Académique Documents

Professionnel Documents

Culture Documents

Due Diligence - Flat/Home Purchases

Transféré par

Paras ShahDescription originale:

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Due Diligence - Flat/Home Purchases

Transféré par

Paras ShahDroits d'auteur :

Formats disponibles

Booking a Flat From a Builder?

Do the Due First

The prospect of owning a house is appealing, but booking a home that is not ready to occupy has its own risks

Abrand new home has its own charm, especially when its price is yet to hit the roof. Many individuals take the risk of booking a flat in an under-construction building mainly for that reason. It not only helps you fulfil the dream of owning a house, but is also cheaper than a readto-occupy flat. But, reports about builders failing to complete the project on time have made many prospective home buyers anxious about booking a flat in an under-construction project. Many also wonder if they should book a property whose final shape is still not known. The biggest advantage of an under-construction flat is a well spread out cash outflow linked to the constructions progress, says Gulam Zia, national director, research & advisory services, Knight Frank India. You can also get the flat customised to your needs. You can also choose the location of the flat, direction and floor when the builder is about to start the project. Locating them is easy, given the large advertisement campaigns that usually accompany a just-launched project and you need not have to go through the brokers. However, it is always better to ponder over few crucial points before booking a flat in an under-construction project. NECESSARY APPROVALS It is in your interest to ensure the project is completed on time. The builder can commence construction only when he has intimation of disapproval (IOD) and commencement certificate (CC) for the project. IOD sets out the conditions based on which the building needs to be constructed. It is usually valid for a year and needs re-validation after that from competent authorities. CC is issued by local authorities, and it allows the builder to start the construction. You should buy an under-construction flat if and only if the builder has a commencement certificate for the floor on which you are booking a flat, says Dhiraj Jain, partner, real estate, SNG & Partners. CLEAR TITLE Due diligence on the title is a must, says Jain. The title ownership right should be clear of encumbrances and litigation. The buyer has the right to verify the title documents. There are instances where the buyer gets into an agreement with the developer to buy a flat and then registers it with the competent authorities. If the developer does not have the ownership of the flat, he cannot transfer its ownership to the new buyer by just registering it. It would make sense to engage a competent lawyer to conduct the title search. Alternatively, you can also apply for a home loan. Home finance companies and banks do the necessary title search and due diligence before approving the loan. Though they charge loan-processing fee, it is worth the buck since it ensures a peaceful possession in future. SAMPLE FLAT Most reputed builders use it as a marketing tool. It is a visual presentation of what the buyer is going to purchase, says Rajev Sharma, country head, wealth management, investing banking and business strategy, Unicon Financial Intermediaries. Sample flats basically serve the purpose of giving the purchaser a sense of space and dimension, he says. A sample flat can give the buyer an indication of what his or her own unit may look like once it is completed, says Mohammed Aslam, COO - residential services, Jones Lang LaSalle India. However, one should ensure that the dimensions and specifications of the purchased unit are the same as those of the

sample flat. It is better to check if the amenities in the sample flats are the same as mentioned in the agreement between you and the builder. There are instances where the builders use chandeliers or costly bathroom fittings to make the sample flat attractive, but such features may not be available in the flat for sale. MORTGAGED PROPERTY Builders borrow from banks and NBFCs and mortgage the project with the bank. While buying an under-construction flat, if you are asked to draw a cheque favouring a specific account of the builder with a specific bank, it is a clear sign that the project is mortgaged with the bank. While buying a flat in such a project, you need to have a no-objection certificate (NoC) from the bank. The NoC must state the details of your flat, such as flat number and building. If the builder cannot repay the funds taken from the bank, the bank can take over the project and ask the buyer to vacate the flat. An NoC will ensure the buyer does not face trouble, as it vacates the banks charge on the flat if the buyer pays the entire price for the property. THE PRICE Many prefer to buy an under-construction flat since the prices are lower when compared with a ready-to-occupy flats. But one should take into account the cost of stamp duty and registration of the property, a one-time expense on electric meter, gas connection, cost of furnishing, fittings and modifications. In large projects and townships, builders charge in advance maintenance deposits for up to five years. The buyer of an under-construction flat has to pay service tax at the rate of 2.38% of the property value. But the levy of service tax has been challenged in court. Hence, builders ask for an escrow fixed deposit with a bank, the proceeds of which will be used to pay the tax if courts decide in favour of service tax. But, some builders prefer to go with an indemnity bond where the buyer takes the responsibility to pay the service tax in future if the courts approve it. One should factor in all such expenses while compare the price of an under-construction flat with that of a finished one. The possibility of a delay in the completion of the project is what makes an under-construction flat cheaper than a finished one. BUILDERS TRACK RECORD A prospective buyer should ascertain the developer's credibility, past projects, and performance and delivery record, says Aslam. It is better to stick with the large players with a good track record as they have better execution abilities and access to resources. Developers handling only project or traders jumping on an upcycle in real estate business are best avoided, as they are the first to get affected in the case of a fall in the real estate market. INVESTORS EXIT If you are an investor in an underconstruction project and intend to sell the flat when the price rises while the project nears completion, it is better to run thorough the terms of the agreement. Builders have been inserting the no-sale clause in sale agreements, which state that the buyers cannot sell the flat only agter a certain period post completion. If you plan to exit before that, you may have to seek an NoC from the builder. The period stipulated in no-sale clause varies from 1.5 years to three years. There is no specific pricing available for an NoC although it ranges between . 100 and . 500 psf, says Sharma. The cost paid to the builder towards the NoC will eat into your profits.

Ankur Lakia Experience

Most important thing to take note of while buying the home : Costs other than quoted per square feet rate. Few of costs like floor rise, parking, stamp duty and registration are fairly well-known. However, I was surprised when asked to pay for value added tax liability and service tax. Since I bought under construction property and with all payments by cheque, I did not have much option but to pay for these costs. These are substantial costs and buyer needs to be aware of these additional costs while budgeting for the property purchase. Biggest advice of caution will you give to new buyers : While buying under construction property, buyer needs to do a thorough due diligence on builders track record on completion of property on time as well as quality of work. It is better to buy from a big name builder like Raheja, Hiranandani, Lokhandwala like (as far as Mumbai is concerned). Even though one might need to pay a bit higher rate, it is worth it as it gives peace of mind when someone accepts all payments by cheques and abide by contractual terms. A good read from Subra on Mumbai vs Navi Mumbai Real estate . One trick/idea which can help new buyers : One thing which helps, is to buy little old / used property, may be 3-5 years old property. 3 to 5 years do not make much difference in usable life of property. However, usually one can get such property at much better rate than normal market price for new property. More important though, buying little old property has several advantages: One gets good idea of available infrastructure like nearby groceries, shops, availability of household help, situation regarding water supply etc which matters more to the lady of the house. One can see whether building is being maintained or not. When I visited a building just two-year old, I was quite surprised to see its shabby look. It turned out that many members of society were quarreling and not paying their dues. One can easily skip such headache if buying slightly old property. You can very well see the neighbours. It might be good idea to just meet them and greet them even if for only little time. It gives good idea on what standard of living is maintained by residents and whether one can easily fit-in. For example, my brother skipped a building which was really well maintained, with quite good location and flat available within budget. Surprised, I asked him the reasons. It turned out that almost every one of the residents was having more than one car in family and holiday trip abroad was fairly common. My brother did not want to be part of such residency as he thought it would not be possible for him to fit in with people having such life styles since he could not afford such life style and, then, he would be odd man out. There are some buildings where there is only one flat occupied on a floor, others being bought by investors. One can avoid possibility of living on a ghost floor by buying little old property.. Any other learning : I am quite amazed by people stretching themselves on floating rate loans while buying property. I think people need to be aware that rates could be headed much higher, and higher enough to make material difference in their EMI obligations. I think there are a lot of people who do not understand risks of floating rate loans or loans with first couple of years of very low-interest rates.

