Académique Documents

Professionnel Documents

Culture Documents

Reliance Industries: Previous Years

Transféré par

Sweta ChakravartyDescription originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Reliance Industries: Previous Years

Transféré par

Sweta ChakravartyDroits d'auteur :

Formats disponibles

Reliance Industries

Previous Years

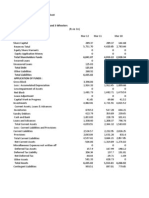

Profit & Loss account

------------------- in Rs. Cr. ------------------Mar '06

Mar '07

Mar '08

Mar '09

Mar '10

12 mths

12 mths

12 mths

12 mths

12 mths

89,124.46

118,353.71

139,269.46

146,328.07

200,399.79

8,246.67

6,654.68

5,463.68

4,369.07

8,307.92

80,877.79

111,699.03

133,805.78

141,959.00

192,091.87

546.96

236.89

6,595.66

1,264.03

3,088.05

2,131.19

654.60

-1,867.16

427.56

3,947.89

83,555.94

112,590.52

138,534.28

143,650.59

199,127.81

59,739.29

80,791.65

98,832.14

109,284.34

153,689.01

1,146.26

2,261.69

2,052.84

3,355.98

2,706.71

978.45

2,094.09

2,119.33

2,397.50

2,330.82

Income

Sales Turnover

Excise Duty

Net Sales

Other Income

Stock Adjustments

Total Income

Expenditure

Raw Materials

Power & Fuel Cost

Employee Cost

Other Manufacturing Expenses

Selling and Admin Expenses

Miscellaneous Expenses

Preoperative Exp Capitalised

668.31

1,112.17

715.19

1,162.98

2,153.67

5,872.33

5,478.10

5,549.40

4,736.60

5,756.44

300.74

321.23

412.66

562.42

651.96

-155.14

-111.21

-175.46

-3,265.65

-1,217.92

68,550.24

91,947.72

109,506.10

118,234.17

166,070.69

Mar '06

Mar '07

Mar '08

Mar '09

Mar '10

12 mths

12 mths

12 mths

12 mths

12 mths

Operating Profit

14,458.74

20,405.91

22,432.52

24,152.39

29,969.07

PBDIT

15,005.70

20,642.80

29,028.18

25,416.42

33,057.12

893.61

1,298.90

1,162.90

1,774.47

1,999.95

14,112.09

19,343.90

27,865.28

23,641.95

31,057.17

3,400.91

4,815.15

4,847.14

5,195.29

10,496.53

Other Written Off

0.00

0.00

0.00

0.00

0.00

Profit Before Tax

10,711.18

14,528.75

23,018.14

18,446.66

20,560.64

0.88

0.51

48.10

0.00

0.00

Total Expenses

Interest

PBDT

Depreciation

Extra-ordinary items

PBT (Post Extra-ord Items)

10,712.06

14,529.26

23,066.24

18,446.66

20,560.64

Tax

1,642.72

2,585.35

3,559.85

3,137.34

4,324.97

Reported Net Profit

9,069.34

11,943.40

19,458.29

15,309.32

16,235.67

Total Value Addition

8,810.95

11,156.07

10,673.96

8,949.83

12,381.68

Preference Dividend

0.00

0.00

0.00

0.00

0.00

1,393.51

1,440.44

1,631.24

1,897.05

2,084.67

195.44

202.02

277.23

322.40

346.24

13,935.08

13,935.08

14,536.49

15,737.98

32,703.74

Equity Dividend

Corporate Dividend Tax

Per share data (annualised)

Shares in issue (lakhs)

Earning Per Share (Rs)

65.08

85.71

133.86

97.28

49.64

Equity Dividend (%)

100.00

110.00

130.00

130.00

70.00

Book Value (Rs)

