Académique Documents

Professionnel Documents

Culture Documents

Demand Liabilities

Transféré par

Kalai VananDescription originale:

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Demand Liabilities

Transféré par

Kalai VananDroits d'auteur :

Formats disponibles

2.

3 Computation of Demand and Time Liabilities Liabilities of a bank may be in the form of demand or time deposits or borrowings or other miscellaneous items of liabilities. Liabilities of the banks may be towards banking system (as defined under Section 42 of RBI Act, 1934) or towards others in the form of Demand and Time deposits or borrowings or other miscellaneous items of liabilities. Reserve Bank of India has been authorized in terms of Section 42 (1C) of the RBI. Act, 1934 to classify any particular liability and hence for any doubt regarding classification of a particular liability, the banks are advised to approach RBI for necessary clarification. 2.3.1 Demand Liabilities 'Demand Liabilities' include all liabilities which are payable on demand and they include current deposits, demand liabilities portion of savings bank deposits, margins held against letters of credit/guarantees, balances in overdue fixed deposits, cash certificates and cumulative/recurring deposits, outstanding Telegraphic Transfers (TTs), Mail Transfer (MTs), Demand Drafts (DDs), unclaimed deposits, credit balances in the Cash Credit account and deposits held as security for advances which are payable on demand. Money at Call and Short Notice from outside the Banking System should be shown against liability to others.

Savings Account

Available to Eligibility

All Cities Resident Indian, >18yrs Metro and Urban locations - Rs.10,000, Semi-urban locations - Rs.5,000, Rural locations - Rs.2,000 Metro / Urban locations MAB between Rs. 5,000 to Rs. 10,000 Rs. 250 per month. MAB - Less than Rs. 5,000 Rs. 350 per month. Semi Urban locations

Minimum monthly average balance (MAB)

Charges for non maintenance of minimum monthly average balance

MAB between Rs. 2,500 to Rs. 5,000 Rs. 250 per month. MAB - Less than Rs. 2,500 Rs. 350 per month. Rural locations MAB between Rs. 1,000 to Rs. 2,000 Rs. 250 per month. MAB - Less than Rs. 1,000 Rs. 350 per month.

Cash transactions at base branch (branches in same city) Anywhere Cash Withdrawals by customer or

Nil for the first 4 transactions of a month; Thereafter in the month, Rs. 90 per transaction. Nil for the first cash withdrawal of a calendar month;

customers representative to the debit of the customers own savings Account at a non-base branch i.e. branch in other city

Thereafter in the month, Rs.5 per thousand rupees or part thereof, subject to a minimum of Rs.150 (Maximum withdrawal limit Self: Rs.50,000 per day, Third party: Rs.15,000 per day)

Anywhere Cash deposit by customer or customers representative to the credit of the customers own savings Account at a non-base branch i.e. branch in other city

Nil for the first cash deposit of a calendar month; Thereafter in the month, Rs.5 per thousand rupees or part thereof, subject to a minimum of Rs.150 (Maximum deposit limit Rs.50,000 per day) Nil for the first five transactions (inclusive of financial and non-financial transactions) in the month.

ATM Interchange (Transactions at Non ICICI Bank ATMs)

Thereafter, Rs.20 (inclusive of service tax) per cash withdrawal (financial) and Rs. 8.50 (exclusive of service tax) per balance inquiry, PIN change and mini statement (non-financial) transactions.

Transactions at ICICI Bank ATMs

Issue of DD drawn on ICICI Bank by cheque/transfer

Free Rs.50 per D.D. up to Rs.10,000;Rs.3 per thousand rupees or part thereof for DD of more than Rs.10,000, subject to a minimum of Rs.75 and maximum of Rs. 15,000 Free Quarterly Statement sent by post

Statement

Free monthly e-mail statement on request Free monthly statement to be collected from branch

Debit Card Fees for first Account Holder Debit Card Fees for joint Account Holder Debit Card Cash withdrawal limit Cheque Books Charges for Multicity cheque payment

Rs.99 p.a. Rs.99 p.a. Daily spending/withdrawal limit: 25,000/25,000 Nil for 30 payable-at-par cheque leaves in a quarter; Rs. 30 for every additional cheque book of 15 leaves Nil. Upto Rs. 5,000 Rs. 25 per instrument.

