Académique Documents

Professionnel Documents

Culture Documents

Global MA Financial Review

Transféré par

Steven HunterCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Global MA Financial Review

Transféré par

Steven HunterDroits d'auteur :

Formats disponibles

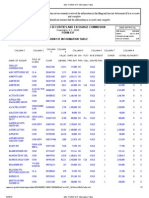

MERGERS & ACQUISITIONS REVIEW

FINANCIAL ADVISORS

Full Year 2010

Full Year 2010 | Mergers & Acquisitions | Financial Advisors

M&A Financial Advisory Review

Table of Contents

Global M&A

Any European Involvement Announced (AD21)

10

Any New Zealand Involvement Announced (AD39)

17

Global Deals Intelligence

Any European Involvement Completed (AF3)

10

Any New Zealand Involvement Completed (AF46)

17

Scorecard: Worldwide Announced M&A

Any UK Involvement Announced (AD32)

11

Scorecard: Worldwide Completed M&A

Any UK Involvement Completed (AF39)

11

Japan Deals Intelligence

18

Top Fifteen Worldwide Announced Deals

Any French Involvement Announced (AD33)

11

Top Ten Japanese Involvement Announced Deals

18

Worldwide Announced (AD1)

Any French Involvement Completed (AF40)

11

Any Japanese Involvement Announced (AD19)

19

Worldwide Completed (AF1)

Any Spanish Involvement Announced (AD34)

12

Any Japanese Involvement Completed (AF23)

19

Any Spanish Involvement Completed (AF41)

12

Americas Deals Intelligence

Any German Involvement Announced (AD35)

12

Top Ten US Announced Deals

Any German Involvement Completed (AF42)

12

Americas M&A

Any Americas Involvement Announced (AD49)

Any Americas Involvement Completed (AF55)

7

7

Any Italian Involvement Announced (AD36)

Any Italian Involvement Completed (AF43)

18

Fairness Opinion Rankings

20

Worldwide Announced Fairness Opinion

20

Any Americas Announced Fairness Opinion

20

Any USAnnounced Fairness Opinion

20

Any EMEA Announced Fairness Opinion

20

Any Asia Pacific Announced Fairness Opinion

20

Any Japanese Announced Fairness Opinion

20

13

13

US Target Announced (AD2)

Any Nordic Involvement Announced (AD37)

13

US Target Completed (AF2)

Any Nordic Involvement Completed (AF44)

13

Any US Involvement Announced (AD41)

Any Benelux Involvement Announced (AD40)

14

Any US Involvement Completed (AF48)

Any Benelux Involvement Completed (AF47)

14

Any Canadian Involvement Announced (AD42)

Any Canadian Involvement Completed (AF49)

Asia Pacific (ex-Japan) M&A

Japan M&A

Criteria Summary

21

15

Mergers & Acquisitions Criteria Summary

21

Asia Pacific (ex-Japan) Deals Intelligence

15

Regional Contacts

21

Top Ten Any Asia (ex-Japan) Involvement Announced Deals

15

European Deals Intelligence

Any Asia (ex-Japan) Involvement Announced (AD25)

16

Top Ten European Involvement Announced Deals

Any Asia (ex-Japan) Involvement Completed (AF32)

16

Any EMEA Involvement Announced (AD47)

10

Any Australian Involvement Announced (AD24)

16

Any EMEA Involvement Completed (AF53)

10

Any Australian Involvement Completed (AF31)

16

EMEA M&A

Thomson ONE for Investment Banking

About Thomson Reuters

22

22

https://www.thomsonone.com

Full Year 2010

FINANCIAL ADVISORS

MERGERS & ACQUISITIONS REVIEW

Worldwide M&A Up 23% to US$2.4 trillion l Emerging Markets Drive 33% of M&A l Goldman Sachs Tops Rankings l Estimated Advisory Fees Up 29%

Global Deals Intelligence

Worldwide Completed M&A by Region - Imputed Fees

WORLDWIDE M&A UP 23%, STRONGEST QUARTER SINCE Q308 - The value of worldwide M&A totalled

US$2.4 trillion during full year 2010, a 22.9% increase from comparable 2009 levels and the strongest full year

period for M&A since 2008. By number of deals, M&A activity is up 3% compared to last year with over 40,000

announced deals. Fourth quarter M&A activity increased 21.2% over the fourth quarter of 2009, to US$716.2

billion, the largest quarter for worldwide M&A since the third quarter of 2008.

Americas

$7

Emea

Asia Pacific (ex Central Asia)

$6

COMPLETED ADVISORY FEES UP 29% - According to estimates from Thomson Reuters/Freeman Consulting,

M&A advisory fees from completed transactions totalled US$29.2 billion for full year 2010, a 29.3% increase from

the comparable period in 2009. Deal activity in the Americas accounted for 51.4% of the worldwide fee pool, while

Europe, Middle East and Africa accounted for 31.3%. Asia Pacific and Japan contributed 14.1% and 4.2%,

respectively.

Japan

$5

Imputed Fees (US$b)

EMERGING MARKETS ACCOUNT FOR 33% OF M&A - M&A involving companies located in the emerging

markets totalled US$806.3 billion during full year 2010, a 76.2% increase over 2009. For full year 2010, emerging

markets M&A accounted for a record-setting 33.1% of worldwide M&A volume compared to 18.8% during the

comparable period in 2009. Cross Border M&A activity totalled US$952.5 billion during full year 2010, accounting

for 39.1% of overall M&A volume, compared to 27.6% last year at this time. Cross border M&A was driven by tripledigit year-over-year growth in the Materials, Financials and Retail sectors.

RESOURCES, FINANCIALS LEAD ACTIVITY - The Energy and Power sector was most active during full year

2010, commanding 20.6% of announced M&A, while the Financials and Materials sectors accounted for 15.2%

and 10.8% of M&A activity, respectively. Deals in the Financials, Healthcare and Industrials sectors were the only

sectors to experience year-over-year percentage declines over full year 2009.

$4

$3

$2

$1

PRIVATE EQUITY M&A UP 89% OVER 2009 - Worldwide private equity-backed M&A activity totalled US$225.4

billion during full year 2010, the biggest year for global buyout activity since 2008. Accounting for 9% of worldwide

announced M&A during 2010, private equity-backed M&A increased 89.2% compared to full year 2009.

$0

1Q07

Worldwide Volume by Deal Status

$1,800

Pending

2Q07

3Q07

4Q07

1Q08

Completed

Withdrawn

$300

70%

% of Withdrawn to Completed

4Q08

1Q09

2Q09

3Q09

4Q09

1Q10

2Q10

3Q10

4Q10

Q3 Volume (US$b)

7.0%

59.3%

60%

8%

Q4 Volume (US$b)

7%

Q2 Volume (US$b)

$250

6.2%

Q1 Volume (US$b)

$1,400

6.2%

6%

% of YTD Global M&A

50%

5.1%

$200

29.6%

28.4%

24.4%

23.5%

21.8%

20.4%21.2%

18.8%

16.0%

16.5%

14.7%

$400

22.8%

9.3%

4.3%

9.7%

7.5%

10%

10

4Q10

10

3Q10

10

2Q10

10

1Q10

09

4Q09

09

3Q09

09

2Q09

09

1Q09

08

4Q08

08

3Q08

08

2Q08

08

1Q08

07

4Q07

07

3Q07

07

2Q07

07

1Q07

06

4Q06

06

3Q06

06

2Q06

1Q06

06

4%

3.2%

2.8%

$100

3%

2.6%

2.2%

2%

$50

1%

$0

0%

$0

4.2%

$150

20%

15.6%15.7%

13.5%

$200

30%

5%

4.7%

% of Global M&A

30.5%

$800

Rank Value (US$b)

40%

$1,000

% of Global Volume

$1,200

Rank Value (US$b)

3Q08

Worldwide Unsolicited Bids

$1,600

$600

2Q08

0%

2000

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010

https://www.thomsonone.com

Full Year 2010 | Mergers & Acquisitions | Financial Advisors

Mergers & Acquisitions

Scorecard: Worldwide Announced M&A

Target Region/Nation

1/1/2010 - 12/31/2010

Rank Val

No.

US$m

Deals

Worldwide

2,434,203.6

Americas

1,136,282.8

Caribbean

18,470.8

52,954.4

Central America

Mexico

47,836.1

North America

921,194.8

United States

821,552.1

Canada

99,642.7

143,662.8

South America

Brazil

104,173.8

15,397.4

Chile

Africa/Middle East

91,010.6

30,265.3

Middle East

9,156.3

North Africa

43,670.7

Sub-Saharan Africa

Europe

641,020.6

Eastern Europe

117,664.0

523,356.7

Western Europe

United Kingdom

162,881.5

Spain

62,820.6

52,067.5

France

Asia-Pacific

482 008 5

482,008.5

Australasia

143,447.3

Australia

131,685.6

Papua New Guinea

8,782.9

South East Asia

85,849.2

Indonesia

40,328.4

16,370.1

Malaysia

214,503.2

North Asia

131,120.8

China

Hong Kong

36,999.0

South Asia

38,208.9

7,918.2

Central Asia

Japan

83,881.1

Worldwide Announced M&A by Target Industry

Scorecard: Worldwide Completed M&A

1/1/2009 - 12/31/2009

Rank Val

No.

