Académique Documents

Professionnel Documents

Culture Documents

Sugar #11 November 6, 2007

Transféré par

Gul AhmedDescription originale:

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Sugar #11 November 6, 2007

Transféré par

Gul AhmedDroits d'auteur :

Formats disponibles

Sugar #11 Daily Market Report

All material herein, including the summarized Terms and conditions of the transaction is for discussion purposes only.

Tuesday, 06 November 2007

Month Closing Price Change Implied Vol Skew Up Skew Down Historical Vol Daily move from Implied Vol Daily move from Historical Vol

H8 K8 N8 V8

10.05 10.23 10.24 10.62

0.15 0.13 0.11 0.10

21.12% 19.72% 18.91% 18.82%

0.40% 0.35% 0.30% 0.30%

0.40% 0.35% 0.30% 0.30%

15.45% 13.42% 12.06% 10.03%

0.13 0.13 0.12 0.13

0.10 0.09 0.08 0.07

Notes: Skew up and down is for strikes +/- .5 strikes only. Historical Vol is calculated as the 20-day historical vol Calculation for average daily move is = Vol x Price / sqrt (252)

Numbers on Futures Today's Volume (As of 1 pm) Previous Days AA/EFS Mar 08 1,732 May 08 7 July 08 6 Oct 08 106 42,487 lots (9,855 pit, 32,623 ICE) 68,719 lots (3,641 pit, 65,078 ICE) March Trading Range Total Open Interest (Change) 9.99-10.08 (9 points) 760,932 11,359

London Whites Premium Z7/H8 54.50/55.25 H8/H8 62.00/63.00

Futures Spread (end of day values): Mar8/ May8 -19/-17 May8/ Jul -1/0 Jul8/ Oct8 -39/-37 Oct8/ Mar9 -61/-58 Mar9/ May9 -16/-13

Eye on Options Macquarie bought 600 H 10p at 40. Settled at 40 on 21.15% IV. Macquarie bought 400 H 11c vs. futures at 10.00. Settled at 15 on 22.84% IV. J.P. Morgan sold 2000 H 11c vs. futures at 10.00. Settled at 15 on 22.84% IV. East Coast sold 500 H 10.5p at 71. Settled at 70 on 21.52% IV. J&H sold 500 K 10p at 40. Settled at 41 on 19.84% IV. J&H bought 300 H 10 straddles at 84. Settled at 85 on 21.17% IV. Calls 8,553 16,062 Puts 4,413 15,519 OFS 0 175 Volatility Matrix

Month H8 K8 N8 V8 H9 Settlement 10.05 10.23 10.24 10.62 11.21 Change in futures 0.15 0.13 0.11 0.10 0.08 Historical Volatility 15.59% 13.42% 12.06% 10.03% 10.07% Implied Volatility 21.17% 19.72% 18.91% 18.82% 19.92% Previous 20.89% 19.26% 18.81% 18.36% 19.80% Change 0.28% 0.46% 0.10% 0.46% 0.12% Straddle Settlement 10.00 10.00 10.00 10.00 10.50 85 104 117 146 192

