Académique Documents

Professionnel Documents

Culture Documents

Tax Incentives For BioNexus Status Companies Process and Procedures

Transféré par

agasthia23Description originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Tax Incentives For BioNexus Status Companies Process and Procedures

Transféré par

agasthia23Droits d'auteur :

Formats disponibles

MALAYSIAN BIOTECHNOLOGY CORPORATION SDN BHD (Company No.

691431-D)

TAX INCENTIVES FOR BIONEXUS STATUS COMPANIES PROCESS AND PROCEDURES

<GP/CSSD/A&P/TAX001>

10 JULY 2009

AUTHORS: WAN HASNUL NADZRIN NORAZAMIAH AHMAD

Please note that the information contained herein is intended to be used for guidance and knowledge only. Whilst every effort has been taken to ensure the accuracy and completeness of the contents at the time this Guidance Paper is issued, inaccuracies may exist due to several reasons including changes in circumstances and/or amendments brought about due to a change in the policy (s) or prevailing rules or regulations. BiotechCorp does not hold out, warrant or guarantee that reliance on the information contained herein will result in the granting or approval of the matters applied for. BiotechCorp welcomes feedback and comments on this document. Feedback and comments can be sent to info@biotechcorp.com.my and by stating clearly in the subject line the document title and document Reference No.

BiotechCorp Tax Incentives for BioNexus Status Companies Process and Procedures

Version 1.0 Dated 10 July 2009

TABLE OF CONTENTS 1

PAGE

OVERVIEW OF TAX INCENTIVES FOR BIONEXUS STATUS COMPANY 1.1 Objective................................................................................................... 1.2 Introduction............................................................................................... 1.3 Definition................................................................................................... 1.4 List of Tax Incentives................................................................................

1 1 1 3

PROCESS AND PROCEDURES 2.1 Income Tax Exemption 2.1.1 General Criteria for Eligibility for Tax Exemption under Order No. 17 and Order No. 18..................................................... 2.1.2 Separate Account.......................................................................... 2.1.3 Application Process....................................................................... 2.2 2.3 Tax Exempt Dividend 2.2.1 Eligibility Criteria............................................................................ Double Deduction on Expenditure incurred for R&D and Double Deduction on Expenditure incurred for the Promotion of Exports 2.3.1 Application Process....................................................................... 2.3.2 Requirement for Approval............................................................. Industrial Building Allowance (IBA) 2.4.1 Definition of Qualifying Building Expenditure................................ 2.4.2 General rules on claiming IBA....................................................... Tax Deduction for Investors 2.5.1 Definition of Investment for Investing Company........................... 2.5.2 Eligibility Criteria............................................................................ 2.5.3 Requirement for Approval............................................................. Stamp Duty and Real Property Gains Tax Exemption for Merger and Acquisition 2.6.1 Approved Scheme of Merger or Acquisition................................. 2.6.2 Period of Exemption...................................................................... Import Duty and Sales Tax Exemption on Imported Raw Materials and Machinery 2.7.1 Eligibility Criteria............................................................................ 2.7.2 Application Process....................................................................... Special Tax Rate after Tax Exempt Period 2.8.1 Qualifying Period...........................................................................

4 4 5

9 11 13 13 14 14 15

2.4

2.5

2.6

17 17

2.7

18 18

2.8

20

BiotechCorp Tax Incentives for BioNexus Status Companies Process and Procedures

Version 1.0 Dated 10 July 2009

ATTACHMENTS Annexure 1 Annexure 2 Annexure 3 Annexure 4 Annexure 5 Example of Computation Application Form for Deduction for Investment in BioNexus Status Company Sample of Cover Letter to Apply Deduction for Investment in a BioNexus Status Company Sample of Cover Letter to Apply for Import Duty and Sales Tax Exemption Sample of Cover Letter to Apply for Approval on Approved Research Project for the Purpose of Claiming Double Deduction on Expenditure Incurred for R&D Sample of Cover Letter to Apply for Claiming Double Deduction on Expenditure Incurred for R&D Sample of Cover Letter to Apply Double Deduction on Expenditure Incurred for the Promotion of Exports List of Non-Application for Order No. 17 and Order No. 18

Annexure 6 Annexure 7 Annexure 8

BiotechCorp Tax Incentives for BioNexus Status Companies Process and Procedures

Version 1.0 Dated 10 July 2009

OVERVIEW OF TAX INCENTIVES FOR BIONEXUS STATUS COMPANY 1.1 Objective This paper explains the process and procedures for application and approval of tax incentives for BioNexus Status Companies. 1.2 Introduction BioNexus Status is a recognition awarded by the Malaysian Government, through Malaysian Biotechnology Corporation Sdn Bhd (BiotechCorp), to qualified companies that participate in and undertake value-added biotechnology activities. BioNexus Status companies enjoy a set of incentives and privileges contained within the BioNexus Bill of Guarantees. 1.3 Definition For the purposes of this paper, the following definitions shall apply: 1.3.1 BioNexus Status company as stated in the Income Tax (Exemption) (No. 17) Order 2007 [P.U. (A) 371/2007] and Income Tax (Exemption (No. 18) Order 2007 [P.U. (A) 372/2007] is a company incorporated under the Companies Act 1965 which is engaged in a business of life sciences. BioNexus Status is a recognition awarded by the Malaysian Government, through BiotechCorp, for engaging in and undertaking value-added biotechnology activities. Expansion project means a project undertaken by a BioNexus Status company in expanding its existing approved business and that business: a. involves new investment; and b. if it is applying for exemption under the Income Tax (Exemption) (No. 17) Order 2007 [P.U. (A) 371/2007], it has not been granted exemption under the Income Tax (Exemption) (No. 18) Order 2007 [P.U. (A) 372/2007]; or If it is applying for exemption under the Income Tax (Exemption) (No. 18) Order 2007 [P.U. (A) 372/2007], it has not been granted exemption under the Income Tax (Exemption) (No. 17) Order 2007 [P.U. (A) 371/2007]. 1.3.3 Life sciences means any several branches of science, such as biology, medicine, anthropology or ecology, that deal with living organisms and their organization, life processes and relationships to each other and their environment.

1.3.2

BiotechCorp Tax Incentives for BioNexus Status Companies Process and Procedures

Version 1.0 Dated 10 July 2009

1.3.4

New business means the first approved business undertaken by a BioNexus Status company. New investment means additional capital investment for the existing biotechnology activities which should result in increasing the existing production capacity or producing related products within the same industry. Qualifying capital expenditure means capital expenditure incurred on an asset used in Malaysia for the purpose of a new business or an expansion project, as the case may be: a. In relation to manufacturing or manufacturing based research, a factory, a building used for the activity of research and development, plant and machinery; or b. In relation to agricultural or agriculture based research, the clearing and preparation of land, the planting of crops (first planting or planting of trial crops), the provision of irrigation or drainage system, the provision of plant and machinery, the purchase or construction of a building used for the activity of research and development, or the activity of agriculture (including those provided for the welfare or living accommodation of persons who are working in the farm), construction of access roads, bridge and any permanent structure and improvement on land which forms part of the land used for the business.

1.3.5

1.3.6

BiotechCorp Tax Incentives for BioNexus Status Companies Process and Procedures

Version 1.0 Dated 10 July 2009

1.4

List of Tax Incentives BioNexus Status companies may apply for the following tax incentives from the Malaysian Government through BiotechCorp: 1.4.1 An exemption of 100% statutory income for: a. 10 years commencing from the first year the company derives statutory income for new business; or b. 5 years commencing from the first year the company derives statutory income for existing and expansion business; The above tax exemption is provided under the Income Tax (Exemption) (No. 17) Order 2007 (Order No. 17). or Exemption of 100% statutory income derived from a new or an expansion project equivalent to an allowance of 100% of qualifying capital expenditure incurred in the basis for a year of assessment within a period of 5 years. This is provided under the Income Tax (Exemption) (No. 18) Order 2007 (Order No. 18). 1.4.2 1.4.3 1.4.4 1.4.5 Tax exemption on dividends distributed by a BioNexus Status company; Double deduction on expenditure incurred for R&D; Double deduction on expenditure incurred for the promotion of exports; Building used solely for the purpose of biotechnology research activities is given Industrial Building Allowance (IBA) over a period of 10 years; A company that invests in a BioNexus Status company is granted tax deduction equivalent to the amount of investment made; BioNexus company undertaking a merger and acquisition with a biotechnology company is given exemption from stamp duty and real property gains tax within a period of 5 years until 31 December 2011; Exemption of import duty and sales tax materials/components and machinery/ equipment; and on raw

1.4.6

1.4.7

1.4.8

1.4.9

A BioNexus Status company is given a concessionary tax rate of 20% on income from qualifying activities for 10 years upon expiry of the tax exemption period.

