Académique Documents

Professionnel Documents

Culture Documents

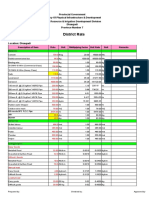

Sin Tax

Transféré par

Vj Lentejas IIIDescription originale:

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Sin Tax

Transféré par

Vj Lentejas IIIDroits d'auteur :

Formats disponibles

Taxation is a system of compulsory contributions levied by government on persons, corporations, and properties, primarily as a source of revenue for governments

expenses and other public purposes. It is for this reason, in order for the government to provide the public with the necessary goods and services, revenue must be raised through taxation. This revenue is generated through direct and indirect forms of taxation. Direct taxes are paid on income. This effectively means that the more income you earn the greater your contribution is expected to be to the state. Indirect taxes are levied on expenditure. This tax is imposed on the basis of the individual consumption the individual pays only on what he consumes. However, it must be noted that taxation is used not only to raise revenue but also to regulate consumption and may even be used to curtail various forms of business activities. For instance, alcoholic beverages and tobacco may be taxed heavily on the grounds that their use is hazardous to the health of individuals. Such revenue, often called a sin tax, is infact a penalty paid by the users of the substance. The regulatory aspects of taxation are more apparent in indirect taxes, such as customs duties and taxes, than in direct taxes such as income tax. For instance, government can control private consumption, especially of imported goods, by increasing customs tariffs. An increase in taxation on personal income on the other hand, may result in a decrease in private savings without affecting the level of consumption. The effectiveness of any government, depends on the willingness of the people governed to surrender or exchange a measure of control over their persons and property, in return for protection and other services. Taxation is one form of this exchange. In designing tax systems, governments customarily consider three basic indicators of taxpayer wealth or ability to pay: what people own, what they spend, and what they earn. The kinds of taxes raised by government for revenue are numerous. The most common are: personal income taxes, corporate income taxes, property taxes, sales taxes, death and gift taxes, and import-export duties. In order for a tax system to operate effectively, certain principles must be put in place. Fairness: the tax must be fair, that is, citizens should be taxed in proportion to their abilities to pay. Clarity and Certainty: Convenience: the application of a tax should be clear and certain. If the application is uncertain and arbitrary the public can have no confidence in the system. compliance with tax laws may increase if it is easy and convenient. Efficiency: a good tax system should be structured so that it can be administered efficiently and economically. Taxes that are difficult or costly to administer divert resources to nonproductive uses and diminish confidence in both the levy and the government.

In the past taxation was regarded solely as a means to finance the necessary obligations of a government. The money was used to pay elected officials, maintain state security, build roads, bridges and public buildings; and pay for such services as schools, hospitals and fire fighters. In recent times, the purposes of taxation have expanded considerably, as have the roles of governments in society. Today taxes have three functions. First and foremost, to provide the money that makes it possible for government to function. Second, taxes have an economic significance: they are used to promote goals such as full employment, satisfactory rates of economic growth, and stability of the money supply. The economic goals of taxation are achieved by raising or lowering tax rates. The fewer taxes people pay, the more they have for their personal use. Conversely, the more taxes they pay, the less money they have available for themselves. Third, taxes are used as a redistribution of wealth. The purpose of income redistribution is to lessen the inequalities of wealth in society. This is done through what is called a system of transfer payments. The effect of the system is to transfer money from those who have a good deal of it to those who have very little. Two of the most common examples are social security payments and welfare payments made to people who, for one reason or another, do not work.

Vous aimerez peut-être aussi

- TFN Declaration FormDocument6 pagesTFN Declaration FormTim DunnPas encore d'évaluation

- 3000 CalorieDocument10 pages3000 CalorieNIKHILPas encore d'évaluation

- Chain of Custody Rule in Drug CasesDocument22 pagesChain of Custody Rule in Drug CasesMairon Bryan RojasPas encore d'évaluation

- ASTM IndexDocument34 pagesASTM IndexJimmy Chan67% (3)

- Proper and Humane Relocation Procedures PDFDocument8 pagesProper and Humane Relocation Procedures PDFidemsonamPas encore d'évaluation

