Académique Documents

Professionnel Documents

Culture Documents

7 CLSP Shares, Debentures and Allotment

Transféré par

Syed Mujtaba HassanDescription originale:

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

7 CLSP Shares, Debentures and Allotment

Transféré par

Syed Mujtaba HassanDroits d'auteur :

Formats disponibles

Allotment of Shares

Application for Allotment of Shares and debentures u/s. 67

Application for allotment of shares and debentures shall be made only on payment of amount specified by the Commission. Application for subscription o Specified Form by Commission o Contain such declaration or verifications deemed necessary All certificates, statements and declarations made by the applicant shall be binding on him. Application shall be irrevocable

Restriction as to First Allotment u/s. 68

1. Minimum Subscription1 in case of Public Company (Full Payment in Cash) a. Amount fixed by the memorandum or articles and specified in statement in lieu of Prospectus; or b. If no amount is fixed and specified, the whole amount of the share capital other than that issued or agreed to be issued 2. Applicants money shall be deposited and kept in a separate bank account in a scheduled bank until a. The certificate to commence business is obtained u/s. 146; or b. If conditions, u/s. 68, are not complied within 45 days after the first issue of the prospectus, all money received shall be forthwith repaid without surcharge. If any such money is not repaid within fifty days after the issue of the prospectus, the directors shall be jointly and severally liable to repay that money with surcharge at the rate of one and a half percent (1.5%) for every month or part thereof from the expiration of the fiftieth day2. 3. Amount payable on application shall be the full nominal amount of the share 4. Any condition requiring or binding any applicant to waive compliance with any requirement u/s. 68 shall be void.

Restriction to Subsequent Allotments u/s. 68

Amount payable on application shall be the full nominal amount of the share.

Statement in lieu of Prospectus u/s. 69

A Public Company having share capital, which a. Does not issue a prospectus on formation; or b. Has issued a prospectus on formation but does not proceed to allotment. Shall only allot its share or debentures, if it delivers to registrar for registration at least three days before the first allotment a statement, called a statement in lieu of prospectus, signed by person named as director or proposed director of the company or by his agent authorized in writing.

Factors of Minimum Subscription: Preliminary Expenses Working Capital Loan Borrowed Property Purchased 2 Provided that a director shall not be liable if he proves that the default in repayment of the money was not due to any misconduct or negligence on his part.

Contents of Statement in lieu of Prospectus [Section 1 Part II, 2nd Schedule]

1. Name of the Company 2. Delivered for registration by 3. The nominal share capital of the company divided by number of shares 4. Description of business to be undertaken and its prospects 5. The consideration for the intended issue of shares and debentures 6. Number and amount of shares and debentures agreed to be issued 7. Period during which the option is exercisable 8. Price to be paid for shares or debentures subscribed for or acquired under option 9. Consideration for the option or the right to option. 10. Particulars of persons to whom the option or the right to option was given or, if given to existing share-holders or debenture-holders 11. and as specified in Section 1 Part II, 2nd Schedule

Reports to be set out in Statement in lieu of Prospectus [Section 2 Part II, 2

nd

Schedule]

1. Where it is proposed to acquire a business: A report made by auditors, with respect to a. The profits or losses of the business of preceding five financial years b. The assets and liabilities of the business as at the last date to which the accounts of the business were made up. 2. Where it is proposed to acquire shares in a body corporate which will become a subsidiary: A report made by auditors with respect to a. Profits and losses; and b. Assets and liabilities of other body corporate, indicating how the profits or losses of the other body corporate dealt with by the report would have concerned members of the company and what allowance would have fallen to be made for holders of other shares, if the company had at all time held the shares to be acquired.

Return as to allotment u/s.73

Upon allotment of its shares, Company shall within thirty (30) days thereafter 1. File with Registrar a Return of allotment3: Statinga. Number & Nominal amount of the allotted shares; b. Prescribed particulars of each allottee; and c. The amount paid on each share; and 2. File with the registrar a. In the case of Bonus shares, a copy of the resolution authorizing the issue of Bonus Shares; b. In the case of Issue of shares at a discount

3

Form 3: Return of Allotment [u/s.73 (1)] Shares allotted payable in Cash o Nominal Amount o Premium o Discount o Total Amount Shares allotted for a consideration otherwise than in Cash o Nominal Amount o Premium o Discount o Total Amount o Cash Received & Consideration Allotment for bonus Shares o Nominal Amount o Amount treated as paid up o Particulars of resolution (Directors/Shareholders)

i. Copy of the resolution passed authorizing such issue; ii. Copy of the order of the Commission sanctioning the issue; and iii. Where maximum rate of discount exceeds ten (10) Percent, Copy of the order of the Commission permitting If the registrar is satisfied that in the circumstances of any particular case the period of thirty days for compliance with the requirement of Section 73 is inadequate, he may extend that period. The provisions u/s.73 shall apply mutatis mutandis to shares which are allotted or issued or deemed to have been issued to a scheduled bank or a financial institution in pursuance of any obligation of a company

Issue of Certificates u/s. 74

1. Every company shall complete and have ready for delivery the certificates of all shares, the debentures and the certificates of all debenture stock allotted or transferred within a. 90 days of allotment; and b. 45 days of application for the registration of transfer shares 2. Company shall register transfer in the name of central depository within 5 days of application for registration of transfer 3. Penalty: Fine not exceeding 100Rs. For every day during which default continues Transfer u/s. 74: Means 1. a transfer duly stamped and otherwise valid; but 2. Does not include a transfer that the company is entitled not to register and does not register.

Issue of Duplicate Certificates u/s. 75

Duplicate of a Certificate shall be issued by the Company within 45 days from the date of application Conditions o Proved to be lost or destroyed; or o defaced or mutilated or torn After making inquiry as to loss, destruction or mutilation of the original company may issue duplicate If company is unable to issue duplicate certificate, it shall notify within 30 days from the date of application to applicant.

Power of Company Limited by Shares to alter its Share Capital: U/s 92

If authorized by its articles, may alter the conditions of its memorandum, through ordinary resolution in General Meeting, so as to o Increase its Share Capital o Consolidate and divide the whole or any part of its share capital into share of larger amount o Sub divide its shares, or any of them in smaller amounts o Cancel shares and diminish the amount of share capital by amount of shares so cancelled at the date of the passing of the resolution In the event of consolidation or sub-division, rights attaching shall be strictly proportional. Rights attached to new same class of shares issued shall be the same as those attaching to shares previously held. New shares issued shall rank pari passu4 with existing shares of the class

pari passu: At par

Notwithstanding . Where the authorized capital of a company is fully subscribed, or the unsubscribed capital is insufficient, the same shall be deemed to have been increased to the extent necessary for issue of share in pursuance of any obligation of the company. Cancellation of shares shall not be deemed to be a reduction of share Capital File notice with registrar within 15 days from exercise thereof.

