Académique Documents

Professionnel Documents

Culture Documents

USA Letter John Campos Case

Transféré par

The Salt Lake TribuneCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

USA Letter John Campos Case

Transféré par

The Salt Lake TribuneDroits d'auteur :

Formats disponibles

DOCKET

By Hand

Honorable Lewis A. Kaplan

United States District Court

Southern District of New York

500 Pearl Street

New York, New York 10007

Re: United States v. John Campos, S7 10 Cr. 336 (LAK)

Dear Judge Kaplan:

The Government respectfully submits this letter in support of its position that the Court

should accept the guilty plea of defendant John Campos (the "defendant") to a bank gambling

misdemeanor offense, in accordance with Rule 11 (c )(3) of the Federal Rules of Criminal

Procedure. For the reasons described below, Campos's plea is in the interests of the Government

and the defendant and otherwise constitutes a fair and just resolution ofthe matter pending

against him.

Background

Campos appeared before the Court on March 30, 2012 and entered a plea of guilty to

Superseding Information S7 IOCr. 336 (the "Information") pursuant to a plea agreement (the

"Plea Agreement") with the Government. As the Court found during the plea proceeding, the

defendant's plea was knowing and voluntary, and was supported by an independent basis in fact

concerning each of the essential elements of the offense. United States v. Campos, Tr., Mar. 28,

2012, at 18.

1

The Court engaged in a thorough allocution of the defendant, in accordance with

all of the requirements of Rule 11 of the Federal Rules of Criminal Procedure, and the defendant

expressly acknowledged that he had read and understood the Plea Agreement, which set forth,

among other things, the maximum penalties at issue, the parties' view of the applicable

Guidelines range, the fact that neither the U.S. Probation Office nor the Court would be bound

by the parties' Guidelines calculations, and the fact that the sentence imposed upon the defendant

would be solely determined by the Court.

The Court deferred acceptance of the plea and questioned the basis for allowing the

defendant to plead guilty to a single gambling count with a one year maximum sentence and the

proposed dismissal of the felony counts originally charged. The Government explained that the

The transcript is attached to this letter for the Court's convenience.

DOCUMENT

ELECTRONICALLY FILED

DOC#: ____ __

U.S. Department of Justice

United States Attorney

rr::::;:============::;f;oulhern District ofNew York

pri! 12, 2012

JUDGE KAPLAN'S CHAMBERS

e SilviO J. Mollo BUilding

ne Saint Andrew's Pla::a

ew York, New York 10007

Case 1:10-cr-00336-LAK Document 174 Filed 04/18/12 Page 1 of 5

Hon. Lewis A. Kaplan Page 2

April 12,2012

misdemeanor charge resulted in a Guidelines range that is similar to the range that would apply

had the defendant pled guilty to the felony charges contained in the Indictment. (Tr. 18-22). The

Court then directed the Government to provide a letter setting forth "the rationale for acceptance

of the plea," noting that the Court would "leave the question of whether to accept the plea" until

the date provisional1y set for sentencing, unless the Court came to a decision on the matter

earlier. (Tr. 23). With this letter, the Government respectfully requests that the Court now

accept the plea.

Applicable Law

Federal Rule of Criminal Procedure I 1 (c)(3)(A) provides that where a plea agreement

provides for the dismissal of other charges (as is the case here), "the court may accept the

agreement, reject it, or defer a decision until the court has reviewed the presentence report." The

rules further provide that, should the Court reject a plea agreement of this kind, the defendant

must be provided with an opportunity to withdraw his plea, although the defendant may elect to

maintain his plea of guilty even without the benefits afforded by the rejected plea agreement.

Fed. R. Crim. P. 11(c)(5).

While we have found no Second Circuit cases directly on point, in United States v.

Severino, 800 F.2d 42, 46 (2d Cir. 1986), the Second Circuit, in a pre-GuideJines case, stated that

a district court may reject a plea if it "has reasonable grounds for believing that acceptance of the

plea would be contrary to the sound administration of justice." See also United States v. Torres

Echavarria, 129 F.3d 692, 696 (2d Cir. 1997) (holding that Severino's analysis remained good

law under the Guidelines). Other Circuits have held that the Government's decision to move to

dismiss charges in exchange for a plea to a lesser charge should be disturbed only where "the

action of the prosecuting attorney is such a departure from sound prosecutorial principle as to

mark it an abuse of discretion." United States v. Ammidown, 497 F.2d 615, 622 (D.C. Cir.

