Académique Documents

Professionnel Documents

Culture Documents

Cross-Country Merger and Acquisition - Sell-Off - Jaguar and Land Rover

Transféré par

Satish ChauhanDescription originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Cross-Country Merger and Acquisition - Sell-Off - Jaguar and Land Rover

Transféré par

Satish ChauhanDroits d'auteur :

Formats disponibles

Cross-Country Merger and Acquisition Sell-off - Jaguar and Land Rover

Presented by Shraddha Shah Pradeep Dixit

Cross-Country Merger and Acquisition Sell-off - Jaguar and Land Rover

Introduction

Jaguar Car Ltd founded in 1922, is one of the worlds premier manufacturer of luxury saloons and sports cars. Land Rover has manufactured four-wheel drive vehicles with widest range of off-road capabilities since 1948. Ford acquired Jaguar from British Leyland Ltd in 1989 for US$ 2.5 billion. Ford Motor Company (Ford) is leading automaker and the third largest multinational corporation in the automobile industries.

Setbacks

After Ford acquired Jaguar, adverse economic condition worldwide in the 1990 led to tough market condition and a decrease in the demand of luxury car. In March 1999, Ford established the PAG (Premier Automotive Group) with Aston Martin, Lincoln, Jaguar and also Volvo Cars. In September 2006, the Ford decided to dismantle the PAG. Ford review of the two brands came, as it was struggling to return to profitability in the face of fierce competition, from Asian Automaker and developing tastes for more fuel-efficient models in its key Northern American Market. These two European luxury brands had become a drag on the cash.

Particularly draining was Jaguar, into which Ford sank nearly $10 billion, trying to revive the brand, after spending $2.5 billion to buy it in a deal that closed in 1990.

Ford had got some huge problems on their owns, really huge, facing survival really on their hands. They actually did not have management capability to make success of Jaguar.

Ford was facing various issues such as:

In Jaguar and Land Rover, Ford acquired antiquated manufacturing facilities in Britain and onerous / burdensome labor pacts. Losses needed to be stemmed. Too many brands Aston Martin, Lincoln, Jaguar and Land Rover and Volvo Cars over stretched Ford. Fords Board decided to focus on core market. In 2006 Ford recorded losses of 6.5 billion. Although these losses were reduced to 1.3 billion in 2007, the Ford recognized that it needed major restructuring, if it was ever to return to profitability. The Ford had been reviewing all of its operation and announced that Ford may be more interested in the selling the two British Brand as it was in need of more cash.

Learning and Remedies

Ford sources revealed that no matter how profitable its luxury brand offshoots were, unless it focused its resources on turning around its core business, it could not hope to recover. PAG accounted for around 1 billion of losses in 2006, resulting in the sell off of first Aston Martin and Now Jaguar and Land Rover.

In June 2007, Ford announced that it was considering selling JLR Jaguar and Land Rover. Ford had finally decided to focus on its key products and markets, especially in the USA, so that it could start making a profit again. Citigroup analyst Jon Rogers said that a sale of Jaguar and Land Rover could benefit Ford, as the two divisions were not at the core of the overall business and cash from sale could be used to accelerate its North American restructuring. After failing to rebrand and integrate these two luxury brands, with its product portfolio, Ford Motors felt that sell out was the only right way to survive.

Looking for Buyer

It had become imperative and absolutely essential for Ford to shed these European luxury brands Jaguar and Land Rover. Jaguar and Land Rover needed buyer that would appreciate their heritage and could restore their glory, especially to Jaguar. The sale to the strategic buyer had been at the central to Ford strategy in order to turn the company around by refocusing the company on its core brand i.e. Ford, Mercury and Lincoln. Ford had initiated the sell- off process by having dialogues and negotiations with various global auto companies. The deal should be meaningful and beneficial to both the parties The acquired company i.e. Ford and the acquiring company.

Cross Country Merger and Acquisition

In the Acquisition Transactions, one firm buys another firm, with intent of more effectively using core competence, by making the acquired firm a subsidiary, within its portfolio of business.

Why Acquisition is important?

Increased market share. Increased speed to market. Economies of scale. Lower risk comparing to develop new products. Increased diversification. Avoid excessive competition. Benefit on account of tax shields like carried forward losses of unclaimed depreciation. Profit for Research and Development. It is faster and easier transaction. The acquirer does not experience the dilution of ownership. Learn from mistake of others. Pick holes in strategy to get the best. Redefine strategy to achieve goal.

