Académique Documents

Professionnel Documents

Culture Documents

Forum Read - PHP 1,177493

Transféré par

dovnadlerDescription originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Forum Read - PHP 1,177493

Transféré par

dovnadlerDroits d'auteur :

Formats disponibles

How Buffett Interprets Financial Statements - GuruFocus.

com

Page 1 of 6

7-Day New CreateFree Portfolio All Insiders Trial My Features Articles Market ($/Year) Guru Stocks KeyPortfolios SubscribeValuation My Portfolios CEO Buys/Sales

Home Screeners Gurus Insiders Market Try Our My Space Submit New Screener Premium Membership By Country Aggregated Picks Home Articles My Account

Articles

Portfolio

SUBSCRIBE

-- Browse Gurus --

oscar

(Personalize)

DIA SPY QQQ GLD (My Stocks) PremiumTicker, Guru, Latest User Portfolios Company, etc. Search CFO Buys/Sales vs. Free -0.05% -0.05% -0.35% -1.66% 7-Day My Articles Create New WritersGuru USA Free Portfolio Market-Cap/GDP Aggregated Portfolio ListModel Membership All EnterWanted Performances Premium Portfolios Homepage Trial Latest GurusPicks Space of Guru Stocks Value Screens Model Portfolios Contact Us Insider Cluster Valuation Picks ($/Year) ($/Year) Upgrade My Blogs GuruFocus Australia Consensus Picks Latest GuruResearch Buffett-Munger (+78.2%) BenPortfolios Net-Net RealGrahamPicks ForumContest Winners Value Strategies Time Forums are Double Guru+Insiderfor serious investors only. GuruFocus Forum Rules. Log PM Latest Contest Editor'sMarket BrazilBargains Global User Portfolios Guru Time Picks Undervalued Valuation Gurus Portfolios Monthly Newsletters: TutorialsAnnouncement RealOut PicksPredictable Buys New Threads Only: Change (Win News Guru $1000) Canada Email Shiller P/E Hot Calculator Gurus Portfolios (+76.25%) Buffett-Munger Screener Aggregated Founder Ben Picks Portfolio Message from Address DCFGraham Net-Net Triple Buys/Sales New Threads & Replies: Change Foreign Submit Grid Value China Companies Market in(+22.47%) S&P Ideas Scoreboard Low 500Password Consensus Picks Buffett-Munger Bargains FAQ P/SArticles Online The All-In-One Screener Insider Trends Dividend Companies France Trends Currencies Sector Picks Low GuruFocus GuruP/B (+19.99%) Micro-Cap Charts AboutBargains Interactive Magic Stocks Download Interviews Germany Geographic Picks InternationalTrend Broadest List DCF Financials S&P Feed with Formula Owned RSS Screener Guru News and Commentaries 10-Y 500 Grid Gurus Forum Guru Top IndiaRanked Guru Screener Download (+8.26%) Portfolio 52-Wk Lows (Old) Dividend Stocks ContactNews, Stock picks and commentaries Model Portfolios Jump to forum ...

