Académique Documents

Professionnel Documents

Culture Documents

Tririga and Managing Capital Projects-3

Transféré par

April Angela Ilao TaggsDescription originale:

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Tririga and Managing Capital Projects-3

Transféré par

April Angela Ilao TaggsDroits d'auteur :

Formats disponibles

IBM Tririga and Managing Capital Projects

By Richard Taggs, President TEAM Global According to Alfred D. Chandler in his Pulitzer Prize winning book on management and organizations, The Visible Hand, modern large-scale firms arose to take advantage of the national markets and productive techniques available after the railroads had been built. He determined that they prospered because they had higher productivity, lower costs, and higher profits. The firms created the "managerial class" because they needed to coordinate the increasingly complex and interdependent system, and to achieve efficiency through coordination and managerial organization and the ability to manage very large capital projects, such as the network of railroads or the building of the Panama Canal. The Visible Hand did not put Adam Smith back with the shipping news, but it put managerial skills at the forefront of industrial successes and set new visions for understanding how large organizations are organized and managed, and the many benefits they provide an advanced industrial economy. Readers might be saying that we know about the writings of Alfred Dupont Chandler, but what has this to do this an article on IBM Tririga and management of real estate. The writer, of course would reply that IBM Tririga is more than managing real estate for it is also about effective organization, capital budgeting, and managing capital projects. More to the point, when reviewing the many features of IBM Tririga for managing large projects one is led to ask if the developers of IBM Tririga were busy reading Chandlers books, including Strategy and Structure and Scale and Scope while busily designing and building the capital projects aspects of Tririga, for the breadth and depth of the many features are of a monumental scale, a tribute to the organizing principles consistently present in Chandlers findings and writings. An application as full featured as IBM Tririga helps us to better understand our own organizational structure, to know who we are and where we want to go, and to help us journey into those existential mysteries that business so often confronts us with. Each new capital project can take management on voyages of discovery, so IBM Tririga will be a wise and trusted advisor to travel with. To begin the journey, lets look at an overall diagram showing how IBM Tririga allows full project planning, from the initial setup, to funding, to tracking and to closing.

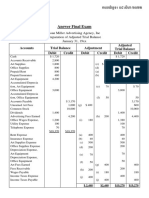

IBM Tririga, as seen in the next diagram, allows funding to be allocated and tracked across programs and projects. This is very important for it allows the company to see what its capital budgeting is. Furthermore, this structure for portfolio management establishes strong connection between strategic planning and the choosing of capital projects, thus selecting projects that are aligned with organizational strategy and core business. IBM Tririga has established portfolio management as an effective way of sharing resources (financial, employees, contractors, equipment) more efficiently than on a project-by-project basis. Plus, this is the standard way that large organizations manage their funds, by portfolio across all projects.

A small list of features are Cost Codes for projects, services, and locations, Funding Requests, many, many templates such as Project Template with Budget Setup (Original Budget, Budget Forecast, Budget Transfer, Budget Change), linking of funding sources to programs and projects.

For a specific project, you can set up and track Schedule Variance, Funding Summary, Projects over Schedule, Contract On-time Completion Rate, Percent Projects over Budget, current budget to forecast, change order to budget, percent RFI overdue. In addition to what appears to be an endless list of financial features, there is also a collaborative aspect to Capital Projects that links all the departments and players, thus providing details about persons who are involved in the project such as investment and financial, the treasurer and the controller, the engineers, operations staff, and others.

Furthermore, there are links to MS project or Primavera, workflows, document management, KPIs, a balanced scorecard, metric measurements for hundreds of project decisions and reports and reports and reports. IBM Tririga allows management to largely determine if the project is economically worthwhile and, if it is, how to fund it, such as from the companys own funds (entity basis) or from borrowed funds (equity basis). It is the separation of these two questions, possibly success and how to fund, that provides a more transparent process. If an organization is planning to borrow funds, it is important that a thorough project assessment be done, such as an engineering aspects study, for financial management has a different outlook than does financial accounting, for they are not concerned primarily with profit but instead with returns of cash over the short and the long term. See below for a simple model of Free Cash Flow, which shows a negative cash investment of $70.5 million by year 4, a profit starting in year 5 and a total profit of $208.8 million over a seven year period. This simple Free Cash Flow model affects the decision criteria, such as payback period, and represents the foundations of engineering economics and capital budgeting. Simple example of Free Cash Flow for a capital project. Year 0 1 2 3 4 5 6 7