US$m

Deals

40,660

12,013

215

335

261

10,080

7,789

2,291

1,383

597

170

1,143

470

138

483

14,779

4,766

10,013

2,301

924

1,291

10 564

10,564

2,057

1,851

12

2,486

680

436

4,866

3,093

677

1,155

52

2,161

1,980,347.2

921,679.9

6,490.1

7,111.3

5,106.0

815,259.8

719,362.0

95,897.8

92,818.7

65,438.8

2,153.2

49,288.8

11,654.9

9,794.8

17,456.1

580,985.4

52,260.4

528,725.1

159,973.4

59,131.1

80,585.1

323 502 6

323,502.6

56,647.8

54,837.0

182.0

44,098.6

6,257.3

14,659.9

202,836.6

108,746.3

34,433.1

19,919.6

10,383.0

104,890.5

% Change

in Rank

Value

39,481

11,776

178

252

185

10,206

7,817

2,389

1,140

442

138

1,010

371

100

460

13,825

4,316

9,509

2,155

824

1,259

10 386

10,386

1,986

1,783

20

2,318

751

381

4,848

2,710

800

1,234

79

2,484

22.9

23.3

184.6

644.7

836.9

13.0

14.2

3.9

54.8

59.2

615.1

84.6

159.7

-6.5

150.2

10.3

125.1

-1.0

1.8

6.2

-35.4

49 0

49.0

153.2

140.1

4,725.8

94.7

544.5

11.7

5.8

20.6

7.5

91.8

-23.7

-20.0

Target Region/Nation

Worldwide

Americas

Caribbean

Central America

Mexico

North America

United States

Canada

South America

Brazil

Chile

Africa/Middle East

Middle East

North Africa

Sub-Saharan Africa

Europe

Eastern Europe

Western Europe

United Kingdom

Germany

France

Asia-Pacific

Australasia

Australia

New Zealand

South East Asia

Singapore

Thailand

North Asia

China

Hong Kong

South Asia

Central Asia

Japan

1/1/2010 - 12/31/2010

No.

Rank Val

Deals

US$m

1,838,870.7

916,201.6

7,377.8

49,687.6

44,844.8

764,154.7

687,156.8

76,998.0

94,981.5

67,142.5

10,327.6

57,529.3

14,745.6

11,863.9

22,797.8

483,645.3

45,171.7

438,473.6

146,423.8

46,706.0

45,569.5

273 384 8

273,384.8

77,378.1

66,662.3

8,797.6

40,371.5

12,863.5

9,686.3

134,257.6

55,383.1

31,020.6

21,377.6

8,122.0

108,109.8

29,896

9,241

126

195

145

7,978

6,496

1,482

942

420

138

668

319

74

240

12,225

4,040

8,185

1,950

1,052

1,214

5 984

5,984

1,494

1,336

8

1,637

282

495

2,121

912

717

732

35

1,778

1/1/2009 - 12/31/2009

Rank Val

No.

US$m

Deals

1,822,391.2

926,233.6

5,692.9

2,253.9

1,846.1

816,344.4

731,653.7

84,690.7

101,942.5

79,008.3

5,364.4

37,904.1

8,168.5

5,499.6

15,135.9

587,561.8

44,618.8

542,942.9

178,087.4

74,026.8

37,294.4

203 886 2

203,886.2

52,968.1

50,750.4

395.3

41,011.0

12,560.6

5,012.7

91,336.4

48,099.0

24,183.6

18,570.7

9,100.1

66,805.6

29,992

9,147

120

138

96

8,104

6,504

1,600

785

331

132

621

245

69

259

11,642

3,681

7,961

1,836

1,031

1,060

6 243

6,243

1,464

1,300

11

1,665

263

611

2,341

983

882

773

48

2,339

% Change

in Rank

Value

0.9

-1.1

29.6

2,104.5

2,329.2

-6.4

-6.1

-9.1

-6.8

-15.0

92.5

51.8

80.5

115.7

50.6

-17.7

1.2

-19.2

-17.8

-36.9

22.2

34 1

34.1

46.1

31.4

2,125.6

-1.6

2.4

93.2

47.0

15.1

28.3

15.1

-10.7

61.8

3%

Date Effective

6/16/2010

Pending

Pending

Pending

Pending

11/1/2010

Intended

10/3/2010

10/4/2010

Pending

8/27/2010

Pending

2/17/2010

Pending

6/8/2010

Target (% Sought/Acquired)

Carso Global Telecom SAB de CV (100%)

GDF Suez Energy International (100%)

Qwest Commun Intl Inc (100%)

Weather Investments Srl (100%)

Genzyme Corp (100%)

American Life Insurance Co Inc (100%)

British Sky Bdcstg Grp PLC (60.9%)

Coca-Cola Entr Inc-NA Bus (100%)

Coca-Cola Enterprises Inc (100%)

Zain Group (51%)

Smith International Inc (100%)

Alcon Inc (24.6%)

The Williams Cos Inc-Gas (100%)

Plus Expressways Bhd (100%)

Zain Africa BV (100%)

20%

5%

7%

7%

15%

8%

8%

11%

9%

Energy and Power

Financials

Materials

Industrials

Healthcare

Telecommunications

Real Estate

High Technology

Consumer Staples

Media and Entertainment

Consumer Products and Services

Retail

Government and Agencies

Top Fifteen Worldwide Announced Deals

Rank Date

1/13/2010

8/10/2010

4/22/2010

10/4/2010

8/29/2010

3/8/2010

6/15/2010

2/25/2010

10/4/2010

9/30/2010

2/21/2010

1/4/2010

1/19/2010

12/20/2010

2/15/2010

2%

4%

Jan 1 2010 Dec 31 2010

Acquiror

America Movil SAB de CV

International Power PLC

CenturyLink Inc

VimpelCom Ltd

Sanofi-Aventis SA

MetLife Inc

News Corp

Coca-Cola Co

Coca-Cola Enterprises Inc

Etisalat

Schlumberger Ltd

Novartis AG

Williams Partners LP

Jelas Ulung Sdn Bhd

Bharti Airtel Ltd

Acquiror / Target Nation

Mexico / Mexico

United Kingdom / United States

United States / United States

Russian Fed / Italy

France / United States

United States / United States

United States / United Kingdom

United States / United States

United States / United States

Utd Arab Em / Kuwait

United States / United States

Switzerland / Switzerland

United States / United States

Malaysia / Malaysia

India / Nigeria

Rank Value (US$m)

27,483.4

25,090.2

22,170.2

20,655.4

19,259.8

16,053.8

13,730.4

13,440.7

13,091.5

13,028.4

12,223.6

12,144.4

11,750.4

10,954.5

10,700.0

Target Macro / Mid Industry

Telecommunications / Telecommunications Services

Energy and Power / Power

Telecommunications / Telecommunications Services

Telecommunications / Telecommunications Services

Healthcare / Biotechnology

Financials / Insurance

Media and Entertainment / Cable

Consumer Staples / Food and Beverage

Consumer Staples / Food and Beverage

Telecommunications / Wireless

Energy and Power / Oil & Gas

Healthcare / Healthcare Equipment & Supplies

Energy and Power / Oil & Gas

Industrials / Transportation & Infrastructure

Telecommunications / Wireless

https://www.thomsonone.com

Full Year 2010 | Mergers & Acquisitions | Financial Advisors

Worldwide Rankings

Worldwide Announced (AD1)

Financial Advisor

Goldman Sachs & Co

Morgan Stanley

JP Morgan

Credit Suisse

Deutsche Bank AG

UBS

Bank of America Merrill Lynch

Citi

Lazard

Barclays Capital

Rothschild

BNP Paribas SA

Nomura

Societe Generale

HSBC Holdings PLC

Evercore Partners

Macquarie Group

Blackstone Group LP

Greenhill & Co, LLC

Perella Weinberg Partners LP

RBC Capital Markets

Santander

Jefferies & Co Inc

Standard Chartered PLC

Houlihan Lokey

Industry Total

Jan 1 2010 Dec 31 2010

Rank Value per Advisor (US$m)

Market

Rank Value Market

2010 2009

Rank Rank

US$m Sh (%) Share Ch.

