Académique Documents

Professionnel Documents

Culture Documents

FIM Assignment

Transféré par

Sar E AhmedCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

FIM Assignment

Transféré par

Sar E AhmedDroits d'auteur :

Formats disponibles

FIN301 Financial Institutions and Markets Answer Sheet

Spring 2012 Assignment 1

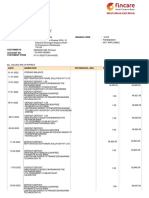

Names of Group Members: Aala Zia, Sarah Ejaz, Uroosa Jeelani & Zara Naeem Table I-a Engro Borrowings as of 31/12/2011

# 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 Allied Bank Ltd. Albaraka Bank (Pakistan) Ltd. Askari Bank Ltd. Bank Al-Falah Ltd. Bank Al-Habib Ltd. Bank Islami Pakistan Ltd. Dawood Islamic Bank Ltd. Dubai Islamic Bank Pakistan Ltd Faysal Bank Ltd. Habib Bank Ltd. Habib Metropolitan Bank Ltd. JS Bank Ltd. KASB Bank Ltd. MCB Bank Ltd. Meezan Bank Ltd. myBank Ltd. NIB Bank Ltd. Samba Bank Ltd. Silk Bank Ltd. Soneri Bank Ltd. Standard Chartered Bank(Pakistan) Summit Bank Ltd. United Bank Ltd. Syndicated Finance, Istisna and Bilateral Term Finance Total Engro Borrowings From Domestic Private Banks # 1 2 3 4 5 1 Barclays Bank Plc. Citi Bank NA Deutsche Bank AE Oman International Bank SAOG The Bank of Tokyo-Mitsubishi Ltd. Borrowing of from National Bank of Pakistan was not included in the table as it is a Public sector Bank. 77,500+700,000 Foreign Bank 31,785,215 39,599,5071 Amount in Rs. 1000s 13,78,880 496,787 299,517 492,738 1,556,715 1,191,667 199,965 454,273 193,750 Domestic Private Bank 1,550,000 Amount in Rs. 1000s

Page 1 of 5

FIN301 Financial Institutions and Markets

6 The HSBC Bank Middle East Ltd. Total Engro Borrowings From Foreign Banks 193,750 971,250

Spring 2012 Assignment 1

Table I-b Engro Borrowings as Percentage of Lending to Private Sector Business Amount in Rs. or % Total Engro Borrowings From Domestic Private Banks Total Loans by Domestic Private Banks to Private Sector Businesses as of 30/6/2011 Engro Borrowings as % of Total Loans Total Engro Borrowings From Foreign Banks Total Loans by Foreign Private Banks to Private Sector Businesses as of 30/6/2011 Engro Borrowings as % of Total Loans 39,599,507,000 Rs. 1,791.3 billion 2.21% Rs. 971,250,000 Rs. 54.2 billion 1.79 %

Answers to Questions Posed in I-5 a. The Engro Rupiya Certificate, TFCs, Sukuk Certificates and LIBOR borrowings are excluded from the calculation as they form a different class of borrowing than the regular bank credit lines. Rupiya certificates are direct borrowing from the public and Sukuks are certificates of equal value representing undivided shares in ownership of tangible assets, usufruct and services or (in the ownership of) the assets of particular projects or special investment activity. There are also convertible loans at LIBOR e.g from IFC. These transactions do not increase the multiple deposit expansion of the money supply. Direct lending from the banks, however, does aid the expansion of money. b. The percentages show that Engro is more indebted to the domestic private banks as compared to the foreign private banks. The 2.21% borrowing from the domestic banks is a moderately high figure because of the amount that it borrows from these banks (39.6 billion) makes up almost 38% (39.6/104.1) of its total borrowing. The 1.79% is a low figure as it makes up only 0.92% (0.971/104.1) of its total borrowing.

