Académique Documents

Professionnel Documents

Culture Documents

Kitty Hawk

Transféré par

patmonksDescription originale:

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Kitty Hawk

Transféré par

patmonksDroits d'auteur :

Formats disponibles

In mid 1994 the Kittyhawk development team was in an uncomfortable position.

The key issue was that sales into the targeted PDA market were not materializing as expected. The few markets in which the drive was making headway were fairly specialized and would likely produce only modest sales volumes, often following a long sales cycle.

The project team had made some admirable technical accomplishments. They succeeded in their goal of producing a drive that was a generation ahead of its competition in terms of its size and power consumption. They met their one-year development goal. They made a drive that could withstand a drop to the floor. However, it was evident that the products feature set, market positioning and pricing was not resonating with enough customers to hit their financial targets. Meanwhile, competitors continued to make progress on ever smaller drives.

HPs original strategy was to leapfrog the 1.8 drive size and be the first to market with a 1.3 drive. Their goal in doing this was to gain a period of competitive advantage where they were the only seller of 1.3 drives in a burgeoning market for miniaturized devices. This would afford them significant pricing power and provide the benefits of learning effects and economies of scale by the time their competitors arrived on the scene.

The project team was comprised of individuals with a history of accomplishment. They were afforded every reasonable resource and given great autonomy. Their charter clearly called for development of the drive in one year, $100m sales in two years, BET in 3 years, and 35% revenue growth. As put by the R&D manager a small, dumb, cheap drive!

The first dilemma came in their choice of whether to target the drive to the mobile computing market or a take a more cost focused approach. By choosing the mobile focus they made their first departure from the charter of small, cheap, dumb. The next such misstep was the decision to include the accelerometer and ruggedization as a standard feature, significantly increasing costs. And finally they hired a reputable market research firm who simply affirmed the opinions of insiders rather than talk to customers.

In the midst of making all of these design and target-market decisions no less than 10 unheeded customers reiterated the need for a $50 price point. Some of them represented projects with potential unit sales in the millions. Nintendo had even gone so far as to design a console with a slot for the drive. Ignoring these customers was their primary downfall.

At the decision point in mid-1994 the team considered three courses of action: 1. Continue to pursue ruggedization, despite slow development and low sales volumes. 2. Leverage the ruggedized technologies for the production of a 2.5 laptop drive. 3. Develop a design and manufacturing technique capable of producing a $50 drive.

The first option (ruggedization) is essentially complete. The ruggedized market is on its way to becoming a modest source of revenue, but does not have the potential for sustaining the volume needed to meet the required sales targets.

The option of creating a 2.5 ruggedized drive would also be playing to a specialized market, having a narrow focus and attendant small sales potential.

I would find the option of pursuing the $50 drive as having the best potential for significant long term sales volume and profitability. The customer base has already voiced its demand for this product, so the market uncertainty is greatly reduced. Seymour characterized the difficulty of its design as being on par with the drive capable of a three-foot fall. At a $50 price point many additional uses for the drive would appear that did not previously seem practical. By eliminating the ruggedization features on the drive and targeting customers with high sales volumes HP can benefit from reduced parts costs, simplified assembly and economies of scale in manufacturing. Once cost leadership is established with significant economies of scale, HP could consider some integrated options or future strategies such as:

1. Offer a ruggedized 1.3 drive as a customization step using the same base drive mechanism plus the accelerometer and shock absorption components. 2. Offer a 2.5 ruggedized form-factor which contains two 1.3 drives in tandem for applications where a main drive and backup drive are needed for reliability. 3. Constantly reevaluate HPs ability to compete in the intermediate disk sizes. 4. Constantly seek feedback from customers and potential customers about their wants. 5. In the longer term, flash memory will play an increasing part in the mass storage of consumer electronics and mobile devices. HP may have been wise to consider the acquisition of flash memory producer Micron technologies, also in Boise. This would give them the opportunity to produce hybrid flash and magnetic drive products, and eventually pure flash based memory products as economies of scale are realized for the production of flash memory. 6. Hindsight is 20/20. However, it is interesting to note that mp3 became an audio standard in 1991, with the first mp3 players appearing in 1996. When it was designing the iPod in the year 2000 how much would Apple have preferred to use a tiny 1.3 drive instead of the bulkier 1.8 drive they ended up using in the original 2001 iPod?

