Académique Documents

Professionnel Documents

Culture Documents

mb0045 FM

Transféré par

Ravinder ChauhanDescription originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

mb0045 FM

Transféré par

Ravinder ChauhanDroits d'auteur :

Formats disponibles

Q.1.- Show the relationship between required rate of return and coupon rate on the value of a bond. Ans.

It is important for prospective bond buyers to know how to determine the price of a bond because it will indicate theyieldreceived should the bond be purchased. In this section, we willrun through some bond price calculations for various types of bond instruments.Bonds can be priced at a premium,discount, o r a t par . If the bonds price is higher than its par value, it will sell at a premium because its interest rate is higher than current prevailing rates. If the bonds price is lower than its par value, the bond will sell at a discount because its interestrate is lower than current prevailing interest rates. When you calculate the price of a bond, you are calculating the maximum price you would want to pay for the bond, given the bonds couponrate in comparison to the average rate most investors are currently receiving in the bond market.Required yield or required rate of return is the interest rate that a security needs to offer in order to encourage investors to purchase it. Usually the required yield on a bond is equal to or greater than the current prevailing interest rates.Fundamentally, however, the price of a bond is the sum of the present valuesof all expectedcouponpayments plus the present value of the par value at maturity.Calculating bond price iss i m p l e : a l l w e a r e d o i n g i s d i s c o u n t i n g t h e k n o w n f u t u r e c a s h f l o w s . R e m e m b e r t h a t t o calculate present value (PV) which is based on the assumption that each payment is re-investedat some interest rate once it is received we have to know the interest rate that would earn us aknown future value. For bond pricing, this interest rate is the required yield. (If the concepts of present and future value are new to you or you are unfamiliar with the calculations, refer to Understanding the Time Value of Money .)H e r e i s t h e f o r m u l a f o r c a l c u l a t i n g a b o n d s p r i c e , w h i c h u s e s t h e b a s i c present value ( P V ) formula:C = c o u p o n p a y m e n t n = n u m b e r o f p a y m e n t s i = i n t e r e s t r a t e , o r r e q u i r e d y i e l d M = value at maturity, or par valueThe succession of coupon payments to be received in the future is referred to as anordinary annuity, which is a series of fixed payments at set intervals over a fixed period of time. (Couponson a straight bond are paid at ordinary annuity.) The first payment of an ordinary annuity occursone interval from the time at which the debt security is acquired. The calculation assumes thistime is the present. You may have guessed that the bond pricing formula shown above may be tedioust o c a l c u l a t e , a s i t r e q u i r e s a d d i n g t h e p r e s e n t v a l u e o f e a c h f u t u r e c o u p o n payment. Because these payments are paid at an ordinary annuity, however, wec a n u s e t h e s h o r t e r P V - o f - o r d i n a r y a n n u i t y f o r m u l a t h a t i s m a t h e m a t i c a l l y equivalent to the summation of all the PVs of future cash flows. This PV-of-ordinaryannuity formula replaces the need to add a l l t h e p r e s e n t v a l u e s o f t h e f u t u r e coupon. The following diagram illustrates how present value is calculated for anordinary annuity: Each full moneybag on the top right represents the f i x e d c o u p o n p a y m e n t s ( f u t u r e v a l u e ) received in periods one, two and three. Notice how the present value decreases for those coupon payments that are further into the future the present value of the second coupon payment is worthless than the first coupon and the third coupon is worth the lowest

