Académique Documents

Professionnel Documents

Culture Documents

Export Notes For Learning

Transféré par

Syed Waqas AhmedDescription originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Export Notes For Learning

Transféré par

Syed Waqas AhmedDroits d'auteur :

Formats disponibles

Introduction

An export contract (also referred to as a sales contract) is essentially an agreement between you and a foreign importer to do business. The export contract can take many different forms. For example: 1. A telephonic offer to sell, covering essential issues such as the product details, quantities offered, price per unit, delivery particulars and payment terms, made by the exporter to the foreign buyer (or an offer to buy from the importer to the exporter) and confirmed by the second party is one example of a legitimate export contract. Such an agreement may or may not be confirmed in writing. Telephonic contracts are somewhat risky and are not that common in international trade. They may occur, however, between long-standing trade partners or between reputable firms dealing in commodities that are subject to rapid price fluctuations. Similarly, any written offer (quotation), either contained in a formal written contract and posted or couriered to the importer, or sent by e-mail, fax, telex or cable to the importer, and confirmed (usually also in writing) by the importer, is another form of legitimate contract. Again this could also be a written offer to buy, initiated by the importer, which is then confirmed by the exporter, although this is seldom the way it works unless it is a long-standing customer. A proforma invoice sent by fax, e-mail, courier or post to the importer (usually on his/her request) and confirmed by the importer, is another common form of export contract. The confirmation could be as simple as the importer writing "I agree to these terms and conditions" on the proforma invoice and signing it or perhaps the importer may generate a separate, signed document agreeing to the proforma invoice which is then attached as reference. Alternatively, the importer may indicate that (s)he is happy with the proforma invoice, but may request a formal contract containing the terms and conditions stipulated in the proforma invoice to be drawn up and signed by both parties.

2.

3.

The first offer is seldom accepted

It is seldom the case that the importer will accept the first offer made by the exporter and normally this first offer will be followed by a series of counter-offers sent back and forth between the exporter and the importer until each party is satisfied with the terms and conditions outlined in the final offer and agree to abide by it.

You need to be clear and precise

Whatever form the export contract takes, you need to be careful in formulating this document as they are drawn up between companies from countries which may have very different legal systems, regulations and attitudes to doing business. These differences may cause disputes even when trading with other fairly developed nations. The challenge is to make your export contracts as clear, precise and comprehensive as is possible.

The provisions in the contract

The basic provision of any contract for the sale of goods is that you, the seller (in this case, the exporter), will transfer ownership of the goods to your buyer (the importer) in exchange for payment (which, in international trade, made be made in a foreign currency). The export contract needs to specify the terms and conditions for doing this, and should at least describe:

Who is party to the contract The validity of the contracts The goods being sold (usually described in some detail) The purchase price of the goods and the currency in question The terms of payment Inspection of the goods if required Where the goods should be delivered At what point transfer of title to the goods takes place Any warranty and/or maintenance conditions associated with the sale Who is responsible for obtaining import or export licenses, if these are required What supporting documentation and/or certificates are required Who is responsible for paying import duties and other taxes Any contract performance security requirements, such as bank letters of guarantee What will happen if either of the parties defaults or cancels The provisions for independent mediation or arbitration to resolve disputes, and whether this would take place in South Africa or the importer's country, or elsewhere

The contract's completion date

The role of Incoterms

To provide a common terminology for international shipping and minimize misunderstandings over contract terms, the International Chamber of Commerce has developed a set of terms known as Incoterms. These are the basic terms used in international sales contracts, and you can learn more about them at the Incoterms 2000 Web site or in the Glossary of International Trade Terms in Appendix A.

Intellectual Property (IP)licensing contracts are particularly tricky

If the contract involves the licensing of proprietary information or technology, be very sure that it's precise about the licensee's rights. Vagueness about these rights can create serious problems and can lead to the loss of your intellectual property. If the licensee uses your technology to create other technologies, for example, this can severely undermine the value of your asset.

Make sure the contract is signed by all contracting parties

Also - and this would seem obvious, but it's sometimes overlooked - be sure that all parties to the contract have signed it. For instance, if you're working through a representative, be sure that the actual buyer signs the contract. The representative's signature is not necessarily enough, because without the buyer's signature, there is no written evidence that the buyer owes you money. Last but certainly not least, have the contract examined by a lawyer familiar with the export market.

The commercial invoice

Introduction

After the pro-forma invoice is accepted, the exporter must prepare a commercial invoice. The commercial invoice is required by both the exporter (to obtain the necessary export documents to enable the consignment to be exported, to prove ownership and to enable payment) and importer (who requires the commercial invoice to facilitate the import of the goods in question). In exporting, the commercial invoice is considered a very important document as it serves as the starting document that underpins an export transaction. The commercial invoice is essentially a bill (i.e. invoice) from the seller (the exporter) to the buyer (the importer) describing the goods to be sold and the terms involved. The commercial invoice will normally be presented on the exporter's letterhead and will be addressed to the importer. It should contain full details of the consignment, including price and other related costs, in order to facilitate customs clearance. It must be signed and dated. Freight and insurance, when included in the selling price, should be itemised separately as these charges are not subject to duty in certain countries. There is usually very little, if any, difference between the final proforma invoice accepted by the importer and the commercial invoice, except that the one is titled "Proforma Invoice", while the other is titled "Commercial Invoice".

Customs' and consular invoices

Some countries, however, may require the commercial invoice to be completed on their own specified forms - such commercial invoices are known as "Customs' invoices" and may be provided in lieu of or in addition to the standard commercial invoices referred to above. In addition, a "consular invoice" is required by certain countries. The consular invoice must be prepared in the language of the destination country and can be obtained from the country's consulate, and often must be "consularised" (i.e. stamped by an authorised Consul official in the exporting country).

Tip

The importer needs the commercial invoice since it is often used

by Customs authorities to assess duties. For this reason, it is common practice to prepare a commercial invoice in English and in the language of the destination country. The freight forwarder can advise you when a translated copy is necessary.

From the proforma to the commercial invoice

Although the proforma invoice comes before the commercial invoice, the proforma invoice really only serves as a means of negotiating the actual contract. We said previously that the proforma invoice is the 'offer' put to the importer by the exporter. The importer may accept the terms specified in the proforma invoice, but a more likely scenario is that the importer will negotiate some of these terms with the exporter. There may be some backward and forward communication between the exporter and importer before the importer finally agrees to the transaction. Once the importer indicates that (s)he is happy with the terms of the contract as outlined in the (final) proforma invoice, the exporter will then be requested to provide the importer with a commercial invoice. The commercial invoice should reflect the final (agreed-upon) profroma invoice exactly - any deviances will result in problems executing the transaction and/or receiving payment. Based on the terms specified in this commercial invoice, the importer will instruct his/her bank (referred to as the issuing bank) to issue a letter of credit. This letter of credit (or the documentation associated with any other form of payment) will also need to reflect the terms specified in the commercial invoice exactly, while all subsequent documentation must reflect the terms of the L/C; there can be no exceptions. From this explanation, it is clear that the commercial invoice plays a central role in an export transaction.

