Académique Documents

Professionnel Documents

Culture Documents

Notice of Penalty - Hindu Temple Society of Canada

Transféré par

Jordan GinsbergTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Notice of Penalty - Hindu Temple Society of Canada

Transféré par

Jordan GinsbergDroits d'auteur :

Formats disponibles

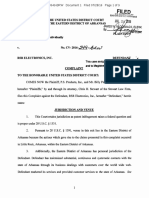

Canada Revenue Agence du revenu

Agency du Canada

+.

JAN 13 2012

REGISTERED MAIL

Carters ProfessionaJ Corporation

Ottawa Office

70 GJoucester Street

Ottawa ON K2P OA2

BN: 118958420 MODO I

Attention: Karen J. Cooper 'File #: 0485094

Subject: Notice of Penalty

Hindu Temple Society of Canada

Dear Ms. Cooper:

I am writing further to our Jetter'dated March,I, 2011 (copy enclosed), in which you were

invited to submit representations as to why we shouJd not assess a penaJty to,the Hindu Temple

Society of Canada (the Society) in accordance with section 188.1 ofthe Income Tax Act.

Our ietter advised your cJient that we would be prepared to forego revocation action in

favour of the imposition ofa penaJtyassessed under subsection 188.1(4) of the Act based on

amounts provided to non-qualified donees and the signingofa Compliance Agreement

containing certain remedial actions that the agrees to undertake to ensure cOmpliance '

with the Act.

Your letter confinns your client's acceptance of the Compliance Agreement and responds

to our request for any submissions the Society wished to make as to why it should not be

assessed a penalty in the amount of $139,520' , based on amounts provided to non-quaHfied

donees, namely the Tamils Rehabilitation Organization (YRO) in Sri the Senthilkumaran

ReliefOrganization, and the Indian Governments of Tamil Nadu and Andhra Pradesh. Your

letter seeks to negotiate both the imposition and the amounfofthe proposed penalty on the,

grounds that

the imposition ofa monetary penalty and a CompJiance Agreement at the same time is

inappropriate;

The penalty amount of $139,520 represents 105 J?Cr cent of$132.876, provided to non-qualified donl:es outside Canada.

'Canada R350 E (OS)

I

-2

-aportion ofthe funds disbursed to the TRO in Sri Lanka were sent after an agency

agreement was drawn up and signed between the Society and TRO;

- it is your client's submission that our letters ofMarch 1,2011, and March 25, 2010,

no evidence that funds sent to non-qualified donees were used for a purpose

.other than that intended by the Society;

the Society maintains that it did not intend to provide support to the Liberation Tigers of

Tamil Eelam (L TIE) and that our letters did not provide evidence that support was in

fact provided to the L TIE; and

your client is concerned that publication of the entirety or any portion of our letters

relating to assessment of a monetary penalty as pennitted by paragraph 241 (3.2)(g) of the

Act is not appropriate in' the circumstances and will harm its capacity to continue to

operate by misrepresenting the relationship between the Society, the TRO and the L TfE. '

We have carefully considered your representations in support of your client's position, in

particular that the payments in question were outside the normal mandate of the Society.

However, for the reasons set out below, our concerns with respect to the Society's

non-compliance with the requirements of subsection 149.1 (1) of the Act have not been

alleviated.

On the basis ofour audit, we have concluded that the Society provided funding in the

amount of $132,876 to non-qualified donees outside Canada, including $117,876 to the Tamils

Rehabilitation Organization (TRO) in Sri Lanka, an organization that formed part of the support

network for'the Liberation Tigers of Tamil Edam, a listed entity under the Criminal Code of

Canada. The extenuating circumstances of the tsunami. disaster and the fact that the payments in

question appeared to have been oUtside the normal operations of the Society were taken into

" account when we proposed the penalty and Compliance Agreement in lieu ofproceeding with

revocation action. The signing of this Compliance Agreement establishes that the Society

certifies that its resoUrces will not be used to provide financial or any other means of support for

the LITE or the goal of Tamil independence or the creation of a Tamil state.

Appropriateness of Sanctions Proposed

We would point out that, for all of the reasons set out in our letter of March 1, 2011,.it

remains our view that, on a balance of probabilities, it is reasonable to conclude that the TRO

fonned part of the support network for the L TTE, that the Society was aware of this affiliation,

arid that it agreed to provide funding to the TRO in spite of that affiliation. These circumstances

require a strong, clear, and balanced regulatory response.

Secondly, we do not agree that there is any basis to suggest that it is inappropriate for the

Canada Revenue Agency (eRA) to combine the use of an intermediate sanction with a

Compliance Agreement in the concept of the CRA enforcing the registration

, . , ,

iii

I

- 3

requirements for registered charWes by following along a-compliance continuum, starting with

facilitating voluntary compliance and moving to taking responsible enforcement measures that

progress from monitoring retwns through to revocation action and the collection ofPart V tax:, is

inconsistent with this approl:!-ch. Nor do we see any inconsistency between this approach and the

. wording used in our published guidelines for applying sanctions. Under the heading "General

Approach", these guidelines rank the tools the Directorate can use to obtain compliance in terms

oftheir potential severity. In addition to noting that the Act allows US to seleCt the tool

appropriate to the circumstances, this section of the ' guide Jines document concludes by stating:

"This describes our general approach. However, we know that exceptionaJ circumstances arise,

and we intend to allow for them ... "

Cl'llculation of Penalty Amount

With regard to your submission that the $90,000 paYment sent to TRO Sri Lanka

foJlowing the execution ofan agency agreement should not be included in the calculation ofa

monetary penalty, we would reiterate that the evidence from our audit indicates that this agency

agreement amounted to an arrangement in which IRO Sri L3.nka exercised fuji direction and

control over the use of the funds transferred to it, and the Society's role was limited to that of

raising the funds requested by TRO representatives. Although the Society was abie to show that

the TRO received the funds sent .to. it, no evidence was available to the eRA's auditors or has

since been provided to the Society'S control over how those funds wen;l spent. A

satisfactory agency re1ationship will not exist for purposes ofmeeting the definitional

requirements of a charitable organization under the Act where funds are supplied by a registered

charity for the operations ofanother orgaruzation, or where the registered charity does not have

sufficient authority and control over an organiZ=ition namedasits agent to ensure that funds

transferred are used appropriately. Moreover, the existence of such an arrangement does riot

remove a registered charity's obligation to ensure that it is not choosing as its agent an

. organization that operates in association with a terrorist group.

For a11 of these reasons, we consider the $90,000 .payment sent to TRO Sri Lanka

immediately foilowing the exe9ution of the purported agency agreement between the Society and

TRO to have been a gift to a non-qualified donee and not the devotion of the Society's resources

to charitable activities carried on by it.

Non-Charitable Use of Resources

As our letter dated March 1,201 I, makes clear, a registered charity is not meeting the

definition ofa charitable organization under the Act when it uses its resources to finance or

sponsor the support network of an entity that engages in terrorist activities. On this basisand for

the reasons elaborated in that letter, we do not accept your argument that " ... there is no .

evidence that support was in fact provided to the LTTE". Neither do we accept.that "[t]here was

no intention to provide support in any way to the LTTE". We would remind you that there is

significant evidence to show not only that the relationship of the TRO to the L TTE WQuld have

been openly known for many years among Tamil organizations and institutions in the Toronto

. i

J,

r

-4

. region, but that those specifically involved in the funding arrangements made between the

Society and TRO network would have known ofthe network's links to the LITE. In

particular. our ietter noted that:

"the Society's records document that Siva Sivalingam played a key mle in the Society's

decision funding to the TRO. In a tribute to Mr.. Sivalingam after his death in

.2010, it is noted that, in addition to having been one of the founding 'trustees of the Hindu

Temple Society of Canada, Mr, Sivalingam was the founding president ofthe Tamil

Eelam Society of Canada (TESq: In March 1998, Justice Teitelbaum of the Federal

. Court of Canada (Trial Division) ruled that, as a condition of release; Manickavasagam

Suresh, whom he had previously found to be a dedicated and trusted member of the

LTIE sent to Canada by the L TIE to head the World Tamil Movement (WTM) 2, was

ordered to "not have direct or indirect contact witf .. any executive n)embers of the .

