Académique Documents

Professionnel Documents

Culture Documents

CF Review

Transféré par

mohit_namanDescription originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

CF Review

Transféré par

mohit_namanDroits d'auteur :

Formats disponibles

BA 212 Review for Test # 3(Chapters 13, 14 and 15) Instructor:U. Ramanujam 1.

1. If a short-term debt investment is sold, the investment account is a. debited for the book value of the bonds at the sale date. b. credited for the cost of the bonds at the sale date. c. credited for the fair value of the bonds at the sale date. d. debited for the cost of the bonds at the sale date. Under the equity method, the Stock Investments account is credited when the a. investee reports net income. b. investee reports a net loss. c. investment is originally acquired. d. investee reports net income and when the investment is originally acquired. If an investor owns less than 20% of the common stock of another corporation as a long-term investment, a. the equity method of accounting for the investment should be employed. b. no dividends can be expected. c. it is presumed that the investor has relatively little influence on the investee. d. it is presumed that the investor has significant influence on the investee. If the cost method is used to account for a long-term investment in common stock, dividends received should be a. credited to the Stock Investments account. b. credited to the Dividend Revenue account. c. debited to the Stock Investments account. d. recorded only when 20% or more of the stock is owned. The cost method of accounting for long-term investments in stock should be employed when the a. investor owns more than 50% of the investee's stock. b. investor has significant influence on the investee and the stock held by the investor are marketable equity securities. c. market value of the shares held is greater than their historical cost. d. investor's influence on the investee is insignificant. Under the equity method of accounting for long-term investments in common stock, when a dividend is received from the investee company, a. the Dividend Revenue account is credited. b. the Stock Investments account is increased. c. the Stock Investments account is decreased. d. no entry is necessary. On January 1, 2003, Belle Corporation purchased 25% of the common stock outstanding of Mann Corporation for $200,000. During 2003, Mann Corporation reported net income of $80,000 and paid cash dividends of $40,000. The balance of the Stock InvestmentsMann account on the books of Belle Corporation at December 31, 2003 is a. $200,000. b. $210,000. c. $220,000. d. $190,000. 1

2.

3.

4.

5.

6.

7.

8.

Which of the following is the correct matching concerning the appropriate accounting for long-term stock investments? % of Investor Ownership Accounting Guidelines a. Less than 20% Cost method b. Between 20%-50% Cost method c. More than 50% Cost or equity method d. Between 20%-50% Consolidated financial statements If the equity method is being used, the Revenue from Investment in Stock account is a. just another name for a Dividend Revenue account. b. credited when dividends are declared by the investee. c. credited when net income is reported by the investee. d. debited when dividends are declared by the investee. A company that owns more than 50% of the common stock of another company is known as the a. charge company. b. subsidiary company. c. parent company. d. management company. Reporting investments at fair value is a. applicable to stock securities only. b. applicable to debt securities only. c. applicable to both debt and stock securities. d. a conservative approach because only losses are recognized.

9.

10.

11.

Use the following information for questions 12-13 Greer Corporation's trading portfolio at the end of the year is as follows: Security Common Stock A Common Stock B 12. Cost $10,000 9,000 $19,000 Market Value $11,000 6,000 $17,000

At the end of the year, Greer Corporation should a. set up a Market Adjustment account for Stock B. b. set up a Market Adjustment account for the portfolio. c. recognize an Unrealized Gain or LossIncome for $3,000. d. report a loss on the income statement for $3,000 under "Other Expenses and Losses."

13.

Greer subsequently sells Stock B for $11,000. What entry is made to record the sale? a. Cash ...................................................................................... 11,000 Stock Investments ........................................................ 11,000 b. Cash ...................................................................................... 11,000 Market Adjustment ....................................................... 2,000 Stock Investments ........................................................ 9,000 c. Cash ...................................................................................... 11,000 Stock Investments ........................................................ 9,000 Gain on Sale of Stock Investments ............................. 2,000 d. Cash ...................................................................................... 11,000 Stock Investments ........................................................ 6,000 Gain on Sale of Stock Investments ............................. 5,000 Which of the following would not be reported under "Other Revenues and Gains" on the income statement? a. Unrealized gain on available-for-sale securities b. Dividend revenue c. Interest revenue d. Gain on sale of short-term debt investments The balance in the Unrealized LossEquity account will a. appear on the balance sheet as a contra asset. b. appear on the income statement under Other Expenses and Losses. c. appear as a deduction in the stockholders' equity section. d. not be shown on the financial statements until the securities are sold. Which one of the following items is not generally used in preparing a statement of cash flows? a. Adjusted trial balance b. Comparative balance sheets c. Current income statement d. Additional information The order of presentation of activities on the statement of cash flows is a. operating, investing, and financing. b. operating, financing, and investing. c. financing, operating, and investing. d. financing, investing, and operating. The category that is generally considered to be the best measure of a company's ability to continue as a going concern is a. cash flows from operating activities. b. cash flows from investing activities. c. cash flows from financing activities. d. usually different from year to year.

14.

15.

16.

17.

18.

19.

