Académique Documents

Professionnel Documents

Culture Documents

Cross Border

Transféré par

Euisun YunDescription originale:

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Cross Border

Transféré par

Euisun YunDroits d'auteur :

Formats disponibles

Cross-Border Mergers and Acquisitions

SYDNEY FINKELSTEIN

The globalization of business over the

past decade has spawned a search for competitive advantage that is worldwide in scale. Companies have followed their customers who are going global themselves as they respond to the pressures of obtaining scale in a rapidly consolidating global economy. In combination with other trends, such as increased deregulation, privatization, and corporate restructuring, globalization has spurred an unprecedented surge in cross-border merger and acquisition activity. According to Securities Data Corporation, there were more than 2000 announced cross-border acquisitions in 1996 worth over $252 billion. While this represents 54% more acquisitions than in 1991, the increase in dollar value has been even more remarkable, tripling during this time period. Clearly crossborder M&As have become a fundamental characteristic of the global business landscape. Even mergers of companies with headquarters in the same country while usually not counted as cross-border are very much of this type. After all, when Boeing acquires McDonnell Douglas, the two American companies

must integrate operations in dozens of countries around the world. This is just as true for other supposedly singlecountry mergers, such as the $27 billion dollar merger of Swiss drug makers Sandoz and Ciba-Geigy (now Novartis). Hence, understanding the problems and opportunities of cross-border mergers and acquisitions is an essential element in understanding most M&As, and indeed in understanding the nature of global strategy. In spite of the huge volume of activity in the cross-border M&A marketplace, an inescapable fact emerges when these deals are examined more closely the majority of crossborder M&As are not successful. For example, economists David J. Ravenscraft and William F. Long found that most of the 89 acquisitions of American companies by foreign buyers between 1977 and 1990 they studied did not improve operational performance one year after the acquisition. Numerous anecdotal accounts corroborate these results. Take, for example, the acquisition of Columbia Pictures by Sony Corp in 1989. After paying a significant premium for the company, and keeping a hands-off attitude toward their senior executives in Hollywood

This is a summary of an article that appeared in Financial Times Mastering Global Business: The Complete MBA Companion in Global Business, London: Financial Times Pitman Publishing. Finkelstein, S. 1999. "Safe ways to cross the merger minefield." p. 119-123. Sydney Finkelstein is the Steven Roth Professor of Management at the Tuck School of Business at Dartmouth. For more information about the book or to contact Sydney please see http://www.whysmartexecutivesfail.com.

who were busy overspending on office renovations, company perks, and unsuccessful movies Sony was forced to take an unprecedented $3.2 billion write-down in 1994. This merger is now a classic case study of what not to do in cross-border deals. Some of the problems encountered by Sony include legal problems stemming from their recruitment of senior management who were under contract at Time Warner, lack of internal controls over budgeting, weak understanding of the fundamentals of the acquired business, and an overly optimistic belief in synergies arising from vertical integration and from applying Sonys technological competencies to the movie and television business. Of course, these are mistakes that can arise in any merger or acquisition; what makes them particularly troublesome in cross-border deals are the inherently greater challenges of melding country cultures, communicating across long distances, dealing with misunderstandings arising from different business norms, and even fundamental differences in management style. Why are cross-border mergers and acquisitions so difficult to implement? Consider all that must go right in any (same-country) acquisition: The two companies must reach agreement on which products and services will be offered, which facility or group will have primary responsibility for making this happen, who will be in charge of each of these facilities or groups, where will the expected cost savings come from, what will the division of labor look like in the executive suite, what timetable to follow that will best generate the potential synergies of the deal, and myriad other issues that are complex, detailed, and immediate. On

