Académique Documents

Professionnel Documents

Culture Documents

Statement of Cash Flows Analysis

Transféré par

lehan2447Description originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Statement of Cash Flows Analysis

Transféré par

lehan2447Droits d'auteur :

Formats disponibles

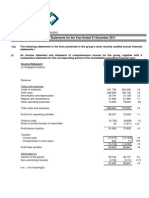

1(a) Tagline Statement of Cash Flows For the year ended 31 December x5 RM000 Cash from operating activities:

Profit before taxation Adjustments fro: Depreciation Profit on disposal of PPE (12,000-7,400) Release of government grant Increase in insurance claim receivable Interest expense Investment income Cash generated from operations Increase in inventories Increase in trade receivables Increase in trade payables Interest paid Income taxes paid Net cash flow from operating activities Cash flows from investing activities: Purchase of plant Proceeds from the disposal of plant Proceeds from government grant Investment income Net cash inflow from investing activities Cash flows from financing activities: Proceeds of 6% loan note Repayment of 10% Loan note Capital payment under finance lease Net cash flow from financing activities Net increase in cash and cash equivalents Cash and cash equivalent at the beginning of period Cash and cash equivalents at the end of the period (2,900) 12,000 950 40 RM000 50 2,200 (4,600) (250) (300) 260 (40) (2,680) (700) (500) 1,100 (2,780) (260) (1,350) (4,390)

10,090

800 (4,000) (1,100) (4,300) 1,400 (550) 850

Working: Property plant and equipment - cost RM000 B/d 20,200 Factory disposal Plant acquired under finance 1,500 lease Other acquisitions 2,900 Bal c/d 24,600 Property plant and equipment - Depreciation Accumulated depreciation on factory disposal Bal c/d RM000 1,200 5,400 6,600 Bal b/d Charge for the year RM000 4,400 2,200 6,600 RM000 8,600 16,000 24,600

Government grant Grant released Bal c/f RM000 250 2,000 2,250 RM000 50 1,350 300 1,700 Bal b/d Received Tax Credit in income statement Paid Bal c/d Bal b/d current and deferred RM000 1,700 1,700 RM000 2,500 1,500 4,000 RM000 1,300 950 2,250

Cash paid Bal c/d

Finance lease RM000 1,100 Bal b/d 2,900 New 4,000

(b) Though there is an inflow of cash of RM1.4 million, it is still losing cash which means its going concern status may be in doubt. Generally, entities will have more cash flow from operations than their net profit. In Taglines case it is the reverse. Also its profit is mainly attributable to the sale of the factory, which is a one off transaction. There is an increase in the insurance claim and the release from government grant.

The high tax payment could be an indication that it was very profitable previously and is facing losses suddenly. Taglines inventories and receivables have increased which reflects poor financial management of these assets. The positive points are that Taglines investment in non-current assets has increased. The sale and lease back of the factory has released cash which was used to repay the expensive loan and get a cheaper and smaller loan. 4 Tiny Bubbles Statement of Cash Flows For the year ended 31 December x5 RMm Cash from operating activities: Cash generated from operations Interest paid Income taxes paid Net cash flow from operating activities Cash flows from investing activities: Purchase of plant Purchase of land and building Proceeds from the disposal of plant Interest income (24-10+6) Net cash inflow from investing activities (120) (220) 30 20 (290) RMm (336) (32) (162) (530)

Cash flows from financing activities: Proceeds from the issue of share capital 320 Issue of variable rate loan (320 - 4) 316 Redemption of 12% loan notes (312) Dividends paid (50) Net cash flow from financing activities Net increase in cash and cash equivalents Cash and cash equivalent at the beginning of period (240 + 150) Cash and cash equivalents at the end of the period (250 -(64 + 30) Reconciliation of cash flows from operations with the net profit for the period RMm Cash from operating activities: Net loss before interest and taxation Adjustments for: Depreciation Building (64) 24

274 (546) 390 (156)

Plant (296+176-310*) Intangibles Loss on sale of plant Decrease in inventories Increase in receivables Increase in trade payables Cash generated from operations

162 220 24 140 (872) 30 (336)

Vous aimerez peut-être aussi

- CBSE Class 12 Accountancy - Cash Flow StatementDocument14 pagesCBSE Class 12 Accountancy - Cash Flow StatementVandna Bhaskar38% (8)