Cash receipts from interest and dividends are classified as a. financing activities. b. investing activities. c. operating activities. d. either financing or investing activities. Significant noncash transactions would not include a. conversion of bonds into common stock. b. asset acquisition through bond issuance. c. treasury stock acquisition. d. exchange of plant assets. Meyer Company reported net income of $40,000 for the year. During the year, accounts receivable increased by $14,000, accounts payable decreased by $6,000 and depreciation expense of $10,000 was recorded. Net cash provided by operating activities for the year is a. $30,000. b. $70,000. c. $38,000. d. $40,000. Which of the following would be subtracted from net income using the indirect method? a. Depreciation expense b. An increase in accounts receivable c. An increase in accounts payable d. A decrease in prepaid expenses Which of the following would not be an adjustment to net income using the indirect method? a. Depreciation Expense b. An increase in Prepaid Insurance c. Amortization Expense d. An increase in Land Which of the following adjustments to convert net income to net cash provided by operating activities is correct? a. b. c. d. Accounts Receivable Prepaid Expenses Inventory Taxes Payable Add to Net Income increase increase decrease decrease Deduct from Net Income decrease decrease increase increase

20.

21.

22.

23.

24.

25.Which of the following adjustments to convert net income to net cash provided by operating activities is not added to net income? a. Gain on Sale of Equipment b. Depreciation Expense c. Patent Amortization Expense d. Depletion Expense

26.

Which of the following would not be needed to determine net cash provided by operating activities? a. Depreciation expense b. Change in accounts receivable c. Payment of cash dividends d. Change in prepaid expenses When equipment is sold for cash, the amount received is reflected as a cash a. inflow in the operating section. b. inflow in the financing section. c. inflow in the investing section. d. outflow in the operating section. Horizontal analysis is a technique for evaluating financial statement data a. within a period of time. b. over a period of time. c. on a certain date. d. as it may appear in the future. In performing a vertical analysis, the base for prepaid expenses is a. total current assets. b. total assets. c. total liabilities. d. prepaid expenses in a previous year. The ratios that are used to determine a company's short-term debt paying ability are a. asset turnover, times interest earned, current ratio, and receivables turnover. b. times interest earned, inventory turnover, current ratio, and receivables turnover. c. times interest earned, acid-test ratio, current ratio, and inventory turnover. d. current ratio, acid-test ratio, receivables turnover, and inventory turnover. The order of presentation of nontypical items that may appear on the income statement is a. Extraordinary items, Discontinued operations, Change in accounting principle. b. Discontinued operations, Extraordinary items, Change in accounting principle. c. Change in accounting principle, Discontinued operations, Extraordinary items. d. Change in accounting principle, Extraordinary items, Discontinued operations.

27.

28.

29.

30.

31.

Problem # 1 Horten Company had the following transactions pertaining to debt securities held as a short-term investment. Jan. 1 Purchased 30, 8%, $1,000 Edwards Company bonds for $30,000 cash plus brokerage fees of $600. Interest is payable semiannually on July 1 and January 1. Received semiannual interest on Edwards Company bonds. Sold 15 Edwards Company bonds for $16,000 plus accrued interest less $300 brokerage fees.

July 1 Oct. 1

Instructions (a) Journalize the transactions. (b) Prepare the adjusting entry for the accrual of interest on December 31.

Solution # 1 (a) Jan. 1 July Oct. 1 1 Debt Investments ............................................................ Cash ....................................................................... Cash ($30,000 8% 1/2) ............................................ Interest Revenue .................................................... Cash .............................................................................. Debt Investments ................................................... Interest Revenue .................................................... Gain on Sale of Debt Investments ......................... ($15,000 8% 3/12 = $300) ($15,700 $15,300 = $400) 30,600 30,600 1,200 1,200 16,000 15,300 300 400

(b) Interest Receivable .......................................................................... Interest Revenue ...................................................................... ($15,000 8% 1/2 = $600)

600 600

Problem # 2 Ryff Corporation's balance sheet at December 31, 2002, showed the following: Short-term investments, at fair value $46,500 Ryff Corporation's trading portfolio of stock investments consisted of the following at December 31, 2002: Stock Dixon Common Stock Boone Preferred Stock Golic Common Stock Number of Shares 200 400 300 Cost $30,000 6,000 9,000 $45,000

During 2003, the following transactions took place: Feb. 5 Mar. 30 Sept. 9 Sold 100 shares of Dixon common stock for $18,000. Purchased 25 shares of Golic common stock for $950. Purchased 75 shares of Golic common stock for $3,000.

At year end on December 31, 2003, the market values per share were: Dixon Common Stock Boone Preferred Stock Golic Common Stock Market Value Per Share $148.00 $ 14.00 $ 25.00

Instructions (a) Prepare the journal entries to record the 2003 stock transactions. (b) (c) On December 31, 2003, prepare any adjusting entry that might be necessary relative to the trading portfolio. Show how the stock investments will appear on Ryff Corporation's balance sheet at December 31, 2003.

