Académique Documents

Professionnel Documents

Culture Documents

f7sgp 2007 Dec Q

Transféré par

Darkeside GarrisonDescription originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

f7sgp 2007 Dec Q

Transféré par

Darkeside GarrisonDroits d'auteur :

Formats disponibles

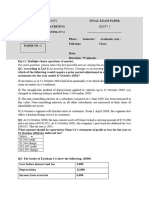

Financial Reporting (Singapore)

Tuesday 11 December 2007

Time allowed Reading and planning: Writing:

15 minutes 3 hours

ALL FIVE questions are compulsory and MUST be attempted.

Do NOT open this paper until instructed by the supervisor. During reading and planning time only the question paper may be annotated. You must NOT write in your answer booklet until instructed by the supervisor. This question paper must not be removed from the examination hall.

The Association of Chartered Certified Accountants

The Institute of Certified Public Accountants of Singapore

Paper F7 (SGP)

Fundamentals Level Skills Module

ALL FIVE questions are compulsory and MUST be attempted 1 On 1 October 2006 Plateau acquired the following non-current investments: 3 million equity shares in Savannah by an exchange of one share in Plateau for every two shares in Savannah plus $1 per acquired Savannah share in cash. The market price of each Plateau share at the date of acquisition was $6. 30% of the equity shares of Axle at a cost of $750 per share in cash.

Only the cash consideration of the above investments has been recorded by Plateau. The summarised draft balance sheets of the three companies at 30 September 2007 are: Plateau $000 Assets Non-current assets Property, plant and equipment Investments in Savannah and Axle Available-for-sale investments Current assets Inventory Trade receivables Total assets Equity and liabilities Equity shares Retained earnings at 30 September 2006 for year ended 30 September 2007 Non-current liabilities 7% Loan notes Current liabilities Total equity and liabilities The following information is relevant: (i) At the date of acquisition the fair values of Savannahs assets were equal to their carrying amounts with the exception of Savannahs land which had a fair value of $500,000 below its carrying amount; it was written down by this amount shortly after acquisition and has not changed in value since then. Savannah $000 Axle $000

18,400 12,000 6,500 36,900 6,900 3,200 47,000 10,000 16,000 8,000 34,000 5,000 8,000 47,000

10,400 nil nil 10,400 6,200 1,500 18,100 4,000 6,500 2,400 12,900 1,000 4,200 18,100

18,000 nil nil 18,000 3,600 2,400 24,000 4,000 11,000 5,000 20,000 1,000 3,000 24,000

(ii) On 1 October 2006, Plateau sold an item of plant to Savannah at its agreed fair value of $25 million. Its carrying amount prior to the sale was $2 million. The estimated remaining life of the plant at the date of sale was five years (straight-line depreciation). (iii) During the year ended 30 September 2007 Savannah sold goods to Plateau for $27 million. Savannah had marked up these goods by 50% on cost. Plateau had a third of the goods still in its inventory at 30 September 2007. There were no intra-group payables/receivables at 30 September 2007. (iv) Impairment tests on 30 September 2007 concluded that the value of the investment in Axle was not impaired, but consolidated goodwill was impaired by $900,000. (v) The available-for-sale investments are included in Plateaus balance sheet (above) at their fair value on 1 October 2006, but they have a fair value of $9 million at 30 September 2007 (vi) No dividends were paid during the year by any of the companies. (vii) The equity share capital of Plateau at 30 September 2007 consists of 10 million shares. The equity share capital of Savannah and Axle consist of 4 million shares each. 2

Required: (a) Prepare the consolidated balance sheet for Plateau as at 30 September 2007. (20 marks)

(b) A financial assistant has observed that the fair value exercise means that a subsidiarys net assets are included at acquisition at their fair (current) values in the consolidated balance sheet. The assistant believes that it is inconsistent to aggregate the subsidiarys net assets with those of the parent because most of the parents assets are carried at historical cost. Required: Comment on the assistants observation and explain why the net assets of acquired subsidiaries are consolidated at acquisition at their fair values. (5 marks) (25 marks)

[P.T.O.

