Académique Documents

Professionnel Documents

Culture Documents

SEB Report: No Response Seen To Slower Growth in India

Transféré par

SEB GroupTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

SEB Report: No Response Seen To Slower Growth in India

Transféré par

SEB GroupDroits d'auteur :

Formats disponibles

India: No decisive policy response expected, despite marked growth slowdown

GDP growth slowed to 5.3 % in Q1: lower than the consensus expectations of 6.1% and the fourth consecutive quarter of slowing growth (Chart 1). The rate is now slower than during the 2008-2009 financial crisis. The deceleration was led by the manufacturing sector, but agricultural production and mining were also weak. This weak growth is largely self-inflicted and is a result of political stalemate and policy paralysis. No decisive policy response or improvement in the reform climate is expected until after the May 2014 parliamentary election. Furthermore, the Reserve Bank of India (RBI) has limited room for rate cuts due to stubborn inflation. Due to much weaker than expected growth in Q1, Indias inability to counter the slowdown with economic policy initiatives and increasing global economic uncertainty, we cut the GDP forecast to 6.0% in 2012 (from 7.0%) and to 6.6% in 2013. Purchasing managers indices (PMIs) for both manufacturing and services have stabilised recently (Chart 2) but figures are still below the long-term average. Industrial production is decelerating. In March, production was 3.5% below the level of a year earlier (Chart 3). High interest rates are harming investment. Export growth has slowed, and in April the year-on-year increase was only slightly above 3%. Imports are also decelerating (Chart 4). Car sales are decelerating, indicating that domestic demand is weakening (Chart 5). Wholesale price index (WPI) inflation rebounded to 7.2% in April; food inflation is above 10% (Chart 6). The RBI is in a tricky position due to the marked growth slowdown and stubborn inflation. The central bank cut its key interest rate by 50 basis points in mid-April (Chart 7). We expect a further cut of 50 basis points in Q3. There is significant downward pressure on the rupee due to weak fundamentals and growing global economic uncertainty (Chart 8). Indias current account deficit continues to weigh down the rupee (Chart 9).

TUESDAY 5 JUNE 2012 Andreas Johnson SEB Economic Research +46 8 763 80 32 andreas.johnson@seb.se

Key data Percentage change

2010 2011 2012 2013 GDP* Inflation (wholesale)* USD/INR** 10.6 9.6 44.7 7.2 9.5 53.0 6.0 6.8 52.0 6.6 7.2 50.0

* Percentage change. ** End of period. Source: IMF, Ministry of Commerce and Industry, Reuters, SEB.

Economic Insights

CHARTS ON THE INDIAN ECONOMY

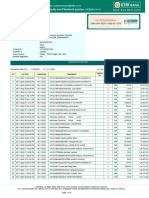

Chart 5: Domestic car sales are weakening

Year-on-year percentage change

70 60 50 40 30 20 10 0 -10 -20 -30 05 06 07 08 09 10 11 12

Source: SIAM

70 60 50 40 30 20 10 0 -10 -20 -30

Vous aimerez peut-être aussi

- Insights From 2014 of Significance For 2015Document5 pagesInsights From 2014 of Significance For 2015SEB GroupPas encore d'évaluation

- Deloitte/SEB CFO Survey Finland 1405: Closing The GapDocument12 pagesDeloitte/SEB CFO Survey Finland 1405: Closing The GapSEB GroupPas encore d'évaluation

- Eastern European Outlook 1503: Baltics and Central Europe Showing ResilienceDocument23 pagesEastern European Outlook 1503: Baltics and Central Europe Showing ResilienceSEB GroupPas encore d'évaluation

- Nordic Outlook 1502: Central Banks and Oil Help Sustain GrowthDocument52 pagesNordic Outlook 1502: Central Banks and Oil Help Sustain GrowthSEB GroupPas encore d'évaluation

- Asia Strategy Focus:Is The Indonesia Rally Over?Document17 pagesAsia Strategy Focus:Is The Indonesia Rally Over?SEB GroupPas encore d'évaluation

- SEB Report: Brazil - Back To Grey Economic Reality After The World CupDocument2 pagesSEB Report: Brazil - Back To Grey Economic Reality After The World CupSEB GroupPas encore d'évaluation

- CFO Survey 1409: More Cautious View On Business ClimateDocument16 pagesCFO Survey 1409: More Cautious View On Business ClimateSEB GroupPas encore d'évaluation

- Investment Outlook 1412: Slowly, But in The Right DirectionDocument38 pagesInvestment Outlook 1412: Slowly, But in The Right DirectionSEB GroupPas encore d'évaluation

