Académique Documents

Professionnel Documents

Culture Documents

IE Matrix

Transféré par

Ali JanDescription originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

IE Matrix

Transféré par

Ali JanDroits d'auteur :

Formats disponibles

SWOT Analysis:

Opportunities: Pakistan is the 7th largest producer of milk. Capitalize on its superior quality milk. Now a days consumers have become health-conscious. Therefore it is an important opportunity for Milkpak to come up with variety of health-based products. Nestle Milkpaks focus extensive milk collection system and agriculture extension ensures that the milk you get is of the finest quality. Nestle Milkpak is using the latest technology in its production units. Joint venture with a foreign company Overall climate for private investment was favourable Milkpak competitors were few and week Increasing interest of people More people are coming toward processed milk because loose milk is dangerous for health due to lot of containment Growth of processed milk increasing Government provided safeguard against nationalization and sought to ensure the safety of investment

Threats: Effects of seasonality upon sales Decreasing the purchasing power of people Raw materials which are imported Introduce the consumer the idea of long life milk. Uncertainty of economic conditions

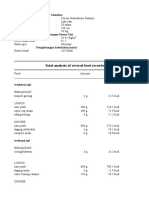

EFE Matrix for Milkpak Limited Key External Factors Opportunities Pakistan is the 7th largest producer of milk. Weight Rating Score

Latest technology Health based products Focus on extensive milk collection and agriculture extension Joint venture with foreign company Few and weak competitors Threats Effects of seasonality upon sales

0.1 0.06 0.05 0.05 0.07 0.08

4 3 3 3 3 3

0.4 0.18 0.15 0.15 0.21 0.24

Decreasing the purchasing power of people Raw materials which are imported Uncertainty of economic conditions Challenge to introduce the consumer the idea of long life milk Total Strengths:

0.14 0.1 0.13 0.12 0.1 1

2 2 2 2 1

0.28 0.2 0.26 0.24 0.1 2.41

Milkpak has a longer shelf life. It is a pure dairy product and so stays fresh even without refrigeration for days. Milkpak is considered safe and hygienic because of the brand name of Nestle backing it. One of Milkpaks major strengths is its distribution network. It is more widely available than any other milk and extensively covers all the important areas. It therefore provides a lot of convenience to loyal users.

Commitment to high quality products. Solid financial position Milkpak was positioned as pure dairy products, processed as scientific, hygienic way and consistent in quality. Expanded from UHT to fruit juices and other dairy products

Weakness: Customers perceive that packaged milk contain many chemicals for their preservation. This is a negative association for Milk Pak. Weak advertising of Milkpak Another weakness of Milkpak Ltd. is that its total packaging depends upon Packages (Pvt.) limited. Problems of transporting and distribution resulting in shortages in major centres milkpak target market. Poor management The target market of MilkPak is only the upper and middle class. As poor class cannot afford to buy UHT milk because of its premium price Poor dairy infrastructure in rural areas Lack of education among the farmers is making it difficult to change farm and dairy management system Increasing demand for imported products.

IFE Matrix for Milkpak Limited Key External Factors Strengths Longer shelf life Safe and hygienic Commitment to high quality products Solid financial position Strong Distribution Network Weaknesses Increasing demand for importing products Target market is only upper and middle class Weak advertising of Milkpak Dependence on packages limited Total Weight 0.08 0.15 0.15 0.08 0.06 Rating Weighted Score 3 4 4 4 4 0.24 0.6 0.6 0.32 0.24

0.16 0.08 0.17 0.07 1

2 1 2 2

0.32 0.08 0.34 0.14 2.88

Internal-External (IE) matrix

The Internal-External (IE) matrix is strategic management tool used to analyze working conditions and strategic position of a business. The Internal External Matrix is based on an analysis of internal and external business factors which are combined into one suggestive model. Basically it is combination of the EFE matrix and IFE matrix. The IE matrix is based on the following two criteria: Score from the EFE matrix -- this score is plotted on the y-axis Score from the IFE matrix -- plotted on the x-axis

The IE matrix works in a way that you plot the total weighted score from the EFE matrix on the y axis and draw a horizontal line across the plane. Then you take the score calculated in the IFE matrix, plot it on the x axis, and draw a vertical line across the plane. The point where your horizontal line meets your vertical line is the determinant of your strategy. This point shows the strategy that your company should follow. On the x axis of the IE Matrix, an IFE total weighted score of 1.0 to 1.99 represents a weak internal position. A score of 2.0 to 2.99 is considered average. A score of 3.0 to 4.0 is strong.