FCF -5.0 -40.5 -55.5 -22.5 50.0 75.0 95.0 108.8 CFCF -5.0 -45.5 -101.0 -123.5 -70.5 5.0 100.0 208.8 FCF = Free Cash Flow CFCF = Cumulative Free Cash Flow

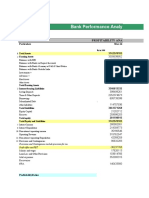

We know that financial statements provide the transparency needed in the business to record and report on assets, cash position and profit. Balance sheet represents the value of the company through its assets and liabilities. Income statement shows the productive effort of the company by representing the companys revenue, cost and profit. Cash flow statement represents the net flow of cash into and out of the business that is the cash position of the company. IBM Tririga allows us to see how Financial statements are different from Project Cash Flows, also called Project Financials, in a way that we see and appreciate that the aim of Project Financials is to determine the free cash flows and not the profit. Financial statements' form and content follow a regulatory requirement set by accounting profession and various bodies of the government. Project Financials guidelines for the layout and format for the project cash flows are that they must be easy to construct, to read, and to interrogate. Both Financial statements and Projects Financials help in determining the projects impact on the companys performance and in assessing the business risk that this project may bring.

With regards to managing of project finances, the cost management process in IBM TRIRIGA application deals with cost codes and budgets. It effectively manages the project finances through monitoring, analyzing, and evaluating, forecasting cost information. The cost management process of IBM TRIRIGA provides a platform to closely monitor costs and also it analyzes budget estimates, cash flows and project funding. Lets now turn from the general to the particular, and use example of oil/gas project challenges, one upstream and one downstream. An oil company is considering the purchase of an oil lease. The expected present value of cash flows, based on leasing, finding and producing oil, is $200 million. The estimated present costs value of leasing, exploring and producing is $120 million. Using Tririga, the company can determine the value of the underlying asset, the least cost, set a time to expire, and calculate the estimated return and its risk. An even bigger project is a $10 billion oil field project somewhere in Russia, which will need a pipeline to a port, and a port refinery. Investments are estimated to be $1.2 billion the first three years, with an estimated production of 200,000 barrels per day, with a production cost estimated at $12 per barrel. The project is funded by a number of oil producers using a bond issue, with bonds being amortized over 20 years. Can engineering economics, prevalent in oil/gas since the 1950s, be used to determine capital allocations? Yes. Will funding for this project be owner managed, a cost-reimbursable contract or lump sum turnkey? Can this project be planned, estimated, funded, approved or not approved, and if approved managed within Tririga. Yes, by identifying the funding requirements, assessing a yes/no decision on the project by assessing project risks and potential paybacks, by automating project management during actual project execution, by providing built-in metrics to determine the project is meeting planned deliverables. The long list of IBM Tririga functionality for capital project management may provide the remedy for the problems faced by many oil executives and their dissatisfaction with overall project performance, especially the costly budget and schedule overruns, which were listed by Booz Allen Hamilton in a recent oil/gas capital projects performance survey. Oil executives are not the only ones suffering from an unprecedented increase in spending and lagging performance of capital projects. In conclusion, no company can solve their organizational and project challenges without the use of superior software. IBM Tririga provides any large company with the ability to organize itself,

and once organized to make informed, transparent decisions, or what we call the act of decision making, from opportunity assessment, to business case, to business plan to final business plan, and an approval of the final implementation plan. Additionally, IBM Tririga helps deliver three important drivers for enhancing a companys success: superior use of finance; superior strategy; and superior organization. If he were still writing today, Alfred D. Chandler would recommend that organizations try Tririga, for he admired large operations that are well managed, and he would surely affirm that, to manage and guide projects to success, todays managers should glove their visible hands in IBM Tririga software. TEAM Global Tririga analysts contributed to this article: Monica Osana, Dianna Gayeta, Melodie Mondevilla Translated into Japanese by TEAM Globals Michael Derr

Vous aimerez peut-être aussi

- How To Ace The Case Study CompetitionsDocument21 pagesHow To Ace The Case Study CompetitionsmaheshPas encore d'évaluation

