of any securities. All intellectual property rights emerging from this guide are and shall remain with PersonalFN. This guide is for users personal use and the user shall not resell, copy, or redistribute this guide, or use it for any commercial purpose. Please read the Terms of Use on the website www.personalfn.com.

www.Personal FN.com

Index

Section I: Introduction Tax Saving Vs. Tax Planning Section II: Mistakes which you have been doing while saving tax Section III: Your small steps (to Tax Planning) can take you leaps Steps to tax planning Parameters for prudent tax planning Section IV: Optimal tax planning with section 80C Tax planning the assured return way Tax planning with market-linked instrument Section V: Thinking beyond section 80C Section VI: Your home loan and tax planning Section VII: House Property and taxes Section VIII: Save tax on your hard earned salary Section IX: Conclusion

30 37 42 46 51 17 06 09 05

www.Personal FN.com

I - Introduction

All men make mistakes, but only wise men learn from their mistakes.- Sir Winston Churchill. The above proverb is very much relevant to our daily lives - be it handling finances or even in any other facets of life. Moreover the famous author John C. Maxwell has also quoted A man must be big enough to admit his mistakes, smart enough to profit from them, and strong enough to correct them. But again this is conveniently forgotten by most, which often leads to failure to learn from mistakes, the arrogance to admit it and which thus leads you to repeat the same mistakes again. While undertaking your tax planning exercise too, you tend to repeat the same mistake of waiting till the eleventh hour and are arrogant enough to admit it. As the financial year draws to a close, we all start feeling the heat and realise that yes, now we have to invest in order to save tax. But have you ever wondered whether it is the prudent way for tax planning? Remember, waiting till the eleventh hour to undertake your tax planning exercise will often drive it towards mere tax saving rather than tax planning; which in our opinion is a suboptimal way to undertake a tax planning exercise. Unlike tax saving which is generally done through investments in tax saving instruments/products, under tax planning we take into consideration ones larger financial plan after accounting for ones age, financial goals, ability to take risk and investment horizon (including nearness to financial goals). And by adapting to such a method of tax planning, you not only ensure long-term wealth creation but also protection of capital. Hence, please remember to commence your tax planning exercise well in advance by complementing it with your overall investment planning exercise.

www.Personal FN.com

II - Mistakes which you have been doing while saving tax

We recognise the fact that many of you are too busy throughout the year, in your economic activities intended to make a living. But if you show the same dedication in your tax planning exercise, the same will enable you to save more and fulfil all your dreams in life. Our experience reveals following 5 mistakes which individuals do while saving taxes.

1. Doing your tax planning at the last moment:

The root of all mistakes in tax planning lies in waiting till the eleventh hour to save taxes, which eventually leads to mere tax saving, rather than tax planning. And this in return is a sub-optimal way of saving taxes, caused by the sheer attitude of procrastination. Waiting till the eleventh hour, will often lead you to forgetting or ignoring the facets of financial planning such as your age, income, ability to take risk and financial goals (explained further in this guide) thus guiding you to not complement your tax planning exercise with investment planning.

Remember waiting till the eleventh, is just going to lead you to a path of sub-optimal tax planning exercise, which would destroys the essence of holistic tax planning.

2. Buying Unit Linked Insurance Plans:

At the end of the financial year, many of you must have attended telephone calls of insurance agents pestering you to buy an investment cum insurance plans typically market linked i.e. Unit Linked Insurance Plans. And many of you realising the need to save taxes, even entertain these calls and eventually tear a cheque for buying one. But do you ever wonder whether you have done the right thing?

www.Personal FN.com

The answer in our opinion is a sheer No. And thats because of the ignorance and / or arrogance (of not admitting your mistakes) which you have while doing your tax saving investments.

Remember when you are thinking of insuring yourself, it should purely mean protecting your life against any contingent events; and thus given that you should be ideally buying only pure term life insurance plans, which gives due importance to your human life value. It is noteworthy that ULIPs are investmentcum-insurance plans where for the premium paid, the insurance cover offered under these plans is far less (usually 10 times your annual premium) when compared to pure term life insurance plans; where for a lesser premium amount you get a greater life cover which precisely what a life insurance plan is intended for.

3. Ignoring power of compounding through tax saving mutual funds:

Many of you despite the fact that age, income, ability to take risk along with financial goals support you to take risk, you absolutely rule out the concept of power of compounding to your portfolio. It is noteworthy that if you want to meet and / or elevate your standard of living going forward, you need to beat the rate of inflation. And thus, role of equity as an asset class cannot be ignored in ones tax saving portfolio too. While some do consider the tax saving mutual funds in their tax saving portfolio the ideal composition (depending on your age, income ability to take risk and financial goals) is not maintained, which leads the tax saving portfolio to give sub-optimal returns.

It is noteworthy that being risk averse is well appreciated by us. But if your age, income, ability to take risk and financial goals, permit you to take equity exposure one should not ignore the same.

www.Personal FN.com

4. Not optimizing all options for tax saving:

For many tax planning starts as well as ends with Section 80C - which enunciates investment instruments for tax saving. But just investing in these investment instruments would not lead to optimal reduction of tax liability.

To bring to your notice our Income Tax Act, 1961 also considers humane side of our life and also gives deduction for contributions made for financing our countrys infrastructure development. So, in case if you pay your medical insurance premium, incur expenditure on the medical treatment of a dependant handicapped, donate to specified funds for specified causes, contribute in monetary form to political parties or electoral trusts, take a loan for pursuing higher education or if you are an individual suffering from specified diseases, then all this too can help you effectively plan your tax obligations, thus optimally reducing your tax liability. Moreover, take into account the urge to buy your dream home by taking a loan, the Act also extends tax saving benefits to you.

www.Personal FN.com

III - Your small steps can take you forward by leaps

There is an old Chinese proverb which says, It is better to take many small steps in the right direction than to make a great leap forward only to stumble backward. which in our opinion applies even to your tax planning exercise. Remember, it is vital for you to step-by-step ascertain where you stand, in terms of your Gross Total Income and Net Taxable Income, so that you effectively undertake your tax planning exercise which in turn would deliver you the objective of long-term wealth creation along with capital protection. In the past if you have taken your tax planning decisions at the eleventh hour, never mind. But, please learn from them and dont the repeat the same mistakes again. Adopt the prudent steps while doing your tax planning.

Steps to tax planning:

Step 1 - Compute the Gross Total Income The process of tax planning begins with computation of your Gross Total Income (GTI). This step enables you to ascertain the total income earned by you during a financial year, from various under-mentioned sources of income, and helps you to judge where you stand. Income from salary Income from house property Profits and gains from business & profession Capital gains (short term and long term) and Income from other sources.

www.Personal FN.com

Hence, GTI is the total income earned by one before availing any deductions under the Income Tax Act, 1961. And it is vital to know the same, in order for you to undertake your tax planning effectively, so that you can plan within the sources of income (by using the relevant provisions of the Income Tax Act applicable to the aforementioned sources of income), as well as by availing deductions to GTI. Now, one may ask how do I undertake this activity if Im a novice? Well, the answer is pretty simple! You can either get it done at your office (many organisation do offer this facility), ask your CA / tax consultant to do it, or use the convenience of the new tax portals that have emerged in more recent times. But, along with all this please do not forget to do your self-study to carry out effective tax planning exercise. One must note that its vital to know at least those provisions of the Income Tax Act, which directly have an impact on your finances. Step 2 - Compute the Net Taxable Income After having done with computation of GTI by using the relevant provisions of the Income Tax Act for each source of income, the next step is to compute your Net Taxable Income (NTI). Under NTI from the GTI, the various deductions allowed under the Income Tax Act, should be accounted for (i.e. subtracted from your GTI), which would thus reduce your taxable income. These deductions enable you to enjoy reduction in tax liability, as it covers Sections under the Income Tax Act for: Investing in tax saving instruments (your most loved and sought after Section 80C, along with the recently introduced Section 80CCF) Donations Expenditure on handicapped dependent Premium payment for your medical insurance Interest paid on loan taken for higher education