1974); see also United States v. Barker, 681 F.2d 589, 591-92 (9th Cir. 1982) ("The decision to

negotiate a plea bargain and seek dismissal ofthe indictment is within the executive's undeniable

discretion to decide not to pursue a particular prosecution any further .... We assume the judge

also has a supervisory duty to determine, from the standpoint of the public interest, after

considering the nature of the charges and the facts involved, whether reducing the plea is so

unreasonable that the prosecutor is not properly carrying out his function.") (internal citations

and quotation marks omitted); cf United States Securities & Exchange Commission v. Citigroup

Global Markets, Inc., --- F.3d ----, 2012 WL 851807 (2d Cir. 2012) ("the scope of a court's

authority to second-guess an agency's discretionary and policy-based decision to settle is at best

minimal. ").

Discussion

In this case, the Government's determination not to further prosecute the original charges

pending against Campos, in return for a plea to a single violation of 18 U.S.C. 1306, advances

the Government's interests and the defendant's interests, constitutes a fair and just resolution of

the matter, and accords with the sound administration of justice. That is true for a number of

reasons enumerated below in greater detail.

Case 1:10-cr-00336-LAK Document 174 Filed 04/18/12 Page 2 of 5

Hon. Lewis A. Kaplan Page 3

April 12,2012

First, the misdemeanor to which Campos pled, 18 V.S.C. 1306, is targeted directly at

his particular offense conduct: causing a bank insured by the Federal Deposit Insurance

Corporation to process illegal gambling transactions. The stated Congressional purpose for the

statute was "To prohibit certain banks and savings and loan associations from fostering or

participating in gambling activities." Pub. Law 90-203 (Dec. 15, 1967). That is what the

defendant principally did in this case: he used his role as Vice Chairman of and consultant to

SunFirst Bank ("SunFirst") to cause the bank to participate in illegal gambling activities.

Second, the Guidelines range stipulated by the parties in the Plea Agreement is

effectively the same as the range would have been had the defendant pled guilty to all five felony

gambling charges against him in the original indictment, S3 10 Cr. 336. Because the gambling

offenses were "connected by a common criminal objective" andlor "constitut[ed] a common

scheme or plan," a plea to all five gambling counts would have been treated as a single group of

closely related counts, pursuant to V.S.s.G. 3Dt.2(b). The base offense level for the felony

gambling counts would have been 12 pursuant to V.S.S.G. 2E3.l - precisely the same as it is

for the single misdemeanor gambling offense. Thus, with a two-level reduction for acceptance

of responsibility pursuant to V.S.S.G. 3El.1 (a), and an additional two-level reduction for a

minor role pursuant to V.S.S.G. 3B 1.2(b), the adjusted offense level for either a felony or

misdemeanor gambling offense is the same: 8, which results in a Guidelines range of 0-6 months

imprisonment for a defendant with no criminal history.2

Third, the Plea Agreement required the defendant to execute a consent order with the

Federal Deposit Insurance Corporation that would bar him from "participating in any manner in

the affairs of any depository institution." In other words, the defendant would be barred from the

banking industry for life. Had the defendant pled guilty to, or been convicted of, the felony

gambling charges in the Indictment, the defendant may also have been subject to such a lifetime

ban,3 but obtaining such a ban would have required the Federal Deposit Insurance Corporation to

bring a separate proceeding and potentially litigate the issue. Accordingly, securing a lifetime

ban from banking in connection with the defendant's plea to the misdemeanor charge

2 Even a plea to the originally charged money laundering offense would not have

sharply altered the Guidelines range. While the Court observed that Campos had been accused

of (and admitted to in connection with the plea) processing over $200 million in gambling

transactions, the base offense level for laundering would not have been based on the dollar value

of the transactions but on the base offense level for gambling -level ]2 - because "the defendant

committed the underlying offense." V.S.S.G. 2S 1.1 (a)(2). The base offense level of 12 would

be increased by 2 levels because the conviction would have been under 18 V.S.C. 1956 (see

V.S.S.G. 2S1.1(b)(2 and possibly a further two levels for "sophisticated laundering" (see

V.S.S.G. 2Sl.l(3, resulting in a total offense level of 16. With a two-level minor-role

reduction and a two-level reduction for acceptance of responsibility, the final offense level would

be 12, which would have resulted in a Guidelines range of 10-16 months, the low-end of which

falls well within the one-year statutory maximum in 18 V.S.C. 1306.

3 A felony conviction does not automatically trigger a lifetime ban from the banking

industry, and whether such a ban is ultimately imposed depends on various factors under FDIC

regulations.

Case 1:10-cr-00336-LAK Document 174 Filed 04/18/12 Page 3 of 5

Hon. Lewis A. Kaplan Page 4

April 12,2012

accomplishes the important objective of preventing the defendant from abusing his position at

another bank in the future.