The following trial balance relates to Llama, a listed company, at 30 September 2007: Land and buildings at valuation 1 October 2006 (note (i)) Plant at cost (note (i)) Accumulated depreciation of plant at 1 October 2006 Investments at fair value through profit and loss (note (i)) Investment income Cost of sales (note (i)) Distribution costs Administrative expenses Loan interest paid Inventory at 30 September 2007 Income tax (note (ii)) Trade receivables Revenue Equity shares Retained earnings at 1 October 2006 2% loan note 2009 (note (iii)) Trade payables Revaluation reserve (re land and buildings) Deferred tax Suspense account (note (iv)) Bank $000 130,000 128,000 26,500 2,200 89,200 11,000 12,500 800 37,900 400 35,100 180,400 60,000 25,500 80,000 34,700 14,000 11,200 24,000 6,600 471,000 $000

32,000

471,000

The following notes are relevant: (i) Llama has a policy of revaluing its land and buildings at each year end. The valuation in the trial balance includes a land element of $30 million. The estimated remaining life of the buildings at that date (1 October 2006) was 20 years. On 30 September 2007, a professional valuer valued the buildings at $92 million with no change in the value of the land. Depreciation of buildings is charged 60% to cost of sales and 20% each to distribution costs and administrative expenses. During the year Llama manufactured an item of plant that it is using as part of its own operating capacity. The details of its cost, which is included in cost of sales in the trial balance, are: Materials cost Direct labour cost Machine time cost Directly attributable overheads $000 6,000 4,000 8,000 6,000

The manufacture of the plant was completed on 31 March 2007 and the plant was brought into immediate use, but its cost has not yet been capitalised. All plant is depreciated at 121/2% per annum (time apportioned where relevant) using the reducing balance method and charged to cost of sales. No non-current assets were sold during the year. The fair value of the investments held at fair value through profit and loss at 30 September 2007 was $271 million. (ii) The balance of income tax in the trial balance represents the under/over provision of the previous years estimate. The estimated income tax liability for the year ended 30 September 2007 is $187 million. At 30 September 2007 there were $40 million of taxable temporary differences. The income tax rate is 25%. Note: you may assume that the movement in deferred tax should be taken to the income statement. (iii) The 2% loan note was issued on 1 April 2007 under terms that provide for a large premium on redemption in 2009. The finance department has calculated that the effect of this is that the loan note has an effective interest rate of 6% per annum.

(iv) The suspense account contains the corresponding credit entry for the proceeds of a rights issue of shares made on 1 July 2007. The terms of the issue were one share for every four held at 80 cents per share. Llamas share price immediately before the issue was $1. The issue was fully subscribed. (v) The equity share capital of Llama prior to the rights issue consisted of 120 million shares. Required: Prepare for Llama: (a) An income statement for the year ended 30 September 2007. (b) A balance sheet as at 30 September 2007. (c) A calculation of the earnings per share for the year ended 30 September 2007. Note: a statement of changes in equity is not required. (25 marks) (9 marks) (13 marks) (3 marks)

[P.T.O.

Shown below are the recently issued (summarised) financial statements of Harbin, a listed company, for the year ended 30 September 2007, together with comparatives for 2006 and extracts from the Chief Executives report that accompanied their issue. Income statement Revenue Cost of sales Gross profit Operating expenses Finance costs Profit before tax Income tax expense (at 25%) Profit for the period Balance sheet Non-current assets Property, plant and equipment Goodwill 2007 $000 250,000 (200,000) 50,000 (26,000) (8,000) 16,000 (4,000) 12,000 2006 $000 180,000 (150,000) 30,000 (22,000) (nil) 8,000 (2,000) 6,000

210,000 10,000 220,000 25,000 13,000 nil 38,000 258,000 100,000 14,000 114,000 100,000 17,000 23,000 4,000 44,000 258,000

90,000 nil 90,000 15,000 8,000 14,000 37,000 127,000 100,000 12,000 112,000 nil nil 13,000 2,000 15,000 127,000

Current assets Inventory Trade receivables Bank

Total assets Equity and liabilities Equity shares (comprising 100 million shares) Retained earnings

Non-current liabilities 8% loan notes Current liabilities Bank overdraft Trade payables Current tax payable

Total equity and liabilities Extracts from the Chief Executives report: Highlights of Harbins performance for the year ended 30 September 2007: an increase in sales revenue of 39% gross profit margin up from 167% to 20% a doubling of the profit for the period.

In response to the improved position the Board paid a dividend of 10 cents per share in September 2007, an increase of 25% on the previous year.