What should appear in the commercial invoice

The following details need to appear in the commercial invoice:

The name of the shipper/exporter and their contact details, including physical address The name of the importer/consignee and their contact details, including physical address An order number of reference to correspondence between the supplier and importer A complete and clear description of the goods in question (including brandmarks and the HS number) The packing details unless provided in a separate packing list The quantity of goods in question including the number and kinds of packaging involved The external dimensions, cubic capacity, weight, numbers and contents of each package shipped. The total price of the goods (and unit price where applicable) usually quotes as a CIF/FOB price The currency in which the goods will be sold (e.g. US dollars or rands) The type and amount of discount given The likely delivery schedule and delivery terms The payment methods, for example cash in advance or L/C The payment terms, for example 30 days on sight The Incoterm to be used Who is responsible for the banking fees and other related costs (insurance and freight costs are covered by the incoterm in question) What the freight and insurance charges are The exporter's banking details A declaration of the country of origin of the goods The expected country of final destination Any freight details such as the port of loading and discharge Any trasshipment requirements Any other information relevant to the order

Commercial invoices are the basis for assessing duties and statistics

Commercial invoices are often used by governments to determine the true value of goods when assessing customs duties and recording trade statistics. Governments that use the commercial invoice to control imports, will often specify its form, content, number of copies, language to be used, and other characteristics.

Examples of commercial invoice

Unzco commercial invoice with instructions for completing the invoice

Packing lists

Introduction

When you prepare your goods for shipment, you will be required to prepare a detailed export packing list. This is a formal document that itemises quite a number of details about the cargo such as:

Your name and contact details The importer's/consignee's/buyer's name, address and contact details The gross, tare and net weights of the cargo The nature, quality and specifications of the product being shipped The type of package (such as pallet, box, crate, drum, carton, etc.) The measurements/dimensions of each package The number of pallets/boxes/crates/drums, etc. The contents of each pallet or box (or other container) The package markings, if any, as well as shipper's and buyer's reference numbers

It is also important that the details on the packing list (such as shipper's/importer's details, number of items involved, etc.), match what is stipulated on the commercial invoice and bill of lading/airway bill. You can imagine that if there is a mismatch between the packing list and the other transport/export documents that this may lead to closer scrutiny of the cargo and may ultimately result in delays in the cargo arriving at its destination! Note that pricing information is not required on the packing list.

Tip

If you are exporting to a market using imperial measures (such as the US or the UK), provide weights and dimensions in both metric (kg and mm), as well as imperial (lbs and inches).

The purpose of the packing list

The packing list should be attached to the outside of a package in a waterproof envelope or plastic sheath marked "Packing list enclosed". The list is used by the shipper or forwarding agent to determine (1) the total shipment weight and volume and (2) whether the correct cargo is being shipped. In addition, customs officials (both local and foreign) may use the list to check the cargo. Packing lists come in fairly standard forms and can be obtained from your freight forwarder.

Don't make mistakes with the packing list

It is essential that the packing list agree exactly with all the terms and conditions of the export sale. It is important for you to realise that any mistake on the packing list may cause a delay in clearance at the port of destination. Customs Authorities in the target country have the right to delay the clearance of the shipment until the importer provides a packing list reflecting the real contents of the container (should your packing list be incomplete or incorrect). If all the information required for the packing list is already stated in the commercial invoice, then the packing list may be unnecessary. Our recommedndation is to provide it anyway - you don't want the consigment delayed simply becuase a customs official demands to see a packing list (you can never provide too much information).

Examples of packing lists

You are here:Step 17: Export documentation >Documents involving the importer > Letter of credit

Share on facebookShare on twitterShare on emailShare on printMore Sharing Services5

Letter of credit

In this section we discuss the following topics and terminology within the area of documentary credits:

Sight credits Usance credits Transferable credits Revolving credits Transferable credits Standby credits

Sight credits

This is an easy enough term to explain. A sight credit or L/C is one which paid upon presentation of the required documentation (as stipulated in the original L/C) to the issuing or confirming bank. As exporter, you need to be careful however, as some L/Cs state that payment will only be made at a specified branch counter of the issuing or confirming bank (and won't necessarily be paid or transferred directly into your account). The process of having to go to a particular branch and receive payment and then to transfer this payment into your account will slow down the payment process and may add further costs to the overall process. Thus, when working with sight L/Cs (or any L/Cs for that matter) make sure where payment will be made.

Usance credits

An L/C can specify any credit period that you have negotiated with the importer. A letter of credit that that incorporates a payment after a given term (e.g. 60 days) is known as a usance credit (also referred to as a term or acceptance credit). The correct phrase is hat the L/C is at usance, meaning that it will come into effect at some future date (also referred to as maturity). You should note that the maturity date may also have further stipulations associated with it; for example:

90 days sight 120 days from Bill of Lading (B/L) date 60 days and upon issuing of a FDA (US Food and Drug Administration) clearance

Some of these provisos can have a significant impact on your receiving payment and you should make yourself fully aware of any such provisos to your L/C. A usance/term credit will require you, as exporter, to finance the gap between delivery and payment.

Transferable credits

An irrevocable L/C may also be transferable. In the case of a transferable L/C, the exporter can transfer all or part of his/her rights to another party. Transferable letters of credit are often used when the exporter is the importer's agent or a middleperson (i.e. export agent) between supplier and importer, and not the actual supplier of merchandise. With a transferable letter of credit, the exporter uses the credit standing of the issuing bank and avoids having to borrow or use his own funds to buy goods from a supplier. Hence, it is a viable pre-export financing vehicle. Before transfer can be made, the exporter must contact, in writing, the bank handling the disbursement of funds - the transferring bank. Transferable L/Cs can only be transferred based on the terms and conditions specified in the original credit, with certain exceptions. Therefore, it may be difficult to achieve flexibility and confidentiality with this finance method. The transferring bank, whether it has confirmed the letter of credit or not, is only obligated to make the transfer to the extent and in the manner expressly specified in the L/C. Transferable L/Cs involve specific risks. When a bank opens a transferable letter of credit for a buyer, neither party can be certain of who will be the ultimate supplier. Both parties must rely upon the importer's assessment of the exporter's reputation and ability to

perform. To reduce overall risk and prevent the shipment of substandard goods, an independent certificate of inspection may be required in the documentation. For simplicity's sake, many banks prefer single transfer and discourage multiple transfers, but will do multiple transfers if conditions are right. Partial transfers can also be made to one or several suppliers if the terms of the original L/C allow for partial shipments. The processing of this type of letter of credit can become complicated and tricky, requiring logistics coordination and the highest level of precision. Incomplete and/or ambiguous information on the transferable letter of credit almost always leads to problems. Furthermore, the beneficiary of the transferable letter of credit must be available throughout the entire negotiation process to assist the transferring bank. Source: http://www.equipment.net/list/letterofcredit.htm

Revolving credits

The term "revolving" is used to describe a letter of credit, which, incorporates a condition whereby the credit amount is to be renewed or reinstated automatically without the need for a specific amendments to the credit. This type of credit is used when regular trade is conducted between an exporter and an overseas buyer. A revolving credit can be irrevocable or confirmed. Although a credit may, in theory, revolve in relation to amount, in practice this is rare, as it would mean that there might be no limit to the number of times a specific amount could be drawn. A credit, which revolves in relation to time, is a much more common form of a revolving credit. For example, a revolving credit could be made available for an amount of US$ 10 000 per month (irrespective of whether any sum was drawn during the previous month) with an overall validity of six months. A revolving credit may be:

Cumulative, i.e. any sum not utilised during the first period is carried over and may be utilised in the subsequent period. Non-cumulative i.e. any sum not utilised during the first period ceases to be available in subsequent periods.