4

Thus, as compared to the consequences the defendant would face

after a conviction on all five of the gambling charges in the Indictment, the Plea Agreement the

Government has reached with Campos exposes him to the same Guidelines recommendation

(albeit a lower statutory maximum), and includes an additional guaranteed ban from the banking

industry.

Fourth, while the defendant's conduct was serious and certainly deserving of criminal

prosecution, his role in the conspiracy charged in the Indictment was relatively minor as

compared to the other defendants charged. The other defendants charged are either (l) founders

and/or senior executives ofthe Poker Companies or (2) payment processors who served as agents

of the Poker Companies in seeking to identify ways to get United States banks to process the

transactions (usually by lying to banks but, sometimes, as was the case with Campos and

SunFirst, offering to prop up failing financial institutions in return for poker processing). Unlike

each of the other defendants - who continued to seek new processing channels over a multi-year

period notwithstanding numerous arrests and seizures Campos processed the transactions only

for his own bank for a period of less than one year. Unlike the other defendants, most of whom

made millions from their illegal conduct, Campos received only $20,000 ($4,500 of which he

kept) as a direct payment for poker processing, although such processing also served temporarily

to prop up SunFirst and Campos's investment in it (now worthless given the regulatory seizure

of the bank). Finally, unlike all but one of the other defendants, Campos was never charged with

any bank or wire fraud offense relating to the disguising of gambling transactions.

Fifth, the defendant's willingness to plead guilty to a misdemeanor gambling offense had

to be assessed against the litigation risk of proceeding to trial on six counts which, with one

exception, carried an identical Guidelines range. While the Government's case against the

defendant is strong - as we noted during the plea proceeding, there is evidence that SunFirst's

lawyer explicitly told Campos that processing poker transactions was illegal, and there is no real

dispute that Campos brought the poker business into SunFirst andlnar'sunFirst processed more

than $200 million in transactions for the Poker Companies - Campos's unique position in the

case provided him with a slightly more viable good f a i t ~ argument, one not available to other

defendants, to the extent alleged good faith reliance evidence would be admissible at trial. In

order to induce bankers like Campos to process their transactions, the Poker Companies and their

agents such as Elie plied Campos with mUltiple legal opinions regarding the alleged legality of

poker processing. Unlike the other defendants - who engaged in, or were aware of, systematic

government action against the Poker Companies and who deliberately solicited legal opinions

whose conclusions were at odds with objectively identifiable reality Campos had a narrower

window into the legal issues confronting the online poker industry, and unlike the other

defendants, was not aware of many of the arrests, court-ordered seizures and other events that

4 While this ban does not, as the Court observed, cover the securities industry, the

defendant has never before been involved in that industry and there is no indication that he

would likely be involved in the future. The defendant's career involved operating a steel

business before he invested money from that business in SunFirst and played a role in running

the bank.

Case 1:10-cr-00336-LAK Document 174 Filed 04/18/12 Page 4 of 5

Hon. Lewis A. Kaplan Page 5

April 12, 2012

cast substantial doubt on the validity of these opinions. As a result, there is an enhanced risk that

jurors could conceivably hesitate to convict Campos despite other evidence tending to negate

Campos's alleged good faith.

For these reasons, the Government submits that the Plea Agreement entered into between

the Government and the defendant is fair and just and well within the bounds of appropriate

prosecutorial discretion. Accordingly, we respectfully request that the Court now accept the

defendant's plea of guilty pursuant to the Plea Agreement.

Respectfully submitted,

PREET BHARARA

By:

Arlo Devlin-Brown/Andrew D. Goldstein

Assistant United States Attorneys

(212) 637-250611559

Cc (by email): Fred Hafetz, Esq.

Neil Kaplan, Esq.

Case 1:10-cr-00336-LAK Document 174 Filed 04/18/12 Page 5 of 5

Vous aimerez peut-être aussi

- The Book of Writs - With Sample Writs of Quo Warranto, Habeas Corpus, Mandamus, Certiorari, and ProhibitionD'EverandThe Book of Writs - With Sample Writs of Quo Warranto, Habeas Corpus, Mandamus, Certiorari, and ProhibitionÉvaluation : 5 sur 5 étoiles5/5 (9)

- Richter Et Al 2024 CRB Water BudgetDocument12 pagesRichter Et Al 2024 CRB Water BudgetThe Salt Lake Tribune100% (4)

- Reply Affidavit SampleDocument3 pagesReply Affidavit SampleMasterbolero86% (7)

- Case of Harvey V FaceyDocument2 pagesCase of Harvey V Faceyveera89% (18)

