Académique Documents

Professionnel Documents

Culture Documents

Answer 1:: TP021713 Mohammad Talha Awan Personal Finance

Transféré par

Talha MunirDescription originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Answer 1:: TP021713 Mohammad Talha Awan Personal Finance

Transféré par

Talha MunirDroits d'auteur :

Formats disponibles

TP021713

Mohammad Talha Awan

Personal Finance

Answer 1:

Financial planning plays an important role in our lives and now a day in a fast-paced world you find yourself face to face with many alternative opportunities to avail. You need to plan for your future in advance so that you can overcome unwanted or unprepared situations. My uncle who is a very rich man has allowed me to operate a joined trustee account with him worth $10million for 3 years. He has granted me this time to see if can invest efficiently enough to gain an average return of 8% or more. Currently the money is managed by HSBC trustee and one of my options is to let them invest into various funds on which I will be earning a specific amount of profit. One of the funds that it can be invested in is RHB Mudharabah, this scheme will allow me to gain annual income plus there are chances of achieving capital growth by investing into shares or stocks listed on the KLSE or other stock exchanges under the rules of Shariah. This is a suitable fund to invest as it lets you enjoy both income and opportunities for capital growth. It also saves me the trouble of managing my own portfolio as it is taken care by the bank. Share prices fluctuate throughout the year and if prices increase, I can sell of my shares in future for a larger amount than I paid and hence gain additional profits. Strategy of RHB Mudharabah: This fund is basically focused towards investors who are willing to invest their money based on Shariah rule, which is the Islamic way. Their objective is to invest in companies that have a high profitability ratio, stable growth rate, reasonable valuations, therefore guarantying investors a healthy and stable return. For fixed income they also invest into securities or Islamic bonds on which you will gain fixed return depending on the yield movements. RHB being one of the largest banks that was involved in many mergers or take-overs in the past 3 years has succeeded CIMB and has the resources for much efficient investments. It has many subsidiary companies under it in which it can invest and hence provide an investor with much higher returns.

TP021713

Mohammad Talha Awan

Personal Finance

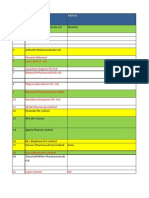

Investment allocation: Equity Investments: 40% - 60% Fixed Income Securities / Cash: 40% - 60% As you can see the table below shows us the criteria of the investment. A minimum of RM 1000 can be invested into the fund whereas the maximum amount is RM 500 million. A small fee of 1.5% will be charged annually on the total return on investment. If you see table 1.2, it shows the recent investment return table, and if I were to invest in this fund I would be gaining approximately 12.90% return on a 3 year investment or 4.3% annually. Calculation: 12.90% of $10million = $1.29million (for 3 years) or 4.3% of 10million= $430,000 (each year)

RHB Mudharabah: Fund Information Table 1.1: Manager Fund type Date Launched Minimum Investment Fund Price as at June 6, 2011 Buy Sell NAV Annual Management Fee 0.8174 0.8174 0.8174 1.5% RHB Investment Mgmt. Sdn. Bhd. Mixed Asset Myr Balanced - Malaysia (Islamic) May 9, 1996 RM1000

(Daily prices courtesy of The Edge Financial Daily) http://www.invest.com.my/personal/funds/profile/one?fund_id=128

TP021713

Mohammad Talha Awan

Personal Finance

Table 1.2: RHB Mudharabah Investment return

(As published in the The Edge-Lipper Fund Performance Ranking Tables) http://www.invest.com.my/game/funds/fund-one?fund_id=128

Figure 1.2: RHB Fund performance

http://rhbim.rhb.com.my/unit_trust/report/archive.asp#

TP021713

Mohammad Talha Awan

Personal Finance

Figure 1.3: RHB Mudharabah investment sectors

http://www.trustnetoffshore.com/Factsheets/Factsheet.aspx?fundCode=A6FY0&univ=DC

Figure 1.2 shows us the performance of the fund throughout the year and we can see that it had a steady growth and has continued to increase promising a better return every year. The fund not only invests in bonds but there are other sectors as well. This shows us that the investment is equally diversified into many sectors including properties, constructions, services etc. Although RHB Mudharabah provides you with good return rates but there are no guarantees as the market or share prices are never constant and fluctuate on daily basis. This does involve a risk factor which is quite low as banks have knowledge of how good an investment can turn and they have full access to the business or market financial position. But the problem arises as I cannot be involved in the investment decision RHB makes and might be unaware of other opportunities in market that would give me a higher return as compared to the above investment. Choosing this fund might be healthy but a 4.3% return annually is still not efficient enough, as there are other opportunities outside Malaysia where further profitable investments can be made.