Solution # 2 (a) Feb. 5 Cash ............................................................................ 18,000 Stock Investments ................................................ 15,000 Gain on Sale of Stock Investments ...................... 3,000 (To record sale of 100 shares of Dixon Common Stock) Stock Investments ......................................................... Cash ..................................................................... (To record purchase of 25 shares of Golic Common Stock) Stock Investments ......................................................... Cash ..................................................................... (To record purchase of 75 shares of Golic Common Stock) Number of Shares 100 400 400 Cost $15,000 6,000 12,950 $33,950 950 950

Mar. 30

Sept. 9

3,000 3,000

(b)

Stock Dixon Common Stock Boone Preferred Stock Golic Common Stock

Market Value $14,800 5,600 10,000 $30,400 5,050 5,050

Unrealized LossIncome [($33,950 $30,400) + $1,500*] ......... Market AdjustmentTrading ................................................ *($46,500 fair value $45,000 cost) (c) Short-term investments, at fair value

$30,400

Problem # 3 On January 1, 2003, Nye Company purchased 5,000 shares of Grand Company stock for $400,000. Nyes investment represents 25 percent of the total outstanding shares of Grand. During 2003, Grand paid total dividends of $100,000 and reported net income of $280,000. Instructions (a) Compute the amount of revenue Nye would report related to this investment. (b) Compute the amount to be reported as an investment in Grand stock at December 31, 2003. Solution # 3 (a) Revenue for 2003 ($280,000 .25) $70,000

(b)

Balance in Investment account Purchase price Less: Dividend receipt ($100,000 .25) Plus: Investment revenue ($280,000 .25) Ending balance Investment in Grand

$400,000 25,000 +70,000 $445,000

Problem # 4 Selected transactions for Eldon Company are listed below. 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. Collected accounts receivable. Declared cash dividends on common stock. Sold long-term investments for cash. Issued stock for equipment. Repaid five-year note payable. Paid employee wages. Converted bonds payable to common stock. Acquired long-term investment with cash. Sold buildings and equipment for cash. Sold merchandise to customers.

Instructions Classify each transaction as either (a) an operating activity, (b) an investing activity, (c) a financing activity, or (d) a noncash investing and financing activity.

Solution # 4 1. 2. 3. 4. 5. Operating activity Financing activity Investing activity Noncash activity Financing activity 6. 7. 8. 9. 10. Operating activity Noncash activity Investing activity Investing activity Operating activity

Problem # 5 Peck Company reported net income of $150,000 for the current year. Depreciation recorded on buildings and equipment amounted to $80,000 for the year. Balances of the current asset and current liability accounts at the beginning and end of the year are as follows: Cash Accounts receivable Inventories Prepaid expenses Accounts payable Income taxes payable End of Year $20,000 19,000 55,000 7,500 12,000 1,600 Beginning of Year $15,000 30,000 65,000 5,000 16,000 1,300

Instructions Prepare the cash flows from the operating activities section of the statement of cash flows using the indirect method.

Solution # 5 Net income ............................................................................................................. ................................................................................................................................. $150,000 Adjustments to reconcile net income to net cash provided by operating activities: Depreciation expense ................................................................................... Decrease in accounts receivable .................................................................. Decrease in inventories ................................................................................ Increase in prepaid expenses ....................................................................... Decrease in accounts payable ..................................................................... Increase in income taxes payable ................................................................ 300 Net cash provided by operating activities ..................................................... $244,800

80,000 11,000 10,000 (2,500) (4,000)

10

Problem # 6 The following information is available for Garrett Corporation for the year ended December 31, 2003: Collection of principal on long-term loan to a supplier Acquisition of equipment for cash Proceeds from the sale of long-term investment at book value Issuance of common stock for cash Depreciation expense Redemption of bonds payable at carrying (book) value Payment of cash dividends Net income Purchase of land by issuing bonds payable $30,000 10,000 32,000 20,000 15,000 24,000 22,000 20,000 40,000

In addition, the following information is available from the comparative balance sheet for Garrett at the end of 2002 and 2003: Cash Accounts receivable (net) Prepaid insurance Total current assets Accounts payable Salaries payable Total current liabilities 2003 $ 69,000 25,000 17,000 $111,000 $ 30,000 4,000 $ 34,000 2002 $14,000 15,000 13,000 $42,000 $19,000 7,000 $26,000

Instructions Prepare Garrett's statement of cash flows for the year ended December 31, 2003 using the indirect method.