Latest Forum Posts Post New Topic: Guru News | Value Ideas ramprasad_bh: Best Investing Resources online ramprasad_bh: Best Online Resources for Investing. AshishGupta: Investing Lesson #3 AshishGupta: Investing Lesson #2 AshishGupta: Investing Lesson #1 queen123: Comment for Lincare Hldgs News,... pachyderm: Comment for Buffett-Munger Screener... (1 reply) heisenman: Comment for TROX Stock Quote -... michaelwang18: Is Warren Buffett Buying into the... scyang: Comment for 10 Year Financials... (1 reply) squiggy: Comment for Portfolio Stocks of... superguru: Prediction: for Profit Education... DurableCompetitiveAd: GuruFocus needs an iPad app OutofDate1980: Comment for 10 Year Financials... (1 reply) cirros: Allen Mecham (1 reply) Latest Comments trotta: Re Finding value in a European Ban... paulwitt: Re Whitney Tilson Defending the ... Proselenes: Re: FOGL.L (Falkland Oil and Gas) pravchaw: Re Prem Watsa Buys More ABH as Sto... jk815: Comment for Portfolio Stocks of Bi... gph56: Re Man versus Magic Formula Joel ... mcwillia: Re European Bank Run at Full Speed... kfh227: Re A Rough Estimation of Facebook ... crafool: A Total ly Cheap Stock KelpieCapital: Re Zicom Group ZGL AU Extre... mcwillia: Re Sony Undervalued at 14 Billio... hardrive118: Re Kraft Blows It with the Mondele... LwC: Re Hussman Weekly Liquidation Syn... pirot: Re How Buffett Interprets Financia... Carmine Romano: Re Is Sterling Bancorp STL So St...

Value Japan Most Highs 52-WkIdea Contest ETFs Weighted (+-7.41%) Videos UK Predictables Companies Options

Goto: More... Stocks Preferred Forum List Message List New Topic Search Log Out

Goto Thread: Previous Next

How Buffett Interprets Financial Statements

Posted by: Jae Jun Date: May 21, 2012 02:44PM (IP Logged) [Ignore this user]

Warren Buffett is one of a kind and while he provides amazing insight and knowledge year after year in his letters and speeches, details about how to choose companies and what to look for is lacking. Warren Buffett and the Interpretation of Financial Statements is a book that manages to explain how Buffett interprets financial statements which we will go through.

How Warren Buffett Interprets the Income Statement

When it comes to analyzing the income statement, it is important to investigate further and drill down to detect what the quality of earnings are made up of and what the numbers interpret. Gross Profit Margin: firms with excellent long term economics tend to have consistently higher margins Durable competitive advantage creates a high margin because of the freedom to price in excess of cost Greater than 40% = Durable competitive advantage Less than 40% = competition eroding margins Less than 20% = no sustainable competitive advantage Consistency is key Sales Goods and Administration: Consistency is key. Companies with no durable competitive advantage show wild variation in SG&A as % of gross profit Less than 30% is fantastic Nearing 100% is in highly competitive industry R&D: if competitive advantage is created by a patent or tech advantage, at some point it will disappear. High R&D usually dictates high SG&A which threatens the competitive advantage Depreciation: Using EBITDA as a measure of cash flow is very misleading Companies with durable competitive advantages tend to have lower depreciation costs as a % of gross profit Interest Expenses: Companies with high interest expenses relative to operating income tend to be either: 1) in a fiercely competitive industry where large capital expenditure required to stay competitive 2) a company with excellent business economics that acquired debt in leveraged buyout Companies with durable competitive advantages often carry little or no interest expense. Warrens favorites in the consumer products category all have less than 15% of operating income. Interest expenses varies widely between industries. Interest ratios can be very informative of level of economic danger. Important: In any industry, the company with the lowest ratio of interest to Operating Income is usually the one with the competitive advantage. Net Earnings Look for consistency and upward long term trend. Because of share repurchase it is possible for net earnings trend to differ from EPS trend. Preferred over EPS Durable competitive advantage companies report higher % net earnings to total revenues. Important: If a company is showing net earnings history greater than 20% on total revenues, it is probably benefiting from a long term competitive advantage. If net earnings is less than 10%, likely to be in a highly competitive business

How Warren Buffett Interprets the Balance Sheet

Cash and Equivalents:

http://www.gurufocus.com/forum/read.php?1,177493

5/23/2012

How Buffett Interprets Financial Statements - GuruFocus.com

Page 2 of 6

7-Day New CreateFree Portfolio All Insiders Trial My Features Articles Market ($/Year) Guru Stocks KeyPortfolios SubscribeValuation My Portfolios CEO Buys/Sales