Meena Sivaram Experience

I will definitely give my inputs based on my experience. My advice will be more geared towards those who want to buy a house for the first time for self-occupancy and NOT those looking for immediate gains and make a killing in the real-estate market. I am not the right person to advise those people as there are experts in that area. Here are my 2 cents: Affordability - Do not go for over-priced properties which are beyond your means. Do not be impressed by those fringe attractions that builders dole out to impress the potential buyers like club,

swimming pool, golf course, gyms, landscaping and what notAll these so-called benefits inflate the price of the property. More important than these are the quality of construction and the basic facilities provided by the builder like earthquake-resistance (the richter scale it can withstand), the ratio of super area:built-in area, quality of material used within the apartment, 24 hr backup of electricity etc. If you can manage your cash flow by reducing some other expenses, go for a size which is bigger than required i.e you need 2 BHK for now, go for 3 BHK and so on. Location This is important. I know most people cannot afford to buy a property on a prime locality like South Mumbai or South Delhi but when you are house-hunting in the suburbs, look for the development activities in the surrounding areas. If there are metros, malls, highways, office or commercial and residential building being constructed in the vicinity, such properties have the potential. Choosing a right property in a right location is like picking up a good stock. Buy when prices are low but has a potential to go up in the medium to long-term. Words of Caution to New buyers 1. The land on which the property is being constructed is not under any legal dispute and the papers are clean 2. Make sure the builder has taken all the necessary approvals from the municipal and other bodies required for the construction of property. Any slack here will delay the possession. 3. Previous track record of the builder on the completion of projects on time. Most builders do not adhere to the schedules. Of course such a risk is not there when you are buying an already constructed property but they are more expensive. One last piece of wisdom: Go for your first property when you are around 30 years of age and do not DELAY it. Go for a 15 year loan tenure and aim to repay it within 10 to 11 years. So by the time you are 40-42 years, you are out of the loan liability. CAGR % for Meena house is around 12% and Tenure is 14 Years , She lives in Delhi-Ghaziabad Border .

Wasim Sayyadd Experience

1. After identifying the property, look if the builder has constructed any apartment nearby/surrounding that is already occupied. Go..talk to people find out how genuine this builder is.This gives you a feedback how genuine and chalu the builder is. That way be prepared based on your questionnaire. 2. Read Agreement carefully before signing it. Eventually, in the process of purchasing Flat we built mutual trust and the builder promised me to give parking, but this was not included in my agreement. He called me to sign at registration office without handing over a copy of agreement in advance.(I also didnt question being a good relation) I got the copy after a registration..same day I read carefully all the lines..and noticed parking is not included..called builder he assured to give parking. Am still waiting..as parking is not yet alloted to the Flat owners yet. Ratio of parking available to the owners is less. And I am following it up..to get my part.

Manish Jagtap Experience

I am assuming the target audience to be the end-user who will stay in the house, and not a Real Estate speculator. Put max possible down payment. Otherwise Bank interest over long tenure will eat up all price appreciation of the property.Also do not keep EMI more than 40% of husbands salary. Ladies are most likely to take breaks for kids. Do not consider their income while planning for EMI. If wife continues her job, you can user her money to do partial pre-payments. (Compare different home loans)

Check Builder reputation. Also, if possible go for ready possession. These days builders show some garden, play area in brochure (you consider such things at the time of buying) and later on build something else on that land. You dont want to see a balcony of some other building that the builder pops up on such land, to stare right into your leaving room/bed room.

If possible go for group booking since it gives you a negotiating power. Lots of IT guys do these now a days. Mistake I did was to go for 95% loan even though I had money to pay for the flat. Price appreciation was eaten up by interest on the loan amount. Also, keep in mind the rising cost of children education, your retirement funds.

Robins Experience

I will start from the first step instead of the zeroth. A buyer has an option to choose from a ready-tooccupy apartment or an under-construction project. Ready to Occupy projects are priced much higher as the risk associated is far less. The unit is all ready. An Under Construction on the other hand is cheaper but other than the risk you also have to wait for the unit to be complete. If one has enough fund for the Ready to Occupy option, people prefer it. In our case the Under Construction works better. We did not have enough funds to actually buy a Ready to Occupy unit. A 2 BHK from a reputed builder was priced upward of 50 lakhs, It would have required a loan of more than 40 lakhs. An EMI of 45k per month was in the uncomfortable zone, plus it meant very little monthly savings. Remember we had a car loan too. Under Construction plan has a silent benefit which most people tend to neglect in their calculation. While the project is under construction, we are also drawing our salaries. Since the payments are construction linked, initial EMIs are quite low. This has an advantage. By the time we get the possession of the flat we would have easily saved more than 10 lacs (we are considering 3 yrs time frame), something which would have been difficult in the Ready to Occupy plan.Other than the financial aspect we also have the legal aspect to take care off. The project should be clean and should have all the necessary permissions from various govt. bodies. SBI seems to have the most stringent legal policies. So if a project is rejected by SBI, one should show extra caution. If one is looking for a flat which is Ready to Occupy type, one should consider the second sale option also. This should be used just before the registration in the original owners name. Most of the original buyers are investors, they would like to sell the property before the registration to avoid paying registration fee. Check Your EMI Check more Amazing Calculators

Vikram Experience

Most important thing to take note of while buying the house : The location of the house is quite important. Are their schools nearby if there what are the standards of the school.What are the standards of my neighbors and so on are also. How far are the groceries or provisional stores and other amenities. Biggest advice of caution for new buyers : Look before you leap. Think a million times before you buy a house. Check the EMI and see if you have enough on your hand to survive. If you are on rent and going to pay EMI for an unfinished house, check if whatever you are left with is sufficient for you to lead a decent life. People with kids especially should tirple check before they commit to a 30 or 40 lakh EMI options. The market never remains the same. Have a backup plan just incase you are not able to pay an EMI. Any other learning you want to share : If you are planning to buy a new house by selling an old house, ensure that you have the new house papers in place before you sell your old house. I personally was

affected by this issue or risk or whatever you wanna call it. Dad had a house and it was planned that that house will be sold and we will buy two new flats for me and my sister. The sale of the house happened but we never were able to buy a house because of market boom. It was the worst decision of my life agreeing with the sale but I am repenting for it and the things I have to do get some extra money to buy a house is making me die everyday. With an 8 month old baby now I am really not sure how to make things happen. A single bad decision ruined a lot more than just my finances.