WTM, or with any of the WTM's employees, and affiliated groups, as... the

executives and empJoyees of FACT or TESC and is not for any reason to. visit the offices

ofthese organizations". Public records show that at that time TESC and TRO (Canada)

shared office space and telephone numbers at 861 Broadview Avenue in Toronto";

"a National Post articJe published on December 9, 2000 lists the TRO as one of eight

organizations namefl iIi a CSIS report as front organizations for the LTTE. The article

states: "The Tigers have traditionally raised money through the use of front groups such

as the World Tamil Movement (WTM) and Tamil Rehabilitation Organization (TRO),

which collect money for humanitarian purposeS, the report says. 'However most funds

raised under the humanitarian organizations such as the TRO are charinelled instead to

fimd the L TTE war effort';" . .

"another National Post article, published on November 23, 20[11, concerning adecision

by the Department of Citizenship and Immigration not to renew funding to TESt notes

that a 'CSIS report says the society has shared addresses in the past w'ith not only FACT,

but also World Tamil Movement (WTM), which a Federal Court judge has described

as the Canadian ann of the Tamil Tigers. It has also shared an address with the Tamil

Rehabilitation Organization ('fRO).' The article goes on to say, 'The TRO and WTM are

both considered by CSIS to be actively engaged in fundmising tor the Tamil Tigers

guerrilla war effort in Sri Lanka. The money they raise in Canada is Shipped to the

I

LlTE's chief-weapons purchaser in Thailand, CSIS claims';" and finalJy that .

I

The following information eom:eming the World Tamil Movement (WTM) appears on the PubliC 'safety Canada Inlernct web

site ofcurrently listed terrorist entities: "The World Tamil Movement was created in 1986 and became a known and leading

front organization for the Liberation Tigers of Tamil Edam (LTrE) in Canada. The leadership of the WTM acts at the

direction. of the LITE and has been instrumental in fundraising in Canada on behalf ofthe LITE. WTM representatives

eanvas for amongst the Canadian Tamil popUlation, and have been involved in aets of intimidation and extortion 'to

secure funds." Online: http:lwww.publicsafety.gc.calprgfnslle/ce-eng.aspx Accessed on 2011-04-19.

I ' , .

HI ,1

,....

1

- 5

in his book "Cold Terror", Stewart Bell of the National Post "... chronicles the pervasive

influence of the LITE within the Tamil community in Toronto' citing his visit to the

Society's temple as an example: 'As [entered the temple grounds, rwaS greeted not by a

priest but by eager youths selling LITE flags. Photos ofPrabhadaran. CDs of his

. speeches, and battle videos were laid out for sale on tables ... Men nearby waived

collection jarS, soliciting money for the Tamil Rehabilitation ..,,3

We nole, further, that since our letter ofMarch 1, 20n, more information

concerning the close nature of the relationship of the IRO to.the W1M and the LTTE has come

to light through a pyblication on April 7,2011 ofThe Honourable Mr. Justice Lemieux's

Forfeiture Order under paragraph 83.l4(l)(a)ofthe Criminal Code o/Canada

4

in the matter of

Canada v. World Tamil Movement o/Ontario.

s

Exhibit A to the Forfeiture Order is the Affidavit

of Corpora! David Kim of the RCMP which contains references to documents seized pursuant to

a search warrant executed at the WTM office at 39 Cosentino Drive. At paragraphs 136 and 137

. of this Affidavit, Corporal Kim states: .

136. I believe that all four documents indicate a strong relationship between the TRO and

the WTM. The content of the four letters signed'by four different individuals all show

that the "in-charge" WTM is being asked to intervene in the management of the

TRO. .

137. I believe that all four authors ofthe letters believe that the WTM has the authority to

effect change in the operations ofthe TRO.

In summary, it is our view that the TRO network acted in concert with the L TIE that

funds under its control were used tosupport.the objectives and operations of the LITE.

Importance of PU blic Disclosure' .

It is also our view that the Government of Canada's efforts to prevent the use or misuse

of charitable organizations to support the financing of terrorism are not best setved by allowing

registered charities found to have given financial support to organizations operating in .

association with terrorist groups to avoid public scrutiny of their actions. The deterrent effect.

both on the charity itself and on other charities, would be lost and the opportunity to better

inform the general public aboutthe nature and extent ofsupport being provided to terrorism by

Canadian organizations would be missed if the CRA agreed to limit its enforcement actions to

avoid public disclosure of the basis for its concerns regarding the charity'S actions.

) Stewart Bell, "Cold Terror: How Canada Nurtures and Exports Terrorism Around the Woild

ff

John Wiley & Sons ,

Canada,Ltd., 2006, page 65. .

4 Section 83.14.

(I) The Attorney General may makc an application to a judge oflhe Federal Court for an order of forfeilUre in respect of

(0) property owned or controlled by or on behalf of a terrorist group. .

5 Docket No: T 308-09.

I :

,

- 6 ~

, '

We woul.ddraw your attention in this regard to the following excerpts from the Final

Report ofthe Commission ofInquiry into the Investigation ofthe Bombing of Air India .

Flight 182 (the Conunission) on Resolving the Challenges ofTerrorist Financing (Volume 5,

Chapter VII): .

7.8.2 Intermediate Sanctions I

~ :

";

.,

It is particularly helpful for the CRA to make full use <?fthe "intermediate .

/

sanctions" now available to it (for example, monetary penalties or the suspension

of a chanty's power to issue tax receipts for donations) to encourage charities to

"clean house" by removing directors and trustees who may be involved in: terrorist

activities. Creative and robust use of intermediate sanctions can indirectly achieve

s o m ~ o f the goals that are obtained in the United Kingdom through a charity

commission.

7.8;6 Publicity

The eRA should, when practicable, publish reasons for denying or revoking the

registration ofcharities or [non-profit organizations] NPOs and for applying

intennediate sanction to charities. fndeed, pUblicity will be an important factor if

. these sanctions are to influence charities andNPOs to reform themselves and to

alert potential donors that a given organization supports terrorism. The

Commission acknowledges the tradition of keeping income tax infonnation

confidential. These concerns are laudable, but the traditional protection of taX

infonnation from disclosure needs to be reconsidered in light of concemsabout

terrorism. . ,

Accordingly, in aU of the circumstances ofthls case, we are not prepared to accept your

representations as to the quantum ofthe penalty to be assessed or your proposal that, in place of

a penalty being assessed under the Act, the terms Qfthe Compliance Agreement be altered to ..

require that the Society instead pay "an amount to be determined to an eligible donee" in order to

prevent the CRA from disclosing information relating to the imposition ofthis penalty as is

contemplated by the provisions of subsection 241 (3.2) of the Act.

I ,

lit I I

- 7

Penalty Assessment

Consequently, for each of the reasons mentioned in our letter dated March 1, 2011, 1 wish to

advise you that, pursuant to section 188.1 of the Act, 1propose to assess a penalty to the Society.

The penalty assessed by the CRA is calculated as follows: .

Fiscal Period Fiscal Period Fiscal Period

Ending Ending Ending

,

Decemb:er 31,2007 Decem ber 31, lOO5 December 31, 2006

Gifts made to non-qualified donees:

- TRO in Sri Lanka $ J15,000 $2,876

- Indian Government ofTamil Nadu

- Indian Government of Andhra

Pradesh

-Senth ilkumaran Rei ief Organization

Total:

Applicable penalty in accordance .

with subsection 188.1(4) of the Act.

Total Penalty Owing per

subsection 188.J( 4) ofthe Act.

,$5,000

$5,000.

. $5,000

$5,000

5125,000 $2,876

105% 105% 105%

$5,250 . 5131,250 53,020

/

Tn accordance with subsection 189(6.3) of the Act, the penalty may be paid to an eligible

donee as defined in subsection] 88(1.3). An eligible donee in respect of a particular charity is a

registered charity:

I. of which more than 50% of the members of the board of directors or trustees of the

registered charity deal at ann's length with each member of the board ofdirectors or

trustees of the particular charity; . . .

2. that is not subject to a suspension of tax-receipting privileges;

3. that has no Wlpaid liabilities under the Income Tax Act or the Excise Tax Act;

. 4. that has filed all its information returns; and

5. that is not s u b j ~ t to a security certificate under the Charities Registration (Security

In/ormation) Act. .