10

www.Personal FN.com

Rent paid for residential accommodation Expenditure incurred on a specified diseases suffered by you Remember, if you use the respective provisions effectively to do tax planning, it will enable you to achieve the long-term objective of wealth creation. Step 3 - Calculate the tax payable After having effectively saved tax in the prudent way mentioned above, the next step is to compute your tax liability based on the present income tax slabs, and thereafter file your tax returns. The income tax rates for Individuals and HUFs for FY 2011-12 are as follows:

Net Taxable Income (in Rs)

Upto 1,80,000 Nil Upto 1,90,000 (for women) Upto 2,50,000 (for senior citizens) 1,60,001 to 5,00,000 10% 5,00,001 to 8,00,000 20% 30% 8,00,001 & above (Source: Finance Act 2010, Personal FN Research)

Rate

Moreover you would also have to pay an education cess @ 3% on your tax liability computed. So, say if your net taxable income (NTI) after availing for all deductions available is Rs 10,00,000 then your tax liability will be computed as under:

Computation of tax liability (2011-12) Taxable Income (in Rs) 10,00,000 Upto 180,000 Nil 160,001 to 500,000 10% 32,000 500,001 to 800,000 20% 60,000 8,00,001 & above 30% 60,000 Tax payable (in Rs) 1,52,000 Education Cess 3% 4,560 Total Tax (in Rs) 1,56,560 (Source: Personal FN Research)

11

www.Personal FN.com

Parameters for prudent tax planning:

A Prudent exercise of tax planning also extends to appropriate investment planning, which also takes into account your ideal asset allocation by considering the under-mentioned factors. Hence after you have utilised the tax provisions within each head / source of income for effective reduction in GTI, you must also consider the following parameters as these will enable you to optimally reduce your tax liability. Age Your age and the tenure of your investment play a vital role in your asset allocation. The younger you are more risk you can take and vice-a-versa. Hence, for prudent tax planning too, if you are young, you should allocate more towards market-linked tax saving instruments such as Equity Linked Saving Schemes (ELSS), Unit Linked Insurance Plans (ULIPs) and National Pension Scheme (NPS), as at a young the willingness to take risk is high. One may also consider taking a home loan when you are young as; number of years of repayment are more along with your willingness to take risk being high. Also a noteworthy point is the earlier you start with your investments, the greater is the tenure you get while investing in an investment avenue, which enables one to make more aggressive investments and create wealth over the long-term to meet your financial goals. Lets understand this much better with the help of an illustration.

12

www.Personal FN.com

An early bird gets a bigger pie

Particulars

Present age (years) Retirement age (years) Investment tenure (years) Monthly investment (Rs) Returns per annum Sum accumulated (Rs)

Suresh

25

Mahesh

30

Sandesh

35

60

60

60

35

30

25

7,000

7,000

7,000

10%

10%

10%

2,65,76,466

1,58,23,415

92,87,834

(Source: Personal FN Research)

The above table reveals that, Suresh starts at age 25, and invests Rs 7,000 per month in an ELSS scheme through SIPs (Systematic Investment Plans) until retirement (age 60). His corpus at retirement is approximately Rs 2.65 crore. Mahesh starts at age 30, a mere 5 years after Suresh, and invests the same amount in ELLSS scheme (through SIPs) until retirement (also at age 60). His corpus builds up to approximately Rs 1.58 crore, note the difference between the 2 corpuses here. And lastly, we have Sandesh, the late bloomer of the lot. He begins investing at age 35, the same amount monthly in an ELSS Scheme as Suresh and Mahesh, and invests up to his retirement (also at age 60). His corpus is, in comparison, a meagre Rs 92 lakh.

13

www.Personal FN.com

(Source: Personal FN Research)

One can also consider donating an affordable amount towards a noble cause, as doing so will make you eligible for a tax benefit (under section 80G of the Income Tax Act which is discussed ahead in this guide). For some of you young people, perusing higher education may be a priority. But there may be a case you do not have enough corpus (funds) garnered by you. However, you need not worry, as there are several banks willing to offer higher education loan; and if you avail the same the interest paid by you on the loan taken will be eligible for tax benefit (under section 80E of the Income Tax Act which is discussed ahead in this guide). Income Similarly, if your income is high, your willingness to take risk is high. This thus can work in your favour, as you have sufficient annual GTI which allows you to park more money towards market-linked tax saving investment instruments, for generating higher returns and creating a good corpus for your financial goal(s). Also, on account of the higher GTI your eligibility to take a home loan also increases, which can also help you to optimally reduce your tax liability. Yes, one may say if I have a high income, then why I need a home loan. I can straight away go ahead and buy!

14

www.Personal FN.com

Sure, you can do so but, the Income Tax Act provides you the tax benefit for repayment of principal amount along with the interest of loan taken, which you will miss. Also given that you are rich, you can also consider donating some of your money towards a noble cause, which can also enable you to enjoy a tax benefit (under section 80G of the Income Tax Act which is discussed ahead in this guide). Similarly, if your income is not high enough (i.e. it is low), you can invest in tax saving instruments which provide you assured returns. These instruments can be Public Provident Fund (PPF), National Savings Certificates (NSCs), 5 Yr Bank Fixed Deposits, 5 Yr Post Office Time Deposits and Senior Citizen Savings Scheme (provided you are a senior citizen). Financial goals The financial goals which one sets in life, also influences the tax planning exercise. So, say for example your goal is retiring from work 5 years from now, then your tax saving investment portfolio will be also less skewed towards market-linked tax saving instruments, as you are quite near to your goal and your regular income will stop. Likewise if you are many years away from the financial goal, you should ideally allocate maximum allocation to market linked tax saving instruments and less towards those instruments (tax saving) which provide you assured returns. Risk Appetite Your willingness to take risk which is a function of your age, income, expenses, nearness to goal, will be an important determinant while doing your tax planning exercise. So, if your willingness to take risk is high (aggressive), you can skew your tax saving investment portfolio more towards the market-linked instruments. Similarly, if your willingness to take risk is relatively low (conservative), your tax saving investment portfolio can be skewed towards instruments which offer you assured returns, and if you are a moderate risk taker

15

www.Personal FN.com

you can take a mix of 60:40 into market-linked tax saving instruments and assured return tax saving instruments respectively. Yes, we reckon the fact that prudent tax planning exercise can be a time consuming and complex. But please note the fact that its an annual activity which every tax payer has to go through and if you start early and plan properly, the task becomes easier. Remember, procrastination will only ensure that you invest at the last moment and not in line with the parameters discussed above. If you are hard pressed for time, consider hiring a competent tax consultant along with an investment advisor.

16

www.Personal FN.com

IV - Optimal tax planning with section 80C

Section 80C of the Income Tax Act enables you to effectively invest in tax saving instruments, in order to optimally reduce your tax liability; and this is seen as one of the most sought after sections when it comes to tax planning. It offers a host of popular investment instruments mentioned below which qualify you for a deduction from your Gross Total Income (GTI): Life Insurance Premium Public Provident Fund (PPF) Employees Provident Fund (EPF) National Saving Certificate (NSC) , including accrued interest 5-Year fixed deposits with banks and Post Office Senior Citizens Savings Scheme (SCSS) National Pension Scheme (NPS) Unit-Linked Insurance Plans (ULIPs) Equity Linked Savings Schemes (ELSS) Tuition fees paid for childrens education (maximum 2 children) Hence, if you invest in any or all of the aforementioned instruments; you would qualify for deduction under this section subject to the maximum of Rs 1,00,000 p.a. But we think rather than just merely investing in any of the above tax saving instruments, one can also can use these tax saving instruments for prudent tax planning by recognising your age, income, financial goals and risk appetite. Now you may ask how? Well, its simple! In the aforementioned list you can classify the tax saving instruments into those offering variable returns (i.e. market-linked instruments) and those offering fixed returns (i.e. assured return instruments). By doing so you would be able to ascertain which suits you

17

www.Personal FN.com

best (taking into account the factors mentioned above) and will also extend your tax planning exercise to investment planning too. Lets discuss in detail the classification into market-linked tax saving instruments and assured return tax saving instruments.

