Académique Documents

Professionnel Documents

Culture Documents

Accounting Ass.

Transféré par

Paulina MichalakDescription originale:

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Accounting Ass.

Transféré par

Paulina MichalakDroits d'auteur :

Formats disponibles

Business functions in context

Tutor Marked Assignment 03

Introduction to accounting

Part I Financial analysis is performed in order to evaluate overall current performance, identify problem/opportunity areas, develop budgets and implement strategies for the future. External groups i.e. investors, perform financial analysis in to invest in a particular company, whether to extend credit etc. In order to advice Peter Harris whether to invest in Tech Logistics plc some financial ratios need to be calculated and analysed. a) Gross profit margin Gross profit margin = gross profit/sales revenue x 100 2011 9300/ 27400 x100 = 33.94% 2010 7300/25000 x 100 = 29.20%

b) Current ratio Current ratio = current assets/ current liabilities, where current assets = inventories + trade receivables + cash 2011 (1380+980+320)/ 3140 = 0.85 c) Acid test ratio Acid test ratio = current assets(excluding inventories)/ current liabilities 2011 (980+320)/3140 = 0.41 2010 (810+400)/2900 = 0.42 2010 (1300+810+400)/ 2900 = 0.87

d) Average settlement period for trade receivables Average settlement period for trade receivables= trade receivables/credit sales revenue x 365 2011 980/27400 x365= 13.05days 2010 810/ 25000 x365= 11.83 days

the lower the ratio the better as it could mean that on average debt is repaid promptly but this figure can be badly distorted by large clients paying fast or taking long time. In this case a settlement period for trade receivables differs by just over a day e) Average inventories turnover

Average inventories turnover= average inventories held/ cost of sales x 365, where cost of sales = revenue gross profit 2011 cost of sales 27400 9300 = 18100 2011 Average inventories turnover f) Gearing ratio 1380/18100 x 365=27.83days

2010

25000 7300 = 17700 2010 1300/17700 x 365= 26.81days

Gearing ratio = long-term (non-current) liabilities/ (share capital+reserves+long-term liabilities) x 100 2011 [1620/(8000+1340+1620)] x 100 = =1620/10960 x 100 = 14.78% 2010 [1700/ (8000+ 860 +1700 )] x 100 = = 1700/10560 x 100 = 16.10%

g) Price/earning ratio= market value per share/earning per share Earning per share = earnings available to ordinary shareholders/number of ordinary shares issue 2011 EPS = (890 500)/8000 = 4.8p 2010 (810 500 )/8000 = 3.8p

For equity shareholders, the amount available will be represented by profit for the year (net profit after taxation) less any preference dividends . Many investment analysts regard the EPS ratio as fundamental measure of share performance. The trend in earnings per share over time is used to help assess the investment. It can be useful to monitor the changes that occur in this ratio for a particular business over time. E.McLaney and P.Atrill (2008) 2011 P/E ratio = 130p/4.8p = 27.08 2010 P/E ratio = 110p/3.8p = 28.95

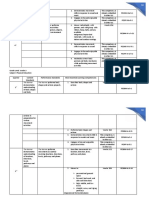

Tech Logistics plc Recent industry 2011 2010 average Gross profit margin 33.94% Current ratio Acid test ratio 0.85:1 0.41:1 29.20% 0.87:1 0.42:1 50.00% 2.5:1 1.9:1

Average settlement 13.05days period for sales receivables Average inventories turnover Gearing ratio P/E ratio 27.83

11.83 days 25days

26.81

30days

14.78%

16.10%

60.00%

27.08times 28.95times 10times

Analysis As numbers cannot be compared in a vacuum overall performance needs to be compared to the average for its industry, pointing out any significant features, assumptions and limitations of the information used in analysis. Gross profit margin represents the difference between sales and cost of sales. The ratio is a measure of profitability in buying or producing and selling goods before any other expenses are taken into account. As costs of sales represent a major expense for many businesses, a change in this ratio can have a significant effect on the bottom line. E.McLaney and P.Atrill (2008) To analyse the information given by this ratio further investigation would need to be carried out to discover what caused the increase in cost of sales and operating expenses, relative to sales revenue, inventories. It will involve looking at each of the individual areas that make up operating expenses to discover which ones were responsible for increase/decrease, yet this data is not provided. For Tech Logistics plc from year to year income as well as gross profit margin increase which suggests that the business is making more profit. Its gross profit margin is below average for the industry but is growing. Available information does not provide figures from previous years so it is not possible at this stage to indicate if it's a continues process. At the moment Tech Logistics figure is significantly below average for its industry, which indicates unfavourable position. Current ratio - the higher the more liquid the business is considered to be. As liquidity is vital to the