-8

. The CRA requires the following dodumentation to confirm that the eligible donee

received the penalty payment:

a letter addressed to the Director, Review and Analysis Division (mail to address

below), signed by an authorized representative of the eligible donee, confirming

that the penalty payment was received and that the amount was paid; and

. a copy of either the cancelled cheque or evidence of a non-cash transfer. i.

(

Should you choose instead to make your payment to the eRA, please make the cheque

payable to the Receiver General for Canada and mail it to;

Director

Review arid Analysis Division

. Charities Directorate

Canada Revenue Agency

320 Queen Street, 13

th

Floor

Ottawa ON KIA OL5

Please note that in accordance with subsection 149.1(1.1) of the Act, the penalty payment

made to an eligible donee shall not be deemed to be an amount expended on charitable activities

, .

nor a gift made to a qualified donee.

Failure to pay this penalty amount of make arrangements for payment will result in us

reconsidering our decision notto proceed with the issuanceofa Noticeoflntention to Revoke

the registration of the Society in the manner described in subsection 168( I) of the Act. .

If you have any questions or further information or clarification regarding the

penalty payment, please

Appeal Process:

Should you wish to appeal this Notice ofPenalty in accordance with subsection 165( I) of

the Act respectively, a written Notice ofObjectidn, which includes the reasons for objection and

all relevant facts, must be filed within 90 days from the mailing oftrus Jetter. The Notice of

Objection should be sent to:

Tax and Charities Appeals Directorate

Appeals Branch

Revenue Agency

250 Albert Street

Ottawa ON K I A OL5

I ' iii I'

- 9

Public Notice:

By virtue of paragraph 24 J(3.2)(g) of thc. Act, the following infonnation relating to the

Society's penalty will be posted on the Charities Directorate website:

Name of Organization: Hindu Temple Society of Canada

Recistration Number: I 118958420 RROO01

Effective date of Penalty: January 13, 2012

Reason for Penalty: Undue benefits to non-qualified donees

Act Reference: 188.1(4),188.1(5), 149.1(1) .

Amount of Penalty: $t39,520

I trust the foregoing fully explains our position .

. C thy Hawara

D ector General

ChllIities Directorate

Attachments:

- Notice of Assessment

. -eRA letter dated March 1, 2011 (less enclosure)

. - Society'S responsed;lted April 7,2011

- Signed Compliance Agreements (2)

. I

I

!

NOTICE OF ASSESSMENT- AVIS DE COTISATION

Date of mailing - Date de I'envol Business Number - Numero d'entreprise Taxation years - Annaes d'lmposition

January 13,2012 118958420 RR0001 .2005, 2006 and 2007

NAME OF ORGANIZATION - NOM. DE L'ORGANISME

HINDU TEMPLE SOCIETY OF CANADA

Penalty amount Amount paid Balance owing

$139,520 . $0 $]39,520

IMontant de la, pena!!_te___.l.-M ____ o ~ n ~ . t paye Soldedfi

Explanation of assessment - explication de la cotisation

Penalty assessed in accordance with subsection 1$8,1(4) for making a gift to an entity other than

a qualified donee. The penalty is equal to 105 per cent of the amount of the gift,

. Linda Lizotte-MacPherson

Col'l1I'ilissioner ofRevenue

Commissaire du revenu

Canada:'

1+1 CANADA REVENUE AGENCE DU REVENU

AGENCY DU CANADA

REGISTERED MAIL

Carters Professional Corporation

21 J Broadway

P.O. Box 440

Orangeville, ON

L9W lK4

BN: 118958420 RROOOI

File #: 0485094

. Attention: Mr. Terrance S. Carter, B.A., LL.B.

March J, 2011

SUbject: Audit oftbe Hindu Temple Society of Canada

Dear Mr. Carter,

This letter is further to the field auditofthe Hindu Temple Society of Canada

(the Society) conducted by the. Canada Revenue Agency (CRA) commencing on

April 9, 2008, and responds to your letter of May 25, 2010. The audit related to the

operations ofthe Society for the period from January 1, 2004 to December 31 , 2006; Jater

events up to date ofthe audit were also reviewed. .

In out Administrative Fairness Letter (AFL) dated March 25,2010, the Society was

advised that the CRA had identified specific areas of with the provisions

ofthe Income Tax Act and/or its Reguliiltions and was invited to provide representations

on these matters. The CRA granted the Society two extensions of time in which to ..

respond. We have considered aU of the representations made in your letter dated May 25.

2010, and remains our v-jew that there are sufficient grounds for revocation of the

Society's under section 168 of the Act. .

We note that your letter closes by that your client "".is prepared to take

whatever remedial action is required to address the concerns expressed in the AFL and

any other concerns the CRA may have with respect to its operations in the interest of

preserving this important cultural and reJigious institution", and that you would be

pleased to discuss a possible Compliance Agreement to avoid its revocation. We are

prepared to offer to your client the terms of the attached Compliance Agreement, together

with a proposal to impose a penalty in the amount of $ 139,520. as an alternative to

proceeding with revocation action. Any representations you wish to make as to why this

penalty provision should not be applied agairist the Society must be received by .

2

Aprii 11, 2011.

1

Unless the Society also agrees at that time to the conditions outlined in

the attached Compliance Agreement, wei are prepared to proceed with revocation action

based on the following grounds:

~ - , .

AREAS OF NON-COMPLIANCE:

Issue ITA ,Reference

Subsection 149.1 (1);

charitable organization

Failure to operate in compliance with the definition ofa 1.

paragraph 168( I )(b)

Gifts to Non-Qualified Donees

Devotion of Resources.to Non-Charitable

Purposes and Activities

Receipting Improprieties Subsection 149.1 (2);

paragraph 168( 1)( dl

2.

L........

1) Gifts to Non-Qualified Donees

a) Audit Observations

The audit revealed that the Society made gifts to non-qualified donees, as follows:

$145,765.00 to the Tamils Rehabilitation Organization in Sri Lanka (TRO

Sri Lanka) between Oecem1;ler 10, 2004 and November 24, 2006, either

directly or indirectly through TRO Canada;

$10,000 to Andhta Pradesh, Chief Minister's Relief Fund, India, $5,000

on December 28, 2004 and $5,000 on January 3,2005;

$10,000 to Tamil Nadu, ChiefMinister's Relief FlUld, India, $5,000 on

December 28, 2004 and $5!OOO on January 3; 2005; and

$5,000 to the Senthilkumatan Relief Organization on December 31, 2007 ..

b) Society's Representation

Your submission does not address the fundamental issue that theSe payments were

made to non-qualified donees. It focuses,instead, on the timing of the Government of

Canada Matching FlUlds Program and the fact that this program was perceived by the

Society as not providing immediate relief to the areas of interest to the Society in the

, North and East ofSri Lanka. Your submission is that "Taken in this context, the charity

I In our conversation of February 8, 20 II, we indicated that we would provide additional time for the Society, to

respond in consideration of the Mardi break period.

I

tJj I I

!

I

I

3

can hardly be criticized for its decision!to fund TRO's tsunami relief operations in the

North and East of Sri Lanka (as well as the government programs in the Indian states of

Tami Nadu and Andhra Pradesh)". It is also your contention that the Society acted in

accordance with the CRA's published guidance by signing an agency agreement with the

Tamils Rehabilitation Organization in Sri Lanka and should, on that basis, be considered

to have been conducting its own charitable activities when it transferred funds directly

and indirectly, through TRO Canada, to TRO Sri Lanka. . .

c) eRA's Position

A registered charity is not permitted to make gifts to non-qualified donees.

Subsection 149.1 (I) of the Act requires that a registered charity operating as a charitable

organization devote all of its resources to "charitable activities carried on by the

organization itself." Subsection 149.1 (6) provides that a charitable organization shaH be

considered to be devoting its resources to charitable activities carried on by it to the

extent that in any taxation year it disburses not more than50% of its income for that year

to qualified donees. The terrn qualified donees is defined in subsection 149.] (l) ofthe

Act to mean only those organizations to which Canadian taxpayers may directly make

charitable gifts (or gifts to the Crown) which can be claimed when filing their income tax

returns. Thus, the Act requires that a charitable organization must control and remain

accoWltabJe for the use of its resources. This requirement is lifted only when charitable

organizations give their resources to a qualified recipient under the Act.