From Ford Perspective

Ford was quite fortunate that it found strategic buyer viz Tata Motors, in the very difficult market environment. The credit crisis and general pessimistic outlook on the auto industry made it very difficult for any another auto company to close the deal. Tata Motors was very serious company, very well funded and not inexperienced in car. They were probably the best possible owner for Jaguar and Land Rover.

Actually they were probably the only company which could come in and acquire the brands. Ford also needed cash and the company was aiming to reach profitability in 2009, which could be tough in a time of declining sales and tight credit. In one of the most significant shifts of clout in the auto industry, Ford Motors had handed over the keys to its high class British Jaguar and Land Rover brands to an Indian company viz Tata Motors, in March 2008 for 1.15 billion.

Tata JIR Deal

In June 2008, Indian based Tata Motors Ltd, announced that it had completed the acquisition of the two iconic British brands Jaguar and Land Rover (JLR) from the USbased Ford Motors for US$ 2.3 billion. Forming a part of the purchase consideration were JLRs manufacturing plants, two advanced design centers in the UK, national sales companies spanning across the world, and also licenses of all necessary intellectual property rights. Tata Motors also entered into long term agreement with Ford Motor Company for supply of engines, stamping and other components to JLR. Other areas of transition support from Ford include IT, accounting and accesses to test facilities. The two companies would continue to cooperate in the areas such as design and development through sharing of platforms and joint development of technologies. Ford Motor Credit Company would continue to provide financing for Jaguar and Land Rover dealers and customers.

From Tata Motors Perspective The Acquiring Company

Tata Motors was interested in acquiring JLR, as it would reduce the companys dependence on the Indian market, which accounted for 90% of its sales. Tata Motors stood to gain on several fronts from the deal.

One, the acquisition would help the company acquire a global footprint and enter the high-end premier segment of the global automobile market. After the acquisition, Tata Motors would own the worlds cheapest car the US$2,500 Nano, and luxury marquees like the Jaguar and Land Rover. Two, Tata also got two advance design studios and technology as part of the deal. This would provide Tata Motors access to latest technology which would also allow Tata to improve their core products in India, e.g., Indica and Safari suffered from internal noise and vibration problems. Three, this deal provided Tata an instant recognition and credibility across globe which would otherwise would have taken years. Four, the cost competitive advantage, as Corus was the main supplier of automotive high grade steel, to JLR and other automobile industry in US and Europe. This would have provided a synergy for TATA Group on a whole. Five, in the long run, TATA Motors will surely diversify its present dependence on Indian markets (which contributed to 90% of Tatas revenue). Along with it, Tatas footprints in South East Asia, would help JLR to diversify its geographic dependence from US (30% of volumes) and Western Europe (55% of volumes). Tata would not have been able enter into the premium segment (>10 lakhs) in India. Tata Motors would have lacked in robust designing capabilities. Above all, at that time no other major automobile brand was available for acquisition with such designing and R & D capabilities.

Cross Country Acquisition - Tata JLR deal focus on the followings:

Advantage of cross-border acquisition. Need for growth through acquisition in foreign country. The role of acquisition as a growth strategy.

Vous aimerez peut-être aussi

- Tata Motors acquires Jaguar Land Rover from FordDocument12 pagesTata Motors acquires Jaguar Land Rover from Fordbhumikasem1Pas encore d'évaluation

- Tata's $2.3 Billion Acquisition of Jaguar and Land Rover from FordDocument17 pagesTata's $2.3 Billion Acquisition of Jaguar and Land Rover from Fordsulabhsingh85Pas encore d'évaluation

- Tata Acquires Luxury Brands Jaguar and Land Rover from Ford for $2.3BDocument15 pagesTata Acquires Luxury Brands Jaguar and Land Rover from Ford for $2.3BJoel SaldanhaPas encore d'évaluation

- EntrepreneurshipDocument16 pagesEntrepreneurshipHyder HussainPas encore d'évaluation

- Merger and Acquisition Ca2Document6 pagesMerger and Acquisition Ca2Uzumaki NarutoPas encore d'évaluation

- TATA AcquisitionDocument4 pagesTATA AcquisitionAashima GuptaPas encore d'évaluation

- Tata - JLRDocument30 pagesTata - JLRpurval1611100% (3)

- Pre-Merger Due Diligence:: Tata-JLR DealDocument12 pagesPre-Merger Due Diligence:: Tata-JLR DealStephen JohnsonPas encore d'évaluation