Ashutosh Tewaris Experience

Most important thing to take note of while buying the home : Connectivity and basic infrastructure (grocery stores, road/ rail connectivity, safety) , Consider re-sale property (less than 5 yrs old construction is the ideal bet) as there are several advantages of it : More carpet area: In most of the new construction the super-buildup to carpet area ratio is barely 60 65% Better Infra : Most of the older construction already have shops and amenities established around them Lesser Maintenance : This is fixed monthly outflow that most people dont take into consideration while decision-making. Newer constructions (especially the ones with exotic themes) can have a pretty high Maintenance outflow. There are some in Mumbai, where its as high as 10,000-12,000 per month. Ready to move : You can move into it right away, as against waiting for 2-3 yrs in case of newer construction. If you stay on rent then this can be an important consideration. Biggest advice of caution for new buyers: Before making the buying decision decide on the budget and strictly stick to it.Do not get tempted by up selling. The net EMI outflow should not exceed 35% of your net monthly take home, this will help reduce the stress level substantially. Also set aside a contingency fund which can cover 6-8 months of EMI. Do not get over excited and limit your spend on furnishing and interior designing. This is an emotional decision in which usually tend to go overboard very easily. Also for people living in metros there is a high possibility of their moving to a bigger apartment or a different city, in that case there are things which may not fetch returns while selling.

Sunil Jaiswani Experience

What is the most important thing to take note of while buying the home : Keeping apart the finance / affordability aspect because it has already been discussed, one important aspect while buying a house is the maintenance expenses,basic amenities and cost of living in the area.Not all places have good water / electricity availability + distance from workplace. Biggest advice of caution will you give to new buyers : To be very careful of the person you are dealing with in case of non branded flats/homes because a new buyer can easily be caught in the nexus of land mafia which are obviously gundas and if something or the other goes wrong you cannot do a thing about it.In small towns we even have instances of some properties being sold multiple times and also illegal land grabs/kabjas. I was lucky enough to escape such a condition but only after facing a lot. One trick/idea which if implemented properly can save some good money : New to this process but if you plan to sell the investment flats or homes in some short time you can save the registration money by holding a POA ( power of attorney ) in your name and save the investment on registration.Later when you sell you can directly transfer the registry to buyer saving you a good amount. + in case of small town purchases more u bargain ( and more the upfront money ) more the price reduces.

Other learning : Other than flats /duplex which yield a return of 12-15% CAGR the land prices in tier 2 and tier 3 cities offer much higher and brisk return sometimes.Thus if you are looking to invest irrespective the location , small cities are a good option to consider.Moreover having been to all major cities and small towns , trust me that living conditions and resources are still much better in small towns with respect to electricity , basic cost of living , proper water and food availability.

Raja Pandas Experience

1. Check out the individual flat plan and match it with the actual size of the flat. Take extra care to match(measure) the size of balconies. This is where most of the builder do plan violation by increasing the size of balconies to get extra money. Thats because the expenditure on the balcony for construction is the least but the customer pays the price as part of the Super Built Up Area. 2. Again measure the exact size(carpet area) of the flat. Most of the customer take the word of builder as sacrosanct when it comes to stated size of flat, but on calculation one can many times find a 2-5% shortfall. Remember that can mean a difference of 80k to 2 lac rupee difference in a 40 lac flat. Now you get it! right ? 3. Check out your undivided share of land. Very simply put an unit of undivided share of land equals (total super built area of all flats in the complex)/(total size of land for the complex). So, to reach at the undivided share of land alloted for your flat it should be (your super built up area) * (the unit calculated above). Lot of times this is overstated by builder to attract customers. But remember, if there is a natural calamity like earthquake,fire etc and the building gets destroyed its only the undivided share of land which you really own. Dont leave it for later. Builder which do not allot undivided share of land to buyers are a strict no-no (yes there are such builders). 4. For under construction flats its very common for the builder to give possession of the flat once its occupation ready. But the amenities (if any) are given after long gap and hassles. My suggestion would be simply hold the money for the amenities part until its really completed. 5. For ready to occupy buildings insist on occupancy letter which is issued by the authorities. This ensures the plan violations has been checked and regularized by authrities when the consturction got over and its really ready to occupy.

My Comments

First thing I would say is dont rush, learn about things, buying a house is one of the biggest decision (atleast financial) you will make in your life and you will commit your lifetime of cash flows in it. Planning things well in advance and doing your investigation will lead to smoother and successful execution. Your chances of making wrong purchase or a bad purchase will be minimized if you take time and do your investigation well enough. Just for an example , You buy a house , you do your basic investigation and the house was available at very very attractive price, and gives you a hope of making 100% profit in 2-3 yrs and suppose later you come to know that everything was fine, however the consturction quality is not that great and have beeen compromised. You really dont want to get into that situation because first point is that if its your first home , you probably be planning to get settled there and wont move out once you are in your comfort zone and once things settle down like your office is very near , your children schools are there and you feel good there. Every decision you take is your decision. Just like Wasim Sayyadd (One of the above), we Indians are emotional, we shy away from talking direct and think too much about feelings, relations and how others will think? We make oral promises and also rely on them many times. There is nothing wrong in asking straight questions and questioning each and every step when you buy anything, because Damn! , its my money and its me who will suffer if things go wrong . So make sure you go through a

