Académique Documents

Professionnel Documents

Culture Documents

Nature and Scope of Management Accounting

Transféré par

asimjalil85Description originale:

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Nature and Scope of Management Accounting

Transféré par

asimjalil85Droits d'auteur :

Formats disponibles

Nature and Scope of Management Accounting : Nature and Scope of Management Accounting PRESENTED BY:- RITU GUPTA Asst.

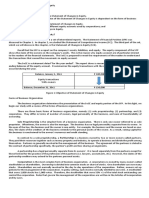

Prof. Commerce, PGGC-11 Slide 2: The maintenance and creation of economic value or wealth. Management accounting : Management accounting It measures and reports financial and non-financial information that helps managers make decisions to fulfill the goals of an organization. EVOLUTION OF MANAGEMENT ACCOUNTING : EVOLUTION OF MANAGEMENT ACCOUNTING TRADITIONAL VIEW MODERN VIEW TRADITIONAL VIEW : TRADITIONAL VIEW PRE- 1930s 1. EMPHASIS ON FINANCIAL MARKETS AND SECURITIES. 2. LITTLE ATTENTION ON ASSET MANAGEMENT. TRADITIONAL VIEW contd : TRADITIONAL VIEW contd 1930s AND 1940s 1. FOCUS ON LEGAL MATTERS DEALING WITH BANKRUPTCY. 2. RECOGNITION OF NEWLY EMERGING GOVT. REGULATIONS. CRITICISM OF TRADITIONAL VIEW : CRITICISM OF TRADITIONAL VIEW TREATS THE ENTIRE SUBJECT OF FINANCE FROM VIEW POINT OF INVESTMENT BANKER. RATHER THAN A FINANCIAL DECISION MAKER WITH IN THE ENTERPRISE. HEAVY EMPHASIS ON LONG TERM FINANCIAL INSTRUMENTS AND LACK OF EMPHASIS ON WORKING CAPITAL MANAGEMENT. CRITICISM OF TRADITIONAL VIEW contd. : CRITICISM OF TRADITIONAL VIEW contd. MUCH EMPHASIS ON CORPORATE FINANCE, LITTLE ATTENTION ON THE PROBLEMS OF NON-CORPORATE ENTERPRISES. DUE TO DEPRESSION IN 1930s AND 1940s EMPHASIS SHIFTED MUCH ON BANKRUPTCY PROBLEMS AND LIQUIDITY CRISIS. MODERN VIEW : MODERN VIEW 1950s INCREASED EMPHASIS ON ASSET MANAGEMENT. 1960s APPLICATION OF MATHEMATICAL MODELS. THEORATICAL DEVELOPMENTS IN COST OF CAPITAL, DIVIDEND POLICY AND RISK ANALYSIS. MODERN VIEW contd. : MODERN VIEW contd. 1980s APPLICATION OF COMPUTER TECHNOLOGY TO ASSIST IN FINANCIALDECISION MAKING. 1990s INCREASED ATTENTION TO INTERNATIONAL COMPETITION AND MANAGEMENT OF MULTINATIONAL FIRMS. DIFFERENCE : DIFFERENCE TRADITIONAL VIEW FOCUS ON THE ACQUISITION OF FUNDS. MODERN VIEW EXPANDS THE FOCUS ON BOTH USE AND ACQUISITION OF FUNDS. Slide 12: 1) Profit Maximization? This Goal Ignores: a) Timing of Returns b) Uncertainty of Returns Slide 13: 2) Shareholder Wealth Maximization? this is the same as: a) Maximizing Firm Value b) Maximizing Stock Price OBJECTIVES OF MANAGEMENT ACCOUNTING : OBJECTIVES OF MANAGEMENT ACCOUNTING Relevant To Making Decisions Types Of Decisions Investing Financing Operating