11

Solution # 6 GARRETT CORPORATION Statement of Cash Flows For the Year Ended December 31, 2003 Cash flows from operating activities Net income .................................................................................... $20,000 Adjustments to reconcile net income to net cash provided by operating activities Depreciation .......................................................................... $15,000 Increase in accounts receivable ........................................... (10,000) Increase in prepaid insurance .............................................. (4,000) Increase in accounts payable ............................................... 11,000 Decrease in salaries payable ............................................... (3,000) 9,000 Net cash provided by operating activities ............................. 29,000 Cash flows from investing activities Collection of long-term loan ........................................................... 30,000 Proceeds from the sale of investments ......................................... 32,000 Purchase of equipment .................................................................. (10,000) Net cash provided by investing activities ............................. 52,000 Cash flows from financing activities Issuance of common stock ............................................................ 20,000 Redemption of bonds ..................................................................... (24,000) Payment of dividends .................................................................... (22,000) Net cash used by financing activities ................................... (26,000) Increase in Cash .................................................................................... 55,000 Cash at beginning of period .................................................................... 14,000 Cash at end of period ............................................................................. $69,000 Noncash investing and financing activities Purchase of land by issuing bonds ................................................ $40,000

12

Problem # 7 Selected information from the comparative financial statements of Grand Company for the year ended December 31, appears below: Accounts receivable (net) Inventory Total assets Current liabilities Long-term debt Net credit sales Cost of goods sold Interest expense Income tax expense Net income 2003 $ 180,000 140,000 1,200,000 140,000 400,000 1,330,000 900,000 50,000 60,000 150,000 2002 $200,000 160,000 800,000 110,000 300,000 700,000 530,000 25,000 29,000 85,000

Instructions Answer the following questions relating to the year ended December 31, 2003. Show computa- tions. 1. Inventory turnover for 2003 is __________. 2. Times interest earned in 2003 is __________. 3. The debt to total assets ratio for 2003 is __________. 4. Receivables turnover for 2003 is __________. 5. Return on assets for 2003 is __________. Solution # 7 1. Inventory turnover for 2003 is 6 times. $900,000 = 6 times. ($140,000 + $160,000) 2 $150,000 + $60,000 + $50,000 = $50,000 $140,000 + $400,000 = 45%. $1,200,000

2. Times interest earned in 2003 is 5.2 times. 5.2 times.

3. The debt to total assets ratio for 2003 is 45%.

4. Receivables turnover for 2003 is 7 times.

$1,330,000 = 7 times. ($180,000 + $200,000) 2

5. Return on assets for 2003 is 15%.

$150,000 = 15%. ($1,200,000 + $800,000) 2

13

Problem # 8 Caldwell Corporation had the following comparative current assets and current liabilities: Dec. 31, 2003 Dec. 31, 2002 Current assets Cash $ 60,000 $ 30,000 Marketable securities 40,000 10,000 Accounts receivable 55,000 95,000 Inventory 110,000 90,000 Prepaid expenses 35,000 20,000 Total current assets $300,000 $245,000 Current liabilities Accounts payable $140,000 $110,000 Salaries payable 40,000 30,000 Income tax payable 20,000 15,000 Total current liabilities $200,000 $155,000 During 2003, credit sales and cost of goods sold were $750,000 and $400,000, respectively. Instructions Compute the following liquidity measures for 2003: 1. Current ratio. 2. Working capital. 3. Acid-test ratio. 4. Receivables turnover. 5. Inventory turnover.

Solution # 8 1. Current Ratio = Current Assets Current Liabilities = $300,000 $200,000 = 1.5:1 2. Working Capital = $300,000 $200,000 = $100,000 Cash + Marketable Securities + Accounts Receivable 3. Acid-test Ratio = Current Liabilities $60,000 + $40,000 + $55,000 = = .78:1 $200,000 Net credit sales $750,000 4. Receivables Turnover = = = 10 times Average accounts receivables $75,000 Cost of goods sold $400,000

14

5. Inventory Turnover = = = 4 times Average inventory $100,000

15

Problem # 9 The balance sheet for Farley Corporation at the end of the current year indicates the following: Bonds payable, 8% ............................................................... 6% Preferred stock, $100 par ............................................... Common stock, $10 par ........................................................ $4,000,000 1,000,000 2,000,000

Income before income taxes was $480,000 and income tax expense for the current year amounted to $144,000. Cash dividends paid on common stock were $300,000, and the common stock was selling for $22 per share at the end of the year. There were no ownership changes during the year. Instructions Determine each of the following: (a) times that bond interest was earned. (b) earnings per share for common stock. (c) price-earnings ratio.

Solution # 9 (a) Times interest earned = $480,000 + $320,000 = $320,000 (b) Income before income taxes and interest expense Interest expense 2.5 times

Net income Preferred dividends Earnings per share = Weighted average common shares outstanding $336,000 $60,000 = $1.38 per share 200,000 shares

(c)

Market price per share Price-earnings ratio = Earnings per share $22.00 = = 15.9 $1.38

16

Problem # 10 Docker Company has income from continuing operations of $400,000 for the year ended December 31, 2003. It also has the following items (before considering income taxes): (1) (2) (3) An extraordinary fire loss of $150,000. A gain of $70,000 on the discontinuance of a major segment. A cumulative effect of a change in accounting principle that resulted in an increase in prior years' depreciation of $60,000.