324.03

439.57

542.74

727.66

392.51

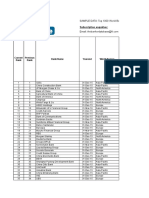

Reliance Industries

Previous Years

Balance Sheet

------------------- in Rs. Cr. ------------------Mar '06

Mar '07

Mar '08

Mar '09

Mar '10

12 mths

12 mths

12 mths

12 mths

12 mths

Total Share Capital

1,393.17

1,393.21

1,453.39

1,573.53

3,270.37

Equity Share Capital

1,393.17

1,393.21

1,453.39

1,573.53

3,270.37

0.00

60.14

1,682.40

69.25

0.00

Sources Of Funds

Share Application Money

Preference Share Capital

Reserves

Revaluation Reserves

0.00

0.00

0.00

0.00

0.00

43,760.90

59,861.81

77,441.55

112,945.44

125,095.97

4,650.19

2,651.97

871.26

11,784.75

8,804.27

49,804.26

63,967.13

81,448.60

126,372.97

137,170.61

7,664.90

9,569.12

6,600.17

10,697.92

11,670.50

Unsecured Loans

14,200.71

18,256.61

29,879.51

63,206.56

50,824.19

Total Debt

21,865.61

27,825.73

36,479.68

73,904.48

62,494.69

Total Liabilities

71,669.87

91,792.86

117,928.28

200,277.45

199,665.30

Mar '06

Mar '07

Mar '08

Mar '09

Mar '10

12 mths

12 mths

12 mths

12 mths

12 mths

Gross Block

84,970.13

99,532.77

104,229.10

149,628.70

215,864.71

Less: Accum. Depreciation

29,253.38

35,872.31

42,345.47

49,285.64

62,604.82

Net Block

55,716.75

63,660.46

61,883.63

100,343.06

153,259.89

6,957.79

7,528.13

23,005.84

69,043.83

12,138.82

Networth

Secured Loans

Application Of Funds

Capital Work in Progress

Investments

Inventories

Sundry Debtors

Cash and Bank Balance

5,846.18

16,251.34

20,516.11

20,268.18

19,255.35

10,119.82

12,136.51

14,247.54

14,836.72

26,981.62

4,163.62

3,732.42

6,227.58

4,571.38

11,660.21

239.31

308.35

217.79

500.13

362.36

Total Current Assets

14,522.75

16,177.28

20,692.91

19,908.23

39,004.19

Loans and Advances

8,266.55

12,506.71

18,441.20

13,375.15

10,517.57

Fixed Deposits

1,906.85

1,527.00

5,609.75

23,014.71

17,073.56

24,696.15

30,210.99

44,743.86

56,298.09

66,595.32

Total CA, Loans & Advances

Deffered Credit

Current Liabilities

0.00

0.00

0.00

0.00

0.00

17,656.02

24,145.19

29,228.54

42,664.81

48,018.65

Provisions

3,890.98

1,712.87

2,992.62

3,010.90

3,565.43

Total CL & Provisions

21,547.00

25,858.06

32,221.16

45,675.71

51,584.08

Net Current Assets

3,149.15

4,352.93

12,522.70

10,622.38

15,011.24

Miscellaneous Expenses

0.00

0.00

0.00

0.00

0.00

Total Assets

71,669.87

91,792.86

117,928.28

200,277.45

199,665.30

Contingent Liabilities

24,897.66

46,767.18

37,157.61

36,432.69

25,531.21

324.03

439.57

542.74

727.66

392.51

Book Value (Rs)

Previous Years

Reliance Industries

Cash Flow

------------------- in Rs. Cr. ------------------Mar '06

Mar '07

Mar '08

Mar '09

Mar '10

12 mths

12 mths

12 mths

12 mths

12 mths

Net Profit Before Tax

10704.06

14520.47

23010.14

18433.23

20547.44

Net Cash From Operating Activities

10301.58

16870.55

17426.74

18245.86

20490.22

-12130.88

-18567.01

-23955.08

-24084.20

-18204.50

366.67

306.08

8973.04

23732.58

-10999.60

-1462.63

-1390.38

2444.70

17894.24

-8713.88

Opening Cash & Cash Equivalents

3608.79

3225.73

1835.35

4282.29

22176.53

Closing Cash & Cash Equivalents

2146.16

1835.35

4280.05

22176.53

13462.65

Net Cash (used in)/from

Investing Activities

Net Cash (used in)/from Financing

Activities

Net (decrease)/increase In Cash and

Cash Equivalents

Reliance Industries

Previous Years

Key Financial Ratios

------------------- in Rs. Cr. -------------------

Mar '06

Mar '07

Mar '08

Mar '09

Mar '10

Face Value

10.00

10.00

10.00

10.00

10.00

Dividend Per Share

10.00

11.00

13.00

13.00

7.00

Operating Profit Per Share (Rs)

103.76

146.44

154.32

153.47

91.64

Net Operating Profit Per Share (Rs)

580.39

801.57

920.48

902.02

587.37

Free Reserves Per Share (Rs)

301.36

416.90

520.59

704.28

378.21

34.58

34.57

33.14

30.61

64.47

Operating Profit Margin(%)