Tax Planning with market-linked instrument:

If you are young, income is high, and therefore willingness to take risk is high along with your financial goals being far away, then this category would suit you. Under this category you are investing in the capital markets, giving you variable returns. Following tax saving instruments are available for investment.

1.

Equity Linked Savings Schemes (ELSS):

These are mutual fund schemes, which are 100% diversified equity funds providing tax benefits. And these are popularly known as Tax Saving Mutual Funds. A distinguishing feature about them is that they are subject to a compulsory lock-in period of three years, but the minimum application amount in most of them is as little as Rs 500, with no upper limit. You can either make lump sum investments or investments through the Systematic Investment Plan (SIP). It is noteworthy that, in the long-term if you intend to create wealth by hedging the inflation risk, then this tax saving instrument can give you luring returns.

18

www.Personal FN.com

Performance of Tax Saving Mutual Funds SIP is the way to go

Scheme Name 1-Yr Returns (%) SIP -6.06 Baroda Pioneer ELSS '96 -11.56 Birla SL Tax Relief '96 (D) -2.41 Canara Robeco Equity Tax Saver (D) -8.39 DSPBR Tax Saver (G) -4.24 Fidelity Tax Advt (G) -0.63 Franklin India Taxshield (G) -5.88 HDFC TaxSaver (G) -3.15 ICICI Pru Tax Plan (G) -3.03 IDFC Tax Saver (G) -5.88 Kotak Tax Saver (G) -8.97 L&T Tax Saver (G) 0.54 Quantum Tax Saving (G) -3.82 SBI Magnum TaxGain'93 (G) -1.69 Sundaram Tax Saver (G) -5.76 Taurus Tax Shield (G) -4.73 Average -6.20 7.20 26.34 7.17 6.46 -6.12 6.48 26.89 9.32 11.95 -6.09 4.13 20.09 5.85 7.08 -5.80 4.59 22.80 4.59 3.75 -3.19 12.17 28.60 -11.69 2.88 24.54 2.82 -0.10 -7.11 4.79 22.59 3.51 2.43 -4.98 7.01 23.30 -4.78 12.04 34.38 10.98 6.87 -6.65 10.11 31.43 10.08 7.78 0.75 11.82 28.81 10.72 9.30 -4.23 10.52 29.20 10.53 9.81 -9.50 5.16 24.96 6.25 7.90 -1.61 11.71 31.94 13.14 12.60 -12.62 1.58 23.90 2.41 2.78 Lump sum -9.36 3-Yr Returns (%) SIP 3.08 Lump sum 21.69 5-Yr Returns (%) SIP 3.04 Lump sum 1.83

(Source: ACE MF, Personal FN Research)

Yes, you may say but there is risk involved. Well, no doubt about that, but in order to even out the shocks of volatility in the equity markets you can adopt the SIP route of investing here which will provide you the advantage of compounding along with rupee-cost averaging.

19

www.Personal FN.com

SIPs provide cushion against market volatility

(Source: ACE MF, Personal FN Research)

Get wealthy Sip by sip

(Source:ACE MF, Personal FN Research)

However a noteworthy point in SIP investing for ELSS is that your every SIP installment (which can be monthly, quarterly or half yearly) should complete the minimum lock-in period of 3 years. Deduction: The maximum tax benefit which you can enjoy is Rs 1,00,000 p.a. under section 80C. Moreover, if you make any long term gains at the time of exit any time after the end of the lock-in period; then you would not have to pay any Long Term Capital Gains Tax (LTCG) too.

2.

Unit-Linked Insurance Plans (ULIPs):

20

www.Personal FN.com

These are typically insurance-cum-investment plans which enable you to invest in equity and / or debt instruments depending on what suits you as per your age, income, risk profile and financial goals. All you simply need to do is, select the allocation option as provided by the insurance company offering such a plan. Generally they are classified as aggressive (which invests in equity), moderate or balanced (which invests in debt as well as equity) and conservative (which is invests purely in debt instruments). Hence apart from the insurance cover (which is 10 times your annual premium) offered under these plans, the returns which you would get would be completely market-linked as your premium amount (after accounting for allocation and other charges) is invested in equity and debt securities. And in order for you to track such plans the NAV is declared on a regular basis. These policies have a minimum 5 year lock-in period, and also have a minimum premium paying term of 5 years. The overall term of the policy would vary from product to product. In case of any eventuality the beneficiaries would be paid the sum assured or fund value, whichever is higher. But a noteworthy point is, while some well selected ULIPs may add value to your portfolio in the long-term; your insurance and investment needs should be dealt separately, thus enabling you to have the optimum insurance coverage and the right investment instruments for long-term wealth creation. Deduction: The premium which you paying for your ULIP plans would be eligible for tax benefit, subject to the maximum eligible amount of Rs 1,00,000 p.a. as available under Section 80C. Moreover, a positive point is that at maturity the amount which you or your beneficiary would receive is tax free (exempt) as per the provisions of Section 10(10D) of the Income Tax Act.

3. National Pension Scheme (NPS):

21

www.Personal FN.com

National Pension Scheme which was earlier available only for Government employees was later on May 1, 2009 also introduced for people in the organised (private) sector, as need for deeper participation in the pension contribution (through this product) was felt. For NPS, if you (eligibility age: from 18 to 60) belong to the unorganised sector (i.e. private sector); the contributions done by you towards the scheme would be voluntary, and you can invest in any of the two under-mentioned accounts: Tier-I Account: In this account your minimum investment amount is Rs 500 per contribution and Rs 6,000 per year, and you are required to make minimum 4 contributions per year. Under this account, premature withdrawals upto a maximum of 20% of the total investment is not permitted before attainment of 60 years, however the balance 80% of the pension wealth has to be utilised by you to buy a life annuity. Tier-II Account: For opening this account you will have to make a minimum contribution of Rs 1,000 per annum. The minimum number of contributions is 4, subject to a minimum contribution of Rs 250. However, if you open an account in the last quarter of the financial year, you will have to contribute only once in that financial year. You will be required to maintain a minimum balance of Rs 2,000 at the end of the financial year. In case you dont maintain the minimum balance in this account and do not comply with the number of contributions in a year, a penalty of Rs 100 will be levied. Moreover, in order to have this account, you first need to have a Tier-I account. This account is a voluntary account and withdrawals will be permitted under this account, without any limits. While investing money in NPS, you have two investment choices i.e. Active or Auto choice. Under the Active choice asset class, your money will be invested in various asset classes viz. E (Equity), C (Credit risk bearing fixed income instruments other than Government Securities) and

22

www.Personal FN.com

G (Central Government and State Government bonds); where you will have an option to decide your asset allocation into these asset classes. In case of Auto Choice, your money will be invested in the aforesaid asset classes in accordance with predetermined asset allocation. But remember, the return on your investment is not guaranteed as it is market-linked. At your age of 60 years, you can exit the scheme; but you are required to invest a minimum 40% of the fund value to purchase a life annuity. And the remaining 60% of the money can be withdrawn in lump sum or in a phased manner upto your age of 70 years. In our opinion this product is not very appealing for creating a substantial corpus to meet your retirement need. Rather, if you chalk-out a prudent financial plan with the help of a financial planner, and invest wisely as per the plan laid out (which would mostly recommend you equity allocation at younger age, and then as your age progresses balance the asset allocation between equity and debt instruments), then the corpus which you would be able to create will be substantial enough to meet your retirements needs. Also under this scheme, when one withdraws money, at the age of 60 it is taxable. Deduction: The contributions which you make to the accounts mentioned above, would be eligible for tax benefit but subject to the maximum eligible amount of Rs 1,00,000 p.a. as available under Section 80C.