It is a matter offact that neither TRO Canada, TRO Sri Lanka, the Chief

Minister's Relief Fund in Andhra Pradesh, the Chief Minister's ReIiefFund in Tamil

Nadu, nor the Senthilkumaran Relief Organization is a qualified donee as that tenn is

defined in the Act: The Society's own records establish that it was aware that TRO

Canada had not qualified to be a registered charity mid, in fact, that there had been

pUblicity in Canada about fRO which made it problematic for the Society to deal with it. .

A registered charity may use an intermediary to carry out its activities and your

representations focus in this regard on th.e fact that an agency agreement between the

Society and TRO Sri Lanka was drawn up and signed by the respective parties on

March 31 and April 7, 2005. We note t h a t ~ by that point, three cheques totaling $52,889

had already been issued to TRO Canada for transmittal to TRO Sri Lanka. A further

$90,000 was wired toTRO Sir Lanka one day later, on ApriJ8, 2005.

As is clear from the Federal Court ofAppeal's decisions in The Canadian

Committee for the Tel Aviv Foundation v. Canada, 2002 FCA 72, and Bay;t Lepletot v..

Canada (Minister ofNational Revenue), 2006 FCA ]28, sigrung an agency agreement is

not sufficient to show that a registered charity is not acting as a condui.t to funnel

donations overseas in contravention of the Income Tax Act requirements. In this regard,

your letter criticizes the CRA's guidance for registered charities operating outside

Canada because it "provides only general guidelines as to the contents ofan agreement

forthe purposes of having an outside party perform charitable works for the Charity". In

4

publishing such guidance, it is impossible to give precise guidelines to cover all situations

and theCRA must look at the facts in a particular case. A satisfactory agency relationship

. will not exist where funds are supplied by a registered charity for the operations of

another organization, or where the registered charity does not have sufficient authority

. and control over an organization named as its agent to ensure that funds transferred are

used appropriately. Moreover, an agency agreement cannot be used to legitimize an

I

inappropriate organizational association, such as to allow a registered charity to mask its

association with aterrorist entity. We would also note that such a document is not .

capable of establishing the existence of an agency relationship prior to its execution.

2

Based o'n our review of the audit materials summarized in 'our AFL and the

representations you have it remains our view, that the Society's records reflect

that it acted essentially to put funds at the disposal ofTRO Sri Lanka t9 satisfy a

commitment to the leadership of the TRO to raise $140,000 towards Tsunami Disaster

Relief Fund, notwithstanding the drafting of a agency agreement between the Society and

TRO Sri Lanka pu.rportedly giving the Society direction and control over TRO Sri Lanka

in the use of those funds. In our view, the evidence indicates that this agency agreement

amounted to an arrangement in which TRO Sri Lanka exercised full direction and control

over the use of the funds transferred to it, and the Society'S role was limited to that of

raising the funds requested by TRO representatives; Although tbe Society was able to

show that the TRO recei ved the funds sent tQ it, no evidence' was available to the CRA's

auditors or has since been provided to establish the Society'S control over how those

funds were spent.

3

..,'.

It therefore remains our position that, by reasOn alone of having provided funding

to the non-qualified donees named above, the Society has ceased to comply with the

of the Act for itS continued registration and is subject to revocation action

pursuant to paragraph 168(l)(b) ofllie Act. .

In these, circumstances, subsection 188.1(4) of the Act also provides for the

levying of a penalty based on the amounts provided to non-qualified donees. According.

to our audit the Society is liable to pay a penalty of $139,520 as follows:

4

a) 2005 Year; $131,250:

TRO

,

, 2005-01-03: $ 25,000

2005-04-08: 90,000

)15,000 x 105% penalty!= $120,750

Z Canadian Magen David Adom for Israel v Canada (Minister ofNational .2002 FCA 323 (C.A.) [hereinafter

CAMDIJ .

1 Canadian Committee for the Tei Aviv Foundation v. Canada, 2002 FCA 72.

Equal to I 05% of the benefit amount, applicable 10 taxation years that begin after March 22, 2004.

I .

I ,

j . I.

5

Indian Governments of Tamil Nadu and Andhra Pradesh

2005-01-03: $ 5,000 " I'

2005-01-03: 5,000

Ip,OOO x 1 05% == $10,500

b) 2006 Taxation Year: $3,020:

"

TRO

2006-10- 14: $ 1,001

2006-11-24: 1,875

2,876 x 105% penalty"" $3,020

c) 2007 Taxation Year: $5,250: ' i

Senthilkumaran Relief Organization

,2007-12-31:$ 5,000 x 105% penalty =

2) Devotion of Resour.:es to Non-Charitable Purposes and Adivities by Makiag

Resour.:es AvaiiabJe To Organizations That Operate Witbin the Overall

Structure of the LTTE

a) Audit Observations

'The audit revealed that the provided' funding in the .amount of$] 45,765

both directly and indirectly (through TRO Canada) to TRO Sri Lanka, an orgBJ:lization .

that we have conCluded operated in association with, and support for, the Liberation

Tigers ofTami1 Eelam (LITE) s. Another $5000 was provided to the Senthilklimaran

Relief Organization which, for the reasons set out in our AFL, vie believe to have been

establish.ed to transfer furids to the TRO network. As noted in our AFL, the LTTE is

listed in Canada as a terrorist organization under both the UnitedNat;ons Suppression 0/

Terrorism Regulations and the Criminal Code o/Canada.It has been an offence since

S The following information concerning the L TIE appears on the Public Safety Canada Inlernel web site ofcurrently

listed entities: "Founded in 1916, the Liberation Tigers ilfTarnii Eelam (LTTE) is a Sri Lankan-based terrorist

organization that seeks !he creation of an independent homeland <;al/ed "Tamil Ee/am" for Sri Lanka's ethnic Tamil

minority. Over the years. the LTIE has waged a violent secessionist campaign with the help ofground, air, and

naval forces, as well as a dedicated suicide bomber wing. LTTE 'tactics have included full military operations, terror

attacks against civilian centres, and political assassinations, such as the successful assassinations of Indian Prime

Minister Rajiv Ghandi and Sri Lankan President Ranasinghe Premadasa. The LTTE has also had an extensive

network of fundraisers, political and propaganda officers, and arms procurers operating in Sri Lanka and wi!hin the

.Tamil diaspora. Although the LTTE was militarily defeated in May 2009, subversion, destabilization, and

fundraising continue, particularly, in the Online: <http://www.publicsafely.gc.calprglnslle/ce-eng.aspx>.

Accessed on 2010-02-09,' .

The mission and aims statements ofTRO Canada were identical to those ofTRO Sri Lanka. eRA has concluded that

TRO Canada was established in order 10 support the objectives ofTRO Sri Lanka, and thai the TRO network

operated in support of Ihe LTTE. Your letter corroborates this by reference to the statement made in the World Food

Program's 2005 Tsunami Flash Appeal that it "works with the Tamil Rehabilitation Organisation (TRO) and other'

LTTEauthorilies", . '

6

i

I

November 7, 2001 for any person in Can'ada to knowingly provide or collect by any

means, directly or indirectly, funds with the intention or in ttie knowledge that the funds,

in whole or in part, are to be used by, or will benefit, the L TTE.

b) Society's Representation

Your letter asserts that:

. the CRA is obligated to show that the Society kriowingly made its

resources available to an entity that raises funds for, and supports, the

LTTE; .

the Society could notbe expected to have been aware of reports about, or

concerns over, the TRO network's affiliation to the L TIE at the time its

decision was taken to provide funding to TRO Sri Lanka, directly and .

indirectly, through TRO Canada; .

the CRA has not taken into account the political realities in Sri Lanka

which motivated the Society's decision to provide funding to TRO; and

that .

the Society's funding was provided prior to the CRA's letter to the TRO

dated June 1,2006 advising it thaUt did not meet the requirements for

registration based, in large p a r t ~ on evidence that it operated within the

overall structure ofthe LITE, and prior to any listing of the TRO itself as

aterrorist entity by Sri Lanka o.r any other government.6 .

c) eRA's Position

Non-Charitable Purposes and Activities Contrary to Canadian Public Policy

Providing support to organizations operating in association- with the L TIE is not

charitable on two grounds. First, political objectives, jncluding the achievement of

nationhood or political autonomy for those ofaparticular ethnic or religious identity, are

not recognized in the law as charitable purposes. In addition, it is well established that an

organization will not be charitable in law ifits activities are illegal or contrary to public

policy.