- NetChoice V Reyes Official ComplaintDocument58 pagesNetChoice V Reyes Official ComplaintThe Salt Lake TribunePas encore d'évaluation

- SEC Cease-And-Desist OrderDocument9 pagesSEC Cease-And-Desist OrderThe Salt Lake Tribune100% (1)

- Govt Response To RothsteinDocument9 pagesGovt Response To RothsteinDavid Oscar MarkusPas encore d'évaluation

- US Gov't Wants $12 Billion From El ChapoDocument12 pagesUS Gov't Wants $12 Billion From El ChapoLaw&CrimePas encore d'évaluation

- United States Court of Appeals, Third CircuitDocument8 pagesUnited States Court of Appeals, Third CircuitScribd Government DocsPas encore d'évaluation

- Judge Rakoff's Opinion in S.E.C. vs. Vitesse SemiconductorDocument12 pagesJudge Rakoff's Opinion in S.E.C. vs. Vitesse SemiconductorDealBookPas encore d'évaluation

- United States of America's Sentencing Memorandum and Motion For An Upward Departure And/or VarianceDocument15 pagesUnited States of America's Sentencing Memorandum and Motion For An Upward Departure And/or VarianceDavid Garrett Jr.Pas encore d'évaluation

- 4.4 Analyzing Supreme Court DecisionsDocument6 pages4.4 Analyzing Supreme Court DecisionsLeonel Villarreal VillarrealPas encore d'évaluation

- E. Steven Dutton v. Wolpoff and Abramson, 5 F.3d 649, 3rd Cir. (1993)Document13 pagesE. Steven Dutton v. Wolpoff and Abramson, 5 F.3d 649, 3rd Cir. (1993)Scribd Government DocsPas encore d'évaluation

- United States v. Nelson Mantecon-Zayas, 949 F.2d 548, 1st Cir. (1991)Document6 pagesUnited States v. Nelson Mantecon-Zayas, 949 F.2d 548, 1st Cir. (1991)Scribd Government DocsPas encore d'évaluation

- United States v. Peter Sleight, 808 F.2d 1012, 3rd Cir. (1987)Document14 pagesUnited States v. Peter Sleight, 808 F.2d 1012, 3rd Cir. (1987)Scribd Government DocsPas encore d'évaluation

- United States v. Theodore v. Anzalone, 766 F.2d 676, 1st Cir. (1985)Document13 pagesUnited States v. Theodore v. Anzalone, 766 F.2d 676, 1st Cir. (1985)Scribd Government DocsPas encore d'évaluation

- United States v. Richard Joseph Kones, Michele Harris, 77 F.3d 66, 3rd Cir. (1996)Document7 pagesUnited States v. Richard Joseph Kones, Michele Harris, 77 F.3d 66, 3rd Cir. (1996)Scribd Government DocsPas encore d'évaluation

- Commonwealth of Massachusetts v. Federal Deposit Insurance Corporation, 47 F.3d 456, 1st Cir. (1995)Document6 pagesCommonwealth of Massachusetts v. Federal Deposit Insurance Corporation, 47 F.3d 456, 1st Cir. (1995)Scribd Government DocsPas encore d'évaluation

- United States v. American Bag & Paper Corp., 609 F.2d 1066, 3rd Cir. (1979)Document5 pagesUnited States v. American Bag & Paper Corp., 609 F.2d 1066, 3rd Cir. (1979)Scribd Government DocsPas encore d'évaluation

- United States District Court Eastern District of Michigan Southern DivisionDocument13 pagesUnited States District Court Eastern District of Michigan Southern DivisionChapter 11 DocketsPas encore d'évaluation

- United States v. Carlomagno Gonzalez Medina, 797 F.2d 1109, 1st Cir. (1986)Document7 pagesUnited States v. Carlomagno Gonzalez Medina, 797 F.2d 1109, 1st Cir. (1986)Scribd Government DocsPas encore d'évaluation

- United States v. Charles Ortiz, 733 F.2d 1416, 10th Cir. (1984)Document4 pagesUnited States v. Charles Ortiz, 733 F.2d 1416, 10th Cir. (1984)Scribd Government DocsPas encore d'évaluation

- Civil Procedure Complete OutlineDocument28 pagesCivil Procedure Complete OutlineDeontrea CampbellPas encore d'évaluation

- George Papadopoulos Plea AgreementDocument9 pagesGeorge Papadopoulos Plea AgreementNational Content Desk100% (3)

- Atlantic Corporation v. United States of America, 311 F.2d 907, 1st Cir. (1962)Document5 pagesAtlantic Corporation v. United States of America, 311 F.2d 907, 1st Cir. (1962)Scribd Government DocsPas encore d'évaluation