Form 6: Notice of consolidation, Division or sub-division of Shares

Incorporation Number Date of passing of special Resolution Notice for o Consolidation & division o Sub division o Cancellation Existing share Capital Consolidated /Divided Shares Sub division of shares Cancellation of shares New Share Capital

Notice5 to Registrar of Consolidation of Share Capital u/s 93

Company having share capital which has consolidated and divided its share capital into share of larger amount shall within 15 days of consolidation & division file notice with the registrar 92(3A) Notwithstanding anything contained in this Ordinance or any other law for the time being in force or the memorandum and articles, where the authorised capital of a company is fully subscribed, or the un-subscribed capital is insufficient, the same shall be deemed to have been increased to the extent necessary for issue of shares to a scheduled bank or financial institution in pursuance of any obligation of the company to issue shares to such scheduled bank or financial institution.

Notice of Increase of Share Capital or of Members u/s 94

1. Resolution 2. File with registrar, within 15 days a Notice a. Form 76; or b. Form 87 3. Failure of Company to Notify registrar a. u/s. 92(3A) the Scheduled bank or financial institution may file notice such increase in authorized capital; or b. Liable to a fine up to Rs.100 for ever day during which default continues.

5 6

Notice: Means to communicate an information which the person may not have access or knowledge. Form 7: Notice of Increase in Nominal Share Capital Amount payable on capital as increased Amount payable on Capital immediately before increase Difference in above amounts Ordinary/Special Resolution Date Increase in Authorized Capital Conditions for issue of new shares 7 Form 8: Notice of Increase in Number of Members Amount payable with reference to number of members as increased Amount which would have been payableand difference in amounts Ordinary/special Resolution Date Existing numbers of Members Addition in number of Members New number of Members

Only fully paid shares to be issued u/s. 91

If a company has partly paid shares on the commencement of Companies Ordinance 1984, it Shall not issue further shares until all the previously issued shares have become fully paid up; and Shall pay dividend only in proportion to the amount paid up on each share.

Issue of Capital (Rules 1996)

Applicability Companies proposing to offer share capital to public; Listed companies proposing to increase share capital through o Right issue; or o Bonus issue All companies proposing to issue shares for consideration otherwise than in cash; and Certain persons offering shares for shale to the public. Policy: A company which proposes to raise capital through public offer for the first time shall comply with following condition for Loan-Based projects: o Size of capital to be issue in accordance with financial plan approved by financing institution o Companys auditors shall certify receipt in full of sponsors subscription and 80% has been utilized in project o Verification by concerned stock exchange of installation of 30% plant and machinery and last consignment of plant & machinery, where required, has been shipped to the company o Sponsors shall retain at least 25% of capital of the Company Equity-Based Projects o The fixed capital expenditure shall be entirely financed by equity. o Appraised by financial institution; a commercial bank; or investment bank o Appraisal report accompanied by certificate from companys auditors confirming Capital allocated to sponsors has been fully paid; and Land for project has been acquired; Letters of credit have been established; and Shipment schedule of plant and machinery has been finalized Issue shall be fully underwritten and underwriters (not being associated companies) shall include at least two financial institutions including commercial banks and investment banks Underwriters shall evaluate the project in their due diligence reports. Sponsors shall retain 25% of capital of the company for a period of 5 years from the date of public subscription. Conditions for Issue of shares on Premium Profitable operational record of at least one year. Premium shall not exceed the amount of premium charged on placements with foreign or local institutions. Also particulars of such institutions shall be disclosed in the Prospectus. Fully underwritten and the underwriters shall include financial institutions, including commercial banks and investment banks, not being associated companies.

Underwriters shall give full justification of the amount of premium in their independent due diligence reports. Report shall form part of the material contracts; Disclosure for full justification for premium in the prospectus Employees getting preferential allocation shall be charged at the same rate as the public; Shares allotted on account of preferential allocation at par shall not be salable for a period of two years from the date of public subscription. Such persons shall be issued o Jumbo Certificates Marked as Not salable for two years Particulars furnished to respective stock exchange Companies while splitting jumbo certificates into marketable lot8 after prescribed period shall inform the respective stock exchange.

Conditions for Issue of Right shares by a listed company Not to be made within one year of the first issue of capital to the public or further issue of capital through right issue while announcing right issue clearly state o Purpose o Benefits o Use of funds; and o Financial projections for three years, signed by the directors present in the meeting in which the right issue was approved; Decision to issue right shares communicated to Authority and respective stock exchange on the day of decision; Company may charge premium on right shares up to the free reserves9 per share as certified by companys auditors. Certificate of auditors shall be furnished to the Authority and respective stock exchange, intimating proposed right issue. In case, Company proposes to charge premium on right issue above the free reserves per share shall be required to o By at least forty percent of all shareholders to subscribe their portion of right issue; and o Remaining shall be fully underwritten and the underwriters shall include financial institutions, including commercial banks and investment banks, not being associated companies. o Underwriters shall give full justification of the amount of premium in their independent due diligence reports; Right issue of a loss making company or whose market share price during the preceding six months has remained below par value shall be fully and firmly underwritten; Book closure within forty-five days for announcement of the right issue

Marketable Lot: Minimum number of shares allowed to be traded. Free Reserves: includes any amount which, have been set aside out of revenue or other surpluses after adjustment of all intangible or fictitious assets, is free in that it is not retained to meet any diminution in value of assets, specific liability, contingency or commitment known to exist at the date of the balance sheet, but does not include; 1. reserves created as a result of revaluation of fixed assets; 2. goodwill reserve; 3. depreciation reserve to the extent of ordinary depreciation including allowance for extra shifts admissible under the Income Tax Ordinance 4. development allowance reserve created under the provisions of Income tax Ordinance 5. workers welfare fund 6. provisions for taxation to the extent of the deferred or current liability of the company; and 7. Capital redemption reserve.

9 8

the payment and renunciation date once announced, letter of right shall not be extended except with the permission of the respective stock exchange under special circumstances; If the announcement of bonus and right issue is made simultaneously, board resolution shall specify whether bonus shares covered by the announcement qualify for right entitlement.

Conditions for Issue of Bonus shares by a listed company Communication of decision of directors to the Authority and respective Stock Exchange on the day of the decision Intimation letter accompanied by auditors certificate that o the free reserves and surpluses retained after the issue of the bonus shares will not be less than twenty five percent of the increased capital; and o All contingent liabilities disclosed in the audited accounts and any subsequent liability shall be deducted while calculating minimum residual reserves of twenty five percent. Free reserves calculated in the manner as specified in rule 5 shall be sufficient to issue the bonus shares after retaining in the reserves 25% of the capital as it will be increased by the proposed bonus shares. Conditions for offer for sale of shares by privatized companies The new management shall not offer shares to the public for a period of three years from the date of privatization at a price higher than the purchase price per share adjusted by right or bonus issue or any other distribution made out of the pre-acquisition reserves. Conditions for issue of shares for consideration otherwise than in cash Consulting engineer registered with PEC10 and borne on the panel of at least two financial institutions as a valuer shall determine the value of assets Value of assets taken over shall be reduced by depreciation charged on consistent basis; The goodwill and other intangible assets shall be excluded from the consideration; and Certificate from practicing CA11 shall be obtained to the effect that the above mentioned conditions have been complied with. Conditions for sale of shares by Certain Person Persons who hold more than 10% company shares Lesser of o Size of capital to be offered not be less than one hundred million rupees or o twenty-five percent of the capital, Charge premium only if company has profitable operational record for at least one year; In case a premium is to be charged on the sale of shares, the offer shall be fully underwritten and the underwriters shall include financial institutions, including commercial banks and investment banks, not being associated companies. Underwriters shall give full justification of the amount of premium in their independent due diligence reports. Due diligence reports shall form part of the material contracts; Full justification for the premium shall be disclosed in the offer for sale.