amount today. The farther intothe future a payment is to be received, the less it is worth today is the fundamental concept for which the PV-of-ordinary-annuity formula accounts. It calculates the sum of the present valueso f a l l f u t u r e c a s h f l o w s , b u t u n l i k e t h e b o n d p r i c i n g f o r m u l a w e s a w e a r l i e r , i t d o e s n t require that we add the value of each coupon payment. (For more on calculating the time valueof annuities, see Anything but Ordinary: Calculating the Present and Future Value of Annuities and Understanding the Time Value of Money .) By incorporating the annuity model into the bond pricing formula, which requires usto also include the present value of the par value received at maturity, we arrive atthe following formula: Lets go through a basic example to find the price of a plain vanilla bond. Example 1: Calculate the price of a bond with a par value of $1,000 to be paid in ten years, acoupon rate of 10%, and a required yield of 12%. In our example well assume that coupon payments are made semi-annually to bond holders and that the next coupon payment is expectedin six months. Here are the steps we have to take to calculate the price: 1. Determine the Number of Coupon Payments: Because two coupon payments will be madeeach year for ten years, we will have a total of 20 coupon payments. 2. Determine the Value of Each Coupon Payment: Because the coupon payments are semi -annual, divide the coupon rate in half. The coupon rate is the percentage off the bonds par value.As a result, each semi-annual coupon payment will be $50 ($1,000 X 0.05). 3. Determine the Semi-Annual Yield: Like the coupon rate, the required yield of 12% must bedivided by two because the number of periods used in the calculation has doubled. If we left therequired yield at 12%, our bond price would be very low and inaccurate. Therefore, the requiredsemi-annual yield is 6% (0.12/2). 4. Plug the Amounts Into the Formula: From the above calculation, we have determined that the bond is selling at a discount; the bond price is less than its par value because the required yield of the bond is greater than the couponr a t e . T h e b o n d m u s t s e l l a t a d i s c o u n t t o a t t r a c t i n v e s t o r s , w h o c o u l d f i n d h i g h e r i n t e r e s t elsewhere in the prevailing rates. In other words, because investors can make a larger return inthe market, they need an extra incentive to invest in the bonds. A c c o u n t i n g f o r D i f f e r e n t P a y m e n t F r e q u e n c i e s In the example above coupons were paid semi -annually, so we divided the i n t e r e s t r a t e a n d coupon payments in half to represent the two payments per year. You may be now wonderingwhether there is a formula that does not require steps two and three outlined above, which arerequired if the coupon payments occur more than once a year. A simple modification of the

above formula will allow you to adjust interest rates and coupon payments to calculate a bond price for any payment frequency: Notice that the only modification to the original formula is the addition of F, which representsthe frequency of coupon payments, or the number of times a year the coupon is paid. Therefore,for bonds paying annual coupons, F wo uld have a value of one.

Should a bond pay quarterly payments, F would equal four, and if the bond paid semi-annual coupons, F would be two.

Q2. What do you understand by operating cycle . Ans. An operating cycle is the length of time between the acquisition of inventory and the sale of that inventory and subsequent generation of a profit. The shorter theoperating cycle, the faster a business gets areturn on investment (ROI) for theinventory it stocks. As a general rule, companies want to keep their operatingcycles short for a number of reasons, but in certain industries, a long operatingcycle is actually the norm. Operating cycles are not tied to accounting periods, butare rather calculated in terms of how long goods sit in inventory before sale.When a business buys inventory, it ties up money in the inventory until it can besold. This money may be borrowed or paid up front, but in either case, once thebusiness has purchased inventory, those funds are not available for other uses. Thebusiness views this as an acceptable tradeoff because the inventory is aninvestment that will hopefully generate returns, but keeping the operating cycleshort is still a goal for most businesses so they can keep their liquidity high.

Keeping inventory during a long operating cycle does not just tie up funds.Inventory must be stored and this can become costly, especially with items thatrequire special handling, such ashumidity controls or security. Furthermore,inventory can depreciate if it is kept in a store too long. In the case of perishablegoods, it can even be rendered unsalable. Inventory must also be insured andmanaged by staff members who need to be paid, and this adds to overall operatingexpenses. There are cases where a long operating cycle in unavoidable. Wineries anddistilleries, for example, keep inventory on hand for years before it is sold, becauseof the nature of the business. In these industries, the return on investment happensin the long term, rather than the short term. Such companies are usually structuredin a way that allows them to borrow against existing inventory or land if funds areneeded to finance short-term operations.Operating cycles can fluctuate. During periods of economic stagnation, inventorytends to sit around longer, while periods of growth may be marked by more rapidturnover. Certain products can be consistent sellers that move in and out of inventory quickly. Others, like big ticket items, may be purchased less frequently.All of these issues must be accounted for when making decisions about orderingand pricing items for inventory.

Q3. Q.3 What is the implication of operating leverage for a firm. Ans.Operating leverage: Operating leverage is the extent to which a firm uses fixedcosts in producing its goods or offering its services. Fixed costs include advertising expenses, administrative costs, equipment and technology, depreciation, and taxes,but not interest on debt, which is part of financial leverage. By using fixedproduction costs, a company can increase its profits. If a company has a largepercentage of fixed costs, it has a high degree of operating leverage. Automatedand high-tech companies, utility companies, and airlines generally have highdegrees of operating leverage.