- Nordic Outlook 1411: Increased Stress Squeezing Global GrowthDocument40 pagesNordic Outlook 1411: Increased Stress Squeezing Global GrowthSEB GroupPas encore d'évaluation

- Investment Outlook 1405: The Road To Reasonable ExpectationsDocument37 pagesInvestment Outlook 1405: The Road To Reasonable ExpectationsSEB GroupPas encore d'évaluation

- Nordic Outlook 1408: Continued Recovery - Greater Downside RisksDocument53 pagesNordic Outlook 1408: Continued Recovery - Greater Downside RisksSEB GroupPas encore d'évaluation

- Swedish Housing Price Indicator Signals Rising PricesDocument1 pageSwedish Housing Price Indicator Signals Rising PricesSEB GroupPas encore d'évaluation

- Investment Outlook 1409: Bright Outlook For Those Who Dare To Take RisksDocument39 pagesInvestment Outlook 1409: Bright Outlook For Those Who Dare To Take RisksSEB GroupPas encore d'évaluation

- Economic Insights:"Sanctions War" Will Have Little Direct Impact On GrowthDocument3 pagesEconomic Insights:"Sanctions War" Will Have Little Direct Impact On GrowthSEB GroupPas encore d'évaluation

- Economic Insights: Riksbank To Lower Key Rate, While Seeking New RoleDocument3 pagesEconomic Insights: Riksbank To Lower Key Rate, While Seeking New RoleSEB GroupPas encore d'évaluation

- SEB Report: Change of Government in India Creates Reform HopesDocument2 pagesSEB Report: Change of Government in India Creates Reform HopesSEB GroupPas encore d'évaluation

- Economic Insights: Subtle Signs of Firmer Momentum in NorwayDocument4 pagesEconomic Insights: Subtle Signs of Firmer Momentum in NorwaySEB GroupPas encore d'évaluation

- Nordic Outlook 1405: Recovery and Monetary Policy DivergenceDocument48 pagesNordic Outlook 1405: Recovery and Monetary Policy DivergenceSEB GroupPas encore d'évaluation

- CFO Survey 1403: Improving Swedish Business Climate and HiringDocument12 pagesCFO Survey 1403: Improving Swedish Business Climate and HiringSEB GroupPas encore d'évaluation

- China Financial Index 1403: Better Business Climate AheadDocument6 pagesChina Financial Index 1403: Better Business Climate AheadSEB GroupPas encore d'évaluation

- Eastern European Outlook 1403: Continued Recovery in Eastern Europe Despite TurmoilDocument24 pagesEastern European Outlook 1403: Continued Recovery in Eastern Europe Despite TurmoilSEB GroupPas encore d'évaluation

- Economic Insights: The Middle East - Politically Hobbled But With Major PotentialDocument5 pagesEconomic Insights: The Middle East - Politically Hobbled But With Major PotentialSEB GroupPas encore d'évaluation

- Economic Insights: Global Economy Resilient To Geopolitical UncertaintyDocument31 pagesEconomic Insights: Global Economy Resilient To Geopolitical UncertaintySEB GroupPas encore d'évaluation

- Investment Outlook 1403: Markets Waiting For Earnings ConfirmationDocument39 pagesInvestment Outlook 1403: Markets Waiting For Earnings ConfirmationSEB GroupPas encore d'évaluation

- Optimism On Swedish Home Prices Fading A LittleDocument1 pageOptimism On Swedish Home Prices Fading A LittleSEB GroupPas encore d'évaluation

- Nordic Outlook 1402: Recovery With Shift in Global Growth EnginesDocument49 pagesNordic Outlook 1402: Recovery With Shift in Global Growth EnginesSEB GroupPas encore d'évaluation

- SEB Report: More Emergency Actions Needed in UkraineDocument2 pagesSEB Report: More Emergency Actions Needed in UkraineSEB GroupPas encore d'évaluation

- Asia Strategy Comment: Tokyo Election May Affect YenDocument3 pagesAsia Strategy Comment: Tokyo Election May Affect YenSEB GroupPas encore d'évaluation

- SEB's China Tracker: Top 7 FAQ On China's SlowdownDocument11 pagesSEB's China Tracker: Top 7 FAQ On China's SlowdownSEB GroupPas encore d'évaluation

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (587)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (399)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (73)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2219)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (265)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (119)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- 3698 Topper 21 101 503 546 8456 Indian Economy On The Eve of Independence Up201707251641 1500981106 9098Document13 pages3698 Topper 21 101 503 546 8456 Indian Economy On The Eve of Independence Up201707251641 1500981106 9098Ruby RawatPas encore d'évaluation