TP021713

Mohammad Talha Awan

Personal Finance

Answer 2: The Foreign exchange market is a worldwide financial market where foreign currencies are exchanged. There are many institutions or centers where buyers and seller come to convert or exchange currency and the market helps to determine the value of each currency. People all over the world participate in foreign exchange to gain profits. The main purpose of foreign exchange was to make it easier for business to trade in foreign currency and now investment has formed a greater purpose. If I were to invest $1million in foreign exchange, it would be in Pakistan because if we compare worldwide interest rates you will notice that they are very low, not higher than 4%, but as there is very less investment in Pakistan due to economic crisis the government of Pakistan has decided to maintain high interest rate in order to attract foreign investment. The State Bank has announced to benchmark the interest at 14% to help the economy recover and to encourage economic growth. (Dawn.com/Business) Pakistan Interest rate chart:

http://www.tradingeconomics.com/pakistan/interest-rate Above graph states the fluctuation of interest rates in pakistan from 2002 to 2010, and we can see that it has increased throughout the year. But now the government has decided to keep it unchanged at an average of 14% untill the economy recovers. The interest rate have been higher during the past few years and have also touched 20% which was recorded highest in pakistan. The following is the calculation of return on investment in a savings account in Pakistani rupees.

TP021713

Mohammad Talha Awan

Personal Finance

Calculation of Investment: (Daily Munafa Account - HBL) Amount: Interest rate Minimum deposit amount Interest profit Interest earned on deposit Total interest earned for 3 years Profit on Foreign Investment $1million @ 85.45= Rs 85,450,000 8.84% per annum Rs 20,000 Paid monthly into your account 8.84% of 85,450,000= Rs 7,553,780 per year Rs 24,723,631 or $ 289,334 (using compound interest) ($289,334 /$1,000,000)* 100= 28.9%

Source: http://www.hbl.com/individual-customers-accounts-savings.php#9 The amount that I would be investing is in HBL (Habib Bank Limited), which was the first ever commercial bank that was set up in Pakistan in1947 and has growed to become one of the largest banks in Pakistan with more than 1450 branches. According to my research HBL pays the highest interest as compared to other banks in Pakistan. I will be converting $1 million to 85,450,000 Pakistani Rupees and depositing into HBL Daily Munafa Account which is a category of savings account and gives an interest on 8.84% per annum. This investment or deposit will be made for 3 years in a savings account and am most likely to earn a 28.9% return on my deposti based on current interest rate. Every year a small amount that is 2.5% of my deposit will be deducted and paid as Zakkah. By the end of 3 years I will have a sum of $1,289,334 or Rs 110,173,590 in my savings account which I can withdraw anytime and use it to invest in some other project. (Daily Munafa Account)

My second investment will be into Property in Malaysia. According to many developers views the property market in Malaysia is doing very good and has been stable during 2010 as Europe and US markets are trying to recover from economic recession more and more investors have shown interest for investing in Asian countries. The property business has always been a good investment as the prices are stable or increasing steadily and you get a good return. Even in Middle east countries like Saudi Arabia a lot of demand has risen for houses or properties and eventually prices have risen and might continue to rise in future due to excessive demand. Talking about Malaysia the property market remains positive as the government has been able to

TP021713

Mohammad Talha Awan

Personal Finance

control interest rates, unemployment rate is quite low and the property investment has proven to be an important and reliable asset. The prices of properties in the upcoming years are about to rise as an increase in inflation rate will be experienced in Malaysia and will further increase the property prices. The property market is like investing in Gold, which never fades in value and has a reasonable demand even after 20 years from now.(2011 property Market outlook).