Assume all items are subject to income taxes at a 30% tax rate. Instructions Prepare an income statement, beginning with income from continuing operations. Solution # 10 DOCKER COMPANY Partial Income Statement For the Year Ended December 31, 2003 Income from continuing operations .............................................................. $400,000 Discontinued operations Gain on discontinued segment, net of $21,000 income taxes ............ 49,000 Income before extraordinary item and cumulative effect of change in accounting principle ................................................................................... 449,000 Extraordinary item Fire loss, net of $45,000 tax saving ..................................................... (105,000) Cumulative effect of change in accounting principle Effect on prior years of change in depreciation method, net of $18,000 income tax saving .............................................................. (42,000) Net income .................................................................................................... $302,000

17

Vous aimerez peut-être aussi

- SIE Exam Practice Question Workbook: Seven Full-Length Practice Exams (2023 Edition)D'EverandSIE Exam Practice Question Workbook: Seven Full-Length Practice Exams (2023 Edition)Évaluation : 5 sur 5 étoiles5/5 (1)

- Practice Multiple Choice Questions For First Test PDFDocument10 pagesPractice Multiple Choice Questions For First Test PDFBringinthehypePas encore d'évaluation

- Practice Multiple Choice Questions For First Test PDFDocument10 pagesPractice Multiple Choice Questions For First Test PDFBringinthehypePas encore d'évaluation

- Make Money With Dividends Investing, With Less Risk And Higher ReturnsD'EverandMake Money With Dividends Investing, With Less Risk And Higher ReturnsPas encore d'évaluation

- Cfas ReviewerDocument10 pagesCfas ReviewershaylieeePas encore d'évaluation

- Intermediate Accounting 2: a QuickStudy Digital Reference GuideD'EverandIntermediate Accounting 2: a QuickStudy Digital Reference GuidePas encore d'évaluation

- Chapter 5 Test BankDocument12 pagesChapter 5 Test Bankmyngoc181233% (3)

- The Entrepreneur’S Dictionary of Business and Financial TermsD'EverandThe Entrepreneur’S Dictionary of Business and Financial TermsPas encore d'évaluation

- Activity 3 FinMaDocument6 pagesActivity 3 FinMaDiomela BionganPas encore d'évaluation

- Chapter 3. Mas-Ambray & BasulDocument7 pagesChapter 3. Mas-Ambray & BasulAmbray LynjoyPas encore d'évaluation

- Summary of Richard A. Lambert's Financial Literacy for ManagersD'EverandSummary of Richard A. Lambert's Financial Literacy for ManagersPas encore d'évaluation

- Answers Homework # 19 - Financial Reporting IDocument5 pagesAnswers Homework # 19 - Financial Reporting IRaman APas encore d'évaluation

- CFA Level 1 Calculation Workbook: 300 Calculations to Prepare for the CFA Level 1 Exam (2023 Edition)D'EverandCFA Level 1 Calculation Workbook: 300 Calculations to Prepare for the CFA Level 1 Exam (2023 Edition)Évaluation : 4.5 sur 5 étoiles4.5/5 (5)

- Principles of Financial Accounting PDFDocument5 pagesPrinciples of Financial Accounting PDFJia SPas encore d'évaluation

- Final PB ToaDocument6 pagesFinal PB ToaYaj CruzadaPas encore d'évaluation

- Applied Corporate Finance. What is a Company worth?D'EverandApplied Corporate Finance. What is a Company worth?Évaluation : 3 sur 5 étoiles3/5 (2)

- Financial AccountingDocument5 pagesFinancial Accountingimsana minatozakiPas encore d'évaluation

- Financial Accounting - Want to Become Financial Accountant in 30 Days?D'EverandFinancial Accounting - Want to Become Financial Accountant in 30 Days?Évaluation : 5 sur 5 étoiles5/5 (1)

- Saint Vincent College of Cabuyao Financial Statement Analysis Quiz No. 1Document8 pagesSaint Vincent College of Cabuyao Financial Statement Analysis Quiz No. 1jovelyn labordoPas encore d'évaluation

- CFP Certification Exam Practice Question Workbook: 1,000 Comprehensive Practice Questions (2018 Edition)D'EverandCFP Certification Exam Practice Question Workbook: 1,000 Comprehensive Practice Questions (2018 Edition)Évaluation : 5 sur 5 étoiles5/5 (1)

- 6939 - Cash and Accruals BasisDocument5 pages6939 - Cash and Accruals BasisAljur SalamedaPas encore d'évaluation

- Acct 284 Clem Exam One - Doc Fall 2004Document3 pagesAcct 284 Clem Exam One - Doc Fall 2004noranycPas encore d'évaluation

- Act-6j03 Comp1 1stsem05-06Document14 pagesAct-6j03 Comp1 1stsem05-06RegenLudevesePas encore d'évaluation

- IA 3 ReviewerDocument23 pagesIA 3 ReviewerLarra NarcisoPas encore d'évaluation

- FAR Review Course Pre-Board - Answer KeyDocument17 pagesFAR Review Course Pre-Board - Answer KeyROMAR A. PIGAPas encore d'évaluation

- Pre Quali 2019Document9 pagesPre Quali 2019Haidie DiazPas encore d'évaluation

- ECO 444 Investments Test Bank-No AnswersDocument17 pagesECO 444 Investments Test Bank-No AnswersAllan Genesis Romblon100% (1)

- Finacc 3 Question Set BDocument9 pagesFinacc 3 Question Set BEza Joy ClaveriasPas encore d'évaluation