-3.6

1

554,549.0

22.8

2

1

22.1

-6.2

2

538,058.3

3

440,127.3

-5.7

3

18.1

4

6

412,764.2

17.0

2.1

5

7

341,779.6

14.0

-0.6

329,451.9

13.5

6

8

-1.0

5

293,119.0

12.0

-4.3

7

8

4

279,567.1

11.5

-11.4

11.3

-0.5

275,745.5

10

9

-3.4

257,750.7

10

9

10.6

155,630.4

6.4

-4.2

11

11

128,592.9

5.3

2.3

12

20

16

120,366.6

4.9

1.2

13

98,789.4

28

14

2.2

4.1

15

17

81,423.8

3.3

-0.2

16

12

80,610.9

3.3

-6.7

35

1.7

17

75,870.6

3.1

18

19

75,337.3

3.1

-0.1

19

31

72,655.9

3.0

1.3

30

64,463.0

20

2.7

0.9

21

15

59 860 1

59,860.1

25

2.5

-1.3

13

22

22

54,935.6

2.3

-0.2

23

18

44,244.7

1.8

-1.7

1.7

40,631.4

1.2

24

53

1.5

25

14

-2.4

36,643.8

2,434,203.6

100.0

Industry % Change from Same Period Last Year

Industry % Change from Last Quarter

22.9%

12.4%

# of Deals per Advisor

# of Market Change in

Deals Sh ($) # of Deals

0.9 +54

370

394

1.0 +80

320

0.8 +8

318

0.8 +48

259

0.6 +29

288

0.7 +27

241

0.6 +36

204

0.5 -15

0.7 +34

277

159

0.4 +61

0.6 +1

261

125

0.3

-4

-1

0.4

171

46

0.1 +16

-1

0.2

80

0.1 +6

38

139

0.3 +21

44

0.1 +21

61

0.2 +16

25

0.1 +10

135

0 3 +24

0.3

0.1 +17

56

118

0.3 +32

36

0.1 +1

154

-2

0.4

40,660

+1,179

3.0%

0.3%

Worldwide Completed (AF1)

Jan 1 2010 Dec 31 2010

Rank Value per Advisor (US$m)

Rank Value Market

Market

2010 2009

Rank Rank

US$m Sh (%) Share Ch.

1

3

432,282.1

23.5

-7.0

-14.9

19.5

1

357,620.7

2

18.9

3

7

347,882.5

2.2

4

5

321,789.9

17.5

-6.9

5

2

313,130.3

17.0

-13.6

2.5

6

10

264,362.9

14.4

7

247,470.2

13.5

-3.6

6

243,555.1

13.2

-3.3

8

8

9

4

232,831.4

12.7

-13.7

10

9

187,555.1

10.2

-5.1

11

11

118,208.5

6.4

-5.2

28

86,845.2

4.7

2.0

12

13

15

-0.4

84,542.5

4.6

14

26

82,749.1

4.5

1.6

15

12

79,257.2

4.3

-5.6

16

13

72,545.1

4.0

-5.7

39

66,983.5

3.6

2.2

17

18

27

60,956.6

3.3

0.5

19

-0.3

21

51,740.1

2.8

20

19

2.8

-1.0

50,798.4

21

48

50 160 7

50,160.7

27

2.7

20

2.0

22

17

46,846.2

2.6

-1.9

18

23

46,497.9

2.5

-1.4

50

24

43,279.7

1.7

2.4

32

40,621.7

25

2.2

-0.1

1,838,870.7

100.0

Financial Advisor

Goldman Sachs & Co

Morgan Stanley

Credit Suisse

JP Morgan

Citi

Barclays Capital

UBS

Deutsche Bank AG

Bank of America Merrill Lynch

Lazard

Rothschild

HSBC Holdings PLC

Greenhill & Co, LLC

Nomura

Evercore Partners

BNP Paribas SA

Jefferies & Co Inc

Houlihan Lokey

Blackstone Group LP

RBS

Centerview Partners LLC

Santander

RBC Capital Markets

Mizuho Financial Group

Perella Weinberg Partners LP

Industry Total

Industry % Change from Same Period Last Year

Industry % Change from Last Quarter

0.9%

9.1%

# of Deals per Advisor

# of Market Change in

Deals Sh (%) # of Deals

319

1.1 +69

324

1.1 +79

0.8 +11

238

0.9

-1

268

179

0.6 -26

131

0.4 +51

228

0.8 +7

0.7

-3

209

197

0.7

-9

241

0.8 +31

227

0.8

-6

71

0.2 +11

0.2 +9

48

162

0.5 +28

34

0.1 +3

99

0.3 -15

104

0.3 +36

152

0.5 +21

36

0.1 +17

57

0.2 -12

13

0 0 +9

0.0

44

0.1 +3

0.4 +26

121

0.4

-4

121

22

0.1 +13

29,896

-96

-0.3%

-6.4%

Imputed Fees (US$m)

Advisor Market

Market

Fees Sh (%) Share Ch.

1,961.1

6.7

0.9

1,431.8

4.9

0.4

1,035.8

3.5

0.3

1,361.9

4.7

0.5

722.5

2.5

0.4

720.5

2.5

0.6

843.8

2.9

0.1

2.7

0.1

792.6

0.7

879.1

3.0

851.8

2.9

0.1

2.4

702.8

0.3

178.3

0.6

0.0 213.4

0.7

0.1

278.2

1.0

0.1

0.6

0.1

172.7

247.0

0.2

0.9

324.6

1.1

0.4

1.0

0.0 289.5

0.6

0.3

159.8

148.4

0.5

0.2

81 9

81.9

03

0.3

02

0.2

0.3

97.8

0.3

303.4

0.1

1.0

135.1

0.5

0.0 0.3

139.2

0.5

29,230.4

100.0

29.3%

12.3%

* tie

Top Worldwide Announced M&A Advisors by Target Industry

Energy and Power

Goldman Sachs & Co

Morgan Stanley

JP Morgan

Financials

Morgan Stanley

Deutsche Bank AG

Goldman Sachs & Co

Materials

Goldman Sachs & Co

Credit Suisse

Bank of America Merrill Lynch

Industrials

JP Morgan

UBS

Goldman Sachs & Co

Healthcare

Goldman Sachs & Co

Credit Suisse

JP Morgan

501,345.1

137,139.1

108,041.3

92,196.4

370,945.4

80,919.1

78,197.3

66,747.9

260,915.6

48,607.5

38,191.0

36,251.7

221,607.6

51,678.8

48,813.3

41,408.5

182,294.7

70,611.4

56,503.4

47,579.1

Mkt.

Rank Share

1

2

3

27.3

21.5

18.3

1

2

3

21.9

21.2

18.1

1

2

3

18.8

14.8

14.0

1

2

3

23.5

22.2

18.9

1

2

3

38.9

31.1

26.2

Top Worldwide Announced M&A Advisors by Transaction Size (AD1)

No.

Deals

3,512

60

50

54

5,126

83

63

56

5,835

48

42

27

5,635

22

27

22

2,166

38

19

36

Jan 1 2010 - Dec 31 2010

Qwest Commun/CenturyLink

$600

GDF Suez/International Power

Carso Global/America Movil

$500

Weather Investments/VimpelCom

Other Top 15 Deals

$400

Rank Value (US$b)