survival of a business a higher ratio may be preferred to have but if a business has a very high ratio it may be that the funds are tied up in cash or other liquid assets and are not , therefore, being used productively. Tech Logistics plc has a very low current ratio in both years and that suggests poor liquidity. Poor liquidity can be caused by high inventories to cash ratio, long average settlement period for trade receivables or high level of liabilities. The company keeps a lot of inventories having not to much cash and although its average time for receiving payments is a lot lower then average for the industry the main problem may be caused by current liabilities. If Tech Logistics plc had any problems with paying its debt off due to i. e. payments being delayed its liquidity would suffer. As the business' non-current assets do not show significant increase it is questionable if the company invests in its development and expansion, which could make potential investors, therefore stock market, nervous as there is no alternative to justify low level of immediately available financial resources. Acid test ratio is similar to current ratio but represents more stringent test of liquidity excluding stock from calculation. I Companies with ratios of less than 1 cannot pay their current liabilities and should be looked at with caution. Furthermore, if the acid-test ratio is much lower than the working capital ratio, it means current assets are highly dependent on inventory. Tech Logistics acid test ratio in both 2010 and 2011 is over two times lower then its current assets ratio and over four and a half times lower then average for the industry. This indicates its lack of financial integrity. gearing ratio - measures the contribution of long-term lenders to the long-term capital structure of businesses As for most ratios, an acceptable level is determined by its comparison to ratios of companies in the same industry. A company with high gearing (high leverage) is more vulnerable to downturns because it must continue to service its debt regardless of how bad sales are. A greater proportion of equity provides a cushion and is seen as a measure of financial strength. Gearing focuses on the capital structure of the business that means the proportion of finance that is provided by debt relative to the finance provided by shareholders.

The gearing ratio is also concerned with liquidity. However, it focuses on the long-term financial stability of a business. A business with a gearing ratio of more than 50% is traditionally said to be highly geared, ones with less than 25% is traditionally described as having low gearing. For the above business, that would suggest that the business is relatively lowly-geared and that the capital structure of the business is pretty safe and cautious but without obtaining additional funds it cannot progress. As cash flow statement details are not available it cannot be stipulated if the company would be able to handle it had it have higher gearing. It is also interesting as to why Tech Logistics gearing ratio is, both years, over three times less then average for the industry. Is it because its credit history is not satisfying or there are no plans for expansion. P/E the ratio is a measure of market confidence in the future of a business, the higher the P/E ratio the greater the confidence and investors are prepared to pay more in relation to the earning stream of the businesses and it can be helpful when compering different businesses but in the same industry. When the markets are optimistic or if investor sentiment is optimistic. Tech Logistics P/E ratio is significantly higher then average for the industry. The P/E is sometimes referred to as the "multiple", because it shows how much investors are willing to pay per unit of earnings. If a company were currently trading at a multiple (P/E) of 20, the interpretation is that an investor is willing to pay 20 for 1 of current earnings. Average settlement period for trade receivables and the lower the ratio the better as it could mean that on average debt is repaid promptly but this figure can be badly distorted by large clients paying fast or taking long time. In this case a settlement period for trade receivables differs by just over a day It is important that investors note an important problem that arises with the P/E measure, and to avoid basing a decision on this measure alone. The earnings are based on an accounting measure of earnings that is susceptible to forms of manipulation, making the quality of the P/E only as good as the quality of the underlying earnings number. http://www.investopedia.com/terms Average inventories turnover time for Tech Logistics is close to average time for this type of company.

Recommendation

Ratios are more of a diagnostic tool that helps us to identify problem areas and opportunities within a company. Ratios are based on financial statements that reflect the past and not the future. On the basis of data available I wouldn't advice Peter to invest in Tech Logistics at present. Although the company is said to be growing fast I am not convinced if it has stability and it's ratios are a lot lower in comparison to industry's average. The company, because of its high P/E ratio could be expected to grow revenue and earnings quickly in the future, yet without more detailed knowledge about the company and the industry it operates in it would be risky to invest in it. Lack of Cash Flow statement imposes some limitation, as other numbers seem to be easier to manipulate. Cash flow is a more reliable indicator of performance. Despite high P/E ratio it would take a long time to make relatively small profit so Peter's funds may as well be left on deposit with the bank. Part II My main suggestion, as most of fellow students', was reducing costs. I focused on trimming operational costs, stock levels control and relatively short turnover time should help to decrease warehouse and logistics costs. Also an efficient information system which would constantly corresponding with accounting is necessary and an important task would involve account payable management and cash flow. It would be important to look into different accounting and regulatory frameworks overseas. Having read TGF posts a few times I realised that we didn't seem to propose increasing money inflow. We have focused mainly on cutting costs but not much on making investments and increasing profit. One way to start would be the retention of existing customers and marketing activities to poses new ones. We suggested increasing cash flow but there wasn't many ideas how to do it. Marketing, building relationships and getting contracts on one hand, but within accounting possibly loans, increasing gearing ratio, to expand, extend company's offer, invest in development, maybe enter stock market to sell some share, to gather assets this way. Drawing upon functional expertise of this block it's important to look at the company, any company in fact, under many angles. Financial statements provide a lot of information and the only think needed to use them is knowledge how to read them. Cash is vital for any business, like blood for organisms, other assets are necessary to build on to grow, settlement period for sales receivables and payables, inventories turnover and other financial ratios analysis and a proper accounting system in place to manage all that happens in a company for control

and planning purpose. Reading done for this block helped me realise that accounting marries other business functions. It's fair to call it language of business.

