Académique Documents

Professionnel Documents

Culture Documents

Banking Industry

Transféré par

Nadia GouwsDescription originale:

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Banking Industry

Transféré par

Nadia GouwsDroits d'auteur :

Formats disponibles

1

SOUTH AFRICAN BANKING SECTOR OVERVIEW

TABLE OF CONTENTS Sections

1 2. 3. 4. 5. 6. 7. 8. 9. 10. 11. 12. 13. 14. Background Financial services sectors contribution to the economy Total Assets Total liabilities Profitability Shareholding structure Branches ,ATMs, POS Usage of payment systems Employment Number of customers Repo and Prime rate movements Regulation The Financial Sector Charter Conclusion

Page

1 2 2 4 5 5 6 6 8 8 8 9 10 11

Figures 1. 2. 3. 4. 5. 6. 7.

Number of banks in SA Total banking sector assets Loans and advances (September 2011) Market share of major four banks Total liabilities of the banking sector Composition of deposits Shareholding in the banking sector

2 3 3 4 4 5 6

Tables

1. 2. 3. 4 5. List of banks in SA Number of ATMs, branches and POS Usage of payment systems Employment profile of banking sector (2009) Repo and Prime rate movements (2005 to 2010) 1 6 7 8 9

Enquiries: Nwabisa Matoti (nwabisam@banking.org.za) Last updated: November 2011

SOUTH AFRICAN BANKING SECTOR OVERVIEW 1. Background

South Africa has a developed and well regulated banking system which compares favourably with those of industrialised countries. The sector has undergone a lot of changes in the past 20 years, with the early 1990s being characterised by a process of consolidation resulting from mergers of a number of banks including Allied, Volkskas and United to form ABSA and the proposed merger between Nedcor and Stanbic which failed eventually. The promulgation of the Banks Act of 1990 led to a number of banking licenses being issued and by the end of 2001 there were 43 registered banks in South Africa. The announcement of Saambous financial troubles in 2002, however, resulted in a run on BOE and other smaller banks which led to a number of banks not renewing their banking licenses and others seeking financial assistance from foreign shareholders. Other banks such as Regal Bank also experienced financial difficulties during that period and were placed under curatorship. Although the South African banking sector has been through a process of volatility and change in the past, it has attracted a lot of interest from abroad with a number of foreign banks establishing presence in the country and others acquiring stakes in major banks, for example, the Barclays ABSA and Industrial and Commercial Bank of China Standard Bank deals. There have been a number of changes in respect of the regulatory environment, product offerings, and number of participants resulting in a greater level of competition on the market from smaller banks such as Capitec bank and African Bank, which have targeted the lowincome and the previously unbanked market. The SA banking industry is currently made up of 17 registered banks, 2 mutual banks, 12 local branches of foreign banks, and 41 foreign banks with approved local representative offices. The banks are listed in Table 1 below. 1.1 Table 1- List of banks in SA

Bank ABSA Bank Limited; African Bank Limited; Bidvest Bank Limited; Capitec Bank Limited; FirstRand Bank Limited; Grindrod Bank Limited; Investec Bank Limited; Nedbank Limited; Regal Treasury Private Bank Limited (In liquidation); Sasfin Bank Limited; Ubank Limited; The Standard Bank of South Africa Limited. Albaraka Bank Limited; Habib Overseas Bank Limited; HBZ Bank Limited; Islamic Bank Limited (In Final Liquidation); Mercantile Bank Limited; The South African Bank of Athens Limited. GBS Mutual Bank; VBS Mutual Bank Bank of Baroda; Bank Of China Limited Johannesburg Branch (trading as Bank Of China Johannesburg Branch); Bank of Taiwan South Africa Branch; China Construction Bank Corporation - Johannesburg Branch; Citibank N.A.; Deutsche Bank AG; JPMorgan Chase Bank N.A. (Johannesburg Branch); Socit Gnrale; Standard Chartered Bank Johannesburg Branch; State Bank of India; The Hongkong and Shanghai Banking Corporation. AfrAsia Bank Limited; Banco BPI, SA; Banco Espirito Santo e Comercial de Lisboa; Banco Privado Portugus, S.A.; Banco Santander Totta S.A.; Bank Leumi Le-Israel BM; Bank of Cyprus Group; Bank of India; Barclays Bank Plc; Barclays Private Clients International Limited; BNP Paribas Johannesburg; Commerzbank AG Johannesburg; Credit Suisse AG; Credit Suisse Securities (Europe) Limited; Ecobank; Export-Import Bank of India; Fairbairn Private Bank (Isle of Man) Limited; Fairbairn Private Bank (Jersey) Limited; First Bank of

