Académique Documents

Professionnel Documents

Culture Documents

David Gratke - Escaping Higher Bond Rates

Transféré par

David GratkeCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

David Gratke - Escaping Higher Bond Rates

Transféré par

David GratkeDroits d'auteur :

Formats disponibles

This article was originally featured on Morningstar.

com, The Online Investor, National Real Estate Investor and two others April 23, 2012.

Escaping Higher Bond Rates

Submitted by David Gratke on Mon, 04/23/2012 - 12:00pm Bondholders are dreading the inevitable rise in interest rates. When rates rise, bonds generally lose value. But there are alternatives for fixed-income investors that wont suffer, or at least not as much: real estate investment trusts (REITs) and convertible bonds. With interest rates at historic multi-decade lows, investors can no longer turn to bonds to reduce risk. After a three-decade decline, rates will rise sooner or later. Now, $9 trillion dollars is in the global economy from central bank printing that was not there five years ago. Historically, bond managers used shorter maturity bonds to manage interest rate risk. This allows them to capture the principal back sooner, for re-investment at higher rates during rising interest rate environments. Plus, when rates rise, shorter-term bonds do not depreciate in value as much as long-term bonds. This strategy is not as viable as it once was, however, because rates for almost all bonds are so low: The benchmark 10-year Treasury yields around 2%. Convertibles and REITS, both publicly and non-publicly traded, have low or negative correlations to stocks and other bonds. Correlations tracks the way two assets relate to each other. A correlation of 1.0 means the two assets rise and fall exactly alike. The lower the correlation, the less they move together. A negative correlation means they move opposite one another. Convertible bonds. These bonds can be switched into a fixed number of a companys common shares. The conversion takes place when the common has risen to a certain price. While you are waiting, you collect bond interest, although usually not as much as the companys regular bonds pay.

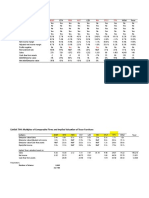

Converts are less impacted in price than traditional bonds amid rising interest rates. Reason: If the bond market is falling apart, people may rush into stocks, giving convert owners a potentially lucrative escape option. Compare the SSI Convertible Income Strategy, a portfolio of converts assembled by SSI Investment Management, with key equity and bond measures. When the stock market falls, converts dont tend to drop as much as their underlying shares. Thats reflected by the SSI portfolios low (0.44) correlation with the Standard & Poors 500 stock index. The convert portfolios correlation to the Barclays Long-Term Bond Index is negative 0.06. Plus, its objective is a dividend return of 6% to 7%. (Minimum investment: $1,000.) REITs. Real estate has typically displayed low correlations to traditional market indexes, as well. Most REITs are landlords: They own commercial buildings and generate earnings from rents, providing nice dividend income for investors. According to the National Association of Real Estate Investment Trusts, the yield averages 3.4%, higher than a 10-year Treasury and the S&P 500 (both around 2%). Commercial buildings are vulnerable to economic downturns. They run the risk of high vacancy rates, which happened during the Great Recession. But REITs high payouts help cushion them. Since the recessions end, vacancies have fallen. In 2008, the FTSE-NAREIT AllREIT Index fell as far as the S&P 500, but has outstripped it in the years since. This REIT index has a fairly high correlation (0.74) to the Russell 3000 stock index, a broad-market benchmark like the S&P 500. But whats important to bond investors is that REITs equity-like characteristic gives it a negative correlation of 0.11 to the widely referenced bond index, Barclays Aggregate Bond Index. Non-listed REITs are even less correlated to stocks (0.17) and bonds (negative 0.08) over the past 15 years, according to Versus Capital Group. These REITs, as the name suggests, do not trade on exchanges like other property trusts.

Investing in them is a lot like buying a bond: The shares are redeemed at a fixed price, often after 10 years. Meanwhile, you enjoy high dividends. The downsides are that non-traded REITs are difficult to get out of before their term elapses.