Outstation cheque collection through ICICI bank branch locations

Rs. 5,001 to Rs. 10,000 Rs. 50 per instrument. Rs. 10,001 to Rs. 1 lakh Rs 100 per instrument. Above Rs. 1 lakh - Rs. 200 per instrument Upto Rs. 5,000 Rs. 25 per instrument.

Outstation cheque collection through non ICICI bank branch locations

Rs. 5,001 to Rs. 10,000 Rs. 50 per instrument. Rs. 10,001 to Rs. 1 lakh Rs 100 per instrument. Above Rs. 1 lakh - Rs. 200 per instrument

Chargeable Transactions if minimum Balance is not maintained

Cash transactions at branch in the event of nonNil for the first two transactions of a month; Thereafter in

maintenance of MAB

the month, Rs. 90 per transaction.

Cheque books in the event of non-maintenance of Rs. 5 per cheque leaf for all cheque books issued MAB

during the month

Note: 1. Common service charges applicable to all savings account variants except for Wealth Management / ICICI Group Global Private Clients and the ones mentioned above. Click here Click here to view charges applicable before April 1, 2012 2. Service tax @ 12.36 % (as per Govt rules) w.e.f. April 1, 2012 is applicable over and above charges indicated above. The charges indicated above are subject to periodic revision.

Service Charges and Fees

Savings Accounts

Deposits

Current Accounts Revised schedule of charges w.e.f November 01, 2011 for Current Account Products Schedule of charges for Foreign Exchange and

Savings Account

Home loans

Silver Savings Account

Money2India online transfers

Freedom Savings Account

Wire Transfers (Inward)

Easy Receive Account

Foreign Currency Cheques

No Frills Account Salary Account

International Business Services w.e.f. May 01,2011. Seasonal Current Account

Select

Public Works Senior Citizens Account Contractors Current Account Company Current Account Merchant Current Account Privilege Banking Classic Plus Current Account w.e.f November 2011 Gold Advantage Current Account w.e.f November 2011 Textile Current Account w.e.f November 2011 Agri Current Account w.e.f October 1, 2009 Revised charges for RTGS_NEFT payment w.e.f Nov15, 2010 Revision in number of Personal Loan cheque leaves for Standard Current Account Change in frequency of charging current account transactions from Monthly to Daily with effect Loans against Securities from on or after October 20, 2010 onwards ATM Interchange Charges Applicable for Current Account

Young Stars

Bank@Campus

Advantage Woman Savings Account

Self Help Groups

Common Charges Across Savings Accounts

Wealth Management / ICICI Group Global Private Clients Loans

Home loan

Car Loan

Two - Wheeler loan

Commercial Vehicle Loan

Construction Equipment

FlexiCash

Holder w.e.f Cards October 15, 2009 Made2order (m2o) Current Account : Changes in Service charges. Effective from October 1, 2008 Demat Service charges Roaming Current Account (Except RCA Privilege) & Elite Current Account w.e.f November 2011 Privilege Roaming Current Account w.e.f Nov 2011 Trade Roaming Current Account w.e.f November 2011 Prepaid Current Account w.e.f November 2011 Local Current Account w.e.f October 1 , 2008 Regular current account (Applicable for eBOR new & migrated accounts only) w.e.f Nov 01, 2011 Previous Schedule of charges

Credit Cards

Corporate Cards

Purchase Cards

Vous aimerez peut-être aussi

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (400)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (74)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- Yasser ArafatDocument4 pagesYasser ArafatTanveer AhmadPas encore d'évaluation

- M Fitra Rezeqi - 30418007 - D3TgDocument6 pagesM Fitra Rezeqi - 30418007 - D3TgNugi AshterPas encore d'évaluation

- Advent of Dawn Raids in India - A Case of Aggressive Anti-Trust Regime - Anti-Trust - Competition Law - IndiaDocument7 pagesAdvent of Dawn Raids in India - A Case of Aggressive Anti-Trust Regime - Anti-Trust - Competition Law - IndiaNitish GuptaPas encore d'évaluation

- CH 04 Personal Safety and Social ResponsibilityDocument41 pagesCH 04 Personal Safety and Social ResponsibilityFirdauz RahmatPas encore d'évaluation