Page 2 of 5

FIN301 Financial Institutions and Markets

Spring 2012 Assignment 1

Table II-a Engro Borrowings as Percentage of Lendings by a Pakistani Bank Name of Pakistani Bank: Dubai Islamic Bank Balance Sheet Date: Dec, 31 2011 Download Address for Most Recent Annual Report: http://www.dibpak.com/Upload/2932012165359DIBPL%20Financial%20Statements%20December %20312011.pdf

Amount in Rs. 1000s or % Total Engro Borrowings From the Bank Total Advances as per Most Recent Balance Sheet Engro Borrowings as % of Total Advances Answers to Questions Posed in II-5 a. Dubai Islamicss exposure to Engro is moderately low. However, if compared to the whole banking sectors exposure (2.21%), Dubai Islamic has as higher exposure of 3.81% to Engro. Whatever business risks Engro has will also affect Dubai Islamic in the form of deferred payment, bad debt, etc. b. Dubai Islamic holds almost 77.3% of its Investments in the form of Federal Government Securities (Rs. 10 billion). 9.28% (1.2 billion) of the portfolio is composed of Mutual Funds of Meezan Sovereign Fund. The remaining 1.744 billion is composed of Sukuk bonds/ available-for-sale securities. Sukuks of 1.744 billion include the loan to Engro. of Rs. 675,000,000 forming around 38.7% of the total issued Sukuks. Dubai Islamics percentage of total investment in Engro is 5.217%. Rs. 492,783,000 Rs. 12,937,179,000 3.809%

Page 3 of 5

FIN301 Financial Institutions and Markets Answers to Questions Posed in III

Spring 2012 Assignment 1

1. The logic in this argument is that Engro is willing to pay more interest rate to the holder of the TFC than it has to pay in interest payments to the IFC which has recently lent it money. A Term Finance certificate (TFC) is a corporate debt instrument issued by companies in Pakistan to generate short and medium-term funds. Engro Rupiya Certificate is offered as a 3 year term finance certificate2. This could be because Engro wants a lot of funds; these funds are insufficient as to what have been provided by the IFC therefore the higher return reflects the fact that Engro wants those people to invest who have sufficient funds to lend to Engro for its projects. For their attention and their money Engro is willing to suffice them with a higher return so that it can gauge enough investment and getting funds for the purposes intended. A higher return means a higher risk. Engros TFC having such a high return might mean that Engro is in a position to default. Also as can be seen by the Engros balance sheet it has acquired a lot of debt from local and foreign banks. Not only has it exhausted its capacity to get a loan but even the company is currently constrained by deteriorating private credit terms and perpetual emphasis on expansion, according to BMA Capital3. This reflects that Engro can go bankrupt or might face a liquidity crisis and hence be unable to pay the holders of TFC therefore it is necessary for Engro to have a high interest rate on its TFC to offset the risk that this TFC carries. In an analysis by the KASB Direct research they say TFCs allow companies to raise funds at a lower rate compared to banks, despite paying a higher profit rate to their investors. Companies benefit by paying a lower cost of borrowing and the investors benefit by earning a higher rate of return4. Hence clear as to why Engro is willing to pay a higher rate of return to the investors as the overall cost of borrowing from banks and otherwise is a lot higher than the return that they will pay to the investors. This is the first time that Engro is going for an IPO; people might have reservations regarding the issue; they might not be comfortable investing with Engro. Therefore Engro wants to eliminate all such thoughts and it wants people to invest, perhaps thats why it is willing to pay a higher interest rate so that people do invest in the TFC and Engro is able to generate the amount of money that it has forecasted from its IPO. 2. Other risks which were not mentioned could be operational risks, credit/default risks, interest rate risks and market risks. When the TFCs were issued, Engro had a sovereign guarantee that their plant would be given the first priority in the supply of gas. This was to transform the entire industry and make Engro the largest player in the market. When a sovereign guarantee is issued, the political risk is considered close to zero unless the government in unstable or if the country is in a state of war. As Pakistan was neither at the time the TFCs were issued, political risk was considered almost negligible at that point in time which boosted investor confidence. However, the government has now defaulted and although the case has been taken to court, the government has not as yet undertaken any responsibility. This has introduced the TFCs further to legal risk. Operational risks have arisen due to the sudden lack of availability of raw material, ie, gas, which would impact production.