detailed chechlist because you buy a house or any other real estate property . Here are some from my side. 1. Patta Verification 2. Guideline Value 3. Demand at least EC for minimum 15 years 4. Check the Property Tax recipt till date & name 5. if the Seller is a power Agent check weather he has all the rights to sell the property 6. Check that the plot is approved by Panchayats/CMDA/DTCP/MMDA 7. Check that the property belongs to which zone (Resi/Agri/Comm/Aquifier/NonResi/industrial/Special) 8. Check that the property had undergone any hier purchase, mortgage, loan, if so NOC from the concern department 9. Check that the plot can be approved for residential purpose in case of unapproved 10. Verify the documents with a legal Advocate 11. Check the documents with a Banker for Loan Possibility (without patta & Approval loan is not possible) 12. Dont agree for any Oral Agreement , Never ! 13. Check that the Layout has been alloted OSR Area ( temple, school, park, shop ) or else the owner has to pay 10% of the land value to the Government for approval. Only if the layout exceeds 3000sqm,32258sqft,74Cents . 14. Insure that the Plot is minimum 500 meter away from National Highway, Sewage Cannal, Sea Shore, River, Pond, Lakes, Dam, Airport, Busstand, Railwaystation, Nuculear Power Station, industries. 15. The Registeration Stamp Duty charge will be 8% of land value and 1% as Registeration fees and Misc Charge extra 16. The Road Width defines the no of floor you can build, in case there is Airport near by you can get only G+1 permit 17. The Zone type and the Road Width defines how much area you can build, in case Aquafier Recharge Zone you can get only 0.8 FSI wherels in residential Zone you get 1.5 FSI 18. Check the frontage length of the plot. 19. Check the type of ground soil. 20. Check the type of ground water. 21. In case of corner plot check the shortage area 22. Check the roadlevel height and rain water stagnating 23. Check for Vastu ( it will be better if it is east faceing and rectangle in shape ) , if you believe in it . 24. Check weather Drainage faculty is there. 25. Have a detail conversation with the landowners near by and always have touch with them 26. It is Mandatory to have the complete details of the property seller including his photograph. 27. If the plot is near by Burial Ground the value will get low. 28. Other Essential Facility Nearby & Need to Know are Schools , Collages , Busstand , Railway Station , Ration shop etc. Understand that you need all these for next many decades , so are they 2-3 Km away or 10 Km away can become one of the biggest deciding factors 29. Make sure you have address and phone numbers of all the relevent and concerned offices like Panchayats Office , V.O Office, R.I Office, Tahsildar office , Register Office,EB Office , Court , Police Station, Post Office

Carpet Area means the net usable floor area within a building excluding that covered by the walls or any other area specially exempted from Floor space index computation in these regulations [Reg 2(15) of DCR for greater Bombay 1991] Built up Area ? Built up area means the area covered by a building on all floors including cantilevered portion, if any , but excepting the areas excluded specially under these regulations [ Reg 2(13) of DCR for greater Bombay 1991] What Is FSI ? FSI Floor Space Index In Respect Of A Plot Of Land It Denotes The Square Meter Area Which Can Be Constructed Upon That Plot Of Land. It Is The Ratio Of The Combined Gross Floor Area Of The Entire Building To The Total Area Of The Plot On Which Its Stands It Is To Be Noted That FSI In Respect Of The Plot Varies Depending Upon The Location And The User Zone Of The Plot. As Per Regulation 15.2.1(C) Of The Development Control Regulations For Mumbai Metropolitan Region, 1999, Floor Space Index Means The Ratio Of The Combined gross Floor Area Of All Floors To The Gross Area Of The Plot, Viz.: Total Covered Area On All Floors/ Gross Plot Area = Floor Space Index Thus, Based On The Permissible FSI, Some Additional Square Feet Of Construction Is Allowed On Each Plot Of Land OC Occupation certificate? OC Occupancy Certificate is a very important document. It evidences the completion of the building as per the approved plan and compliance of local laws. Local bodies like city corporations / city municipalities issue occupancy certificates. Without the occupancy certificate, it is difficult to get the water and sanitary connection. Financial institutions insist on occupancy certificate to sanction loans.This is given by the BMC IOD? IOD means Intimation of disapproval. It is issued when a builder applies for permission of redevelopment of a building and it contains a list of conditions which must be complied with before commencing redevelopment Development Agreement? Development Agreement means the final agreement signed by the society with the developers containing all the terms and conditions for redevelopment scheme before handling over the existing building to the builder for demolition

Realty Terminologies Area (Carpet/Built-up/Super Built-up) Carpet area is the floor area/space of the property/flat which is actually useable or functional and does not include the walls.(can be measured physically) Built-up area is carpet area plus the inside walls and peripheral/outer walls of the flat/property.Super Built-up area is built-up plus the common area building/society/complex like lobby, stairs, lifts, compound ground, etc.

of

the

FSI/FAR (floor space index/floor area ratio) It is the ratio of total built-up area of the building/complex to total area of the plot on which it is built.It is approved by the planning authority like Town planner, BMC. TDR (Transferable Development Rights) It is equivalent awarded FSI (instead of monetary compensation) to the owner for surrendering his land which is been marked by Planning Authority like BMC, others for developmental purpose.This TDR can be utilized by himself or transfer/sold in the market. It can be used as FSI to construct additional floor space over and above the existing FSI (maximum limit 2) & only north of the land (Mumbai). Approved plan This is architectural plan of the proposed building/structure which is authenticated / approved by the planning authority like BMC, with accordance of developmental regulations & conditions. IOD (Intimation of Disapproval) This is communication/intimation from the authorities to the developer of the plan submitted & correction / rectification recommended. CC (Certificate of Commencement) This is to certify the commencement of the construction of the building. It is important document for clients booking flats/apartments under construction. OC (Occupation Certify) This is to certify that the construction of the structure/building is complete according to the approved plan & fit to be occupied by the respective / prospective owners. Title It is an abstract term frequently used to link an individual or entity who owns property to the property itself. When a person has title, he is said to have all the elements, including the documents, records, and acts, that proves his/her ownership. Title establishes the quantity of rights in real estate being conveyed from seller to buyer. Title certificate The statement or certificate stating the title of the said land/property is held by the current owner legally. Title search It is the search carried out by the lawyer/solicitor to ascertain and know the legal owner/heir of the land/property going back to the desired time say 10/15/20..50 years to present one. Title insurance An insurance policy indemnifying against the loss due to title imperfections, purchased usually by the buyer. 7/12 Extract (Utara) It is a revenue document of ownership mainly for agricultural and rural lands issued by Talathi of the respective village. It has name of the owner, description of property i.e; Survey No. & Hissa No.; area of the plot and Mutation entry Nos., of any encumbrances by way of loan, charge, protected tenant, etc, and the tenure of land. This document is always available in local language of the state. It is valid for 6 months duration from the date of issue.