Rank Val

US$m

All Other Transactions

$300

$200

$100

$0

Goldman

Sachs & Co

Morgan

Stanley

JP Morgan

Credit Suisse

Deutsche

Bank AG

UBS

Bank of

America

Merrill Lynch

Citi

Lazard

Barclays

Capital

https://www.thomsonone.com

Full Year 2010 | Mergers & Acquisitions | Financial Advisors

Worldwide M&A Matrix

Exit Multiple Matrix - Year to Date Average Rank Value / EBITDA

2010 UP

2010 DOWN

World

Americas

USA

Canada

EMEA

Europe

UK

Asia ex. Japan

Japan

2009

Consumer Products and Services

12.5x

11.4x

12.1x

13.1x

12.5x

11.4x

5.8x

13.0x

11.4x

13.1x

11.5x

9.3x

10.2x

12.3x

11.9x

11.8x

11.9x

Consumer Staples

10.1x

10.7x

11.0x

11.6x

10.1x

10.7x

9.0x

3.2x

10.9x

10.7x

11.0x

7.4x

7.2x

7.6x

9.9x

11.0x

5.3x

11.0x

Energy and Power

12.2x

9.5x

13.0x

6.4x

12.2x

9.5x

13.5x

6.0x

11.1x

9.5x

11.2x

11.6x

12.4x

18.4x

12.5x

12.9x

11.4x

12.9x

Healthcare

12.3x

11.2x

11.3x

9.8x

12.3x

11.2x

3.8x

0.6x

14.8x

11.2x

15.1x

12.6x

6.9x

12.9x

16.6x

13.2x

7.8x

13.2x

High Technology

12.1x

10.8x

14.5x

13.8x

12.1x

10.8x

12.1x

11.8x

11.6x

10.8x

12.0x

9.8x

12.5x

10.6x

11.6x

11.6x

11.4x

11.6x

Industrials

10.5x

10.5x

10.6x

8.1x

10.5x

10.5x

6.1x

7.6x

9.9x

10.5x

9.8x

10.3x

8.2x

12.1x

12.5x

12.2x

6.0x

12.2x

Materials

11.5x

10.8x

11.7x

14.4x

11.5x

10.8x

15.6x

12.5x

13.0x

10.8x

14.2x

14.0x

24.7x

12.7x

11.0x

9.7x

7.3x

9.7x

Media and Entertainment

10.7x

10.1x

9.4x

10.7x

10.7x

10.1x

4.3x

6.0x

11.1x

10.1x

11.0x

9.5x

8.0x

8.0x

12.4x

11.5x

8.5x

11.5x

Real Estate

20.6x

15.3x

24.5x

15.8x

20.6x

15.3x

19.2x

11.6x

26.2x

15.3x

27.5x

19.5x

27.7x

15.9x

15.9x

12.9x

17.1x

12.9x

Retail

10.8x

11.6x

13.5x

12.4x

10.8x

11.6x

8.9x

11.9x

10.8x

11.6x

10.6x

9.6x

13.4x

10.2x

13.1x

15.1x

8.6x

15.1x

8.2x

9.5x

10.2x

8.7x

8.2x

9.5x

5.7x

6.8x

9.5x

7.0x

8.4x

11.5x

20.6x

10.2x

11.2x

9.3x

11.2x

11.7x

10.9x

12.4x

11.1x

11.7x

10.9x

13.0x

8.6x

11.9x

10.9x

12.0x

10.9x

11.8x

11.4x

12.1x

11.6x

9.3x

11.6x

Telecommunications

Average Industry Total

Bid Premium Matrix - Year to Date Average Premium to 4 Week Stock Price

2010 UP

2010 DOWN

World

Americas

USA

Canada

EMEA

Europe

UK

Asia ex. Japan

Japan

2009

Consumer Products and Services

32.6

33.9

40.1

29.4

40.1

29.8

Consumer Staples

28.0

28.3

27.6

43.2

25.8

47.1

1.0

27.4

33.3

31.1

33.3

31.5

22.7

31.4

32.1

38.2

26.1

25.4

26.1

25.8

89.2

44.1

19.4

19.1

52.7

Energy and Power

25.0

37.0

29.0

39.2

29.2

32.9

33.7

31.1

41.8

24.2

30.9

23.7

30.9

37.1

34.1

14.7

36.3

1.9

Financials

29.7

23.6

45.0

21.2

44.9

20.4

41.9

31.2

30

23.6

25.1

25.1

24.6

40.7

25.6

21.7

20.2

26.6

31.2

Healthcare

35.1

30.9

40.6

32.8

41.3

High Technology

26.7

32.2

35.8

41.5

36.7

33.1

25.1

31.3

34.6

22.9

35.0

22.9

63.4

26.6

23.5

29.9

19.3

21.7

42.4

34.4

41.6

22.7

26.8

21.4

26.1

29.5

27.7

24.3

27.3

22.5

Industrials

24.9

31.0

38.1

46.0

36.0

35.3

50.1

31.9

53.9

26.0

29.4

26.0

28.8

39.8

25.1

19.4

18

25.9

Materials

31.2

35.2

35.2

39.2

40.1

40.4

49.7

34.3

38.3

28.5

21.1

30.1

21.8

33.6

41.2

21.8

23.4

32.3

Media and Entertainment

26.9

29.6

36.6

56.3

33.0

40.1

24.6

13.0

23.3

24.3

42.5

22.7

42.5

37.2

29.9

25.5

15.9

24.1

Real Estate

24.9

30.7

30.8

36.7

32.6

21.8

38.2

33.8

23.7

28.4

26.3

31.4

27

33.6

32.9

19.3

30.6

24.2

Retail

28.8

33.1

24

25.1

22.3

30.9

29.4

3.4

11.7

36.4

35

38.3

35

31.2

43.4

13.1

37.1

37.8

35.9

Telecommunications

31.2

Average Industry Total

28.9

30.5

40.1

37.1

49.4

40.2

33.4

50

14.4

29.3

14.4

30.4

18.8

25

26.4

22.5

47.8

32.7

31.5

35.8

35.0

37.9

33.0

33.2

38.8

26.6

27.9

27.0

28

38.0

30.7

21.2

24.4

30.2

36.4

*Using the valuations matrix you can analyze the average rank value to EBITDA and average premium to 4 week stock price prior to announcement by nation/region, which is indicated in the top row and broken down by

target macro industries. The data given refers to the time period 01/01/2010 - 12/31/2010. The figures in red indicate a decline, while green indicates an increase, compared to the figures from the same time period last year

listed in black. Additionally, for Rank Value/EBITDA the data is capped at 50x and for average premium to 4 week stock price prior to announcement is capped at 100%. All spinoffs, splitoffs, open market repurchases,

exchange offers and equity carveouts are excluded.

https://www.thomsonone.com

Full Year 2010 | Mergers & Acquisitions | Financial Advisors

Worldwide Announced Rankings* - A Decade in Review

Rank

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010

Goldman Sachs & Co

Morgan Stanley

JP Morgan

Credit Suisse

Deutsche Bank AG

UBS

Bank of America Merrill Lynch

Citi

Lazard

10

Barclays Capital

10

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010

*League Table positions reflect consolidation within the banking sector

https://www.thomsonone.com

Full Year 2010 | Mergers & Acquisitions | Financial Advisors

Americas M&A

US M&A Increases 19% | US Leveraged Deals Accounts for 15% of US Volume | Energy & Power Sector Gains Lead

LBOs as a Percentage of US Targeted Announced M&A

M&A activity with US involvement during 2010 increased 18.5% compared to last year, reaching US$1 trillion. This

represents the first yearly increase since 2007. By number of deals, US M&A activity is up 2.9% compared to last year,

with over 10,000 announced deals.

US LBO transactions largely held onto the M&A market share re-established in the second quarter of 2010, at just under

15% of total value, a level not seen since late 2007. Notable buyout transactions in 2010 included the US$5.3 billion

acquisition of Del Monte Foods by Kohlberg Kravis Roberts & Co LLP, Vestar Capital Partners, and Centerview Partners

Holdings LLC and the US$5.2 billion acquisition of EXCO Resources Inc, by a management-led investor group, comprised

of EXCO's Chief Executive Officer Douglas H. Miller.

Non-LBO

LBO as % of US M&A

35%

$600

30%

$500

25%

$400

20%

$300

15%

$200

10%

$100

5%

$0

0%

1Q02

2Q02

3Q02

4Q02

1Q03

2Q03

3Q03

4Q03

1Q04

2Q04

3Q04

4Q04

1Q05

2Q05

3Q05

4Q05

1Q06

2Q06

3Q06

4Q06

1Q07

2Q07

3Q07

4Q07

1Q08

2Q08

3Q08

4Q08

1Q09

2Q09

3Q09

4Q09

1Q10

2Q10

3Q10

4Q10

M&A activity with Canadian involvement during 2010 increased by 24.6% compared to last year, to US$172.1 billion. The

value of Canadian M&A deals increased in 2010 while volume remained flat

LBO

Rank Value (US$b)

The Energy & Power sector led the market, with deal volume totalling US$230.7 billion, a 28.1% share of US M&A activity

during 2010 and a 155.8% increase compared to last year. Healthcare took the second slot with US$108.3 billion. High

Technology led the market based on number of deals with 1,482 transactions.

40%

$700

% of US M&A

Americas Deals Intelligence

Jan 1 2010 Dec 31 2010

Top 10 US Announced M&A Advisors by Target Industry (AD2)

US Announced Advisors by Target Industry

Rank Val

(US$m)

Energy and Power

Goldman Sachs & Co

Barclays Capital

Morgan Stanley

Healthcare

Goldman Sachs & Co

JP Morgan

Morgan Stanley

High Technology

Goldman Sachs & Co

Morgan Stanley

JP Morgan

Financials

Bank of America Merrill Lynch

Goldman Sachs & Co

Morgan Stanley

100%

90%

% Volume Composition

80%

70%

60%

50%

40%

30%

20%

10%

0%

Goldman Sachs & Morgan Stanley

Co

JP Morgan

Barclays Capital

Credit Suisse

Bank of America

Merrill Lynch

Deutsche Bank

AG

Lazard

Citi

Telecommunications

Retail

Real Estate

Media and Entertainment

Materials

Industrials

High Technology

Healthcare

Government and Agencies

Financials

Energy and Power

Consumer Staples

Consumer Products and Services

UBS

Date Effective

Pending

Pending

Pending

11/1/2010

10/3/2010

10/4/2010

8/27/2010

2/17/2010

11/22/2010

Pending

Rank

Mkt.