7

On both of these grounds, the use of a registered charity's resources to sustain

the objectives and operations of the L TIE, either directly or indirectly through

organizations that operate as its support network, is inappropriate.

6 As detailed in our letter of June 1,2006 to the TRO and previously provided to you, the CRA has received numerous

applications for registrationfrom the Tamils Rehabilitation Organization and has. repealediy. since March 1999,

indicated in respons-e that it did not meet the requirements for regis.ration because of its strong ties to TRO Sri Lanka

and the LTTE.

1 Everywoman's Health Centre SOCiety (1988) v Canada (Minister a/Notional Revenue) [1992]2 FC 52 and CAMDI.

, .

"I , .

7

I

Canada's public policy that depriving terrorist organizations of access

to funds is a fundamental tool in undermining terrorist activities as it weakens their

supporting logistical and social infrastructures.

8

As part of its anti-terrorism strategy,

Canada has taken measures to prevent charities from being misused to provide support for

terrorism and, particularly, to prevent organizations that help to provide resources to

terrorist groups from having access to tax benefits extended to registered charities

under the Act.

9

, . . . .

In this regard, Canada has implemented the binding elements of Resolution 1373 of

the United Nations Security Council and has ratified the United Nations International

Convenlionfor the Suppression o/the Financing o/Terrorism. The preamble to the

Convention recalls General Assembly Resolution 511210, which calls upon all States:

3 (d) To investigate,' when sufficient justification exists

according to national laws, arid acting within their

jurisdiction... the abuse of organizations, groups or

associations, including those with charitable, social or

cultural goals, by terrorists who use them' as a cover' for

their own activities; and

3 (f) to take steps to prevent, and counteract,. through

appropriate domestic measures, the financing of terrorists

and terrorist organizations, whether such financing is direct

or indirect through organizations which also have or claim

to have charitable, social or cultural goals ...

Canada's commitment to combating terrorism is also reflected in its membership

in the Financial Action Task Force (FA TF). 10 The F ATF is an intergovernmental policy

making body, comprised of over 30 countries, that has a: ministerial mandate to establish

international standards for combating money laundering and terrorist financing. Over 180

jurisdictions havejoined the FA TF or an FATF-style regional body, and committed at the

ministerial level to implementing the FATF standards and having their anti-money

laundering (AML)/counter-terrorist financing (CTF) systems assessed .. The FATF has

adopted nine recoriunendations on combating the financing of terrorism, including

Special Recommendation VIII which states that countries should take measures to ensure

that charities cannot be misused:

by terrorist organizations posing as legitimate entities;

See Backgroundc:r: TerToris[ Financing, Government of Canada's Air India Inquiry Action Plan in Response to the

Commission of Inquiry into ihe Investigation ofthc: Bombing of Air India Flight 182.

Onlinc: <http//www.pubJicsafcty.gc.ca/media/nr/20 1 0/nr20 1 0207-3cng.aspx>. Accessed on 2011021 L

9 Final Report of the Commission oflnquiry into the Investigation ofthe Bombing ofAir India Flight 182, Volume 5:

TCrTorist Financing .

0 is thc FATFT

Online: <http://www.fatf-gafi.org/documemsl5710.3343.en_32250379_32235720_34432121_._I_I_ OO.html>.

Accessed on 201 10211.

I

8

to exploit legitimate entities as conduits for terrorist financing, including for

the purpose of escaping asset freezing measures; and

to c o n c e ~ l or obscl,lre the clandestine diversion of funds intended for

legitimate purposes to terrorist organizations.

. .

However, the clearest expression of Canada's public policy in this regard is found

in the Charities Registration (Security Information) Act, which was enacted as part of the

Anti-terrorism Act to "demonstrate Canada's commitment to participating in concerted

international efforts to'deny support to those who engage in terrorist activities, to protect,

the ihtegrity ofthe registration system for charities under the IncomeTax Act and to

maintain the confidence of Canadian taxpayers that the benefits of charitable registration

are made available only to organizations that operate exclusively for charitable.

"purposes": The Charities Registration (..f)ecurity l'1formation) Act is designed to deal

with the situation where relevant security and intelligence information shows that an

organization is supporting terrorism, and this evidence is needed to establish that the

. organization should not be allowed to obtain or retain registration as a charity.

Where these special provisions are not needed to establish that a registered charity

has acted in a manner that is contrary to Canada's public policy in regard to charities and

terrorism, it is entirely appropriate for the eRA to use its regulatory powers under the

Income Tax Act to take enforcement action in such cases. Specifically, when a charitable

organization is found to have used its resources to finance the operations of an

organization working to provide support for a terrorist entity, it will not have met the

requirements in subsection 149.1(1) ofthe Income Tax Act that it devote all of its

resources to charitable activities carried on by it and is, therefore, subject to revocation

under paragraph 168(1)(b) of the Act.' .

Many of the policy and guidance statements for charities published on the, CltA

Internet website call attention to the need to observe Canada's laws and public policy in.

this regard. For example,our pUblication entitled "CRA Guidance - Canadian Registered

Carrying Out Activities Outside of Canada" warns:

Charities have to remember their obligations under Canada's anti

terrorism iegislation. As with all individuals and organizations in

Canada, charities are responsible for making sure that they do not

operate in association with individuals or groups that are engaged

in terrorist activities, or that support terrorist activities.

, Civil context and absence ofa mens rea requirement

It is your client's position that the CRA has an obligation to prove that the Society

knowingly made its resources available to an entity that raises funds for, and supports, the

LITE ifit is to base a decision to revoke registration on funding of the TRO. We find no

II Charities Registration (Security In/ormation) Act. Section 2 (Purpose and Principles).

fa I I

9

I

grounds for this assertion in the requirements for registration under the Income Tax Ad.

Your letter further contends that if the eRA is to exercise its administrative authority to

revoke the Society's registration because ofsuch actions, it has an onus to establish the

charity's prior knowledge by showing that public infonnation linking TRO to the L TIE

wouJd have been available to your client before, and not after, those funding decisions

were made. These assertions import a criminal law standard of proof into the civil law

context of the CRA's determination as to whether an organization should be given, or

continue to benefit from, the tax privileges granted to a registered charity based on the

requirements of the Act. There is no mens rea requirement under the relevant Income Tax

Act provisions. In circumstances where the CRA believes that a charity has ceased to .

comply with the requirements of the Act for its registration, subsection 168( I) of the Act.

provides a discretionary power to decide whether notice should be given to the charity

that the Minister proposes to revoke its registration.

According to well-established principles of administrative law, in

whether an organization has operated in compliance with the requirements for charitable

registration the CRA is required to the evidence and reach a determination based

. on the civil law standard of balance ofprobabilities.

In makingthis administrative determination, it is open - if not increasingly

incumbent upon us - to take into account, and to draw reasonable inferences from,

relevant information that is in the public domain, whether that information emerges

before or after an organization has taken a particular course of action.

In our view, it is not unreasonable to assume that there will be a certain lag time

between knowledge of the existence of front groups operating for the benefit ofa terrorist

. entity withih a diaspora community most directly affected Or involved and the time when

awareness of those links will come to wider public attention through court decisions,

designation or listing actions takeri by various jurisdictions, or from media reports or

other publiCly available sources. This does not mean that the CRA is precluded from

relying upon .such infortnation in reaching a decision as to whether there are sufficient

grounds to deny or revoke charitable status. The CRA's obligation in relying upon

infonnation from news reports and from the internet is to give an organization the

opportunity to be heard in relation to that evidence.

12

.

