Académique Documents

Professionnel Documents

Culture Documents

Ethics in Accounting For Printing

Transféré par

Jing SagittariusDescription originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Ethics in Accounting For Printing

Transféré par

Jing SagittariusDroits d'auteur :

Formats disponibles

Ethics in Accounting

a study of moral values & judgement

This public watchdog function demands that the accountant maintain total independence from the client at all times and requires complete fidelity to the public trust. Chief Justice Warren Burger (1984)

Codes of Professional Conduct AICPA

Voluntary professional organization

State Boards of Accountancy

Licensing Bodies Investigates allegations that a CPA violated the rules Issues sanctions

Suspension Revocation

Accounting as Part of Everyday Life

Is one discipline of study that all people regardless of job position should have some knowledge of

How to read your bank statement? Know your financial gains and losses Your income! What are your tax dues?

Its useful in peoples everyday lives. Companies must have reliable financial statements for both internal and external users. Application of Rules All CPAs

Public accounting Private industry Government Education

Services

Accounting Auditing and assurance services Taxation Advisory services Consulting

Importance of Ethics in Accounting Fraud Fraud is an intentional deception, misappropriation of a companys assets, or manipulation of its financial data to advantage of perpetrator.

Ethical Foundations of Accounting

Placing the public interest ahead of ones own self-interest Sixth stage in Kohlbergs model Moral motivation and moral character Integrity Auditing and Ethics Standards Independence Integrity Objectivity Due Care

AICPA Ethics Rules and Interpretations Independence, Integrity and Objectivity Professional Standards and Quality of Work Responsibilities to Clients Other Responsibilities and Practices Independence Financial relationships Business relationships Family relationships

Required for all audit and other attestation services Impairments to Independence Direct financial interest in the client Material indirect financial interest in the client Loans to or from a client including home mortgage loans

Permitted Loans Automobile loans collateralized by the automobile Loans fully collateralized by cash deposits Credit cards balances of less than $10,000 Family Members Spouse Spousal equivalent Dependents Close relatives- if they hold a key or financially sensitive position with the client or hold material financial interest

Parent Sibling Nondependent child

Nonattest Services to an Attest Client

Should not perform management functions Should not make management decisions for the attest client May provide advice and recommendations Interpretation 101-3 Client must agree to perform the following in connection with the nonattest engagement

Make or perform all management decisions and functions Designate an individual who has appropriate skills to oversee the services Evaluate the adequacy and results Accept responsibility for the results Establish and maintain internal controls

Sarbanes-Oxley Prohibitions The following may not be performed for attest clients in addition to bookkeeping or other services related to the accounting records or financial statements of the audit client:

Financial information systems design and implementation Appraisal or valuation services, fairness opinions, or contribution-in-kind reports

Sarbanes-Oxley Prohibitions Actuarial services Internal audit outsourcing services Management functions or human resources Broker or dealer, investment adviser, or investment banking services

Sarbanes-Oxley Prohibitions 7. Legal services and expert services unrelated to the audit 8. Any other service the BOD determines is impermissible Tax services must be preapproved by the audit committee

Cohen Commission

Responsibility to detect fraud Expectation gap between the professions goals for the audit and what the public expects from an audit Management should report on its internal controls and the auditor should evaluate managements report

Enacted as part of SOX

Importance of Cohen Commission Potential conflict of providing non-attest service for an audit client Decried lowballing of audit fees that raised the possibility of decline in audit quality Lowballing along with opinion shopping lead to commercialization of accounting services Definitions Lowballing

Deliberately underbidding for an audit engagement to obtain the audit client, with hope

to secure more lucrative management or consulting services Opinion Shopping

When a client seeks out the views of various accountants until finding one who will go

along with the clients desired accounting treatment

Internal Accounting Environment

National Commission on Fraudulent Financial Reporting, known as the Treadway Committee Committee of Sponsoring Organizations (COSO) Need to change the corporate culture (tone at the top) Establish systems necessary to prevent fraudulent financial reporting Exhibit 2 Ethical Responsibilities of Industry CPAs to Avoid Subordinating Judgment Possible material misstatement of financial statements Express concerns to supervisor Bring concerns to higher levels Consider

Continued employment Responsibilities to external auditors Responsibilities to outsiders

Seek legal advice

Professional Standards and Quality of Work

Professional Competence Due Professional Care Planning and Supervision Sufficient Relevant Data Statements and disclosures are in conformity with GAAP before rendering an opinion

Responsibilities to Clients

Confidentiality

Contingent Fees Confidentiality Must have clients permission to divulge confidential information, except in following situations:

