Académique Documents

Professionnel Documents

Culture Documents

Weekly Overview

Transféré par

api-150779697Description originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Weekly Overview

Transféré par

api-150779697Droits d'auteur :

Formats disponibles

Weekly Market Update

Robert Davies, Patersons Securities

Follow me on Twitter @davies_robert

28/05/2012 12:01:52 PM Page 1 of 3

Weekly Overview

Week ending 25 May 2012

The Greek tragedy continues to unravel. Support seems to be coalescing around both Syrize (antiausterity) and New Democracy (pro-austerity) parties. Elections are on June 17th. Meanwhile Greeks are actively moving money out of Greek banks into mattresses and foreign banks in anticipation of the possibility of a new currency. Multinational firms are clearing their accounts daily. I consider a move to a new drachma possible but unlikely even if Syriza wins the election. If the Europeans stop subsidising and the Greeks dont want to exit the Euro, the government will be forced to balance their budget. Bank runs are now stepping up a gear in Europe. In addition to the Greeks, the same goes for Spanish and Italian bank deposits. See the chart of the week below for more detail.. Lots of pundits now calling the end of the resources boom in Australia. I would be more circumspect. There remains a major investment boom in LNG and natural gas. Gold remains over $1500 per ounce. Remember all the people who called Gold a bubble when it went through $1000 per oz? While commodity prices will come down, volumes will increase to offset the loss in price. Panic is an opportunity to take cheap stock from the frightened. China in the news due to a lagging economic performance. Concerns over bank lending results (flat), and the purchasing managers index (negative). While there are concerns over China, it retains the capacity to stimulate its economy through both monetary and fiscal policy (unlike the USA or Europe). The dip in economic activity from China could be partially due to the political handover due in the latter part of the year. New leaders bring new plans and initiatives. Chg (week)

-0.4% 1.7% -0.5% 0.0% 0.6% -1.2% -0.6% -0.7% 1.4% -0.9% -2.1% 0.1%

2011

All Ords Index S&P 500 Shanghai RBA Cash Rate US Treasury Bond (10yr) Spot Gold Price Copper, spot Oil - WTI USD Index AUDUSD EURUSD USDCNY 4,111 1,258 2,199 4.25% 1.88% 1,563 344 99 80.23 1.022 1.294 6.299

25 May

4,081 1,317 2,334 3.75% 1.74% 1,573 345 91 82.31 0.976 1.252 6.338

Chg (ytd)

-0.7% 4.7% 6.1% -11.8% -7.4% 0.6% 0.4% -8.1% 2.6% -4.5% -3.3% 0.6%

Market expecting more cuts

US$ strongest currency

Market View (All Ords Index)

Last week I noted a change of focus back to accumulation after big drops in the index. The market has stabilised at these lower levels so risk-on opportunities should be looked at. You should be looking for high quality dividend paying stocks, such as Telstra, banks, utilities Overall, I see stocks as cheap relative to historical Price Earning ratios, the main near term growth catalyst to take them significantly higher would be an Australian federal election, currently 18m away, but could be closer.

Weekly Market Update

Robert Davies, Patersons Securities

Follow me on Twitter @davies_robert

XAO.ASX@AUX: 11:20:36: 4086.1, 4111.8, 4086, 4101.9 MA (XAO.ASX@AUX): 200 4278.5267, 100 4328.7238, 50 4351.8507

28/05/2012 12:01:52 PM Page 2 of 3

4800

4600

4400

4200

4000

3800

Vol (XAO.ASX@AUX): 0 2000M 0 RSI (100.000000): 14 30.9485

60 30

May 2011

July

August

September

October

November

December

January 2012

February

March

April

May

Stock of the Week

Nab has dropped significantly in the last few weeks from $25.20 to $23.50, about 7%. However, NAB still has a 90c fully franked dividend which goes ex on May 31st. At this price level the 6m dividend pays 3.8% plus franking. When you compare this to returns in term deposits, its clear where the better returns are. How cheap is the price? NAB is on a 2013 Price earnings ratio of 8.5. Historically banks trade around 11 to 13 times earnings. Could the banks get cheaper? Is the housing bust in Australia going to hurt the banks? Will Europe continue to effect the banks? Will they need to raise more capital? Yes, Yes, Yes, and Maybe. However, the market knows all this and the banks are cheap.

