Académique Documents

Professionnel Documents

Culture Documents

Pharma Intro and Background

Transféré par

Nishesh AgrawalDescription originale:

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Pharma Intro and Background

Transféré par

Nishesh AgrawalDroits d'auteur :

Formats disponibles

The Pharmaceutical industry in India is the world's third-largest in terms of volume and stands 14th in terms of value.

[1] According to Department of Pharmaceuticals, Ministry of Chemicals and Fertilizers, the total turnover of India's pharmaceuticals industry between 2008 and September 2009 was US$21.04 billion.[2] While the domestic market was worth US$12.26 billion. Sale of all types of medicines in the country is expected to reach around US$19.22 billion by 2012. Exports of pharmaceuticals products from India increased from US$6.23 billion in 2006-07 to US$8.7 billion in 2008-09 a combined annual growth rate of 21.25%.[2] According to PricewaterhouseCoopers (PWC) in 2010, India joined among the league of top 10 global pharmaceuticals markets in terms of sales by 2020 with value reaching US$50 billion.[3] Some of the major pharmaceutical firms including Sun Pharmaceutical, Cadila Healthcare and Piramal Healthcare.[2] The government started to encourage the growth of drug manufacturing by Indian companies in the early 1960s, and with the Patents Act in 1970.[4] However, economic liberalization in 90s by the former Prime Minister P.V. Narasimha Rao and the then Finance Minister, Dr. Manmohan Singh enabled the industry to become what it is today. This patent act removed composition patents from food and drugs, and though it kept process patents, these were shortened to a period of five to seven years. India's biopharmaceutical industry clocked a 17 percent growth with revenues of Rs.137 billion ($3 billion) in the 2009-10 financial year over the previous fiscal. Bio-pharma was the biggest contributor generating 60 percent of the industry's growth at Rs.8,829 crore, followed by bio-services at Rs.2,639 crore and bio-agri at Rs.1,936 crore.[6]

Pharmaceutical industry today

The number of purely Indian pharma companies is fairly low. Indian pharma industry is mainly operated as well as controlled by dominant foreign companies having subsidiaries in India due to availability of cheap labour in India at lowest cost. In 2002, over 20,000 registered drug manufacturers in India sold $9 billion worth of formulations and bulk drugs. 85% of these formulations were sold in India while over 60% of the bulk drugs were exported, mostly to the United States and Russia[25]. Most of the players in the market are small-to-medium enterprises; 250 of the largest companies control 70% of the Indian market.[8] Thanks to the 1970 Patent Act, multinationals represent only 35% of the market, down from 70% thirty years ago[20]. Most pharma companies operating in India, even the multinationals, employ Indians almost exclusively from the lowest ranks to high level management. Mirroring the social structure, firms are very hierarchical. Homegrown pharmaceuticals, like many other businesses in India, are often a mix of public and private enterprise. Although many of these companies are publicly owned, leadership passes from father to son and the founding family holds a majority share. In terms of the global market, India currently holds a modest 1-2% share, but it has been growing at approximately 10% per year[27]. India gained its foothold on the global scene with its innovatively engineered generic drugs and active pharmaceutical ingredients (API), and it is now seeking to become a major player in outsourced clinical research as well as contract manufacturing and research. There are 74 U.S. FDA-approved manufacturing facilities in India, more than in any other country outside the U.S, and in 2005, almost 20% of all Abbreviated New Drug Applications (ANDA) to the

FDA are expected to be filed by Indian companies[21,27]. Growth in other fields notwithstanding, generics are still a large part of the picture. London research company Global Insight estimates that Indias share of the global generics market will have risen from 4% to 33% by 2007[27]. India has play a greatest role & plate form for world's pharmaceutical company in very cheap price and land. Every pharma company can grow in India very easily. Indian Pharmaceutical Industry has witnessed a robust growth from US$ 11.4 billion in 2010 to US$ 13 billion in 2011 with a scorching pace of growth of 15%. The industry ranks 3rd in terms of volume and is 14th in terms of value globally. Showing tremendous progress in terms of infrastructure development, technology base creation and a wide range of products, the Indian pharmaceutical industry has established its presence and determination to flourish in the changing environment. Projects worth more than 1.2 billion dollars are currently under implementation on various products, suggesting massive investments by Indian pharmaceutical companies.

R&D

Both the Indian central and state governments have recognized R&D as an important driver in the growth of their pharma businesses and conferred tax deductions for expenses related to research and development. They have granted other concessions as well, such as reduced interest rates for export financing and a cut in the number of drugs under price control. Government support is not the only thing in Indian pharmas favor, though; companies also have access to a highly developed IT industry that can partner with them in new molecule discovery in r&d.