6/12 Extract (Utara) It is a revenue document of the agricultural and rural lands showing details of mutations entries like charges or encumbrances of any nature i.e; transfer, assignment, partition, mortgage etc., popularly known as Pherfar Patrak in Maharashtra. It is valid for 6 months duration from the date of issue. Encumbrance Any restrictions that affects/limits the title of a property like mortgages, leases, easements, others. Property Registered Card This is a revenue document like 7/12 extract but issued by City Survey Officer of respective zone, showing ownership, description of property i.e; Survey No. & Hissa No., area of plot in figures & words; and Mutations entry like way of loan, charge, long term lease and others. It is valid for one year from the date of issue. City Survey Plan This is a plan issued by City Survey Office with survey no., showing the boundaries of the plot and existing structures if any relation if any thereon. The Officer on request can carry out survey and demarcate the boundaries of the plot and issue plan of demarcation to the applicant. Non- Agricultural Permission (N.A Permission) This is the permission issued by the District Collector, when the nature of land is changed from agricultural to non-agricultural land for purpose of residence, commercial, and industrial use / development. This is issued within a period of 30 days and pay the conversion charges & NA assessment taxes to the offices of the Tahasildar concern. Agreement to Sale This is a instrument or document executed duly between the Vendor (Seller) and the Purchaser wherein the property mentioned is to be sold by Seller and purchased by Purchaser and described in details like Survey No., C.T.S. No., etc and area of property with terms, conditions and convenants agreed upon like specifications of construction, scheduled of property giving description, location and area of property; list of amenities, facilities and others. It should have the total compensation sum in figures and words with the duration period. It should have a part payment receipt form the Purchaser. Sale Deed This is a document/ instrument/agreement between Vendor (Seller) and Purchaser wherein the property scheduled is sold by the Vendor and purchased by Purchaser described in details like Survey No., C.T.S. No., etc and area of property with terms, conditions and convenants agreed upon like specifications of construction, scheduled of property giving description, location and area of property; list of amenities, facilities and others. It should have the receipt from the Purchaser of the payment or compensation done in exchange of transfer of titles & rights with possession of the property. Conveyance The process of transfer of the title of the property from one party to another. Leave & License agreement This is short term agreement not more than 9 years between Licensor (Owner of the property) and Licensee (prospective user of the property) with terms and conditions described in details with monthly compensation mentioned. It should have the receipt of deposit amount paid by Licensee to Licensor as the form of security. Lease Deed This is the long term agreement between Lessor (Owner of the property) and Lessee (prospective user of property) with terms and conditions mentioned generally for more than 9 years, varies from 30 years to 99 years; with description of monthly/yearly lease or compensation along with the premium payable by lessee to the lessor. Freehold property This is the property like plot or land belonging to owner himself/herself/themselves not leased out to any other party for long term.

Lease hold property This is the property like plot or land belonging to the lessee (user) who has obtained the rights to use the property from the lessor (owner) and transfer these rights to new or prospective user. Earnest money Token / advance money given by the purchaser to seller as a gesture for not entering with any other party for the sale of the desired property. Power of attorney (PoA) It is a written instrument empowering a specified person to act for and in the name of a person executing it. In other words, a power of attorney is an authorization to act on someone elses behalf in a legal or business matter. (For details see Knowledge Series) Columns & Beams Columns are vertical pillars & beams are horizontal structure made of RCC(Reinforced cement concrete) which supports the entire building. They form skeleton of the building/structure. They should not be altered under any circumstances. Slabs They are flat horizontal platforms which forms the flooring/ceiling of the flat/apartment. Shear walls They are load carrying walls (extended columns) of RCC without any beam. They give stability to the structure/building as well as visually esthetic. Appraisal & Valuation (Real Estate) An appraisal is estimation of value of the property. The appraisal process involves some steps which are as follow Physical & legal identification Identify the property rights like ownership, leased, others. Purpose/Aim of appraisal like mortgage, property insurance, others. Specific date of the valuation as market conditions keeps changing. Accumulating & analyzing data from the market. Valuation of property by different methods. Valuation is actually calculating the value for the property (more information refer knowledge series) Adjudication Adjudication is a procedure done by the stamp duty department to determine the market value of the property on payment of nominal fees by the applicant. Applicants have to submit certain basic data of the property as well as all the factors affecting the valuation of the property. Stamp duty It is the tax paid to the revenue department of state government on documents or instruments under the Bombay Stamp Act, 1958 (real estate) & Indian Stamp Act, 1899. It is usually paid by the buyer unless it is agreed any other way. It is paid as per market value assessed by the Registrar/Sub-registrar Office. The assessment value and amount can be obtained from the Stamp duty Ready Reckoner published by the same department annually. Registration The agreement on which stamp duty is paid should be registered with Registrar/Sub-registrar of the state department as it forms record with the government. The charges for the same are 1% or Rs.30000/- whichever is less. Special Economic Zone (SEZ) is a geographical region that has economic laws different from a countrys typical economic laws. The goal of it is to increase foreign investment, improve infrastructure with the advantage of tax benefits. (refer knowledge series). Coastal regulation zone

In general the land between low tide line and high tide line is the coastal Regulation Zone. For regulating developmental activities, the coastal stretches within 500 meters of HTL (High Tide Line) on the land ward side are classified into the following different categories of coastal regulation zones (CRZ) four categories. Property Assessment Tax (municipal tax) It is revenue earned half yearly or annually by Civic authority for the services being rendered to public viz; water, sewerage, education, streets maintenances, others which is based on Ratable Value decided by the assessment department published periodically. Society Share Certificate It is the certificate issued by the Co- operative Society Ltd of the flat, unit, plot, tenants or housing board owners to the respective owner stating the ownership in the form of numbers of shares & Share Certificate No.

How is saleable area calculated? What is super builtup area?

You have come to a very important page of www.nripro.com. There are two main reasons why it is absolutely important for buyers to understand areas and methods used to calculate saleable areas: (a) Different interpretations of areas and different methods used for calculation of saleable area can have more than 20% variation in total price tag and (b) Actual area that you get directly depends on how saleable area is calculated.

After you are done reading this page, we strongly recommend you read another related page at this link on our website that shows actual examples of typical construction cost in Pune, and how much money builders make. Carpet Area: Area between the walls. Carpet area must have permanent roof (slab) over it, at normal height. Owner must get exclusive rights to use and resell the carpet area. Carpet area is calculated by multiplying dimension of room, i.e. length x width. Total carpet area is calculated by adding carpet areas of all rooms. Generally, in addition to all the rooms, varandas, passages, area inside the main door (if not included in living room dimension), balconies are included in carpet area. FSI is applicable to carpet area. Depending upon builder practice, carpet area may be 50% to 70% of of saleable area. It is always good to find ratio of carpet area to the saleable area, higher the ratio, better it is. This is just to give you idea of what you actually can use, in practice it is in interest of the buyers to find out what is carpet area and then apply loading factor on it (and not do the other way, i.e. should not arrive at carpet by applying loading factor to saleable area. The example below will illustrate trick used by builders/developers, when they say you can find carpet area by applying loading factor on the saleable area. Saleable Area: 1200 sq ft Loading Factor: 25% (or 1.25) Wrong Method (favours seller): Carpet Area: 1200 x (100-25)% = 1200 x 75% = 900 sq ft If you apply 1.25 or 25% loading, saleable area should be 900 sq ft + 900 x 25% = 1125 sq ft As you can see under this method builder is charging you for 1200 - 1125 = 75 sq ft more Right Method (favours buyer): Find carpet area first by measuring actual dimensions, and then apply loading factor Saleable area = 900 sq ft + 900 x 25% = 1125 sq ft Terrace: Open area without roof, attached to the main unit that buyer gets exclusive rights to use and resell (with the main unit). Open areas with slab at least double the height of the floor are also considered terrace area. FSI is not applicable to terrace areas. Balcony: Open area with roof (slab at floor height), attached to the main unit that buyer has exclusive rights to use and resell (with the main unit). Generally balcony area is added to total carpet area. FSI is applicable to balconies.