You have also been provided with the following further information. On 1 October 2006 Harbin purchased the whole of the net assets of Fatima (previously a privately owned entity) for $100 million. The contribution of the purchase to Harbins results for the year ended 30 September 2007 was: Revenue Cost of sales Gross profit Operating expenses Profit before tax There were no disposals of non-current assets during the year. The following ratios have been calculated for Harbin for the year ended 30 September 2006: Return on year-end capital employed (profit before interest and tax over total assets less current liabilities) Net asset (equal to capital employed) turnover Net profit (before tax) margin Current ratio Closing inventory holding period (in days) Trade receivables collection period (in days) Trade payables payment period (based on cost of sales) (in days) Gearing (debt over debt plus equity) Required: (a) Calculate ratios for Harbin for the year ended 30 September 2007 equivalent to those calculated for the year ended 30 September 2006 (showing your workings). (8 marks) (b) Assess the financial performance and position of Harbin for the year ended 30 September 2007 compared to the previous year. Your answer should refer to the information in the Chief Executives report and the impact of the purchase of the net assets of Fatima. (17 marks) (25 marks) 71% 16 44% 25 37 16 32 nil $000 70,000 (40,000) 30,000 (8,000) 22,000

[P.T.O.

(a) An important requirement of the CCDGs Framework for the Preparation and Presentation of Financial Statements (Framework) is that in order to be reliable, an entitys financial statements should represent faithfully the transactions and events that it has undertaken. Required: Explain what is meant by faithful representation and how it enhances reliability. (5 marks)

(b) On 1 April 2007, Fino increased the operating capacity of its plant. Due to a lack of liquid funds it was unable to buy the required plant which had a cost of $350,000. On the recommendation of the finance director, Fino entered into an agreement to lease the plant from the manufacturer. The lease required four annual payments in advance of $100,000 each commencing on 1 April 2007. The plant would have a useful life of four years and would be scrapped at the end of this period. The finance director, believing the lease to be an operating lease, commented that the agreement would improve the companys return on capital employed (compared to outright purchase of the plant). Required: (i) Discuss the validity of the finance directors comment and describe how FRS 17 Leases ensures that leases such as the above are faithfully represented in an entitys financial statements. (4 marks)

(ii) Prepare extracts of Finos income statement and balance sheet for the year ended 30 September 2007 in respect of the rental agreement assuming: (1) It is an operating lease (2) It is a finance lease (use an implicit interest rate of 10% per annum). (2 marks) (4 marks) (15 marks)

Product development costs are a material cost for many companies. They are either written off as an expense or capitalised as an asset. Required: (a) Discuss the conceptual issues involved and the definition of an asset that may be applied in determining whether development expenditure should be treated as an expense or an asset. (4 marks) (b) Emerald has had a policy of writing off development expenditure to the income statement as it was incurred. In preparing its financial statements for the year ended 30 September 2007 it has become aware that, under FRS rules, qualifying development expenditure should be treated as an intangible asset. Below is the qualifying development expenditure for Emerald: Year Year Year Year ended ended ended ended 30 30 30 30 September September September September 2004 2005 2006 2007 $000 300 240 800 400

All capitalised development expenditure is deemed to have a four year life. Assume amortisation commences at the beginning of the accounting period following capitalisation. Emerald had no development expenditure before that for the year ended 30 September 2004. Required: Treating the above as the correction of an error in applying an accounting policy, calculate the amounts which should appear in the income statement and balance sheet (including comparative figures), and statement of changes in equity of Emerald in respect of the development expenditure for the year ended 30 September 2007. Note: ignore taxation. (6 marks) (10 marks)

End of Question Paper

Vous aimerez peut-être aussi

- Dec 2008Document8 pagesDec 2008Jehan PereraPas encore d'évaluation

- 2-5hkg 2007 Jun QDocument11 pages2-5hkg 2007 Jun QKeshav BhuckPas encore d'évaluation

- QuestionsDocument16 pagesQuestionsRuby JanePas encore d'évaluation

- Dipifr 2003 Dec QDocument10 pagesDipifr 2003 Dec QWesley JenkinsPas encore d'évaluation

- College of Accountancy Final Examination Acctg 206A InstructionsDocument4 pagesCollege of Accountancy Final Examination Acctg 206A InstructionsCarmela TolinganPas encore d'évaluation

- 2019 DecemberDocument14 pages2019 DecemberHsaung HaymarnPas encore d'évaluation