As an illustration of operating leverage, assume two firms, A and B, produce andsell widgets. Firm A uses a highly automated production process with roboticmachines, whereas firm B assembles the widgets using primarily semiskilled labor. Table 1 shows both firms operating cost structures. Highly automated firm A has fixed costs of $35,000 per year and variable costs of only $1.00 per unit, whereas labor-intensive firm B has fixed costs of only $15,000per year, but its variable cost per unit is much higher at $3.00 per unit. Both firmsproduce and sell 10,000 widgets per year at a price of $5.00 per widget.Firm A has a higher amount of operating leverage because of its higher fixed costs,but firm A also has a higher breakeven point

the point at which total costs equaltotal sales. Nevertheless, a change of I percent in sales causes more than a I percent change in operating profits for firm A, but not for firm B. The degree of operatingleverage measures this effect. The following simplified equation demonstrates the type of equation used to compute the degree of operating leverage, although tocalculate this figure the equation would require several additional factors such asthe quantity produced, variable cost per unit, and the price per unit, which are usedto determine changes in profits and sales:Operating leverage is a doubleedg ed sword, however. If firm As sales decrease by I percent, its profits will decrease by more than I percent, too. Hence, the degreeof operating leverage shows the responsiveness of profits to a given change insales. Implications: Total risk can be divided into two parts: business risk and financial risk. Business risk refers to the stability of a companys assets if it uses no debt or preferred stock financing. Business risk stems from the unpredictable nature of doing business, i.e., the unpredictability of consumer demand for products andservices. As a result, it also involves the uncertainty of long-term profitability.When a company uses debt or preferred stock financing, additional risk financialrisk is placed on the companys common shareholders. They demand a higher expected return for assuming this additional risk, which in turn, raises a companys costs. Consequently, companies with high degrees of business risk tend to befinanced with relatively low amounts of debt. The opposite also holds: companieswith low amounts of business risk can afford to use more debt financing whilekeeping total risk at tolerable levels. Moreover, using debt as leverage is asuccessful tool during periods of inflation. Debt fails, however, to provide leverageduring periods of deflation, such as the period during the late 1990s brought on bythe Asian financial crisis.

Q2. What are the factors affecting financial plan of a company?

Ans. We live in a society and interact with people and environment. What happens tous is not always accordance to our wishes. Many things turn out in our live areuncontrollable by us. Many decisions we take are the result of external influences.So do our financial matters.There are many factors affect our personal financial planning. Range from economic factors to global influences.Aware of factorsaffecting your money matters below will certainly benefit your planning.Factors Affecting Financial Plan1.Nature of the industry:- Here, we must consider whether it is a capital intensive of labour intensive industry. This will have a major impact on the total assets that the firm owns. 2. Size of the company: -The size of the company greatly influences the availability offunds from different sources.A small company normally finals it difficult to raise funds from long term sources at competitive terms. On the other hand, large companies like Reliance enjoy the privilege of obtaining funds both short term and long term at attractive rates. 3. Status of the company in the industry:-A well established company enjoying agood market share, for its products normally commands investors confidence.Such acompany can tap the capital market for raising funds in competitive term for implementation new projects to exploit the new opportunity emerging from changing

business environment.

4. Sources of finance available:-Sources of finance could be group into debt andequity. Debt is cheap but risky whereas equity is costly.A firm should aim at optimum capital structure that would achieve the least cost capital structure.A large firm with a diversified product mix may manage higher quantum of debt because the firm may manage higher financial risk with a lower business risk.Selectionof sources of finances us closely linked to the firms capacity to manage the risk exposure.

5.The capital structure of a company:- Capital structure of a company is influencedby the desire of the existing management of the company to remain control over the affairs of the company.The promoters who do not like to lose their grip overthe affairs of the company normally obtain extra funds for growth by issuing preference shares and debentures to outsiders.6. Matching the sources with utilization:-The product policy of any good financialplan is to match the term of the source with the term of investment.To finance fluctuating working capital needs, the firm resorts to short term finance.All fixed assets-investment are to be finance by long term sources. It is a cardinal principal of financial planning.7. Flexibility:-The financial plan of company should possess flexibility so as to effectchanges in the composition of capital structure when ever need arises. If the capital structure of a company is flexible, it will not face any difficulty in changing the sources of funds.This factor has become a significant one today because of the globalization of capital market.8. Government Policy:-SEBI guidelines, finance ministry circulars, various clauses ofStandard Listing Agreement and regulatory mechanism imposed by FEMAa ndDepartment of CorporateAffairs (Govt of India) influence the financial plans ofcorporate today. Management of public issues of shares demands the companies with many status in India.They are to be compiled with a time constraint.