Proper Context for the Society's Actions

Your submission maintains that the infonnation provided in our AFL regarding

evidence of the I inkages between the TRO network aild the L TIE should not be used to ..

impugn your client's actions in providing funding to TRO because the useofthat

information amounts to application ofa "hindsight" standard. You further contend that

information connecting the TRO to the L TIE was not readily available to the Society

prior to its decision to fUnd the TRO. .

12 CAMDI.

10

By extension, you are asking us to accept the proposition that the Society could

only have been aware ofthe TRO's association with the LITE by reason of the

infonnation provided to it in our AFL or the appearance of the TRO itself in terrorist

listings. In particular, your letter claims that your client would not have. been aware of the

TRO network's affiliation with the LITE prior to the actions of various govenunents to

fonnally designate the TRO as a terrorist entity and prior to publication of the Human

Rights Watch report referenced in our AFL extensively documenting L TIE fundraising

in the Tamil diaspora, including Canada, through such organizations as the World Tamil

Movement and the Tamils Rehabilitation Organization. In our view, this premise is faulty

and, moreover, asks us to ignore certain facts and evidence which lead us to believe that

the Society is likely to have been fully aware ofevidence pointing to the TRO's

. . relationship to the LITE.

As reflected below, it is our view that it is reasonable to believe that this

information was, in fact, common knowledge within the Tamil community worldwide

and in the Toronto area before the tsunami in December 2004 and the Society'S decision

to send funds to TRO Sri Lanka.

In this regard, your letter indicates that the Society's temple complex has

developed into the largest Hindu Temple in North America built under the Agama Sastra

traditions. You advise that it attracts more than 10,000 Hindu devotees to its more than

200 days of festival celebrations each year, and has more than 400 life members: In this

context, we note the following observations from the Human Rights Watch Report

referenced in our AFL:

the largest numbers of Sri Lankan Tamils outside Sri Lanka are found in

Canada and the vast majority of Canadian Tamils live in the Toronto area,

creating a hrrger urban Tamil popUlation than is found in any city in Sri

.. Lanka itself;

"As Tamils settled abroad, particularly in areas with high Tamil

cc:mcentrations such as in Toronto ... tney established a range of Tamil

institutions and organizations including ... religiouS temples ... and cultural,

political and service organizations ... 10 ensure both political and financial

support, the L TTE sought - and gained - influence or contro lover many

of these institutions. One Toronto Tamil remarked, 'Whatever is

happening in the Tamil community, they make sure their agenda is

there"';

"The majority of Tamils are Hindu... The Toronto area has approximately

forty Hindu temples attended by Sri Lankan Tamils ... Because the temples

provide both ready access to the Tamil community and to a potential

source of funds. the LTIE has sought control over temple events,

management, and revenue"; and .

. .

".

I I

"The L TIE's influence is apparent in many Hindu temples in the West.

Temples may display photographs ofPrabhakaran, the LITE leader, and

sell LTTE flags, CDs ofPrabhakMan' s speeches or videos and DVDs

promoting the LITE. The temple may also collect funds for the Tamil.

Rehabilitation or other L TIE front groups."

In fact, this example ofLTTE influence in the Tamil diaspora mirrors precisely

what Stewart Bell reported in his book "Cold Terror"regarding his visit to jour client's

celebration of the completion ofits temple renovations In September 2001 I Ina chapter

entitled "The Snow Tigers", he chronicles the pervasive influence of the L TTE within the

Tamil community in Toronto citing his vIsit to your client's temple as an example:

"As I entered the temple grounds, I was greeted not by a priest but by eager

youths selling LTTE flags: Photos ofPrabhadaran. CDs of his speeches, and

battle videos were laid out for sale on tables .. '.' Men nearby waved collection

jars, soliciting money for the Tamil Rehabilitation Organization" ... 14 .

Moreover, the Society'S insistence upon channelling monies to the TRO network

is teHing in view 'of cleat indications that the Government of Canada's concerns over the

TRO network's links to the LTTE would have been openly known for many years within

the leadership of organizations and institutions within Toronto's Tamil community and to

those specificaJJy involved in the funding arrangements made between the SocietY and

TRO Canada. For example:

our letter of JUlle I, 2006 to the TROIS made note of the eRA's earlier

refusal in March 1999 to register the Tamils Rehabilitation Orgaruzation

as a charity based on publicly at that time of the TRO

. network's strong ties to the L TTE; 16

the Society's records docUment that Siva Sivalingam played a key role in

. the Society's decision to provide funding to the TRO. In a tribute to

Mr. Sivalingam after his death in 2010, it is noted that, in addition to

having been orie of the founding trustees of the Hindu Temple Society of

IJ Stewart Bell, Terror; How Canada Nurtures and Exports Terrorism Around the World", John Wiley & Sons

Canada, Ltd., 2006, page 65. .

14 '/besc same facts were referenced in our AFL at footnote 20.

. 15 A copy of our letter of Iune 1,2006 was previously provided 10 you with our letter of May 7,2010.

16 For example, our letter cited IhcJain Commission. Repon,lndia's official investigation into circumstances of; and the

conspiracy leading to, Rajiv Gandhi's murder, as having !lamed the Tamils Rehabilitation Organization as one ofa

number.of L TTE front organizations. /I also referenced Rohan Gunaratna's book, "International and Regional

Security Implications ofthe Sri Lankan Tamil Insurgency", published in 1997. in which he reports that: a bulk of the

war budgct ofthe L n"E is raised from the heartland ofcontinental Europe and North America; "the main centers for

LrTE activity are in London and Paris for Europe and New Iersey and Toronto for North America"; "The

LrTE... have established offices and cells around the world. Most of these offices engage in disseminating

propaganda and coilecting mOlley. In most countries the LITE would collect money for the purchase of armaments

under the guise of supporting rehabilitation"; and that "Today, when money is collected by the Tamil Rehabilitation

Organization (TRO), the rehabilitation wing ofrhe LITE, it is welJ known among the,donors that the money is in

fact spent 1I0t only on rehabilitation but also to procure weapons. It is an unwritten understanding both among the

collectors and donors".

12

Canada, Mr. SivaJingam 1.s the founding president of the Tamil Eelam

Society of Canada (TESC).17 In March 1998, Justice Teitelpaum of the

Federal Court of Canada (Trial Division) ruled that, as a condition of

release, Manickavasagam Suresh. whom he had previousiy found to be a

dedicated and trusted member of the L TfE sent to Canada by the L TTE to

head the WTM, was ordered to "not have direct or indirect contact

with... any executive members of the WTM, or wlthany ofthe WTM's

employees, and affiliated groups, such as ... the executives and employees

of FACT or TESC and is not tor any reason to visit the offices of these

organizations". Public records show that at that time TESC and TRO

(Canada) shared office space and telephone numbers at 861 Broadview

Avenue in Toronto;

18 '

onJanuary 14, 1999, the Special Senate Committee on Security and

Intelligence issued a report that identifi'ed .charitable fund raising in Canada

by international terrorist groups as a problem, and recommended changes

to the Income Tax Act. The Toronto Star reported:

. . .

~ ' T h e Committee's concern was that these charitable groups

conduct enforced fundraising in the community," says the

consultant to that committee, Don Gracey, in an interview from

Ottawa. "The Tamil Rehabilitation Organization was one group

identified by the committee that, in fact, raised money for guns

and materiel used by the Tamil Tigers"; J9

newspaper coverage of a fund-raising rally on the lawn of Queen's Park .

sponsored by the World Tamil Movemenro (WTM) in June 2000 to mark

the success of the L TIE in capturing the strategic gateway to the northern

laffna peninsula notes that "the charity the World Tamil Movement say

receives much ofits 1JI0ney, the Tamil Rehabilitation Organization, is

11 "A Life Well Lived - Nagaratnam (Siva) Sivalingam: i940 to 2010", TNS News, (March 3. 2010).

Online: <hnp:(/www.tamiteelamnews.com>. Accessed on 2011-02-24.

IS Online: <hllp:llwww.tro.org.au/AddrcsslAddress.htm>. Accessed 2001-01-29. Also online:

<http://web.archive.org!webIl9981202140846Ihttp:fltesoc.coml>. Accessed on 201 1-02-25.

Dushy Ranetunge. 'British. charities fund terrorists", The Island, (October 4, 2(00).

Online: <http://www.island.lkl2000/10/07/news02.html>. Accessed on 2000-11-21.