- Class Exercise: Cash Flow StatementDocument2 pagesClass Exercise: Cash Flow StatementAbhi SinghPas encore d'évaluation

- Felicia Co Ae101 AccountingDocument4 pagesFelicia Co Ae101 Accountingelsana philipPas encore d'évaluation

- F7.2 - Mock Test 1Document5 pagesF7.2 - Mock Test 1huusinh2402Pas encore d'évaluation

- Review Problems AnswersDocument4 pagesReview Problems AnswersFranchette Yvonne JulianPas encore d'évaluation

- Dipifr 2003 Dec ADocument11 pagesDipifr 2003 Dec AAhmed Raza MirPas encore d'évaluation

- Book Keeping & Accounts/Series-4-2007 (Code2006)Document13 pagesBook Keeping & Accounts/Series-4-2007 (Code2006)Hein Linn Kyaw100% (2)

- Exam June 2008Document9 pagesExam June 2008kalowekamoPas encore d'évaluation

- Delta Inc Balance Sheet and Income StatementDocument22 pagesDelta Inc Balance Sheet and Income StatementRos Yaj NivramePas encore d'évaluation

- Icandocumentsnovemebr 2017 Pathfinder Skills PDFDocument179 pagesIcandocumentsnovemebr 2017 Pathfinder Skills PDFDaniel AdegboyePas encore d'évaluation

- COMSATS University Islamabad: Accounting IDocument3 pagesCOMSATS University Islamabad: Accounting IHassan MalikPas encore d'évaluation

- ACCT 101 QUIZ 11 Section ReviewDocument5 pagesACCT 101 QUIZ 11 Section ReviewhappystonePas encore d'évaluation

- Latihan Soal Consolidation of SOFP Dan SOPLDocument4 pagesLatihan Soal Consolidation of SOFP Dan SOPLRaihan Nabilah AzaliPas encore d'évaluation

- Acp - Acc417 Case Study 1Document6 pagesAcp - Acc417 Case Study 1Faker MejiaPas encore d'évaluation

- BusCom Intercompany SalesDocument13 pagesBusCom Intercompany SalesCarmela BautistaPas encore d'évaluation

- HKICPA QP Exam (Module A) May2007 Question PaperDocument7 pagesHKICPA QP Exam (Module A) May2007 Question Papercynthia tsuiPas encore d'évaluation

- F7uk 2011 Dec AnsDocument10 pagesF7uk 2011 Dec Ansahsan_zeb_1Pas encore d'évaluation

- School of Public & Environmental Affairs V346 (15309) Assignment V346-V Due Date: 08-Apr-10Document4 pagesSchool of Public & Environmental Affairs V346 (15309) Assignment V346-V Due Date: 08-Apr-10Zack HigginsPas encore d'évaluation

- Review Test FarDocument10 pagesReview Test FarEli PinesPas encore d'évaluation

- Advanced Accounting & Financial Reporting2008 E - 14Document5 pagesAdvanced Accounting & Financial Reporting2008 E - 14Noman KhanPas encore d'évaluation

- ACCA Financial Reporting (FR) Further Question Practice Practice & Apply Questions & AnswersDocument7 pagesACCA Financial Reporting (FR) Further Question Practice Practice & Apply Questions & AnswersMr.XworldPas encore d'évaluation

- M - Limited Companies (After Edit)Document41 pagesM - Limited Companies (After Edit)PublicEnemy007Pas encore d'évaluation

- Section B - ALL THREE Questions Are Compulsory and MUST Be AttemptedDocument6 pagesSection B - ALL THREE Questions Are Compulsory and MUST Be AttemptedProf. OBESEPas encore d'évaluation

- Pilot Paper F7Document6 pagesPilot Paper F7Dorian CaruanaPas encore d'évaluation

- Sha1 ACT 201 Final Exam-Fall 2021Document4 pagesSha1 ACT 201 Final Exam-Fall 2021Ifaz Mohammed IslamPas encore d'évaluation

- 1 60Document23 pages1 60Joshua Gabrielle B. GalidoPas encore d'évaluation

- Solutions Guide: Please Reword The Answers To Essay Type Parts So As To Guarantee That Your Answer Is An Original. Do Not Submit As Your OwnDocument9 pagesSolutions Guide: Please Reword The Answers To Essay Type Parts So As To Guarantee That Your Answer Is An Original. Do Not Submit As Your Ownkswb12Pas encore d'évaluation

