Académique Documents

Professionnel Documents

Culture Documents

Streetscape Relief Loan Fund Fact Sheet

Transféré par

bizDC0 évaluation0% ont trouvé ce document utile (0 vote)

98 vues1 pageStreet vendors and regional or national franchises are ineligible for The SRLF. To be eligible for the loan fund, the business must be independently owned, operated, and controlled. Eligible recipients of loans from The SRLF can use the proceeds for: o Working capital; o Inventory; o Repair of furniture, fixtures, machinery, or equipment.

Description originale:

Copyright

© Attribution Non-Commercial (BY-NC)

Formats disponibles

PDF, TXT ou lisez en ligne sur Scribd

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentStreet vendors and regional or national franchises are ineligible for The SRLF. To be eligible for the loan fund, the business must be independently owned, operated, and controlled. Eligible recipients of loans from The SRLF can use the proceeds for: o Working capital; o Inventory; o Repair of furniture, fixtures, machinery, or equipment.

Droits d'auteur :

Attribution Non-Commercial (BY-NC)

Formats disponibles

Téléchargez comme PDF, TXT ou lisez en ligne sur Scribd

0 évaluation0% ont trouvé ce document utile (0 vote)

98 vues1 pageStreetscape Relief Loan Fund Fact Sheet

Transféré par

bizDCStreet vendors and regional or national franchises are ineligible for The SRLF. To be eligible for the loan fund, the business must be independently owned, operated, and controlled. Eligible recipients of loans from The SRLF can use the proceeds for: o Working capital; o Inventory; o Repair of furniture, fixtures, machinery, or equipment.

Droits d'auteur :

Attribution Non-Commercial (BY-NC)

Formats disponibles

Téléchargez comme PDF, TXT ou lisez en ligne sur Scribd

Vous êtes sur la page 1sur 1

Washington Area Community Investment Fund 3624 12th Street, NE Washington DC, 20017 Phone: 202-529-5505 www.wacif.

org

District of Columbia Department of Small and Local Business Development 441 4th Street NW Suite 970N Washington, DC, 20001 Phone: 202-727-3900 www.dslbd.dc.gov

Streetscape Relief Loan Fund (SRLF) Fact Sheet October 2011

The SRLF was established to provide interest-free loans to retail businesses inside or adjoining a streetscape construction or rehabilitation project To be eligible for the loan fund, the business in question must: o Be independently owned, operated, and controlled; o Be licensed to operate and in good standing with DCRA; o Have a Clean Hands Certificate from the Office of Tax and Revenue (OTR) or state that the loan will be used to pay back taxes due to OTR; o Demonstrate financial hardship or debt resulting from, or accumulated during, the streetscape construction or rehabilitation in the District. Street vendors and regional or national franchises are ineligible for the SRLF Eligible recipients of loans from the SRLF can use the proceeds for: o Working capital; o Inventory; o Repair of furniture, fixtures, machinery, or equipment; o Contract cash flow assistance; o Payment of taxes due the Office of Tax and Revenue; o Payment of overdue rent for lease of retail business space affected by the streetscape construction or rehabilitation project; o Payment of overdue mortgage of retail business space affected by the streetscape construction or rehabilitation project; o Payment of other substantiated financial debt affecting the retail business derived from the streetscape construction or rehabilitation project; o Payment of any fees or costs that may be associated with the loan process including 2.5% commitment fee. Commitment fee will sustain loan fund operations. To apply, be ready to provide: o Completed loan application (provided by WACIF or community partner); o Financial status and evidence of hardship, including, but not limited to, tax returns, balance sheet(s), and profit and loss statements; o Clean Hands Certification from the Office of Tax and Revenue or statement that the loan sought will be used to pay outstanding taxes owed the Office of Tax and Revenue together with tax bills; o Certificate of Good Standing and license to operate the retail business from the Department of Consumer and Regulatory Affairs.

Any additional questions may be directed to info@wacif.org or by calling (202) 529-5505. Thank you for your interest in the Streetscape Relief Loan Fund!

Vous aimerez peut-être aussi

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (399)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (587)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (890)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- Build A Log CabinDocument7 pagesBuild A Log Cabineltorro-t50% (2)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (73)

- Guide to Selecting and Using Expansion JointsDocument30 pagesGuide to Selecting and Using Expansion JointsYogesh PangarePas encore d'évaluation

- TR 5075eDocument324 pagesTR 5075eLeandro Ribeiro100% (1)

- Underground Tank Design and Reinforcement DetailsDocument2 pagesUnderground Tank Design and Reinforcement Detailsaaditya chopadePas encore d'évaluation

- Armoured Cables - Types, Standards and Uses ExplainedDocument2 pagesArmoured Cables - Types, Standards and Uses Explaineddaniel_silabanPas encore d'évaluation

- Concepts of Basement Construction MethodsDocument9 pagesConcepts of Basement Construction Methodssreejit77100% (4)

- Astm C 618 02 1Document4 pagesAstm C 618 02 1Ciro Arnold Gonzales PauccarPas encore d'évaluation

- Piping Layout - Piping Guide - 1Document10 pagesPiping Layout - Piping Guide - 1s_baishya100% (1)

- Diaphragm WallsDocument15 pagesDiaphragm WallsWan Eira100% (1)

- Aluminium - Specifications, Properties, Classifications and Classes, Supplier Data by AalcoDocument2 pagesAluminium - Specifications, Properties, Classifications and Classes, Supplier Data by Aalcowongtathong1987Pas encore d'évaluation

- Membrane StructuresDocument6 pagesMembrane StructuresMonica MarcabaPas encore d'évaluation