10 11

PEC: Pakistan Engineering Council CA: Chartered Accountant

Further Issue of Capital Right Allotment u/s.86

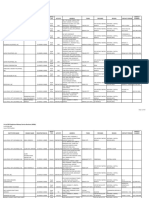

On decision of directors to increase the capital by issue of further shares; 1. Offered to Members in strictly proportion to the existing shares held irrespective of Class Right Allotment u/s. 86 1. Offer share to Existing 2. By Notice specifying Members a. Number of Entitled Shares of Member 2. Circular b. Limit of Time after which offer will deemed to be a. Prescribed Form declined b. Material Information 3. Circular c. Latest Statements of a. Signed by the Directors or an Authorized Officer12 Accounts b. Prescribed Form d. Necessity for the issue c. Material Information about affairs of the Company e. Reasonable time d. Latest Statement of the Accounts e. Necessity for issue of further capital. Filing Requirement for Circular f. Specify a Date within which offer must be accepted, Before issuing to Shareholders or otherwise deemed to be declined. Members first it will be filed to 4. File with registrar registrar a. Duly signed copy of Circular b. Before sending to the shareholders

Note: 1. Fractional Shares13 shall not be offered and shall be consolidated and disposed of by the company and the proceeds, shall be paid to the entitled shareholders who have accepted such offer 2. Upon an application by public company on the basis of special resolution, Federal Government may allow it to raise its further capital without issue of right shares. 3. A Public company may reserve a certain percentage of further issue of its employees under Employees Stock Option Scheme approved by the Commission. Right Allotment Letter to Existing Shareholders Option Sale Acceptance Renunciation Surrender ones right against consideration Issue of Shares in lieu of Outstanding Balance u/s. 8714 Regardless of anything contained in section 86 or the memorandum and articles, a Company may issue ordinary shares or grant option to covert into ordinary shares for the outstanding balance of any loan, advances or credit or other non-interest bearing securities To the extent of Twenty percent of such balance Term: Not less than three years in the Contract for loan Contract with any scheduled bank or a financial institution

12

Officer: Includes any director, chief executive, managing agent, secretary or other executive of the company, howsoever designated but does not includes an auditor: Save in sections 205,220 to 224, 260, 261, 268, 351, 352, 412, 417, 418,474 & 482 13 Fractional Shares: Less than single or one share. 14 Issue of Shares in Lieu of Outstanding Balance u/s. 87 Loaning through Financial Institutions or Scheduled Bank To the extent of twenty percent of such balance Term not less than 3 years.

Further issue of Shares Otherwise than Rights

State the provisions relating to Further issue of Shares otherwise15 than Rights before filing application with the Commission 1. If existing authorized capital is fully subscribed, or the un-issued capital is insufficient for the new issue; a. Alter Memorandum to give effect to increase in authorized capital b. Special Resolution 2. Approval of shareholder through a special resolution for further issue 3. Application to be submitted in a manner prescribed under Rule 30 of Companies (General Provisions and Forms) Rules, 1985 Application to the Commission for approval of Further issue of Shares otherwise than Rights [u/s. 86(1) & Rule 30] After passing Special Resolution file Form 26 with concerned Registrar and obtain a certified copy. The application must narrate specific purpose for which the proceeds will be utilized. Signed by the authorized officer/director of the Company Financial Projections for next three years If Memorandum and Articles have been amended then a certified copy of the same. Certified Copy of Form 26 & detailed text of Special Resolution. Justification Relevant detail of the shares issued within past two years Minutes of the Board of Directors Meeting in which decision was made & attendance sheet Attendance sheet of shareholder Affidavit as required by Rule 30 Copy of voucher evidencing deposit of application fee. State relevant provisions of the Companies Ordinance and Rules stipulating various conditions regarding further issue of shares 1. Companies Ordinance a. Specific Requirements i. Pass a special resolution to alter its Memorandum to give effect to the increased authorized Capital if required. ii. Pass a special resolution to alter its Articles, if not authorized by its articles. iii. Federal Government may allow on application on the basis of special resolution to raise capital without issue of right shares. iv. Notice of General Meeting Approval for issuance of shares otherwise than rights 1. 21 days Prior notice and 2. In case of listed company such notice shall also be published at least in one issue each of a daily newspaper in English and a Urdu having circulation in the Province in which the Stock Exchange is listed.[u/s. 158 & 159] 3. Notice be faxed to the Commission along with statement u/s. 160 on the same date sent to shareholders and

15

Otherwise: In a different state. (Synonyms: other, different)

4. the copies of the newspapers in which the notices of general meeting are published may be sent to Commission within 7 days of their publication 5. Notice to Shareholder Shall specify, a. Proposed resolution is a special Resolution b. Provisions under which resolution is proposed c. Total number of shares to be issued d. Price per share e. Total amount of capital to be issued f. The fact that the shares are to be issued otherwise than rights g. To whom the shares are proposed to be issued. b. General Requirements i. Only fully paid shares should be issued [u/s. 91] ii. New shares issued shall rank pari passu 16with the existing shares of the class [u/s. 92(2)] iii. Notwithstanding where authorized capital of a company is fully subscribed or the unsubscribed capital is insufficient, the same shall be deemed to have been increased to the extent necessary for issue of shares to a scheduled bank or financial institution on pursuance of any obligation of the company.[u/s. 92(3A)] iv. Where a company aims to increase it share capital beyond the authorized capital or such capital is increased u/s. 92(3A), it shall file with the registrar within fifteen days of passing resolution, a notice 17to registrar. [U/s. 94(1)]. Notice shall include particulars of the shares to be affected and the conditions subject to which the new shares are to be issued. [u/s. 94(2)] 2. Companies (General Provisions and Forms) Rules 1985 Rule 30 Rule 30 explains the mode of submission of application to the Commission. a. Duly signed and verified by an affidavit by the applicant , indicating full name and address b. In case of Company, signed and verified by an affidavit by a responsible officer c. Neatly and legibly written, typed and printed d. Setting out precisely the facts, grounds and claims or relief applied for e. Accompanied by i. Documents and copies of documents referred to in the application. ii. In case of an appeal, a certified copy of such order or decision. iii. One spare copy, duly signed, dated and verified of application iv. Original bank challan or draft for the fee paid for the application. 3. Sixth Schedules a. Para VII provides that filling fee by or on behalf of a Company for application with the Commission or Registrar shall be Rs.500.

