Académique Documents

Professionnel Documents

Culture Documents

Trial of Strength: Will Today's Currency Interventions Hurt or Help The World Economy?

Transféré par

Anja MihajlovaDescription originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Trial of Strength: Will Today's Currency Interventions Hurt or Help The World Economy?

Transféré par

Anja MihajlovaDroits d'auteur :

Formats disponibles

Currencies

Trial of strength

Will todays currency interventions hurt or help the world economy? TWENTY-FIVE years ago this week, the finance ministers of America, Japan, Britain, France and West Germany met at a swanky New York hotel and agreed to push the dollar down. The Plaza Accord laid out a package of co-ordinated policies. The dollar duly fell, by more than 50% against the D-mark and yen by 1987. The deal is still seen as a high-water mark of international monetary co-operation. The appeal of intervention is now rising once again. But this time the trend is unilateral, unco-ordinated and in one direction. At its meeting on September 21st the Federal Reserve worried aloud about uncomfortably low inflation and made clear it was prepared to do more to help the flagging recovery. The prospect of even looser monetary policy pushed the dollar down sharply: it dipped to its lowest level since March on a tradeweighted basis. A weaker dollar means stronger currencies elsewherethe euro hit a five-month high against the dollar on September 22nd. A growing number of countries are determined to stop their currencies from rising. Japan sold about 2 trillion ($23.6 billion) on September 15th, its first foray into the currency markets in six years, to stem a surge in the yen that had pushed its nominal rate against the dollar to its highest since 1995. It is not the only rich country to target its exchange rate: in the 15 months to June, Switzerland quadrupled its foreign reserves, to $219 billion, in a bid to stop the franc from rising too fast. The most active interveners, however, are in the emerging world. China is the extreme case. It has built up $2.45 trillion of reserves thanks to its determination to keep the yuan stable against the dollar. Others have less rigid currencies but still intervene to stem what they regard as excessive upward pressure. Between September 13th and 16th Brazils central bank bought dollars at a rate of $1 billion a day. As the recovery slows, a growing number of people worry about a descent into competitive depreciation, as countries try to grab a bigger share of global demand at others expense, a trend that could fuel protectionism. Optimists, however, argue there may be benefits from todays fad for currency fiddling. One argument is that intervention may be a backdoor route to reflation. If central banks all print money to prevent their currencies appreciating and dont mop up or sterilise that liquidity by issuing bonds, then their exchange rates might end up the same but the world will have had a monetary boost in the interim. The truth lies in between. Although most of the intervening governments have the same goalto stop their domestic currency from risingtheir circumstances and motivations vary widely. Chinas ongoing determination to fix the yuan is the least defensible and most distortive. Unfortunately, it is also the worlds most effective intervener. Thanks to a closed capital account (even if cracks are appearing) and government control over domestic banks, China has been able to buy vast quantities of dollars without fuelling inflation. The central bank issues bills to mop up the liquidity created from buying reserves, which obliging banks hold at low rates. For most emerging economies, however, intervention is more about coping with volatile capital flows. Thanks in part to rock-bottom interest rates in the rich world, foreign capital is flooding back into

emerging economies. By intervening, emerging-market central banks restrain the pace at which their currencies appreciate. But they do so at a price. In countries with freer banking systems than Chinas, sterilisation becomes increasingly costly the more reserves are bought. But if the intervention is not sterilised, the added liquidity fuels inflation. In the rich world, where demand is weak and deflation a risk, the calculus is different. Unsterilised intervention is seen as a route both to counter excessive currency strength and to combat deflation (the prime motive for Swiss intervention). In Japans case the first argument does not cut much ice. Thanks to Japanese deflation the yen, in real effective terms, is below its average value since 1990 (see chart). The second rationale has some merit provided the Bank of Japan really does resist the urge to mop up any liquidity. But it could achieve the same reflation, without the political risks of unilateral intervention, in other ways.

Those political risks are the best reason to resist going it alone. Not only is there the danger of a protectionist backlash. But unilateralism will also make it much harder to elicit further action from China, the country whose currency regime distorts the global economy most. The rich world needs reflating but the world economy also needs rebalancing. And that demands a weaker dollar. The finance ministers at the Plaza Accord recognised that reality. It is time their G20 successors did, too.

Brief This article says that 25 years ago the Plaza Accord (when the finance ministers of America, Japan, Britain, France and West Germany met at a swanky New York hotel and agreed to push the dollar down) took place. That was a great example of international monetary cooperation. Nowadays the situation is vice versa. Dollar dipped to its lowest level since March on a trade-weighted basis. A weaker dollar means stronger currencies elsewhere. A growing number of countries are determined to stop their currencies from rising.Japan and Switzerland are of this type. But some countries don`t even try to do so. China, for example, has built up $2.45 trillion of reserves thanks to its determination to keep the yuan stable against the dollar. Such situation worries thousands of people.However, some optimists believe this situation may still bring some benefits such as reflation for example. The rich world needs reflating but the world economy also needs rebalancing. And that demands a weaker dollar. The finance ministers at the Plaza Accord recognised that reality. It is time their G20 successors did, too.