19 Michael Swan, "Tamil War casts long shadow Hindu. Buddhist, Anglican and Catholic Tamils still caught in

homeland's strife", Toronto Star, (february 27, 1999). '

20 As your letter notes, the WTtvt was itself listed as a terioristentity under the Criminal Code a/Canada on June 13,

2008. The listing found on the Internet web site of Public Safety Canada at .

<http://www.publicsafety.gc.calprglnslle/c1e-eng.a.<;px> contains the following information: "The World Tamil

Movement was created in 1986 and became a known and leading front organization for the Liberation Tigers of

Tamil Eelam (I,.TIE) in Canada. The leadership of the WTM acts at the direction of tile LTIE and has been

instrumental in fundraising in Canada on behalf ofthc L TfE. WfM representatives.canvas for donations amongst

the Canadian Tamil population, and have been involved in acts of intimi dation and extortion to secure funds." hlthis

regard, we note that the Affidavit of RCMP Corporal Deanna Hill filed with the Federal Court ofCanada in the

matter of Her Majesty the Queen and The World Tamil Movement o/Otitariosceking ali order to restrain and

manage property of the WTM pursuant to sections 83.13(l)(b) and 83.13(2) of the Criminal Code o/Canada slates

that donation receipt books seized from the WTM office inCluded tickets or donation receipt books for various

fUl1draising schemes, including the Tamil Rehabilitation Organization Relief Fund (para. 382 at page 2 3 3 ~

13

itself controlled by the Tigers, according to officials with several

independent non-govern6ental organizations in Sri Lanka..;21

a National Post article pub/ ished on December 9, 2000 lists the TRO as

one ofeight organizations named in a CSIS report as front organizations

for the L TIE The article states: 'The Tigers have traditionally raised

money through the use of front groups such as the World Tamil

Movement (WTM) and Tamil Rehabilitation Organization (TRO), which

collect money for humanitarian purposes, the reports says. "However most

funds raised under the banner ofhumanitarian organizations such as the

TRO are channelled instead to flind the L TIE war effort;,,22 .

another National Post article; published on November 23,2001,'

concerning a decision by the Department ofCitizenship and Immigration

not to renew funding to the Tamil Ee/am Society of Canada, notes that a

"CSIS report says the society has s6ared addresses in the' past with not

only FACT, but also the World Tamil Movement (WTM), which a Federal

. Court judge has described as the Canadian arm of the Tamil Tigers. It has

also shared an address with the Tamil Rehabilitation Organization

(TRO)." The article goes on to say, "The TRO and WTM are both

considered by CSIS to be actively engaged in fundraising for the Tamil

Tigers guerrilla war effort in Sri The money they raise in Canada is

shipped to the LTIE's chief weapons purchaser in Thailand, CSIS

claims;,.23 . . .

,again in June, 2002, the National Post reported: "A secret list of "LTIE .

front organizations in Canada" compiled by the Canadian intelligence

service lists the WTM at the top, along with the Ellesmere Road address of

the strip mall, as well as seven other non-profit associations in Toronto,

Ottawa, Md,ntreal and Vancouver: The Tamil Eelam Society of Capada,

Tamil Rehabilitation Organization, Federation of Association ofCanadian

Tamils, Tamil Coordinating Committee, Eelam Tamil Association of

. British Columbia, WorJd Tamil Movement (Montreal chapter) and, the

Eelam Tamil Association of Quebec,,;24 .

a Hamilton Spectator article published on January 14,2005, reported that

a Hamilton medical centre backed out a plan to medical supplies'

for tsunami relief to the Tamils Rehabilitation Organization after learning.

21 Somini Sengupta, "Feeding the Tamil Tigers: Fuelling An rnsurrection: Sri Lankans in Canada send millions to

support rebels in their homeland but Onawa is preparing 10 crack down on contributions to 'terrorist groups"',

EdmOn/on Journal. (July 23.2000). page EA_

22 Stewart Bell, "Groups act as tTonts for terror: CSIS: Tamils reject report, deny any part in covert operations",

National Posr. (December 9. 2000), page AI_FRO.

2J Stewan Bell, "Ottawa won 'I renew funding ofTamil society: Panel gets final say: CSIS report named group as front

. for terrorist Tigers", National Post, (November 23,2001 ),page A.2_ .

24 Stewart Bell, "Blood money on tap", National Post, (June 1,2002), page B.1.FRO.

14

i

I

that it had been "named oy the Canadian Intelligence Service as a

front for the Liberation Tigers of Tamil Eelam"; 5 and

a Globe and Mail report on January 18, 2005 documenting attempts being

made at that time to influence then Prime Minister Paul Martin to have the

TRO granted charitable status in Canada also referred to an independent

report posted in 1999 on the Internet web site of the Canadian Security

Intelligence Service describing the TRO as a front the L TIE.

Finally, the Society's own records document that its officials were very much

aware ofconcern in Canada over the TRO and confirm, in fact, that they were aware that'

these concerns had prevented it from being given charitable status in Canada. In an

e-mail dated March 3, 2005 concerning monies sent to TRO

expressed his concern to Siva Sivalingam, saying U(I do Dot have to repeat what was

printed and broadcast in the various media in Canada). It is an organization yet to get

acceptance in Canada (It would have been great ifit had the correct status. You and I

know it is not a government organization and further more in Canada the TRO has not

been able to register as a charity. So what ever we do with TRO for obvious reasons has .

to be carefully handled." (bold emphasis added). .

However, even ifinformation about the TRO's ties to theLTIE had not been so

clearly widespread and available to the Society (particularly if it were to have engaged in

any meaningt\ll due diligence process) it remains our view that a registered charity is not

meeting the definition ofa charitable organization under the Act when it uses its

resources to finance orsponsor the support network of an entity that engages in terrorist

activities.

PolitiCal Realities in Sri Lanka

Your representations also convey your client's submission that our AFL fails to

take into consideration the political realities that existed in post-tsunami Sri Lanka and

which directly impacted its deCision making-process in determining where aid was to be

sent. On the contrary. it is our view that the Society's decision-making process was very .

much influenced by political considerations. This is tacitly admitted in your submissions

that:

the tsunami response reflected the underlying pathologies of the state and

the competing systems of governance in Sri Lanka. with each party seeing

the devastation as an opportunity to strengthen its legitimacy through the

control and distribution of resources;

:IS Daniel Nolan. ;'Medical donation postponed, Centre learns ofTamil group's terro; Thf! Hamiltoll Spectalor;

page A01.

, .

15

the Government of Sri Lanka's response to the tsunami was unfavourable

compared with that of its rivals, even including the Liberation Tigers of

Tamil Eelam (LITE); .

within days of the tsunami, [the LITE] established coordination offices,

staffed by the local NGO consortium;

Sri Lankan humanitarian organizations, like theTRO, benefitedfrom a

huge influx ofdiaspora funding, enabling it to orchestrate a significant

responSe in the North and East; and .

it is well known in the Tamil diaspora that few ofthe mainstreams NGOs

are able to open suppJy routes out ofCoJombo and outside' of

controlled territories, and that the TRO is the primary NGO providing

. huirianitarian assistance in the North and East.

With reference to these statements' and, in particular, the agreement the Society

entered into on March 31, 2005 for the sponsorship of two TRO projects (the building of

a and 100 water tanks), we would point out that the study by Shawn Teresa

Flanigan, "Nonprofjt Service Provision by Insurgent Organizations: The Cases of

HizbaHah and the Tamil Tigers", previously referenced in our AFL and provided to you

on May 7,2010 documented the LITE's control over humanitarian aid projects through

the TRO.26 The study provides what is, in our yiew, an objective and very credible

assessment of the relationship between the TRO and the LTTE and the role of the TRO in

exerting control over humanitarian assistance in the north and east ofSri Lanka on behalf

ofthe LTTE. The foIlowing observations, most particularly, provide important context

for your statement that " .. .it is well known in the Tamil diaspora that the TRO is the

primary NGO providing humanitarian assistance in the North and East":

Although the government in Colombo provides some financial support to

schools, hospitals, and other parts of the bureaucracy in the LTTE provinces,

the Sri Lankan government is reluctant to provide too much assistance to the

.area for fear of being perceived as overly supportive of Tamil separatists; The

Tamil Tigers equally interested in keeping government assistance out

their territories. As Philipson and Thangarajab (2005) noted, "The L TTE also

has been very watchful of any attempt by the government to use rehabilitation

and development programs as a means of further undermining the LITE in

both the North and the East" (32). Recognizing the power ofservice provision

as a means of generating community support, the LITE is eager not to give

such an advantage to the Sri Lankan state. While the L TTE often tolerates the

Sri Lankan government's activities in its regions, allowing the Sri Lankan

government to provide too much aid in Tamil Tiger areas could undermine

popular support for the organization.