- Tata Motors' Acquisition of Iconic British Brands Jaguar and Land RoverDocument2 pagesTata Motors' Acquisition of Iconic British Brands Jaguar and Land Roverrhemrajani793960% (10)

- Case StudyDocument3 pagesCase StudyprateekkapPas encore d'évaluation

- Jaguar Report Case StudyDocument23 pagesJaguar Report Case StudyAkshay JoshiPas encore d'évaluation

- Tata's Jaguar Deal Worries AnalystsDocument5 pagesTata's Jaguar Deal Worries AnalystsDeepak TiwariPas encore d'évaluation

- Tata JLR Case StudyDocument11 pagesTata JLR Case Studytom george100% (1)

- Case Study on TATA Motors' Acquisition of Jaguar and Land RoverDocument8 pagesCase Study on TATA Motors' Acquisition of Jaguar and Land RoverChe Tanifor BanksPas encore d'évaluation

- Post Acquisition Scenario of Tata Motors An OverviewDocument20 pagesPost Acquisition Scenario of Tata Motors An OverviewArun SinghPas encore d'évaluation

- Tata Motors' Acquisition of Jaguar and Land Rover: IntroductionDocument5 pagesTata Motors' Acquisition of Jaguar and Land Rover: IntroductionPallavi GuptaPas encore d'évaluation

- Merger and Acquisition AssignmentDocument11 pagesMerger and Acquisition AssignmentKuumaar AayushPas encore d'évaluation

- Case Study: Tata - JLR Deal (Jaguar Land Rover Acquisition by Tata Motors)Document25 pagesCase Study: Tata - JLR Deal (Jaguar Land Rover Acquisition by Tata Motors)Pratik Prakash BhosalePas encore d'évaluation

- Tata Group Buys Jaguar Land RoverDocument17 pagesTata Group Buys Jaguar Land RoverShubh ShrivastavaPas encore d'évaluation

- The Royal Bank of Scotland Takeover of ABNDocument76 pagesThe Royal Bank of Scotland Takeover of ABNMarmik SoniPas encore d'évaluation

- History of Tata JaguarDocument5 pagesHistory of Tata JaguarLucky ThakurPas encore d'évaluation

- Swot Analysis of Tata MotorsDocument2 pagesSwot Analysis of Tata MotorsSouvik MajumderPas encore d'évaluation

- Mergers and Acquisitions: Study On Jaguar-Land Rover and Hero-Honda CasesDocument9 pagesMergers and Acquisitions: Study On Jaguar-Land Rover and Hero-Honda Casessensharma.rahulPas encore d'évaluation

- Jaguar Land Rover SWOT AnalysisDocument10 pagesJaguar Land Rover SWOT AnalysisSBPas encore d'évaluation

- Naseem FinalDocument13 pagesNaseem FinalimsluckyPas encore d'évaluation

- Tata Group Case StudyDocument16 pagesTata Group Case StudyAshish DeoliPas encore d'évaluation

- Merger of TLJDocument23 pagesMerger of TLJvijay2512Pas encore d'évaluation

- TATA Jaguar and LandRover AcquisitionDocument4 pagesTATA Jaguar and LandRover AcquisitionSubhangkar DasPas encore d'évaluation

- Tata Buys Jaguar PEST AnalysisDocument3 pagesTata Buys Jaguar PEST AnalysisSanjay Tiwari100% (2)

- SWOT AnalysisDocument2 pagesSWOT Analysisanila77Pas encore d'évaluation

- Tata JLR Case StudyDocument11 pagesTata JLR Case StudyRaviPas encore d'évaluation

- Tata and Jagur MargerDocument4 pagesTata and Jagur Margertrilokrarotia7656Pas encore d'évaluation

- SWOT Analysis - Tata Motors Limited: StrengthsDocument3 pagesSWOT Analysis - Tata Motors Limited: StrengthsamanchandelPas encore d'évaluation

- Ford's Dynamic Shuttle Taxi Service Pilot in IndiaDocument9 pagesFord's Dynamic Shuttle Taxi Service Pilot in IndiaEno CasmiPas encore d'évaluation

- Business Problem Related To Mergers and Acquisition: Case Study of Acquisition of Jaguar and Land Rover by Tata MotorsDocument7 pagesBusiness Problem Related To Mergers and Acquisition: Case Study of Acquisition of Jaguar and Land Rover by Tata MotorsDarshan DhawarePas encore d'évaluation