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Jaideep SinghPas encore d'évaluation

- Industrial Cleaning 2009Document84 pagesIndustrial Cleaning 2009Vishal SoniPas encore d'évaluation

- Government Initiatives, Agricultural Reforms and Rural DevelopmentDocument205 pagesGovernment Initiatives, Agricultural Reforms and Rural DevelopmentMansiPas encore d'évaluation

- Top public sector banks in IndiaDocument2 pagesTop public sector banks in IndiaRUBY DIANAPas encore d'évaluation

- Financial Performance Analysis of RSPL LtdDocument108 pagesFinancial Performance Analysis of RSPL LtdAvneesh RajputPas encore d'évaluation

- May 2019 Current Affairs Capsule for Banking, Finance and EconomyDocument45 pagesMay 2019 Current Affairs Capsule for Banking, Finance and EconomyMallika BalimanePas encore d'évaluation

- PNR1Document45 pagesPNR1Christian NicolPas encore d'évaluation

- PPPL Rejected Expiry 10 - Sep - 2019Document34 pagesPPPL Rejected Expiry 10 - Sep - 2019ANANTHA BABU APas encore d'évaluation

- 3 Months BAnking - Anuj GargDocument8 pages3 Months BAnking - Anuj Gargrohitsingh25667Pas encore d'évaluation

- Satish 01.04.2023 To 31.08.2023Document71 pagesSatish 01.04.2023 To 31.08.2023Neduri Kalyan SrinivasPas encore d'évaluation

- Adv N Disadv of Privatisation of Health Sector in IndiaDocument5 pagesAdv N Disadv of Privatisation of Health Sector in IndiaChanthini VinayagamPas encore d'évaluation

- Global Marketing Plan of Pran Mango Juice in India': Masters of Business AdministrationDocument42 pagesGlobal Marketing Plan of Pran Mango Juice in India': Masters of Business AdministrationFairoozFannanaPas encore d'évaluation

- Banks Phone NumbersDocument1 pageBanks Phone NumbersVallela Jagan MohanPas encore d'évaluation

- Perspectives on India's Changing External Sector Management Post-1992Document9 pagesPerspectives on India's Changing External Sector Management Post-1992Shivran RoyPas encore d'évaluation

- Presentation On Entrepreneur - Jamsetji Tata: Subject: Business History Team MembersDocument8 pagesPresentation On Entrepreneur - Jamsetji Tata: Subject: Business History Team Membersviki221988Pas encore d'évaluation

- Agriculture Sector Is The Mainstay of The Indian EconomyDocument2 pagesAgriculture Sector Is The Mainstay of The Indian Economyvampire_sushyPas encore d'évaluation

- Service Sector in India - A SWOT AnalysisDocument12 pagesService Sector in India - A SWOT AnalysisMohammad Miyan0% (1)

- Uber Invoice - MCDDocument1 pageUber Invoice - MCDabcdPas encore d'évaluation

- Anup TransactionsDocument6 pagesAnup TransactionsNirupam DewanjiPas encore d'évaluation

- Sixth Pay Commission - Pay Fixation / Tentative Arrears CalculatorDocument3 pagesSixth Pay Commission - Pay Fixation / Tentative Arrears CalculatorhansareddyPas encore d'évaluation

- SK - Escalation Matrix RevisedDocument2 pagesSK - Escalation Matrix RevisedpsdtPas encore d'évaluation

- Economic & Market position before the Big Bull scam: License Raj & ScamsDocument8 pagesEconomic & Market position before the Big Bull scam: License Raj & ScamsAdarsh ChhajedPas encore d'évaluation

- IT Industry in India Drives EconomyDocument13 pagesIT Industry in India Drives EconomyPreding M MarakPas encore d'évaluation

- FundAllocationGraph PDFDocument1 pageFundAllocationGraph PDFDr-Sanjay SinghaniaPas encore d'évaluation

- Live Banks in API E-Mandate 11 Oct 19Document2 pagesLive Banks in API E-Mandate 11 Oct 19Amit SinghPas encore d'évaluation

- ME All Head Masters, School Assistants Instructed to Submit Seniority ObjectionsDocument149 pagesME All Head Masters, School Assistants Instructed to Submit Seniority ObjectionsRajanala Vignesh Naidu100% (1)

- NilnilnilnilDocument30 pagesNilnilnilnilMahakaal Digital PointPas encore d'évaluation

- New Delhi World Book FairDocument3 pagesNew Delhi World Book FairVikas SainiPas encore d'évaluation

- Uber Zomato Bills MergedDocument6 pagesUber Zomato Bills MergedsahityabujjiPas encore d'évaluation