Académique Documents

Professionnel Documents

Culture Documents

New Microsoft Office Word Document

Transféré par

HP KawaleDescription originale:

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

New Microsoft Office Word Document

Transféré par

HP KawaleDroits d'auteur :

Formats disponibles

9.

Presently NALCO is accepting firm financial arrangements in form of advance and letter of Credit

considering that market is going to be more competitive in future the Company may consider accepting

a wider variety of financial arrangements other than advance and letter of Credit.

10. Opening of more stockyards at different strategic locations to cater to the small customers.

Depending on the requirement even consider setting up Inland Container Depots at central places like

Nagpur and Delhi which are well connected by road and rail.

11. Since the market has become very dynamic, to take advantage of market situation the company

should consider fixed price contracts in exports.

12. To expand the customer base in exports, start looking for new customer and enter into one-to-one

contracts with them with well-defined pre-qualification criteria.

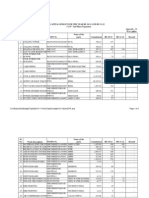

6.0 Production Volumes to be handled

The projected production volume of alumina, aluminum and value added products to be handled after

the project implementation as per the expansion plan are indicated in the following two tables. Table 6

and 7 gives the quantum of alumina and aluminum which are to be handled in next 10 years.

Table 6 ( Ref Annexure W )

Projected production and sales of Alumina/Specialty Alumina

Year

2009-10

2010-11

2011-12

2012-13

2013-14

2014-15

2015-16

2016-17

2017-18

2018-19

2019-20

Calined Alumina

Production

Export

1,875,000

2,074,000

2,161,500

2,249,000

3,224,000

4,074,000

4,249,000

4,249,000

4,249,000

4,249,000

4,249,00

940,000

7,171,600

1,249,400

1,315,560

1,882,190

2,214,210

2,000,240

1,506,510

1,000,170

878,920

878,920

Domestic Internal

Consun

10,000

925000

10,000

892400

10,000

902100

10,000

923440

10,000

1331810

10,000

1849790

10,000

2238760

10,000

2732490

10,000

3238830

10,000

3360080

10,000

3360080

Specialty Alumina

Production Dom

Export

23,706

26,000

26,000

26,000

101,000

126,000

126,000

126,000

126,000

126,000

126,000

20,200

25,200

25,200

25,200

25,200

25,200

25,200

23,706

26,000

26,000

26,000

80,800

10,800

100,800

100,800

100,800

100,800

10,800

Grand Total

1,898,706

2,100,000

2,187,500

2,275,000

3,325,000

4,200,000

4,375,000

4,375,000

4,375,000

4,375,000

4,375,000

Table 7 : ( Ref Annexure IV )

Projected production and sales of Aluminum

Year

Cast Metal

Production

2009-10

2010-11

2011-12

2012-13

2013-14

2014-15

2015-16

2016-17

2017-18

2018-19

2019-20

435,000

425,000

420,000

426,000

599,000

853,500

1,054,000

1,271,000

1,519,500

1,582,000

1,582,000

Figures in MT

Roll

product

Sale

Domestic Export

283,000 152,000

276,000 149,000

252,000 168,000

256,000 170,000

247,000 352,000

362,000 491,500

482,000 572,000

500,000 771,000

520,000 999,500

509,000 1,073,000

509,000 1,073,000

25,000

35,000

45,000

50,000

50,000

50,000

50,000

87,500

100,00

100,000

100,000

Domestic

23,750

33,250

40,500

45,000

45,000

45,000

45,000

74,375

85,000

85,000

85,000

Export

1,250

1,750

4,500

5,000

5,000

5,000

5,000

13,125

15,000

15,000

15,000

Aluminum Alloy

Total metal

Prodn

Production

37,500

50,000

50,000

50,000

50,000

50,000

50,000

Sale

Domestic

37,500

50,000

50,000

50,000

50,000

50,000

50,000

Export

-

The table 6 and 7 ( as per new expansion plan, Ref production plan in Annexure IV ) above provide

aggregated volumes for both alumina and aluminium. However, both alumina and aluminium will

respectively have specialty and downstream products, the details of which are given in table 8 ( Rolled

product is already shown in table 7 ).