Home Screeners Gurus Insiders Market Try Our My Space Submit New Screener Premium Membership By Country Aggregated Picks Home Articles My Account

Articles

Portfolio

SUBSCRIBE

-- Browse Gurus --

oscar

(Personalize)

DIA SPY QQQ GLD (My Stocks) PremiumTicker, Guru, Latest User Portfolios Company, etc. Search CFO Buys/Sales vs. Free -0.05% -0.05% -0.35% -1.66% 7-Day My Articles Create New WritersGuru USA Free Portfolio Market-Cap/GDP Aggregated Portfolio ListModel Membership All EnterWanted Performances Premium Portfolios Homepage Trial Latest GurusPicks Space of Guru Stocks Value Screens Model Portfolios Contact Us Insider Cluster Valuation Picks ($/Year) ($/Year) Upgrade My Blogs GuruFocus Australia Consensus Picks Latest GuruResearch Buffett-Munger (+78.2%) BenPortfolios Net-Net RealGrahamPicks ForumContest Winners Value Strategies Time A high number means Guru+Insider Double either: Log PM Latest Contest Editor'sMarket BrazilBargains Global User Portfolios Guru Time Picks Undervalued Valuation Gurus Portfolios Monthly Newsletters: TutorialsAnnouncement RealOut PicksPredictable Buys The company has competitive advantage generating lots of cash Change (Win News Guru $1000) Canada Email Shiller P/E Hot 1)Calculator Gurus Portfolios (+76.25%) Buffett-Munger Screener Aggregated Founder Ben Picks Portfolio Message from Address DCFGraham Net-Net Triple Buys/Sales Change sold Submit Foreign Value Companies China Ideas Market in(+22.47%) S&P 500Password Scoreboard Low P/SArticles Consensus PicksOnline Buffett-Munger business or FAQAll-In-One Bargains The2) JustGrid aScreener bonds (not necessarily good) Insider Trends Dividend Companies France Picks Currencies SectorGuruFocus Low low (+19.99%) GuruP/B stockpile Micro-Cap Charts AboutBargains Interactive Magicof cash usually means poor to mediocre economics. Stocks A Trends Download Interviews Germany Geographic International Picks Broadest Trend DCF Financials S&P Feed with Formula Owned RSS Screener 10-Y 500 Grid Gurus There are 3 ways to create large cash reserve. 1) Sell new bonds or equity to public

Top IndiaRanked Guru Screener Download (+8.26%) 52-Wk Lows (Old) Dividend Portfolio Contact Stocks Model Portfolios Value Japan Most Highs 52-WkIdea Contest ETFs Weighted (+-7.41%) Videos UK 2) Sell Predictables Companies Options business or asset More... has an ongoing business generating more cash than it burns (usually means durable competitive advantage) Preferred Stocks 3) It