BiotechCorp Tax Incentives for BioNexus Status Companies Process and Procedures

Version 1.0 Dated 10 July 2009

PROCESS AND PROCEDURES 2.1 Income Tax Exemption 2.1.1 General Criteria for Eligibility for tax exemption under Order No. 17 and Order No. 18 The applicant must meet all the following criteria in order to qualify for tax exemption incentives under Order No. 17 and Order No. 18: a. b. Must be a BioNexus Status company approved by the Minister of Finance; Engaged in activities which reflect the element of biotechnology and / or life sciences (mere blending, repackaging, mixing, distributing or trading of biotechnology products shall not qualify); A new business or expansion project must commence within one (1) year from the date of approval of BioNexus Status. The Company must write to BiotechCorp for extension of time if new business or expansion project is expected to start after 1 year from the approval date. Approval of extension is subject to agreement from the Minister of Finance; Expansion project must involve new investment; Continuously complies with the conditions imposed as stated in the Letter of Award for BioNexus Status; Must currently not enjoy any of the tax incentives as stated in the Annexure 8; Additional criteria for Order No. 18: i. For new business, the date of the first qualifying capital expenditure incurred: ii. Must not be earlier than 1 May 2005; or Within 3 years from the date of approval as a BioNexus Status company, whichever is earlier.

c.

d. e. f. g.

For expansion project, the date of first qualifying expenditure shall not be earlier than the date of application received by BiotechCorp.

2.1.2

Separate Account A BioNexus Status company which is exempted under Order No. 17 or Order No. 18, must maintain a separate account for the income derived from the qualifying business and other non-qualifying business. This will ensure that only income derived from the qualifying business is exempted from tax. Incomes from nonqualifying businesses are subject to income tax.

BiotechCorp Tax Incentives for BioNexus Status Companies Process and Procedures

Version 1.0 Dated 10 July 2009

2.1.3

Application Process Application process a. A company must submit an application for tax exemption together with its BioNexus Status application. This must be submitted to BiotechCorp by completing the BioNexus Status Application Form. The company needs to select either : i. An exemption of 100% of statutory income in respect of 10 years for a new business or 5 years for an expansion project; or An exemption of 100% statutory income equivalent to an allowance of 100% of qualifying capital expenditure incurred within a period of 5 years.

b.

ii.

c.

An existing company that is already carrying out biotechnology activities prior to application for BioNexus Status has to make an additional application for certification of on expansion project. The additional application is a process to qualify for 5 years tax exemption. The applicant must complete a Certification of Tax Incentive for Expansion Project in BioNexus Status Companies form and submit to BiotechCorp.

Evaluation and review process a. All applications will be processed by an Account Manager from BiotechCorp for recommendation to the BioNexus Evaluation Committee (BEC). The Account Manager may require additional information / documentation to support the preparation of the report for recommendation to BEC. Details of the process for application and approval for BioNexus Status are provided in Guideline on the Process and Procedures for BioNexus Status Application. All applications should be submitted in both hardcopy (1 copy only) and softcopy format to BiotechCorp at the following address: Vice President Advisory & Processing Department, Client Support Services Division Malaysian Biotechnology Corporation Sdn Bhd Level 23, Menara Atlan 161B, Jalan Ampang 50450 Kuala Lumpur Tel: (603)-2116 5588 Fax: (603)-2116 5528

b.

c.

d.

BiotechCorp Tax Incentives for BioNexus Status Companies Process and Procedures

Version 1.0 Dated 10 July 2009

Approval process a. b. c. d. e. The application will be presented to the BEC for deliberation. BEC may decide to either approve, reject or request for further information on the application. The final conferment of the tax incentive is subject to the approval of the Minister of Finance. Successful applications will be issued a Letter of Award by BiotechCorp. Unsuccessful applications will be issued a Letter of Rejection by BiotechCorp.

BiotechCorp Tax Incentives for BioNexus Status Companies Process and Procedures

Version 1.0 Dated 10 July 2009

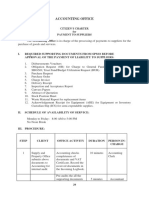

The summary of the process for approval can be illustrated as follows: Identify requirement and eligibility for BioNexus Status Documents required: Application Form Business Plan (3 years) Financial projection (3 years) CCM document Audited Accounts (3 years) Application fees RM2,000 Additional information: The type of tax incentives must be selected in the application form Complete Online PreApplication Form

Assign Account Manager to guide company on submission review complete application

Business and Operations Review Technical Assessment Financial Projections

Review and evaluate application documents

Provide Letter of Acceptance and notification of application date Present recommendation to BioNexus Evaluation Committee (BEC)

Issue a Letter of Rejection

NO

Approve application?

YES

Submit Surat Perakuan to Minister of Finance for approval on tax incentive application

END

Issue Letter of Award for BioNexus Status and tax exemption incentive

Minister of Finance approved

BiotechCorp Tax Incentives for BioNexus Status Companies Process and Procedures

Version 1.0 Dated 10 July 2009

2.2

Tax Exempt Dividend 2.2.1 Eligibility Criteria A BioNexus Status company that has accumulated tax exempt income from its qualifying activities may declare/distribute dividends to its shareholders. This dividend income is exempt from tax in the hands of the recipient as it is derived from the tax exempt income of the BioNexus Status company. This incentive is governed under Paragraph 5 and 6 of Schedule 7A of ITA, 1967.

BiotechCorp Tax Incentives for BioNexus Status Companies Process and Procedures

Version 1.0 Dated 10 July 2009

2.3

Double Deduction on Expenditure Incurred for R&D and Double Deduction on Expenditure Incurred for the Promotion of Exports 2.3.1 Application process a. Double deduction on expenditure incurred for R&D A BioNexus Status company is eligible to claim double deduction on expenditure (non-capital expenditure in nature) incurred for R&D. For example raw materials used in research, manpower in a research project, technical services, travelling cost, transportation cost, maintenance cost, rental and other revenue expenditure incurred directly for research. This incentive is given for approved research projects. The research project is approved by the Inland Revenue Board (IRB). Two (2) application processes have to be completed before claiming double deduction in the income tax return form: i. To qualify as an approved research project: In order to claim double deduction on expenditure incurred for R&D, the research undertaken must first be qualified as an approved research project; The applicant must complete Borang 1 (Sek 34A ACP 1967); This must be submitted with relevant supporting documents six (6) months before the financial year-end of the business; This is to be submitted to Technical Division at the following address: Ketua Pengarah Bahagian Teknikal Lembaga Hasil Dalam Negeri Tingkat 12, Blok 9 Kompleks Bangunan Kerajaan 50600 Jalan Duta Kuala Lumpur ii. To claim double deduction: If the company successfully obtains approval for the research project, it can claim double deduction for the expenditure incurred in the income tax return form; This requires the company to prepare two (2) copies of the supplementary worksheet Borang 2 (Sek 34A ACP 1967); The original copy must be kept by the company for audit purposes; The second copy is to be sent simultaneously to the Technical Division, IRB for records upon submission of income tax return which is seven (7) months from the

BiotechCorp Tax Incentives for BioNexus Status Companies Process and Procedures

Version 1.0 Dated 10 July 2009

financial year-end [Refer to the address mentioned in 2.3.1(a)(i) above]; For further details on type of expenditures as mentioned above for claiming of double deduction, please refer to Public Ruling No. 5/2004 Double Deduction Incentive on Research Expenditure; Borang 1 (Sek 34A ACP 1967) and Borang 2 (Sek 34A ACP 1967) can be downloaded from IRBs website:http://www.hasil.gov.my/lhdnv3e/documents/Ketetapan Umum/2004/ruling5_2004.pdf

b.

Double deduction on Expenditure Incurred for the Promotion of Exports This incentive is available to resident manufacturing, trading and agricultural companies which have incurred expenses primarily and principally for the purpose of seeking opportunities or in creating or increasing demand for the export of goods or agricultural products manufactured or produced in Malaysia. i. ii. iii. The company must complete two (2) copies of the prescribed form LHDN/BT/DD/POE/2007; The original copy of the completed form together with supporting documents are to be kept by the company for audit purposes; The duplicate copy (without any supporting documents) is to be sent to the Technical Division, IRB for record keeping upon submission of income tax return which is within seven (7) months from the financial year-end. The address is as follows: Ketua Pengarah Bahagian Teknikal Lembaga Hasil Dalam Negeri Tingkat 12, Blok 9 Kompleks Bangunan Kerajaan 50600 Jalan Duta Kuala Lumpur v. The relevant forms can be downloaded from the IRB website:http://www.hasil.gov.my/lhdnv3e/documents/GarisPandu anTeknikal/GuidelinesPOE.pdf

iv.