Vous aimerez peut-être aussi

- Currency WarDocument6 pagesCurrency WarNeha KadamPas encore d'évaluation

- "This Is Our Currency, But Your Problem" Foreign Debt Accumulation and Its ImplicationsDocument12 pages"This Is Our Currency, But Your Problem" Foreign Debt Accumulation and Its ImplicationsJohnPapaspanosPas encore d'évaluation

- The Dollar Milkshake TheoryDocument2 pagesThe Dollar Milkshake TheoryHarushika MittalPas encore d'évaluation

- The Dollar Crisis: Causes, Consequences, CuresD'EverandThe Dollar Crisis: Causes, Consequences, CuresÉvaluation : 4 sur 5 étoiles4/5 (1)

- Economics ProjectDocument20 pagesEconomics ProjectSiddhesh DalviPas encore d'évaluation

- ZebrawhiteDocument12 pagesZebrawhitechrisPas encore d'évaluation

- A Rising Dollar Is Hurting Other Currencies. Central Banks Are Stepping In. - The New York TimesDocument4 pagesA Rising Dollar Is Hurting Other Currencies. Central Banks Are Stepping In. - The New York TimesSunny YaoPas encore d'évaluation

- Ie RESEARCH PAPERDocument19 pagesIe RESEARCH PAPERShweta Gopika ChopraPas encore d'évaluation

- What S Behind The Currency WarDocument6 pagesWhat S Behind The Currency WarJeff ChooPas encore d'évaluation

- Currency WarsDocument25 pagesCurrency Warsdivrastogi100% (2)

- The Currency Puzzle (29!10!2010)Document21 pagesThe Currency Puzzle (29!10!2010)adhirajrPas encore d'évaluation

- Factiva 20190909 2243Document2 pagesFactiva 20190909 2243Jiajun YangPas encore d'évaluation

- Emerging Markets Have Coped With The Rate Shock Surprisingly WellDocument2 pagesEmerging Markets Have Coped With The Rate Shock Surprisingly WellRich GPas encore d'évaluation

- The Diminshing USD ($) TrendDocument5 pagesThe Diminshing USD ($) TrendGilani, ObaidPas encore d'évaluation

- The Dollar Dilemma The Worlds Top Currency Faces CompetitionDocument14 pagesThe Dollar Dilemma The Worlds Top Currency Faces Competitionevenwriter1Pas encore d'évaluation

- GLOBAL SYNOPSIS-updatedDocument26 pagesGLOBAL SYNOPSIS-updatedAbhishek pathangePas encore d'évaluation

- Causes of Currency CrisisDocument4 pagesCauses of Currency CrisisAranya GuvvalaPas encore d'évaluation

- Outlook 2011: Three Dominant Factors Will Impact Gold, Silver and Platinum in 2011Document16 pagesOutlook 2011: Three Dominant Factors Will Impact Gold, Silver and Platinum in 2011Khalid S. AlyahmadiPas encore d'évaluation

- Summary of Michael G. Pento's The Coming Bond Market CollapseD'EverandSummary of Michael G. Pento's The Coming Bond Market CollapsePas encore d'évaluation

- Hot Money Roils Growth CurrenciesDocument2 pagesHot Money Roils Growth Currenciesbelle2vuePas encore d'évaluation

- Currency WarDocument20 pagesCurrency WarBhumiPas encore d'évaluation

- Dollar Vs Yuan RenminbiDocument12 pagesDollar Vs Yuan Renminbialejandra casadevallPas encore d'évaluation

- Russia Shifts Half of External Transactions Away From Dollar and EuroDocument7 pagesRussia Shifts Half of External Transactions Away From Dollar and EuroDebre AllenPas encore d'évaluation

- Final Days of The Dollar 11 22 10Document13 pagesFinal Days of The Dollar 11 22 10exDemocratPas encore d'évaluation

- Reserve JudgementDocument2 pagesReserve Judgementvabthegr81Pas encore d'évaluation

- American Dollar: Crisis TimeDocument5 pagesAmerican Dollar: Crisis TimeAxel LippmanPas encore d'évaluation

- Lunch With Dave: David A. RosenbergDocument18 pagesLunch With Dave: David A. Rosenbergwinstonchen5Pas encore d'évaluation

- Business English News 32 - Currency Wars: Discussion QuestionsDocument8 pagesBusiness English News 32 - Currency Wars: Discussion QuestionsPháp Sư Giấu MặtPas encore d'évaluation