16 17

Pari Passu: At par Notice of Increase of Share Capital or Members u/s. 94 Authorized by Articles Exercise of Power in General Meeting, even through Ordinary Resolution Notice Specifying Purpose Form 7 or 8 Payment of Differential Fees Amended copy of Memorandum and Articles

Reduction of share Capital

Reduction of Share Capital 18u/s. 96

A company limited by shares may reduce its share capital in any way o Reduce liability on any of its unpaid share capital; or o Either with or without reducing liability on any of its shares, cancel any paid-up share capital which is lost or unrepresented by available assets; or o Either with or without reducing liability on any of its shares, pay off any paid-up share capital which is in excess of the needs of the company; And may alter its memorandum by reducing the amount of its share capital and of its shares accordingly Conditions/ Restrictions o Confirmation by the Court o If authorized by articles o Special Resolution (Resolution for reducing share capital)

Petition to Court for confirmation of Reduction of Share Capital [u/s. 97 & 101] 1) Petition to Court a) Facts b) Grounds Why? c) Circumstances d) Relief 2) Order Confirming Reduction a) If Court is satisfied with respect of i) Every creditor is entitled to object ii) His consent to reduction is obtained; iii) His debt or claim has been discharged or has been determined or has been secured b) The court may make order confirming the reduction

Objections by Creditors on Reduction of Share Capital u/s. 99

1. Objections By Creditors: Where proposed reduction involves a. Diminution of any liability in respect of unpaid share capital; or b. The payment to any shareholder of any paid-up share Capital ; and c. In any other case , if the court directs every creditors of the company on the date fixed by the Court shall be entitled to object reduction 2. Court shall settle a list of creditors entitled to object, and ascertain a. Name of those creditors b. Nature and amount of their debts or claims 3. and court shall publish notices fixing day(s) within which creditors can object

Registration of order and minute of reduction u/s. 102

Production of Confirmation order

Registrar

18

Certified Copy of Order Minute approved by the Court

Who shall register the order and minute and certify under his hand the registration.

File with

Reduction of Share Capital u/s. 96 Confirmation by Court If authorized by Articles Special Resolution

Transfer of shares & Debentures19

Transfer: Transfer of property, legal ownership against consideration along with transfer deed. Transfer Deed

Particulars of Company Particulars of Transferee Witness Memorandum of Transfer Transmission: Operation of law due to either decision of court or inheritance Nomination: Person whose name is given in case of death for the purpose of transfer of shares Legal Heirs: Persons who will have legal right in case of death of a person Authorized Representative: Person chosen for the representation Indemnity: To compensate loss Indemnity board: Whenever, approached for transfer of shares other than transfer deed. Company demands signing of indemnity bond for avoiding conflict Blank Transfer: The transfer deed which does not carry particulars of transferee Forged Transfer: An Attempt to mutilate particulars of transfer or signature

Registration of Transfer of Shares and Debentures [u/s. 76, 79, 80 & 81]

General Provisions as to Registration o An application for registration for the transfer to the Company either by transferee or transferor o Before registering company may demand indemnity o Company shall enter in its Register of Members the name of transferee if proper instrument of transfer is Duly stamped; Executed by the transferor and transferee; and Delivered to the company Specific Provision for Company to Register o Operation of Law: A company shall register a person to whom the right to any share or debenture of the company has been transmitted by operation of law o Lost Certificate/ Issuance of Duplicate Certificate: Where a transfer deed is lost, destroyed or mutilated before its lodgment company may register the transfer

19

Transfer of Shares & Debentures (Summary) Launching of Transfer o Original Certificate o Transfer Deed Submission of Application for Registration of Transfer o Either party can submit for transfer (transferee or Transferor) Lost Certificate/Issuance of Duplicate Certificate o Application o Indemnity Bond Deceased Nomination o Application o Indemnity Bond Deemed to be Member o Transfer to his/her name; or o Transfer and sell Refusal of Transfer o Reasoned out o Has to be communicated within 30 days Timeframe (Tenure) of Transfer of Certificate o Existing Company: 45 days of launching of transfer o New Company: 90 Days of launching of Transfer

on application bearing stamp required by an instrument of transfer prove the fact it is lost, destroyed or mutilated o Deceased Nomination (Successor in interest) Transfer to lawful nominee On application by nominee duly supported by a document evidencing nomination; or lawful award of the relevant property to such successor/ nominee Company may proceed to transfer on furnishing suitable indemnity Bond Where a member nominates more than one person he shall specify in the nomination the extent of right conferred upon each of the nominees ascertainable in whole numbers o Transfer by nominee or legal Representative: Be valid Note: Every company shall maintain a register of transfer of shares and debentures at its registered office. In case of a public company, a duly approved financial institution by the commission may be appointed transfer agent on behalf of the company

Transmission of Shares (Table A 1st Schedule, Articles 11 to 13)

11. The executors, administrators, heirs, or nominees, as the case may be, of a deceased sole holder of a share shall be the only person recognized by the company as having any title to the share. In the case of a share registered in the names of two or ore holders, the survivors or survivor, or the executors or administrators of the deceased survivor, shall be the only persons recognized by the company as having any title to the share. 12. Any person becoming entitled to a share in consequence of the death or insolvency of a member shall, upon such evidence being produced as may from time to time be required by the directors, have the right either to be registered as a member in respect of the share or, instead of being registered himself, to make such transfer of the share as the deceased or insolvent person could have made; but the directors shall in either case have the same right to decline or suspend registration as they would have had in the case of a transfer of the share by the deceased or insolvent person before the death or insolvency. 13. A person becoming entitled to a share by reason of the death or insolvency of the holder shall be entitled to the same dividends and other advantages to which he would be entitled if he were the registered holder of the share, except that he shall not, before being registered as a member in respect of the share, be entitled in respect of it to exercise any right conferred by membership in relation to meetings of the company

Refusal to Transfer [u/s. 77, 78 & 78A]

The directors shall not refuse to register transfer any fully paid share or debentures unless transfer deed is defective or invalid Notice of Refusal o Notify the defect/invalidity to the transferee o Within 30 days of lodgment of transfer instrument; or Where the transferee is a Central Depository 5 days of lodgment Appeal Against Refusal to Transfer: o The person who gave intimation of the transmission by operation of law may appeal to the commission against any refusal to register the transfer within two months of receipt of notice; transmission within two months of receipt of notice; or

failure on its part to notify or register the transfer within two months from the expiry of period to notify u/s. 78(1) o The Commission shall by an order in writing, direct either that transfer or transmission be registered within 15 days of order; or it needs not be registered o The Commission shall order after Giving reasonable notice to the concerned persons; and Giving reasonable opportunity to make their representation

Treasury/Buy Back Stock

Prohibition of purchase or grant of financial assistance for purchase of shares u/s.95

1. No company shall have a power to buy its own shares or the shares of its holding company. Provided20 a. Subsidiary shall not be barred from i. Acting as trustee unless holding company is beneficially interested under the trust; & ii. Dealing in shares of holding company in the ordinary course of business. Also subsidiary shall not exercise the voting rights attached to such shares. 2. Public Company limited by Shares shall not give, whether directly or indirectly, any financial assistance for the purpose of or in connection with purchase made or to be made of any shares in its holding company. Provided a. If making or securing of advance is part of the contract of service of an employee. Provisions u/s. 95(2) shall not prevent the company from advancing or securing an advance to any of its salaried employees but excluding all directors of the company for purchase of shares of the company or of its subsidiary or holding company

Power of A Company to buy back its own shares u/s. 95A21

1. Notwithstanding . A listed Company may purchase its own shares depending upon the provisions u/s.95A and the rules framed by the Commission. Hereinafter referred to as purchase. 2. The shares purchased may either be a. Cancelled; or b. Held as treasury Stock,

Conditions and Restrictions on Holding Treasury Stock

Voting rights shall remain suspended; No cash dividend shall be paid; and No other distribution including any distribution of assets to members on a winding up shall be made to the company in respect of these shares; But, company can still o Allot treasury shares as fully paid bonus shares; and o Make payment of any amount payable on the redemption of treasury shares.