Back-to-back credits

Back-to-back L/Cs are another common occurrence in the world of international trade. When an exporter, who is not a manufacturer, but obtains goods from a supplier by acting as an export agent for the supplier for example, has received an L/C from an importer, the exporter, in turn, may request his bank to open a L/C in favour of his supplier on the strength of the existing L/C. These two credits are said to be "back-to-back", that is to say the one is issued on the security of the other. A bank will only consider opening a second credit if the same goods are involved in both credits. In terms of the back-to-back L/C, the exporter is both the beneficiary/exporter of the first credit and the applicant/buyer for the second credit.

Standby credits

A standby L/C is one which is issued in favour of the exporter for the purpose of "backing-up" certain specified obligations of the importer. A standby letter of credit requires the exporter's presentation of documents which indicate that importer has not met the obligations which the standby letter of credit backs-up. A standby letter of credit, therefore, is not intended to be drawn upon by the standby letter of credit beneficiary unless the standby letter of credit applicant does not meet its obligations as specified by the standby letter of credit. Export certification

Introduction

In exporting, it is quite common for cargos to require a variety of certificates, including certificates of origin, certificates of value, certificates of health, Consular certificates, etc. before they are permitted to be imported into the country of destination. The purpose of a certificate is to provide preshipment confirmation of the status of a particular aspect (health, value, condition, origin, etc.) of a specific cargo. With these certificates, the cargo will not be permitted to be imported and so certificates paly a very important role in the export process and you need to ensure that (a) you have obtained the certificates required, (b) that these certificates are correct and acceptable to the importing authorities (i.e. that you cargo compliees with the requirements of the importing authority). It is no good having a certificate, but one which confirms that your cargo does not comply with the import requirements; your cargo will simply not be permitted to be imported. The types of certificates that you may be required to obtain, include:

Certificates of origin A Certificate of Origin (C/O) is required by some countries and is intended to certify to the importing authorities as to which country the products being imported were manufactured in - that is, the C/O certifies that the imported product meets the 'Country of Origin' requirements set by the importing country and which are expected of their foreign suppliers. It may be required that the C/O include information such as local material and labour content. In many cases, a statement of origin printed on company letterhead will suffice, although the document may need to be certified in some way. In other instances, specific types of C/Os may be required, such as the Generalised System of Preferences (GSP) Form A and the Chamber of Commerce C/O. Certificates of Value (and Origin) A Certificate of Value is intended to confirm the value of a cargo to assist in quick clearing of the goods in the country of destination. Often the Certificate of value is combined with a Certificate of Origin and is referred to as a Certificate of Value and Origin (CVO). A CVO outlines details about the labour and packing costs, royalties or commissions (if applicable), freight charges and any overseas insurance costs. The CVO also provides an exporter's declaration and statement, in the form of clauses, about the value and origin of the goods. Fumigation certificate Some countries, such as Australia, Canada, New Zealand, the US and the UK, are very strict about letting in goods that might contain bacteria or insects that could harm their agriculture. For this reason, they may require a fumigation certificate - also referred to as a 'pest control certificate - as proof that the packing materials e.g. wooden crates, wood, wool etc., have been fumigated or sterilised. Fumigation certificates usually contain details such as purpose of treatment, the articles in question, temperature range used, chemicals and concentration used, etc. Sometimes they may be required for sea shipments, but not for air shipments. Your freight forwarder should be able to advise you as to whether you require such as certificate. Certificates of health Certificates of health are normally required by the importing country to ensure that the imported goods (plants, plant products, animals and animal products) are in good health and carry no diseases, pests or any healththreatening organisms. Such certificates of health confirm (a) the origin of the shipment and, (b) that local authorities have inspected the consignment and ensure its good health. Certificates of Health can be divided into two types:

Phytosanitary certificates which are required for the import of certain plants and plant products such as seeds and flowers. Phytosanitary certificates are governed by the International Plant Protection Convention and represent an internationally accepted means of pest risk mitigation. Veterinary certificates which are required for the import of live animals, as well as fresh, chilled or frozen animal products. For contact details go to The Department of Agriculture, Forestry and Fishery website.

The exact import requirements are set by the importing country but are usually communicated to the corresponding authorities in South Africa (usually the Department of Agriculture). Your best option is therefore to contact both the importer to determine what the import requirements are and the Department of Agriculture to hear their side of the story. For Phytosanitary certificates, contact the Department of Agriculture at: The local authorities may charge a fee for such inspections and issuing of certificates. Pre-shipment inspection certificates It is not uncommon for importers to want to confirm that the to-be-exported goods meet their requirements. This is particularly so in instances where it is essential that the goods meet certain standards. These same importers unfortunately cannot always fly to all the countries from where they are buying their products and for this reason, they may: a. Require that the shipment be inspected just before loading by an independent third-party arranged and generally paid for by the importer. The exporter will need to indicate an approximate time and place for this inspection to take place. Ask the exporter to obtain the pre-shipment inspection certificate from an independent third-party inspection firm which is then forwarded to the importer. In this instance either the exporter or the

b.

importer may pay for the inspection, depending what was negotiated in the contract. The independent contractor - usually a recognised firm in this field - will undertake a detailed inspection of equipment or materials after manufacture, but prior to shipment. The scope of the inspection includes quantity and quality, packing and marking and supervision of loading. A Certificate of Inspection can be provided against a Letter of Credit and may be authorised by a Chamber of Commerce. Occasionally, the importer may ask a trusted individual to undertake the inspection on their behalf. Furthermore, some countries may require certification for selected products (this is independently from the importer) and in these instances a pre-shipment inspection is a necessary step to receive an import certificate for the shipment. Without this certificate the shipment will not be able to clear customs in the country of destination.

