Académique Documents

Professionnel Documents

Culture Documents

Cost Report 2008 FINAL

Transféré par

Muhammad IdreesDescription originale:

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Cost Report 2008 FINAL

Transféré par

Muhammad IdreesDroits d'auteur :

Formats disponibles

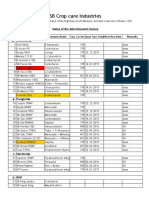

YAQUB & COMPANY

CHARTERED ACCOUNTANTS

CRESCENT SUGAR MILLS & DISTILLERY LIMITED ANNEX TO THE COST AUDITORS REPORT TO THE DIRECTORS FOR THE YEAR ENDED SEPTEMBER 30, 2008

1. CAPACITY (CANE CRUSHING) a. Licensed, installed and utilized capacities are 2008 Installed capacity per day (M. Tons) No. of days worked Total available capacity (M. Tons) Utilized capacity %age utilization of available capacity b. Other production activities of the company The company is also engaged in manufacturing and sale of distillate and yarn. The Company has also setup an embroidery unit. 2. COST ACCOUNTING SYSTEM Subject to our observations, the cost accounting system operated by the company provides the information that could be used to determine the cost of products but certain information is scattered and not readily available. The company maintains records on the basis of actual cost incurred. 3. PRODUCTION a. Production in quantities of each type of product under reference is as under: Particulars Main product: White sugar (M. Tons) By products: Molasses (M. Tons) Bagasse (M. Tons) Press cake (M. Tons) 2008 2007 3,000.000 146 438,000.000 348,333.210 80% 2007 3,000.000 156 468,000.000 346,328.230 74%

25,376.500 16,850.000 103,942.630 8,708.330

25,035.000 16,904.043 108,670.872 8,658.205

Page 1 of 10

YAQUB & COMPANY

CHARTERED ACCOUNTANTS

b. Percentage of production compared with installed capacity 2008 Installed capacity (M. Tons) Actual production (M. Tons) Actual production in % of installed capacity c. Addition to production capacity There is no addition to the production capacity during the year under review or in the immediately preceding two years, though there has been addition to plant and machinery. 4. RAW MATERIAL a. Raw material (sugarcane) consumption 2008 Quantity (M. Tons) Value (Rs.) Rate per M. Ton (Rs.) 348,333.210 544,074,197 1,562 2007 346,328.230 604,174,742 1,744 31,886.400 25,376.500 80% 2007 33,836.400 25,035.000 74%

The cost of transport is born by suppliers (growers). However, a small proportion has been born by the company that can be seen in Annexure-3 (being insignificant, it is not shown here). b. Consumption of raw material per unit of production 2008 Raw material consumed (Rs.) White sugar produced (M. Tons) Consumption per M. Tons (Rs.) 2007 2006 544,946,535 20,487.000 26,600

544,074,197 604,174,742 25,376.500 25,035.000 24,133 21,440

c. Explanation for variances in the consumption of raw material as compared to proceeding two years and standards Consumption of raw material per M. Ton of production depends mainly on cost of raw material and recovery percentage. The reason of the decrease in expense is that reduced growers subsidy is given in this season.

Page 2 of 10

YAQUB & COMPANY

CHARTERED ACCOUNTANTS

The cost per M. Ton of raw material purchased in current and previous two years is as under: YEAR 2008 2007 2006 RATE PER M. TONS (RS.) 1,562 1,744 1,905

The recovery percentage for the current and previous two years is as under: YEAR RECOVERY % 7.280 7.230 7.180

2008 2007 2006

Recovery percentage depends on many factors including quality of sugarcane, timing of crushing and efficiency of production staff. The mill is situated in the area where sugar cane of good quality is not available.

d. Comments on method of accounting for sugarcane In our opinion, the method of accounting followed by the company for recording the quantities and values for receipts of sugarcane, being sole raw material, directly used in production is suitably designed to provide information for the purpose of Annexure-1. Sugarcane purchased is directly put to crushing and thus treated as issued. 5. WAGES AND SALARIES a. Wages and salaries paid i & ii) Direct and indirect labour cost on production iii) Employees cost on administration iv) Employees cost on selling and distribution v) Total employees cost (Total of i to iv) 2008 Rupees 34,974,397 19,695,767 267,350 54,937,514 2007 Rupees 32,644,735 17,877,900 263,273 50,785,908