Tax Planning the assured return way:

Unlike the case presented above (i.e. under tax planning with market-linked instruments), if your age, income, risk profile and financial goals do not permit you to invest in market-linked instruments (for your tax planning) along with the fact that your risk taking ability is low; then you should plan investing in tax saving instruments which offer you assured returns. Under these instruments theres zero risk of erosion to your capital. Following are the tax saving instruments available under this category:

23

www.Personal FN.com

1. Non-Unit Linked Life Insurance Plans:

Life Insurance plans can be broadly classified as pure term life insurance plans and investment-cum-insurance life insurance plans. Pure term life insurance plans are authentic in nature, as they cater to the need of only protection and not investment. Hence such plans offer a high life insurance coverage at low premiums. Generally the term insurance plans offer a policy term of 10, 15, 20, 25 or 30 years. Investment-cum-insurance plans on the other hand, as the name suggest offer you an investment option as well as an insurance option. But here your insurance coverage is far lesser, than the one provided under pure term insurance plans. So, you pay a high premium which gets invested, but insurance coverage on the other hand is meagre. Such insurance plans can be offered in various forms such as ULIPs (as discussed above), endowment plans, money back plan, pension plans etc. We think that while you are considering your insurance needs, you should ideally look at only pure term life insurance plans, thus keeping your insurance needs separate from investment needs. Deduction: Over here too the premium which you paying for your such non-ULIP life insurance plans would be eligible for tax benefit, subject to the maximum eligible amount of Rs 1,00,000 p.a. as available under Section 80C. Moreover, a positive point is that at maturity the amount which you or your beneficiary would receive is tax free (exempt) as per the provisions of Section 10(10D) of the Income Tax Act. 2. Public Provident Fund (PPF):

The PPF scheme is a statutory scheme of the Central Government of India. In order to invest in PPF, you are required to open a PPF account (which is irrespective of your age) at your nearest post office or public sector (nationalized) bank providing this facility. You

24

www.Personal FN.com

can open the account in your name, and also in the name of your wife as well as children. And if do not wish to do so, you can also nominate them; but joint application is not permissible. The account so opened will have an expiry term of 15 years from the end of which the initial investment (subscription) to the account is made. You can invest in the account ranging from a minimum of Rs 500 to a maximum of Rs 100,000 in a financial year in order to enjoy the tax benefit under Section 80C, and the amount to the credit of your account will be entitled to a tax-free interest at 8.6% p.a. Your each deposit in the PPF account should at least be Rs 500, and one has the convenience of depositing in either lump sum or in convenient installments not exceeding 12 such installments. However, a noteworthy point is that it is not necessary to deposit every month and the amount too can be any amount subject to the minimum (Rs 500) and maximum (Rs 1,00,000) amount. The interest to the account will calculated on the lowest balance to the credit of the account between the close of the 5th day and the end of the month, and will be credited to account on March 31, each year. As regards withdrawal from the account is concerned; it is permitted any time after the expiry of 5 years from the end of the year in which initial investment (subscription) to the account is made. However, your withdrawal will be restricted to 50% of the amount which stood to the credit of your account in the immediate 4th year immediately preceding the year of withdrawal or at the end of the preceding year, whichever is lower. And in case if your term of 15 year is over, you can withdraw the entire amount together with the interest accrued till the last day of the month, preceding the month in which application for withdrawal is made. After your term of 15 years is over if you wish to renew your account, you can do so for a period of another 5 years at the rate of interest prevailing then (which can be 8%) without having the compulsion of putting any further deposits in case of extension. The withdrawal in case of extended accounts is permissible once in every financial year. But the total withdrawal should not exceed 60% of the balance accumulated to the account at the commencement of the extension period (of 5 years).

25

www.Personal FN.com

It is noteworthy that if you are risk averse, then this product is best in its class for tax planning. Moreover, it also offers you an appealing tax-free return of 8% p.a. (compounded annually). Deduction: The contributions which you make to the accounts mentioned above, would be eligible for tax benefit but subject to the maximum eligible amount of Rs 1,00,000 p.a. as available under Section 80C.

3. National Savings Certificate (NSC):

The NSC is also a scheme floated by the Government of India, and one can invest in the same through your nearest post offices, as the scheme is available only with the India Post. The certificates can be made in your own name, jointly by two adults, or even by a minor (through the guardian), and has a tenure of 5 years or 10 years. The minimum amount which you can invest is Rs 100, with no maximum limit to the same. NSC maturing in 5 years offers interest @ 8.4% p.a. compounded half-yearly whereas NSC maturing in 10 years offers interest @ 8.7% p.a. compounded half-yearly, thus giving you an effective interest rate of 8.58% p.a. and 8.90% p.a. The interest income accrues annually and is reinvested further in the scheme till maturity (i.e. 5 or 10 years) or until the date of premature withdrawals. Premature withdrawals are permitted only in specific circumstances such as death of the holder. Deduction: Your investment in NSC is eligible for a deduction of upto Rs 100,000 p.a. under Section 80C. Furthermore, the accrued interest which is deemed to be reinvested qualifies for deduction under Section 80C. However, the interest income is chargeable to tax in the year in which it accrues. But in case if you have no other income apart from interest income, then in order to avoid Tax Deduction at Source (TDS), you can submit a declaration in Form 15-H (for general) or Form 15-G (for senior citizens) as applicable.

26

www.Personal FN.com

4. Bank Deposits and Post Office Time Deposits:

The 5-Yr tax saving bank fixed deposits available with your bank is also eligible for a deduction under Section 80C. The minimum amount that you can invest is Rs 100 with an upper limit of Rs 1,00,000 in a financial year. The interest rates offered by some of the popular banks are as under:

Interest Rate(s) (%) Senior General Citizens 8.25 9.25 8.75 9.50 9.25 9.25 9.75 9.25 10.25 9.75

Bank Name Axis Bank Ltd. HDFC Bank Ltd. ICICI Bank Ltd. IDBI Bank Ltd. State Bank of India

(Source: Respective banks website, Personal FN Research)

However, the interest earned here would be subject to tax deduction at source, making it detrimental for your tax planning, but again you can submit a declaration in Form 15-H (for general) or Form 15-G (for senior citizens) as applicable for not deducting tax at source. Similarly 5 Yr Post Office Time Deposits (POTDs) also offer you a tax benefit under Section 80C. The account can be opened by you either in single name or jointly or even by a minor (through a guardian) who has attained the age of 10. The minimum investment amount is Rs 200, and there isnt any upper limit. However, the investment amount over Rs 1,00,000 will not be eligible for any tax benefit. A 5-Yr POTD earns a return of 7.5% p.a. (compounded quarterly), but paid annually. Hence, say if deposit an amount Rs 10,000, the interest income which you will fetch would approximately be Rs 771 p.a. As regards premature withdrawals are concerned, they are permitted only after 6 months from the date of deposit with a penalty in the form of loss of interest.

27

www.Personal FN.com

Deduction: Your investment in the both these schemes are eligible for a deduction of upto Rs 1,00,000 p.a. under Section 80C. But as mentioned above, the interest earned on your investments will be subject to tax deduction at source. However, in case if you have no other income apart from interest income, then in order to avoid Tax Deduction at Source (TDS), you can submit a declaration in Form 15-H (for general) or Form 15-G (for senior citizens) as applicable.