Bill of lading (BOL or B/L)

Introduction

A BOL is one of the oldest and most common forms of transportation documents in use today. It is a document that establishes the terms of a contract between a shipping company (or its agent) and the exporter/shipper (or agent, such as a freight forwarder). Within this contract, it is agreed that freight is to be moved between specified points for a specified charge. [In the world of export documentation, the term commonly used to describe the individual or firm that contracts the transportation company to send goods to a foreign destination generally the exporter is referred as the shipper, even in the case of air freight]

Some more detail

The BOL is normally completed by the exporter on forms issued by the shipping carrier. The BOL serves as a document of title, a contract of carriage, and a receipt for goods. The BOL also describes the kind and quantity of goods being shipped (such as the number of packages, the weight and consignment dimensions), the shipper (or exporter), the consignee (the person or firm to whom the goods are being shipped), the ports of loading and discharge, and the carrying vessel. As the BOL serves as a freight receipt, it will indicate if the freight costs of have been prepaid or are to be paid by the consignee (referred to as freight collect). Neither the form nor the usage of the BOL is standardised at present. With the development of containerisation and the use of different means of transport (land and sea) under one contract of carriage, the traditional marine or ocean BOL is being used less often in international trade. Goods cannot be released at the port of discharge until the consignee or their agent produces the original BOL BOLs may come in both short and long forms. The short form simply refers to the main contract as an existing document, whereas the long form (connaissement intgral) issued by the carrier sets out all the terms of the contract of carriage.

Key points of BOLs

The key points that you should take note of, are:

The BOL is a legal contract between the shipper (normally the exporter) and carrier (the shipping line represented by the ships master or shipping line representative) As a legal document, the BOL plays an important role in releasing payment from the bank in conjunction with the Letter of Credit A BOL is a document issued by a carrier, e.g. a ship's master or by the carriers shipping department, or a representative of either of these two The BOL must be signed or authenticated by the person issuing the document The BOL must name the ship/vessel carrying the goods

The BOL does not afford the holder of the document any ownership of the goods listed in the document (it is not a negotiable document) The BOL acknowledges that specified goods have been received on board as cargo for conveyance The BOL specifies both the ports of loading and discharge The BOL normally has a named consignee The BOL will specify the goods to be conveyed, their number, weight and volume BOLs are usually issued in three originals; one for the exporter/shipper, one for the shipping line and one for receiver/consignee of the goods.

Types of BOLs

Inland, ocean, through, and air waybill are common names given to certain types of BOLs. An inland BOL, for example, is a document that establishes an agreement between an exporter/shipper and a transportation company (such as a road hauler/trucking company or railroad company like Spoornet in South Africa) for the transportation of goods overland. Inland BOLs are used to specify the terms for transporting items from the exporters premises to the exporter's international transportation company (usually a shipping line). In South Africa, if the exporter intends using a road hauler, the inland BOL is referred to as a road consignment note, while if the rail network is to be used, then the inland BOL is referred to as a freight transit order. An ocean bill of lading is the traditional BOL used wihen shipping goods with shipping lines. The ocean (also referred to as a marine) BOL is a document that outlines the terms between an exporter/shipper and the international ocean or marine carrier (i.e. shipping line) for the shipment of goods to a foreign location overseas. The description of a BOL that was provided earlier in this section pertains mainly to an ocean BOL. A through BOL is a contract that covers the specific terms agreed to by an exporter/shipper and carrier. This document covers the domestic and international transportation of export merchandise. It provides the details of the agreed upon transportation between specific locations (usually the exporters premises and the exporters customers premises in a foreign destination) for a set monetary amount. An air waybill is a BOL that establishes terms of flights for the transportation of goods both domestically and internationally. This document also serves as a receipt for the exporter, proving the carrier's acceptance of the exporters goods and agreement to carry those goods to a specific airport. Essentially, an air waybill is a type of through bill of lading click here to learn more about air waybills. This is because air waybills may cover both international and domestic transportation of goods. By contrast, ocean shipments require both inland and ocean bills of lading. Inland bills of lading are necessary for the domestic transportation of goods and ocean bills of lading are necessary for the international carriage of goods. Therefore, through bills of lading may not be used for ocean shipments. Inland and ocean BOL may be negotiable or non-negotiable. If the BOL is non-negotiable, the transportation carrier is required to provide delivery only to the consignee named in the document. If the bill of lading is negotiable, the person with ownership of the bill of lading has the right of ownership of the goods and the right to re-route the shipment

Other types of bills of lading

In addition to the above types of BOLs, there are two additional categories of BOLs, namely: Straight bill of lading This bill states that the goods are consigned to a specified person and it is not negotiable free from existing equities, i.e. any endorsee acquires no better rights than those held by the endorsor. So, for example, if the carrier or another holds a lien over the goods as security for unpaid debts, the endorsee is bound by the lien although, if the endorsor wrongfully failed to disclose the charge, the endorsee will have a right to claim damages for failing to transfer an unencumbered title. Also known as a non-negotiable BOL. Order bill of lading This bill uses express words to make the bill negotiable, e.g. it states that delivery is to be made to the further order of the consignee using words such as "delivery to Company Name Ltd. or to order or assigns". Consequently, it can be endorsed by Company Name Ltd. or the right to take delivery can be transferred by physical delivery of the bill accompanied by adequate evidence of Company Name Ltd.'s intention to transfer.

Also known as a negotiable bill of lading.

Transshipment clauses

If a BOL incorporates a clause stating that the carrier reserves the right to tranship, then the transhipment is allowed even if an accompanying Letter of Credit (L/C) prohibits transhipment.

Loading on deck

Unless otherwise required by the Letter of Credit (L/C), the BOL should not indicate that the goods are to be stored on deck. Modern container ships carry about one-third of the containers on deck. Consequently, the BOL may contain a provision that the goods may be carried on deck. If such a provision is contained in the BOL, then the loading on deck is acceptable even if the Letter of Credit (L/C) stipulates otherwise, provided that the BOL does not specifically state that the goods are or to be stored on deck.

Air waybill

Air waybills (AWB) are a form of BOL and are used for both domestic and international flights. An AWB (also referred to as air consignment note or airway bill of lading) refers to a documentary receipt issued by a carrier (i.e. airline) in favour of a shipper for goods received and is evidence of the contract of carriage to carry the goods to a specified airport under specified conditions, but it is not a document of title to the goods. Hence, the AWB is non-negotiable. It is usually the shipper - the exporter - (or their agent) that completes the AWB. It serves as:

Proof of receipt of the goods for shipment Evidence of the contract of carriage An invoice for the freight, reflecting the shipper, the consignee and the goods being shipped, as well as the full freight amount A certificate of insurance (if carriers insurance is requested by the shipper) A guide to airline staff for the handling, dispatch and delivery of the consignment A means of clearing the goods through customs

Usually, the AWB consists of three originals and nine copies. The first original is intended for the carrier (airline) and is signed by the exporter (or agent); the second original the consignee's copy is also signed by the exporter (or agent) and accompanies the goods; the third original is signed by the carrier and is handed to the exporter (or agent) as a receipt for the goods after they have been accepted for carriage. The AWB must be accompanied by the commercial invoice, packing list, certificate of orgigin and any other document which may be necessary to clear the goods through customs (such as any health certificates, etc.). AWBs have tracking numbers which can be used to check the status of delivery and current position of the goods being transported.

Types of air waybills

There are two types of air waybills used for the international transportation of air cargo:

The "airline air waybill", with preprinted issuing carrier identification, The "neutral air waybill" without preprinted identification of the issuing carrier in any form and used by other bodies than air carriers (such as freight forwarder).