- HBSE-Mock ExamDocument3 pagesHBSE-Mock ExamAnnePas encore d'évaluation

- CooperativeDocument27 pagesCooperativeVj Lentejas IIIPas encore d'évaluation

- Importance and Role of TaxationDocument7 pagesImportance and Role of TaxationZale Crud100% (2)

- Healthcare Financing in IndiADocument86 pagesHealthcare Financing in IndiAGeet Sheil67% (3)

- By: By: BKG Gabay BKG Gabay RM Remotin, Jr. RM Remotin, Jr. Eam Uy Eam UyDocument20 pagesBy: By: BKG Gabay BKG Gabay RM Remotin, Jr. RM Remotin, Jr. Eam Uy Eam UyTine FPas encore d'évaluation

- Amputation and diabetic foot questionsDocument69 pagesAmputation and diabetic foot questionspikacu196100% (1)

- Electrical Interview Questions & Answers - Hydro Power PlantDocument2 pagesElectrical Interview Questions & Answers - Hydro Power PlantLaxman Naidu NPas encore d'évaluation

- Labor Law Case DigestsDocument60 pagesLabor Law Case Digestsmhelei2luvla91% (11)

- Purposes and Effects: Taxpayer (An Individual orDocument6 pagesPurposes and Effects: Taxpayer (An Individual orSreeni Vas LAkshmiPas encore d'évaluation

- Taxation FinalDocument10 pagesTaxation FinalMaelyn GelilangPas encore d'évaluation

- Taxpayer (An Individual Or: Legal Entity StateDocument4 pagesTaxpayer (An Individual Or: Legal Entity StateSaurabh NandyPas encore d'évaluation

- Purposes and EffectsDocument16 pagesPurposes and EffectsChelle OcampoPas encore d'évaluation

- Government RevenueDocument6 pagesGovernment Revenuenihadarfin19Pas encore d'évaluation

- Legal Entity State: Government ActivityDocument3 pagesLegal Entity State: Government ActivityEunice Bucao BuesaPas encore d'évaluation

- Taxation System in BangladeshDocument21 pagesTaxation System in Bangladeshmamun khanPas encore d'évaluation

- Bangladesh Tax System ExplainedDocument24 pagesBangladesh Tax System ExplainedNazmulHasanPas encore d'évaluation

- Direct TaxDocument98 pagesDirect Taxmonali raiPas encore d'évaluation

- Introduction To TaxationDocument28 pagesIntroduction To TaxationpcandohPas encore d'évaluation

- Taxation 123Document3 pagesTaxation 123Cantos FlorencePas encore d'évaluation

- Assignment 305 DraftDocument28 pagesAssignment 305 DraftShahrin ChaityPas encore d'évaluation

- Chapter 1Document55 pagesChapter 1abatePas encore d'évaluation

- Part I Introduction To TaxationDocument56 pagesPart I Introduction To TaxationabrehamdPas encore d'évaluation

- Chapter I Tax LawDocument44 pagesChapter I Tax LawzinedinalePas encore d'évaluation

- A TaxDocument2 pagesA TaxbosserickaPas encore d'évaluation

- Taxation System in BangladeshDocument12 pagesTaxation System in BangladeshkoheliPas encore d'évaluation

- Relevance of Taxation1Document10 pagesRelevance of Taxation1einol padalPas encore d'évaluation

- TaxationDocument20 pagesTaxationBernard OkpePas encore d'évaluation

- TaxationDocument21 pagesTaxationmsjan019100% (1)

- Public Revenue 17396Document54 pagesPublic Revenue 17396sneha9988gargPas encore d'évaluation

- Legal Entity State: Taxo TangōDocument26 pagesLegal Entity State: Taxo Tangōrhodora exPas encore d'évaluation

- CHP 3 Pad370 MDM SarehanDocument8 pagesCHP 3 Pad370 MDM SarehanPaikuna sumoPas encore d'évaluation

- Taxation and Fiscal PoliciesDocument279 pagesTaxation and Fiscal PoliciesFun DietPas encore d'évaluation

- Principles of TaxationDocument36 pagesPrinciples of TaxationyeyPas encore d'évaluation