- (Academic Review and Training School, Inc.) 2F & 3F Crème BLDG., Abella ST., Naga City Tel No.: (054) 472-9104 E-MailDocument11 pages(Academic Review and Training School, Inc.) 2F & 3F Crème BLDG., Abella ST., Naga City Tel No.: (054) 472-9104 E-MailMichael BongalontaPas encore d'évaluation

- AF314 Flexi 2019 - Assignment-PrintDocument3 pagesAF314 Flexi 2019 - Assignment-PrintSamantha NarayanPas encore d'évaluation

- Statement of Cash Flow Set-2Document9 pagesStatement of Cash Flow Set-2vdj kumarPas encore d'évaluation

- F7INT 2014 Jun QDocument9 pagesF7INT 2014 Jun QBilal PashaPas encore d'évaluation

- Separate and Consolidated QuizDocument6 pagesSeparate and Consolidated QuizAllyssa Kassandra LucesPas encore d'évaluation

- Problem No. 1: Ap - 1Stpb - 05.07Document10 pagesProblem No. 1: Ap - 1Stpb - 05.07AnnPas encore d'évaluation

- Cpa Aditional CorlynDocument34 pagesCpa Aditional CorlynAlexaMarieAliboghaPas encore d'évaluation

- Ca Q&a Dec 2017Document101 pagesCa Q&a Dec 2017Bruce GomaPas encore d'évaluation

- 2.3 Paper 2.3 - Accounting For Business - 1Document6 pages2.3 Paper 2.3 - Accounting For Business - 1Himanshu SinghPas encore d'évaluation

- Lebanese Association of Certified Public Accountants - IFRS February Exam 2019Document8 pagesLebanese Association of Certified Public Accountants - IFRS February Exam 2019jad NasserPas encore d'évaluation

- Chapter - 2 - Exercise & Problems ANSWERSDocument5 pagesChapter - 2 - Exercise & Problems ANSWERSFahad Mushtaq100% (2)

- Diploma in International Financial Reporting: Thursday 6 December 2007Document9 pagesDiploma in International Financial Reporting: Thursday 6 December 2007Ajit TiwariPas encore d'évaluation

- 6sgp 2007 Dec QDocument7 pages6sgp 2007 Dec Qapi-19836745Pas encore d'évaluation

- C1 Buscom Classroom Activity With AnswersDocument3 pagesC1 Buscom Classroom Activity With AnswerskimberlyroseabianPas encore d'évaluation

- Balance Sheet Valix C1ValixDocument14 pagesBalance Sheet Valix C1Valixmaryqueenramos79% (24)

- Cost Accounting Problems and SolutionsDocument7 pagesCost Accounting Problems and SolutionspriyaPas encore d'évaluation

- AuditingDocument5 pagesAuditingJona Mae Milla0% (1)

- Consolidation 1 Sub and An Associate 2Document2 pagesConsolidation 1 Sub and An Associate 2Tay?Pas encore d'évaluation

- (L1) Financial Reporting PDFDocument25 pages(L1) Financial Reporting PDFCasius MubambaPas encore d'évaluation

- Homework For Chapter 8Document6 pagesHomework For Chapter 8Pramit Singh0% (1)

- A Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionD'EverandA Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionPas encore d'évaluation

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsD'EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsPas encore d'évaluation

- List of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosD'EverandList of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosPas encore d'évaluation

- Finding Balance 2016: Benchmarking the Performance of State-Owned Enterprise in Island CountriesD'EverandFinding Balance 2016: Benchmarking the Performance of State-Owned Enterprise in Island CountriesPas encore d'évaluation

- Harmonization and Standardization of Bond Market Infrastructures in ASEAN+3: ASEAN+3 Bond Market Forum Sub-Forum 2 Phase 3 ReportD'EverandHarmonization and Standardization of Bond Market Infrastructures in ASEAN+3: ASEAN+3 Bond Market Forum Sub-Forum 2 Phase 3 ReportPas encore d'évaluation

- List of the Most Important Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Key Financial RatiosD'EverandList of the Most Important Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Key Financial RatiosPas encore d'évaluation

- 五子棋一点通Document102 pages五子棋一点通Darkeside GarrisonPas encore d'évaluation

- All-National University of Singapore-2010-Rethinking Agency Theory-The View From LawDocument22 pagesAll-National University of Singapore-2010-Rethinking Agency Theory-The View From LawDarkeside GarrisonPas encore d'évaluation