Market research is required to identify new specialty alumina and application areas. Since alumina and

chemicals are customized roducts, continous market development activities will have to be indetaken,

especially field testing of different grades with the existing and prospective customers for their

applications.

460,000

460,000

465,000

476,000

686,500

953,500

1,154,000

1,408,500

1,669,500

1,732,000

1,732,000

Value Added Products:

Table 8

Projected production and sales of Alumina/Specialty

Alumina

Year

2009-10

2010-11

2011-12

2012-13

2013-14

2014-15

2015-16

2016-17

2017-18

2018-19

2019-20

Specialty Alumina

Product ion Dom

23,706

23,706

26,000

26,000

26,000

26,000

26,000

26,000

101,000

80,800

126,000

100,800

126,000

100,800

126,000

100,800

126,000

100,800

126,000

100,800

126,000

100,800

Figures in MT

Expoet

Aluminium Alloy

Produc tion Dom

20,200

25,200

25,200

25,200

25,200

25,200

25,200

37,500

50,000

50,000

50,000

50,000

50,000

50,000

Export

37,500

50,000

50,000

50,000

50,000

50,000

50,000

No doubt. quality and consistency of Rolled Products (RP) will have to be improved before undertaking

any expansion activity but marketing needs to pay Special attention .RP require vigorous promotional

campaigns. Going down further into foil will result in much higher value Addison but for this the

company may go for joint ventures with experienced and establitad by brand building.

Presently detergent manufacturers are using STPP which is lower in price but has been banned in

developed countries on environmental pollution ground Zeolite sales will improve only when detergent

manufacturers are made to substitute STPP. Before building up further capacity ,the company will have

to lobby with appropriate authorities to ban the use of STTP in detergents for environmental reasons.

For this, marketing and technical data will have to be collected that help convincing both the authorities

concerned as will as existing buyers of STTP and prospective buyer of zeolite.

7.0 Logistics augmentation

The supply chain for a company should be developed in advance considering the following

Factors.

Analysis Of Demand pattern region-wise and seasonal variation.

Vous aimerez peut-être aussi

- The Rationale For Launching Jet Konnect Was To Close Down Loss-Making Routes and Divert The Planes To More Profitable Routes With Higher Passenger Load FactorsDocument2 pagesThe Rationale For Launching Jet Konnect Was To Close Down Loss-Making Routes and Divert The Planes To More Profitable Routes With Higher Passenger Load FactorsHP KawalePas encore d'évaluation

- Portfolio ManagemntDocument50 pagesPortfolio ManagemntHP KawalePas encore d'évaluation

- Jet Airways Shifts Strategy to Low PricingDocument11 pagesJet Airways Shifts Strategy to Low PricingHP KawalePas encore d'évaluation

- Damo CH 12Document65 pagesDamo CH 12HP KawalePas encore d'évaluation

- PHD Simp 2008 Marinos GiannopoulosDocument8 pagesPHD Simp 2008 Marinos GiannopoulosHP KawalePas encore d'évaluation

- AirbusDocument3 pagesAirbusHP KawalePas encore d'évaluation

- Merger & AcquisitionDocument12 pagesMerger & AcquisitionAbhishek SinghPas encore d'évaluation

- T - Angelina Kedzierska SzczepaniakDocument6 pagesT - Angelina Kedzierska SzczepaniakHP KawalePas encore d'évaluation

- Mcs ProjectDocument5 pagesMcs ProjectHP KawalePas encore d'évaluation

- IPO Valuation and Design SunbeamDocument44 pagesIPO Valuation and Design SunbeamHP KawalePas encore d'évaluation

- IPO Valuation and Design SunbeamDocument44 pagesIPO Valuation and Design SunbeamHP KawalePas encore d'évaluation

- Jet AirwayDocument33 pagesJet AirwayHP KawalePas encore d'évaluation

- IInd Phase Project CPPDocument6 pagesIInd Phase Project CPPHP KawalePas encore d'évaluation

- UntitledDocument1 pageUntitledTamas GyörigPas encore d'évaluation

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (890)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (587)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (399)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (73)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (265)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2219)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (119)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- COMOS Piña Fiber Wallets & PursesDocument1 pageCOMOS Piña Fiber Wallets & PursesJoy Jarin100% (2)