- SBFRS 7 Ie (2013)Document9 pagesSBFRS 7 Ie (2013)Tareq ChowdhuryPas encore d'évaluation

- Chapter 22 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Document26 pagesChapter 22 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Falah Ud Din Sheryar100% (1)

- BDP Financial Final PartDocument14 pagesBDP Financial Final PartDeepak G.C.Pas encore d'évaluation

- Investment VI FINC 404 Company ValuationDocument52 pagesInvestment VI FINC 404 Company ValuationMohamed MadyPas encore d'évaluation

- Analysis of Financial StatementsDocument33 pagesAnalysis of Financial StatementsKushal Lapasia100% (1)

- Projected Cash FlowDocument5 pagesProjected Cash FlowSaif Muhammad SazinPas encore d'évaluation

- DFS December 2009 AnswersDocument12 pagesDFS December 2009 AnswersPhilemon N.MalingaPas encore d'évaluation

- HorngrenIMA14eSM ch16Document53 pagesHorngrenIMA14eSM ch16Piyal HossainPas encore d'évaluation

- Solution Advanced Financial Reporting May 2010Document10 pagesSolution Advanced Financial Reporting May 2010Samuel DwumfourPas encore d'évaluation

- Chapter 31 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Document44 pagesChapter 31 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Falah Ud Din SheryarPas encore d'évaluation

- Statement of Cash Flows - Lecture Questions and AnswersDocument9 pagesStatement of Cash Flows - Lecture Questions and AnswersEynar Mahmudov83% (6)

- Cash Flow: Dadasaheb Narale Roll No.10 Sinhgad Institute of Business ManagementDocument20 pagesCash Flow: Dadasaheb Narale Roll No.10 Sinhgad Institute of Business Managementaftabkhan21Pas encore d'évaluation

- Accy 517 HW PB Set 1Document30 pagesAccy 517 HW PB Set 1YonghoChoPas encore d'évaluation

- Chapter 3 Short ProlemsDocument9 pagesChapter 3 Short ProlemsRhedeline LugodPas encore d'évaluation

- Unaudited Financial Statements for Year Ended 31 Dec 2011Document18 pagesUnaudited Financial Statements for Year Ended 31 Dec 2011Jennifer JohnsonPas encore d'évaluation

- A Level Recruitment TestDocument9 pagesA Level Recruitment TestFarrukhsgPas encore d'évaluation

- Cash Flow Analysis: Presentation BY S.ClementDocument34 pagesCash Flow Analysis: Presentation BY S.ClementJugal ShahPas encore d'évaluation

- CS Exec - Prog - Paper-2 Company AC Cost & Management AccountingDocument25 pagesCS Exec - Prog - Paper-2 Company AC Cost & Management AccountingGautam SinghPas encore d'évaluation

- 11 Accountancy Notes Ch08 Financial Statements of Sole Proprietorship 02Document9 pages11 Accountancy Notes Ch08 Financial Statements of Sole Proprietorship 02Anonymous NSNpGa3T93100% (1)

- Mansa Building Balance Sheet As On 31st Dec, 1999Document10 pagesMansa Building Balance Sheet As On 31st Dec, 1999Nirmal SasidharanPas encore d'évaluation

- Accounting For Managers Sessions 21 - 30Document26 pagesAccounting For Managers Sessions 21 - 30Nishant SinghPas encore d'évaluation

- Financial ReportingDocument22 pagesFinancial Reportingmhel cabigonPas encore d'évaluation

- Hls Fy2010 Fy Results 20110222Document14 pagesHls Fy2010 Fy Results 20110222Chin Siong GohPas encore d'évaluation

- Assignment 3 SolutionsDocument2 pagesAssignment 3 SolutionsHennrocksPas encore d'évaluation

- Cashflowstatement IMPDocument30 pagesCashflowstatement IMPAshish SinghalPas encore d'évaluation

- Accounting For Financial ManagementDocument42 pagesAccounting For Financial ManagementTIDURLAPas encore d'évaluation

- Preparation & Analysis of Cash Flow StatementsDocument27 pagesPreparation & Analysis of Cash Flow StatementsAniket PanchalPas encore d'évaluation

- Financial Reports, Depreciation and Cash Flow AnalysisDocument6 pagesFinancial Reports, Depreciation and Cash Flow AnalysisnoortiaPas encore d'évaluation