top of all this the merging companies must continue to compete and serve their customers in a competitive marketplace. Now, take all these challenges, and add a completely new set of problems that arise from the fundamental differences that exist across countries. Consider, for example, for all the similarities that a global imperative places on companies, the very real differences in how business is conducted in, say, Europe, Japan, and the United States. These differences involve corporate governance, the power of rank and file employees, worker job security, regulatory environments, customer expectations, and country culture all representing additional layers of complexity that executives engaged in cross-border M&As must manage. Is it any wonder that crossborder mergers are potential minefields that require the utmost care? Fortunately, there are some basic principles that will make cross-border mergers work more smoothly. They can be divided into the imperatives of strategic logic and acquisition integration. What is the strategic logic for the acquisition? In recent years strategic mergers have gotten a bad name, to the extent that some pundits have defined strategic mergers as those where the acquiring company overpays. While the price paid for a company is a critical determinant of the success of the resulting acquisition, there is no inherent reason why mergers that are strategically wellconceived should go awry. In fact, the evidence is quite the opposite. The recent merger of BPs and Mobils downstream operations across Europe is a case in point. The strategic

logic for this deal says that (1) size and market power are required to compete against the other major oil companies, and even supermarket chains with gas pumps, in Europe, and (2) significant cost savings can be realized by eliminating duplicate facilities and employees, and by rationalizing purchasing and cutting overhead. Although this merger is not without significant integration challenges, it appears to have a solid strategic logic, and indeed is considered a blueprint for similar deals among rivals such as Shell, Texaco, and Amoco. It is also an unusual merger since BP and Mobil are only consolidating their refining and marketing operations in Europe, and remain rivals elsewhere. Nevertheless, estimates of cost savings are in the range of $500 million a year, a figure which, if established and maintained, will clearly make this merger a success. The keys to establishing an effective strategic logic lie in answering questions such as: How will this merger create value, and when will this value be realized? Why are we a better parent for this company than someone else? Can this merger pass the better-off test will we be able to create more value (by being more competitive, having a stronger cost structure, gaining additional competencies that we can leverage in new ways, etc.) after the deal? These are difficult questions that require careful, objective, preacquisition analysis. The tendency for companies in the heat of battle to overstate the real strategic benefits of a deal is a definite problem that must be guarded against. Pressures that arise from the desire to close a deal quickly before rival bidders appear, cultural and

sometimes language barriers that create uncertainty, and the often emotionallycharged atmosphere surrounding negotiations, work against this requirement of objectivity. The best solution in this case is to enter the M&A mode with a carefully developed framework that addresses the key questions, and to stick to that framework in evaluating a potential acquisition candidate even when the seemingly inevitable strains arise. Our own research and experience indicates that the highest potential crossborder M&As tend to be between firms that share similar or complementary operations in such key areas as production and marketing. When two companies share similar core businesses there are often opportunities for economies of scale at various stages of the value chain (e.g., R&D, manufacturing, sales and marketing, distribution, etc.). For example, although the merger between British Telecom and MCI remains controversial and losses associated with MCIs push to enter the local telephone service market in the U.S. are not reassuring there are opportunities for value creation through common software development, shared capital investment, and joint purchasing agreements. The strategic logic of combining complementary assets can also be compelling. These assets, which extend to complementary competencies in technology and know-how, offer great opportunities for companies to create value in the right circumstances. For example, MCI will be a much more formidable competitor in the U.S. telephone market with the backing of BT and its prodigious cash flow. Other potential complementary benefits of this deal include the positive impact of

MCIs aggressive market-oriented corporate culture on the more conservative British Telecom, and the potential of the combination itself to be a well-positioned global competitor as evolving markets in Europe and the U.S. continue to deregulate and change. Thus, what we call economies of fitness arising from complementary operations or competencies can be an important source of value creation in mergers and acquisitions. How will the two companies be integrated? It is probably not an exaggeration to assert that most cross-border deals run into difficulties because of failures in the integration process. What is acquisition integration? First and foremost, it is the process of realizing the strategic benefits of a merger. In other words, it is everything merging companies must do to achieve synergies and position the new firm for growth. It requires effective interaction and coordination between merging firms to realize the strategic potential of the deal at the same time that it necessitates special attention to human resource concerns. Stated in this way, it is a tall order, and indeed seems absolutely critical to M&A success. Nevertheless, it is a remarkable fact of life that many cross-border acquisitions involve insufficient, illconsidered, and inconsequential integration efforts. Consider the acquisition of Firestone, an American company, by Japans Bridgestone in 1988. The problems started when Bridgestone outbid Pirelli to capture Firestone, paying a premium of 158% of the value of Firestone before it came into play. Although the acquisition did have a