Dry terrace or dry balcony: Area meant to dry clothes that buyer has exclusive rights to use and resell (with main unit). If it has roof (slab) at normal height, it should be treated as balcony. If it does not have roof (slab) at normal height, it should be treated as terrace. Builtup Area: Carpet Area + area occupied by walls, doors of the unit. Generally builtup area is not calculated separately, it is included into the loading factor. Loading factor or loading or load: Loading factor is a number used for purpose of arriving at saleable area. It is used to add constructed space not exclusively allocated to the buyer. Such area generally includes shared areas such as lift/elevator area, staircases, clubhouse, gymnasium, amenities area, etc. Loading factor 1.25 indicates that developer/builder is applying 25% on the carpet area. Some builders, in addition to carpet area, include terrace and balcony areas while applying the loading factor. If the project does not have lot of amenities, the loading factor should be small. In most cases loading factor of 1.3 is more than sufficient. Loading factor also includes parking space (irrespective of it is covered, open, stilt, sold separately or not). Superbuiltup Area: Carpet area + terrace + balconies + areas occupied by walls + area occupied by common/shared construction (e.g. lift, stairs, club house, etc). Generally builders use loading factor on carpet area to arrive at superbuiltup area. For example, if carpet area is 500, and loading factor is 1.3, then superbuiltup area is 500 x 1.5 = 750. Usable Area: This is relatively new term. Technically there is no difference between Usable Area and Superbuiltup Area. Some builders use this term to justify higher loading factor, typically in Mumbai where land cost is extremely high. Saleable Area: Generally superbuiltup area is saleable area. FSI: Floor Space Index. This is ratio of land to carpet area. Generally it is 1 for residential plots (much less for agricultural land) For example, if FSI is 1, and land area is 3000 sq ft, then total carpet area on that land cannot exceed 3000 x 1 = 3000 sq ft. It should be noted that FSI is not applicable to terraces, balconies. Also, this definition is provided for your information, enforcement of FSI is taken care of by local authorities, and buyer should not worry about it (unless there are allegations against the builder of misusing FSI). Methods used to calculate saleable area Builders apply different models to arrive at saleable area. The methods used by builder can result into as high as 20% to 25% increase in the effective rate. We will try to explain different methods (not all of them) used by developers/builders and their relative impact on saleable area, total price, and ratio of carpet to saleable area. In the example below, it is assumed that the rate is Rs. 4000 per sq. ft, loading factor is 1.3, and it is a 1BHK unit with the following dimensions:

Room or area

Dimensions (ft)

Area (sq ft)

Kitchen

8 x 10

80

Living room

10 x 15

150

Bathroom

4x7

28

Bedroom

12 x 10

120

Total Carpet Area (C)

402

Dry terrace

4x8

32

Terrace

10 x 13

130

Total terrace area (T)

162

The table below lists different methods/ variations (certainly not all the variations) of arriving at the saleable area. Please note effect of each variation on saleable area, total price, carpet to saleable area ratio, and effective carpet rate. Please also note that calculations done manually don't match 100% with calculations done by builders/architects because they use CAD software. However the difference in two method should not be more than +/- 3%. Because of different methods and variations, it is difficult to "reverse engineer" and find out what method builder has used. It will be good to find out from the builder if terraces/balconies are charged at 50% of 100%, and is loading factor applied on those, and what is the loading factor. Most builders don't answer these questions in written material, and may not even bother to answer even if you ask. In that case only option for you is try different variations as given below and "figure out".

Method #

Carpet charged at

Load applied to carpet?

Terrace charged at

Load applied to terrace?

Calculating saleable area

Saleable area (sq ft)

Total price, Rs., (rate x saleable area)

Carpet to saleable area ratio

Effective carpet rate, Rs., (Total price/C)

100%

Yes

33%

No

(C x 1.3) + (T x 33%)

576.06

23,04,240

69.78%

5,732

100%

Yes

50%

No

(C x 1.3) + (T x 50%)

603.6

24,14,400

66.60%

6,006

100%

Yes

50%

Yes

(C x 1.3) + (T x 50% x 1.3)

627.9

25,11,600

64.02%

6,248

100%

Yes

100%

No

(C x 1.3) + T

684.6

27,38,400

58.72%

6,812

100%

Yes

100%

Yes

(C + T) 1.3

733.2

29,32,800

54.83%

7,296

Method #1 in above table is legal method (because it charges terrace at 33% of the area, that is maximum allowed for terrace). Method #2 is widely used method. Summary a) Bigger saleable area does not mean bigger carpet area b) Lower rate does not mean good deal because it can result into higher effective rate because of loading factor, and the way terraces are charged (at 50% or 100% or at some other %), and if loading factor is applied on top of terraces c) Method used by builder can cause a big swing in the total price as demonstrated in the example above d) Lower loading % does not necessarily mean it is better deal, one needs to look into how it is applied on terraces, gardens and other areas that are not included in FSI e) Per square foot rate is meaningless and misleading if not looked in light of the other factors that influence saleable area

Vous aimerez peut-être aussi

- US vs. Toribio PDFDocument3 pagesUS vs. Toribio PDFAntonio RebosaPas encore d'évaluation

- Punjab National Bank Vs Mithilanchal Industries PvGJ202001092015405363COM765549Document18 pagesPunjab National Bank Vs Mithilanchal Industries PvGJ202001092015405363COM765549Sakshi ShettyPas encore d'évaluation

- Sale Agreement of Immovable Property For Rs.Document6 pagesSale Agreement of Immovable Property For Rs.Anjanikumar BojjanapalliPas encore d'évaluation

- General Power of Attorney Indian Bank NewDocument3 pagesGeneral Power of Attorney Indian Bank NewIb SulochanaPas encore d'évaluation

- Project Yukon - International Prospectus FINAL With F-PagesDocument344 pagesProject Yukon - International Prospectus FINAL With F-PagesMadhurPas encore d'évaluation

- Firstpost Homes LTD V JohnsonDocument2 pagesFirstpost Homes LTD V JohnsonKahmun HorPas encore d'évaluation

- Building Redevelopment Referencer: Written / Compiled byDocument135 pagesBuilding Redevelopment Referencer: Written / Compiled byMayur Masane100% (1)

- Acquisition of Land Ownership in CambodiaDocument16 pagesAcquisition of Land Ownership in Cambodiaរ័ត្នវិសាល (Rathvisal)100% (3)