INVESTMENT DECISIONS : INVESTMENT DECISIONS DETERMINIG THE TOTAL AMOUNT OF ASSETS NEEDED TO BE HELD BY THE FIRM. (ASSETS SIDE OF THE B/S) INVESTMENT CAN BE: 1. INVESTMENT IN FIXED ASSETS 2. INVESTMENT IN WORKING CAPITAL DECISIONS RULE: INVESTMENT IN A PARTICULAR ASSET CAN BE ACCEPTED ONLY IF THE RETURN ON INVESTMENT IS MORE THAN THE MINIMUM ACCEPTABLE RATE INVESTMENT DECISIONS : INVESTMENT DECISIONS THE MAIN TYPES OF INVESTMENT DECISIONS CAN BE: 1. FIXED ASSETS TO BE ACQUIRED. 2. INVESTMENT IN CURRENT ASSETS. 3. BUY OR LEASE DECISIONS. 4. ASSET REPLACEMENT DECISIONS. 5. RESTRUCTURING, MERGER AND ACQUISITION DECISIONS FINANCE DECISIONS : FINANCE DECISIONS RELATED TO THE PROCUREMENT OF FUNDS. (LIABILITY SIDE OF THE B/S). DECISIONS ABOUT DEBT AND EQUITY MIX. THE LONG TERM ASSETS SHOULD BE FINANCED WITH LONG TERM FUNDS AND SHORT TERM ASSETS SHOULD BE FINANCED WITH SHORT TERM FUNDS. FINANCE DECISIONS : FINANCE DECISIONS THE MAIN TYPES OF FINANCE DECISIONS CAN BE: 1. DETERMINING THE DEGREE OF LEVERAGE 2. DETERMINIG THE FINANCING PATTERN OF LONG, MEDIAM AND SHORT TERM FUNDS. 3. ARRANGING FINANCE FOR WORKING CAPITAL. 4. DECISION ABOUT THE INTEREST BURDEN ON THE FIRM. DIVIDEND DECISION : DIVIDEND DECISION CONCERNED WITH HOW MUCH PROFITS TO BE DISTRIBUTED AS DIVIDEND AND HOW MUCH TO BE RETAINED IN THE BUSINESS. IF PROFIT IS PAID AS DIVIDEND IT INFLUENCE THE SHARE PRICE. IF PROFIT IS NOT PAID AS DIVIDEND IT MAXIMISES THE WEALTH OF THE SHAREHOLDER. Functions of Management Accounting : Functions of Management Accounting Management accountants perform these functions Planning & Forecasting Financial analysis & interpretation Communication Facilitates managerial controls Helpful in taking strategic decisions Use of qualitative information Co-ordinating Financial and Management Accounting : Financial and Management Accounting The primary questions about an organizations success that decision makers want to know are: What is the financial picture of the organization on a given day? How well did the organization do during a given period? Financial and Management Accounting : Financial and Management Accounting Accountants answer these primary questions with three major financial statements. Balance sheet shows financial picture on a given day Income statement shows performance over a given period Statement of cash flows shows performance over a given period Financial and Management Accounting : Financial and Management Accounting Annual report - a document prepared by management and distributed to current and potential investors to inform them about the companys past performance and future prospects The annual report is one of the most common sources of financial information used by investors and managers. Financial and Management Accounting : Financial and Management Accounting 1. The major distinction between financial and management accounting is the users of the information. Financial accounting serves external users, such as investors, creditors, and suppliers. Management accounting serves internal users, such as top executives, management, and administrators within organizations. Management Accounting and Financial Accounting : Management Accounting and Financial Accounting Help managers plan and control business operations Help investors, creditors, and others make investment, credit, and other decisions 2. Purpose of Information Management Accounting and Financial Accounting : Management Accounting and Financial Accounting Relevance Reliability, objectivity, and focus on the past 3. Focus and Time Dimension

Management Accounting and Financial Accounting : Management Accounting and Financial Accounting Internal reports not restricted by GAAP Financial statements restricted by GAAP 4. Type of Report Management Accounting and Financial Accounting : Management Accounting and Financial Accounting No independent audit Annual independent audit 5.Verification Management Accounting and Financial Accounting : Management Accounting and Financial Accounting Detailed reports on parts of the company Summary reports primarily on the company as a whole 6.Scope of Information Scope of Management Accounting : Scope of Management Accounting Financial Accounting Cost Accounting Budgeting & Forecasting Inventory control Reporting to management Internal audit Tax accounting Tools & Techniques of Management Accounting : Tools & Techniques of Management Accounting Financial Management Analysis Comparative financial statements Ratio analysis Fund flow statement Trend analysis CVP analysis Cash Flow Analysis Tools & Techniques of Management Accounting contd. : Tools & Techniques of Management Accounting contd. Budgetary Control Standard costing Marginal costing Responsibility accounting Price level accounting Human resource accounting Social cost benefit analysis Importance : Importance Increases efficiency Proper planning Measurement of performance Maximising profitability Improve service to customers Effective management control Limitations of Management Accounting : Limitations of Management Accounting Based on accounting information Lack of knowledge Intuitive decisions Not an alternative to the administration Top heavy structure Evolutionary stage Personal biasness Psychological resistance Slide 35: Thank you