strategic logic Bridgestone wanted to develop global scale in a rapidly consolidating industry and service Japanese car makers setting up production in the U.S. no real integration effort took place for five years. Bridgestone left in place senior Firestone management and did little to generate cost savings, so the tire maker that had performed poorly before the acquisition continued to do so. Total losses amounted to $1 billion by 1992, and Bridgestone has subsequently spent $1.5 billion to upgrade and expand Firestones operations. Leading an extensive integration effort in a foreign marketplace remains one of the biggest challenges in cross-border acquisitions. Employee stress and uncertainty can be particularly troublesome in crossborder deals. Mergers create uncertainty, and people often experience considerable stress during this time. There is a real danger that some of the best people in a company will leave as a result of the merger after all, it is usually the best people that have the most attractive outside opportunities and inattention to their personal concerns may be costly. Studies indicate that the root cause of employee problems are feelings of mistrust and stress, perceived restrictions in career plans, and attacks on established cultural traditions within the acquired company, each of which is exacerbated by the fundamental differences that exist between both merging companies and the countries in which they are based. And these problems do not go away if left untreated. Firestone workers ended up in a highly contentious strike in 199495, driven by their reaction to Bridgestones belated cost-cutting efforts.

Differences among management and workers can sometimes spiral into broader community and political problems. Such was the case in the 1988 acquisition of Rowntree, headquartered in York, England by Nestle, the Swiss foods giant. Concerns about the future of Rowntree workers, facilities, and even the town of York itself created an uproar in the UK, involving Members of Parliament, political parties, and the Archbishop of York. In the end, Nestle was forced to make several concessions to public opinion in its integration of Rowntree, including retaining York facilities and making certain guarantees with respect to the job security of Rowntree workers. Given the importance of integration to acquisition success, how can companies best manage this process? There are several important considerations. Understand that most of the value creation in an acquisition occurs after the deal is done. For all the synergies and benefits that are projected to accrue from an acquisition, none can be realized without substantial effort during the integration process. Plan for integration before doing the deal. There are many reasons why companies do not do this such as time constraints, insufficient information, lack of awareness of how critical integration really is but the alternative is to essentially guess at the sources of value creation. Develop a checklist of key integration issues, assign personal responsibility and a timetable for dealing with these issues, and set targets that will enable the value creation needed

to make the deal work. Although integration is a process that cannot be completed in a few days, this analysis should yield a blueprint for how to create value from the acquisition. Work the details. Some of the confusion and complexity of cross-border mergers can be mitigated by ensuring that executives in an acquiring company learn about differences in accounting standards, labor laws, environmental regulations, and norms and regulations governing how business is conducted in the country of the acquired firm early in the process. Develop a clear communication plan throughout the entire process. The prospective melding of different country cultures in a cross-border deal can easily compound the uncertainty employees experience in any merger, and must be addressed in a proactive manner. In sum, there are two fundamental imperatives that must be underscored in any discussion of cross-border mergers and acquisitions. First, companies engage in a merger or acquisition to create value, and that value creation comes about through a combination of synergy realization to cut costs and competitive strategy repositioning to increase revenues and growth. And second, both the synergy realization and competitive strategy goals cannot be achieved without significant attention to the challenge of acquisition integration. If cross-border M&A strategies are to fulfill their potential, and justify the premium companies typically pay to

engage in them, managers will need to fully understand, and embrace, these two imperatives.

Vous aimerez peut-être aussi

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- System Software Mind MapDocument1 pageSystem Software Mind MapRena AllenPas encore d'évaluation

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5795)

- Mechatronics MaterialDocument86 pagesMechatronics MaterialKota Tarun ReddyPas encore d'évaluation

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- Useful C Library FunctionDocument31 pagesUseful C Library FunctionraviPas encore d'évaluation

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- Azure Arc DoccumentDocument143 pagesAzure Arc Doccumentg.jithendarPas encore d'évaluation

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- God Reborn - The Birth of God and The Creation of The UniverseDocument204 pagesGod Reborn - The Birth of God and The Creation of The UniverseTony Bermanseder100% (1)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (74)