17.87

18.26

16.76

17.01

15.60

Profit Before Interest And Tax

Margin(%)

13.57

13.90

13.06

13.19

10.02

Gross Profit Margin(%)

13.67

13.95

13.14

13.35

10.13

Cash Profit Margin(%)

15.35

15.13

13.73

14.58

13.29

Adjusted Cash Margin(%)

15.35

15.13

13.73

14.58

13.29

Net Profit Margin(%)

11.13

10.64

14.45

10.65

8.35

Adjusted Net Profit Margin(%)

11.13

10.64

14.45

10.65

8.35

Return On Capital Employed(%)

17.37

18.00

15.68

10.96

11.35

Return On Net Worth(%)

20.08

19.49

24.66

13.36

12.64

Adjusted Return on Net Worth(%)

20.17

19.85

17.28

13.76

11.95

9.73

439.57

542.74

727.66

392.51

10.24

458.61

548.73

802.54

419.43

18.88

19.83

17.18

11.34

11.71

Investment Valuation Ratios

Bonus in Equity Capital

Profitability Ratios

Return on Assets Excluding

Revaluations

Return on Assets Including

Revaluations

Return on Long Term Funds(%)

Liquidity And Solvency Ratios

Current Ratio

0.83

0.77

1.01

1.08

1.11

Quick Ratio

0.67

0.69

0.94

0.90

0.76

Debt Equity Ratio

0.48

0.45

0.46

0.65

0.49

Long Term Debt Equity Ratio

0.37

0.32

0.35

0.59

0.44

13.28

13.51

17.05

11.85

10.97

Debt Coverage Ratios

Interest Cover

Total Debt to Owners Fund

0.48

0.45

0.46

0.65

0.49

Financial Charges Coverage Ratio

16.84

16.06

19.95

14.58

16.08

Financial Charges Coverage Ratio

Post Tax

14.95

13.90

21.90

12.56

14.37

9.60

10.65

10.57

12.92

8.29

19.99

28.29

26.87

26.29

23.67

Investments Turnover Ratio

9.60

10.65

10.57

12.92

8.29

Fixed Assets Turnover Ratio

0.96

1.13

1.29

1.01

0.94

Total Assets Turnover Ratio

1.21

1.26

1.15

0.79

1.07

0.96

1.13

1.29

1.01

0.94

Average Raw Material Holding

26.89

20.91

33.46

21.00

36.56

Average Finished Goods Held

18.42

18.28

10.27

8.92

13.25

Number of Days In Working Capital

14.02

14.03

33.69

26.94

28.13

Material Cost Composition

73.86

72.32

73.86

76.98

80.00

Imported Composition of Raw

Materials Consumed

95.41

94.04

93.96

95.74

95.39

5.85

3.27

2.41

2.18

2.14

38.10

52.40

56.80

61.22

53.46

Dividend Payout Ratio Net Profit

17.52

13.75

9.80

14.49

14.97

Dividend Payout Ratio Cash Profit

12.74

9.80

7.85

10.82

9.09

Earning Retention Ratio

82.56

86.50

86.01

85.92

84.16

Cash Earning Retention Ratio

87.30

90.33

89.68

89.41

90.60

1.75

1.64

1.97

3.53

2.42

Mar '06

Mar '07

Mar '08

Mar '09

Mar '10

65.08

85.71

133.86

97.28

49.64

324.03

439.57

542.74

727.66

392.51

Management Efficiency Ratios

Inventory Turnover Ratio

Debtors Turnover Ratio

Asset Turnover Ratio

Profit & Loss Account Ratios

Selling Distribution Cost Composition

Expenses as Composition of Total

Sales

Cash Flow Indicator Ratios

AdjustedCash Flow Times

Earnings Per Share

Book Value

Vous aimerez peut-être aussi

- Mahindra & Mahindra Financial Services: Previous YearsDocument4 pagesMahindra & Mahindra Financial Services: Previous YearsJacob KvPas encore d'évaluation

- Previous Years: Tata Motor S - in Rs. Cr.Document28 pagesPrevious Years: Tata Motor S - in Rs. Cr.priya4112Pas encore d'évaluation

- Balance Sheet of Bharat Petroleum CorporationDocument4 pagesBalance Sheet of Bharat Petroleum CorporationPradipna LodhPas encore d'évaluation

- All Bank of RajasthanDocument7 pagesAll Bank of RajasthanAnonymous 6TyOtlPas encore d'évaluation