References: McLaney E., Atrill P.(2008), Accounting An Introduction, , Prentice Hall Europe Online resouces: http://www.investopedia.com/terms, accessed 12.02.2012

Vous aimerez peut-être aussi

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5795)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (74)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (400)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- 1 Bacterial DeseaseDocument108 pages1 Bacterial DeseasechachaPas encore d'évaluation

- Biology Key Stage 4 Lesson PDFDocument4 pagesBiology Key Stage 4 Lesson PDFAleesha AshrafPas encore d'évaluation

- Draft JV Agreement (La Mesa Gardens Condominiums - Amparo Property)Document13 pagesDraft JV Agreement (La Mesa Gardens Condominiums - Amparo Property)Patrick PenachosPas encore d'évaluation

- Automatic Gearbox ZF 4HP 20Document40 pagesAutomatic Gearbox ZF 4HP 20Damien Jorgensen100% (3)

- SreenuDocument2 pagesSreenuSubbareddy NvPas encore d'évaluation

- Forex Day Trading SystemDocument17 pagesForex Day Trading SystemSocial Malik100% (1)

- Vemu Institute of Technology: Department of Computer Science & EngineeringDocument79 pagesVemu Institute of Technology: Department of Computer Science & EngineeringSiva SankarPas encore d'évaluation

- PE MELCs Grade 3Document4 pagesPE MELCs Grade 3MARISSA BERNALDOPas encore d'évaluation

- Arduino Uno CNC ShieldDocument11 pagesArduino Uno CNC ShieldMărian IoanPas encore d'évaluation

- Frellwits Swedish Hosts FileDocument10 pagesFrellwits Swedish Hosts FileAnonymous DsGzm0hQf5Pas encore d'évaluation

- Phylogeny Practice ProblemsDocument3 pagesPhylogeny Practice ProblemsSusan Johnson100% (1)

- 2016 IT - Sheilding Guide PDFDocument40 pages2016 IT - Sheilding Guide PDFlazarosPas encore d'évaluation

- Native VLAN and Default VLANDocument6 pagesNative VLAN and Default VLANAaliyah WinkyPas encore d'évaluation

- Specifications (018-001) : WarningDocument6 pagesSpecifications (018-001) : WarningRómulo Simón Lizarraga LeónPas encore d'évaluation

- EKRP311 Vc-Jun2022Document3 pagesEKRP311 Vc-Jun2022dfmosesi78Pas encore d'évaluation

- COURTESY Reception Good MannersDocument1 pageCOURTESY Reception Good MannersGulzina ZhumashevaPas encore d'évaluation

- Kapinga Kamwalye Conservancy ReleaseDocument5 pagesKapinga Kamwalye Conservancy ReleaseRob ParkerPas encore d'évaluation

- 1995 Biology Paper I Marking SchemeDocument13 pages1995 Biology Paper I Marking Schemetramysss100% (2)

- Mechanical Engineering - Workshop Practice - Laboratory ManualDocument77 pagesMechanical Engineering - Workshop Practice - Laboratory Manualrajeevranjan_br100% (4)

- Project Document EiDocument66 pagesProject Document EiPrathap ReddyPas encore d'évaluation

- 19c Upgrade Oracle Database Manually From 12C To 19CDocument26 pages19c Upgrade Oracle Database Manually From 12C To 19Cjanmarkowski23Pas encore d'évaluation

- User Manual PM3250Document80 pagesUser Manual PM3250otavioalcaldePas encore d'évaluation

- ADC of PIC MicrocontrollerDocument4 pagesADC of PIC Microcontrollerkillbill100% (2)

- Poetry UnitDocument212 pagesPoetry Unittrovatore48100% (2)

- BIAN How To Guide Developing Content V7.0 Final V1.0 PDFDocument72 pagesBIAN How To Guide Developing Content V7.0 Final V1.0 PDFميلاد نوروزي رهبرPas encore d'évaluation

- Top 100 Chemical CompaniesDocument11 pagesTop 100 Chemical Companiestawhide_islamicPas encore d'évaluation

- C4 Vectors - Vector Lines PDFDocument33 pagesC4 Vectors - Vector Lines PDFMohsin NaveedPas encore d'évaluation

- CiscoDocument6 pagesCiscoNatalia Kogan0% (2)

- Case Study - Kelompok 2Document5 pagesCase Study - Kelompok 2elida wenPas encore d'évaluation

- Prospekt Puk U5 en Mail 1185Document8 pagesProspekt Puk U5 en Mail 1185sakthivelPas encore d'évaluation