- In Re Mary E. Johnson, Debtor. Mary E. Johnson v. Vanguard Holding Corporation, 708 F.2d 865, 2d Cir. (1983)Document5 pagesIn Re Mary E. Johnson, Debtor. Mary E. Johnson v. Vanguard Holding Corporation, 708 F.2d 865, 2d Cir. (1983)Scribd Government DocsPas encore d'évaluation

- Olympus Pools Florida AG FillingDocument9 pagesOlympus Pools Florida AG FillingABC Action NewsPas encore d'évaluation

- Burns v. United States, 501 U.S. 129 (1991)Document22 pagesBurns v. United States, 501 U.S. 129 (1991)Scribd Government DocsPas encore d'évaluation

- United States v. Saiz, 10th Cir. (2015)Document13 pagesUnited States v. Saiz, 10th Cir. (2015)Scribd Government DocsPas encore d'évaluation

- People v. Villarama Jr.Document7 pagesPeople v. Villarama Jr.Ariel Conrad MalimasPas encore d'évaluation

- Motion To Recuse The Honorable CLAY D. LAND PURSUANT TO 28 U.S.C. 144 and 455 (A)Document24 pagesMotion To Recuse The Honorable CLAY D. LAND PURSUANT TO 28 U.S.C. 144 and 455 (A)Jack RyanPas encore d'évaluation

- Hepner v. United States, 213 U.S. 103 (1909)Document9 pagesHepner v. United States, 213 U.S. 103 (1909)Scribd Government DocsPas encore d'évaluation

- United States v. Saxena, 229 F.3d 1, 1st Cir. (2000)Document14 pagesUnited States v. Saxena, 229 F.3d 1, 1st Cir. (2000)Scribd Government DocsPas encore d'évaluation

- Robert and Jennifer Grunbeck v. The Dime Savings Bank of New York, FSB, 74 F.3d 331, 1st Cir. (1996)Document17 pagesRobert and Jennifer Grunbeck v. The Dime Savings Bank of New York, FSB, 74 F.3d 331, 1st Cir. (1996)Scribd Government DocsPas encore d'évaluation

- 11-18-2016 Adnan's Reply To State Opposing Bail PDFDocument9 pages11-18-2016 Adnan's Reply To State Opposing Bail PDFAnonymous ZCCpjiBEL3Pas encore d'évaluation

- Comed 4 Motion To StayDocument45 pagesComed 4 Motion To StayRobert GarciaPas encore d'évaluation

- Trust Company of Columbus v. United States, 776 F.2d 270, 11th Cir. (1985)Document4 pagesTrust Company of Columbus v. United States, 776 F.2d 270, 11th Cir. (1985)Scribd Government DocsPas encore d'évaluation

- Hughey v. United States, 495 U.S. 411 (1990)Document10 pagesHughey v. United States, 495 U.S. 411 (1990)Scribd Government DocsPas encore d'évaluation

- 07 Jesner v. Arab BankDocument91 pages07 Jesner v. Arab BankJay TabuzoPas encore d'évaluation

- 03 Liberal Damage Rules Apply in FDCPA SuitsDocument2 pages03 Liberal Damage Rules Apply in FDCPA SuitsbperkyPas encore d'évaluation

- United States Attorney Southern District O/new York: U.S. Department of JusticeDocument4 pagesUnited States Attorney Southern District O/new York: U.S. Department of JusticeD B Karron, PhDPas encore d'évaluation

- United States v. Hudson, 10th Cir. (2007)Document8 pagesUnited States v. Hudson, 10th Cir. (2007)Scribd Government DocsPas encore d'évaluation

- United States v. Wright Contracting Company, United States of America v. Mid-Atlantic Paving Company, Inc., 728 F.2d 648, 4th Cir. (1984)Document9 pagesUnited States v. Wright Contracting Company, United States of America v. Mid-Atlantic Paving Company, Inc., 728 F.2d 648, 4th Cir. (1984)Scribd Government DocsPas encore d'évaluation

- United States v. Harrison, 78 F.3d 577, 1st Cir. (1996)Document6 pagesUnited States v. Harrison, 78 F.3d 577, 1st Cir. (1996)Scribd Government DocsPas encore d'évaluation

- United States v. Joseph John Russo, 741 F.2d 1264, 11th Cir. (1984)Document5 pagesUnited States v. Joseph John Russo, 741 F.2d 1264, 11th Cir. (1984)Scribd Government DocsPas encore d'évaluation