2 3 4 http://www.kasbdirect.com/staging2/Engro-faq.aspx# http://tribune.com.pk/story/59783/engro-to-launch-tfc-worth-rs4-billion/ http://www.kasbdirect.com/staging2/Engro-faq.aspx#

Page 4 of 5

FIN301 Financial Institutions and Markets

Spring 2012 Assignment 1

Market risk is also high with regard to the TFCs as the commodity market in Pakistan is not very developed. This increases the costs of collecting information as well as introduces mispricing as the prices of the financial instruments do not reflect their true worth. Due to the low trading in this market, liquidity risk and holding risk are also present. 3. There is a constant debate over whether Islamic financial instruments are more or less risky than others. While it is said that Sukuk bonds have greater market risk due to the low volume of trade and the less developed Islamic financial market; and Shariah risk which arises due to non compliance with Islamic principles, liquidity risk as Sukuk bonds are to be held to maturity; on the other side of the argument it is stated that Islamic bonds have seen to function better over time and the overall Islamic banking system has shown more resilience especially after the global financial crisis of 2008. It is considered that Islamic bonds have a certain threshold of risk which is generally lower than the risk on other instruments. However, to give an accurate credit rating the issuer of the bonds needs to be considered. At the time the TFCs were issued, investors had high hopes about the future prospects of Engro. However, in the past 3 months with the resignation of the CEOs and the placement of new Chief executives, the company has been introduced to management risk which could affect the way in which these instruments are perceived. It is therefore quite difficult to make a direct comparison between the credit rating of the two instruments. Sukuk bonds may deserve a higher rating than TFCs in the current scenario.

Page 5 of 5

Vous aimerez peut-être aussi

- WorldcomDocument5 pagesWorldcomHAN NGUYEN KIM100% (1)

- Financing The Mozal Project Case SolutionDocument4 pagesFinancing The Mozal Project Case SolutionSebastian100% (2)

- Recruitment TestsDocument5 pagesRecruitment TestsSharika MenonPas encore d'évaluation

- Bajaj FinanceDocument65 pagesBajaj FinanceAshutoshSharmaPas encore d'évaluation

- Bank Reconciliation Statements (With Answers) : Advanced LevelDocument21 pagesBank Reconciliation Statements (With Answers) : Advanced LevelPrassanna Kumari100% (2)

- Reasons For Lower Visibility of Indian Debt MarketDocument5 pagesReasons For Lower Visibility of Indian Debt MarketkeyulbohraPas encore d'évaluation

- Final Draft-Banking Law A Study of The IL&FS Fiasco: Reasons, Consequences, Response and Legal ImplicationDocument15 pagesFinal Draft-Banking Law A Study of The IL&FS Fiasco: Reasons, Consequences, Response and Legal ImplicationAbhijat SinghPas encore d'évaluation

- SSRN Id2977874Document10 pagesSSRN Id2977874Ravi ShankarPas encore d'évaluation

- Assignment 1 214Document4 pagesAssignment 1 214nidhidPas encore d'évaluation

- Idbi 2Document138 pagesIdbi 2rehan44Pas encore d'évaluation

- IH&SMEFD Cir No 12 of 2022 Prime Minister's Youth Business & Agriculture Loan Scheme (PMYB&ALS)Document5 pagesIH&SMEFD Cir No 12 of 2022 Prime Minister's Youth Business & Agriculture Loan Scheme (PMYB&ALS)Rizwan LatifPas encore d'évaluation

- MPRA Paper 13126Document25 pagesMPRA Paper 13126Rituparna DasPas encore d'évaluation

- Analysis of Private Commercial Borrowing From Foreign Sources in BangladeshDocument16 pagesAnalysis of Private Commercial Borrowing From Foreign Sources in BangladeshkhansaquibahmadPas encore d'évaluation

- Solutions For End-of-Chapter Questions and Problems: Chapter ThreeDocument3 pagesSolutions For End-of-Chapter Questions and Problems: Chapter Threejl123123Pas encore d'évaluation