On the y axis, an EFE total weighted score of 1.0 to 1.99 is considered low. A score of 2.0 to 2.99 is medium. A score of 3.0 to 4.0 is high.

So the total weighted score which we calculated in IFE matrix is 2.88 which points at a company with an average internal strength. We also calculated the EFE matrix. The total weighted score calculated for the EFE matrix is 2.41 which suggest a company has average ability to respond to external factors.

IE Matrix The IFE Total Weighted Score Strong 3.0 to 4.0 Grow I Hold IV Average 2.0 to 2.99 And II And V Weak 1.0 to 1.99 Build III Maintain VI Divest IX

IE

The EFE Total Weighted Score

High 3.0 to 4.0 Medium 2.0 to 2.99 Low 1.0 to 1.99

Harvest VII

And VIII

This IE matrix tells us that the Milkpak should hold and maintain its position. The company should pursue strategies focused on increasing market penetration and product development.

BCG Matrix: The BCG model is a well-known portfolio management tool used in product life cycle theory. BCG matrix is often used to prioritize which products within company product mix get more funding and attention. Placing products in the BCG matrix results in 4 categories in a portfolio of a company:

BCG STARS (high growth, high market share) BCG QUESTION MARKS (high growth, low market share) BCG CASH COWS (low growth, high market share) BCG DOGS (low growth, low market share)

MILKPAK POSITION ON THE BCG MATRIX: CASH COW

MILKPAK is a low-growth business with a relatively high market share. It is a mature, successful business with relatively little need for investment (Advertising etc). Milkpak needs to be managed for continued profit - so that it continues to generate the strong cash flows that the company needs for its Stars

Grand Strategy Matrix:

This is also an important matrix of strategy formulation frame work. Grand strategy matrix it is popular tool for formulating alternative strategies. In this matrix all organization divides into four quadrants. . It is based two major dimensions i.e. Market growth and Competitive position and all quadrants contain all possible strategies.

Rapid Market Growth

Quadrant II

Quadrant 1 Milkpak Limited

Weak Competitive Position Quadrant III Quadrant IV

Strong Competitive Position

Slow Market Growth

As it lies in first quadrant so we should go for following set of strategies.

Market development Market penetration Product development Forward integration Backward integration Horizontal integration

Related diversification

Reasons: It lies in 1st quadrant because of some reasons that are: Excellent strategic position Concentration on current market /products Take risk aggressively when necessary

Vous aimerez peut-être aussi

- HRM Term Report On AKUDocument24 pagesHRM Term Report On AKUaribah_sultanPas encore d'évaluation

- What Are The Six Key Differences Between Multinational and Domestic Financial Management?Document5 pagesWhat Are The Six Key Differences Between Multinational and Domestic Financial Management?susanta87Pas encore d'évaluation

- Why Is Human Resource Management Important To All ManagersDocument8 pagesWhy Is Human Resource Management Important To All ManagersAnonymous Tedtcc4byPas encore d'évaluation

- 8.properties and Pricing of Fin. AssetsDocument23 pages8.properties and Pricing of Fin. AssetsSharif Ullah100% (1)

- Nestle Space Matrix: Financial StrengthDocument2 pagesNestle Space Matrix: Financial Strengthchuin78% (9)

- HRM370.Case 6Document2 pagesHRM370.Case 6Sanzida Sharmin Urme 163219763080% (5)

- Unit 6 Strategy Evaluation and ControlDocument13 pagesUnit 6 Strategy Evaluation and ControlbijayPas encore d'évaluation

- Case Study of Strategic EvaluationDocument9 pagesCase Study of Strategic EvaluationFahad chowdhuryPas encore d'évaluation

- Toyota Efe Matrix: No: Opportunities Weight Rating Weighted ScoreDocument2 pagesToyota Efe Matrix: No: Opportunities Weight Rating Weighted ScoreSaifi50% (2)

- Strategic Issues in Managing Technology & InnovationDocument23 pagesStrategic Issues in Managing Technology & InnovationDr Rushen SinghPas encore d'évaluation

- A Case Study of WalmartDocument7 pagesA Case Study of Walmartscorpian.dude100% (1)

- Chap 6 and Chap 8Document7 pagesChap 6 and Chap 8Raheela Shaikh75% (4)