Validly issued subpoena or summons Necessary information for a peer review Necessary information for ones defense in any investigation initiated by one of the above groups

Contingent Fees Prohibition of contingent fees (and commissions) only with respect to attestation clients Prohibition of acceptance of contingent fees when preparing original or amended tax returns or claims for tax refunds

Other Responsibilities and Practices

Commissions Advertising and Solicitation Operating a CPA Practice

Commissions Prohibited commissions to attestation clients Must disclose to the client that a commission is being paid to the CPA May accept or pay referral fees as long as such acceptance or payment is disclosed to the client Advertising and Solicitation Advertising can not be false, misleading or deceptive Solicitation can not be by use of coercion, over-reaching, or harassing conduct Concern by profession that advertising and solicitation can put commercial interests ahead of the public interest

Responses to Acctg Scandals New forms and regulations were imposed A call for increased in higher education to combat the danger of unthetical behavior. Educating the accountants on ethics before entering workforce. Thorough higher education to help improve the credibility of the accounting profession.

Summary

Pressure imposed on CPAs by superiors and by top management to give to their demands or risk losing ones job or risk loss of audit client Clash between what may be in ones self-interest and doing the right thing Be careful of going along to get along

Vous aimerez peut-être aussi

- The Art of Maximizing Debt Collections: Digitization, Analytics, AI, Machine Learning and Performance ManagementD'EverandThe Art of Maximizing Debt Collections: Digitization, Analytics, AI, Machine Learning and Performance ManagementPas encore d'évaluation

- Chapter 2Document14 pagesChapter 2maryumarshad2Pas encore d'évaluation

- Ch. 1 RittenbergDocument32 pagesCh. 1 RittenbergAira CruzPas encore d'évaluation

- Chapter FourDocument24 pagesChapter FourMelat TPas encore d'évaluation

- Lecture 0224Document27 pagesLecture 0224jasonnumahnalkelPas encore d'évaluation

- ACC718 Topic 1Document22 pagesACC718 Topic 1Fujiyama IputuPas encore d'évaluation

- ACC718 Topic 3Document26 pagesACC718 Topic 3Fujiyama IputuPas encore d'évaluation

- Fundamentals of Auditing and Assurance ServicesDocument5 pagesFundamentals of Auditing and Assurance Servicesschooldocs itemsPas encore d'évaluation

- AA CH 2Document40 pagesAA CH 2mirogPas encore d'évaluation

- Ethical Behaviour and Implications For AccountantsDocument24 pagesEthical Behaviour and Implications For AccountantsKeoikantsePas encore d'évaluation

- Technical Update Refresher For Academics Presentation SlidesDocument58 pagesTechnical Update Refresher For Academics Presentation SlidesabushohagPas encore d'évaluation

- 2.0 Ethical Concerns For Accountants Mike MbayaDocument38 pages2.0 Ethical Concerns For Accountants Mike MbayaREJAY89Pas encore d'évaluation

- Department of Accounting Acc 316: Principles & Practice of AuditingDocument7 pagesDepartment of Accounting Acc 316: Principles & Practice of AuditingFreeman AbuPas encore d'évaluation

- Summary Last SessionDocument81 pagesSummary Last SessionmuhajedaPas encore d'évaluation

- Lecture 1 (I) - IntroductionDocument30 pagesLecture 1 (I) - IntroductionkhooPas encore d'évaluation

- Review Engagements:: Key DefinitionsDocument9 pagesReview Engagements:: Key DefinitionsQais Qazi ZadaPas encore d'évaluation

- Auditing, Assurance, Internal ControlDocument68 pagesAuditing, Assurance, Internal ControlDarji PareshPas encore d'évaluation

- IFA Chapter 1Document12 pagesIFA Chapter 1Suleyman TesfayePas encore d'évaluation

- New 27456Document60 pagesNew 27456Lovely Jane Raut CabiltoPas encore d'évaluation

- S02 EthicsDocument29 pagesS02 EthicsHashPas encore d'évaluation

- Consideration Before Commencing An AuditDocument13 pagesConsideration Before Commencing An AuditTushar GaurPas encore d'évaluation

- Solved Past Paper AuditingDocument7 pagesSolved Past Paper AuditingDaim AslamPas encore d'évaluation

- A 01 SOX ComplianceDocument34 pagesA 01 SOX ComplianceDevika TibrewalPas encore d'évaluation

- Week 3 PlanningDocument38 pagesWeek 3 Planningptnyagortey91Pas encore d'évaluation