One way around this illiquidity is a new closed-end mutual fund that invests in real estate private equity funds, called Versus Capital MultiManager Real Estate Equity Income Fund (VCMRX). It trades like a stock. The fund has stakes in blue chip organizations like UBS Global Real Estate and J.P. Morgan Global Real Assets. With a minimum investment of $10,000, the fund aims for a 5% to 5.5% dividend yield.

David Gratke is chief executive officer of Gratke Wealth LLC in Beaverton, Ore.

AdviceIQ delivers quality personal finance articles by both financial advisors and AdviceIQ editors. It ranks advisors in your area by specialty. For instance, the rankings this week measure the number of clients whose income is between $250,000 and $500,000 with that advisor. AdviceIQ also vets ranked advisors so only those with pristine regulatory histories can participate. AdviceIQ was launched Jan. 9, 2012, by veteran Wall Street executives, editors and technologists. Right now, investors may see many advisor rankings, although in some areas only a few are ranked. Check back often as thousands of advisors are undergoing AdviceIQ screening. New advisors appear in rankings daily. Topic: Investing Bonds REITs

Vous aimerez peut-être aussi

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (400)

- Exit Managed Futures Now-Gratke WealthDocument5 pagesExit Managed Futures Now-Gratke WealthDavid GratkePas encore d'évaluation

- 401 (K) Plan Fee Disclosures in 2011Document4 pages401 (K) Plan Fee Disclosures in 2011David GratkePas encore d'évaluation

- Dividend Stocks in Danger-Gratke WealthDocument2 pagesDividend Stocks in Danger-Gratke WealthDavid GratkePas encore d'évaluation

- Combating Volatility-Gratke WealthDocument3 pagesCombating Volatility-Gratke WealthDavid GratkePas encore d'évaluation

- From The Desk of David Gratke What's Doing' at David Gratke Wealth AdvisorsDocument3 pagesFrom The Desk of David Gratke What's Doing' at David Gratke Wealth AdvisorsDavid GratkePas encore d'évaluation

- From The Desk of David Gratke 2011 Predictions? No, Informed Opinions? Yes.Document9 pagesFrom The Desk of David Gratke 2011 Predictions? No, Informed Opinions? Yes.David GratkePas encore d'évaluation

- From The Desk of David Gratke Blog Archive "If Debt Is A Measure of Consumer Confidence, We Have Become Very Confident Indeed."Document6 pagesFrom The Desk of David Gratke Blog Archive "If Debt Is A Measure of Consumer Confidence, We Have Become Very Confident Indeed."David GratkePas encore d'évaluation

- From The Desk of David Gratke - Commentary - Where Do The Markets Go From HereDocument6 pagesFrom The Desk of David Gratke - Commentary - Where Do The Markets Go From HereDavid GratkePas encore d'évaluation

- Investment Opportunities in A Down MarketDocument7 pagesInvestment Opportunities in A Down MarketDavid Gratke100% (2)

- Target Date Fund Are All Created Equal, RightDocument6 pagesTarget Date Fund Are All Created Equal, RightDavid GratkePas encore d'évaluation

- 2008 Tax Reporting InformationDocument3 pages2008 Tax Reporting InformationDavid Gratke100% (1)

- Investing For The New Year - 5 Key Points - David Gratke Wealth Advisors, LLCDocument10 pagesInvesting For The New Year - 5 Key Points - David Gratke Wealth Advisors, LLCDavid GratkePas encore d'évaluation

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (74)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- PTR MOSES CARLOS B. AGAWA - RESUME / CV - Updated December 2010Document12 pagesPTR MOSES CARLOS B. AGAWA - RESUME / CV - Updated December 2010Ptr MosesPas encore d'évaluation

- Company Secretarial Practice - Part B - (E-Forms) PDFDocument721 pagesCompany Secretarial Practice - Part B - (E-Forms) PDFAnonymous 5Hgrr4Q8JPas encore d'évaluation

- Franchise ConsignmentDocument2 pagesFranchise ConsignmentClarissa Atillano FababairPas encore d'évaluation