Page 3 of 10

YAQUB & COMPANY

CHARTERED ACCOUNTANTS

Though the salary sheets are prepared on departmental basis but the data has not been maintained on the departmental basis from salary sheets. That is why, it is not possible to distinguish direct labour cost on production and indirect employees cost on production. Therefore total amount has been shown under serial No (i) & (ii). Similarly per unit labour cost at paragraph No 5(e) has been calculated on the same basis. b. Salaries and perquisites of Directors and Chief Executive Officer For the year under review these are Rs. 9,790,876/= (2007: Rs. 9,004,260/=). Further the aggregate amount charged in the accounts for the year for fee to 5 directors in respect of 9 meetings is Rs. 125,000.00 (2007: Rs. 100,000.00 to 5 directors for 9 meetings). In addition, they have been provided free maintained vehicles and their personal utility bills have been paid off by the company. c. Total man-days of direct labour available and actually work for the period. 2008 Total man days of labour available Stoppages Total man days of labour actually worked d. Avg. number of workers employed for the year 146 20 126 2007 156 45 111

Officers Workers

79 308 387

80 354 434

e. Direct and indirect labour cost per unit of output On the basis of total production wages and salaries (both direct and indirect) cost per M. Ton is as follows: (Rs.) 1,304 1,378 f. Brief explanations for variances as compared to the previous two years Total direct and indirect cost of production and cost per unit increased in current year as compared to previous year due to increase in minimum wage rate. g. Comments on the incentive scheme There was no incentive scheme in operation during the year under review.

Page 4 of 10

YAQUB & COMPANY

CHARTERED ACCOUNTANTS

6. STORES AND SPARE PARTS a. Expenditure per M. Ton of white Sugar Produced 2008 White sugar produced (M. Tons) Stores, spares and lubricants (Rs.) Expenditure per M. Ton (Rs.) 25,376.500 16,038,668 632 2007 25,035.000 10,605,304 424

b. Brief explanations for variances as compared to the previous two years The expense per M. Ton increased during the year significantly due to general inflation and heavy repair and maintenance of the manufacturing facilities of the company. c. Comments on method of accounting for stores and spare parts The company operates a computerized system of receipt, issuance and balance of store items, both in quantity and value. The stores are valued on moving average basis. The system generates stores consumption on cost center basis. 7. DEPRECIATION a) Depreciation on additions is charged from the date when the asset is available for use and on deletions up to the date when the asset is disposed off. b) No record on departmental basis is maintained. Therefore no allocation of depreciation to departments has been made. However depreciation has been allocated between production and administration on the basis of identification of assets. c) Depreciation related to manufacturing assets has been charged to cost of production. Depreciation related to non-manufacturing assets has been treated as period cost and not included in cost of production. 8. OVERHEADS a. The total amount of overheads and break-up thereof Please refer to the relevant cost statements annexed to this report. b. Reasons for variances The reasons for major variances as compared to last two years are as under:

Page 5 of 10

YAQUB & COMPANY

CHARTERED ACCOUNTANTS

Factory overheads There are no major variances as compared to last two years in factory overheads. Administrative overheads i. Salaries, wages and other benefits: The amount in current year is increased due to increments, increased benefits as compared to previous year. The amount of medical expenses in current year is increased due to medical treatment of the director. Vehicle running expenses: Vehicle running expenses has increased due to hike in fuel cost.

ii.

Selling overheads iii. Loading and unloading expenses: The amount in current year is increased due to increase in basic wage rate.

Financial overheads iv. Mark up: The amount in current year is increased due to increase in mark up rates. The rates in the current year increased from (Year 2007: 10% - 11%) to (Year 2008: 14% - 15%).

c. Basis of allocation of overheads Absorption cost method is adopted in which fixed overheads like depreciation, insurance etc. are included in cost of production. Administrative and selling overheads are not treated as part of cost of product. Rather they are treated as period cost. d. Cost of packing material Total cost (Rs.) No of bags produced Cost per bag (Rs.) 2008 6,486,132 507,530 12.78 2007 5,253,667 500,700 10.49

Increase is due to rise in purchase price of packing material. 9. ROYALTY / TECHNICAL AID PAYMENTS Royalty / Technical aid payments are not applicable to the company.