Share

1

2

3

43.0

27.5

26.7

1

2

3

45.0

38.3

33.4

1

2

3

38.0

34.6

26.8

1

2

3

42.3

41.2

41.0

No.

Deals

773

29

24

23

740

28

22

11

1,482

27

24

23

902

22

20

22

* tie

Top Ten US Announced Deals

Rank Date

8/10/2010

4/22/2010

8/29/2010

3/8/2010

2/25/2010

10/4/2010

2/21/2010

1/19/2010

9/7/2010

2/11/2010

230,750.4

99,011.9

63,253.8

61,460.5

108,324.6

48,643.5

41,331.5

36,071.4

95,315.2

36,019.9

32,813.5

25,390.7

74,749.1

31,079.5

30,311.0

30,169.5

Jan 1 2010 Dec 31 2010

Target (% Sought/Acquired)

GDF Suez Energy International (100%)

Qwest Commun Intl Inc (100%)

Genzyme Corp (100%)

American Life Insurance Co Inc (100%)

Coca-Cola Entr Inc-NA Bus (100%)

Coca-Cola Enterprises Inc (100%)

Smith International Inc (100%)

The Williams Cos Inc-Gas (100%)

Enterprise GP Holdings LP (100%)

Allegheny Energy Inc (100%)

Acquiror

International Power PLC

CenturyLink Inc

Sanofi-Aventis SA

MetLife Inc

Coca-Cola Co

Coca-Cola Enterprises Inc

Schlumberger Ltd

Williams Partners LP

Enterprise Products Partners

FirstEnergy Corp

Acquiror / Target Nation

United Kingdom / United States

United States / United States

France / United States

United States / United States

United States / United States

United States / United States

United States / United States

United States / United States

United States / United States

United States / United States

Rank Value (US$m)

25,090.2

22,170.2

19,259.8

16,053.8

13,440.7

13,091.5

12,223.6

11,750.4

9,000.5

8,943.9

Target Macro / Mid Industry

Energy and Power / Power

Telecommunications / Telecommunications Services

Healthcare / Biotechnology

Financials / Insurance

Consumer Staples / Food and Beverage

Consumer Staples / Food and Beverage

Energy and Power / Oil & Gas

Energy and Power / Oil & Gas

Energy and Power / Oil & Gas

Energy and Power / Power

https://www.thomsonone.com

Full Year 2010 | Mergers & Acquisitions | Financial Advisors

Americas Rankings

Any Americas Involvement Announced (AD49)

Financial Advisor

Goldman Sachs & Co

Morgan Stanley

JP Morgan

Credit Suisse

Bank of America Merrill Lynch

Barclays Capital

Citi

Deutsche Bank AG

UBS

Lazard

Evercore Partners

Blackstone Group LP

Rothschild

Perella Weinberg Partners LP

Societe Generale

BNP Paribas SA

RBC Capital Markets

Santander

Jefferies & Co Inc

Nomura

Greenhill & Co, LLC

Houlihan Lokey

Banco BTG Pactual SA

HSBC Holdings PLC

BMO Capital Markets

Industry Total

Rank Value per Advisor (US$m)

Rank Value Market

Market

2010 2009

Rank Rank

US$m Sh (%) Share Ch.

1

2

378,991.2

28.2

-5.2

2

1

338,053.8

25.2

-8.5

3

3

323,667.6

24.1

-5.9

4

8

293,684.3

21.9

8.5

5

6

224,187.5

16.7

-4.8

6

5

215,187.8

16.0

-8.0

7

4

189,738.7

14.1

-12.0

8

10

182,033.7

13.6

4.1

9

12

173,085.0

12.9

3.6

10

9

129,642.1

9.7

-3.1

11

7

76,847.6

5.7

-12.6

12

16

71,582.3

5.3

-0.6

13

11

70,897.1

5.3

-4.1

14

25

63,971.1

4.8

2.4

15

33

57,951.2

4.3

3.3

16

28

53,992.9

4.0

2.1

17

14

50,358.8

3.8

-2.8

18

26

47,814.5

3.6

1.2

19

15

43,691.5

3.3

-2.8

20

32

42,393.4

3.2

2.0

21

23

39,342.2

2.9

0.4

22

13

35,746.0

2.7

-4.3

23

36

34,759.8

2.6

1.7

24

22

33,896.0

2.5

-0.5

25

35

33,322.6

2.5

1.5

1 342 366 2 100.0

1,342,366.2

100 0

Industry % Change from Same Period Last Year

Industry % Change from Last Quarter

23.9%

8.5%

US Target Announced (AD2)

Financial Advisor

Goldman Sachs & Co

Morgan Stanley

JP Morgan

Barclays Capital

Credit Suisse

Bank of America Merrill Lynch

Deutsche Bank AG

Lazard

Citi

UBS

Blackstone Group LP

Evercore Partners

Perella Weinberg Partners LP

BNP Paribas SA

Societe Generale

Jefferies & Co Inc

Greenhill & Co, LLC

Tudor Pickering & Co LLC

Nomura

Rothschild

Houlihan Lokey

Ondra Partners

Centerview Partners LLC

HSBC Holdings PLC

Allen & Co Inc

Industry Total

Jan 1 2010 Dec 31 2010

Industry % Change from Same Period Last Year

Industry % Change from Last Quarter

# of Deals per Advisor

# of Market Change in

Deals Sh (%) # of Deals

250

1.7 +76

216

1.5 +42

198

1.4 +16

206

1.4 +66

186

1.3 +57

128

0.9 +49

124

0.8

-9

130

0.9 +34

1.1 +41

156

134

0.9 +1

32

0.2 +2

37

0.3 +15

96

0.7

-3

22

0.2 +10

10

0.1 +2

29

0.2 -13

118

0.8 +19

44

0.3 +14

108

0.7 +41

26

0.2 +3

37

0.3 +5

138

0.9 +4

56

0.4 +48

29

0.2 +9

60

0.4 +6

14 636

14,636

+591

Financial Advisor

Goldman Sachs & Co

Credit Suisse

Morgan Stanley

Barclays Capital

JP Morgan

Citi

Bank of America Merrill Lynch

Deutsche Bank AG

UBS

Lazard

Evercore Partners

Jefferies & Co Inc

Houlihan Lokey

Rothschild

HSBC Holdings PLC

Centerview Partners LLC

Blackstone Group LP

Santander

Greenhill & Co, LLC

RBC Capital Markets

Perella Weinberg Partners LP

Tudor Pickering & Co LLC

Moelis & Co

CIBC World Markets Inc

Allen & Co Inc

Industry Total

4.2%

-4.5%

Industry % Change from Same Period Last Year

Industry % Change from Last Quarter

Jan 1 2010 Dec 31 2010

Rank Value per Advisor (US$m)

Rank Value Market

Market

2010 2009

Rank Rank

US$m Sh (%) Share Ch.

1

1

310,239.7

37.8

-2.1

2

2

235,409.7

28.7

-10.4

3

3

229,645.3

28.0

-9.9

4

5

183,127.0

22.3

-5.4

5

9

175,685.0

21.4

11.2

6

7

136,445.8

16.6

-9.3

7

17

108,717.7

13.2

7.5

100,059.1

12.2

8

8

-1.8

9

4

98,469.6

12.0

-18.1

10

14

91,485.1

11.1

4.7

11

11

64,146.9

7.8

-0.8

6

12

58,483.0

7.1

-20.1

13

19

56,515.7

6.9

3.3

14

51

48,842.2

6.0

5.8

15

26

46,676.5

4.9

5.7

36,799.7

4.5

12

16

-4.0

17

20

34,594.4

4.2

1.2

18

33

32,971.0

4.0

3.5

19

35

31,735.4

3.9

3.5

20

10

31,200.8

-5.2

3.8

21

13

26,180.7

3.2

-4.2

22

25,090.2

3.1

3.1

23

21

24,458.8

3.0

0.7

24

48

2.9

23,739.7

2.7

25

25

19,046.5

2.3

1.5

821,552.1 100.0

14.2%

5.6%

Any Americas Involvement Completed (AF55)

# of Deals per Advisor

# of Market Change in

Deals Sh (%) # of Deals

169

2.2 +52

128

1.6 +36

120

1.5 +20

97

1.2 +32

97

1.2 +20

127

1.6 +40

0.7 +5

58

88

1.1

-7

74

1.0

-2

89

1.1 +25

31

0.4 +12

25

0.3

-3

16

0.2 +4

6

0.1 +1

5

0.1 +3

89

1.1 +38

0.3 +1

21

0.5 +28

37

0.1

0

7

0.4 -12

30

119

1.5 +1

1

0.0 +1

0.2 +8

13

7

0.1 +3

7

0.1

-1

7,789

-28

-0.4%

-11.0%

Rank Value per Advisor (US$m)

Rank Value Market

Market

2010 2009

US$m Sh (%) Share Ch.