Category Registered banks locally controlled

Registered banks foreign controlled Mutual banks Local branches of foreign banks

Foreign banks with approved local representative offices

Nigeria; Fortis Bank (Nederland) N.V.; Hellenic Bank Public Company Limited; HSBC Bank International Limited; Icici Bank Limited; KfW Ipex-Bank GmbH; Lloyds TSB Offshore Limited; Millenium BCP; National Bank of Egypt; NATIXIS Southern Africa Representative Office; Royal Bank of Scotland International Limited; Socit Gnrale Representative Office for Southern Africa; Sumitomo Mitsui Banking Corporation; The Bank of New York Mellon; The Bank of Tokyo-Mitsubishi UFJ, Ltd; The Mauritius Commercial Bank Limited; The Rep. Off. for Southern and Eastern Africa of The Export-Import Bank of China; UBS AG; Unicredit Bank AG; Union Bank of Nigeria Plc; Vnesheconombank,; Wells Fargo Bank, National Association; Zenith Bank Plc Source: SA Reserve Bank

1.2

Figure 1 - Number of banks in SA

Number of banks in SA

Number

60 50 41 40 30 30 22 20 15 10 0 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 14 15 20 15 19 15 19 14 19 14 19 14 18 13 17 13 56 52 44 43 47 43 46 43 42 41

Registered banks Banks

Mutual banks

Branches of international banks

Representative offices

2.

Financial services sectors contribution to the economy

The financial services sector contributes about 10,5 percent to gross domestic product (GDP), with assets to the value of over R6 trillion. Taxes amount to over 15 percent of GDP, whilst employment represents about 4 percent. The banking sector assets represent just over 50 percent of total financial services sector assets. 3. Total Assets The assets of the banking sector improved to a level of R3,4 trillion after some moderate increases between December 2008 and June 2011 (Figure 2). There was a 9 percent increase in the total value of assets during the quarter ended September 2011.

3.1

Figure 2 Total banking sector assets

Figure 3 below depicts the composition of loans and advances as at end September 2011. Home loans represented the largest component at 34 percent, followed by term loans at 16 percent. 3.2 Figure 3 Loans and advances (September 2011)

Composition of loans and advances (Sep 2011)

23% 34%

16%

5% 10% Homeloans Credit cards Overdrafts Other 2%

10%

Commercial mortgages Lease and instalment debtors Term loans

Source: SA Reserve Bank

Figure 4 below illustrates the market share of the four major banks as at end September 2011. The four major banks represented about 84 percent of total banking assets. Standard Bank, the largest bank in terms of assets, had a market share of 31 percent, followed by

ABSA with 25 percent. FirstRand and Nedbank had a market share of about 24 percent and 20 percent respectively. 3.3 Figure 4 Market share of the major four banks (Sep 2011)

Source: SA Reserve Bank

4. Total liabilities After a sharp decline in the first quarter of 2011, total liabilities of the banking sector increased by 3 percent between the second and third quarters of 2011 reaching a level of about R2,6 trillion (Figure 5). 4.1 Figure 5 Total liabilities of the banking sector

Total liabilities

R'bn 3 500 3 131 3 000 2 500 2 000 2% 1 500 0% 1 000 500 0 Sep 2008 Dec 2008 Mar 2009 Jun 2009 Sep 2009 Dec 2009 Mar 2010 Jun 2010 Dec 2010 Mar 2011 Jun 2011 Sep 2011 -2% -4% -6% 2 996 2 964 2 768 2 834 2 809 2 769 2 821 2 801 2 904 2 848 2 885 8% 6% 4% Percent 10%