- The Importance of Taxes: What Is A "Tax"Document6 pagesThe Importance of Taxes: What Is A "Tax"Hami KhaNPas encore d'évaluation

- 301 Theory of Pub RevenueDocument85 pages301 Theory of Pub RevenueZannath HabibPas encore d'évaluation

- BACC3 - Antiniolos, FaieDocument21 pagesBACC3 - Antiniolos, Faiemochi antiniolosPas encore d'évaluation

- Chapter No.-1 Meaning of Tax: OverviewDocument28 pagesChapter No.-1 Meaning of Tax: OverviewAnonymous 3W3153sx4OPas encore d'évaluation

- Taxation Laws Module 1: Introduction To Taxation in India: CS Sangeeta BaggaDocument16 pagesTaxation Laws Module 1: Introduction To Taxation in India: CS Sangeeta BaggaBhanu Pratap SinghPas encore d'évaluation

- Taxation LawsDocument15 pagesTaxation LawsVikas RockPas encore d'évaluation

- CHAPTER-TWO PUBLIC REVENUEDocument76 pagesCHAPTER-TWO PUBLIC REVENUEyebegashetPas encore d'évaluation

- Taxation EssayDocument1 pageTaxation EssayHITPas encore d'évaluation

- Local Taxation GuideDocument20 pagesLocal Taxation GuideShanique WilliamsPas encore d'évaluation

- Part Iii - Core - Customs Duty and Goods and Services Tax (N6BPA6T73)Document11 pagesPart Iii - Core - Customs Duty and Goods and Services Tax (N6BPA6T73)loganathanPas encore d'évaluation

- What Is Taxation?Document3 pagesWhat Is Taxation?11-HUMMS B Beltran, Matt Gabriele B.Pas encore d'évaluation

- Lecture One - Introduction To TaxationDocument49 pagesLecture One - Introduction To TaxationIbsa AbrahimPas encore d'évaluation

- TAXATION LAW Final NotesDocument95 pagesTAXATION LAW Final NotesTushita SonkarPas encore d'évaluation

- Taxes ExplainedDocument17 pagesTaxes ExplainedlorenaPas encore d'évaluation

- Concept of Taxation - NotesDocument2 pagesConcept of Taxation - Noteswagisha.w70Pas encore d'évaluation

- Different Taxation Systems - Advantages and DisadvantagesDocument4 pagesDifferent Taxation Systems - Advantages and DisadvantagesGabriella PopovaPas encore d'évaluation

- Fundamentals of Taxation at Islamic University in UgandaDocument10 pagesFundamentals of Taxation at Islamic University in UgandaMugwanya AsadPas encore d'évaluation

- Taxation DiazDocument3 pagesTaxation DiazRyan DiazPas encore d'évaluation

- DT Word 21Document10 pagesDT Word 21Kirti ParkPas encore d'évaluation

- Related: BBA From Amity University, Ranchi (Graduated 2022)Document4 pagesRelated: BBA From Amity University, Ranchi (Graduated 2022)Shy DyPas encore d'évaluation

- HISTORY AND PURPOSES OF TAXATIONDocument14 pagesHISTORY AND PURPOSES OF TAXATIONVirona FernandoPas encore d'évaluation

- 11 - Government and TaxesDocument11 pages11 - Government and TaxesPadmajaPas encore d'évaluation

- Micky Tax LawDocument39 pagesMicky Tax LawŤşinu MđPas encore d'évaluation

- Tax Is CupsDocument34 pagesTax Is CupsJay SuarezPas encore d'évaluation

- Applied Econ - TaxationDocument5 pagesApplied Econ - Taxationsweet miloPas encore d'évaluation

- Income Taxation Assignment - DailyDocument4 pagesIncome Taxation Assignment - DailyMa. Jhoan DailyPas encore d'évaluation

- University of Central Punjab: Assignment No 1 SubjectDocument8 pagesUniversity of Central Punjab: Assignment No 1 SubjectXh MuneebPas encore d'évaluation

- What Is Tax?Document5 pagesWhat Is Tax?Mequanent MengistuPas encore d'évaluation