- Internal Factor Evaluation Matrix (IFE) Key Internal Factors Strength NestleDocument2 pagesInternal Factor Evaluation Matrix (IFE) Key Internal Factors Strength Nestle83110992% (12)

- Review QuestionsDocument5 pagesReview QuestionsAweys Osman100% (2)

- Chap 2 Strategic TrainingDocument5 pagesChap 2 Strategic TrainingCyrelOcfemiaPas encore d'évaluation

- 22-Book Reviews - Operations Management PDFDocument9 pages22-Book Reviews - Operations Management PDFTolbert D'SouzaPas encore d'évaluation

- Human Resource Management Quiz 2Document2 pagesHuman Resource Management Quiz 2Helen Pereira100% (2)

- Research ProposalDocument4 pagesResearch ProposalAsstProf Rahul Singh80% (5)

- CH03Document4 pagesCH03Aliya Ahmad ShaikhPas encore d'évaluation

- Chapter 2 Case Application (MOB)Document11 pagesChapter 2 Case Application (MOB)TưĐồPhânVân100% (5)

- SM Nestle 2Document3 pagesSM Nestle 2Cynthia WalterPas encore d'évaluation

- Limitations of Ratios AnalysisDocument2 pagesLimitations of Ratios AnalysisawaezPas encore d'évaluation

- Chapter 6 - Strategy Analysis and ChoiceDocument28 pagesChapter 6 - Strategy Analysis and ChoiceSadaqat AliPas encore d'évaluation

- Chapter 5 - Strategy in ActionDocument39 pagesChapter 5 - Strategy in ActionKristine Esplana ToraldePas encore d'évaluation

- NotesDocument6 pagesNotesRantharu AttanayakePas encore d'évaluation

- Tesla Case StudyDocument3 pagesTesla Case Studygayathriphd7529Pas encore d'évaluation

- Pestle AnalysisDocument7 pagesPestle AnalysisUmair JavedPas encore d'évaluation

- QSPM FinalDocument2 pagesQSPM Finaldanish khanPas encore d'évaluation

- Space Matrix BMWDocument4 pagesSpace Matrix BMWmadalus123Pas encore d'évaluation

- Case StudyDocument4 pagesCase StudyZeeshan MeharPas encore d'évaluation

- SWOT Analysis: Singapore Airlines Use of Competitive Advantage For Growth (2018)Document3 pagesSWOT Analysis: Singapore Airlines Use of Competitive Advantage For Growth (2018)ashPas encore d'évaluation

- HR RestructuringDocument2 pagesHR Restructuringhridyesha100% (1)

- Chapter 4 The Business Research ProcessDocument30 pagesChapter 4 The Business Research ProcessAmanda SamarasPas encore d'évaluation

- Sleepless Nights at Holiday InnDocument3 pagesSleepless Nights at Holiday InnAyesha Butt25% (4)

- Performance Appraisal System-Jelly BellyDocument13 pagesPerformance Appraisal System-Jelly BellyRaisul Pradhan100% (2)

- Beyond Street Smarts: Data-Driven Crime FightingDocument6 pagesBeyond Street Smarts: Data-Driven Crime FightingsalPas encore d'évaluation

- XeroxDocument6 pagesXeroxirinaestefania100% (1)

- TQM 2nd Assignment On NestleDocument25 pagesTQM 2nd Assignment On NestleSalman Ahmad Khan67% (3)

- Lecture 1 - The Concept of StrategyDocument10 pagesLecture 1 - The Concept of StrategyAbhishekPas encore d'évaluation

- IE Matrix ReportDocument3 pagesIE Matrix ReportAmitesh PuriPas encore d'évaluation

- Case Study On Management Information System.Document10 pagesCase Study On Management Information System.Imran Hossain100% (1)

- FINAL Questionnaire For Lack of Brand Loyalty of KFCDocument3 pagesFINAL Questionnaire For Lack of Brand Loyalty of KFCmarayam112Pas encore d'évaluation

- Chapter 6 - Operations Management and PlanningDocument31 pagesChapter 6 - Operations Management and PlanningPushpendra Singh100% (1)

- Understanding The Manager's Job: Introduction To ManagementDocument44 pagesUnderstanding The Manager's Job: Introduction To ManagementNguyen Phuong Trang (K16HL)Pas encore d'évaluation

- Key Marketing Issues For New VentureDocument24 pagesKey Marketing Issues For New VentureDivyesh Gandhi100% (4)