10

BiotechCorp Tax Incentives for BioNexus Status Companies Process and Procedures

Version 1.0 Dated 10 July 2009

2.3.2

Requirement for Approval a. Double Deduction on Expenditure Incurred for R&D i. ii. Double deduction is given to a person resident in Malaysia who directly incurs revenue expenditure on research; Person as defined under Section 2 of Income Tax Act, 1967 includes a company, a body of persons and a corporation sole; The expenses must be incurred specifically for undertaking in-house research in relation to the business; The research project must be approved by the IRB; The expenditure for approved research project must be incurred in the basis period; In the case of a claim during the tax exempt period: A further amount of deduction of the R&D expenditure (non-capital expenditure in nature) will be accumulated and can be utilised in the first year of assessment after the tax exempt period; For the above purpose, the Borang 2 (Sek 34A ACP 1967) must be completed and submitted to the Technical Division, IRB for the relevant year of assessment [Refer to address mentioned in 2.3.1(a)(iv) above].

iii.

iv. v. vi.

vii.

For further details, please refer to the Public Ruling No. 5/2004 Double Deduction Incentive on Research Expenditure which can be downloaded from IRBs website: - www.hasil.gov.my. Expenditure Incurred for the

b. Double Deduction on Promotion of Exports i.

This incentive is available to resident manufacturing, trading and agricultural companies which have incurred expenses for the export of goods or agricultural products manufactured or produced in Malaysia. These expenses must be primarily and principally for the purpose of promoting the exports of goods or agricultural products manufactured, produced, processed, graded or sorted and assembled in Malaysia.

ii.

11

BiotechCorp Tax Incentives for BioNexus Status Companies Process and Procedures

Version 1.0 Dated 10 July 2009

iii.

This rule is provided under: Section 41 of the Promotion of Investments Act (PIA) 1986; and Income Tax (Deduction for Promotion of Export) Rules 2002 [P.U. (A) 115/2002]. Income Tax (Deduction for Promotion of Export) Rules 2007 [P.U. (A) 14/2007].

iv.

In the case of claims made during the tax exempt period: During the tax exempt period, the company can claim deduction on expenditure incurred on promotion of export. However, a further deduction can only be claimed after the tax exempt period; The form LHDN/BT/DD/POE/2007 must still be submitted for the relevant year of assessment but further deductions are to be accumulated and claimed in the first year of assessment after the tax exempt period.

v.

For details, please refer to Guidelines and Procedure for Claiming Deductions for Promotion of Exports LHDN/BT/GP/POE/2005 which can be downloaded from IRBs website: - www.hasil.gov.my

12

BiotechCorp Tax Incentives for BioNexus Status Companies Process and Procedures

Version 1.0 Dated 10 July 2009

2.4

Industrial Building Allowance (IBA) 2.4.1 Definition of Qualifying Building Expenditure a. b. c. This allowance is provided in the Guideline for Income Tax (Industrial Building Allowance) (BioNexus Status Company) Rules 2007; This is effective for applications submitted to BiotechCorp on or after 2 September 2006; In accordance with the guideline mentioned above, qualifying building expenditure means capital expenditure incurred on the construction or purchase of a building but does not include capital expenditure incurred on buildings used for storage or as living accommodation which are provided wholly and partly for the use of a director or an individual who is a member of the management, administrative or clerical staff; A claim to be made by a BioNexus Status company is equivalent to one tenth of qualifying building expenditure incurred in the basis period of the year of assessment and for each of the following nine (9) years of assessment.

d.

2.4.2

General Rules on Claiming IBA The following are the criteria to be met in claiming IBA: a. b. c. Qualifying building expenditure is incurred by a company resident in Malaysia; A company must have BioNexus Status in the basis period for the year of assessment used for the sole purpose of its new business or expansion project; An allowance to be made is equivalent to one tenth of qualifying building expenditure incurred in the basis period of a year of assessment and for each of the following nine (9) years of assessment; If the qualifying building expenditure is incurred prior to the commencement of new business or expansion project, it is deemed to be incurred on the date the business or project commences; The first qualifying building expenditure incurred will be on a date determined by BiotechCorp and the date will not be earlier than 2 September 2006; For the purpose of determination on first qualifying building expenditure, the company must inform BiotechCorp in writing and support with evidence e.g. Sales and Purchase agreement, invoices from contractor for constructing building, etc.; BiotechCorp will issue an approval letter on commencement date of first qualifying building expenditure incurred; Where a building qualifies for the allowance is disposed within two (2) years from the date of completion or acquisition of the building, the allowance which has been made by the company shall be withdrawn in the basis period for the year of assessment that the building is disposed; Details of the rules can be referred to in Guidelines on Incentives Accorded to the BioNexus Status Companies.

d.

e. f.

g. h.

i.

13

BiotechCorp Tax Incentives for BioNexus Status Companies Process and Procedures

Version 1.0 Dated 10 July 2009

2.5

Tax Deduction for Investors 2.5.1 Definition of Investment for Investing Company a. b. c. This rule is effective for applications submitted to BiotechCorp on or after 1 May 2005; It is provided in the Guidelines on Income Tax (Deduction for Investment in a BioNexus Status Company) Rules 2007; Tax deduction eligible for investors is equivalent to the value of investment made in a BioNexus Status company for the sole purpose of financing activities at seed capital or early stage of a new business in arriving at the adjusted income of a qualifying person; Investment means an investment in the form of cash or holding of issued ordinary share capital in a BioNexus Status company. The ordinary shares must be subscribed via cash; Seed capital stage means the stage of research (excluding basic research), assessment and development of an initial concept or prototype; Early stage means the stage of initiating commercialization of a technology or product, increasing product capacity, product development and marketing.

d. e. f.

2.5.2

Eligibility Criteria The following are the criteria to be met by investors in claiming tax deduction: a. b. c. The investment made must be in the form of cash or ordinary shares; It is for the sole purpose of financing activities at seed capital or early stage of a new business; For investments in the form of share capital, it must not be disposed off within five (5) years from the date of last investment. If the disposal is made within five (5) years, any proceeds on disposal will be added back in ascertaining the adjusted income; If the investor is a company, it must be incorporated under the Companies Act, 1965; If the investor is an individual, he must be a Malaysian citizen, resident and has a business source; The investment must only be made after the investee company has obtained BioNexus Status; If the investment is made prior to the commencement of a new business, it is deemed to be incurred on the date the new business commences. This date shall be determined by BiotechCorp; The deduction on the investment would be applicable at all phases within the seed capital or early stage. The amount of investment made for each phase has to be approved by Minister of Finance before a deduction can be claimed;

d. e. f. g.

h.

14

BiotechCorp Tax Incentives for BioNexus Status Companies Process and Procedures

Version 1.0 Dated 10 July 2009

i.

The tax deduction for investors will cease when a BioNexus Status company derives its first statutory income from its approved qualifying activities.

2.5.3

Requirement for Approval a. Application process i. Investors must complete a prescribed form - Application Form for Deduction for Investment in BioNexus Status Company. Please refer to Annexure 2 for a sample of the form; The form requires investors to provide the following details: Part 1 : Particulars of Investor; Part 2 : Details of the BioNexus Status Company for Investment to be Made; Part 3 : Details of Investment; iii. It is important for investors to detail out the proposed date of investment to be made together with the amount of investment, purpose and its utilization for assessment and verification; The form must be submitted together with: A breakdown of the proposed investment; Certified copies of the latest Form 9, 13, Form 24, 44 and 49 from the Companies Commission of Malaysia (CCM)(for Company investors); Certified copy of the Memorandum & Articles of Association (for Company investors); Certified copy of the Directors Resolution pertaining to the investment; Any other supporting documents as required e.g. financial statements, list of capital expenditures, etc. All applications must be submitted to BiotechCorp at the following address: Vice President Advisory & Processing Department, Client Support Services Division Malaysian Biotechnology Corporation Sdn Bhd Level 23, Menara Atlan 161B, Jalan Ampang 50450 Kuala Lumpur Tel : (603) 2116 5588 Fax : (603) 2116 5528

ii.

iv.

v.

15

BiotechCorp Tax Incentives for BioNexus Status Companies Process and Procedures

Version 1.0 Dated 10 July 2009

b.

Evaluation process i. ii. iii. iv. The application will be reviewed, assessed and evaluated; BiotechCorps personnel will conduct a site visit to verify the utilization of investment; BiotechCorp may require further information to support the completion of an assessment report; The final assessment report will be presented to the BioNexus Evaluation Committee (BEC) meeting for recommendation to the Minister of Finance.

c.