Liabilities (LHS)

Growth (RHS)

Deposits represented about 77 percent of total liabilities at the end of September 2011. The composition of deposits is illustrated in Figure 6 below. Fixed and notice deposits constituted the largest part at 32 percent, followed by current and call deposits both at 17 percent. 4.2 Figure 6 Composition of deposits

Composition of deposits (Sep 2011)

10% 4% 17%

15%

5%

17%

32% Current Savings Call Fixed and notice NCDs Repos Other

Source: SA Reserve Bank

5. Profitability The Return on Equity (RoE) and the Return on Assets (RoA) for the banking sector improved to 15,9 percent and 1,12 percent respectively in September 2011 (September 2010: 15,2 percent and 0,99 percent respectively). The efficiency of the banking sector, however, deteriorated as the cost-to-income ratio increased from 54,6 percent in September 2010 to 55,9 percent in September 2011. Operating expenses increased from R83,8 billion in September 2010 to R93,1 billion in September 2011. 6. Shareholding in the banking sector By end of December 2010, shareholding by foreigners in the sector represented about 43 percent of total nominal banking shares in issue, whilst domestic and minority (those with a shareholding less than 1 percent) represented about 27 percent and 30 percent respectively (Figure 7). The large portion of foreign shareholding can be mainly attributed to the large stake that Barclays Plc has in ABSA.

6.1 Figure 7 Shareholding in the banking sector

7. Branches, ATMs, and Points of Sale By the end of December 2010, the total number of ATMs and branches of banks stood at 26 439 and when points of sale were included, this number increased to (179 319) (Table 2). 7.1 Table 2 Number of ATMs, branches and points of sale (Dec 2010)

Category Number of branches (major four banks) Number of branches (all banks*) Number of ATMs, branches (major four banks) Number of ATMs, branches, POS (major four banks) Number of ATMs, branches, POS (All banks)

* Major four banks, African Bank, Capitec, Ithala,Ubank, and SAPO.

Value 2 927 6 303 26 439 175 839 179 319

8. Usage of payment systems The usage of payment systems for the period 2005 to the first half of 2010 is illustrated in Table 3 below. These statistics, however, only represent domestic transactions. There appears to be a common trend in the figures listed below slow rate of transaction growth in all categories from 2007. This could also be possibly due to changes in economic conditions which negatively affected the consumer (lower disposable income, higher levels of indebtedness therefore changed spending patterns).

8.1

Table 3 Usage of payment system

ATM Transactions % Volume Change Value (Rands) 166 891 507 192 734 194 234 322 151 268 438 678 276 211 771 145 189 138 6.1% 15.5% 21.6% 14.6% 2.9% 40 554 418 390 47 463 298 261 59 058 301 908 71 370 586 351 77 182 864 413 42 126 129 369

Period 2005 2006 2007 2008 2009 June 2010

% Change 8.4% 17.0% 24.4% 20.8% 8.1%

Credit Card Clearing & Settlement (POS) Transactions % % Period Volume Change Value (Rands) Change 2005 2006 2007 2008 2009 June 2010 121 392 698* 257 008 611 278 539 563 265 480 842 260 834 540 146 727 622 8.4% -4.7% -1.8% 41 792 537 747* 93 223 327 767 105 372 094 855 108 087 430 784 109 262 373 476 64 470 320 277 % Change 97.6% 76.1% 35.2% 33.6% 16.7% 13.0% 2.6% 1.1%

Period 2005 2006 2007 2008 2009 June 2010

Debit Card (POS) Transactions % Volume Change Value (Rands) 68 769 674 112 274 366 147 800 549 193 637 674 225 855 348 128 822 461 77.0% 63.3% 31.6% 31.0% 16.6% 15 319 086 087 26 982 144 785 36 491 074 579 48 744 246 683 56 877 976 287 32 488 456 325