- Real Estate Marketing Agent Registration Form: Important InstructionsDocument7 pagesReal Estate Marketing Agent Registration Form: Important InstructionsAshok KumarPas encore d'évaluation

- Life Insurance Advertising in India Analysis of Recen 337186587Document12 pagesLife Insurance Advertising in India Analysis of Recen 337186587Raghav DudejaPas encore d'évaluation

- KCNXBPW /O/Bpw) Ns ) BPW: (") Lem /J) Lem Apm' F LN N Iytbmsv Is MSV)Document24 pagesKCNXBPW /O/Bpw) Ns ) BPW: (") Lem /J) Lem Apm' F LN N Iytbmsv Is MSV)Avani Raju Baai0% (1)

- Black Money-Part-1Document9 pagesBlack Money-Part-1silvernitrate1953Pas encore d'évaluation

- NTPC ReportDocument15 pagesNTPC ReportKaushal Jaiswal100% (1)

- Sample Employment ContractDocument2 pagesSample Employment Contracttimmy_zamora100% (1)

- Sample IB Economics Internal Assessment Commentary - MacroDocument3 pagesSample IB Economics Internal Assessment Commentary - MacroUday SethiPas encore d'évaluation

- CHAPTER 1, 2, 3 and 4Document33 pagesCHAPTER 1, 2, 3 and 4Jobelle MalabananPas encore d'évaluation

- DP HCM (MATHS) Printable PDFDocument81 pagesDP HCM (MATHS) Printable PDFAarzoo RatheePas encore d'évaluation

- Proposal of VLCC CVC Project For PT PertaminaDocument7 pagesProposal of VLCC CVC Project For PT Pertaminajunghyun parkPas encore d'évaluation

- I Dunno What de Puck Is This2010-06-06 - 1901 I Do03 - EdmomdDocument2 pagesI Dunno What de Puck Is This2010-06-06 - 1901 I Do03 - EdmomdMuhammad Dennis AnzarryPas encore d'évaluation

- Indian Accounting StandardsDocument9 pagesIndian Accounting StandardsAman Singh0% (1)

- Adinath InvoiceDocument9 pagesAdinath InvoiceArun AhirwarPas encore d'évaluation

- Airport Planning Management: YoungDocument10 pagesAirport Planning Management: YoungRascel Valenzuela0% (6)

- RTD Pension DocumentsDocument53 pagesRTD Pension Documentsangel_aaahPas encore d'évaluation

- Project On Project ManagementDocument92 pagesProject On Project ManagementSrinath NavadaPas encore d'évaluation

- Dvs Minutes - September 19 2013Document3 pagesDvs Minutes - September 19 2013api-124277777Pas encore d'évaluation

- CRD of Michael Yehuda RiceDocument23 pagesCRD of Michael Yehuda RicebuyersstrikewpPas encore d'évaluation

- Economics of Dr. Ambedkar PDFDocument9 pagesEconomics of Dr. Ambedkar PDFAtul BhosekarPas encore d'évaluation

- What Is A Financial Intermediary (Final)Document6 pagesWhat Is A Financial Intermediary (Final)Mark PlancaPas encore d'évaluation

- Approach To The Market - Milton BergDocument11 pagesApproach To The Market - Milton BergAlexis TocquevillePas encore d'évaluation

- Krugman 4 eDocument7 pagesKrugman 4 eAlexandra80% (5)

- Final-Fall-2009 Mock SolutionDocument16 pagesFinal-Fall-2009 Mock SolutionmehdiPas encore d'évaluation

- Services, Training, Delivery Equipment Right To Trade NameDocument6 pagesServices, Training, Delivery Equipment Right To Trade Namecram colasitoPas encore d'évaluation

- Pyq - Mat112 - Jun 2019Document5 pagesPyq - Mat112 - Jun 2019isya.ceknua05Pas encore d'évaluation

- Teuer B DataDocument41 pagesTeuer B DataAishwary Gupta100% (1)

- IHC Appeal 2014Document2 pagesIHC Appeal 2014isnahousingPas encore d'évaluation