Mode of Purchase (Procedure)

1. The board of directors shall recommend the purchase to the members specifying; a. The number of shares to be purchased (maximum); b. Purpose of purchase, i.e., i. Cancellation or

20 21

Provided: On the condition or understanding that Carries an overriding effect to Section 95

2.

3. 4. 5.

6.

ii. Holding as treasury shares c. The name and address of the designated branches of the authorized bank d. Purchase price; e. Period within which to purchase; f. Source of Funds; g. Justification; and h. Effect on Financial Position On the Conclusion of Board Meeting Purchase Proposal communicated to a. Commission b. Stock Exchange Special Resolution Through a tender offer or stock Exchange (as prescribed by regulations) Purchase within prescribed period by regulations a. Shareholders interested to sell shall make offer in writing through designated branches providing his particulars b. Company shall take a decision on the offers received within ten days of the closing date of receipt of offer c. If offers received exceed the requisite purchase, the acceptance thereof shall be on pro-rata22 basis in lots of five hundred shares d. Communication of acceptance of offer within seven days of decision e. Shareholder, whose offer is accepted, shall submit share certificates along with the transfer deed duly signed, verified and witnessed within seven days of the receipt of acceptance (non-compliance = offer revoked). f. A confirmation from Central Depository System about availability of shares & transfer shall be sent to the designated branches of the bank within seven days of the receipt of acceptance offer, if on Central Depository. (Non-compliance =offer Revoked) Made in cash & out of distributable profits or reserves specifically maintained through bank draft/pay order on receipt of share Certificates & transfer deed or authority to transfer from Central Depository not latter than seven days.

Requirements for Buy-Back of Shares

Debt-equity Ratio of 75:25 Indicated in explanatory statements circulated to the members along with notice of meeting in which proposed purchase is to be considered Current Ratio 1:1, Availability of sufficient cash resources. Disclosure of Purchase a. In the Balance Sheet as reduction of share Capital b. Mode & Purchase Price in explanatory notes to the accounts 5. Documents to be Maintained a. A register of share purchased; and b. Enter following particulars i. Member of shares purchased ii. Consideration paid for the shares purchased iii. Mode of purchase iv. Date of cancellation or re-issuance v. Number & amount of treasury shares redeemed Remember, Company may dispose treasury shares (as prescribed by the regulations) On application commission may allow purchase even if company has higher Debt-Equity ratio. if it is in the interest of the Company and Capital Market (in opinion of Commission)

22

1. 2. 3. 4.

Pro-rate: Based on some proportion

Share23 and Share Capital

Nature of Shares and Certificates u/s. 89

Shall be moveable property, transferable in the manner provided by the articles. Certificate under Common seal, specifying shares held shall be prima facie 24 evidence of the title of the member to the shares.

Share Certificate, Shall specify

Name of the Company Authorized Capital Subject of Memorandum Number of shares Date Distinctive Numbers Common Seal Revenue Stamp Folio Number

Classes and kinds of share Capital 25u/s. 90 & Rules

A Company limited by shares may have more than one kind of share capital and may have different classes of shares under each kind For that company shall specifically provide in its memorandum and articles the kinds and classes.

Nature of rights and privileges [Companies Share Capital (Variation in Rights and Privileged) Rules, 2000]

Each kind of share capital and class of share will have different rights and privileges which shall be provided in the articles. The variation in rights and privileges of the shareholder may be of the nature, including the following o Different voting rights Voting rights disproportionate to the paid up value of shares held Voting rights for specific purposes only; or No voting rights at all o Different rights for entitlement of dividend, right shares or bonus share entitlement to receive the notices and to attend the general meetings; and o Rights and privileges period For indefinite period, For a limited period; or For such period, as from time to time be determined by the members through special resolution.

23 24

Share: Means a share in the share capital of a company. Prima facie: On the face of it 25 Classes and Kinds of Share Capital Authorized/ Registered/ Nominal Capital Issued Capital Subscribed Capital Inactive due to restriction on partly paid Capital Called up Capital Equity Capital Redeemable capital Note: With authorized Capital, issued Capital must be given

Conditions as to variation in Rights and Privileges

Company shall issue further share capital of any kind or class carrying different rights and privileges only o On the Basis of Special Resolution o With approval of the Commission Offer of further share capital carrying different rights and privileges shall be made to each existing shareholder proportionately without any discrimination. If any existing shareholder declines to accept the offer, the share so declined shall be disposed of by the directors in such manner o as provided In the articles or o In accordance with the special resolution passed by shareholders. The fact that company has different classes having different rights and privileges shall be distinctively mentioned in the offering document and the difference in the rights and privileges of any class of share capital shall be conspicuously mentioned in the offering document or prospectus, etc.

Register of Members and index u/s. 147

1. Every Company shall keep in one or more books, register 26and enter a. Particulars of Member27 b. Entry date of each member c. Date at which any person ceased to be a member and reasons 2. Every Company having more than fifty members shall keep an index of the name of member and shall within 14 days after the date at which any alteration is made into her register of members, make the necessary alteration in the index 3. The index shall be such that entries relating to each member can be readily found.

Trusts not to be entered on register u/s. 148

No notice of any trust, expressed, implied or constructive, shall be entered on the register of members, or be receivable by the registrar.

Debenture

Definition u/s. 2(12)

Includes debenture stock, bonds; term finance certificates and any other securities, other than a share, of a company, whether constituting a charge on the assets of the company or not;

Classes of Debentures

1. Registered Debenture: These are recorded in the books of the company and are payable only to those who have written against them as holders. These can be transferred only by the proper transfer executed deeds.

Register: means the register of members of a company and includes the register of debenture-holders or holders of other securities maintained on paper or holders of other securities maintained on paper or computer network, floppy, diskette, magnetic cartridge tape, CD-Rom or any other computer readable media; [u/s. 2(30B)] 27 Member: In relation to a company 1. Having share Capital a. Subscriber b. Allotee c. Holder 2. Not having Share Capital a. Any person agreeing to be a member.