Vous aimerez peut-être aussi

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (400)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (345)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- Corporate Finance (Chapter 4) (7th Ed)Document27 pagesCorporate Finance (Chapter 4) (7th Ed)Israt Mustafa100% (1)

- Illustration: The Following Data Were Reported For 200A Business Activities of Western UniversitiesDocument3 pagesIllustration: The Following Data Were Reported For 200A Business Activities of Western UniversitiesCarlo QuiambaoPas encore d'évaluation

- APS's ProposalDocument373 pagesAPS's ProposalJonathan AllredPas encore d'évaluation

- Progress Test 3Document7 pagesProgress Test 3myriamdzPas encore d'évaluation

- Accomplisment Letter 120611Document3 pagesAccomplisment Letter 120611Latisha WalkerPas encore d'évaluation

- Digital Marketing Assignment 2Document15 pagesDigital Marketing Assignment 2Bright MuzaPas encore d'évaluation

- Ganesh Jain: Personal Information AcademicsDocument1 pageGanesh Jain: Personal Information AcademicsGANESHPas encore d'évaluation

- ISO Certification in NepalDocument9 pagesISO Certification in NepalAbishek AdhikariPas encore d'évaluation

- HMMDocument7 pagesHMMprabhudevaPas encore d'évaluation

- B&M Bargains Requirements StrengthDocument1 pageB&M Bargains Requirements StrengthnorthernmeldrewPas encore d'évaluation

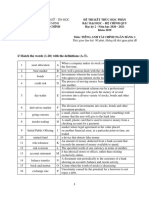

- Đề thi tiếng Anh chuyên ngành Tài chính Ngân hàng 1Document4 pagesĐề thi tiếng Anh chuyên ngành Tài chính Ngân hàng 1Hoang TrieuPas encore d'évaluation

- BMA 1 HW#5.1 GUERRERO, RonneLouiseDocument6 pagesBMA 1 HW#5.1 GUERRERO, RonneLouiseLoisaDu RLGPas encore d'évaluation

- House PerksDocument2 pagesHouse PerkssushmasrPas encore d'évaluation

- 5d6d01005f325curriculum MPSM LatestDocument51 pages5d6d01005f325curriculum MPSM LatestMostafa ShaheenPas encore d'évaluation

- 2009 Tao TourismSustainableLivelihoodStrategyDocument9 pages2009 Tao TourismSustainableLivelihoodStrategydiego rinconPas encore d'évaluation

- BBA V Indian Financial Systems PDFDocument16 pagesBBA V Indian Financial Systems PDFAbhishek RajPas encore d'évaluation

- Questions For Assignment 2078 (NOU, BBS 1st Yr, Account and Taxation, Account Part)Document4 pagesQuestions For Assignment 2078 (NOU, BBS 1st Yr, Account and Taxation, Account Part)rishi dhungel100% (1)

- Cost Management Cloud: Receipt AccountingDocument14 pagesCost Management Cloud: Receipt Accountinghaitham ibrahem mohmedPas encore d'évaluation

- Soal Dan JWBN Siklus DGGDocument17 pagesSoal Dan JWBN Siklus DGGGhina Risty RihhadatulaisyPas encore d'évaluation

- Ice Fili Analysis: Presented by Group11-Anuraj Antil Ishan Malik Kanishka Singh Sunny Malik Surya DeswalDocument13 pagesIce Fili Analysis: Presented by Group11-Anuraj Antil Ishan Malik Kanishka Singh Sunny Malik Surya DeswalKanishka SinghPas encore d'évaluation

- REFLECTION PAPER (CAPEJANA VILLAGE) FinalDocument3 pagesREFLECTION PAPER (CAPEJANA VILLAGE) FinalRon Jacob AlmaizPas encore d'évaluation

- Chapter 4Document24 pagesChapter 4Tanzeel HussainPas encore d'évaluation

- Addis Ababa University College of Development StudiesDocument126 pagesAddis Ababa University College of Development StudieskindhunPas encore d'évaluation

- The Inventory Cost Per Unit Is Proportional To 1/SQRT (Demand Volume)Document4 pagesThe Inventory Cost Per Unit Is Proportional To 1/SQRT (Demand Volume)Ronil JainPas encore d'évaluation

- Review of Company Law On Merger and Acquisition in India Using SCP ParadigmDocument13 pagesReview of Company Law On Merger and Acquisition in India Using SCP ParadigmGokul AbimanyuPas encore d'évaluation

- Business Ethics Question Bank March 2016Document6 pagesBusiness Ethics Question Bank March 2016GowthamSathyamoorthySPas encore d'évaluation

- Cadcam Lec2 PLC PDFDocument16 pagesCadcam Lec2 PLC PDFSaham NajibPas encore d'évaluation

- Procurement WorkDocument8 pagesProcurement WorkbagumaPas encore d'évaluation

- 1 8 - PestelDocument2 pages1 8 - PestelMai HươngPas encore d'évaluation

- Analisa Biaya & Metode Penilaian Investasi Pada Kebakaran - OkDocument22 pagesAnalisa Biaya & Metode Penilaian Investasi Pada Kebakaran - OkCarter GansPas encore d'évaluation