Académique Documents

Professionnel Documents

Culture Documents

Options Guide

Transféré par

Matt LynnDescription originale:

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Options Guide

Transféré par

Matt LynnDroits d'auteur :

Formats disponibles

What Does Implied Volatility - IV Mean? The estimated volatility of a security's price.

In general, implied volatility increases when the market is bearish and decreases when the market is bullish. This is due to the common belief that bearish markets are more risky than bullish markets. Implied volatility is sometimes referred to as "vols." Investopedia explains Implied Volatility - IV In addition to known factors such as market price, interest rate, expiration date, and strike price, implied volatility is used in calculating an option's premium. IV can be derived from a model such as the Black-Scholes Model. What Does Forward Premium Mean? When dealing with foreign exchange (FX), a situation where the spot futures exchange rate, with respect to the domestic currency, is trading at a higher spot exchange rate then it is currently. A forward premium is frequently measured as the difference between the current spot rate and the forward rate, but any expected future exchange rate will suffice. Investopedia explains Forward Premium It is a reasonable assumption to make that the future spot rate will be equal to the current futures rate. According to the forward expectation's theory of exchange rates, the current spot futures rate will be the future spot rate. This theory is routed in empirical studies and is a reasonable assumption to make in the long term. What Does Volatility Smile Mean? A common graphical shape that results from plotting the strike price and implied volatility of a group of options with the same expiration date.

Investopedia explains Volatility Smile A volatility smile is used by investors to price options in the foreign currency market and the equity option market. What Does Strangle Mean? An options strategy where the investor holds a position in both a call and put with different strike prices but with the same maturity and underlying asset. This option strategy is profitable only if there are large movements in the price of the underlying asset. This is a good strategy if you think there will be a large price movement in the near future but are unsure of which way that price movement will be.

Investopedia explains Strangle The strategy involves buying an out-of-the-money call and an out-of-the-money put option. A strangle is generally less expensive than a straddle as the contracts are purchased out of the money.

What Does Straddle Mean? An options strategy with which the investor holds a position in both a call and put with the same strike price and expiration date.

Investopedia explains Straddle Straddles are a good strategy to pursue if an investor believes that a stock's price will move significantly, but is unsure as to which direction. The stock price must move significantly if the investor is to make a profit. As shown in the diagram above, should only a small movement in price occur in either direction, the investor will experience a loss. As a result, a straddle is extremely risky to perform. Additionally, on stocks that are expected to jump, the market tends to price options at a higher premium, which ultimately reduces the expected payoff should the stock move significantly. What Does Short Straddle Mean? An options strategy carried out by holding a short position in both a call and a put that have the same strike price and expiration date. The maximum profit is the amount of premium collected by writing the options. Investopedia explains Short Straddle If a trader writes a straddle with a strike price of $25 and the price of the stock jumps up to $50, the trader would be obligated to sell the stock for $25. If the investor did not hold the underlying stock, he or she would be forced to buy it on the market for $50 and sell it for $25. The short straddle is a risky strategy an investor uses when he or she believes that a stock's price will not move up or down significantly. Because of its riskiness, the short straddle should be employed only by advanced traders due to the unlimited amount of risk associated with a very large move up or down. What Does Long Straddle Mean? A strategy of trading options whereby the trader will purchase a long call and a long put with the same underlying asset, expiration date and strike price. The strike price will usually be at the money or near the current market price of the underlying security. Investopedia explains Long Straddle The strategy is a bet on increased volatility in the future as profits from this strategy are maximized if the underlying security moves up or down from present levels. Should the underylying security's price fail to move or move only a small amount, the options will be worthless at expiration.

What Does Vega Mean? The measurement of an option's sensitivity to changes in the volatility of the underlying asset. Vega represents the amount that an option contract's price changes in reaction to a 1% change in the volatility of the underlying asset. Volatility measures the amount and speed at which price moves up and down, and is often based on changes in recent, historical prices in a trading instrument. Vega changes when there are large price movements (increased volatility) in the underlying asset, and falls as the option approaches expiration. Vega is one of a group of Greeks used in options analysis, and is the only one not represented by a Greek letter. Investopedia explains Vega One of the primary analysis techniques utilized in options trading is the Greeks measurements of the risk involved in an options contract as it relates to certain underlying variables. Vega measures the sensitivity to the underlying instruments volatility. Delta measures the sensitivity to the underlying instrument's price. Gamma measures the sensitivity of delta in response to price changes in the underlying instrument. Theta measures the time decay of the option. What Does Gamma Mean? The rate of change for delta with respect to the underlying asset's price. Gamma is an important measure of the convexity of a derivative's value, in relation to the underlying. In a delta-hedge strategy, gamma is sought to be reduced in order to maintain a hedge over a wider price range. A consequence of reducing gamma, however, is that alpha too will be reduced. Investopedia explains Gamma Mathematically, gamma is the first derivative of delta and is used when trying to gauge the price movement of an option, relative to the amount it is in or out of the money. When the option being measured is deep in or out of the money, gamma is small. When the option is near or at the money, gamma is at its largest. Gamma calculations are most accurate for small changes in the price of the underlying asset. What Does Delta Mean? The ratio comparing the change in the price of the underlying asset to the corresponding change in the price of a derivative. Sometimes referred to as the "hedge ratio". Investopedia explains Delta For example, with respect to call options, a delta of 0.7 means that for every $1 the underlying stock increases, the call option will increase by $0.70. Put option deltas, on the other hand, will be negative, because as the underlying security increases, the value of the option will decrease. So a put option with a delta of -0.7 will decrease by $0.70 for every $1 the underlying increases in price. As an in-the-money call option nears expiration, it will approach a delta of 1.00, and as an in-the-money put option nears expiration, it will approach a delta of -1.00.