Property Details: KLCC view, Damansara Heights-KL

Type: Bungalow Sale Price: RM 6,500,000 Total Area: 4500 sq. feet Bedrooms: 7 Bathrooms: 5 Furnished: semi Facilities: a lawn garden located nearby Ampang Shopping and Golf club. Source: http://thinkproperty.com.my/realestate/index.php?option=com_propertylistings&type1_my=1&a ddress1=KLCC&Itemid=9999&task=detail&id=446562

The above property is a bungalow for Sale in KL City which is one of the most expensive areas and has quite a demand as it is in the center of the Capital, near to PETRONAS Towers. I will be purchasing the property for the given price and then renting it out on a yearly base for the next 3 years. The monthly rental for the bungalow will be RM 22,000 and by the end of 3 years I will be earning a profit or return of total 12.18% which is quite good. Below is the calculation of the investment.

TP021713

Mohammad Talha Awan

Personal Finance

Calculation: Initial investment: Monthly rental: Yearly Income: 3 years Income: RM 6,500,000 or ($2,152,318) RM 22,000 RM 264,000 or ($84,417) RM 792,000 or ($262,252) ($262,252 / $2,152,318)*100 = 12.18%

Return on Investment:

Property Details: Country Heights, Damansara Type: Bungalow Land area: 10,000-25,000 square feet Sale Price: RM 8,500,000 9,500,000 Bedrooms: 5-7 Bathrooms: 5 Location: Sri Damansara-KL Facilities: swimming pool, recreation park, guarded society and surrounded by shopping complex. Source: http://www.iproperty.com.my/developments/1291/Country_Heights_Damansara_Bungalows__L ands#m1 The above bungalows are located in Damansara and are one of the few left out properties with excellent location, excessive facilities and a total luxury feel. These houses are designed to give a unique presence and a quality lifestyle for people living here. Facilities such as swimming pool, nearby shopping complex and located in Kl attract many business men to live and settle here with families. These are for high income group earners as the rentals are high. I would purchase 1 Bungalow in this location worth RM 9,000,000 and then rent it out for 3 years. This will earn me a return of 12%, similar to that of the previous investment in property and is good.

TP021713

Mohammad Talha Awan

Personal Finance

Calculation: Initial Investment: Monthly Rental: Yearly Income: 3 years income: RM 9,000,000 or ($ 2,980,132) RM 30,000 RM 360,000 or ($ 119,205) RM 1,080,000 or ($ 357,616)

Return on Investment: ($ 357,616 / $ 2,980,132)*100 = 12% Both of the above property investments I Plan to make are healthy, stable and beneficial as the Bungalows act as my assets which I can sell off in the future for a much higher price as they might increase in value and currently can rent it out to gain Monthly income.

My third investment will be in the stock exchange market, where I will be investing into one of the major Multinational Company DELL. The reason why I choose this company is because it has been really good in the computer industry and has a maintained a really good financial position throughout the years. Dell has now been operating for more than 26 years and was the first Computer manufacturing Company to offer custom made Pcs and Laptops according to customer requirements and deliver it to their door steps. Throughout then DELL has been very keen about its performance and quality of products and has maintained it by capturing most of the market. Currently DELL has experienced constant increase in its sales and it owns 13.6% of the computer market. (Dell loses market share) Apple and Dell were quoted the market leader for the first quarter of 2011 as it outperformed other competitors. The purchase of DELL shares can directly be made through America stock Transfer & Trust Company. You can see in the graph below that Dells share price has remained constant and has continuously risen over months. Based on the past performance and being one of the major market share holders the company is determined to do well in the upcoming years as the first quarter results of 2011 have shown at least a 3% increase in share prices.

TP021713

Mohammad Talha Awan

Personal Finance

Dell stock Information: Last trade: Change EPS P/E Volume Market capital $15.72 0.07 (0.45%) 1.67 9.40 7,548,437 29.66 Billion

Dell share price graph 2010-2011:

http://ycharts.com/companies/DELL/performance If I were to invest in DELL and purchase 200,000 shares at the current market price, I would be receiving a return of $1.67 on every share I purchase. The amount earned as dividend would be $334,000, which is 10.6% per annum of the total investment made in purchasing the shares. This is quite a high return and if the company continues to perform efficiently based on the previous records a higher return is to be expected in 3 years. By the end of 3 years the shares could be sold for a much higher price than I actually purchased and hence would allow me to gain profit on selling the shares.