Approval process i. ii. iii. iv. v. The application will be presented to the BEC for deliberation. BEC may decide to either approve, reject or request for further information on the application. The final conferment of the tax incentive is subject to the approval of the Minister of Finance. Successful applications will be issued a Letter of Award by BiotechCorp. Unsuccessful applications will be issued a Letter of Rejection by BiotechCorp.

d.

Approving Authority Minister of Finance

Details of the rules can be referred to in Guidelines on Incentives Accorded to the BioNexus Status Companies.

16

BiotechCorp Tax Incentives for BioNexus Status Companies Process and Procedures

Version 1.0 Dated 10 July 2009

2.6

Stamp Duty and Real Property Gains Tax Exemption for Merger and Acquisition This incentive is provided under the Stamp Duty (Exemption) (No. 7) Order 2007. A BioNexus Status Company that undertakes mergers or acquisitions with other biotechnology company may apply for a tax exemption on stamp duty and Real Property Gains Tax (RPGT). 2.6.1 Approved Scheme of Merger or Acquisition a. Approved scheme of merger and acquisition relates to a merger and acquisition (M&A) which is approved by the Malaysian Biotechnology Corporation Sdn Bhd All instruments executed pursuant to an approved scheme of merger or acquisition between a BioNexus status company and a biotechnology company are exempted from paying stamp duty and RPGT.

b.

2.6.2

Period of Exemption The exemption period is given to M&As which are performed between 2 September until 31 December 2011.

17

BiotechCorp Tax Incentives for BioNexus Status Companies Process and Procedures

Version 1.0 Dated 10 July 2009

2.7

Import Duty and Sales Tax Exemption on Imported Raw Materials and Machinery The applicant is eligible for the following incentive, where applicable: a. Import Duty and Sales Tax Exemption on Machinery and Equipment. b. Import Duty and Sales Tax Exemption on Raw Materials and Components. c. Import Duty, Excise Duty and Sales Tax Exemption on Machinery, Equipment and Materials for Selected Services Sub-Sectors. 2.7.1 Eligibility Criteria a. b. c. d. Machinery and equipment must not be produced locally; It must be imported directly and used in the manufacturing, agricultural and related services sectors; Raw materials and components used directly in the production of finished products; As a prerequisite, companies are required to register with the Department of Occupational Safety and Health (DOSH); and Only applications for total duty/tax exemption of RM1,000.00 and above (per submission) will be considered for exemption.

e.

2.7.2

Application Process a. The company must complete the following prescribed forms: i. Form PC 1 Application for Import Duty and/or Sales Tax Exemption on Machinery and Equipment; or Form PC 2 Application for Import Duty and/or Sales Tax Exemption on Raw Materials and Components for the Manufacture of Finished Products; Form PC Services Application for Import Duty, Excise Duty and/or Sales Tax Exemption on Machinery, Equipment and Materials for Services Sub-Sectors Forms can be downloaded from Malaysian Industrial Development Boards (MIDA) website at:www.mida.gov.my

ii.

iii.

18

BiotechCorp Tax Incentives for BioNexus Status Companies Process and Procedures

Version 1.0 Dated 10 July 2009

b.

Number of copies for submission: i. ii. iii. iv. Form PC 1 three (3) completed copies with an additional four (4) copies of Appendix I (attached to Form PC 1); Form PC 2 two (2) completed copies; Form PC Services three (3) completed copies with an additional four (4) copies of Appendix I and/or II (attached to Form PC Services); The application form can either be submitted to BiotechCorp or MIDA at the following addresses: 1. BiotechCorp: Vice President Advisory & Processing Department, Client Support Services Division Malaysian Biotechnology Corporation Sdn Bhd Level 23, Menara Atlan 161B, Jalan Ampang 50450 Kuala Lumpur 2. MIDA: Director-General Malaysian Industrial Development Authority (MIDA) 5th Floor, Plaza Sentral Jalan Sentral 5 Kuala Lumpur Sentral 50470 Kuala Lumpur

c. d. e. f. g.

MIDA will issue a letter of acknowledgement upon receiving a complete application; MIDA will evaluate and assess the application; Report will be prepared and presented at MIDAs Committee for recommendation to the Minister of Finance; Upon approval by the Minister of Finance, MIDA will issue a letter of approval to the applicant; Approval authority Minister of Finance

h.

For further details of the application procedures and sample of the application forms, please refer to the Import Duty and Sales Tax Exemption on Imported Raw Materials and Machinery Process and Procedures

19

BiotechCorp Tax Incentives for BioNexus Status Companies Process and Procedures

Version 1.0 Dated 10 July 2009

2.8

Special Tax Rate after Tax Exempt Period This incentive is given to qualified BioNexus Status company and is applicable after the income tax exemption period of 10 years or 5 years under Order 17 or Order 18 is over. The special tax rate is the income tax rate imposed on the BioNexus Status company on the statutory income generated from the approved activities. The special tax rate incentive to the BioNexus Status company is below the prevailing tax rate. 2.8.1 Qualifying Period A concessionary tax rate of 20% is given on income from qualifying activities for 10 years after the expiry of the exemption period. Note: The process and procedures for this incentive has yet to be finalised by Ministry of Finance.

For further information or clarification, please contact: Vice President Advisory & Processing Department, Client Support Services Division Malaysian Biotechnology Corporation Sdn Bhd Level 23 Menara Atlan 161B, Jalan Ampang 50450 Kuala Lumpur T: 03 2116 5588 F: 03 2116 5528 E: info@biotechcorp.com.my

20

Annexure 1

Example of Computation

i.

An exemption of 100% statutory income (Order No. 17). The calculation is arrived at in the following manner: Amount RM xxx xx/(xx) ------------xxx (xx) (xx) ------------xxx ------------xxx --------------

Net profit before tax Add/(Less): Tax adjustment Adjusted income Less: Capital allowances Industrial Building allowance Statutory Income

Tax exemption 100%

Scenario 1: An existing company which was not carrying out Biotechnology activities prior to the granting of BioNexus status carries on approved biotechnology activities after the granting of the status. The approved biotechnology activities would qualify as a new business. Example: The company was incorporated in May 2001 (Y1). It was carrying out trading electrical devices. In September 2005 (Y5), it started to undertake research and commercialization of bio-fertiliser and applied for BioNexus Status. In January 2006 (Y6), it has been granted a BioNexus Status. The company has made a business loss in the initial 2 years after granted with BioNexus Status. It only made its net profit of RM100,000 in financial year 2008 (Y8) with depreciation of fixed assets of RM20,000 and capital allowances of RM18,000.

BioNexus Status 1 Statutory Income (RM105,000)

st

2001 Non-qualifying years) activities

2005

2006

2007 Business loss on qualifying activities

2008 Exemption period (10 consecutive

2017

Qualifying activities

Annexure 1

Calculation of tax exempt: First year Year 2008: Amount RM 100,000 20,000 120,000 (15,000) 105,000 105,000

Net profit before tax Add/(Less): Tax adjustment - depreciation Adjusted income Less: Capital allowances Statutory Income Tax exemption 100%

Scenario 2: An existing company which was carrying on biotechnology activities prior to the granting of BioNexus Status carries on new additional biotechnology activities after the grant of BioNexus Status. These new additional biotechnology activities (not related to the existing biotechnology activities) constitute the first approved business by BiotechCorp and would qualify as new business. Example: The company was incorporated in August 2005 (Y1). It was carrying out commercialization of bio-fertilizer. Commencing from year 2008 (Y4), it carries out new additional tissue culture activities. It applied for BioNexus Status in 2008 (Y4) and approved in the same year. The company has made a business loss in the year 2008 (Y4). Its first net profit of RM300,000 from the new additional business was generated in Year 2009 (Y5). The depreciation of fixed assets of RM20,000 and capital allowances of RM30,000.

BioNexus Status

1st Statutory Income (RM290,000)

2005

2008

2009

2018

Bio-fertilizers

Business loss

Exemption period (10 consecutive years)

Annexure 1

Calculation of tax exempt: First year Year 2009: Amount RM 300,000 20,000 320,000 (30,000) 290,000 290,000

Net profit before tax Add/(Less): Tax adjustment - depreciation Adjusted income Less: Capital allowances Statutory Income Tax exemption 100%

Scenario 3: An existing company which was carrying on Biotechnology activities prior to the granting of BioNexus Status expand its existing biotechnology activities after the grant of BioNexus Status. These expanded biotechnology activities (related to the existing biotechnology activities) constitute the first approved business by BiotechCorp and would qualify as an expansion project. Example: The company was incorporated in March 2000 (Y1). It was carrying out tissue culture activities. Commencing from April 2006 (Y7), it embarks an expansion project on the same activities and applied for BioNexus Status. The BioNexus status was granted in August 2006 (Y7). The companys first net profit of RM300,000 from the existing and expanded business is in the same year (Y7). The depreciation of fixed assets of RM25,000 and capital allowances of RM20,000.

