Académique Documents

Professionnel Documents

Culture Documents

Bleaching and Dyeing of Cotton Knitted Fabric Project Report

Transféré par

Rajesh Kumar PandeyDescription originale:

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Bleaching and Dyeing of Cotton Knitted Fabric Project Report

Transféré par

Rajesh Kumar PandeyDroits d'auteur :

Formats disponibles

Bleaching and Dyeing of Cotton Knitted Fabric Project report Introduction Bleaching of textile grey fabrics is generally carried

out to impart whiteness to textile fabrics by removing natural colouring matter. The process of dyeing is carried out to improve the marketability of textile products and also to suit the customer needs by adding colour. These two processes are generally carried out in open tank, kier machines, jet dyeing machines, jiggers, soft flow dyeing machines etc. For hosiery goods, it is carried out with winch machines, since it imparts very less tension during operation. Viable processing units can be set up as most of the fabric manufacturing units do not have their own processing units. In this report, details are provided for setting up the unit for bleaching and dyeing of cotton knitted fabrics. Market Potential The demand for hosiery garments is increasing due to its popularity in domestic and export market. There are number of units engaged in manufacturing of knitted cloth and most of these units are not having their own captive processing units. Bleaching and dyeing of knitted fabric produced by these units are normally carried out from outside on paying requisite processing charges. It is, therefore, presumed that setting up of textile processing units is economically very much viable. Basis and Presumptions This project is based on single shift basis with 300 working days in a year. Time period for achieving maximum capacity utilisation is considered from 3rd year from the date on which production is started. Rental value of the building is taken at Rs. 2 per sq. ft. Costs of machinery and equipments/materials indicated refer to a particular make and approximately to those prevailing at the time of preparation of this project. Cost of installation and electrification is taken @ 10% of cost of machinery and equipment. Nonrefundable deposits, project report cost, trial production, security deposit with Electricity Board are classified under pre-operative expenses. Depreciation has been considered at 10% on plant and machinery, 15% on office furniture, fixtures, vehicle and 20% on testing equipments. Interest rate on capital loan has been taken @ 12% per annum. Implementation Schedule The implementation period required for executing this project right from selection of site to starting the trial run production will be 6 months. Technical Aspects Process of Manufacture The knitted fabric to be bleached is thoroughly wet in a soap solution of 2% and piled in kier boiling pan containing 1.5% caustic soda, 2% soda ash and 1% lisapol etc. and allowed to boil for 6-8 hours.

The cloth is washed well and taken to SS winches for bleaching using 2% bleaching powder and then washed thoroughly. This bleached cloth is scoured using hydrochloric acid of 1.5% concentration. After sometime, cloth is washed thoroughly to neutralise the traces of acid. In case of only bleaching the cloth is treated with optical whitening agent, thereafter, it is hydro-extracted, dried and calendered as final operations. In case of dyeing, about 15-20% salts, 2% brightol C paste, 2-4% dyes as per shade are mixed and fabric is treated with the solution in winches. The cloth is allowed to run for several times in order to maintain uniform shade, thereafter, washed, hydro-extracted, dried and calendered. Production Capacity (per annum) Quantity (Kg.) 1. Bleaching Charges 2. Dyeing Charges Total Motive Power 50 HP is required to run the unit and proposed to be obtained from State Electricity Board. Pollution Control As this process involves treatment of chemicals, entrepreneurs are required to obtain NOC from State Pollution Control Board. Energy Conservation Energy can be conserved by proper house-keeping i.e. unnecessary running of boilers, heaters and fans are to be monitored in order to reduce the excess energy consumption. Technical Aspects A. Fixed Capital (i) Land and Building (i) Land 4000 Mtrs. @ Rs. 3000 per Sq. Mtr Boundary wall and gates Factory shed 400 Sq. Mtr, @ Rs. 6000 / Sq. Mtr Raw Material & finished goods storage 500 Sq. Mtr@ Rs. 6000 / Sq. mtr. Rs.1,20,00,000 Rs. 5,00,000 Rs. 24,00,000 4,50,000 4,50,000 9,00,000 Value (Rs.) 1,15,86,000 1,48,05,000 2,63,91,000

Rs. 30,00,000

Office Building 300 Sq. Mtr @ 750 / Sq. Mtr Workers sitting hall 500 Sq.Mtr @ Rs.6000/Mtr

Rs. 22,50,000 Rs. 30,00,000 Rs.1,18.00,000

Utility plants area e.g., bore well, raw water storage, boiler, generator and effluent treatment plant 200 Sq. Rs. 12,00,000 Mtr @ Rs. 6000/Sq. Mtr Total (ii) Machinery and Equipments Sl. Description No. 1. 2. 3. SS Winch m/c of 6-4 86 200kg. SS Winch m/c 6-4' 66 size 150kg. MS Kier wall thick 1/4' bottom 8' Steam callendering m/c roller sizes 51/21 Hydro-extractor 40-45 kg capacity No. Rate (Rs.) Amount (Rs.) Rs 2,43,00,000

1 3 2

4,00,000 2,00,000 1,50,000

4,00,000 6,00,000 3,00,000

4.