Rank Rank

1

2

310,942.5

28.5

-9.4

2

10

245,292.6

22.5

12.1

3

1

221,251.4

20.3

-20.6

4

6

218,985.5

20.1

0.3

5

5

212,753.1

19.5

-4.0

6

4

206,582.1

18.9

-11.6

7

3

173,190.1

15.9

-15.8

8

11

149,269.0

13.7

4.3

9

12

137,499.0

12.6

4.2

10

8

116,662.9

10.7

-0.3

11

7

75,494.0

6.9

-10.3

12

31

66,161.2

6.1

3.9

13

20

60,403.4

5.5

0.6

14

9

55,700.7

5.1

-5.4

15

35

51,171.0

4.7

3.5

16

34

49,660.8

4.6

3.3

17

17

49,002.8

4.5

-0.9

18

27

45,154.1

4.1

1.2

19

13

42,537.4

3.9

-3.8

20

14

38,381.6

3.5

-3.0

21

30

31,755.2

2.9

0.5

22

58

31,094.0

2.9

2.6

23

32

23,955.8

2.2

0.2

24

19

23,866.6

2.2

-2.9

25

48

23,790.1

2.2

1.7

1 090 442 5 100.0

1,090,442.5

100 0

4.3%

29.6%

Jan 1 2010 Dec 31 2010

# of Deals per Advisor

# of Market Change in

Deals Sh (%) # of Deals

216

1.9 +82

154

1.4 +32

169

1.5 +21

105

0.9 +37

180

1.6 +38

111

1.0 -10

155

1.4 +30

114

1.0 +39

129

1.2 +36

132

1.2 +25

28

0.3

0

92

0.8 +37

139

1.2 +29

92

0.8 +13

27

0.2 +11

12

0.1 +8

30

0.3 +12

34

0.3 +4

34

0.3 +9

107

1.0 +24

19

0.2 +15

33

0.3 +25

52

0.5 +15

49

0.4 +15

9

0.1

0

11 182

11,182

+331

3.1%

-6.5%

US Target Completed (AF2)

Financial Advisor

Goldman Sachs & Co

Barclays Capital

JP Morgan

Morgan Stanley

Bank of America Merrill Lynch

Credit Suisse

Citi

Deutsche Bank AG

Lazard

Evercore Partners

UBS

Jefferies & Co Inc

Blackstone Group LP

Greenhill & Co, LLC

Tudor Pickering & Co LLC

Houlihan Lokey

Perella Weinberg Partners LP

Centerview Partners LLC

HSBC Holdings PLC

Allen & Co Inc

Moelis & Co

Guggenheim Securities LLC

Miller Buckfire

RBC Capital Markets

Rothschild

Industry Total

51.3%

17.7%

Jan 1 2010 Dec 31 2010

Rank Value per Advisor (US$m)

Market

Rank Value Market

2010 2009

US$m Sh (%) Share Ch.

Rank Rank

1

2

243,396.0

35.4

-12.6

7

24.6

0.5

2

169,066.3

5

-3.5

3

23.1

158,796.5

128,017.1

18.6

-30.3

4

1

18.6

-18.9

5

3

127,498.6

6

14

122,302.2

17.8

10.1

7

4

15.7

-20.5

107,718.3

11.0

1.3

8

10

75,472.6

9

8

72,904.9

10.6

-3.4

10

6

68,472.9

10.0

-14.3

11

13

64,997.6

9.5

1.0

12

26

63,470.9

9.2

6.6

16

41,767.4

-1.4

13

6.1

14

9

38,159.6

5.6

-4.8

15

37

31,094.0

4.5

4.0

16

17

29,555.9

4.3

-2.5

17

24

29,264.8

4.3

0.9

27

28,242.7

4.1

2.3

18

19

73

24,444.5

3.6

3.5

20

1.7

31

15,643.1

2.3

12,228.1

1.8

-1.0

21

25

22

1.1

34

10,659.1

1.6

23

32

10,275.3

0.9

1.5

24

33

9,773.4

0.9

1.4

25

12

9,008.9

1.3

-7.5

687,156.8 100.0

Industry % Change from Same Period Last Year

Industry % Change from Last Quarter

Imputed Fees (US$m)

Advisor Market

Market

Fees Sh (%) Share Ch.

1,460.4

8.1

1.1

762.4

4.2

0.8

957.4

5.3

0.7

637.8

3.6

0.3

990.5

5.5

0.0 502.7

2.8

0.6

726.5

4.0

0.6

530.9

3.0

1.2

540.8

3.0

0.5

460.6

2.6

0.3

149.9

0.8

0.5

305.0

1.7

0.5

266.1

1.5

0.1

331.1

1.8

0.3

70.0

0.4

0.1

80.4

0.5

0.4

143.7

0.8

0.2

87.4

0.5

0.3

141.1

0.8

0.1

270.9

1.5

0.1

101.9

0.6

0.4

106.2

0.6

0.4

163.3

0.9

0.2

181.6

1.0

0.1

52.1

0.3

0.1

17 980 4 100.0

17,980.4

100 0

-6.1%

46.7%

# of Deals per Advisor

# of Market Change in

Deals Sh (%) # of Deals

149

2.3 +61

87

1.3 +29

107

1.6 +35

1.5 +17

97

111

1.7 +31

77

1.2 +14

68

1.0 +9

55

0.8 +11

87

1.3 +10

25

0.4

-1

68

1.0 +12

78

1.2 +40

27

0.4 +12

21

0.3 +7

33

0.5 +25

1.8 +23

120

16

0.2 +12

10

0.2 +6

10

0.2 +8

7

0.1 +1

46

0.7 +9

0.1 +5

6

14

0.2

0

53

0.8 +14

30

0.5

0

6,496

-8

-0.1%

-7.6%

Imputed Fees (US$m)

Advisor Market

Market

Fees Sh (%) Share Ch.

1,141.3

10.1

1.7

523.9

4.6

0.1

6.2

707.0

1.0

671.6

5.9

1.1

588.8

5.2

0.3

435.6

3.9

0.9

352.3

3.1

0.3

329.1

2.9

1.0

341.1

3.0

0.8

140.1

1.2

0.8

305.6

2.7

0.2

2.4

272.5

1.0

1.2

0.2

134.7

112.6

1.0

0.0 106.2

0.9

0.6

231.4

2.0

0.4

86.5

0.8

0.4

73.4

0.7

0.5

35.7

0.3

0.3

34.5

0.3

0.1

130.6

1.2

0.6

31.2

0.3

0.2

51.2

0.5

0.0 120.0

1.1

0.4

101.8

0.9

0.8

11,322.8 100.0

55.9%

29.5%

* tie

https://www.thomsonone.com

Full Year 2010 | Mergers & Acquisitions | Financial Advisors

Americas Rankings

Any US Involvement Announced (AD41)

Financial Advisor

Goldman Sachs & Co

Morgan Stanley

JP Morgan

Credit Suisse

Barclays Capital

Bank of America Merrill Lynch

Deutsche Bank AG

UBS

Lazard

Citi

Evercore Partners

Blackstone Group LP

Perella Weinberg Partners LP

BNP Paribas SA

Rothschild

Societe Generale

Nomura

Jefferies & Co Inc

Greenhill & Co, LLC

Houlihan Lokey

Tudor Pickering & Co LLC

Centerview Partners LLC

HSBC Holdings PLC

Ondra Partners

RBC Capital Markets

Industry Total

Rank Value per Advisor (US$m)

Rank Value Market

Market

2010 2009

Rank Rank

US$m Sh (%) Share Ch.