26

2. Bearer Debenture: The names of the holder of debentures are not registered and they are payable to those who present them. They can be transferred by means of redelivery by one person to another. 3. Simple Debenture: Unsecured debentures 4. Naked Debenture: These are without any security i.e. having no charge on any assets of the company. For practical purpose these are merely promissory notes. In the event of liquidation of the company the holders are ranked as unsecured creditors. 5. Mortgage Debenture: These have certain specific rights against the assets of the company in other words the company pledges its assets to the lenders. 6. Redeemable Debenture: These are repaid by the company after a specific number of years after giving the prescribed notice of redemption to the debenture holder. 7. Perpetual or Irredeemable Debenture: These are the debentures which are not paid during life of the company but on the liquidation of company the debenture holder gets their amount back. 8. Convertible Debenture28: A debenture loan that can be converted into stock (share) by the holder and, under certain circumstances, the issuer of the bond. 9. Non-convertible Debenture: Instruments that cannot be converted in to equity shares. They usually carry higher rates of interest. The debenture holder will have no present or future stake in the company due to the non-convertibility element. Secured: Backed up by Collateral

Differences between shareholders and Debenture-holders

1. A share holder is a member of the company and has ownership rights, whereas a debenture-holder is simply creditor of the Company 2. A shareholder has the voting right whereas a debenture holder has no right to vote at any meeting of the company 3. A debenture-holder is entitled to a fixed rate of interest which the company must pay irrespective of whether it has earned a profit or not. Shareholders are entitled to get dividend that represents distribution of profit. 4. Unless the debentures are perpetual, the company can pay back the debenture-holder, but shareholders cannot be paid back as long as the company is a going concern. 5. The Claim of debenture-holder supersedes the claim of shareholders.

Issue of Debentures: Public company can issue debentures upon obtaining certificate of Commencement of Business.29

Debentures Trust Deed

It is a trust deed for securing any issue of debentures. It shall contain, 1. Name of Company 2. Amount of charge 3. Nature of Charge

28

Explanation on Convertible Debentures: Convertible debentures are different from convertible bonds because debentures are unsecured; in the even of bankruptcy the debenture would be paid after other fixed income holders. The convertible feature is factored into the calculation of the diluted per share metrics as if the debentures had been converted. Therefore, a higher share count reduces metrics such as earnings per share, which is referred to as dilution. 29 Certificate of Commencement of Business u/s. 146 1. Minimum Subscription Cash 2. Filing of Prescribed form 3. Filing of a. Prospectus; or b. Statement in lieu of Prospectus with Registrar

4. Details of properties 5. Date of signing Any other material Terms 6. Form 10 Submitted to Registrar

Special Provisions as to Debentures [u/s. 113, 114 & 115]

1. Every debenture-holder and shareholder shall have right, at his request & on payment of prescribed fee, to have copy of trust deed 2. Perpetual Debentures: A condition contained in any debenture or any deed or securing any debentures shall not be invalid by reason only that a. debentures are made irredeemable or redeemable only on the happening of a contingency; or b. on the expiration of a period 3. Debentures not to carry Voting Rights: No company is allowed to issue debentures carrying voting rights at any meeting of the company after the commencement of Companies Ordinance 1984. Provided Convertible debentures30 may carry voting rights at the option of the company Voting rights on convertible debentures shall not be in excess of those attaching to ordinary shares of equal paid-up value 4. Notwithstanding Debenture-holder having voting rights immediately before the commencement of the Companies Ordinance 1984, shall only exercise such rights at a meeting of debenture-holders

Register of Members and Debenture Holders

Register and index of debenture-holders u/s. 149

1. Every company shall keep a register of the holders of its debentures and enter a. Particulars of holder i. Name ii. Fathers or Husbands Name iii. Nationality iv. Address v. Occupation b. Debentures held by each holder, distinguishing each debenture by its number and the amount paid or agreed c. Date at which each person was entered in the register as holder d. Date at which any person ceased to be a holder. 2. Every Company having more than fifty holders shall keep an index of the names of the holders and shall within 14 days after the date at which any alteration is made in the register make the necessary alteration in the index 3. The index shall be such that entries relating to each holder can be readily found. 4. This section shall not apply with respect to debentures which, ex-facie31, are payable to the bearer thereof.

30 31

Convertible Debentures include debentures with subscription warrants Ex-facie: on the face of it.

Inspection of Register u/s. 150

1. 2. 3. 4. 5. Register of Members Name index of Members Register of Debenture holders Name index of debenture holders Annual list of members 32[u/s. 156(4)], shall be kept at the registered office of the company for inspection during the business hours not less than two hours in each day

Note: Register shall be kept at Registered office for inspection except when closed under the provisions of Companies Ordinance In general Meeting Company can impose reasonable restrictions to ensure inspection time is not less than two hours in each day.

Who are allowed to inspect Register of Member and what are the relevant provision regarding them u/s. 150 Persons allowed to inspect Register o Members or debenture-holders any fee (gratis33); and o Any other person on payment of amount prescribed by the company Any such member, debenture-holder or other person may o Make extracts there from o Require a certified copy or of any part thereof, on payment of amount fixed by company

Power to close register (Closure of Books) u/s. 151

Each time -7 days prior notice by advertisement in newspaper having circulation in the province or part of Pakistan in which o Registered office is situated; and o In case of a listed company, stock exchange on which company is listed is situated Closure of Books o One time Maximum 30 days o In whole year -45 days

32

Annual List of Member etc. u/s. 156 1. Company having Share Capital a. Once in each year b. Form A 3rd Schedule c. on the date of AGM or where no such meeting is held or not concluded on the last day of Calendar year d. Filed with registrar e. Listed company within 45 days f. Any other company within 30 days 2. Company not having Share Capital a. Once in each year b. Form B 3rd Schedule c. On the date of AGM or where no such meeting is held or if held is not concluded on the last day of the calendar year d. Filed with Registrar within 30 days 33 Gratis: without Consideration

Rectification of Register [u/s. 152 & 154]

1. Power of Court: a. The court has power to rectify register, if i. Any persons Name is fraudulently or without sufficient cause entered in or omitted from; or ii. Default is made or unnecessary delay takes place in entering the fact of person having become or ceased to be a member b. On application, the Court may decide any question i. Relating to the title of any person who is party to the application; or ii. Which it is necessary or expedient to decide for rectification 2. Application to the Court: a. The aggrieved person or any member or debenture-holder may apply to the court for rectification of register. The court may either i. Refuse; or ii. May order rectification b. Grounds: Mentioned in section 100 of Code of civil procedures c. If original side is subordinate Civil Court then Appellant side will be High court: Bench(consisting of two or more Judges of High Court) d. If Company Bench (consisting of single Judge) 3. Notice a. On order for rectification, i. Copy of the order to Company ii. Company shall file 1. Company shall File list of its members with Registrar 2. Notice Form 24 With Registrar within 15 days from receipt of order Form 24 Notice of Rectification of Register of Members Name of Court Date of order Copy of order of the court Declaration that in pursuant to a. section 154 of the Companies Ordinance; b. order of the Court, rectification in register of members has been made Details of rectification ordered by the Court

Vous aimerez peut-être aussi

- 1040 Exam Prep Module III: Items Excluded from Gross IncomeD'Everand1040 Exam Prep Module III: Items Excluded from Gross IncomeÉvaluation : 1 sur 5 étoiles1/5 (1)

- Banking ProcessDocument17 pagesBanking Processpijej25153Pas encore d'évaluation

- Issue of SharesDocument14 pagesIssue of SharesSenelwa AnayaPas encore d'évaluation

- MSBsDocument435 pagesMSBsSophiePas encore d'évaluation

- Step-By-Step SBLC Transaction ProcedureDocument1 pageStep-By-Step SBLC Transaction ProcedureAmit DasPas encore d'évaluation

- Procedural Checklist For Buyback of Shares by An Unlisted CompanyDocument8 pagesProcedural Checklist For Buyback of Shares by An Unlisted CompanyRamji SukumarPas encore d'évaluation