5. Senior Citizens Savings Scheme (SCSS):

Well, the SCSS is an effort made by the Government of India for the empowerment and financial security of senior citizens. So, in case if you are over 60 years old, you are eligible to invest in this scheme. Moreover, if you have attained 55 years of age and have retired under a voluntary retirement scheme; then too you are eligible to enjoy the benefits of this scheme. In order to avail the benefits of this scheme, you are required to open an SCSS account (either in a single name, or jointly along with your spouse) at your nearest post office or any nationalised bank. You can do a onetime deposit under this scheme subject to the minimum investment amount of Rs 1,000 and a maximum of Rs 15,00,000. The maturity period provided for this scheme is 5 years offering a rate of interest of 9% p.a. payable on a quarterly basis (i.e. on March 31, June 30, September 30 and December 31) every year from the date of deposit. After one year from the date of opening the account, premature withdrawals are permitted. If you withdraw between 1 and 2 years, 1.5% of the initial amount invested will be deducted. And in case if you withdraw after 2 years, 1.0% of the balance amount is deducted. Deduction: Your investments upto Rs 1,00,000 in SCSS are entitled for a deduction under Section 80C. However, the interest earned by you would be subject to tax deduction at source. But in case if you have no other income apart from interest income, then in order to avoid Tax Deduction at Source (TDS), you can submit a declaration in Form 15-H (for general) or Form 15G (for senior citizens) as applicable.

28

www.Personal FN.com

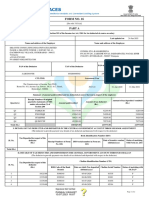

Options Galore - Snapshot of section 80C

Schemes Type Interest Rate Term Min Max Investment Premature Withdrawal Section No.

Tax Saving Funds/ ELSS Unit Linked Insurance Plans (ULIPs) National Pension Scheme

Growth Growth Growth

Tax planning with market-linked instruments Term: Ongoing Market-Linked Returns Rs 500 - No upper Limit Lock-in-period: 3 years Market-Linked Returns Market-Linked Returns Term: 10 - 20 years; Lock-in-period: 5 years 30-35 years Premium varies from scheme to scheme Rs 6,000

No Yes Yes

80C 80C & 10(10D) 80C

Public Provident Fund National Savings Certificate 5 Yr National Savings Certificate 10 Yr Bank Deposits

Recurring Deposit Deposit Fixed Deposit

8% p.a. 8.4% (compounded half-yearly) 8.7% (compounded half-yearly) 8.25% to 10.25% p.a. 1-YR: 6.25%; 2-YR: 6.50%; 3-YR: 7.25%; 5-YR: 7.50%; (compounded quarterly & paid annually 9% p.a. (payable quarterly) Sum Assured (i.e. Insurance Cover)

Tax planning the "assured return" way 15 years 5 years 10 years 5 years

Rs 500 - Rs 70,000 Rs 100 - No upper Limit Rs 100 - No upper Limit No upper Limit

Yes No No No

80C 80C 80C 80C

Post Office Time Deposit

Fixed Deposit

1-5 years

Rs 200 - No upper Limit

Yes

80C

Senior Citizens Savings Schemes Non-ULIP Insurance Plans

Deposit

5 years 5-40 years (Source: Personal FN Research)

Rs 1,000 - Rs 15,00,000 Premium depends upon the insurance cover

Yes Varies from policy to policy

80C 80C & 10(10D)

29

www.Personal FN.com

V - Thinking beyond Section 80C

Well, most people think that tax planning ends with Section 80C; but please note that theres more to tax planning than just investment instruments specified under Section 80C. Our Income Tax Act, 1961 also considers the humane side of our life and also gives deduction for contributions made for financing our countrys infrastructure development. So, in case if you pay your medical insurance premium, incur expenditure on the medical treatment of a dependant handicapped, donate to specified funds for specified causes, contribute in monetary form to political parties or electoral trusts, take a loan for pursuing higher education or if you are an individual suffering from specified diseases, then all this too can help you effectively plan your tax obligations, thus optimally reducing your tax liability. So, lets understand how each of the above expenses for a cause or an investment, can help you in effective tax planning. Herein below is the list of some major ones. 1. Premium paid for medical insurance (Section 80D):

The premium paid by you on medical insurance policy (commonly referred to as a mediclaim policy) to cover your spouse and you, dependent children and parents against any unexpected medical expenses, qualifies for a deduction under Section 80D. The maximum amount allowed annually as a deduction (from your GTI) is Rs 15,000, in case if you pay for yourself, spouse and dependent children. And if you are a senior citizen, the maximum deduction gets extended to Rs 20,000. Further, if you pay medical insurance premium for your parents (irrespective of whether they are dependant or not on you), you can claim an additional deduction of upto Rs 15,000 under this section. So, for example, if you pay a premium of Rs 15,000 for yourself and Rs 15,000 for your parents, you will be eligible for a total deduction of Rs 30,000. However, while paying the premium you need to ensure that the payment is made in any mode other than cash.

30

www.Personal FN.com

2.

Maintenance including medical treatment of a handicapped dependent (Section 80DD):

If you have incurred any expenditure in the form medical treatment (including nursing), training and rehabilitation for a handicapped dependent suffering from disability, then the expenditure so incurred by you qualifies for deduction under Section 80DD of the Income Tax Act. Similarly, if you have deposited a sum of money under any scheme framed in this behalf by LIC (Life Insurance Corporation of India) or any other insurer or administrator or a specified company (approved by the Board), for maintenance of the dependent being a person with disability; also qualifies for a deduction under Section 80DD. The quantum of deduction here depends upon the severity of the disability suffered by the dependent. Hence, if the dependent is suffering from 40% of any disability *Specified under section 2(i) of the Person with Disability (Equal Opportunities, Protection of Rights and Full Participation) Act, 1955], then you would be entitle to a deduction of a fixed sum of Rs 50,000 p.a. from your GTI irrespective of the expenditure incurred or amount deposited. Similarly, if the dependent is suffering from severe disability (i.e. 80% of any disability), then you claim a higher deduction of fixed sum of Rs 100,000, from your GTI irrespective of the expenditure incurred or amount deposited. It is noteworthy that over here the term dependent being a person with disability means your spouse, children, parents, brothers and sisters. Moreover, in order to claim the deduction you need to submit a medical certificate issued by a medical authority along with your return of income. Also if you are claiming a deduction in your tax returns for such an expenditure incurred or amount deposited, your dependent cannot claim a deduction under Section 80U in case hes (handicapped dependent) filing his tax returns separately.

31

www.Personal FN.com

3.

Expenditure incurred on your medical treatment (Section 80DDB):

If you have incurred expenditure on your medical treatment or for your dependents, then too the expenditure so incurred, makes you eligible for deduction under Section 80DDB of the Income Tax Act. The deduction from your GTI, which you are entitled to, is Rs 40,000 or the amount actually paid, whichever is lower. And if you are a senior citizen, then you are eligible for a deduction of Rs 60,000 or the amount actually paid, whichever is lower. It is noteworthy that over here the term dependent means your wholly or mainly dependent spouse, children, parents, brothers and sisters. Also, in order to claim a deduction under this section, you are required to submit a medical certificate from a doctor (neurologist, oncologist, urologist, haematologist, immunologist, or any other specialist) working in a Government hospital. 4. Repayment of loan taken for pursuing higher education (Section 80E):

While pursuing a personal goal of enrolling for higher education in order to be competitive enough to meet your financial goals; the Income Tax Act offers you deduction (from your GTI), when you take a loan to fulfil such dreams. Sure, you can also take an education loan for your wifes or childrens education or for any person (minor) for whom you are the legal guardian. But that makes you eligible for deduction under Section 80E of the Income Tax Act, to the extent of the interest paid on such a loan taken. The deduction is available for a maximum of 8 years or till the interest is paid, whichever is earlier. So, to simplify it further, the deduction is available from the year in which you start paying the interest on the loan, and the seven immediately succeeding financial years or until the interest is paid in full, whichever is earlier.