Page 6 of 10

YAQUB & COMPANY

CHARTERED ACCOUNTANTS

10. ABNORMAL AND NON- RECURRING FEATURE a) The management is of the view that no abnormal events like strikes lock outs, major break downs in the plant, substantial power cuts, serious accidents etc. occurred during the year under review. Also no information about such events came to our knowledge during the process of audit. b) No special expenditures were allocated to the product under reference during the year under review. 11. COST OF PRODUCTION Total cost of bagged sugar (Rs.) (as per No.20 of annexure-1) Production M. Tons Cost of production per M. Ton (Rs.) 2008 2007

564,361,581 25,376.500 22,240

638,617,767 25,035.000 25,509

The main reason of decrease in the cost of production is reduction in cost of raw material and fuel consumption in the current year. 12. SALES a. Sales Quantity - (M. Tons) Net Sales realization (Rs.) Net Sales realization Per M. Ton (Rs.) b. Exports 13. (LOSS) / PROFITABILITY (Gross) Rs. Net sales realization per M. Ton (as per para-12 above) Avg. cost of sales (As per no. 23 of annex-1) (Loss) / Profit per M. Ton 2008 2007

24,956.800 544,153,067 21,804 NIL 2008 21,804 22,391 (587)

24,710.850 613,595,475 24,831 NIL 2007 24,831 25,805 (974)

Sale price of sugar in current year has not increased in proportion to cost of production; resultantly the company is facing gross loss.

Page 7 of 10

YAQUB & COMPANY

CHARTERED ACCOUNTANTS

14. COST AUDITORS OBSERVATRIONS AND CONCLUSIONS a. OBSERVATIONS i Non maintenance of records on departmental basis The company does not maintain records on departmental basis. Due to lack of information the prescribed annexure are not properly filled in. This is evidenced from the followings instances. Direct labour cost per unit of output and indirect employees cost per unit of output cannot be segregated as required by paragraph no.5 (a) i & ii of this report. The company has paid utility bills of directors and executives and has provided them free maintained vehicles. The expense on account of these overheads has not been charged to wages and salaries. No allocation of overheads like printing and stationery, entertainment, traveling and conveyance, vehicle running etc. has been made to factory overheads (see annexure-9).

ii. Wrong allocation of inter segment expenses Common expenses have not been apportioned among different divisions of the company. The detail of major instances is as under: o Production overheads No allocation of gas and power utilized by distillery division has been made. During the year additions to plant and machinery has been made but no salaries and wages have been capitalized. Such expenditure has been charged to expense during the year.

a. Cases where the companys funds have been used in negligent or inefficient manner None b. Factors, which could have been controlled, but have not been done resulting in increase in the cost of production None c. i. The adequacy or otherwise of budgetary control system, if any, in vogue in the company The company has implemented budgetary control system.

Page 8 of 10

YAQUB & COMPANY

CHARTERED ACCOUNTANTS

c. ii. The scope and performance of internal audit, if any The management has established an independent internal audit department as well as audit committee as required by the Code of Corporate Governance. e. Suggestions for improvements in performance i. Rectification of general imbalance in production facilities We have not identified any general imbalance in production facilities. ii. Fuller utilization of installed capacity Full utilization of installed capacity is possible subject to easy availability of sugarcane. iii. Comments on areas offering scope for improvement a) Key limiting factor causing production bottlenecks is non availability of sugarcane. The mill has been surrounded by urban arrears and there are problems in getting sugarcane. However, stoppages due to no cane have decreased from 610 hours in 2007 to 233 hours in 2008. The company should take measures to improve availability of sugar cane. b) The company should establish cost department, maintain record on departmental basis, set budgets and targets, and make variance analysis. f. State of technology Defection Melt Phosphatation process is in use. g. Plant condition at the time of installation The plant, when installed, was all new. 15. RECONCILIATION WITH FINANCIAL ACCOUNTS The reconciliation statements for cost of sales, administrative expenses and selling and distribution expenses with financial accounts are annexed to the report. 16. COST STATEMENTS The cost statements prescribed by the Securities and Exchange Commission of Pakistan under clause (e) of subsection (1) of section 230 of the Companies Ordinance 1984, as mentioned in SRO 97 (1) 2001 dated Feb.13, 2001 are being annexed herewith.

Page 9 of 10

YAQUB & COMPANY

CHARTERED ACCOUNTANTS

17. MISCELLANEOUS` Comparative figures have been rearranged / reclassified wherever necessary for the purpose of better comparison. However, no material rearrangement / reclassification have been made. Figures have been rounded off to the nearest rupee unless otherwise stated.