BioNexus Status

2000 Qualifying activities

2006 Exemption period (5 consecutive years)

2015

Expand business & 1st Statutory Income (RM305,000)

Annexure 1

Calculation of tax exempt: First year Year 2006: Amount RM 300,000 25,000 325,000 (20,000) 305,000 305,000

Net profit before tax Add/(Less): Tax adjustment - depreciation Adjusted income Less: Capital allowances Statutory Income Tax exemption 100%

ii.

An exemption of 100% statutory income is equivalent to an allowance of 100% of qualifying capital expenditure incurred for a period of five (5) years (Order No. 18). The calculation is arrived at in the following manner: Amount RM xxx xx/(xx) ------------xxx (xx) (xx) ------------xxx (xxx) ------------NIL -------------

Net profit before tax Add/(Less): Tax adjustment Adjusted income Less: Capital allowances Industrial Building allowance Statutory Income Less: Tax Allowance under Order No. 18 Taxable Statutory Income

Annexure 1

Scenario: A company is carrying on biotechnology activities and granted BioNexus Status. The company incurs a significant amount in qualifying capital expenditures. These new additional biotechnology activities (not related to the existing biotechnology activities) constitute the first approved business by BiotechCorp and would qualify as new business.

Example: The company was incorporated in August 2005 (Y1). It was carrying out activities which involved in providing contract research services. BioNexus Status was applied in year 2008 (Y4) and has been granted in the same year. The company has incurred capital expenditures on product validation tests to support its research activities amounting to RM800,000. The first net profit of RM500,000 was generated year 2009 (Y5). In Year 2008 (Y4), the company has made a business loss. The depreciation of fixed assets of RM50,000 and capital allowances of RM40,000.

st

BioNexus Status

1 Statutory Income (RM510,000)

2005 Qualifying activities

2008 Business loss

2009

2012

Capital expenditure incurred

5 years entitlement for tax allowance on capital expenditure incurred within this period

Calculation of tax exempt: First year Year 2009: Amount RM 500,000 (50,000) --------------550,000 (40,000) ----------------510,000 (800,000) ------------------NIL -------------------

Net profit before tax Add/(Less): Depreciation Adjusted income Less: Capital allowances Statutory Income Less: Tax allowance under Order No. 18 Taxable Statutory Income

Annexure 1

Tax Allowance account : RM Balance b/f Add: Current year allowance Less : Utilization of allowance 800,000 (510,000) 290,000 Balance c/f 290,000 RM NIL

Note : 1. Period of entitlement of allowance for capital expenditures is 5 years from the first year capital expenditures incurred. 2. In the case of unutilization of allowance, it can be carried forward to set off against statutory income of the same qualifying business in future years.

Malaysian Biotechnology Corporation Confidential Version1.0 Dated 9 June 2008

All information required in the application form must be provided. Please note that this application form may be updated and enhanced as and when required. The version and revision date are indicated on the top right hand corner of each page.

For office use only Date received Reference Staff

Malaysian Biotechnology Corporation Confidential Version1.0 Dated 9 June 2008

APPLICATION FOR : [PLEASE TICK ( / ) WHERE APPLICABLE]

1. 1 1.2

New Business Expansion Activity

: :

Incentive offered: Individual or a company which invests in the BioNexus Status company is eligible to be given tax deduction equivalent to the amount invested. PART 1: PARTICULARS OF INVESTOR

1. 1 1.2

Name of Individual / Company : Identification Card Number / : Company Registration Number

1.3

Correspondence Address

1.4 1.5 1.6 1.7

Nationality Income Tax File Number Income Tax Branch Contact Details i) ii) iii) iv) Name Office Number Facsimile Number E-mail

: : :

: : : :

v)

Mobile Number

Malaysian Biotechnology Corporation Confidential Version1.0 Dated 9 June 2008

PART 2 : DETAILS OF THE BIONEXUS STATUS COMPANY FOR INVESTMENT TO BE MADE

2.1 Name of BioNexus Status Company :

2.2 BioNexus Application Number 2.3 Date of BioNexus Status Awarded

: :

2.4 Business Address

2.5 BioNexus Status Qualifying Business Activity(s)

2.6 Date of Proposed Commencement of Business

PART 3: DETAILS OF INVESTMENT 3.1 Number of Shares Total Value (RM) Percentage (%)

3.2 Point of Investment (Please tick one)

Seed Capital Stage

(The stage of research, assessment and development of an initial concept or prototype)

Early Stage (pre-commercialization onwards)

(The stage of initiating commercialization of a technology or product, increasing product capacity, product development and marketing)

Malaysian Biotechnology Corporation Confidential Version1.0 Dated 9 June 2008

3.3 Proposed Date of Investment in the BioNexus Status Company

3.4 Period / Duration of Investment for Seed Capital Stage or Early Stage Expected to Complete

3.5 Please Provide Details of the Proposed Investment

(You may require the BioNexus Status Company to provide with the information)

Proposed Date of Investment

Amount

Purpose

Malaysian Biotechnology Corporation Confidential Version1.0 Dated 9 June 2008

PART 4 : DECLARATION 4.1 Declaration I, hereby declare that the facts stated in this application and the accompanying information are true and correct to the best of my knowledge. Name

Designation

Signature

Date

Please complete this application form and submit to the following address: Malaysian Biotechnology Corporation Sdn Bhd Level 20, Menara Naluri 161, Jalan Ampang 50450 Kuala Lumpur Attention: Senior Vice President, Client Support Services Division Tel Fax E-mail URL : 603-2116 5588 : 603-2116 5528 : cssd@biotechcorp.com.my : www.biotechcorp.com.my

Malaysian Biotechnology Corporation Sdn Bhd reserves the right to reject any Application made based on false information submitted by applicants.

Malaysian Biotechnology Corporation Confidential Version1.0 Dated 9 June 2008

PART 5 : OTHER SUPPORTING FORMS AND DOCUMENTS

5.1 Documentation checklist

Applicants are to submit the following supporting documents (where applicable) together with this form to the address as stated in Part 4: Breakdown of proposed investment (if the space provided in Part 3.5 is inadequate) Certified copies of the latest Form 9, Form 13, Form 24, Form 44 & Form 49 (for Company investors) Certified Memorandum & Article of Association (for Company investors) Certified copy of Directors Resolution pertaining to the investment

Annexure 3

{ TO BE TYPED ON INVESTORS LETTERHEAD} Our reference : { } Date : Senior Vice President Client Support Services Division Malaysian Biotechnology Corporation Sdn Bhd Level 20, Menara Atlan 161B, Jalan Ampang 50450 Kuala Lumpur Dear Sir, Application for Deduction for Investment in {name of BioNexus Status Company} With reference to the above matter, wish to apply incentive of tax deduction for investment in {name of BioNexus Status Company}. {Name of BioNexus Status Company} is a BioNexus Status Company which was awarded on {date of approval}. In view of the above, we enclose herewith the following documents for your kind consideration and approval : 1. A complete and duly signed application form of Deduction for Investment in BioNexus Status Company. 2. Certified copies of Form 9, Form 13, Form 24, Form 44 and Form 49 (for company investor) or a copy of the Business Registration Certificate from Companies Commission Malaysia (for individual investor). 3. Certified Memorandum & Article of Association (for company investor). 4. Certified copy of Directors Resolution pertaining to the investment. 5. Any other supporting documents e.g. financial statements, list of capital expenditures from utilization of investments, etc. Kindly do not hesitate to contact us should you require any additional information. Thank you. Yours sincerely, {Name of investor}

Annexure 4

{ TO BE TYPED ON APPLICANTS LETTERHEAD} Our reference : { } Date : Senior Vice President Client Support Services Division Malaysian Biotechnology Corporation Sdn Bhd Level 20, Menara Atlan 161B, Jalan Ampang 50450 Kuala Lumpur Dear Sir, Application for Import Duty and Sales tax Exemption With reference to the above matter, we are pleased to submit our application for Customs Duty Exemption on the purchase of {please state type of raw materials/equipments} from {name of exporter} for your further action. In view of the above, we enclosed the following documents for your reference:: 1. Three (3) sets of complete and duly signed Form PC1 (2007) application form for import duty/sales tax exemption on machinery/equipment, or Two (2) sets of complete and duly signed Form PC2 (2007) application form for import duty/sales tax exemption on raw materials 2. Additional one (1) copy of Appendix I (Form PC1). 3. Other supporting documents (please state details). In the documents are in order, please forward them to Malaysian Industrial Development Authority (MIDA) for processing and approval. Your co-operation on the above matter is highly appreciated. If you need further clarification, please contact {contact person name, telephone number and email address}. Thank you. Yours sincerely, {Name of company} .