When a company is suffering a short term problem, Buffett looks at cash or marketable securities to see whether it has the financial strength to ride it out. Important: Lots of cash and marketable securities + little debt = good chance that the business will sail on through tough times. Test to see what is creating cash by looking at past 7 yrs of balance sheets. This will reveal how the cash was created. Inventory Manufacturers with durable competitive advantages have the advantage that the products they sell do not change, and therefore will never become obsolete. Buffett likes this advantage. When identifying manufacturers with durable competitive advantage, look for inventory and net earnings that rise correspondingly. This indicates that the company is finding profitable ways to increase sales which called for an increase in inventory. Manufacturers with inventories that spike up and down are indicative of competitive industries subject to boom and bust. Net Receivables Net receivables tells us a great deal about the different competitors in the same industry. In competitive industries, some attempt to gain advantage by offering better credit terms, causing increase in sales and receivables. If company consistently shows lower % Net receivables to gross sales than competitors, then it usually has some kind of competitive advantage which requires further digging. Property, Plant & Equipment A company with durable competitive advantage doesnt need to constantly upgrade its equipment to stay competitive. The company replaces when it wears out. On the other hand, a company without any advantages must replace to keep pace. Difference between a company with a moat and one without is that the company with the competitive advantage finances new equipment through internal cash flows, whereas the no advantage company requires debt to finance. Producing a consistent product that doesnt change equates to consistent profits. There is no need to upgrade plants which frees up cash for other ventures. Think Coca Cola, Johnson & Johnson etc. Goodwill Whenever you see an increase in goodwill over a number of years, you can assume its because the company is out buying other businesses above book value. GOOD if buying businesses with durable competitive advantage. If goodwill stays the same, the company when acquiring other companies is either paying less than book value or not acquiring. Businesses with moats never sell for less than book value. Intangible Assets Intangibles acquired are on balance sheet at fair value. Internally developed brand names (Coke, Wrigleys, Band-Aid) however are not reflected on the balance sheet. One of the reasons competitive advantage power can remain hidden for so long. Total Assets & Return on Total Assets Measure efficiency using ROA Capital is barrier to entry. One of things that make a competitive advantage durable is the cost of assets needed to get in. This is why we calculate the Asset Reproduction Value along with the EPV. Many analysts argue the higher return the better. Buffett states that really high ROA may indicate vulnerability in the durability of the competitive advantage. E.g. Raising $43b to take on KO is impossible, but $1.7b to take on Moodys is. Although Moodys ROA and underlying economics is far superior to Coca Cola, the durability is far weaker because of lower entry cost. Current Liabilities Includes accounts payable, accrued expenses, other current liabilities and short term debt. Stay away from companies that roll over the debt e.g. Bear Stearns When investing in financial institutions, Buffett shies from those who are bigger borrowers of short term than long term debt. His favorite Wells Fargo has 57 cents short term debt for every dollar of long term

http://www.gurufocus.com/forum/read.php?1,177493

5/23/2012

How Buffett Interprets Financial Statements - GuruFocus.com

Page 3 of 6

7-Day New CreateFree Portfolio All Insiders Trial My Features Articles Market ($/Year) Guru Stocks KeyPortfolios SubscribeValuation My Portfolios CEO Buys/Sales

Home Screeners Gurus Insiders Market Try Our My Space Submit New Screener Premium Membership By Country Aggregated Picks Home Articles My Account

Articles

Portfolio

SUBSCRIBE

-- Browse Gurus --

oscar

(Personalize)

DIA SPY QQQ GLD (My Stocks) PremiumTicker, Guru, Latest User Portfolios Company, etc. Search CFO Buys/Sales vs. Free -0.05% -0.05% -0.35% -1.66% 7-Day My Articles Create New WritersGuru USA Free Portfolio Market-Cap/GDP Aggregated Portfolio ListModel Membership All EnterWanted Performances Premium Portfolios Homepage Trial Latest GurusPicks Space of Guru Stocks Value Screens Model Portfolios Contact Us Insider Cluster Valuation Picks ($/Year) ($/Year) Upgrade My Blogs GuruFocus Australia Consensus Picks Latest GuruResearch Buffett-Munger (+78.2%) BenPortfolios Net-Net RealGrahamPicks ForumContest Winners Value Strategies Time Guru+Insider Double Bank of America) has $2.09 short term for every dollar long term Aggressive banks (like Log PM Latest Contest Editor'sMarket BrazilBargains Global User Portfolios Guru Time Picks Undervalued Valuation Gurus Portfolios Monthly Newsletters: TutorialsAnnouncement RealOut PicksPredictable Durability equates to the stability of being conservative. Buys Change (Win News Guru $1000) Canada Email Shiller P/E Hot Calculator Gurus Portfolios (+76.25%) Buffett-Munger Screener Aggregated Founder Ben Picks Portfolio Message from Address DCFGraham Net-Net Triple Buys/Sales coming Due Change Foreign Submit Grid Value Companies China Ideas Market in(+22.47%) S&P 500Term Bargains Scoreboard Low P/S Password Consensus Picks Buffett-Munger Screener FAQAll-In-OneDebt TheLongArticles Online Insider Trends Some Companies Dividend (+19.99%) France Trends Currencies Sector Picks Low GuruFocus GuruP/B companies Micro-Cap Charts AboutBargains Interactive Magic lump their yearly long term debt due with short term debt on the balance sheet. This makes it seem like there Stocks is more Download short term debt than the real amount. Interviews Germany Geographic International Picks Broadest Trend DCF Financials S&P Feed with Formula Owned RSS Screener 10-Y 500 Grid Gurus