Vous aimerez peut-être aussi

- Financial Management BMS 5th Sem JulyDocument31 pagesFinancial Management BMS 5th Sem Julygusheenarora60% (5)

- BAC 813 - Financial Accounting Premium Notes - Elab Notes LibraryDocument111 pagesBAC 813 - Financial Accounting Premium Notes - Elab Notes LibraryWachirajanePas encore d'évaluation

- Maryland International College: Accounting and Finance For ManagersDocument161 pagesMaryland International College: Accounting and Finance For Managershadush Gebreslasie100% (1)

- Maryland International College: Accounting and Finance For ManagersDocument26 pagesMaryland International College: Accounting and Finance For ManagersANTENEH ENDALE DILNESSAPas encore d'évaluation

- B215 AC01 - Numbers and Words - 6th Presentation - 17apr2009Document23 pagesB215 AC01 - Numbers and Words - 6th Presentation - 17apr2009tohqinzhiPas encore d'évaluation

- Chapter 1Document26 pagesChapter 1Robel HabtamuPas encore d'évaluation

- Ica Afm 2022Document64 pagesIca Afm 2022Muhammed FayisPas encore d'évaluation

- Introduction To Financial AccountingDocument19 pagesIntroduction To Financial AccountingJashan100% (1)

- Unit-I: SVD & SGL College of Management and Technology: RajahmundryDocument38 pagesUnit-I: SVD & SGL College of Management and Technology: RajahmundryHappyPrincePas encore d'évaluation

- Chapter One HandoutDocument16 pagesChapter One HandoutNati AlexPas encore d'évaluation

- FM 35Document38 pagesFM 35Dhanalakshmi MurugesanPas encore d'évaluation

- Accounting QuizDocument14 pagesAccounting QuizMarthen YoparyPas encore d'évaluation

- Class 1 - The Bigger PictureDocument33 pagesClass 1 - The Bigger PictureTae-Jin ParkPas encore d'évaluation

- Topic 1 - Af09101 - Introduction To AccountingDocument25 pagesTopic 1 - Af09101 - Introduction To Accountingarusha afroPas encore d'évaluation

- Accounting Theory Handout 1Document43 pagesAccounting Theory Handout 1Ockouri Barnes100% (3)

- Introduction To Basic Elements of Financial ManagementDocument27 pagesIntroduction To Basic Elements of Financial Managementvansh.s3Pas encore d'évaluation

- Aee Unit-3Document55 pagesAee Unit-3downloaderPas encore d'évaluation

- Chapter 1Document15 pagesChapter 1abraha gebruPas encore d'évaluation

- Accounting Group AssignmentDocument10 pagesAccounting Group AssignmentHailuPas encore d'évaluation

- Accounting For ManagersDocument235 pagesAccounting For Managerssajaggrover100% (2)

- Asm 1Document28 pagesAsm 1Thuy QuynhPas encore d'évaluation

- FinAcc Chapter 1Document8 pagesFinAcc Chapter 1IrmaPas encore d'évaluation

- Accounting For Management Unit 1Document5 pagesAccounting For Management Unit 1Mani SankarPas encore d'évaluation

- Topic 1 - Introduction To AccountingDocument5 pagesTopic 1 - Introduction To AccountingFernando Alfayate FernándezPas encore d'évaluation

- Fa I Chapter 1Document10 pagesFa I Chapter 1Tewanay BesufikadPas encore d'évaluation

- Unit - I Meaning and Nature of Financial AccountingDocument26 pagesUnit - I Meaning and Nature of Financial Accountingaadi1988Pas encore d'évaluation

- Financial Management Class Notes Bba Iv Semester: Unit IDocument49 pagesFinancial Management Class Notes Bba Iv Semester: Unit IGauravs100% (1)

- AAT Paper 2 FinanceDocument4 pagesAAT Paper 2 FinanceRay LaiPas encore d'évaluation

- Introduction To Corporate FinanceDocument22 pagesIntroduction To Corporate FinanceTushar GargPas encore d'évaluation

- Conceptual FrameworkDocument5 pagesConceptual FrameworkElla CunananPas encore d'évaluation