NAB.ASX@AUX: 23.5, 23.69, 23.47, 23.56

MA (NAB.ASX@AUX): 200 23.7447, 100 24.0326, 50 24.5514 28

26

24

22

20

Vol (NAB.ASX@AUX): 2742.683T 20000T 0 RSI (100.000000): 14 31.7295

60 30

May June 2011

July

August

September

October

November

December

January 2012

February

March

April

May

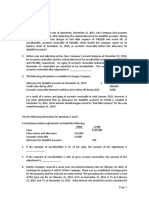

Chart of the Week

This chart shows the extent what is happening in Europe now with money moving from the Southern region to Germany. This is a classic bank run in peripheral countries.

Weekly Market Update

Robert Davies, Patersons Securities

Follow me on Twitter @davies_robert

28/05/2012 12:01:52 PM Page 3 of 3

Vous aimerez peut-être aussi

- Weekly OverviewDocument3 pagesWeekly Overviewapi-150779697Pas encore d'évaluation

- Weekly OverviewDocument4 pagesWeekly Overviewapi-150779697Pas encore d'évaluation

- Weekly OverviewDocument4 pagesWeekly Overviewapi-150779697Pas encore d'évaluation

- Weekly CommentaryDocument4 pagesWeekly Commentaryapi-150779697Pas encore d'évaluation

- Weekly OverviewDocument3 pagesWeekly Overviewapi-150779697Pas encore d'évaluation

- Weekly OverviewDocument3 pagesWeekly Overviewapi-150779697Pas encore d'évaluation

- Weekly OverviewDocument4 pagesWeekly Overviewapi-150779697Pas encore d'évaluation

- Weekly OverviewDocument4 pagesWeekly Overviewapi-150779697Pas encore d'évaluation

- Weekly CommentaryDocument3 pagesWeekly Commentaryapi-150779697Pas encore d'évaluation

- Weekly CommentaryDocument4 pagesWeekly Commentaryapi-150779697Pas encore d'évaluation

- Weekly OverviewDocument4 pagesWeekly Overviewapi-150779697Pas encore d'évaluation

- Weekly CommentaryDocument4 pagesWeekly Commentaryapi-150779697Pas encore d'évaluation

- Weekly OverviewDocument4 pagesWeekly Overviewapi-150779697Pas encore d'évaluation

- Market Update As of 31 Aug (Eng)Document10 pagesMarket Update As of 31 Aug (Eng)Alex KwokPas encore d'évaluation

- Inside Debt: U.S. Markets Today Chart of The DayDocument8 pagesInside Debt: U.S. Markets Today Chart of The DaydmaximPas encore d'évaluation

- MRE121015Document3 pagesMRE121015naudaslietas_lvPas encore d'évaluation

- More Oil in The Chinese Machinery: Morning ReportDocument3 pagesMore Oil in The Chinese Machinery: Morning Reportnaudaslietas_lvPas encore d'évaluation

- Promising US Data: Morning ReportDocument3 pagesPromising US Data: Morning Reportnaudaslietas_lvPas encore d'évaluation

- Weakening of Yen Continued Yesterday: Morning ReportDocument3 pagesWeakening of Yen Continued Yesterday: Morning Reportnaudaslietas_lvPas encore d'évaluation

- US Housing Market Shows Strenght: Morning ReportDocument3 pagesUS Housing Market Shows Strenght: Morning Reportnaudaslietas_lvPas encore d'évaluation

- The Tough Fight of A Small Safe Haven: Morning ReportDocument3 pagesThe Tough Fight of A Small Safe Haven: Morning Reportnaudaslietas_lvPas encore d'évaluation

- Weekly OverviewDocument3 pagesWeekly Overviewapi-150779697Pas encore d'évaluation