The Air Waybill Handbook

This handbook contains all resolutions and recommended practices endorsed by the IATA Cargo Services Conference in relation to the completion of air waybils. The handbook can be purchased online here the cost is US$ 100. The IATA Cargo Services Conference (CSC) is responsible for the development and maintenance of Air Waybill

specifications and standards: Click here to purchase an online air waybill

Freight transit order

A Freight Transit Order (FTO) is a form of inland BOL used in South Africa and required by Spoornet, the primary rail operator in the country.

Transport documents and special Instructions

Spoornet has the following to say about transport documents:

Spoornet shall only accept goods into its care if it has been timeously furnished with fully completed transport documents, or the relevant Electronic Data Interchange information, by the consignor (e.g. exporter) who warrants that all information reflected on the transport documents is accurate in all respects, and especially for Customs and Consular purposes. The consignor shall indemnify Spoornet and hold it harmless against all losses, damages, expenses and fines arising from any inaccuracy or omission made by the Consignor in the transport documents. Wherever it is necessary, for the purpose of these conditions or any other purpose whatever, for special instructions such as stoppage or diversion of goods to be given to Spoornet, such instructions shall only be recognised by Spoornet as valid if they are timeously given and agreed to by Spoornet. In addition, in order to render such special instructions valid, they shall either be given in writing by the consignor or, if owing to the urgency of the situation it is not practicable to give same in writing, they may be given orally and thereafter confirmed in writing as soon as reasonably practicable.

Click here to visit the Spoornet website [http://www.spoornet.co.za] Click here to learn more about the Standard Conditions of Carriage for Transnet Limited trading as Spoornet Click here to learn more about the special commodity services provided by Spoornet Road consignment note

A road consignment note (also referred to as a road transport document, a road waybill or a road manifest) is a form of inland BOL used in South Africa, although, as road consignment notes can cover cargo moving across borders, it is also a form of through BOL. As road haulage is driven by a large number of private road haulers, you may come across many different types of road consignment notes, although there is a tendency to follow the typical BOL used in the case of ocean shipping (i.e. there is still a consignee, a shipper, a description of the goods, etc.). The road consignment note is also:

Proof of receipt of the goods for trasnportation by road Evidence of the contract of carriage An invoice for the freight, reflecting the shipper, the consignee and the goods being shipped, as well as the full freight amount A guide to the road hauler for the handling, dispatch and delivery of the consignment A means of clearing the goods through customs

To clear the goods through customs, the road consignment note will need to be accompanied by a commercial invoice, a packing list and any other documentation relevant for clearing puurposes (such as phytosanitary documents, etc.).

Introduction

The Export Cargo Shipping Instruction (ECSI)* is the written instruction from the exporter to the freight forwarder or carrier (shipping line, airline, road hauler, etc.) for them to facilitate the movement goods to the desired destination. It contains information on the goods and the route to their destination, any transport requirements, customs information, who is to receive what documents and how costs are to be allocated. It is extremely important that the information provided in the ECSI is accurate. Most freight forwarders and transportation companies have standard documents that exporters can complete. The document provided will capture all of the

necessary information to enable the freight forwarder or transport company to execute their obligations.

Tip:

It would be wise for you to provide the freight forwarder/transport company with a copy of the L/C (where this is applicable) as well as any changes thereto, to enable them to accurately generate any additional documents that they may be required to complete in order to facilitate the movement of your cargo to your ultimate destination. * This is the term used by SITPRO in the UK. In South Africa, reference may simply be made to the "exporter's instructions".

Documents required for payment

The export process is encumbered by the amount of documentation the exporter faces around every turn. These documents can be broken down into four groups; (1) those required by the importer (and for customs clearing in the target market), (2) those required to export the goods from South Africa, (3) those required for payment and (4) those required to transport the goods (i.e. the transport documents). In many instances, the documents may be the same (for example, the commercial invoice may be required in more than one instance as may the bill of lading/airway bill). In this section, we deal with the documents required to faciliate payment. These documents include: The commercial invoice

Introduction

After the pro-forma invoice is accepted, the exporter must prepare a commercial invoice. The commercial invoice is required by both the exporter (to obtain the necessary export documents to enable the consignment to be exported, to prove ownership and to enable payment) and importer (who requires the commercial invoice to facilitate the import of the goods in question). In exporting, the commercial invoice is considered a very important document as it serves as the starting document that underpins an export transaction. The commercial invoice is essentially a bill (i.e. invoice) from the seller (the exporter) to the buyer (the importer) describing the goods to be sold and the terms involved. The commercial invoice will normally be presented on the exporter's letterhead and will be addressed to the importer. It should contain full details of the consignment, including price and other related costs, in order to facilitate customs clearance. It must be signed and dated. Freight and insurance, when included in the selling price, should be itemised separately as these charges are not subject to duty in certain countries. There is usually very little, if any, difference between the final proforma invoice accepted by the importer and the commercial invoice, except that the one is titled "Proforma Invoice", while the other is titled "Commercial Invoice".

Customs' and consular invoices

Some countries, however, may require the commercial invoice to be completed on their own specified forms such commercial invoices are known as "Customs' invoices" and may be provided in lieu of or in addition to the standard commercial invoices referred to above. In addition, a "consular invoice" is required by certain countries. The consular invoice must be prepared in the language of the destination country and can be obtained from the country's consulate, and often must be "consularised" (i.e. stamped by an authorised Consul official in the exporting country).

Tip

The importer needs the commercial invoice since it is often used

by Customs authorities to assess duties. For this reason, it is common practice to prepare a commercial invoice in English and in the language of the destination country. The freight forwarder can advise you when a translated copy is necessary.

From the proforma to the commercial invoice Although the proforma invoice comes before the commercial invoice, the proforma invoice really only serves as a means of negotiating the actual contract. We said previously that the proforma invoice is the 'offer' put to the importer by the exporter. The importer may accept the terms specified in the proforma invoice, but a more likely scenario is that the importer will negotiate some of these terms with the exporter. There may be some backward and forward communication between the exporter and importer before the importer finally agrees to the transaction. Once the importer indicates that (s)he is happy with the terms of the contract as outlined in the (final) proforma invoice, the exporter will then be requested to provide the importer with a commercial invoice. The commercial invoice should reflect the final (agreed-upon) profroma invoice exactly - any deviances will result in problems executing the transaction and/or receiving payment. Based on the terms specified in this commercial invoice, the importer will instruct his/her bank (referred to as the issuing bank) to issue a letter of credit. This letter of credit (or the documentation associated with any other form of payment) will also need to reflect the terms specified in the commercial invoice exactly, while all subsequent documentation must reflect the terms of the L/C; there can be no exceptions. From this explanation, it is clear that the commercial invoice plays a central role in an export transaction. What should appear in the commercial invoice The following details need to appear in the commercial invoice:

The name of the shipper/exporter and their contact details, including physical address The name of the importer/consignee and their contact details, including physical address An order number of reference to correspondence between the supplier and importer A complete and clear description of the goods in question (including brandmarks and the HS number) The packing details unless provided in a separate packing list The quantity of goods in question including the number and kinds of packaging involved The external dimensions, cubic capacity, weight, numbers and contents of each package shipped. The total price of the goods (and unit price where applicable) usually quotes as a CIF/FOB price The currency in which the goods will be sold (e.g. US dollars or rands) The type and amount of discount given The likely delivery schedule and delivery terms The payment methods, for example cash in advance or L/C The payment terms, for example 30 days on sight The Incoterm to be used Who is responsible for the banking fees and other related costs (insurance and freight costs are covered by the incoterm in question) What the freight and insurance charges are The exporter's banking details A declaration of the country of origin of the goods

The expected country of final destination Any freight details such as the port of loading and discharge Any trasshipment requirements Any other information relevant to the order

Commercial invoices are the basis for assessing duties and statistics Commercial invoices are often used by governments to determine the true value of goods when assessing customs duties and recording trade statistics. Governments that use the commercial invoice to control imports, will often specify its form, content, number of copies, language to be used, and other characteristics. Examples of commercial invoice

Unzco commercial invoice with instructions for completing the invoice WOSA commercial invoice Meridian commercial invoice BellAir commercial invoice

Letter of credit

In this section we discuss the following topics and terminology within the area of documentary credits:

Sight credits Usance credits Transferable credits Revolving credits Transferable credits Revolving credits

Sight credits

This is an easy enough term to explain. A sight credit or L/C is one which paid upon presentation of the required documentation (as stipulated in the original L/C) to the issuing or confirming bank. As exporter, you need to be careful however, as some L/Cs state that payment will only be made at a specified branch counter of the issuing or confirming bank (and won't necessarily be paid or transferred directly into your account). The process of having to go to a particular branch and receive payment and then to transfer this payment into your account will slow down the payment process and may add further costs to the overall process. Thus, when working with sight L/Cs (or any L/Cs for that matter) make sure where payment will be made.

Usance credits

An L/C can specify any credit period that you have negotiated with the importer. A letter of credit that that incorporates a payment after a given term (e.g. 60 days) is known as a usance credit (also referred to as a term or acceptance credit). The correct phrase is hat the L/C is at usance, meaning that it will come into effect at some future date (also referred to as maturity). You should note that the maturity date may also have further stipulations associated with it; for example:

90 days sight 120 days from Bill of Lading (B/L) date 60 days and upon issuing of a FDA (US Food and Drug Administration) clearance

Some of these provisos can have a significant impact on your receiving payment and you should make yourself fully aware of any such provisos to your L/C. A usance/term credit will require you, as exporter, to finance the gap between delivery and payment.

Transferable credits

An irrevocable L/C may also be transferable. In the case of a transferable L/C, the exporter can transfer all or part of his/her rights to another party. Transferable letters of credit are often used when the exporter is the importer's agent or a middleperson (i.e. export agent) between supplier and importer, and not the actual supplier of merchandise. With a transferable letter of credit, the exporter uses the credit standing of the issuing bank and avoids having to borrow or use his own funds to buy goods from a supplier. Hence, it is a viable pre-export financing vehicle. Before transfer can be made, the exporter must contact, in writing, the bank handling the disbursement of funds - the transferring bank. Transferable L/Cs can only be transferred based on the terms and conditions specified in the original credit, with certain exceptions. Therefore, it may be difficult to achieve flexibility and confidentiality with this finance method. The transferring bank, whether it has confirmed the letter of credit or not, is only obligated to make the transfer to the extent and in the manner expressly specified in the L/C. Transferable L/Cs involve specific risks. When a bank opens a transferable letter of credit for a buyer, neither party can be certain of who will be the ultimate supplier. Both parties must rely upon the importer's assessment of the exporter's reputation and ability to perform. To reduce overall risk and prevent the shipment of substandard goods, an independent certificate of inspection may be required in the documentation. For simplicity's sake, many banks prefer single transfer and discourage multiple transfers, but will do multiple transfers if conditions are right. Partial transfers can also be made to one or several suppliers if the terms of the original L/C allow for partial shipments. The processing of this type of letter of credit can become complicated and tricky, requiring logistics coordination and the highest level of precision. Incomplete and/or ambiguous information on the transferable letter of credit almost always leads to problems. Furthermore, the beneficiary of the transferable letter of credit must be available throughout the entire negotiation process to assist the transferring bank. Source: http://www.equipment.net/list/letterofcredit.htm

Revolving credits

The term "revolving" is used to describe a letter of credit, which, incorporates a condition whereby the credit amount is to be renewed or reinstated automatically without the need for a specific amendments to the credit. This type of credit is used when regular trade is conducted between an exporter and an overseas buyer. A revolving credit can be irrevocable or confirmed. Although a credit may, in theory, revolve in relation to amount, in practice this is rare, as it would mean that there might be no limit to the number of times a specific amount could be drawn. A credit, which revolves in relation to time, is a much more common form of a revolving credit. For example, a revolving credit could be made available for an amount of US$ 10 000 per month (irrespective of whether any sum was drawn during the previous month) with an overall validity of six months. A revolving credit may be:

Cumulative, i.e. any sum not utilised during the first period is carried over and may be utilised in the subsequent period. Non-cumulative i.e. any sum not utilised during the first period ceases to be available in subsequent periods.

Back-to-back credits

Back-to-back L/Cs are another common occurrence in the world of international trade. When an exporter, who is not a manufacturer, but obtains goods from a supplier by acting as an export agent for the supplier for example, has received an L/C from an importer, the exporter, in turn, may request his bank to open a L/C in favour of his supplier on the strength of the existing L/C. These two credits are said to be "back-to-back", that is to say the one is issued on the security of the other. A bank will only consider opening a second credit if the same goods are involved in both credits. In terms of the back-to-back L/C, the exporter is both the beneficiary/exporter of the first credit and the applicant/buyer for the second credit.

Standby credits

A standby L/C is one which is issued in favour of the exporter for the purpose of "backing-up" certain specified obligations of the importer. A standby letter of credit requires the exporter's presentation of documents which indicate that importer has not met the obligations which the standby letter of credit backs-up. A standby letter of credit, therefore, is not intended to be drawn upon by the standby letter of credit beneficiary unless the standby letter of credit applicant does not meet its obligations as specified by the standby letter of credit. Additional links: Checklist for Export Letters of Credit Downloadable pdf document from the Food Export Association - USA.