- Bajaj AutoDocument8 pagesBajaj Autorpandey0607Pas encore d'évaluation

- Idea Cellular: Previous YearsDocument4 pagesIdea Cellular: Previous YearsParvez AnsariPas encore d'évaluation

- Balance Sheet of Hero Motocorp - in Rs. Cr.Document16 pagesBalance Sheet of Hero Motocorp - in Rs. Cr.Khushboo VishwakarmaPas encore d'évaluation

- Previous Years: Larse N and Toubr o - in Rs. Cr.Document12 pagesPrevious Years: Larse N and Toubr o - in Rs. Cr.Parveen BabuPas encore d'évaluation

- Key Financial Ratios of Ultratech Cement: Next Years Previous YearsDocument6 pagesKey Financial Ratios of Ultratech Cement: Next Years Previous YearsRamana VaitlaPas encore d'évaluation

- Valuation SheetDocument23 pagesValuation SheetDanish KhanPas encore d'évaluation

- Balance Sheet of ACC: - in Rs. Cr.Document8 pagesBalance Sheet of ACC: - in Rs. Cr.Rekha RaoPas encore d'évaluation

- Balance Sheet of Bajaj AutoDocument6 pagesBalance Sheet of Bajaj Autogurjit20Pas encore d'évaluation

- Balance Sheet of Axis BankDocument8 pagesBalance Sheet of Axis BankKushal GuptaPas encore d'évaluation

- CSDCVDVDVDFVDocument12 pagesCSDCVDVDVDFVlakshita1234Pas encore d'évaluation

- Financial Status of The CompanyDocument5 pagesFinancial Status of The Companyankit_shri19Pas encore d'évaluation

- Balance Sheet of Axis Bank: - in Rs. Cr.Document37 pagesBalance Sheet of Axis Bank: - in Rs. Cr.rampunjaniPas encore d'évaluation

- Balance Sheet of Reliance PowerDocument10 pagesBalance Sheet of Reliance PowerJoe SharmaPas encore d'évaluation

- Balance Sheet of Amara Raja BatteriesDocument11 pagesBalance Sheet of Amara Raja Batteriesashishgrover80Pas encore d'évaluation

- Hindustan Petroleum Corporation: PrintDocument2 pagesHindustan Petroleum Corporation: PrintRakesh RoshanPas encore d'évaluation

- Balance Sheet of Bharti AirtelDocument7 pagesBalance Sheet of Bharti Airteltiku_048Pas encore d'évaluation

- Ashok LeylandDocument13 pagesAshok LeylandNeha GuptaPas encore d'évaluation

- Wipro P&L AccDocument12 pagesWipro P&L AccSwati PahujaPas encore d'évaluation

- Satyam Computer Services LTDDocument2 pagesSatyam Computer Services LTDManoj KarandePas encore d'évaluation

- Kotak Mahindra Bank: Previous YearsDocument24 pagesKotak Mahindra Bank: Previous YearsSandip PatelPas encore d'évaluation

- Airtel RatiosDocument9 pagesAirtel RatiosakshayuppalPas encore d'évaluation

- in Rs. Cr.Document20 pagesin Rs. Cr.tanuj_mohantyPas encore d'évaluation

- Bajaj Auto LTD Industry:Automobiles - Scooters and 3-WheelersDocument10 pagesBajaj Auto LTD Industry:Automobiles - Scooters and 3-WheelersVibhor AggarwalPas encore d'évaluation

- Punjab and Sind BankDocument13 pagesPunjab and Sind Banksimran jeetPas encore d'évaluation

- Gujarat Apollo Industries LimitedDocument30 pagesGujarat Apollo Industries LimitedChitsimran NarangPas encore d'évaluation

- Balance Sheet GodrejDocument4 pagesBalance Sheet Godrejjohn11051990100% (1)

- Group 1 - Financial Plan For Projectv0.2Document20 pagesGroup 1 - Financial Plan For Projectv0.2ntadbmPas encore d'évaluation

- Ashok Leyland Annual Report 2012 2013Document108 pagesAshok Leyland Annual Report 2012 2013Rajaram Iyengar0% (1)

- Previous Years : Sintex Industrie SDocument4 pagesPrevious Years : Sintex Industrie Sprince455Pas encore d'évaluation

- Submission v2Document32 pagesSubmission v2MUKESH KUMARPas encore d'évaluation

- Reliance Industries: PrintDocument2 pagesReliance Industries: Printkumar_india707Pas encore d'évaluation