- Bus Fin Topic 3Document18 pagesBus Fin Topic 3Nadjmeah AbdillahPas encore d'évaluation

- Financial Plans and PoliciesDocument31 pagesFinancial Plans and PoliciesSantosh....100% (1)

- Part IDocument23 pagesPart IYonasPas encore d'évaluation

- Management Accounting HighlightsDocument4 pagesManagement Accounting HighlightsCathlene TitoPas encore d'évaluation

- Chapter 1. TeoriaDocument5 pagesChapter 1. TeoriaclaudiazdeandresPas encore d'évaluation

- FM1.1 2017Document67 pagesFM1.1 2017Mridul PantPas encore d'évaluation

- Lec 1Document35 pagesLec 1Mohamed AliPas encore d'évaluation

- Cost Accounting: Adolph Matz Milton F. UsryDocument18 pagesCost Accounting: Adolph Matz Milton F. UsrySaifNazirPas encore d'évaluation

- E For Finance and Accountingfinal TestDocument6 pagesE For Finance and Accountingfinal TestNguyễn Ngọc Thanh TrangPas encore d'évaluation

- Financial Management Notes PDFDocument68 pagesFinancial Management Notes PDFtirumala ReddyPas encore d'évaluation

- Accounts NotesDocument12 pagesAccounts NotesRishi KumarPas encore d'évaluation

- AFM-Cash Flow StatementDocument14 pagesAFM-Cash Flow StatementkanikaPas encore d'évaluation

- LESSON ONE Mba808Document17 pagesLESSON ONE Mba808francis MagobaPas encore d'évaluation

- Accounts NotesDocument12 pagesAccounts NotesRishi KumarPas encore d'évaluation

- FINMAN Notes - April 14, 2021Document10 pagesFINMAN Notes - April 14, 2021Nicole Andrea TuazonPas encore d'évaluation

- 395 33 Powerpoint Slides 1 Financial Management Overview CHAPTER 1Document25 pages395 33 Powerpoint Slides 1 Financial Management Overview CHAPTER 1Ravi Pratap Singh TomarPas encore d'évaluation

- Financial Management - Its Meaning, Scope & Objectives. By: Anurag ChakrabortyDocument17 pagesFinancial Management - Its Meaning, Scope & Objectives. By: Anurag Chakrabortymdr32000Pas encore d'évaluation

- Business Finance ABM StrandDocument107 pagesBusiness Finance ABM StrandMiss Anonymous23Pas encore d'évaluation

- Fundamental of Accounting: Chapter 1-2Document31 pagesFundamental of Accounting: Chapter 1-2Renshey Cordova MacasPas encore d'évaluation

- Financial AccountingDocument33 pagesFinancial AccountingsureshPas encore d'évaluation

- 2021-22 International Accounting MaterialsDocument59 pages2021-22 International Accounting MaterialsLamis ShalabiPas encore d'évaluation

- Introduction To Management AccountingDocument71 pagesIntroduction To Management AccountingAnonymous kwi5IqtWJPas encore d'évaluation

- Bản Sao CHAPTER 1-INTRODUCTION ACCOUNTINGDocument28 pagesBản Sao CHAPTER 1-INTRODUCTION ACCOUNTINGHảo HuỳnhPas encore d'évaluation

- CH 01 KiesoDocument29 pagesCH 01 KiesoToni TriyuliantoPas encore d'évaluation

- Module 1 Financial Reporting LMSDocument15 pagesModule 1 Financial Reporting LMSGAZA MARY ANGELINEPas encore d'évaluation

- Lesson 1: Learning ObjectivesDocument54 pagesLesson 1: Learning ObjectivesCarl Aaron LayugPas encore d'évaluation

- Module 2Document29 pagesModule 2Katrina DacquelPas encore d'évaluation

- Accounting For ManagementDocument21 pagesAccounting For ManagementSeban KsPas encore d'évaluation

- Financial Literacy for Entrepreneurs: Understanding the Numbers Behind Your BusinessD'EverandFinancial Literacy for Entrepreneurs: Understanding the Numbers Behind Your BusinessPas encore d'évaluation

- MUCLecture 2022 51643431Document15 pagesMUCLecture 2022 51643431gold.2000.dzPas encore d'évaluation

- Section: 10: Name Id NoDocument13 pagesSection: 10: Name Id NoMd Basit Chowdhury 183182963050% (2)