- Federal Deposit Insurance Corporation Deposit Insurance National Bank of Oklahoma City, Oklahoma v. Rocket Oil Company, 865 F.2d 1158, 10th Cir. (1989)Document5 pagesFederal Deposit Insurance Corporation Deposit Insurance National Bank of Oklahoma City, Oklahoma v. Rocket Oil Company, 865 F.2d 1158, 10th Cir. (1989)Scribd Government DocsPas encore d'évaluation

- Barbara Falzarano v. United States of America, 607 F.2d 506, 1st Cir. (1979)Document10 pagesBarbara Falzarano v. United States of America, 607 F.2d 506, 1st Cir. (1979)Scribd Government DocsPas encore d'évaluation

- Daan v. Sandiganbayan, 28 March 2008Document11 pagesDaan v. Sandiganbayan, 28 March 2008dondzPas encore d'évaluation

- United States v. William Sams Appeal of Victor Carlucci, 521 F.2d 421, 3rd Cir. (1975)Document14 pagesUnited States v. William Sams Appeal of Victor Carlucci, 521 F.2d 421, 3rd Cir. (1975)Scribd Government DocsPas encore d'évaluation

- Raylon Jones PleaDocument11 pagesRaylon Jones Pleasteve_gravellePas encore d'évaluation

- Fred Marvel and Angela Marvel, Dba Marvel Photo v. United States, 548 F.2d 295, 10th Cir. (1977)Document8 pagesFred Marvel and Angela Marvel, Dba Marvel Photo v. United States, 548 F.2d 295, 10th Cir. (1977)Scribd Government DocsPas encore d'évaluation

- United States v. Luongo, 11 F.3d 7, 1st Cir. (1993)Document6 pagesUnited States v. Luongo, 11 F.3d 7, 1st Cir. (1993)Scribd Government DocsPas encore d'évaluation

- United States v. Gerald L. Vaughn, 636 F.2d 921, 4th Cir. (1980)Document7 pagesUnited States v. Gerald L. Vaughn, 636 F.2d 921, 4th Cir. (1980)Scribd Government DocsPas encore d'évaluation

- United States v. James W. Dean, 87 F.3d 1212, 11th Cir. (1996)Document4 pagesUnited States v. James W. Dean, 87 F.3d 1212, 11th Cir. (1996)Scribd Government DocsPas encore d'évaluation

- First State Insurance Company v. National Casualty Co, 1st Cir. (2015)Document12 pagesFirst State Insurance Company v. National Casualty Co, 1st Cir. (2015)Scribd Government DocsPas encore d'évaluation

- United States v. Nerio Zuleta, 14 F.3d 45, 1st Cir. (1993)Document4 pagesUnited States v. Nerio Zuleta, 14 F.3d 45, 1st Cir. (1993)Scribd Government DocsPas encore d'évaluation

- Clarence Hardy v. United States, 691 F.2d 39, 1st Cir. (1982)Document4 pagesClarence Hardy v. United States, 691 F.2d 39, 1st Cir. (1982)Scribd Government DocsPas encore d'évaluation

- Money JudgementDocument7 pagesMoney JudgementJoel Burgess100% (1)

- State Finance Company, A Corporation v. Roy Lee Morrow, 216 F.2d 676, 10th Cir. (1954)Document5 pagesState Finance Company, A Corporation v. Roy Lee Morrow, 216 F.2d 676, 10th Cir. (1954)Scribd Government DocsPas encore d'évaluation

- California Supreme Court Petition: S173448 – Denied Without OpinionD'EverandCalifornia Supreme Court Petition: S173448 – Denied Without OpinionÉvaluation : 4 sur 5 étoiles4/5 (1)

- Supreme Court Eminent Domain Case 09-381 Denied Without OpinionD'EverandSupreme Court Eminent Domain Case 09-381 Denied Without OpinionPas encore d'évaluation

- U.S. v. Sun Myung Moon 718 F.2d 1210 (1983)D'EverandU.S. v. Sun Myung Moon 718 F.2d 1210 (1983)Pas encore d'évaluation

- An Inexplicable Deception: A State Corruption of JusticeD'EverandAn Inexplicable Deception: A State Corruption of JusticePas encore d'évaluation

- Obtaining A Criminal Pardon: Clear Your Name LegallyD'EverandObtaining A Criminal Pardon: Clear Your Name LegallyPas encore d'évaluation

- U.S. Army Corps of Engineers LetterDocument3 pagesU.S. Army Corps of Engineers LetterThe Salt Lake TribunePas encore d'évaluation

- Salt Lake City Council Text MessagesDocument25 pagesSalt Lake City Council Text MessagesThe Salt Lake TribunePas encore d'évaluation