- Role of Stock Exchange in Economic Development With Reference To PakistanDocument21 pagesRole of Stock Exchange in Economic Development With Reference To PakistanAshar Shamim70% (10)

- Chapter 2 Solution of Strategic Management Fred R David 13th EditionDocument4 pagesChapter 2 Solution of Strategic Management Fred R David 13th EditionAmit Das75% (4)

- Case 3.1 - Pepsi's Indra Nooyi: Performance With A PurposeDocument6 pagesCase 3.1 - Pepsi's Indra Nooyi: Performance With A PurposeAnishma AcharyaPas encore d'évaluation

- Operations ManagementDocument4 pagesOperations ManagementFarel Abdia HarfyPas encore d'évaluation

- Revision Questions For Final ExamDocument3 pagesRevision Questions For Final ExamEngMohamedReyadHelesy50% (2)

- Case - Concept Design Services: Dr. Atul RazdanDocument6 pagesCase - Concept Design Services: Dr. Atul RazdanSunil ChaudharyPas encore d'évaluation

- Habib Oil MillsDocument17 pagesHabib Oil MillsNabeel Raja100% (7)

- Bimco Milk - 1Document20 pagesBimco Milk - 1Mustapha AbdullahiPas encore d'évaluation

- Pest Analysis: Political ChangesDocument4 pagesPest Analysis: Political ChangesAsif ToorPas encore d'évaluation

- Bản sao của Quản Trị (Nhóm 2)Document34 pagesBản sao của Quản Trị (Nhóm 2)nguyenquynhqt123Pas encore d'évaluation

- Life Care (PVT) LTDDocument62 pagesLife Care (PVT) LTDmuza_marwan100% (1)

- Vinamilk Micro and MacroDocument18 pagesVinamilk Micro and MacroPhạm Phương Minh100% (2)

- Draft Mission VisionDocument22 pagesDraft Mission VisionTanvir Hossain100% (1)

- Baby StramanDocument4 pagesBaby StramanCarlos DauzPas encore d'évaluation

- Financial Ratio AnalysisDocument58 pagesFinancial Ratio AnalysisShamsun NaharPas encore d'évaluation

- CEB 3103 Geotechnical Engineering I: Soil Water and Water FlowDocument39 pagesCEB 3103 Geotechnical Engineering I: Soil Water and Water FlowKia MahiksinhoPas encore d'évaluation

- C 08 S 09Document8 pagesC 08 S 09Marnel Roy MayorPas encore d'évaluation

- Dolor Postoperatorio y Efectos Secundarios de La Uvulo Palstia Con Radiofrecuencia en Roncopatia Primaria.Document5 pagesDolor Postoperatorio y Efectos Secundarios de La Uvulo Palstia Con Radiofrecuencia en Roncopatia Primaria.Alejandro RuizPas encore d'évaluation

- Management of AsthmaDocument29 pagesManagement of AsthmaAbdullah Al ArifPas encore d'évaluation

- 006R5-WMS-JI-MI-MAU-ACS-II-23 Working Method - Pile CapDocument20 pages006R5-WMS-JI-MI-MAU-ACS-II-23 Working Method - Pile CapEko Budi HartantoPas encore d'évaluation

- Powermatic 58480438-Millrite-Mvn-Manual PDFDocument54 pagesPowermatic 58480438-Millrite-Mvn-Manual PDFJason Willis75% (4)

- Excerpts From Roe v. Wade Majority OpinionDocument2 pagesExcerpts From Roe v. Wade Majority OpinioncatherinewangcPas encore d'évaluation

- Tugas Gizi Caesar Nurhadiono RDocument2 pagesTugas Gizi Caesar Nurhadiono RCaesar 'nche' NurhadionoPas encore d'évaluation

- Aircraft Noise Management: Graduation Project Defense For The Diploma of Air Traffic Management EngineerDocument46 pagesAircraft Noise Management: Graduation Project Defense For The Diploma of Air Traffic Management Engineerchouchou chamaPas encore d'évaluation

- Soduim Prescription in The Prevention of Intradialytic HypotensionDocument10 pagesSoduim Prescription in The Prevention of Intradialytic HypotensionTalala tililiPas encore d'évaluation

- ICT ContactCenterServices 9 Q1 LAS3 FINALDocument10 pagesICT ContactCenterServices 9 Q1 LAS3 FINALRomnia Grace DivinagraciaPas encore d'évaluation

- Contoh Perhitungan DDD Excell - IRNADocument8 pagesContoh Perhitungan DDD Excell - IRNAMaya DamanikPas encore d'évaluation

