Académique Documents

Professionnel Documents

Culture Documents

CH 3 Adjusting Entry Preparing Fs

Transféré par

Trần Quốc HùngDescription originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

CH 3 Adjusting Entry Preparing Fs

Transféré par

Trần Quốc HùngDroits d'auteur :

Formats disponibles

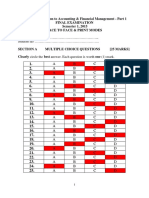

CH 3: ADJUSTING ACCOUNTS AND PREPARING FINANCIAL STATEMENTS I.

The Accounting Period

Time period principle assumes that an organizations life can be divided into specific time periods Annual financial statements cover a one-year period o Calendar year accounting period ending December 31 o Fiscal year accounting period consisting of any twelve consecutive months (e.g., ending March 31, ending November 30, etc.) Interim financial statements cover less than one year II. The Matching Concept

Revenue recognition principle requires that revenues be recorded when earned when services are rendered or ownership over goods is transferred Matching concept requires that expenses are recorded in the same accounting period as the revenues that are earned as a result of these expenses III. Accrual basis versus Cash basis Accrual basis accounting - uses the adjusting process to recognize revenues when earned and to match expenses with revenues Cash basis accounting recognizes revenues when cash is received and records expenses when cash is paid IV. Adjusting Entries a. Deferred Expenses (Prepaid Expenses) Items paid for in advance of receiving their benefits Initially recorded as assets; become expenses when used Prepaid insurance Example: On 1 Nov. 2006, White Company paid P2,160 cash for 12 months of insurance through October 31 of the next year 11/1/06 12/31/06 Prepaid insurance Cash Insurance expense Prepaid insurance (2,160 x 2/12 = 360) 2,160 2,160 360 360

Supplies Example: On 3 February 2006, Brown Company bought P5,000 worth of supplies in cash. A year-end count showed that only P1,240 worth of supplies remain. 2/03/06 12/31/06 Supplies Cash Supplies expense Supplies (5,000 1,240 = 3,760) 5,000 5,000 3,760 3,760

b. Deferred Revenue (Unearned Revenue) Refers to cash received in advance of providing products and services Initially recorded as liability; become earned revenues as products or services are provided Example: On 1 October 2006, Blue Company received P8,600 cash for a fivemonth subscription to Blue magazine. 10/01/06 12/31/06 Cash Unearned revenue Unearned revenue Subscription revenue (8,600 3/5 = 5,160) 5,160 5,160 8,600 8,600

c. Accrued Expenses (Accrued Liabilities) Refer to costs tat are incurred in a period but are both unpaid and unrecorded Increase expenses and liabilities (payables) Accrued salaries expense Example: Green Company has ten employees who are paid weekly. As of the end of the year, three days wages have accrued at the rate of P400 per day. 12/31/06 Salaries expense Salaries payable (P400 x 3 x 10) 12,000 12,000

Accrued interest expense Example: On 30 June 2006, Yellow Company obtained a P100,000 bank loan, 8% p.a., payable in 3 years. Interest is payable at maturity of the loan. 12/31/06 Interest expense 4,000 Interest payable 4,000 (P100,000 x 8% x 6/12 = 4,000)

d. Accrued Revenues (Accrued Assets) Refer to revenue earned in a period that are both unrecorded and not yet received in cash (or other assets) Increase assets (receivables) and revenue Example: Pink Company rendered P56,800 advertising services to Serf Laundry on 14 December 2006. Pink Company allowed a 30-day credit to Serf. 12/14/06 Accounts receivable Service revenue 56,800 56,800

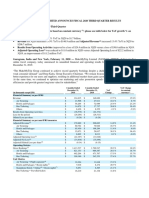

e. Fixed Assets (Accumulated Depreciation) Plant assets refer to long-term tangible assets used in the operations of the business (e.g., buildings, computers, machines, etc.) Depreciation process of allocating the costs of plant assets over their expected useful lives Accumulated depreciation a contra account of the asset account Example: Black Company purchased a sewing machine for P85,400 on March 1. Black estimated that the machine has a useful life of four years with salvage value of P5,000. Black uses straight-line method. 12/31/06 Depreciation expense Accumulated depreciation 85,400 (5,000) 80,400 4 20,100 16,750 16,750 16,750

Cost Salvage value Depreciable cost Divide by: Useful life Depreciation per year Depreciation (Mar-Dec) 20,100 x 10/12 V.