- D11 Principles of AuditingDocument373 pagesD11 Principles of AuditingDixie Cheelo100% (1)

- Chapter 4 Ethics and AcceptanceDocument10 pagesChapter 4 Ethics and Acceptancerishi kareliaPas encore d'évaluation

- Ethical Issues in AccountingDocument16 pagesEthical Issues in AccountingsimplyhemsPas encore d'évaluation

- Auditor Independence, Ethics and Liability: Relates To Chapter 4 of TextDocument19 pagesAuditor Independence, Ethics and Liability: Relates To Chapter 4 of TextSteve SmithPas encore d'évaluation

- Chapter 13 Codes of Professional EthicsDocument26 pagesChapter 13 Codes of Professional EthicslnghiilwamoPas encore d'évaluation

- 2) Chapter 1 Assurance EngagementsDocument27 pages2) Chapter 1 Assurance Engagementsazone accounts & audit firmPas encore d'évaluation

- Old Engagement and New EngagementDocument3 pagesOld Engagement and New EngagementMohammad MonirujjamanPas encore d'évaluation

- In The Name of God, The Most Beneficent, The Eternally MercifulDocument22 pagesIn The Name of God, The Most Beneficent, The Eternally MercifulJhon AntoniPas encore d'évaluation

- Chapter 6 PlanningDocument19 pagesChapter 6 PlanningAbdulahi farah AbdiPas encore d'évaluation

- Chapter 1 Assurance EngagementsDocument31 pagesChapter 1 Assurance EngagementsOmer UddinPas encore d'évaluation

- Governance and Responsibility - Lecture 1Document16 pagesGovernance and Responsibility - Lecture 1Anep ZainuldinPas encore d'évaluation

- Group 4 The Audit ProcessDocument31 pagesGroup 4 The Audit ProcessYonica Salonga De BelenPas encore d'évaluation

- 01 Rittenberg PPT Ch1Document48 pages01 Rittenberg PPT Ch1Isabel HigginsPas encore d'évaluation

- Chapter ThreeDocument36 pagesChapter ThreeVida SalehiPas encore d'évaluation

- Chapter 4 - AuditDocument59 pagesChapter 4 - AuditMisshtaCPas encore d'évaluation

- Ethics: Understanding and Meeting Ethical ExpectationsDocument30 pagesEthics: Understanding and Meeting Ethical ExpectationsbaburamPas encore d'évaluation

- General Principles of A Financial Statement AuditDocument14 pagesGeneral Principles of A Financial Statement AuditMary Grace P CastroPas encore d'évaluation

- Code of Ethics: FOR Professional AccountantsDocument42 pagesCode of Ethics: FOR Professional AccountantsTracy Marsh RapanutPas encore d'évaluation

- Financial Statement AuditDocument43 pagesFinancial Statement AuditMahmudul HasanPas encore d'évaluation

- Audit Planning Lecture 6 NewDocument24 pagesAudit Planning Lecture 6 Newpadjetey00Pas encore d'évaluation

- Audit 1Document26 pagesAudit 1ngothimyduyen27042003Pas encore d'évaluation

- Sarbanes Oxley Audit Committee RequirementsDocument32 pagesSarbanes Oxley Audit Committee RequirementsMarian's PrelovePas encore d'évaluation

- 03.2 Handbook of The International Code of Ethics For Professional AccountantsDocument92 pages03.2 Handbook of The International Code of Ethics For Professional AccountantsnuggsPas encore d'évaluation

- Expanded Services of Accountants-FABM Chapter 2Document8 pagesExpanded Services of Accountants-FABM Chapter 2Jeannie Lyn Dela CruzPas encore d'évaluation

- Cycle 6 TM Session 3Document77 pagesCycle 6 TM Session 3abdulkadir mohamedPas encore d'évaluation

- ACCA Paper F8 - : Audit and Assurance (INT)Document232 pagesACCA Paper F8 - : Audit and Assurance (INT)sohail merchantPas encore d'évaluation

- F8 PresentationDocument232 pagesF8 PresentationDorian CaruanaPas encore d'évaluation

- Ethics in Accounting and Finance: Presented byDocument13 pagesEthics in Accounting and Finance: Presented byNikita WalterPas encore d'évaluation

- Performing Preliminary Engagement Activities: 1. Engagement Acceptance Procedures 2. Basis of EngagementDocument14 pagesPerforming Preliminary Engagement Activities: 1. Engagement Acceptance Procedures 2. Basis of EngagementCarlo manejaPas encore d'évaluation