Vous aimerez peut-être aussi

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (400)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (74)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (345)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- MKTG 201 - Principles of Marketing-Aneela Malik PDFDocument4 pagesMKTG 201 - Principles of Marketing-Aneela Malik PDFmehmood aliPas encore d'évaluation

- Café Coffee DayDocument21 pagesCafé Coffee DayJerin Shaju Francis100% (1)

- CV RanjitDocument3 pagesCV RanjitIto LawputraPas encore d'évaluation

- TOS IA SchemeDocument4 pagesTOS IA SchemePradeep BiradarPas encore d'évaluation

- Strategic Social Media MarketingDocument21 pagesStrategic Social Media MarketingTahir SaeedPas encore d'évaluation

- Business Strategy of The E-Type Company PDFDocument2 pagesBusiness Strategy of The E-Type Company PDFHadeer KamelPas encore d'évaluation

- Scarcity Is The Central Economic Problem in All Societies Irrespective of The Type of Economic System. DiscussDocument2 pagesScarcity Is The Central Economic Problem in All Societies Irrespective of The Type of Economic System. DiscussCarlitoPas encore d'évaluation

- MS05-03 Cost Volume Profit AnalysisDocument10 pagesMS05-03 Cost Volume Profit AnalysisMIMI LAPas encore d'évaluation

- Faisah Bandrang: Preciosa CelestinaDocument4 pagesFaisah Bandrang: Preciosa CelestinaBarangay MukasPas encore d'évaluation

- 06 AnsDocument4 pages06 AnsAnonymous 8ooQmMoNs1Pas encore d'évaluation

- Air Bed &: BreakfastDocument12 pagesAir Bed &: BreakfastPrateek VermaPas encore d'évaluation

- Entrepreneurial EcosystemDocument37 pagesEntrepreneurial EcosystemParimal ParmarPas encore d'évaluation

- Returnable Goods Register: STR/4/005 Issue 1 Page1Of1Document1 pageReturnable Goods Register: STR/4/005 Issue 1 Page1Of1Zohaib QasimPas encore d'évaluation

- ReSA B43 AUD First PB Exam Questions Answers SolutionsDocument20 pagesReSA B43 AUD First PB Exam Questions Answers SolutionsLuna V100% (1)

- Strategic Plan of UnileverDocument14 pagesStrategic Plan of Unileverkaka kynPas encore d'évaluation

- Global Cost Accounting Add inDocument36 pagesGlobal Cost Accounting Add inmayeuxPas encore d'évaluation

- AvariDocument35 pagesAvariirfan10315833% (3)

- Cost & Cost CurvesDocument46 pagesCost & Cost CurvesManoj Kumar SunuwarPas encore d'évaluation

- Jack and Jones Analysis: Subject-Elements of FashionDocument12 pagesJack and Jones Analysis: Subject-Elements of FashionShrutiPas encore d'évaluation

- Group 6 - Transforming Luxury Distribution in AsiaDocument5 pagesGroup 6 - Transforming Luxury Distribution in AsiaAnsh LakhmaniPas encore d'évaluation

- WK 2 Audit Responsibilities and ObjectivesDocument96 pagesWK 2 Audit Responsibilities and ObjectivesKEITH WONG KANE YOUNGPas encore d'évaluation

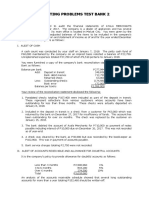

- Auditing Problems Test Bank 2Document15 pagesAuditing Problems Test Bank 2Mark Jonah Bachao80% (5)

- Freezing Out ProfitDocument9 pagesFreezing Out ProfitNormala HamzahPas encore d'évaluation

- PoM Case-Study FinalDocument13 pagesPoM Case-Study FinalArun VermaPas encore d'évaluation

- Maf451 Question July 2020Document12 pagesMaf451 Question July 2020JannaPas encore d'évaluation

- 1.3.2 The Methods and Problems of Measuring Business SizeDocument9 pages1.3.2 The Methods and Problems of Measuring Business Sizehassan haniPas encore d'évaluation

- 3rd Sem Tourism MarketingDocument2 pages3rd Sem Tourism MarketingakashbpradeepcorpusPas encore d'évaluation

- Tristar CompanyDocument11 pagesTristar Companyahmedradwan2005Pas encore d'évaluation

- Highly Competitive Warehouse Management: January 2012Document46 pagesHighly Competitive Warehouse Management: January 2012prabhukamaraj26Pas encore d'évaluation

- Theories: Manufacturing - Actual Costing ReviewerDocument12 pagesTheories: Manufacturing - Actual Costing ReviewerJuan Dela CruzPas encore d'évaluation