- wts2019 e PDFDocument178 pageswts2019 e PDFFebbi anggyPas encore d'évaluation

- Mcs 2010Document196 pagesMcs 2010rvillgPas encore d'évaluation

- Import and Export Through CourierDocument10 pagesImport and Export Through CourierPrabhmeher NandaPas encore d'évaluation

- Leading Jute & Cotton Bags Manufacturer and Exporter in IndiaDocument3 pagesLeading Jute & Cotton Bags Manufacturer and Exporter in IndiaPuspa Jute BagsPas encore d'évaluation

- DHL Express Rate Transit Guide BD en PDFDocument18 pagesDHL Express Rate Transit Guide BD en PDFDildar AlamPas encore d'évaluation

- Pre-Class International EconomicsDocument11 pagesPre-Class International Economicshfyau123100% (5)

- 1.1 License Master Data Maintenance-Define License ClassDocument21 pages1.1 License Master Data Maintenance-Define License ClassNithinmohananPas encore d'évaluation

- List of IBDP Economics HL TerminologyDocument13 pagesList of IBDP Economics HL TerminologyMiss Pau100% (1)

- Central Asia - 5 Critical IssuesDocument11 pagesCentral Asia - 5 Critical IssuesThe American Security Project100% (7)

- Imp Dec GuideDocument68 pagesImp Dec GuideSrinivasa KirankumarPas encore d'évaluation

- WtoDocument46 pagesWtoEmelie Marie DiezPas encore d'évaluation

- " Basis. The: Cottage IndustryDocument5 pages" Basis. The: Cottage IndustryArslan Mahmood DarPas encore d'évaluation

- 214-Caltex (Phil.), Inc. v. CA G.R. No. 104781 July 10, 1998Document7 pages214-Caltex (Phil.), Inc. v. CA G.R. No. 104781 July 10, 1998Jopan SJPas encore d'évaluation

- Case PresentationDocument9 pagesCase PresentationdevrajkinjalPas encore d'évaluation

- German Food Service Sales Grow 3.8% in 2011Document13 pagesGerman Food Service Sales Grow 3.8% in 2011Sandeep Kumar AgrawalPas encore d'évaluation

- Export and ImportDocument98 pagesExport and ImportGeetika MalhotraPas encore d'évaluation

- Kindleberger Has Discussed Eight Effects of Tariff On The Imposing CountryDocument3 pagesKindleberger Has Discussed Eight Effects of Tariff On The Imposing CountryappajinarasimhamPas encore d'évaluation

- Financial Performance Full ReportDocument85 pagesFinancial Performance Full ReportananthakumarPas encore d'évaluation

- SamsungDocument13 pagesSamsungGaurav KumarPas encore d'évaluation

- History of Cement IndustryDocument6 pagesHistory of Cement Industrypraveenkv_keskarPas encore d'évaluation

- Presentation On Afroze TextilesDocument25 pagesPresentation On Afroze TextilesSanam NarejoPas encore d'évaluation

- Export - Import Cycle - PPSXDocument15 pagesExport - Import Cycle - PPSXMohammed IkramaliPas encore d'évaluation

- An Overview of Bangladesh Furniture IndustryDocument13 pagesAn Overview of Bangladesh Furniture Industryspurtbd67% (3)

- India - Cosmetics Imports & Regulatory AspectsDocument6 pagesIndia - Cosmetics Imports & Regulatory AspectsSuruchi ChopraPas encore d'évaluation

- Promoting Exports of Medicinal Plants and Essential Oils from NepalDocument41 pagesPromoting Exports of Medicinal Plants and Essential Oils from Nepalbharat33% (3)

- Coinage of The AmericanDocument358 pagesCoinage of The AmericanDigital Library Numis (DLN)Pas encore d'évaluation

- CPRS Affidavit-Revised.11-22-16Document2 pagesCPRS Affidavit-Revised.11-22-16Rosalie Padilla100% (2)

- 0455 s03 Ms 1+2+3+4+6Document17 pages0455 s03 Ms 1+2+3+4+6Muhammad Salim Ullah KhanPas encore d'évaluation

- Barriers of Export Import in Bangladesh by Khandakar Niaz Morshed (Business English)Document18 pagesBarriers of Export Import in Bangladesh by Khandakar Niaz Morshed (Business English)Morshed Season100% (7)