Period 2005 2006 2007 2008 2009 June 2010

EFT Total Transactions % Volume Change Value (Rands) 515 535 477 572 166 154 627 449 606 663 052 101 698 078 054 357 831 347 9.6% 11.0% 9.7% 5.7% 5.3% 2 925 646 354 523 3 520 882 895 027 4 142 740 609 760 4 872 121 613 920 4 896 464 564 124 2 548 728 819 900

% Change 16.6% 20.3% 17.7% 17.6% 0.5%

Source: Payment Association SA (PASA)

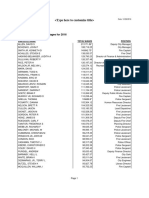

9. Employment According to the Labour Force Survey (third quarter of 2011), the financial services industry was the third largest employer in the country, representing about 13,3 percent of total employment. By the end of December 2010, there were just over 155 000 people employed in the banking sector. The major four banks represented about 82 percent of this amount Table 4 depicts the employment figures by some of the banks operating in SA. 9.1 Table 4 Employment profile of banking sector (2010)

Bank ABSA Standard Bank FirstRand Bank Nedbank Investec Bank Citibank N.A. African Bank Duetsche Bank JP Morgan Chase Standard Chartered Bank Societe Generale Capitec Bank China Construction Bank Mercantile Bank Bank of China State Bank of India Bidvest Bank Sasfin The SA Bank of Athens Total Source: PWC Banking Survey 2011 Number of employees 38 000 30 000 32 000 28 000 3 700 300 15 000 200 500 230 51 5 331 50 430 56 45 1058 560 170 155 681

10.

Number of retail accounts

According to the PriceWaterhouseCoopers (PWC) 2011 SA Banking Survey, the number of retail accounts by the major four banks amounted to 34,5 million in 2010 and this number is expected to increase to 40 million accounts by 2014. 11. Repo and Prime rate movements

Table 5 below illustrates changes in the SA Reserve Bank repo rate and the prime rate charged by banks. The difference between the two rates is 3,5 percentage points. The SA Reserve Bank increased its repo rate 9 times between June 2006 and June 2008 due to the economic developments at the time, resulting in the subsequent increase in the prime rate which had huge impact on the disposable income. However, interest rates started to decline from December 2008 as conditions improved.

11.1

Table 5 Repo and Prime rate movements (2005 to 2010)

Date 2005/04/14 2006/06/08 2006/08/03 2006/10/13 2006/12/08 2007/06/08 2007/08/17 2007/10/12 2007/12/07 2008/04/11 2008/06/13 2008/12/12 2009/02/06 2009/03/25 2009/05/04 2009/05/29 2009/08/14 2010/03/26 2010/09/10 2010/11/19 Repo (%) 7 7.5 8 8.5 9 9.5 10 10.5 11 11.5 12 11.5 10.5 9.5 8.5 7.5 7 6.5 6 5.5 Prime (%) 10.5 11 11.5 12 12.5 13 13.5 14 14.5 15 15.5 15 14 13 12 11 10.5 10 9.5 9

12.

Regulation

The South African banking sector is heavily regulated to ensure proper oversight over its operations. Legislation that affects the banking industry includes, amongst others: The The The The The The The The Banks Act ; National Payment System Act ; Financial Intelligence Centre Act (FICA); Financial Intermediary and Advisory Services Act (FAIS); National Credit Act; Consumer Protection Act; Home Loan and Mortgage Disclosure Act; and Competition Act.

Further, banks have to comply with the King Code on Corporate Governance and Basel II (except for the 2 mutual banks). There are also various ombudsmen tasked with achieving quick and effective dispute resolution for banks and their customers in a fair, impartial and confidential manner. In the aftermath of the 2008 global financial crisis, various strategies have been announced by international standard-setting bodies to address the fundamental weaknesses revealed by the crisis. These include the new amendments to the regulatory framework (Basel III) where banks will be required to hold more capital of higher quality and have enough liquid assets to

10

cover outflow of funds. South Africa, a member of G20, has to comply with the new amendments. Further, the National Treasury has proposed a twin-peaks regulatory system, which proposes a macroprudential approach to banking supervision, to ensure a safer financial sector. 13. The Financial Sector Charter