Vous aimerez peut-être aussi

- An MBA in a Book: Everything You Need to Know to Master Business - In One Book!D'EverandAn MBA in a Book: Everything You Need to Know to Master Business - In One Book!Pas encore d'évaluation

- Mohamed Nada - Learn Pivot Tables in One Hour EbookDocument37 pagesMohamed Nada - Learn Pivot Tables in One Hour EbookEjlm OtoPas encore d'évaluation

- Determinants of Interest Rates (Revilla & Sanchez)Document12 pagesDeterminants of Interest Rates (Revilla & Sanchez)Kearn CercadoPas encore d'évaluation

- Bond Valuations:: What Does "Bond Valuation" Mean?Document7 pagesBond Valuations:: What Does "Bond Valuation" Mean?SandeepPas encore d'évaluation

- Chapter 3: Product and Process DesignDocument29 pagesChapter 3: Product and Process DesignGigiPas encore d'évaluation

- Part 3 Toeic WritingDocument33 pagesPart 3 Toeic WritingNguyen Thi Kim ThoaPas encore d'évaluation

- Term Structure of Interest RatesDocument12 pagesTerm Structure of Interest RatesNikunj ShahPas encore d'évaluation

- Performance Analysis of Chinas Fast Fashion ClothDocument10 pagesPerformance Analysis of Chinas Fast Fashion ClothQuỳnh LêPas encore d'évaluation

- CFA Level 1 - Section 2 QuantitativeDocument81 pagesCFA Level 1 - Section 2 Quantitativeapi-376313867% (3)

- Bond Value - YieldDocument40 pagesBond Value - YieldSheeza AshrafPas encore d'évaluation

- Leave To Defend SinghalDocument6 pagesLeave To Defend SinghalLavkesh Bhambhani50% (4)

- Session 1.: Debt Capital MarketsDocument79 pagesSession 1.: Debt Capital MarketsLeonardo MercuriPas encore d'évaluation

- Yield To CallDocument16 pagesYield To CallSushma MallapurPas encore d'évaluation

- Asset Valuation: Basic Bond Andstock Valuation ModelsDocument23 pagesAsset Valuation: Basic Bond Andstock Valuation ModelsMa Via Bordon SalemPas encore d'évaluation

- Overview of Stock Transfer Process in SAP WMDocument11 pagesOverview of Stock Transfer Process in SAP WMMiguel TalaricoPas encore d'évaluation

- GADocument72 pagesGABang OchimPas encore d'évaluation

- Executive Summary:: Advanced & Applied Business Research Pillsbury Cookie Challenge Due Date: 4 March 2013Document6 pagesExecutive Summary:: Advanced & Applied Business Research Pillsbury Cookie Challenge Due Date: 4 March 2013chacha_420100% (1)

- High-Q Financial Basics. Skills & Knowlwdge for Today's manD'EverandHigh-Q Financial Basics. Skills & Knowlwdge for Today's manPas encore d'évaluation

- MB0045 - Financial Management Assignment Set-1 (60 Marks)Document8 pagesMB0045 - Financial Management Assignment Set-1 (60 Marks)Ahmed BarkaatiPas encore d'évaluation

- MBA - R. No - 511222964: T. Antony Joseph PrabakarDocument8 pagesMBA - R. No - 511222964: T. Antony Joseph PrabakarAntony Joseph PrabakarPas encore d'évaluation

- Advanced Bond ConceptsDocument32 pagesAdvanced Bond ConceptsJohn SmithPas encore d'évaluation

- Premium Discount Par: Understanding The Time Value of MoneyDocument5 pagesPremium Discount Par: Understanding The Time Value of Moneyvaibhavc87Pas encore d'évaluation

- Premium Discount Par: Understanding The Time Value of MoneyDocument5 pagesPremium Discount Par: Understanding The Time Value of Moneyvaibhavc87Pas encore d'évaluation

- Bond Concepts: Bond Pricing: Ihtisham Abdul Malik (Department of Management Sciences)Document9 pagesBond Concepts: Bond Pricing: Ihtisham Abdul Malik (Department of Management Sciences)ammar123Pas encore d'évaluation

- Advanced Bond ConceptsDocument8 pagesAdvanced Bond ConceptsEllaine OlimberioPas encore d'évaluation

- Ques No 1.briefly Explain and Illustrate The Concept of Time Value of MoneyDocument15 pagesQues No 1.briefly Explain and Illustrate The Concept of Time Value of MoneyIstiaque AhmedPas encore d'évaluation