- FM - Valuation of Securities 2Document8 pagesFM - Valuation of Securities 2Lipika haldarPas encore d'évaluation

- 10 11648 J Ijefm 20140201 15 PDFDocument10 pages10 11648 J Ijefm 20140201 15 PDFFatema JidnaPas encore d'évaluation

- Marketing ProjectDocument7 pagesMarketing ProjectErato BrianPas encore d'évaluation

- Fixed Income Markets Assignment: TanushiDocument5 pagesFixed Income Markets Assignment: TanushiTanushiPas encore d'évaluation

- Sources of Long-Term FinanceDocument21 pagesSources of Long-Term FinanceMuhammad Sajid SaeedPas encore d'évaluation

- Finance Report - AusiDocument6 pagesFinance Report - AusiMichael NguriPas encore d'évaluation

- The Impact of Unclaimed Dividends On Capital Market Development in NigeriaDocument45 pagesThe Impact of Unclaimed Dividends On Capital Market Development in Nigeriamryuuz100% (1)

- Auto Finance Industry AnalysisDocument15 pagesAuto Finance Industry AnalysisMitul SuranaPas encore d'évaluation

- 5indian Bond Market WP Nipfp 2012Document22 pages5indian Bond Market WP Nipfp 2012Rajat KaushikPas encore d'évaluation

- SpeakDocument3 pagesSpeakInvincible BaluPas encore d'évaluation

- Senior Analyst-FMS Finance MagazineDocument47 pagesSenior Analyst-FMS Finance MagazineShas RockstonePas encore d'évaluation

- 19 - 1st January 2009 (010109)Document8 pages19 - 1st January 2009 (010109)Chaanakya_cuimPas encore d'évaluation

- Lease Financing of Bangladesh A Descriptive AnalysDocument11 pagesLease Financing of Bangladesh A Descriptive AnalysAsif HassanPas encore d'évaluation

- Fixed Income Markets Assignment: TanushiDocument5 pagesFixed Income Markets Assignment: TanushiTanushiPas encore d'évaluation

- Notaire: Prosperity of The Process and Issuance of Regional Bonds and Risk of Public Bonds Registration in IndonesiaDocument22 pagesNotaire: Prosperity of The Process and Issuance of Regional Bonds and Risk of Public Bonds Registration in IndonesiaRefi Ranto RozakPas encore d'évaluation

- FRS & J.P. Morgan London Whale CaseDocument10 pagesFRS & J.P. Morgan London Whale CasedecalgosPas encore d'évaluation

- Corporate Bonds Market in Pakistan - Business FinanceDocument19 pagesCorporate Bonds Market in Pakistan - Business FinanceAfzal Hanif100% (1)

- IOSR JournalsDocument5 pagesIOSR JournalsInternational Organization of Scientific Research (IOSR)Pas encore d'évaluation

- Index PHPDocument2 pagesIndex PHPLadi O DanielPas encore d'évaluation

- Non Banking Finance Companies: Capital X Leverage GrowthDocument19 pagesNon Banking Finance Companies: Capital X Leverage GrowthdevrajkinjalPas encore d'évaluation

- Cases For AssignmentDocument10 pagesCases For AssignmentShravya T SPas encore d'évaluation

- Investment Strategies in NBFCS: An Over ViewDocument9 pagesInvestment Strategies in NBFCS: An Over ViewIAEME PublicationPas encore d'évaluation

- Financial Market ActivityDocument6 pagesFinancial Market ActivityKenneth BactulPas encore d'évaluation

- Frequently Asked Questions (Faq)Document8 pagesFrequently Asked Questions (Faq)David RudiantoPas encore d'évaluation

- Indian Bond GuideDocument23 pagesIndian Bond GuideSupreet NarangPas encore d'évaluation

- ALM Mismatch, IL&FS Crisis and RBIDocument2 pagesALM Mismatch, IL&FS Crisis and RBIRaghav DhootPas encore d'évaluation