- Case StudyDocument9 pagesCase StudyKinnari PandyaPas encore d'évaluation

- UN Procurement ManualDocument378 pagesUN Procurement Manuallengyianchua206Pas encore d'évaluation

- Deloitte Cracking The CaseDocument41 pagesDeloitte Cracking The CaseArka DasPas encore d'évaluation

- Organization Structure of KMMLDocument15 pagesOrganization Structure of KMMLSirajuDeenMPas encore d'évaluation

- Project Management Analyst A Complete Guide - 2021 EditionD'EverandProject Management Analyst A Complete Guide - 2021 EditionPas encore d'évaluation

- Organization Silence Behavior in Navana Limited.Document95 pagesOrganization Silence Behavior in Navana Limited.Kazi50% (2)

- Guide to Contract Pricing: Cost and Price Analysis for Contractors, Subcontractors, and Government AgenciesD'EverandGuide to Contract Pricing: Cost and Price Analysis for Contractors, Subcontractors, and Government AgenciesPas encore d'évaluation

- Corporate Governance - The Case of AMECDocument20 pagesCorporate Governance - The Case of AMECRouny NightflyPas encore d'évaluation

- Construction Users Roundtable 2004Document20 pagesConstruction Users Roundtable 2004cityrenPas encore d'évaluation

- PWC Divestment Services eDocument3 pagesPWC Divestment Services ep10souravnPas encore d'évaluation

- Kapsch Exum ExampleDocument45 pagesKapsch Exum ExampleLionel StefanPas encore d'évaluation

- OIG Investigation 2018-0005: Palm Tran - Contractor Maruti Fleet & Management, LLCDocument111 pagesOIG Investigation 2018-0005: Palm Tran - Contractor Maruti Fleet & Management, LLCSabrina LoloPas encore d'évaluation

- Tata Nano Case MemoDocument6 pagesTata Nano Case MemositanshubindraPas encore d'évaluation

- Statutory Compliance in HR & Payroll in India - Complete GuideDocument9 pagesStatutory Compliance in HR & Payroll in India - Complete GuidePriya priyankaPas encore d'évaluation

- ZA MABrochure Chapter3 300508Document12 pagesZA MABrochure Chapter3 300508Praveena RajaPas encore d'évaluation

- This Is An Editable Poster Presentation Template - 123, Broadway, New York, NY 10027Document1 pageThis Is An Editable Poster Presentation Template - 123, Broadway, New York, NY 10027Munk-Onon Munk-OnonPas encore d'évaluation

- MECE and Data Structuring in The Consulting IndustryDocument8 pagesMECE and Data Structuring in The Consulting IndustryAnkush Gulati0% (1)

- Mahulo - Supply Chain Management Practices and Performance of Cement Companies in KenyaDocument82 pagesMahulo - Supply Chain Management Practices and Performance of Cement Companies in KenyaAbdul Rafay SaleemPas encore d'évaluation

- Lessons LearnedDocument49 pagesLessons LearnedRuna JullyPas encore d'évaluation

- Questions and Ansers in Public ProcurementDocument80 pagesQuestions and Ansers in Public ProcurementapmegremisPas encore d'évaluation

- Asset Based FinancingDocument64 pagesAsset Based FinancingChintan Shah100% (1)

- Corporate Financial Analysis with Microsoft ExcelD'EverandCorporate Financial Analysis with Microsoft ExcelÉvaluation : 5 sur 5 étoiles5/5 (1)

- Managing Your Capital Project: ConnectedthinkingDocument16 pagesManaging Your Capital Project: ConnectedthinkingArnab DebPas encore d'évaluation

- Cost Estimation and Prediction Using andDocument17 pagesCost Estimation and Prediction Using andMayhendra ESPas encore d'évaluation

- Unit 4 Company Analysis: Establishing The Value BenchmarkDocument51 pagesUnit 4 Company Analysis: Establishing The Value BenchmarkHarshk JainPas encore d'évaluation

- Task Force Report 2019 PDFDocument52 pagesTask Force Report 2019 PDFhsingla25Pas encore d'évaluation

- Case Discussion Questions Fall 2010Document6 pagesCase Discussion Questions Fall 2010j_zaikovskayaPas encore d'évaluation