- Global Rate Rises Are Happening On An Unprecedented ScaleDocument2 pagesGlobal Rate Rises Are Happening On An Unprecedented ScaledanPas encore d'évaluation

- Currency WarsDocument9 pagesCurrency WarsAnkit BindalPas encore d'évaluation

- Barron's: Why The Market Will Keep Sliding: Perry DDocument32 pagesBarron's: Why The Market Will Keep Sliding: Perry DAlbert L. PeiaPas encore d'évaluation

- Sumner Gold Report May2015Document3 pagesSumner Gold Report May2015mercosurPas encore d'évaluation

- Discussion Around The Article Linked BelowDocument12 pagesDiscussion Around The Article Linked BelowAllan WortPas encore d'évaluation

- Doomsday For The US DollarDocument7 pagesDoomsday For The US DollarklatifdgPas encore d'évaluation

- The New Depression: The Breakdown of the Paper Money EconomyD'EverandThe New Depression: The Breakdown of the Paper Money EconomyÉvaluation : 4 sur 5 étoiles4/5 (5)

- Why We Need A Stable Currency and Financial Standard (D Popa)Document2 pagesWhy We Need A Stable Currency and Financial Standard (D Popa)Ping LiPas encore d'évaluation

- Us Dollar Paper. ImprovedDocument7 pagesUs Dollar Paper. ImprovedKaan KeskinPas encore d'évaluation

- American and Chinese Monetary PolicyDocument5 pagesAmerican and Chinese Monetary PolicyadrienSassiPas encore d'évaluation

- De DollarizationDocument8 pagesDe Dollarizationbushra farmanPas encore d'évaluation

- China and The SDR-JRFM-Final-ProofDocument15 pagesChina and The SDR-JRFM-Final-ProofMik SerranoPas encore d'évaluation

- g20 The Power of YuanDocument2 pagesg20 The Power of YuanThomas IgielskiPas encore d'évaluation

- TSW Journal Nov-Dec 2010Document16 pagesTSW Journal Nov-Dec 2010SchoolofWashingtonPas encore d'évaluation

- 11-14-11 What's Driving GoldDocument4 pages11-14-11 What's Driving GoldThe Gold SpeculatorPas encore d'évaluation

- Currency Wars A Threat To Global Recovery October 2010Document6 pagesCurrency Wars A Threat To Global Recovery October 2010Joaquim MorenoPas encore d'évaluation

- Price Insensitive Sellers and Ten Quick Topics To Ruin Your SummerDocument24 pagesPrice Insensitive Sellers and Ten Quick Topics To Ruin Your SummerCanadianValue0% (1)

- How Does China Manipulate Their CurrencyDocument3 pagesHow Does China Manipulate Their CurrencyArbaz K. YousafzaiPas encore d'évaluation

- International Monetary SystemDocument6 pagesInternational Monetary SystemBora EfePas encore d'évaluation

- Questioning USD As Global Reserve CurrencyDocument8 pagesQuestioning USD As Global Reserve CurrencyVincentiusArnoldPas encore d'évaluation

- Dagdag Trabaho TsssDocument3 pagesDagdag Trabaho TsssLeslie Jean SangalangPas encore d'évaluation

- JPF The G-20 and The Currency War 01Document3 pagesJPF The G-20 and The Currency War 01BruegelPas encore d'évaluation

- 338 339 Editorial GrosDocument2 pages338 339 Editorial GroslongchempaPas encore d'évaluation

- CHINA-SDR - jrfm-12-00060-v2Document15 pagesCHINA-SDR - jrfm-12-00060-v2GANESHPas encore d'évaluation

- The Global Crash of 2015 and What You Can Do to Protect YourselfD'EverandThe Global Crash of 2015 and What You Can Do to Protect YourselfPas encore d'évaluation

- The Economist - Finacial CrisisDocument4 pagesThe Economist - Finacial CrisisEnzo PitonPas encore d'évaluation

- Crypto TDCDocument29 pagesCrypto TDCAraujo PauloPas encore d'évaluation

- European ReformDocument3 pagesEuropean ReformChintu PatelPas encore d'évaluation

- The Hegemony of The US DollarDocument4 pagesThe Hegemony of The US DollarJoey MartinPas encore d'évaluation

- Eclectica 08-09Document4 pagesEclectica 08-09ArcturusCapitalPas encore d'évaluation

- Crisis of The UDocument10 pagesCrisis of The UAn TranPas encore d'évaluation

- Never Accept Economic Truths Merely Because Somebody Said SoDocument3 pagesNever Accept Economic Truths Merely Because Somebody Said SoARBITRAJ COMERCIAL -Mircea Halaciuga,Esq. aka. Mike SerbanPas encore d'évaluation