- Purposes and Effects of Taxation: CorvéeDocument16 pagesPurposes and Effects of Taxation: CorvéeRuchi JatakiaPas encore d'évaluation

- TaxationDocument34 pagesTaxationShyamKumarKCPas encore d'évaluation

- Apostol - Taxation Written ReportDocument2 pagesApostol - Taxation Written Reportkarylle apostolPas encore d'évaluation

- How America was Tricked on Tax Policy: Secrets and Undisclosed PracticesD'EverandHow America was Tricked on Tax Policy: Secrets and Undisclosed PracticesPas encore d'évaluation

- Cdi 4 Organized Crime 2020 Covid ADocument66 pagesCdi 4 Organized Crime 2020 Covid AVj Lentejas IIIPas encore d'évaluation

- Tami Cdi 4 Finality 12Document67 pagesTami Cdi 4 Finality 12Vj Lentejas IIIPas encore d'évaluation

- Activities For Org CrimeDocument3 pagesActivities For Org CrimeVj Lentejas IIIPas encore d'évaluation

- PREFACEDocument1 pagePREFACEVj Lentejas IIIPas encore d'évaluation

- MdteuDocument3 pagesMdteuGjenerrick Carlo MateoPas encore d'évaluation

- Republic Act No 7279 (Udha) PDFDocument24 pagesRepublic Act No 7279 (Udha) PDFHenteLAWcoPas encore d'évaluation

- 13 PDFDocument2 pages13 PDFArchie VillaluzPas encore d'évaluation

- JR No. 8Document28 pagesJR No. 8Vj Lentejas IIIPas encore d'évaluation

- Siegel, Larry J. Criminology: Theories, Patterns and Typologies. Thomson Wadsworth. USA. 2004Document8 pagesSiegel, Larry J. Criminology: Theories, Patterns and Typologies. Thomson Wadsworth. USA. 2004Vj Lentejas IIIPas encore d'évaluation

- Table of Contents-TrafficDocument2 pagesTable of Contents-TrafficVj Lentejas IIIPas encore d'évaluation

- BFP 01212020Document4 pagesBFP 01212020Vj Lentejas IIIPas encore d'évaluation

- Office of The President National Housing Authority: Ana V. BaulDocument2 pagesOffice of The President National Housing Authority: Ana V. BaulVj Lentejas IIIPas encore d'évaluation

- Helping Struggling Law Students Master Critical SkillsDocument38 pagesHelping Struggling Law Students Master Critical SkillsVj Lentejas IIIPas encore d'évaluation

- Helping Struggling Law Students Master Critical SkillsDocument38 pagesHelping Struggling Law Students Master Critical SkillsVj Lentejas IIIPas encore d'évaluation

- Assigment MPRMDocument29 pagesAssigment MPRMVj Lentejas IIIPas encore d'évaluation

- Welcome: National Housing Authority Region 8Document1 pageWelcome: National Housing Authority Region 8Vj Lentejas IIIPas encore d'évaluation

- AxiomsDocument11 pagesAxiomsVj Lentejas IIIPas encore d'évaluation

- Acdi OutputDocument8 pagesAcdi OutputVj Lentejas IIIPas encore d'évaluation

- Commercial Law, Also Known As Trade Law, Is The Body ofDocument1 pageCommercial Law, Also Known As Trade Law, Is The Body ofVj Lentejas IIIPas encore d'évaluation

- ChanRobles Professional Review for Philippine Bar ExamDocument6 pagesChanRobles Professional Review for Philippine Bar ExamVj Lentejas IIIPas encore d'évaluation

- RVP ClusteringDocument26 pagesRVP ClusteringVj Lentejas IIIPas encore d'évaluation

- CS English Review Oct 2015 Subject - Verb Agreement PDFDocument24 pagesCS English Review Oct 2015 Subject - Verb Agreement PDFMark Robert Bryan PeraltaPas encore d'évaluation

- AmrDocument9 pagesAmrVj Lentejas IIIPas encore d'évaluation

- Assigment MPRMDocument29 pagesAssigment MPRMVj Lentejas IIIPas encore d'évaluation