- The Effect of Big-Data On The HEC of ChinaDocument9 pagesThe Effect of Big-Data On The HEC of ChinaAbdulGhaffarPas encore d'évaluation

- Read MeDocument21 pagesRead MeSyafaruddin BachrisyahPas encore d'évaluation

- STP and Marketing MixDocument25 pagesSTP and Marketing MixKurt canonPas encore d'évaluation

- Google Diversity Annual Report 2019Document48 pagesGoogle Diversity Annual Report 20199pollackyPas encore d'évaluation

- African Diaspora in IndiaDocument24 pagesAfrican Diaspora in Indiafanm_belPas encore d'évaluation

- Stross ComplaintDocument7 pagesStross ComplaintKenan FarrellPas encore d'évaluation

- As-1 Disclosure of Accounting PoliciesDocument7 pagesAs-1 Disclosure of Accounting PoliciesPrakash_Tandon_583Pas encore d'évaluation

- Basic Survival Student's BookDocument99 pagesBasic Survival Student's BookIgor Basquerotto de CarvalhoPas encore d'évaluation

- C-Profile Text - 2015 PT. Hydroraya Adhi PerkasaDocument11 pagesC-Profile Text - 2015 PT. Hydroraya Adhi Perkasadaniel_dwi_rahma100% (1)

- Ethics BSCE 2nd Sem 2023 2024Document12 pagesEthics BSCE 2nd Sem 2023 2024labradorpatty2003Pas encore d'évaluation

- Present SimpleDocument5 pagesPresent SimpleNghi PhuongPas encore d'évaluation

- A Study of Customer Relationship Management at Big Bazaar"Document68 pagesA Study of Customer Relationship Management at Big Bazaar"Mohd Adil25% (4)

- Acme Corporation: Strategic Plan 2014-2016: What Is Our Purpose? Financial How Will We Measure Success?Document1 pageAcme Corporation: Strategic Plan 2014-2016: What Is Our Purpose? Financial How Will We Measure Success?Peter Garga PanalanginPas encore d'évaluation

- Public Service Vacancy Circular 05 of 2019Document186 pagesPublic Service Vacancy Circular 05 of 2019jonnydeep1970virgilio.itPas encore d'évaluation

- Land Use Management (LUMDocument25 pagesLand Use Management (LUMgopumgPas encore d'évaluation

- The Technical University of KenyaDocument46 pagesThe Technical University of KenyaBori GeorgePas encore d'évaluation

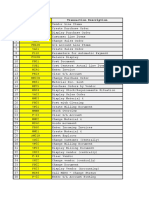

- # Transaction Code Transaction DescriptionDocument6 pages# Transaction Code Transaction DescriptionVivek Shashikant SonawanePas encore d'évaluation

- Negros Oriental State University Bayawan - Sta. Catalina CampusDocument6 pagesNegros Oriental State University Bayawan - Sta. Catalina CampusKit EdrialPas encore d'évaluation

- Resort Operations ManagementDocument15 pagesResort Operations Managementasif2022coursesPas encore d'évaluation

- Unit Test 7A: 1 Choose The Correct Form of The VerbDocument4 pagesUnit Test 7A: 1 Choose The Correct Form of The VerbAmy PuentePas encore d'évaluation

- When The Artists of This Specific Movement Gave Up The Spontaneity of ImpressionismDocument5 pagesWhen The Artists of This Specific Movement Gave Up The Spontaneity of ImpressionismRegina EsquenaziPas encore d'évaluation

- Portable IT Equipment PolicyDocument3 pagesPortable IT Equipment PolicyAiddie GhazlanPas encore d'évaluation

- School Form 5 (SF 5) Report On Promotion and Level of Proficiency & AchievementDocument2 pagesSchool Form 5 (SF 5) Report On Promotion and Level of Proficiency & AchievementNeølie Abello LatúrnasPas encore d'évaluation

- Capital PunishmentDocument29 pagesCapital PunishmentMovies ArrivalPas encore d'évaluation

- 5.2.1 List of Placed Students VESIT NAAC TPCDocument154 pages5.2.1 List of Placed Students VESIT NAAC TPCRashmi RanjanPas encore d'évaluation

- CNT A HandbookDocument276 pagesCNT A Handbookv_singh28Pas encore d'évaluation