- in Rs. Cr.Document19 pagesin Rs. Cr.Ashish Kumar SharmaPas encore d'évaluation

- Balance Sheet of Reliance IndustriesDocument7 pagesBalance Sheet of Reliance IndustriesNEHAAA26Pas encore d'évaluation

- Balance Sheet P&LDocument36 pagesBalance Sheet P&Lshashank_shekhar_74Pas encore d'évaluation

- Company Net Sales Gross Profit Amara Raja Gabriel India ZF Steering Bharat Gear JMT AutoDocument52 pagesCompany Net Sales Gross Profit Amara Raja Gabriel India ZF Steering Bharat Gear JMT AutoShailesh DwivediPas encore d'évaluation

- PFD CalculationsDocument14 pagesPFD CalculationsMUKESH KUMARPas encore d'évaluation

- Bhel Balance Sheet: Balance Sheet of Bharat Heavy Electricals - in Rs. Cr.Document4 pagesBhel Balance Sheet: Balance Sheet of Bharat Heavy Electricals - in Rs. Cr.Shavya RastogiPas encore d'évaluation

- Capital and Liabilities:: ApplicationDocument6 pagesCapital and Liabilities:: ApplicationKeshav GoyalPas encore d'évaluation

- Bajaj Auto LTD Industry:Automobiles - Scooters and 3-WheelersDocument16 pagesBajaj Auto LTD Industry:Automobiles - Scooters and 3-WheelersCma Saurabh AroraPas encore d'évaluation

- Previous Years: Bajaj Auto - in Rs. Cr.Document10 pagesPrevious Years: Bajaj Auto - in Rs. Cr.maddikaPas encore d'évaluation

- Balance Sheet of Tata MotorsDocument10 pagesBalance Sheet of Tata Motorssarvesh.bhartiPas encore d'évaluation

- RelianceDocument22 pagesReliance122jasbirkaur2003Pas encore d'évaluation

- Dabur India: Key Financial RatiosDocument5 pagesDabur India: Key Financial RatiosHiren ShahPas encore d'évaluation

- IAPM AssignmentsDocument29 pagesIAPM AssignmentsMUKESH KUMARPas encore d'évaluation

- Consolidated Balance Sheet of Mahindra and Mahindra - in Rs. Cr.Document10 pagesConsolidated Balance Sheet of Mahindra and Mahindra - in Rs. Cr.bhagathnagarPas encore d'évaluation

- Six Yrs Per OGDCLDocument2 pagesSix Yrs Per OGDCLMAk KhanPas encore d'évaluation

- Balance Sheet of Titan IndustriesDocument24 pagesBalance Sheet of Titan IndustriesAkanksha NandaPas encore d'évaluation

- Cash FlowDocument1 pageCash FlowAaryanPas encore d'évaluation

- 10.40L Masala MakingDocument10 pages10.40L Masala MakingVedant AssociatesPas encore d'évaluation

- Profitability Test: Profit/Net Sales Pat-Pref Div/ No of Eq Shares (Pat-Pref Div) / Eqty FundDocument7 pagesProfitability Test: Profit/Net Sales Pat-Pref Div/ No of Eq Shares (Pat-Pref Div) / Eqty FundJatin AroraPas encore d'évaluation

- Balance Sheet of Tata SteelDocument9 pagesBalance Sheet of Tata SteelsahumonikaPas encore d'évaluation

- Cash Flow of Cadbury India: - in Rs. Cr.Document6 pagesCash Flow of Cadbury India: - in Rs. Cr.Somraj RoyPas encore d'évaluation

- Archies Financial StatmentsDocument5 pagesArchies Financial StatmentsShitiz JainPas encore d'évaluation

- Speed Changers, Drives & Gears World Summary: Market Values & Financials by CountryD'EverandSpeed Changers, Drives & Gears World Summary: Market Values & Financials by CountryPas encore d'évaluation

- A Comparative Analysis of Tax Administration in Asia and the Pacific: 2020 EditionD'EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: 2020 EditionPas encore d'évaluation

- List of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosD'EverandList of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosPas encore d'évaluation

- PWC Roadmap To An Ipo PDFDocument100 pagesPWC Roadmap To An Ipo PDFVenp Pe100% (1)

- Air Marshal D.C. KumariaDocument14 pagesAir Marshal D.C. KumariasssssPas encore d'évaluation