- Buy Back of SharesDocument32 pagesBuy Back of SharesSiddhant Raj PandeyPas encore d'évaluation

- Sample - Gap Analysis IndonesiaDocument101 pagesSample - Gap Analysis IndonesiapalmkodokPas encore d'évaluation

- Minutes of A MeetingDocument2 pagesMinutes of A MeetingSyed Mujtaba HassanPas encore d'évaluation

- UUbillDocument1 pageUUbillGaby PlayGame0% (1)

- Project Report On Buy - Back of Shares-KhushbuDocument7 pagesProject Report On Buy - Back of Shares-KhushbucahimanianandPas encore d'évaluation

- 18.1. PROSPECTUS, ALLOTMENT EtcDocument7 pages18.1. PROSPECTUS, ALLOTMENT EtcMuzammil LiaquatPas encore d'évaluation

- MBA 3.5-4th-BUSA4140-13Document14 pagesMBA 3.5-4th-BUSA4140-13Bilal AhmadPas encore d'évaluation

- 6 CLSP ProspectusDocument5 pages6 CLSP ProspectusSyed Mujtaba HassanPas encore d'évaluation

- 51 Checklist Buy BackDocument3 pages51 Checklist Buy BackvrkesavanPas encore d'évaluation

- Buy Back of Securities ObjectivesDocument21 pagesBuy Back of Securities ObjectivesArchana KhaprePas encore d'évaluation

- Note On Buy BackDocument6 pagesNote On Buy BacksravyaPas encore d'évaluation

- Allotment of Share & Share WarrentsDocument12 pagesAllotment of Share & Share WarrentsMuhammad RizwanPas encore d'évaluation

- DividendDocument8 pagesDividendMuzammil LiaquatPas encore d'évaluation

- (B) Share Capital of A CompanyDocument34 pages(B) Share Capital of A CompanyGhulam Murtaza KoraiPas encore d'évaluation

- Reduction of Share Capital-Section 66Document10 pagesReduction of Share Capital-Section 66Niraj PandeyPas encore d'évaluation

- General Principles of AllotmentDocument10 pagesGeneral Principles of AllotmentAnonymous uftmOeJxqPas encore d'évaluation

- 2nd Share Capital of A CompanyDocument34 pages2nd Share Capital of A Companywaqasjaved869673Pas encore d'évaluation

- Declaration of DividendsDocument3 pagesDeclaration of DividendsAnubha DwivediPas encore d'évaluation

- Buy-Back Regulations LLM 26122022Document24 pagesBuy-Back Regulations LLM 26122022KavyaPas encore d'évaluation

- Incorporation and Organization CHP5Document11 pagesIncorporation and Organization CHP5Light StormPas encore d'évaluation

- Companies Act 2013Document15 pagesCompanies Act 2013biplav2uPas encore d'évaluation

- CHP 7a Allotment and Buy-BackDocument16 pagesCHP 7a Allotment and Buy-Backmsnethrapal100% (2)

- Company Law 2Document33 pagesCompany Law 2Rubina RubinaPas encore d'évaluation

- Stocks and StockholdersDocument12 pagesStocks and Stockholders123Pas encore d'évaluation

- Complete Procedure of Buyback of SharesDocument4 pagesComplete Procedure of Buyback of SharesMuskan GuptaPas encore d'évaluation

- Report On Capital ReductionDocument4 pagesReport On Capital ReductionManik BansalPas encore d'évaluation

- By Sriram Parthasarathy, Director Prowis Corporate Services Private LTD.Document41 pagesBy Sriram Parthasarathy, Director Prowis Corporate Services Private LTD.riteshsharda767Pas encore d'évaluation

- Bankruptcy Assessment SecondDocument5 pagesBankruptcy Assessment SecondSachin KandloorPas encore d'évaluation

- Declaration and Distribution of Dividends by A Company Under Indian LawDocument8 pagesDeclaration and Distribution of Dividends by A Company Under Indian LawHarimohan NamdevPas encore d'évaluation

- Winding Up of A CompanyDocument22 pagesWinding Up of A CompanyAnant GargPas encore d'évaluation

- Allotment of Shares: Syed Iftikhar-Ul-Hassan ShahDocument17 pagesAllotment of Shares: Syed Iftikhar-Ul-Hassan ShahAyman KhalidPas encore d'évaluation

- Capital Reduction Process and QuestionsDocument8 pagesCapital Reduction Process and QuestionsShital Darak MandhanaPas encore d'évaluation

- Process of Voluntary Liquidation of A CompanyDocument7 pagesProcess of Voluntary Liquidation of A CompanyNeelotpala AlapatiPas encore d'évaluation

- Synopsis-2-Din Sir-Corporate LawDocument8 pagesSynopsis-2-Din Sir-Corporate LawRakib AhmedPas encore d'évaluation

- Concept of DividendDocument26 pagesConcept of DividendAnant GargPas encore d'évaluation

- Final OneDocument12 pagesFinal OneNeha KrishnaniPas encore d'évaluation

- LAW2WEEK5ADocument10 pagesLAW2WEEK5AAaliah Rain EdejerPas encore d'évaluation

- Raising of CapitalDocument40 pagesRaising of CapitalIsh ChitranshiPas encore d'évaluation

- BCOM 204 Advance AccountingDocument269 pagesBCOM 204 Advance AccountingMelody Aludo Borja AgravantePas encore d'évaluation

- Bachelor of Commerce: Company Law-BCOM 402-18 Topic-Share CapitalDocument40 pagesBachelor of Commerce: Company Law-BCOM 402-18 Topic-Share CapitalRubina RubinaPas encore d'évaluation

- Dividend & Accounts of ComplanyDocument38 pagesDividend & Accounts of ComplanySrikant0% (1)

- Corporate Law - Unit 2Document17 pagesCorporate Law - Unit 2Shem W LyngdohPas encore d'évaluation

- PROCESS OF ISSUE OF NCDs ON PRIVATE PLACEMENT BASISDocument7 pagesPROCESS OF ISSUE OF NCDs ON PRIVATE PLACEMENT BASISRachit SharmaPas encore d'évaluation

- Company Law: Methods of Raising CapitalDocument40 pagesCompany Law: Methods of Raising CapitalSamuel DwumfourPas encore d'évaluation

- Buyback of SharesDocument2 pagesBuyback of Sharessauravlex100% (1)

- Advanced Financial Accounting: An Outlook On The Process and The How It Was Implemented byDocument9 pagesAdvanced Financial Accounting: An Outlook On The Process and The How It Was Implemented byNishant AjitsariaPas encore d'évaluation

- Prospectus & Shares & BorrowingsDocument40 pagesProspectus & Shares & Borrowingsmanish_sherPas encore d'évaluation

- Buy Back of SharesDocument75 pagesBuy Back of Sharesdaxa29Pas encore d'évaluation

- Chapter VIII Dividend FinalDocument29 pagesChapter VIII Dividend FinalSriram RamPas encore d'évaluation

- CA Shubham Singhal Chapter 6 - Registration of Charges 1656206682Document7 pagesCA Shubham Singhal Chapter 6 - Registration of Charges 1656206682Priyanshu DewanganPas encore d'évaluation