3,00,000

3,00,000

5.

2,50,000

5,00,000

6.

4 cylinder drier with motor and gear 1 box S.S. Conveyors with ball bearing Baby boiler with storage tank chimney, water softening plant Water softening plant (cap. 6kl/hr), with storage tank pumps and S.S. piping 4

7,00,000

7,00,000

7.

50,000

2,00,000

8.

8,00,000

8,00,000

9.

7,00,000

7,00,000

10. Effuent treatment plant 11. Steam pipeline and other

1 LS

5,00,000 3,00,000

500,000 300,000

accessories Deep tube well with submersible 12. pump with storage tank, pumping and distribution system 13. Mini transport vehicle (3 Wheelers) 14. Fire extinguisher 5 kg capacity 15. Testing equipments Computer colour matching equipment (optional)

5,00,00

5,00,000

1 2 LS

3,00,000 20,000

3,00,000 40,000 2,00,000

16.

25,00,000

25,00,000

Total

88,40,000

(iii) Other Fixed Assets (a) Erection and installation (b) Office furniture (c) Pre-operative expenses Total Total Fixed Capital (i) + (ii) + (iii) B. Working Capital (i) Staff and Labour Wages Sl. Designation No. 1. 2. 3. G. Manager Finance and Accountant Computer Operator Nos.

(Rs.) 8,84,000 5,00,000 3,00,000 16,84,000 3,48,24,000

Rate (Rs.) 30000

Amount (Rs.) 30,000 15,000

1 2 1

20,000 20,000

4. 5. 6.

Sales, marketing, administrative and Peon Watchman

6 2 4 3500 3500

50,000 7,000 14,000 1,26,000

Total (i) (ii) Production Staff Dyeing Master 01 no. and shift supervisors 03 nos. Skilled Workers Semi-skilled Workers Lab. Chemists and Attendant Boiler Attendant Electrician 12 15 6 4 3 4000 4000 5,000 3,000

7.

36,000

8. 9. 10. 11. 12. Total

60,000 45,000 30,000 16,000 12,000 1,99,000 3,25,000 72,000 3,97,000

Total (i) + (ii) Perquisites@ 22% G. Total (iii) Raw Material (per month) Sl. Description No. Rate/ unit (Rs.) 35 20 10

Unit

Qty.

Amount (Rs.)

1. 2. 3.

Caustic Soda Soda ash Sodium silicate

Kgs. Kgs. Kgs.

1500 5500 2500

53,000 1,10,000 25,000

4. 5. 6. 7. 8. 9.

Lisopal Bleaching Powder Hydrochloric acid Glabour's salt Common salt Optical whitening agent

Kgs. Kgs. Kgs. Kgs. Kgs. Lit. Lit. Lit. Lit. Kgs. Lumpsum

750 3,000 8,000 800 1000 225 1200 2500 750 750

150 20 8 10 3 140 20 10 75 150

1,13,000 60,000 64,000 8,000 3,000 32,000 24,000 25,000 56,000 1,13,000

10. Hydrogen peroxide 11. Sulphuric acid 12. Acetic acid 13. Dye fixing agent

14. Dyes of different shades

1,00,000

Total

7,86,000

(iv) Utilities Electricity bill 37.5 x 25 x 4 x 0.8 x 24 Water charges Fuel Coal/furnace oil Fuel for vehicle Total

(Rs.) 72,000 10,000 100,000 8,000 1,90,000

(v) Other Contingent Expenses

(Rs.)