- Chapter Four FMDocument7 pagesChapter Four FMHope GoPas encore d'évaluation

- Final FinDocument28 pagesFinal Finashraful islam shawonPas encore d'évaluation

- Valuation of Bonds and SharesDocument30 pagesValuation of Bonds and SharesJohn TomPas encore d'évaluation

- Financial DecisionsDocument45 pagesFinancial DecisionsLumumba KuyelaPas encore d'évaluation

- EconomicsDocument3 pagesEconomicsbsnsPas encore d'évaluation

- Fi CH 3Document54 pagesFi CH 3Gena AlisuuPas encore d'évaluation

- Security Valuation: Bond, Equity and Preferred StockDocument40 pagesSecurity Valuation: Bond, Equity and Preferred StockMohamed KonePas encore d'évaluation

- Bond and Stock ValuationDocument14 pagesBond and Stock ValuationadikopPas encore d'évaluation

- Basic Long Term Financial ConceptsDocument47 pagesBasic Long Term Financial ConceptsJustine Elissa Arellano MarceloPas encore d'évaluation

- Time Value of Money, Compounding and DiscountingDocument6 pagesTime Value of Money, Compounding and DiscountingAmenahPas encore d'évaluation

- Chapter 3 Time Value of MoneyDocument22 pagesChapter 3 Time Value of MoneymedrekPas encore d'évaluation

- AnnuityDocument6 pagesAnnuityGokul NathPas encore d'évaluation

- Fidelia Agatha - 2106715765 - Summary & Problem MK - Pertemuan Ke-4Document12 pagesFidelia Agatha - 2106715765 - Summary & Problem MK - Pertemuan Ke-4Fidelia AgathaPas encore d'évaluation

- Interest Rate Models and Derivatives 2019Document69 pagesInterest Rate Models and Derivatives 2019Elisha MakoniPas encore d'évaluation

- Time Value of MoneyDocument7 pagesTime Value of MoneyMarlon A. RodriguezPas encore d'évaluation

- MathDocument4 pagesMathTrisha ChanPas encore d'évaluation

- FME 322 SIM For Week 6 7Document4 pagesFME 322 SIM For Week 6 7Cheryl Diane Mae LumantasPas encore d'évaluation

- Security Analysis and Portfolio Management LBBLBC603Document19 pagesSecurity Analysis and Portfolio Management LBBLBC603Ayush Kumar GuptaPas encore d'évaluation

- Ta CN TCNH - Unit 2 - Time Value of MoneyDocument19 pagesTa CN TCNH - Unit 2 - Time Value of MoneyPhương NhiPas encore d'évaluation

- Formula For The Amount of An Ordinary AnnuityDocument3 pagesFormula For The Amount of An Ordinary AnnuityAbbyPas encore d'évaluation

- Group 5 - Bond and Stock ValuationDocument56 pagesGroup 5 - Bond and Stock Valuationtuan sonPas encore d'évaluation

- EFN406 Module 03 Notes S12022Document21 pagesEFN406 Module 03 Notes S12022zx zPas encore d'évaluation

- Bond Valuation: Coupon Rate: Some Bonds Have An Interest Rate, Also Known As The CouponDocument2 pagesBond Valuation: Coupon Rate: Some Bonds Have An Interest Rate, Also Known As The CouponNikki QuilonPas encore d'évaluation

- Finance - Cost of Capital TheoryDocument30 pagesFinance - Cost of Capital TheoryShafkat RezaPas encore d'évaluation

- Net Sales Gross Sales - (Returns and Allowances)Document11 pagesNet Sales Gross Sales - (Returns and Allowances)kanchanagrawal91Pas encore d'évaluation

- Financial - Management Book of Paramasivam and SubramaniamDocument21 pagesFinancial - Management Book of Paramasivam and SubramaniamPandy PeriasamyPas encore d'évaluation

- ValuationDocument44 pagesValuationRajesh ShresthaPas encore d'évaluation

- 8 Mutual FundDocument4 pages8 Mutual Fundelise tanPas encore d'évaluation

- Fin - Group 2Document57 pagesFin - Group 2Heidi NatividadPas encore d'évaluation

- 7 8 Equivalence Rev 1Document32 pages7 8 Equivalence Rev 1Mateo, Elijah Jonathan C.Pas encore d'évaluation

- Unit II Eng Economics PresentDocument28 pagesUnit II Eng Economics PresentSudeep KumarPas encore d'évaluation

- FM Ch-5Document36 pagesFM Ch-5Riad FaisalPas encore d'évaluation

- Otc Swaps LiborDocument15 pagesOtc Swaps LibormackymayaPas encore d'évaluation

- Corporate Finance and Investment AnalysisDocument80 pagesCorporate Finance and Investment AnalysisCristina PopPas encore d'évaluation