32

www.Personal FN.com

It is noteworthy that, here the term higher education means full-time studies for any graduate or post-graduate course in engineering (including technology / architecture) , medicine, management or for post-graduate courses in applied science or pure science including mathematics and statistics. But now from present Finance Act of 2011 its scope is extended to cover all fields of studies (including vocational studies) pursued after passing the Senior Secondary Examination or its equivalent from any school, board or university recognised by the Central or the State Government or local authority or any other authority authorised by the Central or the State Government or local authority to do so. However, no deduction is available for part-time courses 5. Donations to certain funds and charitable institutions (Section 80G):

As mentioned earlier that our Income Tax Act, 1961 considers the humane side of our life, and so if on humanitarian grounds you donate to certain specified funds, charitable institutions, approved educational institutions etc, the donation amount qualifies for deduction under this section. The deductions allowed can be 50% or 100% of the donation, subject to the stated limits as provided under this section. For example, donations to National Defence Fund set up by the Central Government are allowed 100% deduction, while for Prime Minister Drought Relief Fund are allowed at 50%. Under the Income Tax Act, if you make donations to any of the host of notified funds and / or charitable institutions, you are eligible for deduction under Section 80G.

33

www.Personal FN.com

Funds / Charitable Institutions National Defence Fund Prime Ministers National Relief Fund Prime Ministers Armenia Earthquake Relief Fund Africa (Public Contributions India) Fund National Foundation for Communal Harmony Any approved university or educational institution Maharashtra Chief Ministers Relief Fund and Chief Ministers Earthquake Relief Fund Any fund set up by Gujarat State Government for providing relief to earthquake victims Jawaharlal Nehru Memorial Fund Prime Ministers Drought Relief Fund National Childrens Fund Indira Gandhi Memorial Trust Rajiv Gandhi Foundation (Source: Personal FN Research)

Amount Deductible 100% 100% 100% 100% 100% 100%

100% 100% 50% 50% 50% 50% 50%

Note: There are also other funds and charitable institutions that are eligible for deduction under Section 80G. The full list is available here: http://www.incometaxindia.gov.in/Acts/INCOME TAX Act/80g.asp

In order to claim deduction under this section, you are required to attach a proof of payment along with your return of income. 6. Rent paid in respect property occupied for residential use (Section 80GG):

If you are a self employed or a salaried individual who is not in receipt of any House Rent Allowance (HRA), and is paying a rent for an accommodation (irrespective whether furnished or unfurnished) occupied for residential use, then you can claim a deduction under this section. But as a pre-condition for availing deduction under this section, you or your spouse or your minor child must not own any residential accommodation either in India or abroad. And the deduction which will be available to you under this section is the least of: 25% of the total income or, Rs 2,000 per month or, Excess of rent paid over 10% of total income

34

www.Personal FN.com

7.

Contributions made to any political parties or electoral trust(Section 80GGC):

Say, if you have some nepotism for any political party or electoral trust as you appreciate the work done by them; and therefore decide to make a monetary contribution to the party or electoral trust, then the amount so contributed would be eligible for a deduction under this section. 8. Specified disability(s) (Section 80U):

As said earlier, that our Income Tax Act, 1961 considers the humane side of life; so if you as an individual resident in India is suffering from any specified disability i.e. not suffering from not less than 40% any specified diseases given below, then you would be eligible for deduction under this section. Specified disabilities: Blindness Low vision Leprosy-cured Hearing impairment Locomotor disability Mental retardation Mental illness

The deduction available under this section is flat (i.e. fixed) Rs 50,000, immaterial of the expenditure incurred. But if the disability is severe in nature (i.e. 80% or above), then one is entitled to flat (i.e. fixed) deduction of Rs 1,00,000. However in order to avail of the deduction, one needs to file copy of certificates issued by the medical authority, at the time of filing returns.

35

www.Personal FN.com

9.

Investment in long-term infrastructure bonds (Section 80CCF):

In the Finance Act 2010, the Government introduced this new section, (and even extended the benefits of this section in the Finance Act, 2011) which enables you to invest an additional sum of money in long-term infrastructure bonds (notified by the Central Government), and avail a deduction over and above the investment limit of Rs 1,00,000 specified under section 80C. But under this section from a tax deduction purpose only a sum upto Rs 20,000 would be eligible for a deduction.

Options Galore - Snapshot of deduction under other 80s

Section 80D Quick Description of Deduction Premium paid for medical insurance Limit Maximum upto Rs 15,000 or Rs 20,000 in case of senior citizen Rs 50,000, irrespective of the amount incurred or deposited. However in case of disability of more than 80% a higher deduction of flat Rs 75,000 shall be allowed. Actual incurred, with a ceiling of up to Rs 40,000 or Rs 60,000 in case of senior citizen, whichever is lower Maximum deduction for interest paid for a maximum of 8 years or till such interest is paid, whichever is earlier Maximum deductions allowed can be 50% or 100% of the donation, subject to the stated limits as provided under this section Maximum deduction allowed is least of the following: Rs 2,000 per month; 25% of total income; Excess of rent paid over 10% of total income Amount donated to political party is fully exempt Rs 50,000, irrespective of the amount incurred or deposited. However in case of disability of more than 80% a higher deduction of flat Rs 100,000 is allowed. Maximum deduction allowed is Rs 20,000.

80DD

Maintenance including medical treatment of a handicapped dependent who is a person with disability

80DDB

Expenditure incurred in respect of medical treatment

80E

Repayment of loan taken for pursuing higher education

80G

Donations to certain funds and charitable institutions

80GG

Rent paid in respect of property occupied for residential use Contribution made to any political parties or electoral trust

80GGC

80U

Person suffering from specified disability(s)

80CCF

Investment in long-term infrastructure bonds

(Source: Personal FN Research)

36

www.Personal FN.com

VI - Your home loan and tax planning

While all of us have a dream of buying a dream home or constructing or reconstructing or repairing our homes, its also important to consider the tax angle when we decide to do any of these activities. For some, the amount of wealth they have created allows buying or constructing or reconstructing or repairing or renewing homes from our own funds - i.e. without opting for a home loan; but again doing so precludes you to avail of the tax benefit, which are attached if one takes a home loan for such activities. But again just to reiterate please dont rule out the financial planning aspect of number of years left with you for repayment of your home loan. Yes, our Income Tax Act, 1961 too considers our desire to buy or construct or reconstruct or repair or renew our dream home and gets a little benevolent, if one avails of a loan to fulfill these desires for ones dream home. The Act encourages you to buy, to do the aforementioned activities (for your home) with a loan, as it provides you with tax benefits (that come along with it). Both, repayment of principal amount and payment of interest are eligible for tax benefit. The repayment of principal amount, makes you eligible to claim a deduction upto a sum of Rs 100,000 under section 80C; and that benefit is available with you immaterial of the fact whether you stay in the same property (Self Occupied Property - SOP), or has let it out on rent (Let Out Property LOP). As far as the payment of interest amount (for the loan amount availed) is concerned, its available for deduction under section 24(b). So, if you buy or acquire a house and decide to stay in the same (SOP) then the maximum sum Rs 150,000 p.a. can be availed by you as a deduction for interest. However, if you have let out the property on rent (LOP), then the actual interest payable is eligible for deduction, thus not being subject to any maximum limit.

37

www.Personal FN.com

Similarly, if you have taken a loan for the purpose of reconstructing, repairing or renewing the property, the amount of deduction under section 24(b) which youll be eligible for will be restricted to Rs 30,000, irrespective whether you want to stay in it or let it out on rent. Lets understand with an example how home loan taken for buying your dream home to stay in it (SOP) can reduce the total tax payable by you. Lets assume you earn Rs 650,000 p.a. by way of salary and have taken a home loan of Rs 40,00,000 for buying your dream home and you have decided to stay in it. The home loan is for tenure of 20 years and the rate of interest is 9.0% p.a. and the Equated Monthly Installments (EMI) is Rs 35,989.