- Tata - Jaguar - Land Rover Deal: Presented By: Swati ChaudhryDocument10 pagesTata - Jaguar - Land Rover Deal: Presented By: Swati ChaudhryswatiPas encore d'évaluation

- Case Study: Tata Motors JLR - A Two-Edged SwordDocument12 pagesCase Study: Tata Motors JLR - A Two-Edged SwordVidushi ThapliyalPas encore d'évaluation

- Tata Motors SWOT Analysis StrengthsDocument3 pagesTata Motors SWOT Analysis StrengthsS FPas encore d'évaluation

- Tata Motors' Acquisition of Jaguar Land RoverDocument9 pagesTata Motors' Acquisition of Jaguar Land RoverziaecePas encore d'évaluation

- Ib Case StudyDocument19 pagesIb Case StudySunidhi ChauhanPas encore d'évaluation

- The origins of Jaguar can be traced back to the 1920sDocument3 pagesThe origins of Jaguar can be traced back to the 1920sKrushali DondaPas encore d'évaluation

- Tata's Post-Merger Success With Jaguar Land RoverDocument19 pagesTata's Post-Merger Success With Jaguar Land Roversibubanerjee100% (3)

- Mergers and Acquisitions V2Document16 pagesMergers and Acquisitions V2solvedcare0% (1)

- TATA JLR Deal Group 4Document12 pagesTATA JLR Deal Group 4Xyz YxzPas encore d'évaluation

- Tata Jaguar - Amit and AmritDocument22 pagesTata Jaguar - Amit and AmritTaruna JunejaPas encore d'évaluation

- Tata Motors Case Study.Document5 pagesTata Motors Case Study.Bhumitra DeyPas encore d'évaluation

- Tata Jaguar MergerDocument17 pagesTata Jaguar MergerMayank MittalPas encore d'évaluation

- Tata Finds Success in Turning Around Jaguar Land RoverDocument4 pagesTata Finds Success in Turning Around Jaguar Land Rover于佳卉Pas encore d'évaluation

- SWOT AnalysisDocument7 pagesSWOT AnalysislanguagembaPas encore d'évaluation

- Tata MotorsDocument4 pagesTata MotorsKeshri DubeyPas encore d'évaluation

- Ford Motor Company SWOT AnalysisDocument3 pagesFord Motor Company SWOT AnalysisneonerdPas encore d'évaluation

- Opportunities GLOBAL WORLDDocument10 pagesOpportunities GLOBAL WORLDmustkimdhukkarediffmPas encore d'évaluation

- Financial Analysis and Management Decision Making: Tata Jaguar Case StudyDocument5 pagesFinancial Analysis and Management Decision Making: Tata Jaguar Case StudyAnjay BaliPas encore d'évaluation

- Jewels in the Crown: How Tata of India Transformed Britain's Jaguar and Land RoverD'EverandJewels in the Crown: How Tata of India Transformed Britain's Jaguar and Land RoverÉvaluation : 5 sur 5 étoiles5/5 (1)

- My Years with General Motors (Review and Analysis of Sloan Jr.'s Book)D'EverandMy Years with General Motors (Review and Analysis of Sloan Jr.'s Book)Évaluation : 5 sur 5 étoiles5/5 (1)

- Comeback: The Fall & Rise of the American Automobile IndustryD'EverandComeback: The Fall & Rise of the American Automobile IndustryÉvaluation : 4.5 sur 5 étoiles4.5/5 (4)

- Automotive Intelligentsia 2009-2010 Sports Car GuideD'EverandAutomotive Intelligentsia 2009-2010 Sports Car GuideÉvaluation : 5 sur 5 étoiles5/5 (2)

- Return to Glory: The Story of Ford's Revival and Victory at the Toughest Race in the WorldD'EverandReturn to Glory: The Story of Ford's Revival and Victory at the Toughest Race in the WorldPas encore d'évaluation

- 1969 Plymouth Road Runner: Muscle Cars In Detail No. 5D'Everand1969 Plymouth Road Runner: Muscle Cars In Detail No. 5Évaluation : 4.5 sur 5 étoiles4.5/5 (3)

- DettolDocument20 pagesDettolSatish ChauhanPas encore d'évaluation

- Hyundai Card Case StudyDocument19 pagesHyundai Card Case StudyAhsan Shahid100% (1)

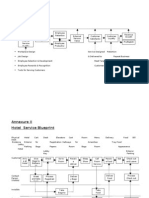

- Annexure I Service Profit ChainDocument7 pagesAnnexure I Service Profit ChainSatish ChauhanPas encore d'évaluation