The Financial Sector Charter (FSC), a transformation charter in terms of the Broad-based Black Economic Empowerment (BBBEE) Act, was signed in 2003 for implementation in 2004. The participants (financial institutions) committed to 'actively promoting a transformed, vibrant, and globally competitive financial sector that reflects the demographics of South Africa, and contributing to the establishment of an equitable society by effectively providing accessible financial services to black people and by directing investment into targeted sectors of the economy'. They committed to transforming the sector in the areas of:

Human resource development; Procurement of goods and services; Access to financial services; Empowerment financing (including targeted investments in transformational infrastructure, low-income housing, agricultural development and black SMEs as well as BEE transaction financing); Ownership and control; and Corporate social investment (CSI).

Targets for the first 5-year period were set and by the end of 2008 the following had been achieved by the banking sector: Achievements 2004 2010: Access to housing finance - about R65 billion; SME finance - about R16 billion; Agricultural finance - just over R3 billion; Transformational infrastructure - about R12 billion; Mzansi accounts totalled 4,6 million (with a 30 percent dormancy rate); Access of LSM 1-5 to bank branches within a 15km radius was 74,4 percent; Access to branches and ATMs within 10km radius was 79,2 percent. percent of LSM1-5) (FSC target 80

The FSC gazetting (as a Sector Code) has not yet been finalised, so financial institutions are currently reporting under BBBEE Codes of Good Practice.

11

14.

Conclusion

The South African banking system has been through some dramatic changes in the past two decades. It is, however, very well developed and comparable to those of industrialised countries. It is generally viewed as world class, with adequate capital resources, technology and infrastructure and a strong regulatory and supervisory environment. This strong regulatory system saved the sector from the global financial crisis that started about three years ago which resulted in bank bailouts in a number of countries. Further, the SA banks risk management systems are fairly robust as a result of the early implementation of Basel II. The country, however, went through an economic recession in 2009 which affected consumer affordability (and therefore spending patterns), resulting in them being more reluctant to take on more debt. This resulted in the increase in non-performing loans which had a huge impact on the banks loan books. The total assets and liabilities declined in 2009 but have started to pick up as the country is moving out of recession. Banks also started to apply stricter lending measures as a result of the implementation of the National Credit Act in 2007. South Africa has a large unbanked population which stood at about 15 million (about 52 percent of the adult population) in 2004. The banking sector has taken some great strides in banking the previously unbanked through the implementation of the FSC in 2004 as about 36 percent of the adult population now remain unbanked1. The implementation of the FSC resulted in an increase in product offerings, with smaller banks emerging as major players and creating some competition in catering for the needs of this market through entry-level banking. Further, through the implementation of the FSC, transformation in the sector has now been institutionalised.

Finscope 2009.

12

Vous aimerez peut-être aussi

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (345)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (74)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- Instructions For Preparing Manuscript For Ulunnuha (2019 Template Version) Title (English and Arabic Version)Document4 pagesInstructions For Preparing Manuscript For Ulunnuha (2019 Template Version) Title (English and Arabic Version)Lailatur RahmiPas encore d'évaluation

- Pipe Cleaner Lesson PlanDocument2 pagesPipe Cleaner Lesson PlanTaylor FranklinPas encore d'évaluation

- CN1111 Tutorial 4 QuestionDocument3 pagesCN1111 Tutorial 4 Questionthenewperson0% (1)

- 3 Diversion&CareDocument2 pages3 Diversion&CareRyan EncomiendaPas encore d'évaluation

- CAA Safety Plan 2011 To 2013Document46 pagesCAA Safety Plan 2011 To 2013cookie01543Pas encore d'évaluation

- Forex Day Trading SystemDocument17 pagesForex Day Trading SystemSocial Malik100% (1)

- ALE Manual For LaserScope Arc Lamp Power SupplyDocument34 pagesALE Manual For LaserScope Arc Lamp Power SupplyKen DizzeruPas encore d'évaluation