10

TP021713

Mohammad Talha Awan

Personal Finance

Calculations: Invested amount: $3,144,000 Amount of shares: Dividend received: Return in 3 years: 200,000 $334,000 per annum $1,002,000

Return on investment: 10.6% The EPS (earning per share) ratio might fluctuate during the 3 years, but based on my assumptions the earnings will not change much and if it does then only a slight difference on return might be experienced. Conclusion: The amount of investment that I have made in all 3 businesses is approximately $ 9,276,450 and this was calculated based on the current prices and exchange rate. The return on all investments made in property, foreign exchange and stock exchange totals up to 63.7% for 3 years. On an average I will be earning a 21.3% return of my investments which is far better than investing my money in RHB Mudharabah which provided me an average return of 4.3%. All returns and values have been calculated and shown in US Dollar; these investments are mere estimated values and are subjected to change on a daily basis. Values of properties and foreign currencies are taken from Yahoo finance and other Official finance websites.

11

TP021713

Mohammad Talha Awan

Personal Finance

References: Dell Loses More Market Share In Q4 (DELL). 2011. Dell Loses More Market Share In Q4 (DELL). [ONLINE] Available at: http://www.businessinsider.com/2009/1/dell-losing-marketshare-in-anemic-pc-market-dell. [Accessed 09 June 2011] Country Heights Damansara Bungalows / Lands, Bungalow House, , Sri Damansara, Kuala Lumpur, Malaysia. 2011. Country Heights Damansara Bungalows / Lands, Bungalow House, , Sri Damansara, Kuala Lumpur, Malaysia. [ONLINE] Available at:

http://www.iproperty.com.my/developments/1291/Country_Heights_Damansara_Bungalows__L ands#m1. [Accessed 09 June 2011]. 2011 Property Market Outlook | Malaysia property news and resources. 2011. 2011 Property Market Outlook | Malaysia property news and resources. [ONLINE] Available at: http://www.iproperty.com.my/news/3142/2011-Property-Market-Outlook-. [Accessed 09 June 2011]. Daily Munafa Account. 2011. Daily Munafa Account. [ONLINE] Available at:

http://www.investorspk.com/saving-schemes-in-pakistan/non-islamic-saving-schemes-inpakistan/daily-munafa-account. [Accessed 09 June 2011]. Pakistan Interest Rate . 2011. Pakistan Interest Rate . [ONLINE] Available at: http://www.tradingeconomics.com/pakistan/interest-rate. [Accessed 09 June 2011].

12

Vous aimerez peut-être aussi

- Capital Letter December 2011Document5 pagesCapital Letter December 2011marketingPas encore d'évaluation

- Basics of Financial Market: Report By: Rahul SinghDocument47 pagesBasics of Financial Market: Report By: Rahul Singhrrajpoot_1Pas encore d'évaluation

- How To Invest For Financial Freedom in PakistanDocument5 pagesHow To Invest For Financial Freedom in PakistanAnonymous DlNhQiPas encore d'évaluation

- Project Report ON Study ofDocument78 pagesProject Report ON Study ofSana MoidPas encore d'évaluation

- RHB Dana Hazeem Fund FactsheetDocument2 pagesRHB Dana Hazeem Fund FactsheetHarun AliasPas encore d'évaluation

- Investor Perception On Investment AvenuesDocument55 pagesInvestor Perception On Investment AvenuesVenkatrao Vargani100% (1)

- Retirerment Study Notes SampleDocument35 pagesRetirerment Study Notes SampleDeep ShikhaPas encore d'évaluation

- Innovative Investments in MalaysiaDocument30 pagesInnovative Investments in MalaysiaNavin RajagopalanPas encore d'évaluation

- 7 Investment Planning PDPDocument8 pages7 Investment Planning PDPManish ChandwaniPas encore d'évaluation

- Basics of Unit Trust InvestingDocument30 pagesBasics of Unit Trust InvestingnanabobomomoPas encore d'évaluation

- Tradecap Managed Account ServicesDocument4 pagesTradecap Managed Account ServicesRajesh ThangarajPas encore d'évaluation

- FinancialPlanning & MutualFundsDocument32 pagesFinancialPlanning & MutualFundsChris LukePas encore d'évaluation

- Reliance Mutual Fund Presents: Systematic Investment Plan Systematic Investment PlanDocument24 pagesReliance Mutual Fund Presents: Systematic Investment Plan Systematic Investment Planpuneetk20Pas encore d'évaluation