- Upper Basin Alternative, March 2024Document5 pagesUpper Basin Alternative, March 2024The Salt Lake TribunePas encore d'évaluation

- Park City ComplaintDocument18 pagesPark City ComplaintThe Salt Lake TribunePas encore d'évaluation

- Superintendent ContractsDocument21 pagesSuperintendent ContractsThe Salt Lake TribunePas encore d'évaluation

- Spectrum Academy Reform AgreementDocument10 pagesSpectrum Academy Reform AgreementThe Salt Lake TribunePas encore d'évaluation

- The Church of Jesus Christ of Latter-Day Saints Petition For Rehearing in James Huntsman's Fraud CaseDocument66 pagesThe Church of Jesus Christ of Latter-Day Saints Petition For Rehearing in James Huntsman's Fraud CaseThe Salt Lake TribunePas encore d'évaluation

- Opinion Issued 8-Aug-23 by 9th Circuit Court of Appeals in James Huntsman v. LDS ChurchDocument41 pagesOpinion Issued 8-Aug-23 by 9th Circuit Court of Appeals in James Huntsman v. LDS ChurchThe Salt Lake Tribune100% (2)

- Unlawful Detainer ComplaintDocument81 pagesUnlawful Detainer ComplaintThe Salt Lake Tribune100% (1)

- US Magnesium Canal Continuation SPK-2008-01773 Comments 9SEPT2022Document5 pagesUS Magnesium Canal Continuation SPK-2008-01773 Comments 9SEPT2022The Salt Lake TribunePas encore d'évaluation

- Settlement Agreement Deseret Power Water RightsDocument9 pagesSettlement Agreement Deseret Power Water RightsThe Salt Lake TribunePas encore d'évaluation

- Gov. Cox Declares Day of Prayer and ThanksgivingDocument1 pageGov. Cox Declares Day of Prayer and ThanksgivingThe Salt Lake TribunePas encore d'évaluation

- David Nielsen - Memo To US Senate Finance Committee, 01-31-23Document90 pagesDavid Nielsen - Memo To US Senate Finance Committee, 01-31-23The Salt Lake Tribune100% (1)

- Teena Horlacher LienDocument3 pagesTeena Horlacher LienThe Salt Lake TribunePas encore d'évaluation

- Employment Contract - Liz Grant July 2023 To June 2025 SignedDocument7 pagesEmployment Contract - Liz Grant July 2023 To June 2025 SignedThe Salt Lake TribunePas encore d'évaluation

- HB 499 Utah County COG LetterDocument1 pageHB 499 Utah County COG LetterThe Salt Lake TribunePas encore d'évaluation

- 2023.03.28 Emery County GOP Censure ProposalDocument1 page2023.03.28 Emery County GOP Censure ProposalThe Salt Lake TribunePas encore d'évaluation

- Wasatch IT-Jazz ContractDocument11 pagesWasatch IT-Jazz ContractThe Salt Lake TribunePas encore d'évaluation

- PLPCO Letter Supporting US MagDocument3 pagesPLPCO Letter Supporting US MagThe Salt Lake TribunePas encore d'évaluation

- US Magnesium Canal Continuation SPK-2008-01773 Comments 9SEPT2022Document5 pagesUS Magnesium Canal Continuation SPK-2008-01773 Comments 9SEPT2022The Salt Lake TribunePas encore d'évaluation

- US Magnesium Canal Continuation SPK-2008-01773 Comments 9SEPT2022Document5 pagesUS Magnesium Canal Continuation SPK-2008-01773 Comments 9SEPT2022The Salt Lake TribunePas encore d'évaluation

- Goodly-Jazz ContractDocument7 pagesGoodly-Jazz ContractThe Salt Lake TribunePas encore d'évaluation

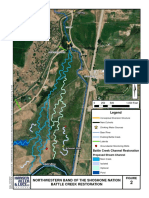

- EWRP-035 TheNorthwesternBandoftheShoshoneNation Site MapDocument1 pageEWRP-035 TheNorthwesternBandoftheShoshoneNation Site MapThe Salt Lake TribunePas encore d'évaluation

- Final Signed Republican Governance Group Leadership LetterDocument3 pagesFinal Signed Republican Governance Group Leadership LetterThe Salt Lake TribunePas encore d'évaluation

- Proc 2022-01 FinalDocument2 pagesProc 2022-01 FinalThe Salt Lake TribunePas encore d'évaluation

- Ruling On Motion To Dismiss Utah Gerrymandering LawsuitDocument61 pagesRuling On Motion To Dismiss Utah Gerrymandering LawsuitThe Salt Lake TribunePas encore d'évaluation