- A Study On The Impact of Lease CapitalisationDocument20 pagesA Study On The Impact of Lease CapitalisationSeema BeheraPas encore d'évaluation

- Relationships Between Stock Returns and Corporate Financial Ratios Based On A Statistical Analysis of Corporate Data From The Hong Kong Stock MarketDocument14 pagesRelationships Between Stock Returns and Corporate Financial Ratios Based On A Statistical Analysis of Corporate Data From The Hong Kong Stock MarketAngella TiosannaPas encore d'évaluation

- Budgeting Case StudyDocument1 pageBudgeting Case Studykisschotu100% (1)

- Vendor Evaluation From Buyer PerspectiveDocument22 pagesVendor Evaluation From Buyer PerspectiveJiaul HaquePas encore d'évaluation

- EY Funding For Growth The EY Guide To Going PublicDocument2 pagesEY Funding For Growth The EY Guide To Going PublicAayushi AroraPas encore d'évaluation

- Assignment PM The Case 1Document3 pagesAssignment PM The Case 1Ali Khan88% (8)

- FDD ListDocument16 pagesFDD Listantonius adi prasetyaPas encore d'évaluation

- PWC Evan Kelly School of Mines PresentationDocument38 pagesPWC Evan Kelly School of Mines PresentationJesus SalamancaPas encore d'évaluation

- Procurement PolicyDocument61 pagesProcurement PolicyValber Santos SantosPas encore d'évaluation

- Logistics IndustryDocument48 pagesLogistics IndustryTanu NigamPas encore d'évaluation

- ExxonMobil Merger - Carlos GonzalezDocument29 pagesExxonMobil Merger - Carlos Gonzalezcargoa0% (1)

- Mckinsey Reports 2016Document79 pagesMckinsey Reports 2016sandeep patialPas encore d'évaluation

- Assignment Design PrinciplesDocument9 pagesAssignment Design PrincipleskashifPas encore d'évaluation

- Nuts and Bolts of Project Management: Right Timing + Right Decision = SuccessD'EverandNuts and Bolts of Project Management: Right Timing + Right Decision = SuccessÉvaluation : 5 sur 5 étoiles5/5 (1)

- MTWO CloudA2K BrochureDocument9 pagesMTWO CloudA2K BrochureGGPas encore d'évaluation

- ERP General ElectricDocument35 pagesERP General ElectricMufti FirmanPas encore d'évaluation

- EBK TMS Toolkit TMS Selection GTreasuryDocument25 pagesEBK TMS Toolkit TMS Selection GTreasurymashael abanmiPas encore d'évaluation

- Lecture 22Document14 pagesLecture 22lc_surjeetPas encore d'évaluation

- Program and Project Developent and ManagementDocument4 pagesProgram and Project Developent and ManagementBeñamine UbponPas encore d'évaluation

- NMIMS M & A Presentation.1Document58 pagesNMIMS M & A Presentation.1Pratik KamaniPas encore d'évaluation

- Foreign Exchange Risk Analysis Sumesh NairDocument92 pagesForeign Exchange Risk Analysis Sumesh Nairsumesh894Pas encore d'évaluation

- Tesla Management and Business Strategy ReportDocument22 pagesTesla Management and Business Strategy ReportMuhammad Zeeshan KhanPas encore d'évaluation

- Introduction To VC Business ModelDocument3 pagesIntroduction To VC Business ModelMuhammad Shahood JamalPas encore d'évaluation

- Strategic PlanningDocument19 pagesStrategic PlanningDevPas encore d'évaluation

- Key Performance IndicatorsDocument39 pagesKey Performance IndicatorsTung NgoPas encore d'évaluation

- Checklist Supplier DebriefDocument2 pagesChecklist Supplier DebriefSumber UnduhPas encore d'évaluation

- Tax Full Report LatesteststtsststsDocument25 pagesTax Full Report Latesteststtsststsathirah jamaludinPas encore d'évaluation

- Tax & TDS Calculation From Salary Income (20-21 Assess Year) - ShortDocument17 pagesTax & TDS Calculation From Salary Income (20-21 Assess Year) - ShortMohammad Shah Alam ChowdhuryPas encore d'évaluation