Todays Volume (est.) Previous Day

Macquarie Futures USA Inc. Page 1 of 3

My Spin March Sugar #11 settled up 15 points at 10.05 cents per pound on strong buying spurred on by record highs in Crude Oil and the CRB Index, as well as a weakening US dollar. The market opened 10 higher on fund buying, but found trade and local sellers all too willing to take profits at those levels. March briefly got below 10.00 in the mid-morning but found new life late in the day settling at 10.05. Todays electronic session closed at 10.07 (3:15 EST), trading as high as 10.11 on the ICE screen. Volume was light at 42,000 lots and the rally was not all that urgent. The situation remains the same, with funds and specs buying based on the strength of Crude and other commodities, yet current cane crush, harvest, and acreage numbers for 2008 seem bearish. We are starting to see a discrepancy between the 2008 and 2009 contracts based on Indian acreage conversion (to more wheat) and increased Brazilian ethanol demand affecting the latter. The bulls needed this settlement, and further probes to 10.25 are expected if Crude continues its run to $100 a barrel. March finds support at 9.99, 9.97-9.96, 9.95, 9.93 and 9.90 cents, with resistance at 10.08, 10.10, 10.12, 10.15 and 10.17 cents. In the options pit volatility was unchanged on light volume of 13k option contracts. March at the money implied vol remained at 21% with the 10 straddle going out with a market of 84-86. All of the other contract and back months were unchanged as well. Well the options market took a breather today as most players seemed disinterested with only a 9 point intraday range. We did open up 15 points higher making yet another case for owning gamma/vol at these levels. The trade of the day was one brokerage firm selling over 2k March 11 calls at 14 and 15 tied to futures at 10.00 at around 22% to 22.50% effectively bringing the skew in. Ironically, yesterday the same brokerage firm bought the same calls with futures at 9.90 at 14 and 15 points (24.50%) aggressively forcing the skew out. Go figure? You could have scratched the options and made 10 points on your futures. Sounds like a good trade to me. We saw firm bids in the H 10 straddle all day at around 20% vol but going into the close paper bid up the straddle to around 21% (84 points). With the absence of aggressive put selling which we have witnessed over the last couple of months vol seems to have found its comfort zone between 19-21%. Keep an eye on the upside skew as another day of aggressive selling could force the skew in further creating a good opportunity to put fences and call spreads on for close to flat vol. For instance, H 10 straddle got bid up to 21% while the H 11 calls got sold down to 22%. Selling a call vertical with only 1 vol tick difference between the 10 and the 11 strikes seems like a no brainer. March 2008

Macquarie Futures USA Inc.

Page 2 of 3

Regards, Joshua Goldfarb / Jason Wendland Macquarie Futures USA Inc. Floor Access Line: 212-748-3200 Mobile: 917-733-6785, 201-725-4309 Email: Joshua.Goldfarb@Macquarie.com, Jason.Wendland@gmail.com Yahoo, AOL, and MSN Messenger: macquariefloor

This publication has been prepared for general circulation and does not have regard to the particular circumstances or needs of any specific person who may read it. Macquarie Futures USA Inc. expressly disclaims all, or any liability and responsibility to any person in respect to anything (and the consequences of anything) done or omitted to be done by any person in reliance on the whole or any part of this publication.

Any views expressed herein are those of the individual sender, except where the sender specifically states that such views are those of Macquarie Futures USA Inc. Opinions expressed are current opinions only. Opinions, historical price(s) or value(s) are as of the date and, if applicable time, indicated. Macquarie Futures USA Inc. does not accept any responsibility to update any opinions or other information contained in this communication.

Disclosure of Interest: Macquarie Futures USA Inc. and any of its associates may have interests in securities, futures or options referred to in this publication, including directorships or performance of investment banking services. In addition, they may buy or sell those securities as principal or agent and as such may effect transactions which are not consistent with any recommendations in the publication. The contents of this publication are copyright and confidential to Macquarie Futures USA Inc. This information has been provided only to specified clients of Macquarie Futures USA Inc. If you are not specifically authorised by Macquarie Futures USA Inc. any use, copying or other dissemination of this information is illegal and legal proceedings may be commenced against you.

This publication is published solely for informational purposes and is not to be construed as an offer to buy or sell, or a solicitation of an offer to buy or sell, any financial instrument or to enter into any transaction, and should not be construed as investment advice. This report is based upon information believed to be reliable but is not guaranteed as being accurate or complete. Past performance is not indicative of future results. Futures, options and derivatives products are not suitable for all investors and trading in these instruments is considered risky. Macquarie Futures USA Inc. is a US registered futures commission merchant and member of the National Futures Association.

Macquarie Inc.

Page 3 of 3

Vous aimerez peut-être aussi

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (400)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (345)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- Concrete Design Using PROKONDocument114 pagesConcrete Design Using PROKONHesham Mohamed100% (2)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- ASME-Y14.5.1M 1994 Mathematical Definition of Dimensioning and Tolerancing Principles PDFDocument89 pagesASME-Y14.5.1M 1994 Mathematical Definition of Dimensioning and Tolerancing Principles PDFwulfgang66Pas encore d'évaluation

- Dark Witch Education 101Document55 pagesDark Witch Education 101Wizard Luxas100% (2)

- Deed of Power of Attorney To Sell SharesDocument8 pagesDeed of Power of Attorney To Sell SharesridhofauzisPas encore d'évaluation

- Payment Billing System DocumentDocument65 pagesPayment Billing System Documentshankar_718571% (7)