- Quiz 4Document7 pagesQuiz 4Vivienne Rozenn LaytoPas encore d'évaluation

- FAR Review Course Pre-Board - FinalDocument17 pagesFAR Review Course Pre-Board - FinalROMAR A. PIGA100% (1)

- English To Math and VocabDocument10 pagesEnglish To Math and VocabezaPas encore d'évaluation

- 01 (PRELIMS) FAR 2 (Intacc 1 - 2)Document19 pages01 (PRELIMS) FAR 2 (Intacc 1 - 2)Francis AsisPas encore d'évaluation

- College of Accountancy Final Examination Acctg.3A Instruction: Multiple ChoiceDocument7 pagesCollege of Accountancy Final Examination Acctg.3A Instruction: Multiple ChoiceDonalyn BannagaoPas encore d'évaluation

- OrcaDocument201 pagesOrcaFritzie Ann ZartigaPas encore d'évaluation

- P1 QuizzerDocument26 pagesP1 QuizzerLorena Joy AggabaoPas encore d'évaluation

- 5 13Document13 pages5 13rain06021992Pas encore d'évaluation

- Acctg 3b Midterm ExamDocument10 pagesAcctg 3b Midterm ExamDonalyn BannagaoPas encore d'évaluation

- Ias 7 Test Bank PDFDocument8 pagesIas 7 Test Bank PDFAB Cloyd100% (2)

- Midterm ExaminationDocument10 pagesMidterm ExaminationJo KePas encore d'évaluation

- Par Cor Accounting Cup - Average Round QuestionsDocument6 pagesPar Cor Accounting Cup - Average Round QuestionsShin YaePas encore d'évaluation

- Select The Best Answer From The Choices Given.: TheoryDocument14 pagesSelect The Best Answer From The Choices Given.: TheoryROMAR A. PIGAPas encore d'évaluation

- Far Theory Test BankDocument15 pagesFar Theory Test BankKimberly Etulle Celona100% (1)

- Adjusting ProcessDocument13 pagesAdjusting ProcessEly IseijinPas encore d'évaluation

- Corporate Finance Canadian 7th Edition Jaffe Test BankDocument27 pagesCorporate Finance Canadian 7th Edition Jaffe Test Bankdeborahmatayxojqtgzwr100% (13)

- FARAP 4702 ReceivablesDocument8 pagesFARAP 4702 Receivablesliberace cabreraPas encore d'évaluation

- ACYFAR1 CE On PAS1 (IAS1) Presentation of FSDocument4 pagesACYFAR1 CE On PAS1 (IAS1) Presentation of FSElle KongPas encore d'évaluation

- Theory of Accounts-SIR SALVADocument245 pagesTheory of Accounts-SIR SALVASofia SanchezPas encore d'évaluation

- Receivables QuizDocument3 pagesReceivables QuizGIRLPas encore d'évaluation

- Exercise 1Document3 pagesExercise 1CZARINA COMPLEPas encore d'évaluation

- Fundamentals of Accounting 1Document8 pagesFundamentals of Accounting 1julietpamintuanPas encore d'évaluation

- Examen Contabilidad IntermediaDocument8 pagesExamen Contabilidad IntermediaMariaPas encore d'évaluation

- Ia IDocument8 pagesIa IPamela BugarsoPas encore d'évaluation

- CASH FLOW STATEMENTS - Quiz 3Document2 pagesCASH FLOW STATEMENTS - Quiz 3JyPas encore d'évaluation

- Practical Accounting 1Document32 pagesPractical Accounting 1EdenA.Mata100% (9)

- Corporate Finance Canadian 7th Edition Ross Test BankDocument27 pagesCorporate Finance Canadian 7th Edition Ross Test BankChristinaCrawfordigdyp100% (16)

- Answers Homework # 20 - Financial Reporting IIDocument5 pagesAnswers Homework # 20 - Financial Reporting IIRaman APas encore d'évaluation

- Pamela Galang Bsa 2 IA3 Quiz - Cash Flows True or FalseDocument10 pagesPamela Galang Bsa 2 IA3 Quiz - Cash Flows True or FalseYukiPas encore d'évaluation

- Work Standards: 1) Five-Day Exception RuleDocument2 pagesWork Standards: 1) Five-Day Exception Rulemohit_namanPas encore d'évaluation

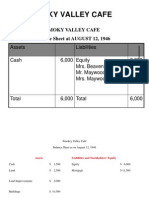

- Smoky Valley CafeDocument3 pagesSmoky Valley Cafemohit_namanPas encore d'évaluation

- Team NamesDocument14 pagesTeam Namesmohit_namanPas encore d'évaluation

- EstimationDocument6 pagesEstimationmohit_namanPas encore d'évaluation

- Proposal For: Co-Location FacilityDocument9 pagesProposal For: Co-Location Facilitymohit_namanPas encore d'évaluation

- 06 Feb 2024 - 451362AccStmtDownloadReport 1 4Document4 pages06 Feb 2024 - 451362AccStmtDownloadReport 1 4mohammedPas encore d'évaluation