Vous aimerez peut-être aussi

- A Simple Guide for Drafting of Conveyances in India : Forms of Conveyances and Instruments executed in the Indian sub-continent along with Notes and TipsD'EverandA Simple Guide for Drafting of Conveyances in India : Forms of Conveyances and Instruments executed in the Indian sub-continent along with Notes and TipsPas encore d'évaluation

- Aed-1 Unit-3 Export Sales ContractDocument18 pagesAed-1 Unit-3 Export Sales Contractsudhir.kochhar353050% (2)

- Soccer (Football) Contracts: An Introduction to Player Contracts (Clubs & Agents) and Contract Law: Volume 2D'EverandSoccer (Football) Contracts: An Introduction to Player Contracts (Clubs & Agents) and Contract Law: Volume 2Pas encore d'évaluation

- International Trade Law Assignment - 1Document4 pagesInternational Trade Law Assignment - 1Rajvi ChatwaniPas encore d'évaluation

- Ibo-4 Unit-3 Export Import Documents OverviewDocument35 pagesIbo-4 Unit-3 Export Import Documents OverviewSudhir Kochhar Fema Author100% (1)

- Textbook of Urgent Care Management: Chapter 7, Exit Transactions: The Process of Selling an Urgent Care CenterD'EverandTextbook of Urgent Care Management: Chapter 7, Exit Transactions: The Process of Selling an Urgent Care CenterPas encore d'évaluation

- ChetnaDocument20 pagesChetnaChetna VermaPas encore d'évaluation

- Export ProceduresDocument10 pagesExport ProceduresGenious GeniousPas encore d'évaluation

- Export Process in PakistanDocument14 pagesExport Process in Pakistanazeemtahir56625% (4)

- The Proforma InvoiceDocument8 pagesThe Proforma InvoiceAmit AgrawalPas encore d'évaluation

- Documentation in Export Import BusinessDocument25 pagesDocumentation in Export Import BusinessBhupesh Roy100% (1)

- Role of Foreign Exchange Department in Exports and ImportsDocument15 pagesRole of Foreign Exchange Department in Exports and ImportsniteshhgiriiPas encore d'évaluation

- Documents of Import and Export TradeDocument22 pagesDocuments of Import and Export Tradederejefeye85Pas encore d'évaluation

- Apparel Export DocumentationDocument68 pagesApparel Export DocumentationarivaazhiPas encore d'évaluation

- Icl ###Document5 pagesIcl ###Khan BabaPas encore d'évaluation

- Đ T Béo Incoterms B SungDocument24 pagesĐ T Béo Incoterms B Sungdat phanPas encore d'évaluation

- Unit 3 Export Sales: ContractDocument10 pagesUnit 3 Export Sales: Contractfer nandoPas encore d'évaluation

- Cdocumentary Letter of Credit in Apparel IndustryDocument3 pagesCdocumentary Letter of Credit in Apparel Industrysuman_ishaPas encore d'évaluation

- Midterm Essay 2Document2 pagesMidterm Essay 2NathoPas encore d'évaluation

- International Business English SpeakingDocument11 pagesInternational Business English SpeakingVõ Trung NguyênPas encore d'évaluation

- Import Export DocumentsDocument21 pagesImport Export Documentsshehzaib tariqPas encore d'évaluation

- Assignment - 2 Q-2 IMDocument6 pagesAssignment - 2 Q-2 IMoishika bosePas encore d'évaluation

- Documentation in Global Business - Topic 6Document9 pagesDocumentation in Global Business - Topic 6Money CafePas encore d'évaluation

- Export Documentation in IndiaDocument23 pagesExport Documentation in IndiaRamalingam ChandrasekharanPas encore d'évaluation

- Exim DocumentationDocument25 pagesExim DocumentationKARCHISANJANAPas encore d'évaluation

- International Trade DocumentationDocument43 pagesInternational Trade DocumentationChirag KakkarPas encore d'évaluation

- Note 3-Brief On MCCDocument17 pagesNote 3-Brief On MCCNikhil SinghPas encore d'évaluation

- Import Export DocumentsDocument20 pagesImport Export Documentsshehzaib tariqPas encore d'évaluation

- Introduction To Export Documentatio1Document9 pagesIntroduction To Export Documentatio1Achin AgarwalPas encore d'évaluation

- Documentation For LogisticsDocument10 pagesDocumentation For LogisticsNick NikhilPas encore d'évaluation

- Export-Import Documentation and Risk Management in Export-Import BusinessDocument32 pagesExport-Import Documentation and Risk Management in Export-Import BusinessPraveena KumariPas encore d'évaluation

- Export Import DocumentationDocument24 pagesExport Import DocumentationNimesh ShahPas encore d'évaluation

- Transport Documents Used in International Trade PDFDocument5 pagesTransport Documents Used in International Trade PDFsatyaseerPas encore d'évaluation

- Export Import DocumentationDocument159 pagesExport Import DocumentationPriya JainaniPas encore d'évaluation

- CDCS Incoterms 2010 Supplement FINAL SecDocument26 pagesCDCS Incoterms 2010 Supplement FINAL Secsreeks456100% (4)

- Bài thuyết trìnhDocument9 pagesBài thuyết trìnhHuyền TràPas encore d'évaluation

- DocumentsDocument5 pagesDocumentsVimalanathan VimalPas encore d'évaluation

- Unit 4Document15 pagesUnit 4Sahil ShahPas encore d'évaluation

- LC Import ProcedureDocument37 pagesLC Import Procedureusmanprince20038901Pas encore d'évaluation

- Export ProcedureDocument38 pagesExport ProcedureVishwamitra TiwariPas encore d'évaluation

- International Trade DocumentsDocument4 pagesInternational Trade DocumentsNazmul H. Palash100% (1)

- Export ProcedureDocument8 pagesExport ProcedureTonmoyPas encore d'évaluation

- Export Import DocumentationDocument159 pagesExport Import DocumentationMohak NihalaniPas encore d'évaluation

- Processing An Export OrderDocument21 pagesProcessing An Export OrderasifanisPas encore d'évaluation

- DocumentsDocument8 pagesDocumentsswatts6510Pas encore d'évaluation

- Export-Import DocumentationDocument31 pagesExport-Import DocumentationpakhtunPas encore d'évaluation

- Exim DocumentsDocument24 pagesExim DocumentsPraveen KumarPas encore d'évaluation

- Export-Import Documentation in IndiaDocument23 pagesExport-Import Documentation in IndiaMageswariPas encore d'évaluation

- Export Procedure: The PreliminaryDocument34 pagesExport Procedure: The PreliminarySohel BangiPas encore d'évaluation

- 25 FM Incoterm & Export Documantation1Document45 pages25 FM Incoterm & Export Documantation1Anmol JainPas encore d'évaluation

- International Transport DocumentDocument13 pagesInternational Transport DocumentGlobal Negotiator100% (1)

- EXIMDocument3 pagesEXIMtanayjoshiPas encore d'évaluation

- International Trade Documentation: Dr. Anupam VarmaDocument43 pagesInternational Trade Documentation: Dr. Anupam VarmamaheshkulkaniPas encore d'évaluation

- List of Documents Used in Garment Export ProcessDocument13 pagesList of Documents Used in Garment Export ProcessFaruk AhmedPas encore d'évaluation

- Export and Import DocumentsDocument14 pagesExport and Import DocumentsGlobal Negotiator100% (2)

- Law of Taxation AssignmnetDocument13 pagesLaw of Taxation Assignmnetsohan h m sohan h mPas encore d'évaluation

- International Business Export and Import Documentation Regarding INDIADocument23 pagesInternational Business Export and Import Documentation Regarding INDIASabyasachi SarkerPas encore d'évaluation

- Ba2463d Assignment2Document36 pagesBa2463d Assignment2Aqilah PeiruzPas encore d'évaluation