- Draft Lease AgreementDocument17 pagesDraft Lease AgreementAbhishekPas encore d'évaluation

- Justice Ramesh D Dhanuka Judge Bombay High Court 1680326277Document103 pagesJustice Ramesh D Dhanuka Judge Bombay High Court 1680326277sangeetha ramPas encore d'évaluation

- Continue: Lease Agreement Format in Tamil PDFDocument2 pagesContinue: Lease Agreement Format in Tamil PDFAlbert vivekPas encore d'évaluation

- A Pocket Guide To Lease TransactionsDocument10 pagesA Pocket Guide To Lease TransactionsBrandon GracePas encore d'évaluation

- Agreement For Sale-FlatDocument15 pagesAgreement For Sale-FlatIX17-41 Suvayu ChatterjeePas encore d'évaluation

- T30 - RespondentDocument17 pagesT30 - Respondentdiwakar0% (1)

- Extraordinary Gazette - Toll Charges For New Extension of Southern ExpresswayDocument8 pagesExtraordinary Gazette - Toll Charges For New Extension of Southern ExpresswayAda DeranaPas encore d'évaluation

- 22082022022255RFP WSA Brown 10th MP RFPDocument76 pages22082022022255RFP WSA Brown 10th MP RFPMS KPas encore d'évaluation

- Agreement To SellDocument5 pagesAgreement To Sellabhinandan khanduriPas encore d'évaluation

- Civ2 (Sale, Lease, Agency Notes)Document67 pagesCiv2 (Sale, Lease, Agency Notes)bile_driven_opusPas encore d'évaluation

- Banks Ratio AnalysisDocument22 pagesBanks Ratio AnalysisKiran PoudelPas encore d'évaluation

- (I) Business Plan TAADocument21 pages(I) Business Plan TAAAmirah HudaPas encore d'évaluation

- Fee Letter - 1005Document1 pageFee Letter - 1005Manoj KumarPas encore d'évaluation

- Irrevocable Consent For Re Development1Document4 pagesIrrevocable Consent For Re Development1Prime NinePas encore d'évaluation

- Consumer Protection ActDocument31 pagesConsumer Protection ActHaresh kPas encore d'évaluation

- RENTALAGREEMENT M. Thinaharan M6Document3 pagesRENTALAGREEMENT M. Thinaharan M6Jaykay2212Pas encore d'évaluation

- Deed of Settlement & DeclarationDocument5 pagesDeed of Settlement & Declarationadvocateshailendra1Pas encore d'évaluation

- Mr. Narinder Arora Vs Altus Space Builders Private ... On 25 March, 2019Document18 pagesMr. Narinder Arora Vs Altus Space Builders Private ... On 25 March, 2019Monica ChandrashekharPas encore d'évaluation

- TM LIcense Agreement 2Document4 pagesTM LIcense Agreement 2Chandana SurthiPas encore d'évaluation

- Balaji Entersises CommercialDocument20 pagesBalaji Entersises CommercialVrinda Goyal100% (1)

- Application Form For Introduction of AFD-I Category ItemsDocument7 pagesApplication Form For Introduction of AFD-I Category ItemssukritgoelPas encore d'évaluation

- Draft Petition at Chopda CourtDocument44 pagesDraft Petition at Chopda CourtVivek AgarwalPas encore d'évaluation

- Draft of Simple Mortgage DeedDocument3 pagesDraft of Simple Mortgage DeedDaniyal Siraj100% (1)

- Commercial CourtsDocument23 pagesCommercial CourtsSatyam SinghPas encore d'évaluation

- Marketing Services Agreement NeutropathDocument3 pagesMarketing Services Agreement NeutropathDemystifyPas encore d'évaluation

- DownloadDocument5 pagesDownloadRISHABHPas encore d'évaluation

- IBC PresentationDocument26 pagesIBC PresentationAbhishek Nath TripathiPas encore d'évaluation

- Difference Between LLP and CompanyDocument6 pagesDifference Between LLP and CompanycaharshPas encore d'évaluation

- Before The Hon'ble District Consumer Dispute Redressal Forum, AmritsarDocument11 pagesBefore The Hon'ble District Consumer Dispute Redressal Forum, Amritsarvidit mongaPas encore d'évaluation

- Sample Sale DeedDocument11 pagesSample Sale DeedAdityaPas encore d'évaluation

- Municipal Law MootDocument24 pagesMunicipal Law MootdiwakarPas encore d'évaluation

- Agreement of Sale - KittuDocument5 pagesAgreement of Sale - KittuSitaram PREDCRPas encore d'évaluation

- Bitcoin in India: Akshaya Tamradaman, Sangeeta NagpureDocument3 pagesBitcoin in India: Akshaya Tamradaman, Sangeeta NagpureMaruko ChanPas encore d'évaluation

- Important QueStion ListDocument10 pagesImportant QueStion ListrafiinamdargPas encore d'évaluation

- Annx-1 Colly - 30-03-2015Document320 pagesAnnx-1 Colly - 30-03-2015Neeraj JhaPas encore d'évaluation

- Premarket CurrencyDaily ICICI 15.12.16Document4 pagesPremarket CurrencyDaily ICICI 15.12.16Rajasekhar Reddy AnekalluPas encore d'évaluation

- Complaint Format 1Document23 pagesComplaint Format 1Akanksha RamakrishnaPas encore d'évaluation

- Eminence Capital & Fincorp Web Page ContentDocument37 pagesEminence Capital & Fincorp Web Page ContentChinmaya DasPas encore d'évaluation

- Sales - Lease ReviewerDocument11 pagesSales - Lease ReviewerDana Jeuzel MarcosPas encore d'évaluation

- of Nbfc'sDocument56 pagesof Nbfc'sChanakya Khandelwal100% (2)

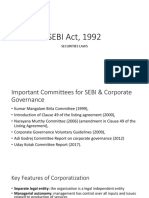

- SEBI Act, 1992: Securities LawsDocument25 pagesSEBI Act, 1992: Securities LawsAlok KumarPas encore d'évaluation

- Bombay Land Revenue CodeDocument378 pagesBombay Land Revenue CodeUmesh Hb100% (3)

- Rule 481 of Bihar Prison ManualDocument5 pagesRule 481 of Bihar Prison ManualMD AATIF IQBALPas encore d'évaluation

- FTPrep Exam 1Document27 pagesFTPrep Exam 1Motion ParallaxPas encore d'évaluation

- Wechat Pay and Alipay - Aub FormDocument5 pagesWechat Pay and Alipay - Aub FormMark Byncent Mejorada BayugaPas encore d'évaluation

- Release DeedDocument5 pagesRelease DeedSitaram PREDCRPas encore d'évaluation

- UntitledDocument38 pagesUntitledknowledge cityPas encore d'évaluation

- Economic Substance NotificationDocument4 pagesEconomic Substance NotificationUsmän MïrżäPas encore d'évaluation