Vous aimerez peut-être aussi

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (400)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (74)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- 2201 IntGCSE (9-1) Subject Grade Boundaries V1Document4 pages2201 IntGCSE (9-1) Subject Grade Boundaries V1Fariha RahmanPas encore d'évaluation

- Practice - Test 2Document5 pagesPractice - Test 2Nguyễn QanhPas encore d'évaluation

- 7Document6 pages7Joenetha Ann Aparici100% (1)

- CHARACTER FORMATION 1 PrelimDocument15 pagesCHARACTER FORMATION 1 PrelimAiza Minalabag100% (1)

- Derivational and Inflectional Morpheme in English LanguageDocument11 pagesDerivational and Inflectional Morpheme in English LanguageEdificator BroPas encore d'évaluation

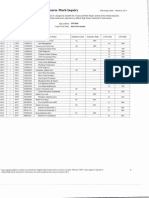

- PM Jobs Comp Ir RandDocument9 pagesPM Jobs Comp Ir Randandri putrantoPas encore d'évaluation

- PDFDocument3 pagesPDFAhmedraza123 NagdaPas encore d'évaluation

- G10 Lesson2 DLPDocument13 pagesG10 Lesson2 DLPAngeles, Mark Allen CPas encore d'évaluation

- Pubb-0589-L-Rock-mass Hydrojacking Risk Related To Pressurized Water TunnelsDocument10 pagesPubb-0589-L-Rock-mass Hydrojacking Risk Related To Pressurized Water Tunnelsinge ocPas encore d'évaluation

- Assessment of Embodied Carbon Emissions For Building Construc - 2016 - Energy AnDocument11 pagesAssessment of Embodied Carbon Emissions For Building Construc - 2016 - Energy Any4smaniPas encore d'évaluation

- Simon Ardhi Yudanto UpdateDocument3 pagesSimon Ardhi Yudanto UpdateojksunarmanPas encore d'évaluation

- Philodendron Plants CareDocument4 pagesPhilodendron Plants CareSabre FortPas encore d'évaluation

- SW OSDocument11 pagesSW OSErnest OfosuPas encore d'évaluation

- Yale Revision WorksheetDocument3 pagesYale Revision WorksheetYASHI AGRAWALPas encore d'évaluation

- Alchemy of The HeartDocument7 pagesAlchemy of The HeartAbdul RahimPas encore d'évaluation

- Case Study - Suprema CarsDocument5 pagesCase Study - Suprema CarsALFONSO PATRICIO GUERRA CARVAJALPas encore d'évaluation

- Module 6 Metal Properties and Destructive TestingDocument46 pagesModule 6 Metal Properties and Destructive TestingMiki Jaksic100% (6)

- Lightning Arrester Lightningcontroller MC 125-B/Npe: Operation and Fields of ApplicationDocument2 pagesLightning Arrester Lightningcontroller MC 125-B/Npe: Operation and Fields of ApplicationAnas BasarahPas encore d'évaluation

- SubaruDocument7 pagesSubaruclaude terizlaPas encore d'évaluation

- D&D 5.0 Combat Reference Sheet Move Action: Interact With One Object Do Other Simple ActivtiesDocument2 pagesD&D 5.0 Combat Reference Sheet Move Action: Interact With One Object Do Other Simple ActivtiesJason ParsonsPas encore d'évaluation

- Quality Control of Rigid Pavements 1Document58 pagesQuality Control of Rigid Pavements 1pranjpatil100% (1)

- Words of Radiance: Book Two of The Stormlight Archive - Brandon SandersonDocument6 pagesWords of Radiance: Book Two of The Stormlight Archive - Brandon Sandersonxyrytepa0% (3)

- The Palestinian Centipede Illustrated ExcerptsDocument58 pagesThe Palestinian Centipede Illustrated ExcerptsWael HaidarPas encore d'évaluation

- Derma Notes 22pages. DR - Vishwa Medical CoachingDocument23 pagesDerma Notes 22pages. DR - Vishwa Medical CoachingΝίκος ΣυρίγοςPas encore d'évaluation

- BiografijaDocument36 pagesBiografijaStjepan ŠkalicPas encore d'évaluation

- Total Physical Response (G4)Document3 pagesTotal Physical Response (G4)Aq Nadzrul LarhPas encore d'évaluation

- Img 20150510 0001Document2 pagesImg 20150510 0001api-284663984Pas encore d'évaluation

- ISA InTech Journal - April 2021Document50 pagesISA InTech Journal - April 2021Ike EdmondPas encore d'évaluation

- ST Arduino Labs CombinedDocument80 pagesST Arduino Labs CombineddevProPas encore d'évaluation

- 3400 MD IomDocument52 pages3400 MD IomIhabPas encore d'évaluation