- Catch Invoice 00161Document1 pageCatch Invoice 00161Syed Waqas AhmedPas encore d'évaluation

- Import-Export Procedure FlowchartDocument95 pagesImport-Export Procedure Flowcharttusharcwg90% (10)

- How To Use Your Inventoryloader Template: Step 1Document5 pagesHow To Use Your Inventoryloader Template: Step 1Syed Waqas AhmedPas encore d'évaluation

- Band OnDocument17 pagesBand OnSyed Waqas AhmedPas encore d'évaluation

- Pengekstrakan BesiDocument5 pagesPengekstrakan BesiNajwa Ghazali100% (1)

- CorexII User ManualDocument6 pagesCorexII User ManualTechne PhobosPas encore d'évaluation

- Sap Etm - Fi PerspectiveDocument33 pagesSap Etm - Fi Perspectivemoorthykem100% (1)

- PipingDocument8 pagesPipingAhmed ElalfyPas encore d'évaluation

- Cabro Paving BlocksDocument5 pagesCabro Paving BlocksVincent Odhiambo Odhiambo100% (3)

- SDM - Part II - Mod. 4Document41 pagesSDM - Part II - Mod. 4Nivedita AtrePas encore d'évaluation

- Materials of Construction 1Document8 pagesMaterials of Construction 1RavikiranSharmaSrkPas encore d'évaluation

- TemplateDocument4 397 pagesTemplateakeey4uPas encore d'évaluation

- Catalogue MetalweldDocument17 pagesCatalogue MetalweldRadivojevic SasaPas encore d'évaluation

- Technical Specifications For BuildingsDocument340 pagesTechnical Specifications For BuildingsTanvir Shahrier MahmudPas encore d'évaluation

- VANOC Transportation PlanDocument57 pagesVANOC Transportation PlanBob MackinPas encore d'évaluation

- F-3 - TOL - Sept. 11Document68 pagesF-3 - TOL - Sept. 11Miranda GathercolePas encore d'évaluation

- LovableDocument1 pageLovableKushal Akbari100% (1)

- Amadeus Vista Basic Reservation ThailandDocument83 pagesAmadeus Vista Basic Reservation ThailandalexqrbkkPas encore d'évaluation

- Aerial Ropeways - Automatic Cargo Transport For A BargainDocument19 pagesAerial Ropeways - Automatic Cargo Transport For A BargainWANKEL25Pas encore d'évaluation

- CBN WheelDocument49 pagesCBN WheelAbdulPas encore d'évaluation

- Sland KY: Burrard Heavy Duty Deck MachineryDocument6 pagesSland KY: Burrard Heavy Duty Deck MachinerykstapletPas encore d'évaluation

- BASF BrochureDocument8 pagesBASF BrochureALBArsenalPas encore d'évaluation

- DB End of Schematic Stage Engineering ReportDocument180 pagesDB End of Schematic Stage Engineering ReportRăzvan StăncuțPas encore d'évaluation

- NCRDocument3 pagesNCRAkhilesh KumarPas encore d'évaluation

- Easa Ad CF-2018-03 1Document2 pagesEasa Ad CF-2018-03 1cf34Pas encore d'évaluation

- Akzo Nobel NDocument3 pagesAkzo Nobel NAnulekha AtriPas encore d'évaluation

- Moment Connections To Column WebsDocument3 pagesMoment Connections To Column WebsAmro Ahmad AliPas encore d'évaluation

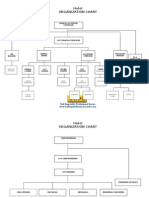

- Bali Hotel Organization Chart FullDocument14 pagesBali Hotel Organization Chart FullAltaf Khan100% (1)

- Mall and Event ManagementDocument5 pagesMall and Event ManagementNik GuptaPas encore d'évaluation

- Design Guidelines: Basic OperationsDocument2 pagesDesign Guidelines: Basic OperationsLokesh NarasimhaiahPas encore d'évaluation

- Concrete Column FormworkDocument19 pagesConcrete Column FormworkLuke ObusanPas encore d'évaluation

- Ms Doors: Properties of Mild SteelDocument4 pagesMs Doors: Properties of Mild Steeln.k.indiaPas encore d'évaluation

- Skybus MetroDocument3 pagesSkybus MetroAnjanKumarMahantaPas encore d'évaluation

- Avr Fasteners: About UsDocument9 pagesAvr Fasteners: About UsDurgesh MechPas encore d'évaluation

- Summary of Noah Kagan's Million Dollar WeekendD'EverandSummary of Noah Kagan's Million Dollar WeekendÉvaluation : 5 sur 5 étoiles5/5 (2)

- The Millionaire Fastlane, 10th Anniversary Edition: Crack the Code to Wealth and Live Rich for a LifetimeD'EverandThe Millionaire Fastlane, 10th Anniversary Edition: Crack the Code to Wealth and Live Rich for a LifetimeÉvaluation : 4.5 sur 5 étoiles4.5/5 (90)

- $100M Leads: How to Get Strangers to Want to Buy Your StuffD'Everand$100M Leads: How to Get Strangers to Want to Buy Your StuffÉvaluation : 5 sur 5 étoiles5/5 (19)

- $100M Offers: How to Make Offers So Good People Feel Stupid Saying NoD'Everand$100M Offers: How to Make Offers So Good People Feel Stupid Saying NoÉvaluation : 5 sur 5 étoiles5/5 (25)

- The Coaching Habit: Say Less, Ask More & Change the Way You Lead ForeverD'EverandThe Coaching Habit: Say Less, Ask More & Change the Way You Lead ForeverÉvaluation : 4.5 sur 5 étoiles4.5/5 (186)

- The Leader Habit: Master the Skills You Need to Lead--in Just Minutes a DayD'EverandThe Leader Habit: Master the Skills You Need to Lead--in Just Minutes a DayÉvaluation : 4 sur 5 étoiles4/5 (5)

- High Road Leadership: Bringing People Together in a World That DividesD'EverandHigh Road Leadership: Bringing People Together in a World That DividesPas encore d'évaluation

- Summary of Thinking, Fast and Slow: by Daniel KahnemanD'EverandSummary of Thinking, Fast and Slow: by Daniel KahnemanÉvaluation : 4 sur 5 étoiles4/5 (117)

- Radical Confidence: 11 Lessons on How to Get the Relationship, Career, and Life You WantD'EverandRadical Confidence: 11 Lessons on How to Get the Relationship, Career, and Life You WantÉvaluation : 5 sur 5 étoiles5/5 (52)

- Broken Money: Why Our Financial System Is Failing Us and How We Can Make It BetterD'EverandBroken Money: Why Our Financial System Is Failing Us and How We Can Make It BetterÉvaluation : 5 sur 5 étoiles5/5 (3)

- Summary of Zero to One: Notes on Startups, or How to Build the FutureD'EverandSummary of Zero to One: Notes on Startups, or How to Build the FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (100)

- The First Minute: How to start conversations that get resultsD'EverandThe First Minute: How to start conversations that get resultsÉvaluation : 4.5 sur 5 étoiles4.5/5 (57)