- 2014 October 17 Weekly Report UpdateDocument4 pages2014 October 17 Weekly Report UpdateAnthony WrightPas encore d'évaluation

- Towards Stabilization in China: Morning ReportDocument3 pagesTowards Stabilization in China: Morning Reportnaudaslietas_lvPas encore d'évaluation

- MRE120514Document3 pagesMRE120514naudaslietas_lvPas encore d'évaluation

- Positive News From The US: Morning ReportDocument3 pagesPositive News From The US: Morning Reportnaudaslietas_lvPas encore d'évaluation

- Daily Comment RR 21jul11Document3 pagesDaily Comment RR 21jul11timurrsPas encore d'évaluation

- Chinese Exports Fall Back: Morning ReportDocument3 pagesChinese Exports Fall Back: Morning Reportnaudaslietas_lvPas encore d'évaluation

- SEB Asia Corporate Bulletin: MayDocument7 pagesSEB Asia Corporate Bulletin: MaySEB GroupPas encore d'évaluation

- Growth Weakens in China: Morning ReportDocument3 pagesGrowth Weakens in China: Morning Reportnaudaslietas_lvPas encore d'évaluation

- US Fixed Income Markets WeeklyDocument96 pagesUS Fixed Income Markets Weeklyckman10014100% (1)

- SEB Report: Investors To Move Away From Dollar, EuroDocument44 pagesSEB Report: Investors To Move Away From Dollar, EuroSEB GroupPas encore d'évaluation

- "No Need To Panic": Morning ReportDocument3 pages"No Need To Panic": Morning Reportnaudaslietas_lvPas encore d'évaluation

- MRE120106Document3 pagesMRE120106naudaslietas_lvPas encore d'évaluation

- Major Developments: December 2011Document9 pagesMajor Developments: December 2011Kajal SarkarPas encore d'évaluation

- Weak Macro Figures Intensify Pressure: Morning ReportDocument3 pagesWeak Macro Figures Intensify Pressure: Morning Reportnaudaslietas_lvPas encore d'évaluation

- Spain Turned The Sentiment, Again: Morning ReportDocument3 pagesSpain Turned The Sentiment, Again: Morning Reportnaudaslietas_lvPas encore d'évaluation

- Daily Comment RR 04jul11Document3 pagesDaily Comment RR 04jul11timurrsPas encore d'évaluation

- LTI Newsletter - Sep 2011Document19 pagesLTI Newsletter - Sep 2011LongTermInvestingPas encore d'évaluation

- Weekly OverviewDocument4 pagesWeekly Overviewapi-150779697Pas encore d'évaluation

- Weekly Trends Nov 5Document4 pagesWeekly Trends Nov 5dpbasicPas encore d'évaluation

- MRE121016Document3 pagesMRE121016naudaslietas_lvPas encore d'évaluation

- Barclays FX Weekly Brief 20100902Document18 pagesBarclays FX Weekly Brief 20100902aaronandmosesllcPas encore d'évaluation

- Daily Breakfast Spread: EconomicsDocument6 pagesDaily Breakfast Spread: EconomicsShou Yee WongPas encore d'évaluation

- Towards A Solution To The Debt Crisis: Morning ReportDocument3 pagesTowards A Solution To The Debt Crisis: Morning Reportnaudaslietas_lvPas encore d'évaluation

- Slightly Tighter Norwegian Credit Standards: Morning ReportDocument3 pagesSlightly Tighter Norwegian Credit Standards: Morning Reportnaudaslietas_lvPas encore d'évaluation

- FX Compass: Looking For Signs of Pushback: Focus: Revising GBP Forecasts HigherDocument25 pagesFX Compass: Looking For Signs of Pushback: Focus: Revising GBP Forecasts HighertekesburPas encore d'évaluation

- ZEW-jump Lifted Stocks. But!: Morning ReportDocument3 pagesZEW-jump Lifted Stocks. But!: Morning Reportnaudaslietas_lvPas encore d'évaluation