- Grace Gural-Balaguer: Acctg 22 InstructorDocument59 pagesGrace Gural-Balaguer: Acctg 22 InstructorMary CuisonPas encore d'évaluation

- Federal Incentives That Can Show You The Money & Increase Cash FlowDocument23 pagesFederal Incentives That Can Show You The Money & Increase Cash FlowCBIZ Inc.Pas encore d'évaluation

- Lecture 5-Professional Ethics and Code of ConductDocument29 pagesLecture 5-Professional Ethics and Code of ConductNatalia NaveedPas encore d'évaluation

- Activity 1: Yellow Paper 1/4Document21 pagesActivity 1: Yellow Paper 1/4saralimanuyag8_25539Pas encore d'évaluation

- Advanced Auditing Chapter ThreeDocument49 pagesAdvanced Auditing Chapter ThreemirogPas encore d'évaluation

- Auditing Information Systems and Controls: The Only Thing Worse Than No Control Is the Illusion of ControlD'EverandAuditing Information Systems and Controls: The Only Thing Worse Than No Control Is the Illusion of ControlPas encore d'évaluation

- Accounting Policies and Procedures For Savings & Credit CoopDocument1 pageAccounting Policies and Procedures For Savings & Credit CoopJing SagittariusPas encore d'évaluation

- Joint Rules Implementing R.A. 9520 or The Cooperative Code of The PhilippinesDocument14 pagesJoint Rules Implementing R.A. 9520 or The Cooperative Code of The PhilippinesEdd N Ros AdlawanPas encore d'évaluation

- With Both Members and Non-MembersDocument2 pagesWith Both Members and Non-MembersJing SagittariusPas encore d'évaluation

- With Both Members and Non-MembersDocument2 pagesWith Both Members and Non-MembersJing SagittariusPas encore d'évaluation

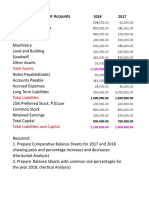

- Balance Sheet Accounts: Total AssetsDocument4 pagesBalance Sheet Accounts: Total AssetsJing SagittariusPas encore d'évaluation

- R.A 7160 Local Government CodeDocument1 pageR.A 7160 Local Government CodeJing SagittariusPas encore d'évaluation

- Finman Session 4 ForecastingDocument3 pagesFinman Session 4 ForecastingJing SagittariusPas encore d'évaluation

- Philippine Financial Reporting FrameworkDocument18 pagesPhilippine Financial Reporting FrameworkJing SagittariusPas encore d'évaluation

- 2 Risk and Credit Management - Hermes VergaraDocument119 pages2 Risk and Credit Management - Hermes VergaraJing SagittariusPas encore d'évaluation

- Standard Charts of Account For CooperativesDocument54 pagesStandard Charts of Account For CooperativesJing SagittariusPas encore d'évaluation

- Coop Pesos PaperDocument46 pagesCoop Pesos Paperkhasper_d100% (5)

- Cda Memorandum Circular 2015-09Document32 pagesCda Memorandum Circular 2015-09Jing Sagittarius100% (2)

- Coop Pesos FormulaDocument60 pagesCoop Pesos FormulaJing Sagittarius80% (5)

- VILLANUEVA-CASTRO COMMERCIAL LAW - New PDFDocument40 pagesVILLANUEVA-CASTRO COMMERCIAL LAW - New PDFJing Sagittarius100% (4)

- UP Civil Law Quizzer PDFDocument116 pagesUP Civil Law Quizzer PDFJing SagittariusPas encore d'évaluation

- Org BehaviorDocument29 pagesOrg BehaviorJing SagittariusPas encore d'évaluation

- Civ Pro (Riano) PDFDocument110 pagesCiv Pro (Riano) PDFJude-lo Aranaydo100% (3)

- Introduction To Statistical Thinking For Decision MakingDocument13 pagesIntroduction To Statistical Thinking For Decision MakingJing Sagittarius100% (1)

- SERVA 4-Axle Coiled Tubing Unit - Electric Over HydraulicDocument25 pagesSERVA 4-Axle Coiled Tubing Unit - Electric Over HydraulicWilliamPas encore d'évaluation

- Application For Type Aircraft Training: Farsco Training Center IR.147.12Document1 pageApplication For Type Aircraft Training: Farsco Training Center IR.147.12benyamin karimiPas encore d'évaluation