34.2

-5.5

1

1

350,392.6

29.0

-9.2

2

2

296,778.5

27.2

3

3

278,130.9

-7.7

20.7

8.0

4

9

211,777.4

5

5

203,348.7

19.9

-7.0

6

7

182,532.2

17.8

-4.8

7

16.0

7.0

12

163,725.7

8

10

136,477.9

13.3

3.3

9

-3.0

8

128,180.4

12.5

10

12.5

-18.9

4

127,637.1

7.5

-15.4

11

6

76,686.6

12

14

71,493.3

7.0

-0.4

3.1

13

62,462.3

6.1

21

4.9

4.6

14

54

50,274.7

15

11

48,813.9

4.8

-4.2

16

47,197.8

3.7

26

4.6

17

23

40,641.8

4.0

2.6

39,510.6

3.9

18

15

-3.4

19

22

38,766.0

3.8

1.2

20

13

35,610.1

3.5

-5.1

21

43

32,971.0

3.2

2.8

22

18

28,624.1

-1.6

2.8

23

19

28,054.8

2.7

-0.6

24

25,090.2

2.5

2.5

25

24

22,815.2

2.2

0.9

1 023 685 1 100.0

1,023,685.1

100 0

Industry % Change from Same Period Last Year

Industry % Change from Last Quarter

18.5%

6.7%

Any Canadian Involvement Announced (AD42)

Financial Advisor

Morgan Stanley

Goldman Sachs & Co

RBC Capital Markets

BMO Capital Markets

CIBC World Markets Inc

JP Morgan

Bank of America Merrill Lynch

TD Securities Inc

Citi

UBS

Scotiabank-Bank of Nova Scotia

Barclays Capital

GMP Capital Corp

Credit Suisse

Deutsche Bank AG

Rothschild

Jefferies & Co Inc

Macquarie Group

Canaccord Genuity

Houlihan Lokey

Moelis & Co

Dundee Securities Corporation

Miller Buckfire

Deloitte

Standard Chartered PLC

Industry Total

Jan 1 2010 Dec 31 2010

Industry % Change from Same Period Last Year

Industry % Change from Last Quarter

24.6%

14.6%

# of Deals per Advisor

# of Market Change in

Deals Sh (%) # of Deals

218

2.1 +60

186

1.8 +45

170

1.6 +23

154

1.5 +54

122

1.2 +49

157

1.5 +45

111

1.1 +24

133

1.3 +36

118

0

1.1

1.0

107

-2

31

0.3 +1

0.3 +14

36

20

0.2 +8

17

0.2 +4

70

0.7

-1

8

0.1 +3

21

0.2

0

104

1.0 +41

36

0.3 +13

136

1.3 +9

37

0.4 +28

17

0.2 +11

20

0.2 +7

1

0.0 +1

70

0.7 +15

10 453

10,453

+296

Financial Advisor

Goldman Sachs & Co

Barclays Capital

JP Morgan

Morgan Stanley

Credit Suisse

Citi

Bank of America Merrill Lynch

Deutsche Bank AG

Lazard

UBS

Evercore Partners

Jefferies & Co Inc

Houlihan Lokey

Centerview Partners LLC

Blackstone Group LP

HSBC Holdings PLC

Greenhill & Co, LLC

Rothschild

Tudor Pickering & Co LLC

Perella Weinberg Partners LP

Moelis & Co

Allen & Co Inc

RBC Capital Markets

Peter J. Solomon Co Ltd

Guggenheim Securities LLC

Industry Total

2.9%

-9.6%

Industry % Change from Same Period Last Year

Industry % Change from Last Quarter

Jan 1 2010 Dec 31 2010

Rank Value per Advisor (US$m)

Rank Value Market

Market

2010 2009

Rank Rank

US$m Sh (%) Share Ch.

1

6

34,130.4

3.8

19.8

2

8

33,759.7

19.6

5.4

3

1

32,154.8

18.7

-26.5

18.0

4

13

31,041.1

12.0

2

28,329.7

16.5

5

-20.8

11

27,198.5

15.8

7.9

6

3

22,872.5

13.3

-10.5

7

8

10

22,534.7

13.1

0.8

15

20,097.7

11.7

6.6

9

16

19,857.0

11.5

6.5

10

4

15,938.2

9.3

-11.8

11

12

5

12,549.2

7.3

-11.1

13

17

12,113.3

7.0

3.1

14

-2.0

12

9,937.6

5.8

15

7

9,139.9

5.3

-9.1

16

14

4.9

-0.7

8,372.6

17

19

6,449.7

3.8

0.5

18

9

4,400.3

2.6

-11.2

19

23

4,167.0

2.4

0.2

20

32

3,991.3

2.3

1.4

2.2

21

111*

3,859.9

2.2

22

73

3,753.6

2.2

2.1

66

3,359.0

2.0

1.9

23

24

91

3,273.8

1.9

1.9

25

46

3,250.0

1.9

1.7

172,077.0 100.0

Any US Involvement Completed (AF48)

Rank Value per Advisor (US$m)

Rank Value Market

Market

2010 2009

Rank Rank

US$m Sh (%) Share Ch.

1

1

295,331.5

34.2

-11.3

2

6

207,107.4

24.0

2.1

3

5

187,822.0

-5.7

21.7

21.4

4

2

185,343.4

-23.5

5

14

177,484.8

20.5

12.9

6

4

154,770.5

17.9

-17.1

3

144,761.9

16.8

-18.6

7

6.0

8

9

131,076.7

15.2

9

8

115,105.6

13.3

0.1

10

112,915.4

13.1

4.3

11

11

7

75,332.9

8.7

-13.1

12

26

66,047.6

7.6

5.1

13

17

60,403.4

7.0

1.0

14

27

49,660.8

5.7

4.1

15

15

48,913.8

5.7

-1.1

16

35

48,514.6

5.6

4.9

17

10

41,961.2

4.9

-4.3

18

13

33,602.6

3.9

-4.0

19

44

31,094.0

3.6

3.2

24

20

30,246.4

3.5

0.5

25

20,986.3

21

2.4

-0.1

22

39

16,465.1

1.9

1.3

23

32

15,408.1

1.8

0.7

24

72

13,377.3

1.6

1.5

25

41

10,659.1

1.2

0.7

864 452 7 100.0

864,452.7

100 0

4.4%

37.3%

Jan 1 2010 Dec 31 2010

# of Deals per Advisor

# of Market Change in

Deals Sh (%) # of Deals

2.3 +78

195

99

1.2 +35

153

1.8 +36

146

1.7 +30

124

1.4 +44

97

1.1 +8

137

1.6 +29

101

1.2 +35

114

1.3 +19

109

1.3 +29

27

0.3

-1

90

1.1 +37

136

1.6 +30

12

0.1 +8

29

0.3 +11

22

0.3 +13

33

0.4 +17

72

0.8 +23

33

0.4 +25

17

0.2 +13

0.6 +12

49

8

0.1

0

64

0.7 +18

6

0.1 +3

6

0.1 +5

8 564

8,564

+238

2.9%

-10.6%

Any Canadian Involvement Completed (AF49)

# of Deals per Advisor

# of Market Change in

Deals Sh (%) # of Deals

27

0.8 +12

24

0.7 +2

58

1.7 +1

44

1.3 +4

52

1.5 +14

-2

13

0.4

19

0.5 +11

55

1.6 +16

8

0.2

0

0.6 +12

21

20

-4

0.6

9

0.3 +4

33

1.0 +3

10

0.3 +1

0.3 +5

10

15

0.4 +3

0.2

-2

8

19

0.5 -25

19

0.5 +5

9

0.3 +2

3

0.1 +2

11

0.3 +5

3

0.1 +1

8

0.2

-3

1

0.0

0

3,460

+6

Financial Advisor

Goldman Sachs & Co

CIBC World Markets Inc

RBC Capital Markets

Morgan Stanley

BMO Capital Markets

UBS

JP Morgan

TD Securities Inc

Bank of America Merrill Lynch

Citi

Barclays Capital

Scotiabank-Bank of Nova Scotia

GMP Capital Corp

Deutsche Bank AG

Rothschild

Credit Suisse

Jefferies & Co Inc

Macquarie Group

Moelis & Co

Houlihan Lokey

FirstEnergy Capital Corp

Miller Buckfire

Standard Chartered PLC

Canaccord Genuity

National Bank Financial Inc

Industry Total

Rank Value per Advisor (US$m)

Rank Value Market

Market

2010 2009

Rank Rank

US$m Sh (%) Share Ch.

1

5.9

9

25,046.0

19.3

2

2

23,866.6

18.4

-21.5

18.3

1

-27.0

3

23,763.8

4

5

22,646.2

17.5

-2.5

5

12

21,579.6

16.6

10.3

6

14.7

16

19,126.9

9.7

7

13

16,784.4

12.9

6.6

8

10

16,571.1

12.8

1.5

9

13,854.0

3

10.7

-13.7

10

15

9.9

4.7

12,861.7

11

7

11,477.2

8.8

-9.0

12

4

11,117.1

8.6

-12.4

13

18

10,209.4

7.9

4.3

14

8

9,322.3

7.2

-7.2

15

14

8,941.4

6.9

1.3

16

11

6,867.9

5.3

-3.1

17

21

5,977.2

4.6

2.3

18

6

4,615.7

3.6

-15.2

3,859.9

19

3.0

3.0

3.0

2.1

20

32

3,855.5

21*

17

3,439.2

2.7

-1.6

2.7

2.7

21*

87

3,439.2

23

48

3,250.0

2.5

2.3

24

26

2,835.2

2.2

0.6

25

19

2,620.3

2.0

-0.9

129,775.6 100.0

0.2%

9.6%

Industry % Change from Same Period Last Year

Industry % Change from Last Quarter

-2.1%

6.8%

Imputed Fees (US$m)

Advisor Market

Market

Fees Sh (%) Share Ch.