Summary of Adjustment Process (Adjusted trial balance)

Vous aimerez peut-être aussi

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (399)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- 2 CashDocument8 pages2 CashEISEN BELWIGANPas encore d'évaluation

- Teknik AkersonDocument60 pagesTeknik Akerson060098401Pas encore d'évaluation

- Preparing SFP of Single Propriertorship BusinessDocument18 pagesPreparing SFP of Single Propriertorship Businessjudith100% (2)

- First Quarter 2022 Earnings Presentation May 5, 2022Document30 pagesFirst Quarter 2022 Earnings Presentation May 5, 2022ignaciaPas encore d'évaluation

- Bkar3033 A221 Assignment 5Document5 pagesBkar3033 A221 Assignment 5Patricia TangPas encore d'évaluation

- NsDocument2 pagesNsVALEREE ROSE GARCIAPas encore d'évaluation

- 5419 Advance AccountingDocument5 pages5419 Advance AccountingmansoorPas encore d'évaluation

- Investment Bank in BangladeshDocument13 pagesInvestment Bank in BangladeshTopu RoyPas encore d'évaluation

- AdFAR.701 - Partnership Accounting - OnlineDocument6 pagesAdFAR.701 - Partnership Accounting - OnlineMikaela Lapuz Salvador100% (2)

- Chapter 10 Part A and Part B ReviewDocument9 pagesChapter 10 Part A and Part B ReviewNhi HoPas encore d'évaluation

- CA Foundation Accounts RTP May 2023Document32 pagesCA Foundation Accounts RTP May 2023PushkarPas encore d'évaluation

- Answer All Questions in Part A. Answer Three Questions Only in Part BDocument13 pagesAnswer All Questions in Part A. Answer Three Questions Only in Part BHazim BadrinPas encore d'évaluation

- Kami Export - Short StoryDocument2 pagesKami Export - Short StorySama NazimiPas encore d'évaluation

- 2015 Final Exam SolutionsDocument8 pages2015 Final Exam SolutionsAyaan Ahaan Malik-WilliamsPas encore d'évaluation

- API Training SheetDocument21 pagesAPI Training SheetAnirban KunduPas encore d'évaluation

- Create LawDocument47 pagesCreate LawRen Mar CruzPas encore d'évaluation

- Adjusting Entries Asnwer KeyDocument19 pagesAdjusting Entries Asnwer KeyCATUGAL, LANCE ALECPas encore d'évaluation

- Introduction To Corporate Finance: True / False QuestionsDocument89 pagesIntroduction To Corporate Finance: True / False QuestionsBet NaroPas encore d'évaluation

- Share CertificateDocument4 pagesShare CertificateSohail Shaikh'sPas encore d'évaluation

- POA Lecture 7Document34 pagesPOA Lecture 7Phạm Thu Hà 1M-20ACNPas encore d'évaluation

- Quiz - Single Entry (Answer Key)Document2 pagesQuiz - Single Entry (Answer Key)Gloria BeltranPas encore d'évaluation

- FR M4 - Module Quiz 2: Total Marks: 1 Marks Obtained 1Document10 pagesFR M4 - Module Quiz 2: Total Marks: 1 Marks Obtained 1Nah HamzaPas encore d'évaluation

- MakeMyTrip-Quarterly Report (Q3-2019)Document14 pagesMakeMyTrip-Quarterly Report (Q3-2019)AlbertPas encore d'évaluation

- Treasury and Risk Management PDFDocument25 pagesTreasury and Risk Management PDFShanidPas encore d'évaluation

- Coursework: International Financial Management For Business AFE - 7 - IFMDocument11 pagesCoursework: International Financial Management For Business AFE - 7 - IFMPrajit ParajuliPas encore d'évaluation

- ReillyDocument20 pagesReillyLalitha Janaki Chamarty0% (1)

- Module Fs AnalysisDocument12 pagesModule Fs AnalysisCeejay RoblesPas encore d'évaluation

- DMSSF ACC003 Review Questions TemplatesDocument27 pagesDMSSF ACC003 Review Questions TemplatesJosh lamPas encore d'évaluation

- Tutorial 3Document3 pagesTutorial 3Thuận Nguyễn Thị KimPas encore d'évaluation

- Pfrs For Smes Full PFRS: Same Same Same SameDocument14 pagesPfrs For Smes Full PFRS: Same Same Same SameAnthon GarciaPas encore d'évaluation