- AIDTauditDocument74 pagesAIDTauditCaleb TaylorPas encore d'évaluation

- 3-Module 3-23-Feb-2021Material I 23-Feb-2021 Error Detection and CorrectionDocument39 pages3-Module 3-23-Feb-2021Material I 23-Feb-2021 Error Detection and CorrectionPIYUSH RAJ GUPTA 19BCE2087Pas encore d'évaluation

- OOAD Documentation (Superstore)Document15 pagesOOAD Documentation (Superstore)Umâir KhanPas encore d'évaluation

- BUSINESS PROPOSAL-dönüştürüldü-2Document15 pagesBUSINESS PROPOSAL-dönüştürüldü-2Fatah Imdul UmasugiPas encore d'évaluation

- Law EssayDocument7 pagesLaw EssayNahula AliPas encore d'évaluation

- International Journal On Cryptography and Information Security (IJCIS)Document2 pagesInternational Journal On Cryptography and Information Security (IJCIS)ijcisjournalPas encore d'évaluation

- ACI 533.5R-20 Guide For Precast Concrete Tunnel SegmentsDocument84 pagesACI 533.5R-20 Guide For Precast Concrete Tunnel SegmentsJULIE100% (3)

- C10G - Hardware Installation GD - 3 - 12 - 2014Document126 pagesC10G - Hardware Installation GD - 3 - 12 - 2014Htt Ếch CốmPas encore d'évaluation

- 02 IG4K TechnologiesDocument47 pages02 IG4K TechnologiesM Tanvir AnwarPas encore d'évaluation

- Bugreport Fog - in SKQ1.211103.001 2023 04 10 19 23 21 Dumpstate - Log 9097Document32 pagesBugreport Fog - in SKQ1.211103.001 2023 04 10 19 23 21 Dumpstate - Log 9097chandrakanth reddyPas encore d'évaluation

- QuickTransit SSLI Release Notes 1.1Document12 pagesQuickTransit SSLI Release Notes 1.1subhrajitm47Pas encore d'évaluation

- SAM3-P256 Development Board Users Manual: This Datasheet Has Been Downloaded From at ThisDocument21 pagesSAM3-P256 Development Board Users Manual: This Datasheet Has Been Downloaded From at ThissunnguyenPas encore d'évaluation

- 010 Informed Search 2 - A StarDocument20 pages010 Informed Search 2 - A StarRashdeep SinghPas encore d'évaluation

- Final - Far Capital - Infopack Diana V3 PDFDocument79 pagesFinal - Far Capital - Infopack Diana V3 PDFjoekaledaPas encore d'évaluation

- Debt RestructuringDocument4 pagesDebt Restructuringjano_art21Pas encore d'évaluation

- A218437 HUET PDFDocument271 pagesA218437 HUET PDFKayser_MPas encore d'évaluation

- Bearing SettlementDocument4 pagesBearing SettlementBahaismail100% (1)

- LC1D40008B7: Product Data SheetDocument4 pagesLC1D40008B7: Product Data SheetLê Duy MinhPas encore d'évaluation

- MSW - 1 - 2016 Munisicpal Solid Waste Rules-2016 - Vol IDocument96 pagesMSW - 1 - 2016 Munisicpal Solid Waste Rules-2016 - Vol Inimm1962Pas encore d'évaluation

- Islm ModelDocument7 pagesIslm ModelPrastuti SachanPas encore d'évaluation

- Performance Online - Classic Car Parts CatalogDocument168 pagesPerformance Online - Classic Car Parts CatalogPerformance OnlinePas encore d'évaluation

- Gas Turbine Performance CalculationDocument7 pagesGas Turbine Performance CalculationAtiqur RahmanPas encore d'évaluation

- Lab Manual: Department of Computer EngineeringDocument65 pagesLab Manual: Department of Computer EngineeringRohitPas encore d'évaluation

- Qualifications and Disqualifications of CandidatesDocument3 pagesQualifications and Disqualifications of CandidatesCARLO JOSE BACTOLPas encore d'évaluation

- Introduction To Risk Management and Insurance 10th Edition Dorfman Test BankDocument26 pagesIntroduction To Risk Management and Insurance 10th Edition Dorfman Test BankMichelleBellsgkb100% (50)

- Sample Resume FinalDocument2 pagesSample Resume FinalSyed Asad HussainPas encore d'évaluation

- Testing Template - Plan and Cases CombinedDocument3 pagesTesting Template - Plan and Cases Combinedapi-19980631Pas encore d'évaluation

- Google Translate - Google SearchDocument1 pageGoogle Translate - Google SearchNicole Alex Bustamante CamposPas encore d'évaluation