- AdvacDocument13 pagesAdvacAmie Jane MirandaPas encore d'évaluation

- Introduction To Public HealthDocument54 pagesIntroduction To Public HealthKristelle Marie Enanoria Bardon50% (2)

- Discussion #3: The Concept of Culture Learning ObjectivesDocument4 pagesDiscussion #3: The Concept of Culture Learning ObjectivesJohn Lery SurellPas encore d'évaluation

- MSDS PetrolDocument13 pagesMSDS PetrolazlanPas encore d'évaluation

- THE LAW OF - John Searl Solution PDFDocument50 pagesTHE LAW OF - John Searl Solution PDFerehov1100% (1)

- BIOCHEM REPORT - OdtDocument16 pagesBIOCHEM REPORT - OdtLingeshwarry JewarethnamPas encore d'évaluation

- S - BlockDocument21 pagesS - BlockRakshit Gupta100% (2)

- Anclas Placas Base para Columnas Thomas MurrayDocument89 pagesAnclas Placas Base para Columnas Thomas MurrayMariano DiazPas encore d'évaluation

- Rosenberg Et Al - Through Interpreters' Eyes, Comparing Roles of Professional and Family InterpretersDocument7 pagesRosenberg Et Al - Through Interpreters' Eyes, Comparing Roles of Professional and Family InterpretersMaria AguilarPas encore d'évaluation

- WaiverDocument1 pageWaiverWilliam GrundyPas encore d'évaluation

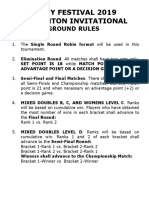

- Ground Rules 2019Document3 pagesGround Rules 2019Jeremiah Miko LepasanaPas encore d'évaluation

- TugasFilsS32019.AnthoniSulthanHarahap.450326 (Pencegahan Misconduct)Document7 pagesTugasFilsS32019.AnthoniSulthanHarahap.450326 (Pencegahan Misconduct)Anthoni SulthanPas encore d'évaluation

- Icc Enrichment AcitivityDocument2 pagesIcc Enrichment AcitivityDan Rey Miras MiñaPas encore d'évaluation

- 111Document1 page111Rakesh KumarPas encore d'évaluation

- A Study On Investors Perception Towards Sharemarket in Sharekhan LTDDocument9 pagesA Study On Investors Perception Towards Sharemarket in Sharekhan LTDEditor IJTSRDPas encore d'évaluation

- Framework For Marketing Management Global 6Th Edition Kotler Solutions Manual Full Chapter PDFDocument33 pagesFramework For Marketing Management Global 6Th Edition Kotler Solutions Manual Full Chapter PDFWilliamThomasbpsg100% (9)

- Pathfinder CharacterSheet.1.8InterActiveDocument3 pagesPathfinder CharacterSheet.1.8InterActiveJessica AlvisPas encore d'évaluation

- Directions: Choose The Best Answer For Each Multiple Choice Question. Write The Best Answer On The BlankDocument2 pagesDirections: Choose The Best Answer For Each Multiple Choice Question. Write The Best Answer On The BlankRanulfo MayolPas encore d'évaluation

- Ergonomics For The BlindDocument8 pagesErgonomics For The BlindShruthi PandulaPas encore d'évaluation

- Personal Philosophy of Education-Exemplar 1Document2 pagesPersonal Philosophy of Education-Exemplar 1api-247024656Pas encore d'évaluation

- Papadakos PHD 2013Document203 pagesPapadakos PHD 2013Panagiotis PapadakosPas encore d'évaluation

- Cambridge English Key Sample Paper 1 Reading and Writing v2Document9 pagesCambridge English Key Sample Paper 1 Reading and Writing v2kalinguer100% (1)

- PETE 689 Underbalanced Drilling (UBD) : Well Engineering Read: UDM Chapter 5 Pages 5.1-5.41Document74 pagesPETE 689 Underbalanced Drilling (UBD) : Well Engineering Read: UDM Chapter 5 Pages 5.1-5.41Heris SitompulPas encore d'évaluation

- Seismic Response of Elevated Liquid Storage Steel Tanks Isolated by VCFPS at Top of Tower Under Near-Fault Ground MotionsDocument6 pagesSeismic Response of Elevated Liquid Storage Steel Tanks Isolated by VCFPS at Top of Tower Under Near-Fault Ground MotionsciscoPas encore d'évaluation

- ReadingDocument2 pagesReadingNhư ÝPas encore d'évaluation