- Help WalaDocument36 pagesHelp WalaPratikshya KarkiPas encore d'évaluation

- Sector ReportDocument19 pagesSector ReportDeep GhoshPas encore d'évaluation

- Fin358 Individual Assignment (Bond)Document9 pagesFin358 Individual Assignment (Bond)nur hazaniPas encore d'évaluation

- Bond Market in BD For Financing Big BusinessDocument11 pagesBond Market in BD For Financing Big BusinessMaliha FarzanaPas encore d'évaluation

- 13 - 1st March 2008 (010308)Document5 pages13 - 1st March 2008 (010308)Chaanakya_cuimPas encore d'évaluation

- Vidyasagar UniversityDocument62 pagesVidyasagar UniversityPrem KumarPas encore d'évaluation

- QFIP-159-F23 Private Debt Fund Returns, Persistence, and Market ConditionsDocument54 pagesQFIP-159-F23 Private Debt Fund Returns, Persistence, and Market ConditionsNoodles FSA100% (1)

- Firoz ProjectDocument104 pagesFiroz ProjectRishi GoyalPas encore d'évaluation

- Negetive Return of Debt MarketDocument2 pagesNegetive Return of Debt MarketRobin SadayatPas encore d'évaluation

- Asset Backed Securitization in BangladeshDocument22 pagesAsset Backed Securitization in BangladeshA_D_I_BPas encore d'évaluation

- Supplier of Fund Intermediaries Uses of Fund: JANUARY 2013Document5 pagesSupplier of Fund Intermediaries Uses of Fund: JANUARY 2013amirulfitriePas encore d'évaluation

- Borrowing Abroad TougherDocument1 pageBorrowing Abroad TougherMayankGirotraPas encore d'évaluation

- Corporate Debt Market: Presented BY: Amit Kr. GuptaDocument38 pagesCorporate Debt Market: Presented BY: Amit Kr. Guptabb2Pas encore d'évaluation

- Factors Affecting International Investment: 1. GovernmentDocument16 pagesFactors Affecting International Investment: 1. GovernmentDILMILEJBPas encore d'évaluation

- The Economic Times ET in The Classroom - Archives - 1 (Economics Concepts Explained)Document95 pagesThe Economic Times ET in The Classroom - Archives - 1 (Economics Concepts Explained)Namrata KulkarniPas encore d'évaluation

- The Effect of Profitability and Liquidity On The Ranking of Bonds in The Construction, Real Estate, and Property SectorsDocument8 pagesThe Effect of Profitability and Liquidity On The Ranking of Bonds in The Construction, Real Estate, and Property SectorsFAUZI HERMAWAN AMDPas encore d'évaluation

- Micro Finance - Policy InitiativesDocument12 pagesMicro Finance - Policy Initiativesshashankr_1Pas encore d'évaluation

- Define Different Types of Market Risk and Idiosyncratic Risk With Examples in The Context of Bangladeshi Firms To Operate A BusinessDocument43 pagesDefine Different Types of Market Risk and Idiosyncratic Risk With Examples in The Context of Bangladeshi Firms To Operate A BusinessNiaz Ahmed100% (1)

- Chapter 10 - The Mortgage MarketDocument12 pagesChapter 10 - The Mortgage MarketMerge MergePas encore d'évaluation

- Financial Markets Fundamentals: Why, how and what Products are traded on Financial Markets. Understand the Emotions that drive TradingD'EverandFinancial Markets Fundamentals: Why, how and what Products are traded on Financial Markets. Understand the Emotions that drive TradingPas encore d'évaluation

- Bonds Decoded: Unraveling the Mystery Behind Bond MarketsD'EverandBonds Decoded: Unraveling the Mystery Behind Bond MarketsPas encore d'évaluation

- S Ep JFX 3 Wa El Al GS2Document8 pagesS Ep JFX 3 Wa El Al GS2Danda RavindraPas encore d'évaluation

- Giro Form FinalDocument2 pagesGiro Form FinalJulius Putra Tanu SetiajiPas encore d'évaluation

- Prudential Norms On Income Recognition, Asset Classification and Provisioning Pertaining To Advances - Projects Under Implementation PDFDocument2 pagesPrudential Norms On Income Recognition, Asset Classification and Provisioning Pertaining To Advances - Projects Under Implementation PDFPraveer MoreyPas encore d'évaluation