- Examples of Civic CentreDocument34 pagesExamples of Civic CentreAnonymous lnOSjQzPas encore d'évaluation

- Main Streets - North CapitolDocument1 pageMain Streets - North CapitolbizDCPas encore d'évaluation

- Streetscape Relief Loan Fund ApplicationDocument5 pagesStreetscape Relief Loan Fund ApplicationbizDCPas encore d'évaluation

- Main Streets - Historic Dupont CircleHeightsDocument1 pageMain Streets - Historic Dupont CircleHeightsbizDCPas encore d'évaluation

- Main Streets - H Street NEDocument1 pageMain Streets - H Street NEbizDCPas encore d'évaluation

- Main Streets - Deanwood HeightsDocument1 pageMain Streets - Deanwood HeightsbizDCPas encore d'évaluation

- STEP GRANT Clean Hands Self CertificationDocument1 pageSTEP GRANT Clean Hands Self CertificationbizDCPas encore d'évaluation

- Main Streets - Barracks RowDocument1 pageMain Streets - Barracks RowbizDCPas encore d'évaluation

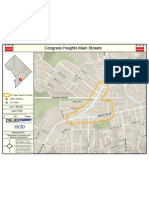

- Main Streets - Congress HeightsDocument1 pageMain Streets - Congress HeightsbizDCPas encore d'évaluation

- SBA Debarment CertificationDocument2 pagesSBA Debarment CertificationbizDCPas encore d'évaluation

- Main Streets - ShawDocument1 pageMain Streets - ShawbizDCPas encore d'évaluation

- SBA Self Representation FormDocument1 pageSBA Self Representation FormbizDCPas encore d'évaluation

- STEP GRANT SelfCertificationForm EligibilityCriteria DCDocument1 pageSTEP GRANT SelfCertificationForm EligibilityCriteria DCbizDCPas encore d'évaluation

- STEP GRANT Clean Hands Self CertificationDocument1 pageSTEP GRANT Clean Hands Self CertificationbizDCPas encore d'évaluation

- CBE Pre-Certification Orientation Presentation 2012Document57 pagesCBE Pre-Certification Orientation Presentation 2012bizDCPas encore d'évaluation

- DC Step Program Application Form - April 2012Document14 pagesDC Step Program Application Form - April 2012bizDCPas encore d'évaluation

- Export DC - February 3 2012 Event FlyerDocument1 pageExport DC - February 3 2012 Event FlyerbizDCPas encore d'évaluation

- Cenovnik j1 Jakka VentilatoriDocument14 pagesCenovnik j1 Jakka VentilatorimealysrPas encore d'évaluation

- Roll Up Door DesignDocument1 pageRoll Up Door DesignLester Neil LomodPas encore d'évaluation

- Steel and Pipes For Africa Price ListDocument1 pageSteel and Pipes For Africa Price ListG A U G E100% (3)

- Design Collaboration Paper - Aia Aisc - 081320 PDFDocument23 pagesDesign Collaboration Paper - Aia Aisc - 081320 PDFjackcan501Pas encore d'évaluation

- Alfa Laval Base 10: Gasketed Plate Heat Exchanger For Hygienic ApplicationsDocument2 pagesAlfa Laval Base 10: Gasketed Plate Heat Exchanger For Hygienic ApplicationsJOSE ANTONIO ANDRADE CRUZPas encore d'évaluation

- Kids pool diagram schematic overviewDocument1 pageKids pool diagram schematic overviewHarta Dwi AsmanaPas encore d'évaluation

- Sakuragawa - U Series - High Head PumpDocument2 pagesSakuragawa - U Series - High Head PumpDave WallacePas encore d'évaluation

- RFP Construction Management ServicesDocument8 pagesRFP Construction Management ServicesyvonnePas encore d'évaluation

- G.F.R.C. Guide for Polymer Modified ConcreteDocument5 pagesG.F.R.C. Guide for Polymer Modified ConcreteVladoiu SorinPas encore d'évaluation

- Geotechnical Lab Preliminary Report on Stabilization of Residual SoilDocument20 pagesGeotechnical Lab Preliminary Report on Stabilization of Residual SoilJODIN MAKINDA -Pas encore d'évaluation

- Triaxial Testing of Weak Rocks Including The Use of Triaxial Extension Tests - Peter J. MillarDocument11 pagesTriaxial Testing of Weak Rocks Including The Use of Triaxial Extension Tests - Peter J. MillarShakil IqbalPas encore d'évaluation

- MGCG MGCG (Emc)Document4 pagesMGCG MGCG (Emc)aykopelektronikPas encore d'évaluation

- Áfico de Correlación Del Martillo Schmidt Miller 1965 PDFDocument1 pageÁfico de Correlación Del Martillo Schmidt Miller 1965 PDFalexanderPas encore d'évaluation

- Analysis of Tension MembersDocument7 pagesAnalysis of Tension MembersAekJayPas encore d'évaluation

- Thermal Stress Composite Bars: Bibin ChidambaranathanDocument30 pagesThermal Stress Composite Bars: Bibin ChidambaranathanDr. BIBIN CHIDAMBARANATHAN100% (1)

- Finned Tube Heat ExchangerDocument1 pageFinned Tube Heat ExchangerDinesh ScientificPas encore d'évaluation

- Stiffness Modulus Test Report EN 12697-26Document1 pageStiffness Modulus Test Report EN 12697-26Angela DeaquizPas encore d'évaluation

- Home Heating and Cooling Solution: 0C - 0M - 71Y - 0KDocument12 pagesHome Heating and Cooling Solution: 0C - 0M - 71Y - 0KCarlos ManriquezPas encore d'évaluation