- Crdi Low Cost Technology Options For Sanitation A State of The Art Review and Annotated Bibliography 1978Document184 pagesCrdi Low Cost Technology Options For Sanitation A State of The Art Review and Annotated Bibliography 1978Stuart BuenoPas encore d'évaluation

- Health TourismDocument61 pagesHealth TourismT. Chang100% (1)

- Financial Assets ReviewDocument3 pagesFinancial Assets ReviewJobelle Candace Flores AbreraPas encore d'évaluation

- SSS Required Online RegistrationDocument2 pagesSSS Required Online RegistrationTin AvenidaPas encore d'évaluation

- Idh 8 R 5Document30 pagesIdh 8 R 5Quint WongPas encore d'évaluation

- Indian Association of Soil and Water ConservationistsDocument521 pagesIndian Association of Soil and Water Conservationistsshyam143225Pas encore d'évaluation

- Steel Asia 9.28.23Document1 pageSteel Asia 9.28.23Kate PerezPas encore d'évaluation

- Amount of Net Taxable Income Rate Over But Not OverDocument1 pageAmount of Net Taxable Income Rate Over But Not OverDennah Faye SabellinaPas encore d'évaluation

- Fibonacci Trading (PDFDrive)Document148 pagesFibonacci Trading (PDFDrive)ARK WOODYPas encore d'évaluation

- Chapter-5: Findings Summary, Suggestions AND ConclusionDocument7 pagesChapter-5: Findings Summary, Suggestions AND ConclusionPavan Kumar SuralaPas encore d'évaluation

- Av1.0Document1 pageAv1.0Muhammad AbuBakarPas encore d'évaluation

- Auto Title Loans and The Law BrochureDocument2 pagesAuto Title Loans and The Law BrochureSC AppleseedPas encore d'évaluation

- Toyota STP StrategiesDocument25 pagesToyota STP Strategiesvmk005100% (1)

- 3Document1 page3Joane ColipanoPas encore d'évaluation

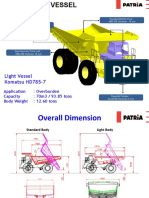

- Patria Light Vessel HD 785-7Document9 pagesPatria Light Vessel HD 785-7bayu enasoraPas encore d'évaluation

- Material 2. Writing A Synthesis Essay. Behrens, Rosen - pp.120-134Document15 pagesMaterial 2. Writing A Synthesis Essay. Behrens, Rosen - pp.120-134George MujiriPas encore d'évaluation

- GDP One of The Greatest Inventions in 20th Century-2Document6 pagesGDP One of The Greatest Inventions in 20th Century-2Karina Permata SariPas encore d'évaluation

- Money MarketDocument67 pagesMoney MarketAvinash Veerendra TakPas encore d'évaluation

- Historias de Éxito FH Bolivia LivDocument14 pagesHistorias de Éxito FH Bolivia LivMarcelo Alvarez AscarrunzPas encore d'évaluation

- Aramco PDFDocument26 pagesAramco PDFGanga DaranPas encore d'évaluation

- Trainers Manual For Sustainable Cocoa GhanaDocument199 pagesTrainers Manual For Sustainable Cocoa GhanaKookoase Krakye100% (1)

- What Are The Similarities and Differences Between Marshall Ian's and Hicks Ian Demand Functions ?Document2 pagesWhat Are The Similarities and Differences Between Marshall Ian's and Hicks Ian Demand Functions ?Zahra Malik100% (5)

- Economic Development Democratization and Environmental ProtectiDocument33 pagesEconomic Development Democratization and Environmental Protectihaimi708Pas encore d'évaluation

- Business Plan of Budaya KopiDocument12 pagesBusiness Plan of Budaya KopiDeccy Shi-Shi100% (1)

- Fish Farm ProposalDocument14 pagesFish Farm ProposalMichael Odiembo100% (1)

- Invitation Letter - Detecting Fraud - MisrepresentationsDocument1 pageInvitation Letter - Detecting Fraud - MisrepresentationsANgel Go CasañaPas encore d'évaluation

- Super Final Applied Economics First Periodical ExamDocument4 pagesSuper Final Applied Economics First Periodical ExamFrancaise Agnes Mascariña100% (2)

- Anarcho Syndicalism and Principles of Urban Planning Scott RittenhouseDocument8 pagesAnarcho Syndicalism and Principles of Urban Planning Scott RittenhouseRichard DodsonPas encore d'évaluation

- VJEPADocument6 pagesVJEPATrang ThuPas encore d'évaluation

- When KD Is Less Than Coupon Intrest RateDocument3 pagesWhen KD Is Less Than Coupon Intrest RateAmit Kr GodaraPas encore d'évaluation