- Utah Senators Encourage Gov. DeSantis To Run For U.S. PresidentDocument3 pagesUtah Senators Encourage Gov. DeSantis To Run For U.S. PresidentThe Salt Lake TribunePas encore d'évaluation

- Villa v. Altavas Case DigestDocument3 pagesVilla v. Altavas Case DigestKian FajardoPas encore d'évaluation

- Tesla v. ZooxDocument26 pagesTesla v. ZooxTechCrunchPas encore d'évaluation

- United States Court of Appeals, Eleventh CircuitDocument9 pagesUnited States Court of Appeals, Eleventh CircuitScribd Government DocsPas encore d'évaluation

- En Banc (G.R. No. 101083, July 30, 1993) : 296 Phil. 694Document21 pagesEn Banc (G.R. No. 101083, July 30, 1993) : 296 Phil. 694Shally Lao-unPas encore d'évaluation

- Bureau of Forestry v. Court of AppealsDocument5 pagesBureau of Forestry v. Court of AppealsRoseanne MateoPas encore d'évaluation

- Green vs. LopezDocument1 pageGreen vs. LopezAlecsandra ChuPas encore d'évaluation

- Damages in Torts. MRS MomoduDocument5 pagesDamages in Torts. MRS MomoduSaint OdunwaPas encore d'évaluation

- Tuzon and Mapagu Vs CADocument3 pagesTuzon and Mapagu Vs CAAiken Alagban Ladines100% (1)

- Motion To Amend Petition SCRIBDocument2 pagesMotion To Amend Petition SCRIBAlijoh Aries M. AquidadoPas encore d'évaluation

- Chavez v. CA (Sulit)Document4 pagesChavez v. CA (Sulit)Peter Joshua OrtegaPas encore d'évaluation

- Cyber Solutions v. Priva Security - Opinion PDFDocument18 pagesCyber Solutions v. Priva Security - Opinion PDFMark JaffePas encore d'évaluation

- Marvin Josue Garcia, A097 535 345 (BIA Aug. 13, 2013)Document5 pagesMarvin Josue Garcia, A097 535 345 (BIA Aug. 13, 2013)Immigrant & Refugee Appellate Center, LLCPas encore d'évaluation

- Edward Sinyama V The People (1993 - 1994) ZR 16Document3 pagesEdward Sinyama V The People (1993 - 1994) ZR 16talk2marvin70Pas encore d'évaluation

- 1 Callo VS MorenteDocument5 pages1 Callo VS MorenteSusie VanguardiaPas encore d'évaluation

- GDocument20 pagesGCesPas encore d'évaluation

- Terre V TerreDocument5 pagesTerre V TerreJennilyn TugelidaPas encore d'évaluation

- Daniel Wilson No Contact ViolationDocument7 pagesDaniel Wilson No Contact ViolationlydentvPas encore d'évaluation

- Statcon - Case DigestsDocument5 pagesStatcon - Case DigestsDon Salamidaa100% (1)

- Stewart V Apple ComplaintDocument5 pagesStewart V Apple ComplaintEric GoldmanPas encore d'évaluation

- Cebu Port Labor Union Vs States Marine Co PDFDocument13 pagesCebu Port Labor Union Vs States Marine Co PDFDexter CircaPas encore d'évaluation

- Development Bank of Rizal vs. Sima Wei G.R. No. 85419Document3 pagesDevelopment Bank of Rizal vs. Sima Wei G.R. No. 85419Gendale Am-isPas encore d'évaluation

- London Show Daily March 16, 2017Document32 pagesLondon Show Daily March 16, 2017Publishers WeeklyPas encore d'évaluation

- Chapter 47 Business LawDocument2 pagesChapter 47 Business LawGloria AvedanoPas encore d'évaluation

- S4 Useful Sentence StructuresDocument11 pagesS4 Useful Sentence StructuresLUk YanPas encore d'évaluation

- 124 Sta. Ana v. MaliwatDocument2 pages124 Sta. Ana v. MaliwatNN DDLPas encore d'évaluation

- 7-Crl MP - Sri M Pradeep KumarDocument3 pages7-Crl MP - Sri M Pradeep Kumarsaif khanPas encore d'évaluation

- Quebral vs. CA G.R. No. 101941Document1 pageQuebral vs. CA G.R. No. 101941Marianne AndresPas encore d'évaluation

- Defense Asks To Redact Materials in Seminole Heights Serial Killings CaseDocument4 pagesDefense Asks To Redact Materials in Seminole Heights Serial Killings Case10News WTSPPas encore d'évaluation