- Monitor Zoncare - PM-8000 ServicemanualDocument83 pagesMonitor Zoncare - PM-8000 Servicemanualwilmer100% (1)

- Nursing Care Plan ConstipationDocument3 pagesNursing Care Plan Constipationbmrose3783% (12)

- Structral DatasheetDocument254 pagesStructral DatasheetdeepakPas encore d'évaluation

- RX Gnatus ManualDocument44 pagesRX Gnatus ManualJuancho VargasPas encore d'évaluation

- CITEC Genesis & GenXDocument45 pagesCITEC Genesis & GenXPutra LangitPas encore d'évaluation

- Celgene V Actavis AbraxaneDocument131 pagesCelgene V Actavis AbraxaneiphawkPas encore d'évaluation

- LR-360KAS-BROCHURE-LNG Sampling SystemsDocument4 pagesLR-360KAS-BROCHURE-LNG Sampling SystemsIdehen KelvinPas encore d'évaluation

- API Filter Press - Test ProcedureDocument8 pagesAPI Filter Press - Test ProcedureLONG LASTPas encore d'évaluation

- Diablo LED Wall LightDocument2 pagesDiablo LED Wall LightSohit SachdevaPas encore d'évaluation

- Narrative Pathophysiology of PregnancyDocument2 pagesNarrative Pathophysiology of PregnancyMarvin ChulyaoPas encore d'évaluation

- Molecular MechanicsDocument26 pagesMolecular MechanicsKarthi ShanmugamPas encore d'évaluation

- DoDough FriedDocument7 pagesDoDough FriedDana Geli100% (1)

- Information Technology Solutions: ADMET Testing SystemsDocument2 pagesInformation Technology Solutions: ADMET Testing Systemskrishgen biosystemsPas encore d'évaluation

- Materials Management in Hospital Industry Nandi ProjectDocument27 pagesMaterials Management in Hospital Industry Nandi Projectkumaraswamy226Pas encore d'évaluation

- Child-Centered and Progressive EducationDocument2 pagesChild-Centered and Progressive EducationDibyendu ChoudhuryPas encore d'évaluation

- Food DirectoryDocument20 pagesFood Directoryyugam kakaPas encore d'évaluation

- Industrial Attachment ReportDocument34 pagesIndustrial Attachment ReportOtsile Charisma Otsile Saq100% (1)

- Itc AccDocument24 pagesItc AccSuraj PatelPas encore d'évaluation

- How to Talk to Anyone at Work: 72 Little Tricks for Big Success Communicating on the JobD'EverandHow to Talk to Anyone at Work: 72 Little Tricks for Big Success Communicating on the JobÉvaluation : 4.5 sur 5 étoiles4.5/5 (37)

- How to Lead: Wisdom from the World's Greatest CEOs, Founders, and Game ChangersD'EverandHow to Lead: Wisdom from the World's Greatest CEOs, Founders, and Game ChangersÉvaluation : 4.5 sur 5 étoiles4.5/5 (95)

- Summary of Noah Kagan's Million Dollar WeekendD'EverandSummary of Noah Kagan's Million Dollar WeekendÉvaluation : 5 sur 5 étoiles5/5 (2)

- The First Minute: How to start conversations that get resultsD'EverandThe First Minute: How to start conversations that get resultsÉvaluation : 4.5 sur 5 étoiles4.5/5 (57)

- The Coaching Habit: Say Less, Ask More & Change the Way You Lead ForeverD'EverandThe Coaching Habit: Say Less, Ask More & Change the Way You Lead ForeverÉvaluation : 4.5 sur 5 étoiles4.5/5 (186)

- The 7 Habits of Highly Effective PeopleD'EverandThe 7 Habits of Highly Effective PeopleÉvaluation : 4 sur 5 étoiles4/5 (2566)

- Scaling Up: How a Few Companies Make It...and Why the Rest Don't, Rockefeller Habits 2.0D'EverandScaling Up: How a Few Companies Make It...and Why the Rest Don't, Rockefeller Habits 2.0Évaluation : 5 sur 5 étoiles5/5 (2)

- Transformed: Moving to the Product Operating ModelD'EverandTransformed: Moving to the Product Operating ModelÉvaluation : 4.5 sur 5 étoiles4.5/5 (2)