- 61-Article Text-180-1-10-20170303 PDFDocument25 pages61-Article Text-180-1-10-20170303 PDFSOUMYA GOPAVARAPUPas encore d'évaluation

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Modern Steel ConstructionDocument70 pagesModern Steel ConstructionohundperPas encore d'évaluation

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- Global Governance and Interstate SystemDocument25 pagesGlobal Governance and Interstate SystemRay Stephen SantosPas encore d'évaluation

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Micromine TutorialDocument5 pagesMicromine TutorialFerdinand Siahaan100% (1)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (400)

- Week 5 Teradata Practice ExerciseDocument14 pagesWeek 5 Teradata Practice ExerciseWooyeon ChoPas encore d'évaluation

- Motorola Phone Tools Test InfoDocument98 pagesMotorola Phone Tools Test InfoDouglaswestphalPas encore d'évaluation

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (345)

- Plasterboard FyrchekDocument4 pagesPlasterboard FyrchekAlex ZecevicPas encore d'évaluation

- Annex A2 - CS Form 100 - Revised 2023 - CSESP - A1 - Edited - A1Document2 pagesAnnex A2 - CS Form 100 - Revised 2023 - CSESP - A1 - Edited - A1obs.obando2022Pas encore d'évaluation

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- Paper 19 AugustDocument552 pagesPaper 19 AugustUma Sankar Pradhan100% (1)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- E Catalog YooilDocument10 pagesE Catalog Yooilom jangidPas encore d'évaluation

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- Unit 9 TelephoningDocument14 pagesUnit 9 TelephoningDaniela DanilovPas encore d'évaluation

- PmtsDocument46 pagesPmtsDhiraj ZanzadPas encore d'évaluation

- Letter For LACDocument7 pagesLetter For LACDahlia G. MaglasangPas encore d'évaluation

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- List of Marketing Metrics and KpisDocument5 pagesList of Marketing Metrics and KpisThe KPI Examples ReviewPas encore d'évaluation

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- National Article Writing Competition 2020: Centre For Competition and Investment Laws and PolicyDocument8 pagesNational Article Writing Competition 2020: Centre For Competition and Investment Laws and PolicyNisha PasariPas encore d'évaluation

- Group Screening Test, English 6Document4 pagesGroup Screening Test, English 6Jayson Alvarez MagnayePas encore d'évaluation

- #5-The Specialities in The Krithis of Muthuswamy DikshitharDocument5 pages#5-The Specialities in The Krithis of Muthuswamy DikshitharAnuradha MaheshPas encore d'évaluation

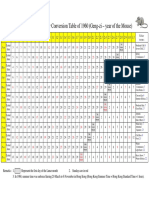

- Gregorian-Lunar Calendar Conversion Table of 1960 (Geng-Zi - Year of The Mouse)Document1 pageGregorian-Lunar Calendar Conversion Table of 1960 (Geng-Zi - Year of The Mouse)Anomali SahamPas encore d'évaluation

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- PMP Exam Questions and Answers PDFDocument12 pagesPMP Exam Questions and Answers PDFAshwin Raghav SankarPas encore d'évaluation

- 67 9268Document34 pages67 9268Salvador ReyesPas encore d'évaluation

- Umihara Et Al-2017-Chemistry - A European JournalDocument3 pagesUmihara Et Al-2017-Chemistry - A European JournalNathalia MojicaPas encore d'évaluation

- The Necessary Art of PersuasionDocument14 pagesThe Necessary Art of PersuasionAnugragha SundarPas encore d'évaluation

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- Part-II Poem Article and Report For College Magazine-2015-16 Dr.M.Q. KhanDocument4 pagesPart-II Poem Article and Report For College Magazine-2015-16 Dr.M.Q. KhanTechi Son taraPas encore d'évaluation

- Plato, Timaeus, Section 17aDocument2 pagesPlato, Timaeus, Section 17aguitar_theoryPas encore d'évaluation

- Youth and Moral ValuesDocument6 pagesYouth and Moral ValuesAlka SinghPas encore d'évaluation

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)