- Principles of Accounting Chapter 13Document43 pagesPrinciples of Accounting Chapter 13myrentistoodamnhigh100% (1)

- Chapter 5 - Cash Flows - HandoutDocument53 pagesChapter 5 - Cash Flows - HandoutĐứcAnhLêVũ100% (1)

- Cash Flow StatementDocument28 pagesCash Flow StatementJaan Sonu100% (2)

- Financial Accounting11Document14 pagesFinancial Accounting11AleciafyPas encore d'évaluation

- FM09-CH 24Document16 pagesFM09-CH 24namitabijwePas encore d'évaluation

- Financial PlanningDocument26 pagesFinancial PlanningKevinVdKPas encore d'évaluation

- Chapter 2: Financial Statements and Cash Flow AnalysisDocument43 pagesChapter 2: Financial Statements and Cash Flow AnalysisshimulPas encore d'évaluation

- Strauss Printing Services Statement of Cash Flows For The Year Ended December 31, 2013 Cash Flow From Operating ActivitiesDocument2 pagesStrauss Printing Services Statement of Cash Flows For The Year Ended December 31, 2013 Cash Flow From Operating ActivitiesChristian Shino Delos SantosPas encore d'évaluation

- Cash Flow Statement Indirect MethodDocument5 pagesCash Flow Statement Indirect MethodSaivyjayanthiPas encore d'évaluation

- Financial Statements, Cash Flow, and TaxesDocument29 pagesFinancial Statements, Cash Flow, and TaxesHooriaKhanPas encore d'évaluation

- DCF ValuationDocument19 pagesDCF ValuationVIJAYARAGAVANPas encore d'évaluation

- Cash Flow Statement for ABC LtdDocument30 pagesCash Flow Statement for ABC LtdNaushad GulPas encore d'évaluation

- Cash flow statement problemsDocument12 pagesCash flow statement problemsAnjali Mehta100% (1)

- Calculate startup costs and projected financesDocument8 pagesCalculate startup costs and projected financesInder KeswaniPas encore d'évaluation

- Cash Flow Statement ReviewDocument3 pagesCash Flow Statement ReviewSarah WinzenriedPas encore d'évaluation

- Solved ProblemsDocument75 pagesSolved Problemsgut78Pas encore d'évaluation

- Wk2. Financial Statements Cash Flows (MKL G)Document54 pagesWk2. Financial Statements Cash Flows (MKL G)Haifa Fitriya QolbyPas encore d'évaluation

- Plan Your Cash Flow and Finances with These ToolsDocument4 pagesPlan Your Cash Flow and Finances with These Toolscialee100% (2)

- CH 01 Review and Discussion Problems SolutionsDocument11 pagesCH 01 Review and Discussion Problems SolutionsArman BeiramiPas encore d'évaluation

- Statement of Cash Flow - Ias 7Document5 pagesStatement of Cash Flow - Ias 7Benjamin JohnPas encore d'évaluation

- IAS-7 S C F: Tatement of ASH LowsDocument11 pagesIAS-7 S C F: Tatement of ASH LowsAsim NazirPas encore d'évaluation

- IAS-7 S C F: Tatement of ASH LowsDocument11 pagesIAS-7 S C F: Tatement of ASH LowsLauren WebbPas encore d'évaluation

- Solved ProblemsDocument76 pagesSolved ProblemssizzlingsalmankhanPas encore d'évaluation

- Boeing: I. Market InformationDocument20 pagesBoeing: I. Market InformationJames ParkPas encore d'évaluation

- What Are Quantitative FactorsDocument5 pagesWhat Are Quantitative FactorsJunaid CheemaPas encore d'évaluation

- Workshop Solutions T1 2014Document78 pagesWorkshop Solutions T1 2014sarah1379Pas encore d'évaluation

- Cash Flow Statement PracticeDocument6 pagesCash Flow Statement PracticeVinod Gandhi100% (3)

- Cash Flow Statement for Relic SpotterDocument10 pagesCash Flow Statement for Relic SpotterKetanMehtaPas encore d'évaluation

- Miscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryD'EverandMiscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryPas encore d'évaluation

- Securities Brokerage Revenues World Summary: Market Values & Financials by CountryD'EverandSecurities Brokerage Revenues World Summary: Market Values & Financials by CountryPas encore d'évaluation