- Legal and Conceptual Framework of BWS PDFDocument22 pagesLegal and Conceptual Framework of BWS PDFKris Antonnete DaleonPas encore d'évaluation

- f1AGENDA JUNE 22 - As of 16 JuneDocument4 pagesf1AGENDA JUNE 22 - As of 16 JuneVj Lentejas IIIPas encore d'évaluation

- Nursing Care of ElderlyDocument26 pagesNursing Care of ElderlyIndra KumarPas encore d'évaluation

- Khatr Khola ISP District RatesDocument56 pagesKhatr Khola ISP District RatesCivil EngineeringPas encore d'évaluation

- Secondary AssessmentsDocument12 pagesSecondary Assessmentsapi-338389967Pas encore d'évaluation

- 2005-05-12Document18 pages2005-05-12The University Daily KansanPas encore d'évaluation

- Calculation of Lightning and Switching Overvoltages Transferred Through Power TransformerDocument9 pagesCalculation of Lightning and Switching Overvoltages Transferred Through Power TransformerBožidar Filipović-GrčićPas encore d'évaluation

- 01 01Document232 pages01 01Muhammad Al-MshariPas encore d'évaluation

- Experiment 4 (Group 1)Document4 pagesExperiment 4 (Group 1)Webster Kevin John Dela CruzPas encore d'évaluation

- PGAU - BOHC2018-05 - 20pg - Lowres - Leader Cable AAC Conductor Data PDFDocument20 pagesPGAU - BOHC2018-05 - 20pg - Lowres - Leader Cable AAC Conductor Data PDFKelly chatPas encore d'évaluation

- Limetas Maximos ResidualesDocument27 pagesLimetas Maximos ResidualesXjoelx Olaya GonzalesPas encore d'évaluation

- Introduction To Integrative Homeopathy - Bob LeckridgeDocument16 pagesIntroduction To Integrative Homeopathy - Bob LeckridgeBob LeckridgePas encore d'évaluation

- Separation/Termination of Employment Policy SampleDocument4 pagesSeparation/Termination of Employment Policy SampleferPas encore d'évaluation

- Research PaperDocument12 pagesResearch PapershreyanshPas encore d'évaluation

- Baileys in 2009: Case Study Reference No 509-050-1Document17 pagesBaileys in 2009: Case Study Reference No 509-050-1Ernesto KulasinPas encore d'évaluation

- 2VV-33C-R4-V5 Product SpecificationsDocument5 pages2VV-33C-R4-V5 Product Specificationsnhan sieuPas encore d'évaluation

- Chapter 2 Electronic StructureDocument62 pagesChapter 2 Electronic StructureLivan TuahPas encore d'évaluation

- Berman Et Al-2019-Nature Human BehaviourDocument5 pagesBerman Et Al-2019-Nature Human BehaviourMira mPas encore d'évaluation

- CASR Part 830 Amdt. 2 - Notification & Reporting of Aircraft Accidents, Incidents, or Overdue Acft & Investigation OCRDocument17 pagesCASR Part 830 Amdt. 2 - Notification & Reporting of Aircraft Accidents, Incidents, or Overdue Acft & Investigation OCRHarry NuryantoPas encore d'évaluation

- Lab 9-Measurement of Filtrate Loss and Mud Cake Thickness of Drilling Mud Sample Using Dead Weight Hydraulic Filter Press Considering API Standard.Document17 pagesLab 9-Measurement of Filtrate Loss and Mud Cake Thickness of Drilling Mud Sample Using Dead Weight Hydraulic Filter Press Considering API Standard.Sunny BbaPas encore d'évaluation

- Impact of Dairy Subsidies in NepalDocument123 pagesImpact of Dairy Subsidies in NepalGaurav PradhanPas encore d'évaluation

- Product GuideDocument13 pagesProduct Guidekhalid mostafaPas encore d'évaluation

- T1D Report September 2023Document212 pagesT1D Report September 2023Andrei BombardieruPas encore d'évaluation

- BOD FormatDocument4 pagesBOD FormatSkill IndiaPas encore d'évaluation

- Grade 9 P.EDocument16 pagesGrade 9 P.EBrige SimeonPas encore d'évaluation