- 5 Structured Products Forum 2007 Hong KongDocument11 pages5 Structured Products Forum 2007 Hong KongroversamPas encore d'évaluation

- 1 Cash and Cash EquivalentsDocument3 pages1 Cash and Cash EquivalentsSkie MaePas encore d'évaluation

- Bank Clerks' Exam: EnglishDocument8 pagesBank Clerks' Exam: Englishਰਾਹ ਗੀਰPas encore d'évaluation

- Principles of Macroeconomics 5E 5E Edition Ben Bernanke Et Al All ChapterDocument67 pagesPrinciples of Macroeconomics 5E 5E Edition Ben Bernanke Et Al All Chapterroscoe.carbonaro447100% (6)

- Contemporary Financial Management 13th Edition by Moyer McGuigan Rao ISBN Test BankDocument19 pagesContemporary Financial Management 13th Edition by Moyer McGuigan Rao ISBN Test Bankfrederick100% (25)

- Elements-Of Money FinancesDocument2 pagesElements-Of Money FinancesMayte DeliyorePas encore d'évaluation

- REPUBLIC ACT NO. 10883, July 17, 2016 An Act Providing For A New Anti-Carnapping Law of The PhilippinesDocument16 pagesREPUBLIC ACT NO. 10883, July 17, 2016 An Act Providing For A New Anti-Carnapping Law of The PhilippinesGabe BedanaPas encore d'évaluation

- What Is Spread Betting (Good) PDFDocument4 pagesWhat Is Spread Betting (Good) PDFMyriam GrissaPas encore d'évaluation

- Plagiarism Declaration Form (T-DF)Document8 pagesPlagiarism Declaration Form (T-DF)Nur HidayahPas encore d'évaluation

- Balance Statement ReportingDocument12 pagesBalance Statement ReportingahnaflionheartPas encore d'évaluation

- Accountancy em Iii RevisionDocument7 pagesAccountancy em Iii RevisionMalathi RajaPas encore d'évaluation

- DHFLDocument7 pagesDHFLSubhadip Sinha100% (1)

- CIR vs. Sekisui Jushi Philippines, IncDocument2 pagesCIR vs. Sekisui Jushi Philippines, IncCombat GunneyPas encore d'évaluation

- Fundamentals of Partnership: Dhiman ClaimsDocument7 pagesFundamentals of Partnership: Dhiman ClaimsAyareena GiriPas encore d'évaluation

- Boi and HDFCDocument24 pagesBoi and HDFCDharmikPas encore d'évaluation

- Shares Class PPT Sunil PandaDocument60 pagesShares Class PPT Sunil Pandadollpees01Pas encore d'évaluation

- SBR - Mock A - AnswersDocument14 pagesSBR - Mock A - AnswersDylan MutambanengwePas encore d'évaluation

- Receivables Management: "Any Fool Can Lend Money, But It TakesDocument37 pagesReceivables Management: "Any Fool Can Lend Money, But It Takesjai262418Pas encore d'évaluation

- Characteristics and Functions of MoneyDocument2 pagesCharacteristics and Functions of Moneyanastasiasteele_greyPas encore d'évaluation

- Modern Banking Services - A Key Tool For Banking Sector: Mobile No: 90038 12289Document6 pagesModern Banking Services - A Key Tool For Banking Sector: Mobile No: 90038 12289MD Hafizul Islam HafizPas encore d'évaluation

- Investments AssignmentDocument5 pagesInvestments Assignmentapi-276011592Pas encore d'évaluation

- Blueprint For Service Design of A Credit Card DivisionDocument3 pagesBlueprint For Service Design of A Credit Card Divisionanaghmahajan100% (1)

- Cakpo T. Paul Luc U: Who I'Am Personal InformationDocument4 pagesCakpo T. Paul Luc U: Who I'Am Personal Informationchancia angePas encore d'évaluation

- Dillon Read & The Aristocracy of Stock Profits - Catherine Austin FittsDocument231 pagesDillon Read & The Aristocracy of Stock Profits - Catherine Austin Fittsfourcade100% (2)

- Shriram Payslip MayDocument2 pagesShriram Payslip MayGanesh SahuPas encore d'évaluation

- Account Summary: Past Due Current Charges Total Amount DueDocument2 pagesAccount Summary: Past Due Current Charges Total Amount DueGuillermina HerreraPas encore d'évaluation

- Letter of Credit ProcedureDocument4 pagesLetter of Credit ProcedureKarthickDevanPas encore d'évaluation

- Final Accounts of CompaniesDocument30 pagesFinal Accounts of CompaniesAkanksha GanveerPas encore d'évaluation

- Chapter 15 HW SolutionDocument5 pagesChapter 15 HW SolutionZarifah FasihahPas encore d'évaluation

- I Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)D'EverandI Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)Évaluation : 4.5 sur 5 étoiles4.5/5 (15)

- Tax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesD'EverandTax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesPas encore d'évaluation

- Getting to Yes: How to Negotiate Agreement Without Giving InD'EverandGetting to Yes: How to Negotiate Agreement Without Giving InÉvaluation : 4 sur 5 étoiles4/5 (652)