- Sales Financing Revenues World Summary: Market Values & Financials by CountryD'EverandSales Financing Revenues World Summary: Market Values & Financials by CountryPas encore d'évaluation

- GST Invoice Format With Bank DetailsDocument24 pagesGST Invoice Format With Bank DetailsTarun GuptaPas encore d'évaluation

- 10.20.22 Letter Gretchen Sierra CTC PRDocument2 pages10.20.22 Letter Gretchen Sierra CTC PRMetro Puerto RicoPas encore d'évaluation

- PT Qu-Be Berseri Worksheet: December 2019Document5 pagesPT Qu-Be Berseri Worksheet: December 2019Orlando29100% (1)

- GST - Payment ChallanDocument2 pagesGST - Payment ChallanPatel SumitPas encore d'évaluation

- PayrollDocument16 pagesPayrollshahirahPas encore d'évaluation

- Semester fee receipt for BALLB courseDocument2 pagesSemester fee receipt for BALLB courseGuddu Singh0% (1)

- Receipt TravelokaDocument1 pageReceipt TravelokaEmilia Rosanti100% (1)

- Gross Income (Tax)Document52 pagesGross Income (Tax)HOOPE JISONPas encore d'évaluation

- June 14, 2019 July 3, 2019: Credit Card StatementDocument4 pagesJune 14, 2019 July 3, 2019: Credit Card StatementMahesh Kumar K BPas encore d'évaluation

- IT II AnswerDocument4 pagesIT II AnswerChandhini RPas encore d'évaluation

- E-Business Tax SetupDocument61 pagesE-Business Tax SetupAli IqbalPas encore d'évaluation

- Cash Advance Form Feb 2016Document2 pagesCash Advance Form Feb 2016bisankhe2Pas encore d'évaluation

- Final Reviewer For TAX 2Document45 pagesFinal Reviewer For TAX 2Mosarah AltPas encore d'évaluation

- Fraud Awareness PosterDocument1 pageFraud Awareness PosterAnonymous NbMQ9YmqPas encore d'évaluation

- 7713 16122023150018 UnlockedDocument12 pages7713 16122023150018 Unlockedloanbackend1997Pas encore d'évaluation

- HDFC Bank Freedom Credit CardDocument9 pagesHDFC Bank Freedom Credit CardKuldeep rajakPas encore d'évaluation

- Estatement Chase JulyDocument6 pagesEstatement Chase JulyAtta ur RehmanPas encore d'évaluation

- ListDocument24 pagesListManav PtelPas encore d'évaluation

- ProjectDocument67 pagesProjectnihalwandoor12Pas encore d'évaluation

- 20-0453 RPT LAFD 05-15-2020Document41 pages20-0453 RPT LAFD 05-15-2020deeperPas encore d'évaluation

- ADocument31 pagesAZake CarderPas encore d'évaluation

- DESIGNER DRUGZ LLC Statement AprilDocument4 pagesDESIGNER DRUGZ LLC Statement AprilJonathan Seagull LivingstonPas encore d'évaluation

- Module 9 - Government Accounting ProcessDocument10 pagesModule 9 - Government Accounting ProcessJeeramel TorresPas encore d'évaluation

- SAPayslipDocument1 pageSAPayslipmomen rababahPas encore d'évaluation

- CA Final Idt GST Customs Flow Charts May June 2019Document187 pagesCA Final Idt GST Customs Flow Charts May June 2019yogeshaggarwal09Pas encore d'évaluation

- Income From House PropertyDocument6 pagesIncome From House Propertypardeep bainsPas encore d'évaluation

- Years Ago at P 500, 000 With FMV at Date of Donation Equal To P 600, 000 But With Unpaid Mortgage of P 50, 000 Assumed by The Donee?Document4 pagesYears Ago at P 500, 000 With FMV at Date of Donation Equal To P 600, 000 But With Unpaid Mortgage of P 50, 000 Assumed by The Donee?Prince PierrePas encore d'évaluation

- NIL MidtermDocument28 pagesNIL MidtermAnonymous B0aR9GdNPas encore d'évaluation

- BSNL Landline Bill DetailsDocument2 pagesBSNL Landline Bill DetailsjimmylalPas encore d'évaluation

- MITC Document CustomerDocument14 pagesMITC Document CustomerSwapnil PankePas encore d'évaluation