- Better in The US, But OECD Still Worried: Morning ReportDocument3 pagesBetter in The US, But OECD Still Worried: Morning Reportnaudaslietas_lvPas encore d'évaluation

- Stronger Euro: Morning ReportDocument3 pagesStronger Euro: Morning Reportnaudaslietas_lvPas encore d'évaluation

- The Politicians Spoil The Party: Morning ReportDocument2 pagesThe Politicians Spoil The Party: Morning Reportnaudaslietas_lvPas encore d'évaluation

- Important Meetings Today: Morning ReportDocument3 pagesImportant Meetings Today: Morning Reportnaudaslietas_lvPas encore d'évaluation

- Weekly OverviewDocument3 pagesWeekly Overviewapi-150779697Pas encore d'évaluation

- MRE120530Document3 pagesMRE120530naudaslietas_lvPas encore d'évaluation

- Norges Bank Closer To Rate Cut: Morning ReportDocument3 pagesNorges Bank Closer To Rate Cut: Morning Reportnaudaslietas_lvPas encore d'évaluation

- Draghi Lifted Markets: Morning ReportDocument3 pagesDraghi Lifted Markets: Morning Reportnaudaslietas_lvPas encore d'évaluation

- Ireland Returns To The Debt Markets: Morning ReportDocument3 pagesIreland Returns To The Debt Markets: Morning Reportnaudaslietas_lvPas encore d'évaluation

- Ranges (Up Till 11.50am HKT) : Currency CurrencyDocument3 pagesRanges (Up Till 11.50am HKT) : Currency Currencyapi-290371470Pas encore d'évaluation

- MRE110926Document3 pagesMRE110926naudaslietas_lvPas encore d'évaluation

- Weekly CommentaryDocument3 pagesWeekly Commentaryapi-150779697Pas encore d'évaluation

- Weekly CommentaryDocument4 pagesWeekly Commentaryapi-150779697Pas encore d'évaluation

- Weekly CommentaryDocument4 pagesWeekly Commentaryapi-150779697Pas encore d'évaluation

- Weekly OverviewDocument3 pagesWeekly Overviewapi-150779697Pas encore d'évaluation

- Weekly OverviewDocument4 pagesWeekly Overviewapi-150779697Pas encore d'évaluation

- Weekly OverviewDocument4 pagesWeekly Overviewapi-150779697Pas encore d'évaluation

- Weekly OverviewDocument4 pagesWeekly Overviewapi-150779697Pas encore d'évaluation

- UntitledDocument1 pageUntitledapi-150779697Pas encore d'évaluation

- Weekly OverviewDocument3 pagesWeekly Overviewapi-150779697Pas encore d'évaluation

- Weekly OverviewDocument4 pagesWeekly Overviewapi-150779697Pas encore d'évaluation

- Weekly OverviewDocument4 pagesWeekly Overviewapi-150779697Pas encore d'évaluation

- Weekly OverviewDocument4 pagesWeekly Overviewapi-150779697Pas encore d'évaluation

- Weekly OverviewDocument3 pagesWeekly Overviewapi-150779697Pas encore d'évaluation

- Weekly OverviewDocument3 pagesWeekly Overviewapi-150779697Pas encore d'évaluation

- MACS - Assignment 3 - Question PaperDocument8 pagesMACS - Assignment 3 - Question PaperAudrey KhwinanaPas encore d'évaluation

- Sick Unit ProjectsDocument62 pagesSick Unit ProjectsPratik Shah100% (1)

- Saturn Retrograde Will Trigger Global RecessionDocument26 pagesSaturn Retrograde Will Trigger Global RecessionmichaPas encore d'évaluation

- Sbi Balance SheetDocument5 pagesSbi Balance SheetNirmal BhagatPas encore d'évaluation

- Quiz Conceptual Framework WITH ANSWERSDocument25 pagesQuiz Conceptual Framework WITH ANSWERSasachdeva17100% (1)

- MQF Syllabus 22 390 587Document2 pagesMQF Syllabus 22 390 587Economiks PanviewsPas encore d'évaluation