Annexure 5

{ TO BE TYPED ON APPLICANTS LETTERHEAD}

Rujukan kami : { } Tarikh : Ketua Pengarah Bahagian Teknikal Lembaga Hasil Dalam Negeri Tingkat 12, Blok 9 Kompleks Bangunan Kerajaan Jalan Duta 50600 Kuala Lumpur Tuan, PERMOHONAN MENDAPATKAN KELULUSAN BAGI PROJEK PENYELIDIKAN UNTUK MEMBUAT TUNTUTAN POTONGAN PERBELANJAAN DUA KALI BAGI PENYELIDIKAN DAN PEMBANGUNAN (R&D) Dengan segala hormatnya, dimaklumkan bahawa kami adalah syarikat yang telah diberi status BioNexus oleh Menteri Kewangan melalui Malaysian Biotechnology Corporation Sdn Bhd. Salah satu insentif cukai yang layak dinikmati oleh syarikat berstatus BioNexus adalah potongan perbelanjaan dua kali bagi R&D. 2. Sehubungan dengan itu, kami sertakan bersama-sama surat ini satu (1) salinan Borang 1 (Sek 34A ACP1967) untuk permohonan kelulusan bagi projek penyelidikan bagi Tahun Taksiran 20 Diharapkan pihak Tuan dapat mempertimbangkan dan memberi kelulusan terhadap permohonan kami ini. Sekian, terima kasih. Yang benar, {Name of company} .

Annexure 6

{ TO BE TYPED ON APPLICANTS LETTERHEAD}

Rujukan kami : { } Tarikh : Ketua Pengarah Bahagian Teknikal Lembaga Hasil Dalam Negeri Tingkat 12, Blok 9 Kompleks Bangunan Kerajaan Jalan Duta 50600 Kuala Lumpur Tuan, PERMOHONAN UNTUK MENDAPATKAN INSENTIF POTONGAN PERBELANJAAN DUA KALI BAGI PENYELIDIKAN DAN PEMBANGUNAN (R&D) Dengan segala hormatnya, dimaklumkan bahawa kami adalah syarikat yang telah diberi status BioNexus oleh Menteri Kewangan melalui Malaysian Biotechnology Corporation Sdn Bhd. Salah satu insentif cukai yang layak dinikmati oleh syarikat berstatus BioNexus adalah potongan perbelanjaan dua kali bagi R&D. 2. Sehubungan dengan itu, kami sertakan bersama-sama surat ini satu (1) salinan Borang 2 (Sek 34A ACP1967) bagi membuat tuntutan potongan dua kali bagi R&D untuk Tahun Taksiran 20 Diharapkan pihak Tuan dapat mempertimbangkan dan memberi kelulusan terhadap permohonan kami ini. Sekian, terima kasih. Yang benar, {Name of company} .

Annexure 7

{ TO BE TYPED ON APPLICANTS LETTERHEAD}

Rujukan kami : { } Tarikh : Ketua Pengarah Bahagian Teknikal Lembaga Hasil Dalam Negeri Tingkat 12, Blok 9 Kompleks Bangunan Kerajaan Jalan Duta 50600 Kuala Lumpur Tuan, PERMOHONAN UNTUK MENDAPATKAN PENGGALAKAN EKSPORT INSENTIF POTONGAN BAGI

Dengan segala hormatnya, dimaklumkan bahawa kami adalah syarikat yang telah diberi status BioNexus oleh Menteri Kewangan melalui Malaysian Biotechnology Corporation Sdn Bhd. Salah satu insentif cukai yang layak dinikmati oleh syarikat berstatus BioNexus adalah potongan perbelanjaan dua kali bagi penggalakan eksport. 2. Sehubungan dengan itu, kami sertakan bersama-sama surat ini satu (1) salinan Borang LHDN/BT/DD/POE/2003 dalam membuat tuntutan potongan dua kali bagi penggalakan eksport untuk Tahun Taksiran 20 Diharapkan pihak Tuan dapat mempertimbangkan dan memberi kelulusan terhadap permohonan kami ini. Sekian, terima kasih. Yang benar, {Name of company} .

Annexure 8

List of non-application for Order No. 17 and Order No. 18

Order No. 17 and Order No. 18 shall not apply to: (a) A new business or an expansion project, as the case may be, that commences after one year from the date of approval after such extended period approved by the Minister. A company in the basis period for a year of assessment which has been granted:i. ii. iii. iv. v. vi. vii. viii. ix. x. xi. xii. xiii. Deduction under the Income Tax (Allowance for Increased Exports) Rules 1999 [P.U. (A) 128/1999] Deduction under the Income Tax (Deduction for Cost on Acquisition of a Foreign Owned Company) Rules 2003 [P.U. (A) 310/2003] Deduction under the Income Tax (Deduction for Investment in an Approved Food Production Project) Rules 2006 [P.U. (A) 55/2006] Exemption on the value of increased exports under the Income Tax (Exemption) (No. 17) Order 2005 [ P.U. (A) 158/2005] Reinvestment allowance under Schedule 7A of the Act Any incentives (except deductions for promotion of exports) under the Promotion of Investments Act 1986 Exemption for an approved food production project under the Income Tax (Exemption) (No. 10) Order 2006 [P.U. (A) 51/2006] Exemption under the Income Tax (Exemption) (No. 40) Order 2005 [P.U. (A) 307/2005] Exemption under the Income Tax (Exemption) (No. 41) Order 2005 [P.U. (A) 308/2005 Exemption under the Income Tax (Exemption) (No. 42) Order 2005 [P.U. (A) 309/2005 Exemption for venture capital company under the Income Tax (Exemption) (No. 11) Order 2005 [P.U. (A) 75/2005 Deduction under the Income Tax (Deduction for Investment in a Venture Company) Rules 2005 [P.U. (A) 76/2005] Deduction under the Income Tax (Deduction for Investment in a BioNexus Status Company) Rules 2007 [P.U. (A) 373/2007]

(b)

Vous aimerez peut-être aussi

- Industrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisD'EverandIndustrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisPas encore d'évaluation

- Etaxguide Cit Enterprise-Innovation-SchemeDocument37 pagesEtaxguide Cit Enterprise-Innovation-Schemei91171618Pas encore d'évaluation

- Corporate Governance: A practical guide for accountantsD'EverandCorporate Governance: A practical guide for accountantsÉvaluation : 5 sur 5 étoiles5/5 (1)

- 2007 Revised Rules in The Availment of Income Tax HolidayDocument23 pages2007 Revised Rules in The Availment of Income Tax HolidayArchie Guevarra100% (1)

- The Application of Tax IncentivesDocument6 pagesThe Application of Tax IncentivesAshenafi .APas encore d'évaluation

- 1 Taxation 2009 SupplementaryDocument84 pages1 Taxation 2009 Supplementaryabc3579Pas encore d'évaluation

- Scheme For Startup Policy 2016 21Document29 pagesScheme For Startup Policy 2016 21raman00119168Pas encore d'évaluation

- Guidelines On Employment Pass Applications in MalaysiaDocument25 pagesGuidelines On Employment Pass Applications in Malaysiamohammadmaroof1987Pas encore d'évaluation

- Taxation For StartupsDocument10 pagesTaxation For StartupsSarthak VijPas encore d'évaluation

- Income Tax & Wealth Tax 2012 13Document53 pagesIncome Tax & Wealth Tax 2012 13Raja_Babu_6208Pas encore d'évaluation

- Capital Authorization Request PolicyDocument19 pagesCapital Authorization Request PolicySaikumar SelaPas encore d'évaluation

- Tax Incentives For Promotion of Investment: Relevant To Acca Qualification Paper P6 (Mys)Document5 pagesTax Incentives For Promotion of Investment: Relevant To Acca Qualification Paper P6 (Mys)Yogendran GanesanPas encore d'évaluation

- Guidelines in The Filing of Application For Registration Under Book 1 of The Omnibus Investments Code of 1987Document4 pagesGuidelines in The Filing of Application For Registration Under Book 1 of The Omnibus Investments Code of 1987Gabe RuaroPas encore d'évaluation

- Investment IncentiveDocument47 pagesInvestment IncentiveAzizki WaniePas encore d'évaluation

- BOI Incentive and Application GuidelinesDocument7 pagesBOI Incentive and Application GuidelinesAnonymous 7qv2ubCTd9Pas encore d'évaluation

- Module 01 CREATE Law Tax IncentivesDocument30 pagesModule 01 CREATE Law Tax IncentivesMitch PacientePas encore d'évaluation