- M4 Dividend Paying CapacityDocument2 pagesM4 Dividend Paying CapacityReginald ValenciaPas encore d'évaluation

- Fabm2 Q1Document149 pagesFabm2 Q1Gladys Angela Valdemoro100% (2)

- Earnings Management: A Review of Selected Cases: July 2018Document15 pagesEarnings Management: A Review of Selected Cases: July 2018Andre SetiawanPas encore d'évaluation

- Lesson Plan in Business Finance I. ObjectiveDocument3 pagesLesson Plan in Business Finance I. ObjectiveZandra QuillaPas encore d'évaluation

- Does Competition Destroy Ethical Behavior?: Ndrei HleiferDocument5 pagesDoes Competition Destroy Ethical Behavior?: Ndrei HleiferKlinik Jurnal KJ FH UBPas encore d'évaluation

- SPM Unit2 2marksDocument2 pagesSPM Unit2 2marksjormnPas encore d'évaluation

- Assessing Officer (AO Code) : Last Name/Surname First Name Middle NameDocument3 pagesAssessing Officer (AO Code) : Last Name/Surname First Name Middle NameAbu Afaq ZaidiPas encore d'évaluation

- Income From Bussiness and ProfessionDocument2 pagesIncome From Bussiness and ProfessionKr KvPas encore d'évaluation

- Agri Economics Question For Ao TNPSC ExamDocument77 pagesAgri Economics Question For Ao TNPSC ExamecodheepuPas encore d'évaluation

- TES-AMM (Singapore) Pte. LTD.: Company Registration No. 200508881RDocument43 pagesTES-AMM (Singapore) Pte. LTD.: Company Registration No. 200508881RJoyce ChongPas encore d'évaluation

- Medina Vs Cir 1 Scra 302 January 28Document1 pageMedina Vs Cir 1 Scra 302 January 28Jenine QuiambaoPas encore d'évaluation

- Loma 357 C5Document25 pagesLoma 357 C5May ThirteenthPas encore d'évaluation

- Ch2 - Basic Cost Management Concepts - OutlineDocument8 pagesCh2 - Basic Cost Management Concepts - OutlineirquadriPas encore d'évaluation

- Answer Final Exam (POA)Document2 pagesAnswer Final Exam (POA)Phâk Tèr ÑgPas encore d'évaluation

- Answering Machine. The Company's Income Statement For The Most Recent Year Is Given BelowDocument10 pagesAnswering Machine. The Company's Income Statement For The Most Recent Year Is Given BelowmeselePas encore d'évaluation

- Problem 4-1a AnswersDocument5 pagesProblem 4-1a AnswersKenton LauPas encore d'évaluation

- Cost Behavior and Cost-Volume-Profit Analysis: Opening CommentsDocument16 pagesCost Behavior and Cost-Volume-Profit Analysis: Opening CommentsNnickyle LaboresPas encore d'évaluation

- SAHARA INDIA PARIWAR Summer Training ReportDocument116 pagesSAHARA INDIA PARIWAR Summer Training ReportUjjawalpratap Singh100% (1)

- ISAK 35 Non Profit Oriented EntitiesDocument48 pagesISAK 35 Non Profit Oriented Entitiesnabila dhiyaPas encore d'évaluation

- Report 29Document9 pagesReport 29Pran piya100% (1)

- Retained EarningsDocument72 pagesRetained EarningsItronix MohaliPas encore d'évaluation

- Shreya Jain - PGFC1935 - Performance AnalysisDocument13 pagesShreya Jain - PGFC1935 - Performance AnalysisSurbhî GuptaPas encore d'évaluation

- Chapter 5 New11 - Block Hirt BookDocument14 pagesChapter 5 New11 - Block Hirt BookRamishaPas encore d'évaluation

- 1 Latest Latest Manual LatestDocument9 pages1 Latest Latest Manual LatestRohanMohapatraPas encore d'évaluation

- KSFC ProfileDocument143 pagesKSFC ProfilenishaarjunPas encore d'évaluation

- Project Report ON "To Study of Npa Management"Document64 pagesProject Report ON "To Study of Npa Management"Dhiraj KokarePas encore d'évaluation

- Engineering Economy Module 6Document52 pagesEngineering Economy Module 6shaitoPas encore d'évaluation