- CN02Document8 pagesCN02Darkeside GarrisonPas encore d'évaluation

- CN01Document7 pagesCN01Darkeside GarrisonPas encore d'évaluation

- Portfolio As On 30.11.2019Document275 pagesPortfolio As On 30.11.2019ishan bapatPas encore d'évaluation

- Central Bank of Kuwait Issues and Regulates CurrencyDocument7 pagesCentral Bank of Kuwait Issues and Regulates CurrencyrossmckenziePas encore d'évaluation

- Lbo Model Short FormDocument6 pagesLbo Model Short FormHeu Sai HoePas encore d'évaluation

- Role of Merchant Bankers in Capital MarketsDocument23 pagesRole of Merchant Bankers in Capital MarketschandranilPas encore d'évaluation

- Moran Vs CA (133 Scra 88)Document9 pagesMoran Vs CA (133 Scra 88)theo_borjaPas encore d'évaluation

- Comparison Table of Luxembourg Investment VehiclesDocument11 pagesComparison Table of Luxembourg Investment Vehiclesoliviersciales100% (1)

- Pubbid041219ncr (WD) PDFDocument11 pagesPubbid041219ncr (WD) PDFJayson VedraPas encore d'évaluation

- Receivables Management: Unit 5Document28 pagesReceivables Management: Unit 5ANUSHAPas encore d'évaluation

- Business PlanDocument29 pagesBusiness PlanShuvro Kumar Paul100% (1)

- Chapter (1) The Conceptual Framework of Accounting: February 2019Document25 pagesChapter (1) The Conceptual Framework of Accounting: February 2019Vincent Angelo AutenticoPas encore d'évaluation

- Chartered Wealth ManagerDocument4 pagesChartered Wealth ManagerKeith Parker100% (1)

- FORM16: Signature Not VerifiedDocument5 pagesFORM16: Signature Not Verifiedmath_mallikarjun_sapPas encore d'évaluation

- Gitman CH 14 15 QnsDocument3 pagesGitman CH 14 15 QnsFrancisCop100% (1)

- Strategic Analysis & Choice Topic 5Document48 pagesStrategic Analysis & Choice Topic 5venu100% (1)

- CH 10Document46 pagesCH 10Dissa ElvarettaPas encore d'évaluation

- Ajanta Pharma LTD.: Net Fixed AssetsDocument4 pagesAjanta Pharma LTD.: Net Fixed AssetsDeepak DashPas encore d'évaluation

- Chapter 04 XLSolDocument11 pagesChapter 04 XLSolSyafira Taqia H FPas encore d'évaluation

- The Process of Portfolio Management: Mohammad Ali SaeedDocument35 pagesThe Process of Portfolio Management: Mohammad Ali SaeedShahrukh Abdur RehmanPas encore d'évaluation

- Securities and Exchange G.R. No. 164197 Commission, Petitioner, PresentDocument24 pagesSecurities and Exchange G.R. No. 164197 Commission, Petitioner, PresentMariam BautistaPas encore d'évaluation

- Ays 082914 3331 PDFDocument18 pagesAys 082914 3331 PDFFabian R. GoldmanPas encore d'évaluation

- Panasonic vs. CIRDocument6 pagesPanasonic vs. CIRLeBron DurantPas encore d'évaluation

- Kohler CompanyDocument3 pagesKohler CompanyDuncan BakerPas encore d'évaluation

- Andrews' PitchforkDocument23 pagesAndrews' PitchforkDoug Arth100% (8)

- Living TrustDocument7 pagesLiving TrustRocketLawyer100% (30)

- Portfolio Analysis Exam 1Document7 pagesPortfolio Analysis Exam 1Amadou JallohPas encore d'évaluation

- Midland Energy A1Document30 pagesMidland Energy A1CarsonPas encore d'évaluation

- Chapter 3 McCannDocument39 pagesChapter 3 McCannEvan TanPas encore d'évaluation

- Merill Lynch Supernova Final UpdatedDocument16 pagesMerill Lynch Supernova Final UpdatedKnv Chinnarao100% (2)

- A Study On Stock MarketDocument4 pagesA Study On Stock Marketrahul yadavPas encore d'évaluation

- Government Accounting Manual: Legal BasisDocument41 pagesGovernment Accounting Manual: Legal BasisNoelPas encore d'évaluation