- Ppp/Pfi Terminology Unravelled: Richard Dyton (Simmons & Simmons) and Nick Hopkins (KPMG) 16 January 2007Document25 pagesPpp/Pfi Terminology Unravelled: Richard Dyton (Simmons & Simmons) and Nick Hopkins (KPMG) 16 January 2007Kasun ChathurangaPas encore d'évaluation

- 3 Phrasal Verbs + Idioms B2Document6 pages3 Phrasal Verbs + Idioms B2Abel GordilloPas encore d'évaluation

- British Columbia Application For Change of NameDocument8 pagesBritish Columbia Application For Change of NamecalebfriesenPas encore d'évaluation

- 236-Estrada v. Desierto G.R. No. 156160 December 9, 2004Document7 pages236-Estrada v. Desierto G.R. No. 156160 December 9, 2004Jopan SJPas encore d'évaluation

- ARTICLE 1338 - Metropolitan Totan (LABANON) PDFDocument2 pagesARTICLE 1338 - Metropolitan Totan (LABANON) PDFXing Keet LuPas encore d'évaluation

- AchformDocument2 pagesAchformhancockmedicalsolutionsllcPas encore d'évaluation

- AisDocument22 pagesAisMarvi Ned Xigrid Cruz100% (1)

- Requirements Based TestingDocument4 pagesRequirements Based TestingVick'y A'AdemiPas encore d'évaluation

- Reg ZDocument62 pagesReg ZYolanda Lewis100% (1)

- M/s Auto India Case StudyDocument3 pagesM/s Auto India Case Studyashrin67% (3)

- Corporate Guarantee and Bank GuaranteeDocument1 pageCorporate Guarantee and Bank GuaranteeChaitanya SharmaPas encore d'évaluation

- 7'P S of Banking in MarketingDocument15 pages7'P S of Banking in MarketingAvdhesh ChauhanPas encore d'évaluation

- Top 50 World BanksDocument36 pagesTop 50 World BanksDilipPas encore d'évaluation

- Chapter 13 Intermediate AccoutingDocument8 pagesChapter 13 Intermediate AccoutingMarlind3Pas encore d'évaluation

- Property Amount: Compute For The Gross Estate of Each Decedent BelowDocument2 pagesProperty Amount: Compute For The Gross Estate of Each Decedent Belowjarlen cosasPas encore d'évaluation

- Chapter 1 Overview of Financial MarketsDocument18 pagesChapter 1 Overview of Financial MarketsizwanPas encore d'évaluation

- Bba FileDocument81 pagesBba FileVaibhav GuptaPas encore d'évaluation

- Annual Report 2008Document90 pagesAnnual Report 2008ericmacknorrPas encore d'évaluation

- Infosys Latest Placement Solved Papers - 2019 - Praxis Group PDFDocument762 pagesInfosys Latest Placement Solved Papers - 2019 - Praxis Group PDFTom SanthoshPas encore d'évaluation

- Custom Search: PD No. 1792 R.A. No. 7653Document1 pageCustom Search: PD No. 1792 R.A. No. 7653Hariette Kim TiongsonPas encore d'évaluation

- Maharashtra State Electricity Distribution Co. LTD.: For Any Queries On This Bill Please ContactDocument2 pagesMaharashtra State Electricity Distribution Co. LTD.: For Any Queries On This Bill Please ContactKushAggarwalPas encore d'évaluation

- THE IMPACT OF GLOBAL RECESSION ON INFORMATION TECHNOLOGY SECTOR IN INDIA PPT by Sumeet DolheDocument40 pagesTHE IMPACT OF GLOBAL RECESSION ON INFORMATION TECHNOLOGY SECTOR IN INDIA PPT by Sumeet DolheSumeet DolhePas encore d'évaluation

- Controller Accounting Manager Non Profit in NYC NY Resume Mila BudilovskayaDocument2 pagesController Accounting Manager Non Profit in NYC NY Resume Mila BudilovskayaMilaBudilovskayaPas encore d'évaluation

- Sales 1-5Document68 pagesSales 1-5Munchie MichiePas encore d'évaluation

- Practice Problem 2 Cash ReconDocument5 pagesPractice Problem 2 Cash ReconKhyla DivinagraciaPas encore d'évaluation

- Risk Management in E-BankingDocument94 pagesRisk Management in E-Bankingfrompooja20Pas encore d'évaluation

- Assignment On: Corporate Governance in Banking Sector in BangladeshDocument6 pagesAssignment On: Corporate Governance in Banking Sector in BangladeshFàrhàt HossainPas encore d'évaluation

- The AffidavitDocument20 pagesThe AffidavitCharlton Butler100% (1)