- C3 Crafting & Executing Strategy 21eDocument62 pagesC3 Crafting & Executing Strategy 21eMuthia Khairani100% (1)

- TB ch07Document31 pagesTB ch07ajaysatpadi100% (1)

- Supply Side PoliciesDocument5 pagesSupply Side PoliciesVanessa KuaPas encore d'évaluation

- BA 114.1 - Module2 - Receivables - Exercise 1 PDFDocument4 pagesBA 114.1 - Module2 - Receivables - Exercise 1 PDFKurt Orfanel0% (1)

- FM Project ReportDocument16 pagesFM Project Reportharitha hnPas encore d'évaluation

- Financial Ratio AnalysisDocument53 pagesFinancial Ratio AnalysisLaurentia Nurak100% (4)

- United States Bankruptcy Court For The District of DelawareDocument9 pagesUnited States Bankruptcy Court For The District of DelawareChapter 11 DocketsPas encore d'évaluation

- Notes - Mr. Rajiv Luthia - Intensuve Course Course - 30th August, 2013Document21 pagesNotes - Mr. Rajiv Luthia - Intensuve Course Course - 30th August, 2013Aayushi AroraPas encore d'évaluation

- Ketan RathodDocument92 pagesKetan RathodKetan RathodPas encore d'évaluation

- Hedge Fund Structures PDFDocument9 pagesHedge Fund Structures PDFStanley MunodawafaPas encore d'évaluation

- PD 1034 - Offshore BankingDocument5 pagesPD 1034 - Offshore BankingSZPas encore d'évaluation

- Cash Management Cover LetterDocument9 pagesCash Management Cover Letterrqaeibifg100% (2)

- 1 Financial Statements Cash Flows and TaxesDocument13 pages1 Financial Statements Cash Flows and TaxesAyanleke Julius OluwaseunfunmiPas encore d'évaluation

- Hacienda Royale Subdivision: San Fernando, PampangaDocument11 pagesHacienda Royale Subdivision: San Fernando, PampangaRenzo GuevarraPas encore d'évaluation

- 2017 It Tesidi Laurea MagureanDocument124 pages2017 It Tesidi Laurea Magureanضحى مسكورPas encore d'évaluation

- Strategic Financial Performance Analysis Using Altman's Z Score Model: A Study of Listed Unicorn Startups in India From 2019 To 2023Document12 pagesStrategic Financial Performance Analysis Using Altman's Z Score Model: A Study of Listed Unicorn Startups in India From 2019 To 2023index PubPas encore d'évaluation

- Conceptual Framework in AccountingDocument4 pagesConceptual Framework in AccountingKrizchan Deyb De LeonPas encore d'évaluation

- Cost Behavior and Cost-Volume-Profit Analysis: ObjectivesDocument44 pagesCost Behavior and Cost-Volume-Profit Analysis: ObjectivestechnicaleducationPas encore d'évaluation

- How To Manage Your Small Business EffectivelyDocument3 pagesHow To Manage Your Small Business EffectivelyMudFlap gaming100% (1)

- Petunjuk: Ujian Kompetensi Dasar I Program Pascasarjana Teknik Industri Universitas Sebelas MaretDocument4 pagesPetunjuk: Ujian Kompetensi Dasar I Program Pascasarjana Teknik Industri Universitas Sebelas MaretriadPas encore d'évaluation

- Invoice: Orange Bio Science Products Private Limited Bill ToDocument1 pageInvoice: Orange Bio Science Products Private Limited Bill ToTanmoy Sarkar GhoshPas encore d'évaluation

- Cost Audit ProjectDocument49 pagesCost Audit Projectashuti75% (4)

- Jun 2004 - Qns Mod BDocument13 pagesJun 2004 - Qns Mod BHubbak Khan100% (1)

- ST TH: Ordinance No. 28, Series of 2017Document20 pagesST TH: Ordinance No. 28, Series of 2017Marites TaniegraPas encore d'évaluation