Tax savings on account of home loan

Gross Annual Salary (Rs) Loan Amount (Rs) Tenure (yrs) Rate of Interest p.a.( % ) EMI (Rs) Annual Interest Paid (Rs) Principal paid in the 1st year (Rs) Tax paid without availing home loan benefits (Rs) Tax paid after availing home loan benefits (Rs) Tax Savings (Rs)

(*tax calculated after giving effect for education cess) (Source: Personal FN Research)

650,000 4,000,000 20 9.0 35,989 356,960 74,908 45,320* 24,720* 20,600*

The above table clearly shows the benefit of availing a housing loan if you are contemplating buying a house. The total tax payable on your income without a home loan works out to Rs 45,320. The same with a home loan works out to Rs 24,720, thus saving you Rs 20,600.

38

www.Personal FN.com

Maximise your tax benefits Now, lets delve deeper into the benefits available. Your interest amount in the first year is Rs 356,960 which is much more than the maximum amount of Rs 150,000 allowed as a deduction. Your principal repayment amount of Rs 74,908 is within the Rs 100,000 limit allowed under Section 80C. However, it takes away a big chunk of the amount eligible under Section 80C and leaves you with little (i.e. Rs 25,092) to claim towards other tax saving instruments such as PPF, NSC, Life Insurance, ELSS, POTDs. And now consider, you have invested in the following manner under Section 80C.

Particulars Principal Repayment Life Insurance PPF EPF NSC Total Claim deductions under Section 80 C Contributed but can't claim tax benefit Amt ( Rs) 74,908 10,000 20,000 10,000 20,000 134,908 100,000 34,908

(Source: Personal FN Research)

The amount eligible is more than what you can claim. Yes, you have an option of not investing in PPF, POTDs or NSC but these are assured return schemes with attractive returns. And as said earlier your portfolio should always comprise of a mix of assured return and market-linked return instruments, in a composition which is in accordance to your financial goals and willingness to take risk. Hence, ignoring these investment avenues may not be prudent from financial planning perspective. So, now the next question is how do you claim maximum available deductions to minimise your tax liability? The answer lies in taking a joint home loan. A joint home loan can be taken with your spouse or relative.

39

www.Personal FN.com

Lets understand with an example how a joint home loan with your spouse can help reduce your tax liability. Assume your spouse and you decide to take a joint home loan of the same amount as mentioned above and shares the loan in ratio of 50:50.

Particulars Gross Salary (Rs) Home Loan Amount (Rs) Tenure (yrs) Rate of Interest p.a. EMI (Rs) Annual Interest Paid (Rs) Principal paid in the 1st year (Rs) Life Insurance (Rs) Other contributions towards tax-efficient instruments (Rs) Total amount contributed under section 80C & 24(b) (Rs) Amount which cannot be claimed to reduce tax liability (Rs) Tax Paid when: (Rs) 1. No home loan benefit availed 2. Single home loan benefit availed 3. Joint home loan benefit availed Total Household Tax Savings (Single Home Loan) (Rs) Total Household Tax Savings (Joint Home Loan) (Rs)

spouse are in the ratio 50:50 (Source: Personal FN Research)

You Your Spouse 650,000 650,000 4,000,000 20 9.0% 35,989 178,480 178,480 37,454 37,454 10,000 10,000 50,000 247,454 28,480 53,560 24,720 24,982 20,600 57,156 50,000 247,454 28,480 50,470 21,630 31,509

Note: * calculations on the done assuming the spouse here is a woman. Assumption made that home loan and the EMI paid by you and your

Now since your spouse is a co-owner and has contributed towards repayment of the loan she too would be eligible for the tax benefit (both principal and interest component). So, as indicated in the table above, if the principal and interest amount is shared equally between your spouse and you, the contribution per person comes to Rs 37,454 for principal repayment and Rs 178,480 for interest payment. The principal amount is now half of what was

40

www.Personal FN.com

earlier which allows you to claim deductions towards other contributions. At the same time it reduces the tax liability to a significant extent and leads to a household saving of upto Rs 57,156. As compared to a Single home loan, a Joint home loan leads to a saving of Rs 36,556. From the tax planning point of view, it is vital to ensure that the higher earning member pays higher portion of the home loan EMI. This is because the tax benefit accrues in proportion to your contribution towards loan repayment. So, remember if you plan to buy a house, it makes sense to include your spouse as a co-owner; especially if your spouses income is taxable. This will result in higher tax saving in addition to boosting your loan eligibility.

41

www.Personal FN.com

VII - House Property and taxes

After showing benevolent side by providing you with the tax benefit, for availing a home loan (to buy or construct or reconstruct or repair or renew), the Income Tax Act then eyes the *house property owned by you for taxing the same. And this applies especially when you have an income from let out property, or in case where you have more than one property which arent let out on rent, but which are vacant (known as Deemed to be Let Out Property DLOP).

*Owning a farm house, which forms a part of your agriculture income, is not brought under the tax net.

Now you may ask How can the income tax authority tax me, if I have not let out my property on rent? Well, thats because annual value of your property after proving for deduction available under Section 24(b) is taxed under the head income from house property. A noteworthy point is, term house property includes building(s) or land appurtenant (i.e. attached) thereto also. And now the next question which may be popping on your mind is What is annual value of the property and which deductions are available? Annual Value: To understand that better let us take a case where you have let out the property (LOP) and then DLOP. Let Out Property (LOP)

In cases where you are enjoying a regular income from the property in the form of rent, then the annual value of your property would be calculated by adopting the following steps:

42

www.Personal FN.com

a) Find out the reasonable expected rent of the property ( which is municipal rent or fair rent, whichever is higher) b) *Consider rent actually received / receivable c) Take whichever is higher from a) and b) d) Calculate loss due to vacancy ( i.e. in case if the property is vacant for period(s) during the financial year) e) The difference between step c) and step d), will be your annual value which is here referred to as the Gross Annual Value (GAV) Now when we go one step further and minus the municipal taxed paid by you (on the property) from step e) youll arrive at the Net Annual Value of your property. But to avail the deduction for municipal taxes; they have to paid by the landlord only.

*Note: Rent earned by you from the property is calculated after subtracting unrealised rent from the tenant (i.e. in case if he defaults to pay)

Deemed to be Let Out Property (DLOP)

In case you own more than one house, and the other house(s) apart from the one where you are staying are vacant throughout the month, then the other house property(s) would be considered as a Deemed to be Let Out Property(s) - DLOPs. Moreover, you would be liable to pay tax on such property(s) after having calculated the Gross Annual Value (GAV), which will be calculated in the same way as for LOP. But the only difference being that, here rent would be the standard rent calculated as per the municipal laws. Thereafter, if you as the landlord are paying any municipal taxes towards theses properties, then those would be subtracted to obtain the Net Annual Value (NAV). Remember, over here in case you have multiple DLOPs, then you have an option to consider one of property as an SOP and the rest would be considered as DLOPs as the present Income Tax law. So, say you have 4 such DLOPs then you should be ideally select the property with the highest GAV as an SOP property, as this optimise your tax planning exercise, as the remaining properties available with you will have a lower GAV.