- Land & Real Estate LawsDocument57 pagesLand & Real Estate LawsMadhavPas encore d'évaluation

- NEATDocument24 pagesNEATharikrishnaPas encore d'évaluation

- Agreement For Sale: Two Thousand and Eighteen (2018)Document18 pagesAgreement For Sale: Two Thousand and Eighteen (2018)Monika MukherjeePas encore d'évaluation

- Spl. Suit RastogiDocument30 pagesSpl. Suit RastogiAnagha PowalePas encore d'évaluation

- Case Study On Salomon V SalomonDocument15 pagesCase Study On Salomon V SalomonSHEKHAR SUMITPas encore d'évaluation

- Gain From New Housing Players: EstateDocument1 pageGain From New Housing Players: EstatekrjuluPas encore d'évaluation

- FAQ On FDIDocument14 pagesFAQ On FDIParas ShahPas encore d'évaluation

- Paras Shah ProfileDocument2 pagesParas Shah ProfileParas ShahPas encore d'évaluation

- 15 G Form (Pre-Filled)Document2 pages15 G Form (Pre-Filled)Palaniappan Meyyappan83% (6)

- PAN Change Request FormDocument6 pagesPAN Change Request FormAlok ShahPas encore d'évaluation

- Form 49 AADocument8 pagesForm 49 AASunil KumarPas encore d'évaluation

- New Pan Card Form 49aDocument7 pagesNew Pan Card Form 49aParas ShahPas encore d'évaluation

- TDS Rate Chart Financial Year 2012-13Document3 pagesTDS Rate Chart Financial Year 2012-13jeet2211Pas encore d'évaluation

- Bhiwandi - Diva - Vasai Train Time TableDocument1 pageBhiwandi - Diva - Vasai Train Time TableParas Shah78% (9)

- Profession Tax Registration ProcedureDocument9 pagesProfession Tax Registration ProcedureParas ShahPas encore d'évaluation

- 46 46 Sample First Board Meeting MinutesDocument4 pages46 46 Sample First Board Meeting MinutesDeepak Sharma0% (1)

- Marketing TipsDocument6 pagesMarketing TipsParas ShahPas encore d'évaluation

- Revised SCH VIDocument8 pagesRevised SCH VIParas ShahPas encore d'évaluation

- Communities Cagayan Inc. v. Sps. NanolDocument2 pagesCommunities Cagayan Inc. v. Sps. NanolIvy Clarize Amisola BernardezPas encore d'évaluation

- Ict 039Document29 pagesIct 039Christian Jake TabangcuraPas encore d'évaluation

- Chavez Vs Public Estates AuthorityDocument104 pagesChavez Vs Public Estates AuthorityNelia Mae S. VillenaPas encore d'évaluation

- Government v. El HogarDocument10 pagesGovernment v. El Hogarvictoria4391tiangco100% (1)

- Class Notes: Set 1: Brief Overview of Finance BasicsDocument34 pagesClass Notes: Set 1: Brief Overview of Finance BasicsMuhammad Ikhlaq Ahmed KalrooPas encore d'évaluation

- Real Estate Manager Brian Brodeur ResponsesDocument2 pagesReal Estate Manager Brian Brodeur ResponsesWPXI Staff100% (1)

- Property TranscriptDocument9 pagesProperty TranscriptJámie LatPas encore d'évaluation

- Ra 7279 - Lina Law (Udha) Urban Development and Housing ActDocument2 pagesRa 7279 - Lina Law (Udha) Urban Development and Housing ActJoan Marie Uy-QuiambaoPas encore d'évaluation

- Malayan Insurance Company Inc., v. St. Francis Square Realty CorpDocument22 pagesMalayan Insurance Company Inc., v. St. Francis Square Realty CorpDavid Sim Christopher Tampus100% (1)

- Action For ReconveyanceDocument9 pagesAction For ReconveyanceMeYe OrestePas encore d'évaluation

- Sales Digest MIDDocument10 pagesSales Digest MIDDessa ReyesPas encore d'évaluation

- G.R. No. 195072. August 1, 2016. Bonifacio Danan, Petitioner, Spouses Gregorio Serrano and Adelaida Reyes, RespondentsDocument19 pagesG.R. No. 195072. August 1, 2016. Bonifacio Danan, Petitioner, Spouses Gregorio Serrano and Adelaida Reyes, RespondentsJENNY BUTACANPas encore d'évaluation

- Jurisprudence On Acquisitive PrescriptionDocument45 pagesJurisprudence On Acquisitive PrescriptionMaria Zola Estela GeyrozagaPas encore d'évaluation

- BIRKENSTOCK Vs PSEMCDocument4 pagesBIRKENSTOCK Vs PSEMCJem AysonPas encore d'évaluation

- The Rei Vindicatio and Estoppel PDFDocument10 pagesThe Rei Vindicatio and Estoppel PDFfoxations100% (1)

- G.R. No. L-47673 October 10, 1946Document12 pagesG.R. No. L-47673 October 10, 1946Felix Gabriel BalaniPas encore d'évaluation

- Intellectual Property Due Diligence in Mergers & AcquisitionsDocument70 pagesIntellectual Property Due Diligence in Mergers & AcquisitionsrudraarjunPas encore d'évaluation

- 149 China Banking V LozadaDocument4 pages149 China Banking V Lozadaangelo prietoPas encore d'évaluation

- 26 Pichel vs. Alonzo 111 SCRA 341 (1982)Document19 pages26 Pichel vs. Alonzo 111 SCRA 341 (1982)Jr Dela CernaPas encore d'évaluation

- Module 2Document7 pagesModule 2Hermay BanarioPas encore d'évaluation

- Ligon v. Ca-1995Document2 pagesLigon v. Ca-1995Imelda Arreglo-AgripaPas encore d'évaluation

- Q&A PartnershipDocument4 pagesQ&A PartnershipRobert Ramirez0% (1)

- FAQs - DMCI Condo PhilippinesDocument12 pagesFAQs - DMCI Condo Philippinesippon_osotoPas encore d'évaluation

- Copyright AssignmentDocument12 pagesCopyright AssignmentParul Nigam100% (1)

- Magallanes vs. Kayanan, L-31048Document7 pagesMagallanes vs. Kayanan, L-31048DAISY REE JANE LUPASEPas encore d'évaluation

- Bpi209 Sap Business Workflow Case Studies at Nestle UsaDocument58 pagesBpi209 Sap Business Workflow Case Studies at Nestle Usafj_pastorPas encore d'évaluation

- Legal Nature and Types of Digital AssetsDocument24 pagesLegal Nature and Types of Digital AssetsamandaverissimovPas encore d'évaluation

- Land Laws Study Material 4th Sem NotesDocument32 pagesLand Laws Study Material 4th Sem NotesRitika100% (2)