- How Does A Company Reduce Their Paid-Up Share CapitalDocument4 pagesHow Does A Company Reduce Their Paid-Up Share CapitalFakhrul Azman NawiPas encore d'évaluation

- Allotment of SharesDocument17 pagesAllotment of SharesHimanshu Premani100% (1)

- Law Unit IvDocument86 pagesLaw Unit IvTejus Vinayak MorePas encore d'évaluation

- Class 7 - Corporate InsolvencyDocument18 pagesClass 7 - Corporate InsolvencyDickson Tk Chuma Jr.Pas encore d'évaluation

- Kith and KinDocument4 pagesKith and KinVengai SureshPas encore d'évaluation

- The Following Rules Regarding Allotment of Shares Are NotedDocument3 pagesThe Following Rules Regarding Allotment of Shares Are NotedIshika AroraPas encore d'évaluation

- Process To Issue Shares by Unlisted Public CompanyDocument4 pagesProcess To Issue Shares by Unlisted Public CompanyNavin SuranaPas encore d'évaluation

- Satisfaction ChargesDocument11 pagesSatisfaction Chargesrajesh.dhawan74Pas encore d'évaluation

- SECP Regulations 2000Document3 pagesSECP Regulations 2000Syed Mujtaba HassanPas encore d'évaluation

- SECP (Securities and Exchange Commission of Pakistan) Act 1997Document8 pagesSECP (Securities and Exchange Commission of Pakistan) Act 1997Syed Mujtaba Hassan67% (3)

- Doctrine of Indoor Management & Constructive NoticeDocument2 pagesDoctrine of Indoor Management & Constructive NoticeSyed Mujtaba Hassan80% (5)

- Uniform CostingDocument2 pagesUniform CostingSyed Mujtaba HassanPas encore d'évaluation

- Code of Corporate GovernanceDocument5 pagesCode of Corporate GovernanceSyed Mujtaba HassanPas encore d'évaluation

- Central Depository Act, 1997Document6 pagesCentral Depository Act, 1997Syed Mujtaba Hassan100% (1)

- 11 CLSP Chief Executive & SecretaryDocument4 pages11 CLSP Chief Executive & SecretarySyed Mujtaba HassanPas encore d'évaluation

- 8 CLSP Mortgages and ChargesDocument5 pages8 CLSP Mortgages and ChargesSyed Mujtaba Hassan100% (1)

- 9 CLSP DirectorsDocument9 pages9 CLSP DirectorsSyed Mujtaba HassanPas encore d'évaluation

- Notice of AGM and EOGMDocument3 pagesNotice of AGM and EOGMSyed Mujtaba HassanPas encore d'évaluation

- 10 CLSP Investments and Insider TradingDocument4 pages10 CLSP Investments and Insider TradingSyed Mujtaba HassanPas encore d'évaluation

- 4 CLSP MemorandumDocument6 pages4 CLSP MemorandumSyed Mujtaba HassanPas encore d'évaluation

- 2 CLSP Jurisdiction of CourtDocument1 page2 CLSP Jurisdiction of CourtSyed Mujtaba HassanPas encore d'évaluation

- 3 CLSP Incorporation of CompaniesDocument5 pages3 CLSP Incorporation of CompaniesSyed Mujtaba HassanPas encore d'évaluation

- Single Member Company Rules 2003Document3 pagesSingle Member Company Rules 2003Syed Mujtaba Hassan100% (1)

- 1 CLSP Introduction & DefinitionsDocument5 pages1 CLSP Introduction & DefinitionsSyed Mujtaba HassanPas encore d'évaluation

- 258 Crop Cal. PK SindhDocument2 pages258 Crop Cal. PK SindhSyed Mujtaba Hassan100% (1)

- Factories Act 1934Document25 pagesFactories Act 1934Syed Mujtaba HassanPas encore d'évaluation

- Corporate Finance II Tutorials - Lease - QuestionsDocument2 pagesCorporate Finance II Tutorials - Lease - Questionsngoniwessy0% (1)

- Free Indonesia 4d3n Yogya Solo Tour 010212 310113Document2 pagesFree Indonesia 4d3n Yogya Solo Tour 010212 310113Orangutan SolutionsPas encore d'évaluation

- Customers Perspective On Personal Loans of Icici BankDocument28 pagesCustomers Perspective On Personal Loans of Icici BankAbhi ShekPas encore d'évaluation

- Economics Class 12 Project On Self Help GroupDocument10 pagesEconomics Class 12 Project On Self Help GroupShyam SoniPas encore d'évaluation

- Yngson CaseDocument10 pagesYngson CaseKim EsmeñaPas encore d'évaluation

- COMMISSION ON AUDIT CIRCULAR NO. 90-326 February 22, 1990 TODocument7 pagesCOMMISSION ON AUDIT CIRCULAR NO. 90-326 February 22, 1990 TObolPas encore d'évaluation

- Edexcel IGCSE Accounting AnswersDocument92 pagesEdexcel IGCSE Accounting Answerskwakwa480% (5)

- Warm Greetings From: An ISO 9001:2015 Certified CompanyDocument4 pagesWarm Greetings From: An ISO 9001:2015 Certified Companypunavatbhavesh123Pas encore d'évaluation

- MAT112 - Past Year Bank Discount Promissory NotesDocument5 pagesMAT112 - Past Year Bank Discount Promissory Notesatiqahcantik100% (1)

- NACHA Quick Start GuideDocument3 pagesNACHA Quick Start GuideSaurabh SaxenaPas encore d'évaluation

- Series eDocument34 pagesSeries eYamil EzequielPas encore d'évaluation

- Create ER DiagramsDocument8 pagesCreate ER DiagramsPremPas encore d'évaluation

- Bank Coursework Barclay Case StudyDocument4 pagesBank Coursework Barclay Case Studypriyanka sharmaPas encore d'évaluation

- Icici Subsidiaries Ar 2015 16Document492 pagesIcici Subsidiaries Ar 2015 16RAHIM KHANPas encore d'évaluation

- Indian Overseas Bank PO 2009 Solved Question PaperDocument59 pagesIndian Overseas Bank PO 2009 Solved Question PaperVishesh AgrawalPas encore d'évaluation

- Accounting Acc106Document23 pagesAccounting Acc106zary100% (3)

- Sample Bank Statement TemplateDocument2 pagesSample Bank Statement Templateras rahmaniPas encore d'évaluation

- Department of Labor: ListDocument9 pagesDepartment of Labor: ListUSA_DepartmentOfLaborPas encore d'évaluation

- Internship Report FinalDocument41 pagesInternship Report Finalsohana0% (1)

- Bank - WikipediaDocument38 pagesBank - WikipediaShruthi AmmuPas encore d'évaluation

- Suco BankDocument20 pagesSuco BankRavi Kumar SPPas encore d'évaluation

- Straumann enDocument26 pagesStraumann enyeochunhongPas encore d'évaluation

- Halka Arz Takip ÇizelgesiDocument26 pagesHalka Arz Takip Çizelgesimurat sabanPas encore d'évaluation

- Exim Bank Claim FormDocument9 pagesExim Bank Claim Formmufaddal.pittalwala513Pas encore d'évaluation