- Risk and Return AnalysisDocument38 pagesRisk and Return AnalysisAshwini Pawar100% (1)

- Smart Mutual FundsDocument7 pagesSmart Mutual FundsMahesh ThirupathiPas encore d'évaluation

- Three Key Financial Management Principles: Risk-Return Tradeoff, Cash Flow, Competitive MarketsDocument6 pagesThree Key Financial Management Principles: Risk-Return Tradeoff, Cash Flow, Competitive MarketsRoopini RavindranPas encore d'évaluation

- Economics Project 1Document15 pagesEconomics Project 1gangarbhakti89% (18)

- Knowledge Initiative - July 2014Document10 pagesKnowledge Initiative - July 2014Gursimran SinghPas encore d'évaluation

- Carry Trade Lesson 2: Carry Trades: An Opportunity To Profit From International Changes in Supply and DemandDocument15 pagesCarry Trade Lesson 2: Carry Trades: An Opportunity To Profit From International Changes in Supply and Demandsaied jaberPas encore d'évaluation

- Assignment PDBM - MarketingDocument23 pagesAssignment PDBM - MarketingNorita YahayaPas encore d'évaluation

- Proposal Prakash KarnDocument11 pagesProposal Prakash Karnmkg_just4u8932Pas encore d'évaluation

- Why Should An Accounting Professional Become Literate About Foreign Exchange?Document3 pagesWhy Should An Accounting Professional Become Literate About Foreign Exchange?Bea LadaoPas encore d'évaluation

- Manage Funds and Maximize ProfitsDocument84 pagesManage Funds and Maximize ProfitsNeha SharmaPas encore d'évaluation

- Thesis Unit Trust Management LTDDocument4 pagesThesis Unit Trust Management LTDafkomeetd100% (1)

- Strategic Analysis of SBIMFDocument19 pagesStrategic Analysis of SBIMF26amitPas encore d'évaluation

- Viability of Business Associate ModelDocument16 pagesViability of Business Associate Modelaman27jaiswalPas encore d'évaluation

- Q2 Describe The Features and Benefits of THREE ProductDocument1 pageQ2 Describe The Features and Benefits of THREE ProductYEOH SENG WEI NICKLAUSPas encore d'évaluation

- A Project of EnterpreneurshipDocument18 pagesA Project of EnterpreneurshipKomal ShujaatPas encore d'évaluation

- Mutual Fund......Document113 pagesMutual Fund......Amrin ChaudharyPas encore d'évaluation

- Mallu MBA: PG Department of Business Administration, BELAGAVIDocument72 pagesMallu MBA: PG Department of Business Administration, BELAGAVImallikarjunkalatippiPas encore d'évaluation

- Eliotwave Fund Management AccountDocument9 pagesEliotwave Fund Management AccountToni NathanielPas encore d'évaluation

- Real Estate Quarterly Q1 2011Document20 pagesReal Estate Quarterly Q1 2011Pushpak Reddy GattupalliPas encore d'évaluation

- Investment PlanningDocument231 pagesInvestment PlanningKamna Deepak ThorvePas encore d'évaluation

- DSPBRIM-Mutual Fund Basics and SIP Presentation NewDocument45 pagesDSPBRIM-Mutual Fund Basics and SIP Presentation NewavinashmunnuPas encore d'évaluation

- Portfolio ConstructionDocument21 pagesPortfolio ConstructionRobin SahaPas encore d'évaluation

- Ifp 20 Fundamentals of Investment PlanningDocument4 pagesIfp 20 Fundamentals of Investment Planningsachin_chawlaPas encore d'évaluation

- Stock Market Sharekhan BBA MBA Project ReportDocument44 pagesStock Market Sharekhan BBA MBA Project Reportfun_mag100% (1)

- Participants Enrol. NoDocument18 pagesParticipants Enrol. NoShashank TiwariPas encore d'évaluation

- Understanding The Concept of InvestmentDocument17 pagesUnderstanding The Concept of InvestmentSUDHIRPas encore d'évaluation

- Capital Letter May 2011Document6 pagesCapital Letter May 2011marketingPas encore d'évaluation

- Relationship Between Interest Rates, Deposits, Lending and Inflation in NepalDocument64 pagesRelationship Between Interest Rates, Deposits, Lending and Inflation in NepalMukesh Raj BanshiPas encore d'évaluation