Page 10 of 10

Vous aimerez peut-être aussi

- Refund Application AdeelDocument1 pageRefund Application AdeelMuhammad IdreesPas encore d'évaluation

- Gift Deed Saqib SBDocument1 pageGift Deed Saqib SBMuhammad IdreesPas encore d'évaluation

- Getting Started With MediaFire PDFDocument6 pagesGetting Started With MediaFire PDFDiego Alejandro Alonso LopezPas encore d'évaluation

- Objection Jan-13 2Document3 pagesObjection Jan-13 2Muhammad IdreesPas encore d'évaluation

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (399)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- Chapter 3 Depreciation - Sum of The Years Digit MethodPart 4Document8 pagesChapter 3 Depreciation - Sum of The Years Digit MethodPart 4Tor GinePas encore d'évaluation

- Science Grade 10 (Exam Prep)Document6 pagesScience Grade 10 (Exam Prep)Venice Solver100% (3)

- EvolutionCombatMedic 2022Document17 pagesEvolutionCombatMedic 2022smith.kevin1420344100% (1)

- Resa Auditing Theorydocx - CompressDocument64 pagesResa Auditing Theorydocx - CompressMaePas encore d'évaluation

- Voice Over Script For Pilot TestingDocument2 pagesVoice Over Script For Pilot TestingRichelle Anne Tecson ApitanPas encore d'évaluation

- Mini Project A-9-1Document12 pagesMini Project A-9-1santhoshrao19Pas encore d'évaluation

- The Chassis OC 500 LE: Technical InformationDocument12 pagesThe Chassis OC 500 LE: Technical InformationAbdelhak Ezzahrioui100% (1)

- IFSSO Newsletter Jul-Sep 2010Document2 pagesIFSSO Newsletter Jul-Sep 2010rjotaduranPas encore d'évaluation

- Rolling TechnologyDocument4 pagesRolling TechnologyFrancis Erwin Bernard100% (1)

- EPA Section 608 Type I Open Book ManualDocument148 pagesEPA Section 608 Type I Open Book ManualMehdi AbbasPas encore d'évaluation

- OnTime Courier Software System Requirements PDFDocument1 pageOnTime Courier Software System Requirements PDFbilalPas encore d'évaluation

- Products ListDocument11 pagesProducts ListPorag AhmedPas encore d'évaluation

- Volvo Catalog Part2Document360 pagesVolvo Catalog Part2Denis Konovalov71% (7)

- Lecture 1 Electrolyte ImbalanceDocument15 pagesLecture 1 Electrolyte ImbalanceSajib Chandra RoyPas encore d'évaluation

- Turnbull CV OnlineDocument7 pagesTurnbull CV Onlineapi-294951257Pas encore d'évaluation

- PC Engines APU2 Series System BoardDocument11 pagesPC Engines APU2 Series System Boardpdy2Pas encore d'évaluation

- Introduction of ProtozoaDocument31 pagesIntroduction of ProtozoaEINSTEIN2D100% (2)

- Early Christian ArchitectureDocument38 pagesEarly Christian ArchitectureInspirations & ArchitecturePas encore d'évaluation

- NCPDocument6 pagesNCPJoni Lyn Ba-as BayengPas encore d'évaluation

- 3 AcmeCorporation Fullstrategicplan 06052015 PDFDocument11 pages3 AcmeCorporation Fullstrategicplan 06052015 PDFDina DawoodPas encore d'évaluation

- Molde Soldadura TADocument1 pageMolde Soldadura TAMarcos Ivan Ramirez AvenaPas encore d'évaluation

- E-Waste: Name: Nishant.V.Naik Class: F.Y.Btech (Civil) Div: VII SR - No: 18 Roll No: A050136Document11 pagesE-Waste: Name: Nishant.V.Naik Class: F.Y.Btech (Civil) Div: VII SR - No: 18 Roll No: A050136Nishant NaikPas encore d'évaluation

- Bobcat E34 - E35Z Brochure - Adare MachineryDocument8 pagesBobcat E34 - E35Z Brochure - Adare MachineryNERDZONE TVPas encore d'évaluation

- M.Sc. Steel Structures LEC. #7 Plastic Analysis and Design: Dr. Qasim Shaukat KhanDocument43 pagesM.Sc. Steel Structures LEC. #7 Plastic Analysis and Design: Dr. Qasim Shaukat KhanSSPas encore d'évaluation

- Eaai S 23 02045 PDFDocument28 pagesEaai S 23 02045 PDFAnjali JainPas encore d'évaluation

- General Characteristics of Phonemes: Aspects of Speech SoundsDocument8 pagesGeneral Characteristics of Phonemes: Aspects of Speech SoundsElina EkimovaPas encore d'évaluation

- Pds Hempel's Maestro Water Borne Primer 28830 En-GbDocument2 pagesPds Hempel's Maestro Water Borne Primer 28830 En-GbKalaiyazhagan ElangeeranPas encore d'évaluation

- Studies - Number and Algebra P1Document45 pagesStudies - Number and Algebra P1nathan.kimPas encore d'évaluation

- April 8/91: All GroupsDocument33 pagesApril 8/91: All Groupsreza mirzakhaniPas encore d'évaluation

- ProjectDocument22 pagesProjectSayan MondalPas encore d'évaluation