- Oakley (1984 y 1985) PDFDocument26 pagesOakley (1984 y 1985) PDFCarlos Alberto Flores QuirozPas encore d'évaluation

- Cape Economics Past Paper Solutions June 2008Document11 pagesCape Economics Past Paper Solutions June 2008Akeemjoseph50% (2)

- Tugas 1 TMK Adbi4201 Bahasa Inggris NiagaDocument3 pagesTugas 1 TMK Adbi4201 Bahasa Inggris NiagaSakazukiPas encore d'évaluation

- Sole Proprietorship Accounting TransactionsDocument17 pagesSole Proprietorship Accounting TransactionsErica Mae GuzmanPas encore d'évaluation

- NorQuant Multi-Asset Fund White Paper 2023Document24 pagesNorQuant Multi-Asset Fund White Paper 2023oscar.haukvikPas encore d'évaluation

- 2595 5165 1 SMDocument4 pages2595 5165 1 SMJatinder KumarPas encore d'évaluation

- Past Year ACC106 Oct 2012 PDFDocument11 pagesPast Year ACC106 Oct 2012 PDFShamPas encore d'évaluation

- AppendixDocument30 pagesAppendixLeigh Arrel DivinoPas encore d'évaluation

- Enterprise Risk ManagementDocument29 pagesEnterprise Risk ManagementSujeewa LakmalPas encore d'évaluation

- (Acb) SFRDocument57 pages(Acb) SFRVu Thi NinhPas encore d'évaluation

- Sealand Coins ListDocument6 pagesSealand Coins Listsubrata.chakrabarti2544Pas encore d'évaluation

- 2nd Mini Case StudyDocument4 pages2nd Mini Case StudyMarga GuilaranPas encore d'évaluation

- A Century of Capital Structure: The Leveraging of Corporate AmericaDocument68 pagesA Century of Capital Structure: The Leveraging of Corporate AmericaMuhammad UsmanPas encore d'évaluation

- Statementofaccount: Primary Holder Name: Chetan Sharma Address Branch CodeDocument4 pagesStatementofaccount: Primary Holder Name: Chetan Sharma Address Branch CodeRohit raagPas encore d'évaluation

- Receivable FINANCING PDFDocument30 pagesReceivable FINANCING PDFChristian Blanza LlevaPas encore d'évaluation

- Private BankingDocument53 pagesPrivate BankingChristine Gillespie100% (12)

- LAS ABM - FABM12 Ia B 1 Week 1Document9 pagesLAS ABM - FABM12 Ia B 1 Week 1ROMMEL RABOPas encore d'évaluation

- Cuestionario 4Document3 pagesCuestionario 4Carlos Hasler Ballesteros BarraganPas encore d'évaluation

- Capsa UnitedDocument12 pagesCapsa Unitedvenkat rajPas encore d'évaluation

- Money Banking and Financial Markets 4th Edition Cecchetti Test Bank DownloadDocument119 pagesMoney Banking and Financial Markets 4th Edition Cecchetti Test Bank DownloadJean Standridge100% (23)

- Australian Financial Accounting 6th Edition Deegan Test BankDocument53 pagesAustralian Financial Accounting 6th Edition Deegan Test Banklacewingdespise6pva100% (26)

- Bbse3009 1415 EnggEcon 01Document60 pagesBbse3009 1415 EnggEcon 01Jeff MedinaPas encore d'évaluation

- Commercial Bank of EthiopiaDocument3 pagesCommercial Bank of EthiopiaEmiru ayalew100% (1)

- Bank Reconciliation Assignment 2Document8 pagesBank Reconciliation Assignment 2Caira De AsisPas encore d'évaluation

- Chart 10 Discounting and Compounding TablesDocument6 pagesChart 10 Discounting and Compounding TablesDhandhi PratamaPas encore d'évaluation

- RRL ForeignDocument4 pagesRRL Foreignゔ違でStrawberry milkPas encore d'évaluation