- Tax Memorandum 2011finalDocument42 pagesTax Memorandum 2011finalbazitPas encore d'évaluation

- BIHAR Induatrail Policy 2011Document16 pagesBIHAR Induatrail Policy 2011Vikram SaharanPas encore d'évaluation

- WPPF and WWF (As Per Labour Law and Rules Amended Upto Sept 2015) Accountants PerspectiveDocument29 pagesWPPF and WWF (As Per Labour Law and Rules Amended Upto Sept 2015) Accountants PerspectiveFahim Khan0% (1)

- Finance Bill, 2010 2Document27 pagesFinance Bill, 2010 2Pervez KhanPas encore d'évaluation

- Project On Fund Costing Synopsis SarikaDocument12 pagesProject On Fund Costing Synopsis SarikassssaruPas encore d'évaluation

- HandbookDocument16 pagesHandbookjohnny wakelPas encore d'évaluation

- Startup - Bareilly - Zari-BambooDocument6 pagesStartup - Bareilly - Zari-Bamboosaakshiis295Pas encore d'évaluation

- Requirements For Registering With BOIDocument2 pagesRequirements For Registering With BOIN CPas encore d'évaluation

- Directors ReportDocument16 pagesDirectors ReportvineminaiPas encore d'évaluation

- Incentives For New InvestmentsDocument21 pagesIncentives For New InvestmentsJosephPas encore d'évaluation

- SECURKLOUD 06082021101443 Q1 OutcomeDocument29 pagesSECURKLOUD 06082021101443 Q1 OutcomemohiduPas encore d'évaluation

- Missive Volume IV - July 2011: Transaction AdvisorsDocument11 pagesMissive Volume IV - July 2011: Transaction AdvisorsAkhil BansalPas encore d'évaluation

- Assignment of ID MPA19010836 PDFDocument13 pagesAssignment of ID MPA19010836 PDFmir makarim ahsanPas encore d'évaluation

- Deduction Allowed and Not Allowed Under The Head Income From Business PDFDocument6 pagesDeduction Allowed and Not Allowed Under The Head Income From Business PDFMuhammad sheran sattiPas encore d'évaluation

- Null 2Document12 pagesNull 2Kaif UddinPas encore d'évaluation

- 14,036 Startup Applications Have Been Recognised As Startups by DIPPDocument4 pages14,036 Startup Applications Have Been Recognised As Startups by DIPPYoo JinwooPas encore d'évaluation

- Entrepreneurship DevelopmentDocument23 pagesEntrepreneurship DevelopmentParmeet kaurPas encore d'évaluation

- Guidelines For SSSDocument3 pagesGuidelines For SSShariselvarajPas encore d'évaluation

- The Pioneer Legislation and Its Tax Implications AwokeDocument12 pagesThe Pioneer Legislation and Its Tax Implications Awokeawokede100% (2)

- 001 - STM - Create ActDocument22 pages001 - STM - Create ActAlbert SantiagoPas encore d'évaluation

- Budget 2012 TPDocument26 pagesBudget 2012 TPVimukthi TwkPas encore d'évaluation

- COVID-19 - Impact On Industry and The Economy 24 March 2020Document58 pagesCOVID-19 - Impact On Industry and The Economy 24 March 2020kavenindiaPas encore d'évaluation

- Business Accounting Assignment: Submitted By: Akash Yadav Course: Bms 1 Year ROLL No.: 6538Document9 pagesBusiness Accounting Assignment: Submitted By: Akash Yadav Course: Bms 1 Year ROLL No.: 6538akash yadavPas encore d'évaluation

- SEBI Board Meeting: PR No.24/2021Document6 pagesSEBI Board Meeting: PR No.24/2021Avinash SPas encore d'évaluation

- Financial Results With Results Press Release & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document9 pagesFinancial Results With Results Press Release & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderPas encore d'évaluation

- Substantial Activity Requirements Guidelines September 2020 VersionDocument12 pagesSubstantial Activity Requirements Guidelines September 2020 VersionAkash TeeluckPas encore d'évaluation

- Taxation: 8. Special Economic Zone ActDocument6 pagesTaxation: 8. Special Economic Zone ActJustin Robert RoquePas encore d'évaluation

- Industrial Sickness FinalDocument42 pagesIndustrial Sickness Finalalpz4scribd100% (1)

- Role of Venture Capital in Indian Energy Sector: in Partial Fulfillment of The Requirements of The CourseDocument11 pagesRole of Venture Capital in Indian Energy Sector: in Partial Fulfillment of The Requirements of The CoursePratik DhakePas encore d'évaluation

- Venture Capital in IndiaDocument14 pagesVenture Capital in IndiaRemy HerbiePas encore d'évaluation

- Module 04 - CREATE Law Tax IncentivesDocument24 pagesModule 04 - CREATE Law Tax IncentivesKyla Shmily GonzagaPas encore d'évaluation

- Revised GR 01 04 2017 08112017Document13 pagesRevised GR 01 04 2017 08112017jimbarotPas encore d'évaluation

- Dividend Distribution PolicyDocument4 pagesDividend Distribution Policyneetu_gkv08Pas encore d'évaluation

- MB0045 Set 2Document5 pagesMB0045 Set 2Ahmed BarkaatiPas encore d'évaluation

- Note On Msme Policy 2020Document2 pagesNote On Msme Policy 2020RajeshPas encore d'évaluation

- Company Loss RecoupmentDocument15 pagesCompany Loss RecoupmentKhrychelle AgasPas encore d'évaluation

- Small Sclae IndustriesDocument22 pagesSmall Sclae IndustriesDev kartik AgarwalPas encore d'évaluation

- 2.1 Alternatives For PASB To Improve The Effective Tax Rate of The GroupDocument4 pages2.1 Alternatives For PASB To Improve The Effective Tax Rate of The Groupanis AtiqahPas encore d'évaluation

- Rehabforsickunits 111103120753 Phpapp02Document12 pagesRehabforsickunits 111103120753 Phpapp02Amit MaisuriyaPas encore d'évaluation

- Starters' CFO - PresentationDocument27 pagesStarters' CFO - PresentationAbhishek GuptaPas encore d'évaluation

- Swamin Athan: Digitally Signed by Swaminathan Date: 2023.04.13 21:07:15 +05'30'Document86 pagesSwamin Athan: Digitally Signed by Swaminathan Date: 2023.04.13 21:07:15 +05'30'Contra Value BetsPas encore d'évaluation

- Tax Incentives For Research Behind Chapter 13Document9 pagesTax Incentives For Research Behind Chapter 13KAM JIA LINGPas encore d'évaluation

- Merger and Acquisition Practise PaperDocument9 pagesMerger and Acquisition Practise PaperRicha KhatriPas encore d'évaluation

- Annexa 8Document29 pagesAnnexa 8gladtan0511Pas encore d'évaluation

- Annual Report 2017 PDFDocument147 pagesAnnual Report 2017 PDFRamanReet SinghPas encore d'évaluation

- Company Profile KE 2019 (Compro) PDFDocument34 pagesCompany Profile KE 2019 (Compro) PDFhadibaliPas encore d'évaluation

- Midterms ACCP301 Chapter End ProblemsDocument69 pagesMidterms ACCP301 Chapter End ProblemsJessica TurianoPas encore d'évaluation

- Textual Learning Material - Module 2Document34 pagesTextual Learning Material - Module 2Jerry JohnPas encore d'évaluation

- Prepared by Reviewed & Approved By: Signatory Designation Food Technologist Production Manager DateDocument3 pagesPrepared by Reviewed & Approved By: Signatory Designation Food Technologist Production Manager DatenasuhaPas encore d'évaluation

- Afm-Ppt - N Somesh NewDocument9 pagesAfm-Ppt - N Somesh Newsomesh NPas encore d'évaluation

- Sybms and Fybaf AuditingDocument31 pagesSybms and Fybaf AuditingDeepa BhatiaPas encore d'évaluation

- Threat Finance Intelligence Analyst in Washington DC Resume Michael BlountDocument3 pagesThreat Finance Intelligence Analyst in Washington DC Resume Michael BlountMichaelBlountPas encore d'évaluation

- Tia Robinson Resume 11 02 15Document3 pagesTia Robinson Resume 11 02 15api-311192185Pas encore d'évaluation

- Big Bazaar ErpDocument12 pagesBig Bazaar ErpVarun Tripathi100% (1)

- CPA101 - Author: LaikwanDocument116 pagesCPA101 - Author: Laikwanapi-3717306Pas encore d'évaluation

- Total Quality Management in EducationDocument65 pagesTotal Quality Management in EducationEDWIN DUMOPOY100% (1)