The Tamil Tigers have realized that the people will be bebolden to those that

take care of them. In an effort to capture tbat community support, the Tamil

26 Studies in Conflict & Terrorism. (June 2OQ8), 31 :6. pages 499 to 519.

16.

Tigers have ensured that the commuDities in LTTE-controlled provinces

perceive health aod social services as coming from the LTTE itself. The LTTE

has accomplished this goal through elaborate effort to direct the service

activities of the and interna.ional NGO communities, create its own

NGOs, and appoint steering committees to Sri Lankan government agencies

that provide services. By creating this public image of a welfilfe"state," the

LTTE ensures tbat the population under its control sees it as the primary

provider of relief and rehabilitation.

the Tamil Tigers meet the social service needs of the population in its

territories by using the resources of the local and international NGO

community. The LITE makes use ofthese resources by "taxing" NGO&. by

steering the activities oftbe NGO community to meet its needs, and through

the work of its own NGO, the Tamil ReHef Organization (TRO).

The LTIE is able to direct these humanitarian activities by requiring NGOs

to conduct their work through the TRO and "local NGO" partners. By

requiring NGOs to direct their resources and efforts through these entities,

the LTTE can. maintain relatively bigh degree ofcontJ:"ol over how resources

are used and what programs are implemented. It is in the Tamil Tiger's

interest to exert control over the NGO sector and make the services appear as

if they are coming from the LTIE itself, because thiS boosts the LTIE's

legitimacy in the eyes of the Tamil community in the north and east. Some

experts.. on Sri Lanka's NGO sector suggest that the LITE actively uses

development projects to gain public support from the community,

therefore uses the TRO and its services as a tool to ensure dependency on the

LTIE for reliehnd rehabilitation services (pbilipson and Thangarajab,

2005). Chandra.kanthan (2000) noted that the LTIE's provision ofvarioilS .

servicesand development of infrastructure has had the added benefit of

causing youtll to feel they are part of a distinct nation to which they

shou,ld be loyal, which aids in generating geruJine community support and

reducing the LTIE's reliance on silenCing al!d coercion.

The close relationship between the Tamil TIgeri and the TRO is noted by ,

scholars as well (Wayland, 2004). Some observe that the LTTE bas appointed

. the eastern bead ofTRO as the LTIE's political chief for tite east of the

country, and ci1e .tbis as an exampie of the unity of the two organiZations

(philipson alJd Thangarajah, 2005). Some of the interview

participants reported an explicit relationship between the LITE alid the TRO,

stating tbatin theLTIE areas the TROis known simply as "The Relief

Organization" rather than, the "Tamil ReliefOtganization,'" and is widely

viewed by tbe local population as the LTIE's'ofticial social services arm. As

one indhtidual describes, .

They like it if anybody says it, but yes, tbe TRO is the

humanitarian arm of the LTTE. Basically they are the LTIE's social

services department. That's one thing they do bave. They have their own

they their own police, they have their own army, and they

have tbeir own social service department, the TRO. Everything else, all

the other departments are regular Sri Lankan government departments.

. .

17

As Wayland (2004) noted, "Certainly, some or. most of the TRO funds support

legitimate relief efforts, but only those that are in keeping with the wishes of .

the L TTE leadership" (422). According to tbeir financial report, the TRO is

engaged in the construction of permanent and temporary housing, education

and early childhood ser.vices, water and sanitation projects, and health and

medical relief, among other activities (TRO,200S). .

Whether an independent entity or an official arm of the LITE, most interview . ,

participants described the TRO's activities. as symbolic, and believe tbat tbe

TRO primarily serves as a fund-raising mechanism for. the LTTE. In

numerous scholars have noted the tremendous amount ofresourccs'the LITE

receives from the Tamil diaspora worldwide, and some cite the TRO and other

organizations engaged in relief activities as a potentially important source of

LTTE funding (La, 2004; Wayland, 2004).

A number of international aid agencies reportedly contract with the TRO in

their development and many interview participants suggested that

theTRO inDates their prices far beyood those of other NGOs operating in Sri

.Lanka, and then funnels tbeexcess fuods to tbe LITE. One NGO worker told

the following story,

Otber tban a few projects the bas no serious development

activities, to a fairly large extent the NGOs are abo a way of

making money for. the LITE. International agencies have to give money

to them, and then they quote, well, for example toilets. We were building

toilets for 11,000 rupees, that's almost $200. The quote we got from the

TRO was rupees. OfCourse they have their own overhead, .

minimal, but they do. But everything else is just hidden bere and tbere

and then taxied out to the LTTE. Tbe quality of what they provide isn't

any better tban tbe otber NGOs, even though tbeir priceS are bigher.

Particularly since the :.W04 Asian tsunami, the T,RO lias played an iniportant

role in channeling aid from donor countries and international NGOs to LTTE-.

controlled areas (Hogg, 2006). As describedearJler, NGOs bave come under

pressure to work witb TRO in tsunami reconstruction activities, and tbere are

reports tbat in some cases relief camps operated by other NGOs were taken

over by force. There is a great deal of concern in the NGO community that,

considering tbe current context ofterror existing in the east ofthe country, tbe

TROslowly will gain the compliance of the majorityofNGOs working in

these areas as it seeks to bring all reliefand, development activities under its

umbrella (Philipson and Thangarajah, 2P05).

Your submission strengthens our view that it was with first hand knowledge of

. these political realities in Sri Lanka that the Society was asked and agreed to s!')nd funds

to the TRO.

With regard to due diligence and the Society's efforts to draw up an agreement

with TRO Sri Lanka to shelter its actions under the protection ofan agency arrangement, ...

we would point out that the existence of such an arrangement does not remove a

registered charity's obligation to ensure that it is not choosing as its agent an organization

18

that operates in association with a terrorist group. In our view, to suggest that your client

did so unwittingly in this instance is not credible in all of the circumstances.

We would also point out that our AFL did not, in fact, assert that the Society

blindly entered into an agreement with the TRO, with no consideration ofthe type of

project the Society. wished to support, or the need to comply with CRA regulations.

Rather, on the basis of the facts detailed in our AFL, it is our view that the Society

undertook to send funding requested by the TR021 and then later, realizing that this

action could be challenged by the CRA, put an agency agreement in place to validate its

actions. Nothing in your submission changes our view that, on a plain reading ofthe .

facts, the leadership of theTRO turned to the Society as a source of funding and that,

once provided, the monies gent to TRO Sri Lanka were no longer administered under the

Society's direction and control.

In summary, based on the infonnation that the CRA has examined and conveyed

to your client, it remains our view that, on a balance of probabilities, it is reasonable to

conclude that the TRO fonned part of the support network for the L TTE, that the Society

was aware of this affiliation, and that it agreed to provide funding to the TRO in spite of

that affiliation.

Our position therefore remains that the agency agreement your client erltered into

with TRO Sri Lanka cannot be considered to have been either valid or appropriate. Both

before and after the agreement was put in place, the Society operated essentially toput

funds at the disposal ofthe TRO Sri Lanka, either directly or through TRO Canada. It is

our view that, in so doing; the Society made its resources available to an organization

operating in association with, and in support for, a terrorist group, contrary to Canadian

public policy and the requirements of the Income Tax Act for its .continued registration.

For this reason, the Society is subject to revocation action pursuant to paragraph

168(1)(b) of the Act.

Field Auditors Working Papers

Your submission argues that the comments of the field auditor have been largely

ignored in the preparation of the AFL. In this case, however, the Headquarters directive

to the field in advance of the audit specified that the audit papers compiled in the field