(a) Rent (b) Postage/stationery (c) Repair and maintenance (d) Transport/travelling charges (e) Insurance (f) Telephone bills (g) Miscellaneous Total (vi) Total Recurring Expenses (per month) (vii) Total Working Capital for 3 months C. Total Capital Investment (i) Machinery and equipment (ii) Working capital for 3 months Total Machinery Utilisation Capacity utilisation is considered as 75% of installed capacity. Financial Analysis (1) Cost of Production (per year) Recurring expenses Depreciation on machinery @ 10% Depreciation on office furniture, computor and testing equipments @ 20% Depreciation on civil construction @ 5%

5,000 22,000 30,000 19,000 10,000 50,000 1,34,000 11,10,000 33,30,000

Rs. 3,48,24,000 Rs. 33,30,000 Rs. 4,81,54,000

(Rs.) 1,33,20,000 6,14,000

6,40,000

5,90,000

Interest on total investment @ 12% Total (2) Turnover (per year) Processing Charges Bleaching Charges Dyeing charges Total Qty. Kgs. 4,50,000 4,50,000 Rate/Kg. 25.75 32.90

57,78,000 2,03,02,000

Amount (Rs.) 1,15,86,000 1,48,05,000 2,63,91,000

(3) Net Profit (per year) (4) Net profit ratio (Net profit/Turnover (per year) (5) Rate of return on investment (Net profit/Total capital investment) (6) Break-even Point Fixed Cost Depreciation Rent Interest on capital investment 40% of wages of staff and labour 40% of other expenses Insurance Total (Rs.) 18,44,000 57,78,000 19,05,000 6,43,000 2,28,000

60,89,000 23.07%

12.64%

1,03,98,000

B.E.P.

= Fixed Cost 100

-------------------Fixed cost + Profit

1,03,98,000 100 ---------------------1,03,98,000 + 60,89,000

= 63.07%

Vous aimerez peut-être aussi

- Installation Procedure For Pressure Vessel - EnglishDocument8 pagesInstallation Procedure For Pressure Vessel - EnglishApri Dianto92% (13)

- Chapter 05Document745 pagesChapter 05Amjad Salam100% (4)

- Pretreatment of Fabrics That Contain SpandexDocument8 pagesPretreatment of Fabrics That Contain SpandexaymanPas encore d'évaluation

- TRI 3005 Garment Washing Techniques For Cotton ApparelDocument13 pagesTRI 3005 Garment Washing Techniques For Cotton Apparelapi-26494555Pas encore d'évaluation

- DAIRY FARM GROUP - Redesign of Business Systems and Processes - Case AnalysisDocument5 pagesDAIRY FARM GROUP - Redesign of Business Systems and Processes - Case Analysisbinzidd007Pas encore d'évaluation

- Cross Training Project PresentationDocument16 pagesCross Training Project Presentationunknown139Pas encore d'évaluation

- GSFC FY12-14Recruitment StrategyDocument10 pagesGSFC FY12-14Recruitment StrategyTejas PatelPas encore d'évaluation

- RCA2600 User Manual Rev C PDFDocument9 pagesRCA2600 User Manual Rev C PDFMarcus DragoPas encore d'évaluation

- ASSHTO Example Strut and TieDocument62 pagesASSHTO Example Strut and TieSothea Born100% (4)

- Dyeing of Knitted Fabrics PDFDocument7 pagesDyeing of Knitted Fabrics PDFAhmed AksarPas encore d'évaluation

- Textile ProcessingDocument13 pagesTextile ProcessingSivaraj PadmanabanPas encore d'évaluation

- Chemical Finishing of Textiles PDFDocument286 pagesChemical Finishing of Textiles PDFdineshv7450% (2)

- Special Finishes of TextilesDocument19 pagesSpecial Finishes of Textilespronoy34Pas encore d'évaluation

- Woven Fabric Dyeing ProcedureDocument67 pagesWoven Fabric Dyeing ProcedureNaim UddinPas encore d'évaluation

- Bio PreparationDocument18 pagesBio PreparationJorge Salgado SalgadoPas encore d'évaluation

- Textile Internship Report at Alok Industries Ltd.Document96 pagesTextile Internship Report at Alok Industries Ltd.Ak Jajabar100% (1)

- Nice Denim Limited BrochureDocument20 pagesNice Denim Limited Brochuremmorshed2kPas encore d'évaluation

- Summer Internship On Ankur TextilesDocument47 pagesSummer Internship On Ankur TextilesSarthak Sagar100% (1)

- Important Characteristics of Reactive DyeingDocument5 pagesImportant Characteristics of Reactive DyeingMohammed Atiqul Hoque ChowdhuryPas encore d'évaluation

- 9 After Print Washing Printing Training 1&2Document55 pages9 After Print Washing Printing Training 1&2yadi haryadiPas encore d'évaluation

- Garments FinishingDocument18 pagesGarments FinishingJames_45Pas encore d'évaluation

- Indian Dyestuff Industry-FICCI Whitepaper-180906Document21 pagesIndian Dyestuff Industry-FICCI Whitepaper-180906krprakashPas encore d'évaluation

- 02.4 Dyeing Machinery Presentation PDFDocument34 pages02.4 Dyeing Machinery Presentation PDFMD JAHID HASAN RAJPas encore d'évaluation