- KSDLDocument82 pagesKSDLSurya PrashathPas encore d'évaluation

- Timeline IIADocument1 pageTimeline IIAMiljane PerdizoPas encore d'évaluation

- 10 21008j 2083-4950 2017 7 4 3 PDFDocument9 pages10 21008j 2083-4950 2017 7 4 3 PDFParveen ChauhanPas encore d'évaluation

- Silicon Valley Community Foundation 2008 990Document481 pagesSilicon Valley Community Foundation 2008 990TheSceneOfTheCrimePas encore d'évaluation

- Practical Guide To Documentation For AuditDocument13 pagesPractical Guide To Documentation For AuditWuming07Pas encore d'évaluation

- Final Fraud ReportDocument27 pagesFinal Fraud Reportpvchandu100% (1)

- Factors Affecting Tax Compliance BehaviorDocument109 pagesFactors Affecting Tax Compliance Behaviorshimelis adugnaPas encore d'évaluation

- T O O-INDEX-Volume-2Document343 pagesT O O-INDEX-Volume-2Asif Hassan71% (7)

- Chapter 9: Man-Day Calculations: 1.0.definitions: 1.1.audit DurationDocument3 pagesChapter 9: Man-Day Calculations: 1.0.definitions: 1.1.audit DurationRohit SoniPas encore d'évaluation

- VSU Tolosa: AccountingDocument2 pagesVSU Tolosa: AccountingKim Kenneth RocaPas encore d'évaluation

- Specialized Industries PDFDocument10 pagesSpecialized Industries PDFMary DenizePas encore d'évaluation

- GovAcc Quiz AcctgDocument19 pagesGovAcc Quiz AcctgChingPas encore d'évaluation

- Inventory Management Efficiency Analysis: A Case Study of An SME CompanyDocument7 pagesInventory Management Efficiency Analysis: A Case Study of An SME Companybaya alexPas encore d'évaluation

- Rps Bahan Ajar EA64006 126 1Document21 pagesRps Bahan Ajar EA64006 126 1Muhammad Rifan JailaniPas encore d'évaluation

- Thesis PDFDocument65 pagesThesis PDFApril Jane FabrePas encore d'évaluation

- AccountingDocument118 pagesAccountingReshmi R Nair100% (1)

- ISAGO Audit Follow-Up Activities (July2018)Document16 pagesISAGO Audit Follow-Up Activities (July2018)M RPas encore d'évaluation

- 11 - Planning The Internal Audit WK 4Document17 pages11 - Planning The Internal Audit WK 4Camilo ToroPas encore d'évaluation

- Tax Strategies: The Essential Guide to All Things Taxes, Learn the Secrets and Expert Tips to Understanding and Filing Your Taxes Like a ProD'EverandTax Strategies: The Essential Guide to All Things Taxes, Learn the Secrets and Expert Tips to Understanding and Filing Your Taxes Like a ProÉvaluation : 4.5 sur 5 étoiles4.5/5 (43)

- Small Business Taxes: The Most Complete and Updated Guide with Tips and Tax Loopholes You Need to Know to Avoid IRS Penalties and Save MoneyD'EverandSmall Business Taxes: The Most Complete and Updated Guide with Tips and Tax Loopholes You Need to Know to Avoid IRS Penalties and Save MoneyPas encore d'évaluation

- How to get US Bank Account for Non US ResidentD'EverandHow to get US Bank Account for Non US ResidentÉvaluation : 5 sur 5 étoiles5/5 (1)

- The Panama Papers: Breaking the Story of How the Rich and Powerful Hide Their MoneyD'EverandThe Panama Papers: Breaking the Story of How the Rich and Powerful Hide Their MoneyÉvaluation : 4 sur 5 étoiles4/5 (52)

- Bookkeeping: Step by Step Guide to Bookkeeping Principles & Basic Bookkeeping for Small BusinessD'EverandBookkeeping: Step by Step Guide to Bookkeeping Principles & Basic Bookkeeping for Small BusinessÉvaluation : 5 sur 5 étoiles5/5 (5)

- Tax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesD'EverandTax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesPas encore d'évaluation

- Make Sure It's Deductible: Little-Known Tax Tips for Your Canadian Small Business, Fifth EditionD'EverandMake Sure It's Deductible: Little-Known Tax Tips for Your Canadian Small Business, Fifth EditionPas encore d'évaluation

- Taxes for Small Businesses QuickStart Guide: Understanding Taxes for Your Sole Proprietorship, StartUp & LLCD'EverandTaxes for Small Businesses QuickStart Guide: Understanding Taxes for Your Sole Proprietorship, StartUp & LLCÉvaluation : 4 sur 5 étoiles4/5 (5)

- Beat Estate Tax Forever: The Unprecedented $5 Million Opportunity in 2012D'EverandBeat Estate Tax Forever: The Unprecedented $5 Million Opportunity in 2012Pas encore d'évaluation

- Small Business: A Complete Guide to Accounting Principles, Bookkeeping Principles and Taxes for Small BusinessD'EverandSmall Business: A Complete Guide to Accounting Principles, Bookkeeping Principles and Taxes for Small BusinessPas encore d'évaluation

- What Your CPA Isn't Telling You: Life-Changing Tax StrategiesD'EverandWhat Your CPA Isn't Telling You: Life-Changing Tax StrategiesÉvaluation : 4 sur 5 étoiles4/5 (9)

- How to Pay Zero Taxes, 2020-2021: Your Guide to Every Tax Break the IRS AllowsD'EverandHow to Pay Zero Taxes, 2020-2021: Your Guide to Every Tax Break the IRS AllowsPas encore d'évaluation

- Founding Finance: How Debt, Speculation, Foreclosures, Protests, and Crackdowns Made Us a NationD'EverandFounding Finance: How Debt, Speculation, Foreclosures, Protests, and Crackdowns Made Us a NationPas encore d'évaluation

- Tax Savvy for Small Business: A Complete Tax Strategy GuideD'EverandTax Savvy for Small Business: A Complete Tax Strategy GuideÉvaluation : 5 sur 5 étoiles5/5 (1)

- Public Finance: Legal Aspects: Collective monographD'EverandPublic Finance: Legal Aspects: Collective monographPas encore d'évaluation

- Taxes for Small Business: The Ultimate Guide to Small Business Taxes Including LLC Taxes, Payroll Taxes, and Self-Employed Taxes as a Sole ProprietorshipD'EverandTaxes for Small Business: The Ultimate Guide to Small Business Taxes Including LLC Taxes, Payroll Taxes, and Self-Employed Taxes as a Sole ProprietorshipPas encore d'évaluation

- Invested: How I Learned to Master My Mind, My Fears, and My Money to Achieve Financial Freedom and Live a More Authentic Life (with a Little Help from Warren Buffett, Charlie Munger, and My Dad)D'EverandInvested: How I Learned to Master My Mind, My Fears, and My Money to Achieve Financial Freedom and Live a More Authentic Life (with a Little Help from Warren Buffett, Charlie Munger, and My Dad)Évaluation : 4.5 sur 5 étoiles4.5/5 (43)

- Tax-Free Wealth For Life: How to Permanently Lower Your Taxes And Build More WealthD'EverandTax-Free Wealth For Life: How to Permanently Lower Your Taxes And Build More WealthPas encore d'évaluation

- Estrategias de Impuestos: Cómo Ser Más Inteligente Que El Sistema Y La IRS Cómo Un Inversionista: Al Incrementar Tu Ingreso Y Reduciendo Tus Impuestos Al Invertir Inteligentemente Volumen CompletoD'EverandEstrategias de Impuestos: Cómo Ser Más Inteligente Que El Sistema Y La IRS Cómo Un Inversionista: Al Incrementar Tu Ingreso Y Reduciendo Tus Impuestos Al Invertir Inteligentemente Volumen CompletoPas encore d'évaluation

- The Tax and Legal Playbook: Game-Changing Solutions To Your Small Business Questions 2nd EditionD'EverandThe Tax and Legal Playbook: Game-Changing Solutions To Your Small Business Questions 2nd EditionÉvaluation : 5 sur 5 étoiles5/5 (27)

- The Tax and Legal Playbook: Game-Changing Solutions To Your Small Business QuestionsD'EverandThe Tax and Legal Playbook: Game-Changing Solutions To Your Small Business QuestionsÉvaluation : 3.5 sur 5 étoiles3.5/5 (9)

- S Corporation ESOP Traps for the UnwaryD'EverandS Corporation ESOP Traps for the UnwaryPas encore d'évaluation

- The Payroll Book: A Guide for Small Businesses and StartupsD'EverandThe Payroll Book: A Guide for Small Businesses and StartupsÉvaluation : 5 sur 5 étoiles5/5 (1)