- The ZERO Percent: Secrets of the United States, the Power of Trust, Nationality, Banking and ZERO TAXES!D'EverandThe ZERO Percent: Secrets of the United States, the Power of Trust, Nationality, Banking and ZERO TAXES!Évaluation : 4.5 sur 5 étoiles4.5/5 (14)

- The Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindD'EverandThe Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindÉvaluation : 5 sur 5 étoiles5/5 (231)

- Start, Study and Pass The CPA Exam FAST - Proven 8 Step CPA Exam Study PlaybookD'EverandStart, Study and Pass The CPA Exam FAST - Proven 8 Step CPA Exam Study PlaybookÉvaluation : 5 sur 5 étoiles5/5 (4)

- Overcoming Underearning(TM): A Simple Guide to a Richer LifeD'EverandOvercoming Underearning(TM): A Simple Guide to a Richer LifeÉvaluation : 4 sur 5 étoiles4/5 (21)

- SAP Foreign Currency Revaluation: FAS 52 and GAAP RequirementsD'EverandSAP Foreign Currency Revaluation: FAS 52 and GAAP RequirementsPas encore d'évaluation

- The Big Four: The Curious Past and Perilous Future of the Global Accounting MonopolyD'EverandThe Big Four: The Curious Past and Perilous Future of the Global Accounting MonopolyPas encore d'évaluation

- The Accounting Game: Learn the Basics of Financial Accounting - As Easy as Running a Lemonade Stand (Basics for Entrepreneurs and Small Business Owners)D'EverandThe Accounting Game: Learn the Basics of Financial Accounting - As Easy as Running a Lemonade Stand (Basics for Entrepreneurs and Small Business Owners)Évaluation : 4 sur 5 étoiles4/5 (33)

- A Beginners Guide to QuickBooks Online 2023: A Step-by-Step Guide and Quick Reference for Small Business Owners, Churches, & Nonprofits to Track their Finances and Master QuickBooks OnlineD'EverandA Beginners Guide to QuickBooks Online 2023: A Step-by-Step Guide and Quick Reference for Small Business Owners, Churches, & Nonprofits to Track their Finances and Master QuickBooks OnlinePas encore d'évaluation

- How to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)D'EverandHow to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)Évaluation : 4.5 sur 5 étoiles4.5/5 (5)

- How to Measure Anything: Finding the Value of "Intangibles" in BusinessD'EverandHow to Measure Anything: Finding the Value of "Intangibles" in BusinessÉvaluation : 4.5 sur 5 étoiles4.5/5 (28)

- Beyond the E-Myth: The Evolution of an Enterprise: From a Company of One to a Company of 1,000!D'EverandBeyond the E-Myth: The Evolution of an Enterprise: From a Company of One to a Company of 1,000!Évaluation : 4.5 sur 5 étoiles4.5/5 (8)

- Ratio Analysis Fundamentals: How 17 Financial Ratios Can Allow You to Analyse Any Business on the PlanetD'EverandRatio Analysis Fundamentals: How 17 Financial Ratios Can Allow You to Analyse Any Business on the PlanetÉvaluation : 4.5 sur 5 étoiles4.5/5 (14)

- The Wall Street MBA, Third Edition: Your Personal Crash Course in Corporate FinanceD'EverandThe Wall Street MBA, Third Edition: Your Personal Crash Course in Corporate FinanceÉvaluation : 4 sur 5 étoiles4/5 (1)

- Accounting For Small Businesses QuickStart Guide: Understanding Accounting For Your Sole Proprietorship, Startup, & LLCD'EverandAccounting For Small Businesses QuickStart Guide: Understanding Accounting For Your Sole Proprietorship, Startup, & LLCÉvaluation : 5 sur 5 étoiles5/5 (1)

- Purchasing, Inventory, and Cash Disbursements: Common Frauds and Internal ControlsD'EverandPurchasing, Inventory, and Cash Disbursements: Common Frauds and Internal ControlsÉvaluation : 5 sur 5 étoiles5/5 (1)

- The Intelligent Investor, Rev. Ed: The Definitive Book on Value InvestingD'EverandThe Intelligent Investor, Rev. Ed: The Definitive Book on Value InvestingÉvaluation : 4.5 sur 5 étoiles4.5/5 (760)

- Contract Negotiation Handbook: Getting the Most Out of Commercial DealsD'EverandContract Negotiation Handbook: Getting the Most Out of Commercial DealsÉvaluation : 4.5 sur 5 étoiles4.5/5 (2)

- Your Amazing Itty Bitty(R) Personal Bookkeeping BookD'EverandYour Amazing Itty Bitty(R) Personal Bookkeeping BookPas encore d'évaluation

- Financial Accounting For Dummies: 2nd EditionD'EverandFinancial Accounting For Dummies: 2nd EditionÉvaluation : 5 sur 5 étoiles5/5 (10)

- Small Business: A Complete Guide to Accounting Principles, Bookkeeping Principles and Taxes for Small BusinessD'EverandSmall Business: A Complete Guide to Accounting Principles, Bookkeeping Principles and Taxes for Small BusinessPas encore d'évaluation