- Macro Economics - Anik AhmedDocument6 pagesMacro Economics - Anik AhmedAnupam BiswasPas encore d'évaluation

- Treasury Securities in BangladeshDocument12 pagesTreasury Securities in BangladeshAmit KumarPas encore d'évaluation

- Iip ReportDocument83 pagesIip ReportVikram Singh BishtPas encore d'évaluation

- MBA 216 - B (Investment Analysis and Portfolio Management)Document2 pagesMBA 216 - B (Investment Analysis and Portfolio Management)CEDDFREY JOHN ENERIO AKUTPas encore d'évaluation

- Are You InvestingDocument10 pagesAre You InvestingShailesh BansalPas encore d'évaluation

- Finance ProjectDocument19 pagesFinance ProjectKumar KokiPas encore d'évaluation

- Systematic Investment Plan - A Better Way To Build Wealth Over The Long TermDocument5 pagesSystematic Investment Plan - A Better Way To Build Wealth Over The Long Termginig69Pas encore d'évaluation

- Prasarn Trairatvorakul: The Strength of The Thai Economy and Future Development in Thailand's Financial SystemDocument3 pagesPrasarn Trairatvorakul: The Strength of The Thai Economy and Future Development in Thailand's Financial Systemivan anonuevoPas encore d'évaluation

- Practical Orientation: of National Bank LimitedDocument10 pagesPractical Orientation: of National Bank LimitedJamal Uddin RajibPas encore d'évaluation

- Think FundsIndia August 2014Document8 pagesThink FundsIndia August 2014marketingPas encore d'évaluation

- Best Bank Fixed DepositsDocument9 pagesBest Bank Fixed DepositsAkanksha SrivastavaPas encore d'évaluation

- Time Value of Money (TVM)Document30 pagesTime Value of Money (TVM)thomasderz1961Pas encore d'évaluation

- Financial Planning for BeginnersDocument48 pagesFinancial Planning for Beginnersthen12345Pas encore d'évaluation

- Assignment Number 4 by Asghar Ali Atif Rehman Nadia Rasheed Shabi Ul Hasan & M.AbrarDocument15 pagesAssignment Number 4 by Asghar Ali Atif Rehman Nadia Rasheed Shabi Ul Hasan & M.AbrarAsghar AliPas encore d'évaluation

- 3 CettDocument37 pages3 Cettsanjana13Pas encore d'évaluation

- Freedom Unleashed: How to Make Malaysia a Tax Free CountryD'EverandFreedom Unleashed: How to Make Malaysia a Tax Free CountryÉvaluation : 5 sur 5 étoiles5/5 (1)

- How To Make Money In Stocks Value Investing StrategiesD'EverandHow To Make Money In Stocks Value Investing StrategiesPas encore d'évaluation

- The Exciting World of Indian Mutual FundsD'EverandThe Exciting World of Indian Mutual FundsÉvaluation : 5 sur 5 étoiles5/5 (1)

- Bcs Budget PlanDocument1 pageBcs Budget PlanTalha MunirPas encore d'évaluation

- Financial ReportingDocument16 pagesFinancial ReportingTalha MunirPas encore d'évaluation

- Corporate Failure (Assignment)Document9 pagesCorporate Failure (Assignment)Talha MunirPas encore d'évaluation

- Bcs Budget PlanDocument1 pageBcs Budget PlanTalha MunirPas encore d'évaluation

- Accounting AssignmentDocument7 pagesAccounting AssignmentTalha MunirPas encore d'évaluation

- Cfa BrochureDocument8 pagesCfa BrochureTalha MunirPas encore d'évaluation

- J&JDocument12 pagesJ&JTalha MunirPas encore d'évaluation

- EditorialDocument1 pageEditorialTalha MunirPas encore d'évaluation

- Hani AssignmentDocument4 pagesHani AssignmentTalha MunirPas encore d'évaluation

- Mee437 Operations Research Fall Sem 2016-17: Introduction To Sequencing ProblemsDocument22 pagesMee437 Operations Research Fall Sem 2016-17: Introduction To Sequencing ProblemsShyloo GsaPas encore d'évaluation

- Chap 016Document12 pagesChap 016dbjn100% (1)

- Jay Cesar system developer worksheet adjustmentsDocument4 pagesJay Cesar system developer worksheet adjustmentsAdam CuencaPas encore d'évaluation