43

www.Personal FN.com

Self Occupied Property

You need not worry here if you are occupying the property, throughout the financial year for your stay (i.e residential use) and thus the NAV of the property will be considered as Nil. But if you are occupying the property for some part of the year, and the rest of the year you have earned an income by letting it out, then proportionately for the rest of the year when the property was let out, the calculation of annual value would be applicable as that of LOP. Deductions: After having calculated the Net Annual Value (NAV) as seen above, you are eligible to claim deductions under Section 24(b), which further reduces your taxability under this head of income. You broadly get the following deductions: Standard Deduction [Section 24(a)] Owning a home and maintaining the same costs you money. But irrespective of the fact whether you have incurred any expenditure or not to do so, you will be eligible to claim a flat deduction of 30% calculated on the NAV of the property. And this deduction is of specific use if ones property is LOP and / or DLOP. In case if the property is SOP, then you are not eligible to claim any deduction as the NAV of your SOP is Nil. Interest on borrowed capital [Section 24(b)] As reiterated above too (in the home loan section), if one wisely takes an home loan for buying a house property then the interest so paid on the borrowed capital will make you eligible for deduction under Section 24(b), irrespective whether the house property is SOP, LOP or DLOP. In case of SOP the income from house property will be negative income, (if interest is paid on capital borrowed by you to buy or construct or reconstruct or renew or repair the house), which will enable you to reduce your overall Gross Total Income (GTI). In case other properties

44

www.Personal FN.com

i.e., LOP and DLOP the income from house property will be positive, but would be reduced to the extent to standard deduction and interest paid. The quantum of deduction depends upon the purpose for which you take a loan i.e. purchase, construction, reconstruction, repair or renewals, and also the type of property i.e. SOP, LOP or DLOP. Hence, in case you have taken a loan for the purpose of purchase or acquisition of the house which is an SOP, then you we eligible for a maximum deduction of a sum of Rs 1,50,000. But if the loan is taken for the purpose of repair, renewal, or reconstruction, then eligible deduction is restricted to Rs 30,000. Now if the property is LOP or DLOP, then you do not have any maximum restriction for claiming interest so it can be above the otherwise limit of Rs 1,50,000, irrespective of the usage i.e whether for the purpose of purchase, construction, reconstruction, repair or renewals.

Remember, while everyone buys house property(s), it is important to avail the benefits available under the Income Tax Act, wisely as this would enable in optimally saving your tax liability, and off course enjoy the fruits of your investment made too and / or enjoy the comfort of your dream house too.

45

www.Personal FN.com

VIII - Save tax on your hard earned salary

While many of you in employment take enormous efforts to earn a salary, it is also equally important in our opinion that you restructure your salary well, in order to save tax on your hard earned salary. And mind you if you do so youll have a greater Net Take Home (NTH) pay, which will allow you to streamline your finances well and also buy physical assets such as your dream house and a dream car. Many of you today get a big fat pay cheque, but it is important that one restructures the vital components of salary well in order to be saved from being taxed. The vital components of salary, where restructuring is requires as under: Basic Salary: While this is the base of your head of income income from salary, it is important that you have your basic salary set right. This is because the basic salary constitutes 30% 40% of your Cost-to-Company (CTC). So, having a very high basic component may lead to having a high tax liability in absolute Indian rupee terms. But similarly if you reduce your basic salary considerably, then you would lose out with the other benefits such as Leave Travel Allowance (LTA) and superannuation benefits associated with your salary. House Rent Allowance (HRA):

If you are paying rent for an accommodation, and if your organisation extends you HRA benefits, then this is another vital component which can help you to reduce your tax liability. But it should be noted that you cannot pay rent for the house which you own and if you are residing in it.

46

www.Personal FN.com

Hence, now on the other if you are staying in a rented house house and you are the one paying the rent, then HRA exemption [under Section 10(13A)] can be availed for the period during which you occupy the rented house during the financial year. However in order to obtain an exemption, you are required to submit appropriate and adequate proof of payment of rent for the entire period for which you want to claim exemption. But, if you as an employee is drawing an HRA upto Rs 3,000 per month, you are not

required to provide a rent receipt to your employer. The maximum exemption which you can enjoy for HRA is as under:

In Chennai/ Delhi/ Kolkata/ Mumbai Least of: Actual HRA Rent paid in excess of 10% of salary* 50% of salary*

(Source: Personal FN Research)

In other cities Least of: Actual HRA Rent paid in excess of 10% of salary* 40% of salary*

*Salary for this purpose includes basic salary + dearness allowance (if in terms of service)

Here a noteworthy points is, if you are rent is very high and if you are not fully covered by the HRA limit, then it would be wise to pick a company leased accommodation (if the company in which you work in offers so), as this company leased accommodation would constitute to be the perk value and would be taxed @ 15% of your gross income. Sure, the perk value is taxable but it still works out to be more effective for tax planning, than opting for a HRA than doesnt fully cover your rent. Leave Travel Concession (LTC):

While you may be fond of opting for a leave and travel with your family for a holiday, dont forget to assess what tax benefits are extended to you for doing so. The Income Tax Act provides you tax concession if you have actually incurred expenditure on your travel fare anywhere in India either alone or along with your family members (i.e. your spouse, children, parents, brothers and sisters who mainly or wholly dependent on you).

47

www.Personal FN.com

The exemption extended to you under the Act is for two journeys performed in a block of four calendar years. And the current block of four calendar years is from 2010 to 2013 (i.e. from January 1, 2010 to December 31, 2013). As per the present Income Tax Rule, the exemption would be available to you in the following manner:

Particulars Where the journey is performed by air Amount exempt Amount of "economy class" airfare of the national carrier by the shortest route to the place of destination or amount actually spent, whichever is less. Amount of air-conditioned first class rail fare by the shortest route to the place of destination or amount actually spent, whichever is less. Air-conditioned first class rail fare by the shortest route to the place of destination or amount actually spent, whichever is less.

Where the journey is performed by rail Where the places of origin of journey and destination are connected by rail and journey is performed by any mode of transport other than air. Where the place of origin of journey and destination (or part thereof) are not connected by rail > Where a recognised public transport exists

First class or deluxe class fare by the shortest route or the amount spent, whichever is less. Air-conditioned first class rail fare by the shortest route (as if > Where no recognised public transport system exists the journey is performed by rail) or the amount actually spent, whichever is less. (Source: Personal FN Research)

In case you have not availed of a LTC and have not travelled in any of the four calendar year block period, then you are allowed to carry-over the concession to the first calendar year of the next block, but for only one journey. It is vital that you utilise your leaves wisely and travel to any of your loved holiday destination in India, as this will not only de-stress you, but also help you in reducing tax liability. After you have returned from your journey, in an excitement please do not tear your travel tickets / boarding pass (for air travel) as you need to submit them to your employer so that your tax liability can be reduced.

48

www.Personal FN.com

Education allowance:

If you are married with kids, and if your employer is providing with education allowance, then do not refrain from availing it, as this can again help you in reduction of your tax liability. The exemption extended to you under the Income Tax Act is Rs 100 per month for a maximum of two children (i.e. in other words Rs 2,400 p.a. totally). Similarly, if your children are staying in a hostel then a maximum of Rs 300 per month per child but subject to a maximum of two children will be available to you as an exemption (i.e. Rs 7,200 per month). Food Coupons / Cards: While you may be tempted to increase your NTH (in the cash form) you should not ignore to avail the food coupon / card benefit, if your employer provides one. This is because effective utilization of the same will enable you to effectively reduce your tax liability along with getting the feeling of being pampered by your employer. The exemption amount which you can enjoy is Rs 50 per meal available only in respect of meals during office hours. However, the exemption is also available in case your employer provides you food vouchers / cards of value of which can be used at eating joints. The exemption limit in this case is restricted to Rs 2,500 per month for a food voucher / card value. So remember, if your employer is providing you food coupon / card dont refrain from availing the same for a maximum voucher value of Rs 2,500 every month. Medical reimbursement:

During the year if you and / or family members have visited a doctor or bought medicines from a chemist, then all the expenditure incurred by you and / or your family members during the year for medical purpose too, would help you in reducing your tax liability.

49

www.Personal FN.com