1,360.0

9.3

1.1

600.2

4.1

0.1

886.5

6.1

0.2

865.3

5.9

0.9

646.0

4.4

1.5

463.2

3.2

0.3

667.2

4.6

0.8

473.7

3.2

1.3

427.8

2.9

0.7

455.4

3.1

0.3

148.4

1.0

0.6

303.6

2.1

0.7

265.1

1.8

0.2

80.4

0.6

0.4

142.8

1.0

0.2

60.0

0.4

0.1

138.9

1.0

0.2

257.1

1.8

0.1

106.2

0.7

0.4

95.0

0.4

0.7

143.8

1.0

0.4

38.7

0.3

0.1

141.7

1.0

0.3

29.1

0.2

0.1

31.2

0.2

0.1

14 618 0 100.0

14,618.0

100 0

58.9%

21.8%

Jan 1 2010 Dec 31 2010

# of Deals per Advisor

# of Market Change in

Deals Sh (%) # of Deals

22

0.1 +5

49

0.2 +15

50

0.2 +5

18

0.1 +6

38

0.1 +6

0.1 +12

19

15

0.1 +5

48

0.2 +11

13

0.0 +4

6

0.0

0

6

0.0 +3

13

0.0

-6

37

0.1 +16

9

0.0 +4

14

0.0 +3

0.0

0

7

7

0.0 +1

20

0.1 -17

4

0.0 +4

9

0.0 +3

16

0.1

0

4

0.0 +3

1

0.0

0

15

0.1 +2

15

0.1 +3

2,129

-118

-5.3%

5.8%

Imputed Fees (US$m)

Advisor Market

Market

Fees Sh (%) Share Ch.

133.3

4.8

0.9

181.6

6.5

1.0

137.6

2.0

5.0

113.1

4.1

1.0

138.1

5.0

1.7

81.4

2.9

1.7

80.9

2.9

0.7

136.0

4.9

0.9

52.4

1.9

1.1

1.2

0.2

32.7

32.1

1.2

0.6

37.9

1.4

1.0

70.4

2.5

1.0

40.1

1.4

0.3

37.1

1.3

0.1

33.6

1.2

1.0

27.7

1.0

0.0 41.2

1.5

4.1

24.0

0.9

0.9

17.0

0.6

0.1

31.5

1.1

1.1

16.4

0.6

0.6

20.0

0.7

0.6

30.5

1.1

0.1

23.4

0.8

0.1

2,781.2 100.0

45.7%

0.6%

* tie

https://www.thomsonone.com

Full Year 2010 | Mergers & Acquisitions | Financial Advisors

EMEA M&A

EMEA Announced M&A Up 32% While Fees from Completed M&A Up 10% | Financial Sponsor Activity on the Rise | Morgan Stanley Finishes First

European Financial Sponsor Investments

$300

Announced M&A with EMEA involvement totalled US$1.1 trillion during 2010 and represented a 32.3% increase compared to

last year. EMEA fee volumes on deals completed in 2010 reached US$11.9 billion, a 10.3% increase compared to last year,

according to estimates from Thomson Reuters/Freeman Consulting.

$250

Rank Value (US$b)

Buy-side financial sponsor activity involving European targets recovered during 2010 with the announcements of 1,517 deals

worth a combined US$80 billion, an 83.6% increase compared to last year. Financial sponsor activity made up 12.5% of

European deal making activity this year, an increase from the previous year's 7.5%. Onexs US$4.6 billion joint bid with

Canada Pension Investment Board to acquire Tomkins was the largest sponsor-driven deal during 2010. Other notable

sponsor-driven transactions included CVC and ACS's US$3.7 billion purchase of a minority in Abertis and 3i, Morgan Stanley

Infrastructure Partners and Star Capitals joint bid to purchase Eversholt Rail for US$3.4 billion.

Q4 Volume (US$b)

Q3 Volume (US$b)

Q2 Volume (US$b)

Q1 Volume (US$b)

% of Europe

$200

$0

15.9%

12.5%

8.8%

15%

10%

7.5%

4.9%

5%

0%

2000

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010

European Involvement Announced Advisors by Target Industry

Outbound (US$m)

Number of deals

1 800

1,800

$800,000

1,600

$700,000

1,400

$600,000

1,200

$500,000

1,000

$400,000

800

$300,000

600

$200,000

400

$100,000

200

0

Energy and Power

Goldman Sachs & Co

JP Morgan

Morgan Stanley

Financials

Deutsche Bank AG

Morgan Stanley

UBS

Materials

JP Morgan

Credit Suisse

Lazard

Healthcare

Goldman Sachs & Co

Morgan Stanley

JP Morgan

Industrials

JP Morgan

Rothschild

Citi

Rank Val US$m

249,867.0

82,284.7

68,026.5

62,407.6

155,730.9

56,276.4

32,581.5

26,965.3

94,082.4

16,438.2

15,845.2

14,158.0

81,716.5

47,137.1

27,775.9

27,158.8

81,369.0

18,369.2

17,399.5

17,192.9

Rank

Mkt

Mkt.

Share

1

2

3

33.5

27.7

25.4

1

2

3

36.9

21.3

17.7

1

2

3

23.9

23.0

20.6

1

2

3

60.9

35.9

35.1

1

2

3

25.8

24.4

24.1

No. Deals

1,552

29

34

20

2,157

37

40

39

1,536

16

22

14

795

11

10

14

2,936

11

33

8

1Q02

2Q02

3Q02

4Q02

1Q03

2Q03

3Q03

4Q03

1Q04

2Q04

3Q04

4Q04

1Q05

2Q05

3Q05

4Q05

1Q06

2Q06

3Q06

4Q06

1Q07

2Q07

3Q07

4Q07

1Q08

2Q08

3Q08

4Q08

1Q09

2Q09

3Q09

4Q09

1Q10

2Q10

3Q10

4Q10

$0

# of Deals

Rank Value (US$m)

17.0%

8.2%

$100

The largest EMEA transaction of the year was International Power's US$25.1 billion reverse takeover of GDF Suez Energy

International which is the largest cross border Energy & Power deal since the 2007 acquisition of Endesa.

Inbound (US$m)

17.0%

12.6%

$50

$900 000

$900,000

20%

16.3%

$150

Cross border activity involving European companies during 2010 totalled US$716.1 billion, a 35.8% increase. This was

largely due to activity by European buyers as outbound investments increased by 57.2% to US$388.1 billion.

Quarterly European Cross Border Volume

25%

21.3%

% of Europe

EMEA Deals Intelligence

Top Ten European Involvement Announced Deals

Rank Date

8/10/2010

10/4/2010

8/29/2010

6/15/2010

1/4/2010

5/10/2010

12/15/2010

7/30/2010

12/20/2010

6/22/2010

Date Effective

Pending

Pending

Pending

Intended

Pending

9/27/2010

Intended

10/29/2010

Pending

Pending

Target (% Sought/Acquired)

GDF Suez Energy International (100%)

Weather Investments Srl (100%)

Genzyme Corp (100%)

British Sky Bdcstg Grp PLC (60.9%)

Alcon Inc (24.6%)

Brasilcel NV (50%)

Capital Shopping Centres Grp (94.9%)

EDF Energy-UK Power Distn Bus (100%)

Sil'vinit (80%)

Bancaja SA (100%)

Jan 1 2010 Dec 31 2010

Acquiror / Target Nation

United Kingdom / United States

Russian Fed / Italy

France / United States

United States / United Kingdom

Switzerland / Switzerland

Spain / Brazil

United States / United Kingdom

Hong Kong / United Kingdom

Russian Fed / Russian Fed

Spain / Spain

Acquiror

International Power PLC

VimpelCom Ltd

Sanofi-Aventis SA

News Corp

Novartis AG

Telefonica SA

Simon Property Grp Inc

Investor Group

Uralkaliy

Caja Madrid

Rank Value (US$m)

25,090.2

20,655.4

19,259.8

13,730.4

12,144.4

9,742.8

9,596.1

9,056.4

8,221.7

8,140.3

Target Macro / Mid Industry

Energy and Power / Power

Telecommunications / Telecommunications Services

Healthcare / Biotechnology

Media and Entertainment / Cable

Healthcare / Healthcare Equipment & Supplies

Telecommunications / Telecommunications Services

Real Estate / Non Residential

Energy and Power / Power

Materials / Metals & Mining

Financials / Banks

https://www.thomsonone.com

Full Year 2010 | Mergers & Acquisitions | Financial Advisors

EMEA Rankings

Any EMEA Involvement Announced (AD47)

Financial Advisor

Morgan Stanley

Goldman Sachs & Co

JP Morgan

Deutsche Bank AG

Credit Suisse

UBS

Lazard

Citi