- Group 4Document9 pagesGroup 4Nurul AinPas encore d'évaluation

- Internship Report On GPDocument45 pagesInternship Report On GPpavel2051Pas encore d'évaluation

- BP 68 - Corporation CodeDocument25 pagesBP 68 - Corporation CodeJacinto Jr JameroPas encore d'évaluation

- PRINCE2 2009 Syllabus 2011 V1 5Document25 pagesPRINCE2 2009 Syllabus 2011 V1 5nosternosterPas encore d'évaluation

- 1st Public Auction Acquired AssetsDocument31 pages1st Public Auction Acquired AssetsPatrick LorenzoPas encore d'évaluation

- LOI JET A1 - McMatthise GlobalDocument2 pagesLOI JET A1 - McMatthise GlobalTCL TPas encore d'évaluation

- Design and Methodology of an Inpatient Medical Record SystemDocument6 pagesDesign and Methodology of an Inpatient Medical Record SystemJun Rey SantaritaPas encore d'évaluation

- Divynshu Yadav - Final Internship ReportDocument61 pagesDivynshu Yadav - Final Internship ReportTamanna AroraPas encore d'évaluation

- Dell-Using E-Commerce For Success: Application CaseDocument12 pagesDell-Using E-Commerce For Success: Application CaseAri MuhardonoPas encore d'évaluation

- Mumbai Pharma CompanyDocument8 pagesMumbai Pharma CompanyPankaj BaghPas encore d'évaluation

- Gutierrez Corporation’s department A should sell component C to department B at P96 per unitDocument4 pagesGutierrez Corporation’s department A should sell component C to department B at P96 per unitRoseann KimPas encore d'évaluation

- The False Expectations of Michael Porter's Strategic Management Framework / Omar AktoufDocument33 pagesThe False Expectations of Michael Porter's Strategic Management Framework / Omar AktoufBiblioteca CHGMLPas encore d'évaluation

- Aerospace Lean Six Sigma NadeemDocument4 pagesAerospace Lean Six Sigma NadeemSyedNadeemAhmedPas encore d'évaluation

- l1 - Technopreneur Perspective & MotivationDocument27 pagesl1 - Technopreneur Perspective & MotivationAzizul AsriPas encore d'évaluation

- Hull RMFI4 e CH 22Document11 pagesHull RMFI4 e CH 22jlosamPas encore d'évaluation

- 115 - Indian Stock Market - Sumit DwivediDocument23 pages115 - Indian Stock Market - Sumit DwivedishobikhanPas encore d'évaluation

- The importance of ethics in businessDocument6 pagesThe importance of ethics in businessAyisOgaPas encore d'évaluation

- Tahapan KesadaranDocument11 pagesTahapan KesadaranFerlo NicoPas encore d'évaluation

- Obligation of The Agent (Explanation)Document3 pagesObligation of The Agent (Explanation)Joshua Chavez100% (1)

- Handbook of Metal Injection MoldingDocument3 pagesHandbook of Metal Injection MoldingPk Jha0% (2)

- Introduction To Accounting - Model PaperDocument7 pagesIntroduction To Accounting - Model PaperrkPas encore d'évaluation

- La Casa Del Fake 2Document111 pagesLa Casa Del Fake 2naointeressa1321736Pas encore d'évaluation

- Fast Fashion: The Value of Fast Fashion - Rapid Production, Enhanced Design and Stratefic Consumer BehaviourDocument32 pagesFast Fashion: The Value of Fast Fashion - Rapid Production, Enhanced Design and Stratefic Consumer BehaviourJohn Paul HodgePas encore d'évaluation

- Differences Between PAS 55 and ISO 55000Document4 pagesDifferences Between PAS 55 and ISO 55000BaberBegPas encore d'évaluation

- Correspondence Between The Election Assistance Commission and ES&SDocument9 pagesCorrespondence Between The Election Assistance Commission and ES&SChristopher GleasonPas encore d'évaluation

- Qwest: A Focus On Presentation and Disclosure: SynopsisDocument3 pagesQwest: A Focus On Presentation and Disclosure: SynopsisCryptic LollPas encore d'évaluation

- English Oven Company ProfileDocument10 pagesEnglish Oven Company ProfileAadil Kakar100% (1)