- Wrinkle Free FinishingDocument4 pagesWrinkle Free FinishingkreeshnuPas encore d'évaluation

- Knitted FabricsDocument67 pagesKnitted Fabrics郭哲宏100% (1)

- Lab Equipments For Textile Wet ProcessingDocument2 pagesLab Equipments For Textile Wet ProcessingRezaul Karim TutulPas encore d'évaluation

- Pretreatment of WoolDocument2 pagesPretreatment of WoolPooja Sain100% (1)

- Indigo Dyeing Machinery The Concept Dyes Chemicals Express TextileDocument6 pagesIndigo Dyeing Machinery The Concept Dyes Chemicals Express TextilechtamoorPas encore d'évaluation

- Singeing Process: Introduction To Textile Chemical ProcessingDocument28 pagesSingeing Process: Introduction To Textile Chemical ProcessingrehanabbaciPas encore d'évaluation

- Dyeing CalculationDocument6 pagesDyeing CalculationRihan Ahmed RubelPas encore d'évaluation

- Textile Finishing - Textile CentreDocument17 pagesTextile Finishing - Textile CentreashrafbookPas encore d'évaluation

- Enzymes For TextileDocument31 pagesEnzymes For TextileSuyash ManmohanPas encore d'évaluation

- Econtrol Web 4 PDFDocument10 pagesEcontrol Web 4 PDFJeyaraj KLPas encore d'évaluation

- Chemical Testing For FabricDocument24 pagesChemical Testing For FabricParth Dev Verma100% (3)

- Fabric Preparation For Dyeing and PrintingDocument28 pagesFabric Preparation For Dyeing and Printingsakshi ranadePas encore d'évaluation

- Water Less DyeingDocument20 pagesWater Less DyeingDhanashree Kudale100% (1)

- Pre Treatment For Fabrics Before DyeingDocument16 pagesPre Treatment For Fabrics Before DyeingNayomi Rathnaweera0% (1)

- Knitting Calculation:: Yarn CountDocument4 pagesKnitting Calculation:: Yarn CountGustavo G. Garcia OchoaPas encore d'évaluation

- Nasa Smart FabricsDocument20 pagesNasa Smart FabricsPavan KumarPas encore d'évaluation

- Heat B SettingDocument18 pagesHeat B SettingharisPas encore d'évaluation

- Singeing Fundamentals: By: Tanveer HussainDocument12 pagesSingeing Fundamentals: By: Tanveer HussainPushpanjali VermaPas encore d'évaluation

- Textile Dyeing and Printing-IIDocument99 pagesTextile Dyeing and Printing-IIKeshav Dhawan100% (1)

- Right First Time Dyeing: RFT PrinciplesDocument8 pagesRight First Time Dyeing: RFT PrinciplesAnu MehtaPas encore d'évaluation

- Dyeing LabDocument19 pagesDyeing LabFathi MustafaPas encore d'évaluation

- Continuous Bleaching RangeDocument8 pagesContinuous Bleaching RangeKhandakar Nayem100% (1)

- Recent Advancements in Dyestuff IndustryDocument85 pagesRecent Advancements in Dyestuff IndustryPranjal AgarwalPas encore d'évaluation

- Industrialattachmentofnazbangladeshltd 140515042508 Phpapp02Document198 pagesIndustrialattachmentofnazbangladeshltd 140515042508 Phpapp02Ripon SayanPas encore d'évaluation

- Denim Wash and Bio FinishingDocument2 pagesDenim Wash and Bio FinishingRezaul KarimPas encore d'évaluation

- Denim WashingDocument141 pagesDenim WashingAamir Shabbir78% (9)

- Jigger Dyeing Machine:: Fabric PreparationDocument2 pagesJigger Dyeing Machine:: Fabric PreparationnaaomaiPas encore d'évaluation

- Denim Finishing With EnzymesDocument3 pagesDenim Finishing With Enzymesapi-26494555Pas encore d'évaluation

- Comprehensive View On Garment Dyeing and FinishingDocument6 pagesComprehensive View On Garment Dyeing and Finishingapi-26494555Pas encore d'évaluation

- Fabric DyeingDocument34 pagesFabric Dyeinghridi147100% (1)

- Carr and Latham's Technology of Clothing ManufactureD'EverandCarr and Latham's Technology of Clothing ManufactureDavid J. TylerÉvaluation : 4 sur 5 étoiles4/5 (1)

- The Identification of Vat Dyes on Cellulosic MaterialsD'EverandThe Identification of Vat Dyes on Cellulosic MaterialsPas encore d'évaluation