- PPTDocument25 pagesPPTSatish ChauhanPas encore d'évaluation

- Course Lecture Notes For Cumulative Final Exam (Combined Weeks 1-10)Document178 pagesCourse Lecture Notes For Cumulative Final Exam (Combined Weeks 1-10)James CrombezPas encore d'évaluation

- CH 02Document143 pagesCH 02Hassaan ShaikhPas encore d'évaluation

- 4 Inventory Planning and ControlDocument55 pages4 Inventory Planning and ControlSandeep SonawanePas encore d'évaluation

- Pfrs 2 - Share-Based PaymentsDocument23 pagesPfrs 2 - Share-Based PaymentsAdrianIlaganPas encore d'évaluation

- Progressive Pay As You Go InsuranceDocument24 pagesProgressive Pay As You Go InsuranceANKUR PUROHITPas encore d'évaluation

- History of Mergers and AcquisitionsDocument23 pagesHistory of Mergers and AcquisitionsZeeshan AliPas encore d'évaluation

- Dev Academy of Science and Commerce March Examination 12 EconomicsDocument2 pagesDev Academy of Science and Commerce March Examination 12 Economicsरजत जाँगडाPas encore d'évaluation

- Five Types of Khiyar in Buyu'Document4 pagesFive Types of Khiyar in Buyu'I K100% (1)

- Final SoFDocument1 pageFinal SoFpatilchinmayi972Pas encore d'évaluation

- Assignment1 2020 PDFDocument8 pagesAssignment1 2020 PDFmonalPas encore d'évaluation

- Diaper StudyDocument28 pagesDiaper StudyMathes Waran100% (1)

- IndiGo Q2 FY22 Earnings CallDocument16 pagesIndiGo Q2 FY22 Earnings CallBhav Bhagwan HaiPas encore d'évaluation

- Bus 504Document13 pagesBus 504RaselAhmed082Pas encore d'évaluation

- B124 - Book 7 Part 2: Standard Costing and Variance AnalysisDocument40 pagesB124 - Book 7 Part 2: Standard Costing and Variance AnalysisNabil Al hajjPas encore d'évaluation

- ENTIRE Fall 2016 Symposium Slide ShowDocument102 pagesENTIRE Fall 2016 Symposium Slide ShowLydia DePillisPas encore d'évaluation

- United States v. AMR Corporation, 335 F.3d 1109, 10th Cir. (2003)Document25 pagesUnited States v. AMR Corporation, 335 F.3d 1109, 10th Cir. (2003)Scribd Government DocsPas encore d'évaluation

- Tesla Motors Strategic IssueDocument18 pagesTesla Motors Strategic IssueJacob Andrew Lueck92% (13)

- EconomicsDocument107 pagesEconomicsWala LangPas encore d'évaluation

- LeverageDocument3 pagesLeverageSatish Kumar SonwaniPas encore d'évaluation

- Water Level IndicatorDocument10 pagesWater Level IndicatorKodati KasiPas encore d'évaluation

- Cost-Volume-Profit Analysis: Mcgraw-Hill/IrwinDocument78 pagesCost-Volume-Profit Analysis: Mcgraw-Hill/IrwinSheila Jane Maderse AbraganPas encore d'évaluation

- Understanding the Difference Between Positive and Normative EconomicsDocument21 pagesUnderstanding the Difference Between Positive and Normative EconomicsKevin Fernandez MendioroPas encore d'évaluation

- XI Accountancy T-IIDocument5 pagesXI Accountancy T-IIBaluPas encore d'évaluation

- 33 - HomeworkDocument7 pages33 - HomeworkChâu TrầnPas encore d'évaluation

- 4 (A) Income Tax-1Document4 pages4 (A) Income Tax-1anjanaPas encore d'évaluation

- Apr Form No. 02Document4 pagesApr Form No. 02Bobbie KasandraPas encore d'évaluation

- Service Pricing and The Financial and Economic Effect of ServiceDocument25 pagesService Pricing and The Financial and Economic Effect of ServicePietro BertolucciPas encore d'évaluation

- Case Assignment 2 (Eharmony)Document3 pagesCase Assignment 2 (Eharmony)JackPas encore d'évaluation

- Multi Level MarketingDocument156 pagesMulti Level MarketingFrancis LoboPas encore d'évaluation

- Business Blue PrintDocument65 pagesBusiness Blue PrintImtiaz KhanPas encore d'évaluation