- CAPE Accounting Unit 1 Module 1 The Nature and Scope of AccountingDocument11 pagesCAPE Accounting Unit 1 Module 1 The Nature and Scope of AccountingRhea Lee Ross100% (1)

- 4 - 1-A Macro Risk-Based Approach - J-TeiletcheDocument19 pages4 - 1-A Macro Risk-Based Approach - J-TeiletcheLoulou DePanamPas encore d'évaluation

- Extreme Commerce by Sunny AliDocument7 pagesExtreme Commerce by Sunny AlimoazzamPas encore d'évaluation

- Intermediate Accounting 15Th Edition Kieso Solutions Manual Full Chapter PDFDocument67 pagesIntermediate Accounting 15Th Edition Kieso Solutions Manual Full Chapter PDFprise.attone.itur100% (11)

- FINS1613 File 04 - All 3 Topics Practice Questions PDFDocument16 pagesFINS1613 File 04 - All 3 Topics Practice Questions PDFisy campbellPas encore d'évaluation

- Profit and Loss Account of Friends Flower and ShopDocument11 pagesProfit and Loss Account of Friends Flower and ShopHitesh BalPas encore d'évaluation

- Blueprint Capital Management - Profile - September 2013Document1 pageBlueprint Capital Management - Profile - September 2013towsonncPas encore d'évaluation

- Cemex'S Internationalization StrategyDocument8 pagesCemex'S Internationalization StrategyVatsal MaheshwariPas encore d'évaluation

- Catholic Syrian BankDocument29 pagesCatholic Syrian BanksherwinmitraPas encore d'évaluation

- A Study of Concept of Limited Liability Partnership in IndiaDocument7 pagesA Study of Concept of Limited Liability Partnership in IndiaShahbaz MalbariPas encore d'évaluation

- Marketing Strategies Adopted by Reliance Mart & Vishal Mega MartDocument84 pagesMarketing Strategies Adopted by Reliance Mart & Vishal Mega Martvivek_gupta290893% (14)

- Sales Stint ReviewDocument50 pagesSales Stint ReviewTrivikram SurabattulaPas encore d'évaluation

- Aggregate Planning and Master Production Scheduling: MBA9 - Group 1Document25 pagesAggregate Planning and Master Production Scheduling: MBA9 - Group 1abhishek ghagPas encore d'évaluation

- FICO Syllabus: FI/CO Course ContentDocument6 pagesFICO Syllabus: FI/CO Course ContentBrodsky RjPas encore d'évaluation

- Limitations of Ratio AnalysisDocument2 pagesLimitations of Ratio AnalysisJahanzeb Hussain QureshiPas encore d'évaluation

- 0 - Tybms If Sem 6 QBDocument47 pages0 - Tybms If Sem 6 QBMangesh GuptaPas encore d'évaluation

- Towards A Characterisation of Adaptive Capacity: A Framework For Analysing Adaptive Capacity at The Local LevelDocument8 pagesTowards A Characterisation of Adaptive Capacity: A Framework For Analysing Adaptive Capacity at The Local LevelOxfamPas encore d'évaluation

- FTSE4Good Global ConstituentsDocument5 pagesFTSE4Good Global ConstituentsRavi AgarwalPas encore d'évaluation

- Summary and Reflection: Chapter 6: Cost-Volume-ProfitDocument5 pagesSummary and Reflection: Chapter 6: Cost-Volume-ProfitJohn Kenneth BoholPas encore d'évaluation

- F OptionsDocument29 pagesF OptionsXiaoou YePas encore d'évaluation

- M&e Module 5Document17 pagesM&e Module 5Soniya Laxmappa RathodPas encore d'évaluation

- Statement of Changes in EquityDocument9 pagesStatement of Changes in Equityheart lelim100% (1)

- Baring Bank Case Analysis - Group 8 - Ver3Document10 pagesBaring Bank Case Analysis - Group 8 - Ver3Puneet Agarwal100% (1)

- Portfolio 3Document27 pagesPortfolio 3nehalefatPas encore d'évaluation

- FE Review: Engineering EconomicsDocument41 pagesFE Review: Engineering EconomicsNana BaPas encore d'évaluation

- Theories of Development 1Document82 pagesTheories of Development 1Hashaira AlimPas encore d'évaluation

- Jntuh Mba CCC Syllabus 2013-14Document48 pagesJntuh Mba CCC Syllabus 2013-14Yepuru ChaithanyaPas encore d'évaluation