- The Power of People Skills: How to Eliminate 90% of Your HR Problems and Dramatically Increase Team and Company Morale and PerformanceD'EverandThe Power of People Skills: How to Eliminate 90% of Your HR Problems and Dramatically Increase Team and Company Morale and PerformanceÉvaluation : 5 sur 5 étoiles5/5 (22)

- Summary: Choose Your Enemies Wisely: Business Planning for the Audacious Few: Key Takeaways, Summary and AnalysisD'EverandSummary: Choose Your Enemies Wisely: Business Planning for the Audacious Few: Key Takeaways, Summary and AnalysisÉvaluation : 4.5 sur 5 étoiles4.5/5 (3)

- Billion Dollar Lessons: What You Can Learn from the Most Inexcusable Business Failures of the Last Twenty-five YearsD'EverandBillion Dollar Lessons: What You Can Learn from the Most Inexcusable Business Failures of the Last Twenty-five YearsÉvaluation : 4.5 sur 5 étoiles4.5/5 (52)

- Transformed: Moving to the Product Operating ModelD'EverandTransformed: Moving to the Product Operating ModelÉvaluation : 4 sur 5 étoiles4/5 (1)

- Good to Great by Jim Collins - Book Summary: Why Some Companies Make the Leap...And Others Don'tD'EverandGood to Great by Jim Collins - Book Summary: Why Some Companies Make the Leap...And Others Don'tÉvaluation : 4.5 sur 5 étoiles4.5/5 (63)

- The 7 Habits of Highly Effective People: 30th Anniversary EditionD'EverandThe 7 Habits of Highly Effective People: 30th Anniversary EditionÉvaluation : 5 sur 5 étoiles5/5 (337)

- The Introverted Leader: Building on Your Quiet StrengthD'EverandThe Introverted Leader: Building on Your Quiet StrengthÉvaluation : 4.5 sur 5 étoiles4.5/5 (35)

- Spark: How to Lead Yourself and Others to Greater SuccessD'EverandSpark: How to Lead Yourself and Others to Greater SuccessÉvaluation : 4.5 sur 5 étoiles4.5/5 (132)

- Unlocking Potential: 7 Coaching Skills That Transform Individuals, Teams, & OrganizationsD'EverandUnlocking Potential: 7 Coaching Skills That Transform Individuals, Teams, & OrganizationsÉvaluation : 4.5 sur 5 étoiles4.5/5 (28)

- Leadership Skills that Inspire Incredible ResultsD'EverandLeadership Skills that Inspire Incredible ResultsÉvaluation : 4.5 sur 5 étoiles4.5/5 (11)

- The 4 Disciplines of Execution: Revised and Updated: Achieving Your Wildly Important GoalsD'EverandThe 4 Disciplines of Execution: Revised and Updated: Achieving Your Wildly Important GoalsÉvaluation : 4.5 sur 5 étoiles4.5/5 (48)

- The Manager's Path: A Guide for Tech Leaders Navigating Growth and ChangeD'EverandThe Manager's Path: A Guide for Tech Leaders Navigating Growth and ChangeÉvaluation : 4.5 sur 5 étoiles4.5/5 (99)

- The Friction Project: How Smart Leaders Make the Right Things Easier and the Wrong Things HarderD'EverandThe Friction Project: How Smart Leaders Make the Right Things Easier and the Wrong Things HarderPas encore d'évaluation

- 7 Principles of Transformational Leadership: Create a Mindset of Passion, Innovation, and GrowthD'Everand7 Principles of Transformational Leadership: Create a Mindset of Passion, Innovation, and GrowthÉvaluation : 5 sur 5 étoiles5/5 (52)

- Multipliers, Revised and Updated: How the Best Leaders Make Everyone SmarterD'EverandMultipliers, Revised and Updated: How the Best Leaders Make Everyone SmarterÉvaluation : 4.5 sur 5 étoiles4.5/5 (146)

- The Little Big Things: 163 Ways to Pursue ExcellenceD'EverandThe Little Big Things: 163 Ways to Pursue ExcellencePas encore d'évaluation

- The 12 Week Year: Get More Done in 12 Weeks than Others Do in 12 MonthsD'EverandThe 12 Week Year: Get More Done in 12 Weeks than Others Do in 12 MonthsÉvaluation : 4.5 sur 5 étoiles4.5/5 (411)

- The E-Myth Revisited: Why Most Small Businesses Don't Work andD'EverandThe E-Myth Revisited: Why Most Small Businesses Don't Work andÉvaluation : 4.5 sur 5 étoiles4.5/5 (709)