- BondsDocument6 pagesBondsAli Akbar MalikPas encore d'évaluation

- Yield To CallDocument2 pagesYield To CallHarley BuctolanPas encore d'évaluation

- Stock Valuation EquationsDocument5 pagesStock Valuation EquationsRashid HussainPas encore d'évaluation

- Bond Valuation Yield To CallDocument2 pagesBond Valuation Yield To CallDe cockPas encore d'évaluation

- Present Value 1Document7 pagesPresent Value 1shotejPas encore d'évaluation

- Time Value of MoneyDocument4 pagesTime Value of Moneyshiva ranjaniPas encore d'évaluation

- Valuation of Debt SecuritiesDocument2 pagesValuation of Debt Securitiespriyanka mehtaPas encore d'évaluation

- Unit - Vi Energy Economic Analysis: Energy Auditing & Demand Side ManagementDocument18 pagesUnit - Vi Energy Economic Analysis: Energy Auditing & Demand Side ManagementDIVYA PRASOONA CPas encore d'évaluation

- Payback PeriodDocument32 pagesPayback Periodarif SazaliPas encore d'évaluation

- FOD Awareness: Basic Training in Foreign Object Damage PreventionDocument35 pagesFOD Awareness: Basic Training in Foreign Object Damage PreventionHumberto AnguloPas encore d'évaluation

- CH3Document4 pagesCH3Chang Chun-MinPas encore d'évaluation

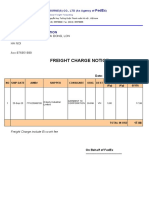

- Freight Charge Notice: To: Garment 10 CorporationDocument4 pagesFreight Charge Notice: To: Garment 10 CorporationThuy HoangPas encore d'évaluation

- Lesson 1: Company Formation and Conversion: Choice of Form of Business EntityDocument13 pagesLesson 1: Company Formation and Conversion: Choice of Form of Business EntityMamtha MPas encore d'évaluation

- Sample CH 01Document29 pagesSample CH 01Ali Akbar0% (1)

- ALKO Case StudyDocument13 pagesALKO Case StudyAnass MessaoudiPas encore d'évaluation

- 7 Financial Management Part 4Document7 pages7 Financial Management Part 4Riz CanoyPas encore d'évaluation

- Assignment 1.3Document3 pagesAssignment 1.3ZeusPas encore d'évaluation

- GeM Bidding 2401209Document4 pagesGeM Bidding 2401209SRARPas encore d'évaluation

- PAC DocumentDocument554 pagesPAC DocumentOlakachuna AdonijaPas encore d'évaluation

- Solutions ArtLog Edition9Document15 pagesSolutions ArtLog Edition9scottstellPas encore d'évaluation

- Satyam Infoway LTD Vs Siffynet Solutions Pvt. LTD On 6 May, 2004Document10 pagesSatyam Infoway LTD Vs Siffynet Solutions Pvt. LTD On 6 May, 2004HEMASHEKHARPas encore d'évaluation

- Modern OfficeDocument10 pagesModern OfficesonuPas encore d'évaluation

- Know Your BSNLDocument96 pagesKnow Your BSNLFarhanAkramPas encore d'évaluation

- Cultural Norms, Fair & Lovely & Advertising FinalDocument24 pagesCultural Norms, Fair & Lovely & Advertising FinalChirag Bhuva100% (2)

- Career Objective: Soni Sharma 9015989558Document4 pagesCareer Objective: Soni Sharma 9015989558AKV CreatorsPas encore d'évaluation

- All Bom HC CircularsDocument55 pagesAll Bom HC CircularsSkk IrisPas encore d'évaluation

- A Reaction PaperDocument6 pagesA Reaction PaperRedelyn Guingab Balisong100% (2)

- Leonardo Roth, FLDocument2 pagesLeonardo Roth, FLleonardorotharothPas encore d'évaluation

- Obayomi & Sons Farms: Business PlanDocument5 pagesObayomi & Sons Farms: Business PlankissiPas encore d'évaluation

- Planning & Managing Inventory in Supply Chain: Cycle Inventory, Safety Inventory, ABC Inventory & Product AvailabilityDocument24 pagesPlanning & Managing Inventory in Supply Chain: Cycle Inventory, Safety Inventory, ABC Inventory & Product AvailabilityAsma ShoaibPas encore d'évaluation