- All Day Breakfast: .Served With Cappuccino or Espresso or Lime Juice or TeaDocument7 pagesAll Day Breakfast: .Served With Cappuccino or Espresso or Lime Juice or TeaBryan KuoKyPas encore d'évaluation

- Top 100 Chemical CompaniesDocument11 pagesTop 100 Chemical Companiestawhide_islamicPas encore d'évaluation

- Computer Class 3 ThirdDocument1 pageComputer Class 3 ThirdbeakraamPas encore d'évaluation

- ADC of PIC MicrocontrollerDocument4 pagesADC of PIC Microcontrollerkillbill100% (2)

- HRMDocument118 pagesHRMKarthic KasiliaPas encore d'évaluation

- BLP#1 - Assessment of Community Initiative (3 Files Merged)Document10 pagesBLP#1 - Assessment of Community Initiative (3 Files Merged)John Gladhimer CanlasPas encore d'évaluation

- User Manual PM3250Document80 pagesUser Manual PM3250otavioalcaldePas encore d'évaluation

- IcarosDesktop ManualDocument151 pagesIcarosDesktop ManualAsztal TavoliPas encore d'évaluation

- Myanmar 1Document3 pagesMyanmar 1Shenee Kate BalciaPas encore d'évaluation

- 1.water, Acids, Bases, Buffer Solutions in BiochemistryDocument53 pages1.water, Acids, Bases, Buffer Solutions in BiochemistryÇağlaPas encore d'évaluation

- 2016 W-2 Gross Wages CityDocument16 pages2016 W-2 Gross Wages CityportsmouthheraldPas encore d'évaluation

- Module 1 Lesson 2Document31 pagesModule 1 Lesson 2Angela Rose BanastasPas encore d'évaluation

- Product NDC # Compare To Strength Size Form Case Pack Abcoe# Cardinal Cin # Mckesson Oe # M&Doe#Document14 pagesProduct NDC # Compare To Strength Size Form Case Pack Abcoe# Cardinal Cin # Mckesson Oe # M&Doe#Paras ShardaPas encore d'évaluation

- Google Tools: Reggie Luther Tracsoft, Inc. 706-568-4133Document23 pagesGoogle Tools: Reggie Luther Tracsoft, Inc. 706-568-4133nbaghrechaPas encore d'évaluation

- EGurukul - RetinaDocument23 pagesEGurukul - RetinaOscar Daniel Mendez100% (1)

- WHO Guidelines For Drinking Water: Parameters Standard Limits As Per WHO Guidelines (MG/L)Document3 pagesWHO Guidelines For Drinking Water: Parameters Standard Limits As Per WHO Guidelines (MG/L)114912Pas encore d'évaluation

- Data Asimilasi Untuk PemulaDocument24 pagesData Asimilasi Untuk PemulaSii Olog-olog PlonkPas encore d'évaluation

- MSC-MEPC.2-Circ.17 - 2019 Guidelines For The Carriage of Blends OfBiofuels and Marpol Annex I Cargoes (Secretariat)Document4 pagesMSC-MEPC.2-Circ.17 - 2019 Guidelines For The Carriage of Blends OfBiofuels and Marpol Annex I Cargoes (Secretariat)DeepakPas encore d'évaluation

- Pioneer vsx-1020-k 1025-k SM PDFDocument132 pagesPioneer vsx-1020-k 1025-k SM PDFluisclaudio31Pas encore d'évaluation

- Account Statement 250820 240920 PDFDocument2 pagesAccount Statement 250820 240920 PDFUnknown100% (1)

- Formula:: High Low Method (High - Low) Break-Even PointDocument24 pagesFormula:: High Low Method (High - Low) Break-Even PointRedgie Mark UrsalPas encore d'évaluation

- Conservation Assignment 02Document16 pagesConservation Assignment 02RAJU VENKATAPas encore d'évaluation

- Business-Communication Solved MCQs (Set-3)Document8 pagesBusiness-Communication Solved MCQs (Set-3)Pavan Sai Krishna KottiPas encore d'évaluation