- Bleaching and Dyeing of Cotton Knitted Fabric: NtroductionDocument5 pagesBleaching and Dyeing of Cotton Knitted Fabric: NtroductionPRATEEKMAHAJAN02Pas encore d'évaluation

- Cotton Knitted Undergarments (Briefs, Panties, Vests) : 1. Procurement of Knitted FabricDocument6 pagesCotton Knitted Undergarments (Briefs, Panties, Vests) : 1. Procurement of Knitted FabricPaka ManojPas encore d'évaluation

- Ready Made GarmentsDocument8 pagesReady Made Garmentsarmk_0073141Pas encore d'évaluation

- Plaster of ParisDocument5 pagesPlaster of ParisAniket Salvi100% (1)

- Manufacture of Shirt (Top) and Skirts: Ntroduction Arket OtentialDocument5 pagesManufacture of Shirt (Top) and Skirts: Ntroduction Arket OtentialAnurag PalPas encore d'évaluation

- A Project Profile On Saddlery & Harness: Dcdi-Agra@dcmsme - Gov.inDocument8 pagesA Project Profile On Saddlery & Harness: Dcdi-Agra@dcmsme - Gov.inroufzargarPas encore d'évaluation

- Cotton Yarn Dyeing Project ReportDocument6 pagesCotton Yarn Dyeing Project ReportkreeshnuPas encore d'évaluation

- Men's Readymade GarmentsDocument5 pagesMen's Readymade Garmentsmorshed.mahamudPas encore d'évaluation

- Lycra & Air Covered YarnDocument6 pagesLycra & Air Covered YarnDanish NawazPas encore d'évaluation

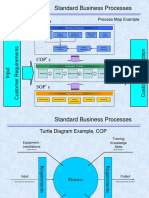

- Process Maps and Turtle Diagrams ExampleDocument2 pagesProcess Maps and Turtle Diagrams ExampleJohn Oo100% (1)

- SCM Asian PaintsDocument22 pagesSCM Asian PaintsDhaval lokhande100% (2)

- The Case For CMDocument25 pagesThe Case For CMsmd davisPas encore d'évaluation

- BR100Document14 pagesBR100Sreekanth Reddy PothulaPas encore d'évaluation

- AS 7630 SampleDocument6 pagesAS 7630 SamplebriankimbjPas encore d'évaluation

- BODIN & GASS - Exercises For Teaching The Analytic Hierarchy Process PDFDocument21 pagesBODIN & GASS - Exercises For Teaching The Analytic Hierarchy Process PDFAndriantsalamaPas encore d'évaluation

- Washer GTWN3000MWS ManualDocument24 pagesWasher GTWN3000MWS ManualTravisPas encore d'évaluation

- PLC ListDocument28 pagesPLC ListIshfaqAhmedMayoPas encore d'évaluation

- Printed Circuit Board Manufacturing ProcessDocument2 pagesPrinted Circuit Board Manufacturing ProcessDipesh AggarwalPas encore d'évaluation

- KLN 90B Installation ManualDocument152 pagesKLN 90B Installation Manualsandyz007Pas encore d'évaluation

- Jeremy Langhans ResumeDocument6 pagesJeremy Langhans ResumeexecsourcerPas encore d'évaluation

- CA Business Intelligence For CAServDeskMgr PDFDocument395 pagesCA Business Intelligence For CAServDeskMgr PDFOctavio DiazPas encore d'évaluation

- Elegance Meets Performance. Aluminium Doors and Windows From AisDocument9 pagesElegance Meets Performance. Aluminium Doors and Windows From AisPuja BhallaPas encore d'évaluation

- 255.woodworking IndustryDocument7 pages255.woodworking IndustryGian Luca Riva RiquelmePas encore d'évaluation

- SM - Presentation Viva NamitaDocument33 pagesSM - Presentation Viva NamitaMayur ApparelsPas encore d'évaluation

- TIEMBA Application FormDocument12 pagesTIEMBA Application FormbehanchodPas encore d'évaluation

- Who Trs 937-Annex4Document72 pagesWho Trs 937-Annex4Reza Jafari100% (1)

- Biometric PDFDocument14 pagesBiometric PDFprasadum2321Pas encore d'évaluation

- 14 Capacity AnalysisDocument84 pages14 Capacity AnalysisMehrozPas encore d'évaluation

- Slope Site SolutionsDocument2 pagesSlope Site SolutionspolyplopPas encore d'évaluation

- Fiat IndiaDocument30 pagesFiat IndiaParagPas encore d'évaluation

- Electrical: Section - V Technical SpecificationsDocument6 pagesElectrical: Section - V Technical SpecificationsvijaysatawPas encore d'évaluation