TopImportant: IndiaRanked Guru Screener (Old) Download (+8.26%) 52-Wk Lows Companies with durable comparable advantages need little or no LT debt to maintain operations. Dividend Portfolio Contact Stocks Model Portfolios

Too Value Japan much Most Highsdebt coming due 52-WkIdea Contest ETFs Weighted (+-7.41%) in a single year spooks investors and can offer attractive entry points.

Videos UK However, mediocre company in problems with too much debt due leads to cash flow problems and certain bankruptcy. PredictablesaCompanies Options More... Preferred Stocks

Long Term Debt Buffett says that durable competitive advantages carry little to no LT debt because the company is so profitable that even expansions or acquisitions are self financed. We are interested in long term debt load for the last ten years. If the ten yrs of operation show little to no long term debt, then the company has some kind of strong competitive advantage. Buffetts historic purchases indicate that on any given year, the company should have sufficient yearly net earnings to pay all long term within 3 or 4 year earnings period. (e.g. Coke + Moodys = 1yr) Companies with enough earning power to pay long term debt in less than 3 or 4 years is a good candidate in our search for long term competitive advantage. BUT, these companies are targets for leveraged buy outs, which saddles the business with long term debt If all else indicates the company has a moat, but it has ton of debt, a leveraged buyout may have created the debt. In these cases the companys bonds offer the better bet, in that the companys earnings power is focused on paying off the debt and not growth. Important: little or no long term debt often means a Good Long Term Bet Total Liabilities & Debt to Shareholders Equity Ratio Debt to shareholders equity ratio helps identify whether the company uses debt or equity (includes retained earnings) to finance operations. Company with a moat uses earning power and should show higher levels of equity and lower level of liabilities. Debt to Shareholders Equity Ratio : Total Liabilities / Shareholders Equity Problem with using as identifier is that economics of companies with durable competitive advantages are so great they dont need large amount of equity or retained earnings on the balance sheet to get the job done. Important: if the Treasury Share Adjusted Debt to Shareholder Equity Ratio is less than 0.8, the company has a durable competitive advantage. Retained Earnings: Buffetts Secret One of the most important indicators of durable competitive advantage. Net earnings can be paid out as dividends, used to buy back shares or retained for growth. If the company loses more than it has accumulated, retained earnings is negative. If a company isnt adding to its retained earnings, it isnt growing its net worth. Rate of growth of retained earnings is good indicator whether its benefiting from a competitive advantage. Microsoft is negative because it chose to buyback stock and pay dividends The more earnings retained, the faster it grows and increases growth rate for future earnings. Treasury Stock Carried on the balance sheet as a negative value because it represents a reduction in shareholders equity. Companies with moats have free cash, so treasury shares are hallmark of durable competitive advantages. When shares are bought back and held as treasury stock, it is effectively decreasing the company equity. This increases return on shareholders equity. High return is a sign of competitive advantage. Its good to know if its generated by financial engineering or exceptional business economics or combination. To see which is which, convert negative value of treasury shares into a positive and add it to shareholders equity. Then divide net earnings by new shareholders equity. This will give the return on equity minus effects of window dressing. Important: presence of treasury shares and a history of buyback are good indicators that company has competitive advantage

How Warren Buffett Interprets the Cash Flow Statement

Capital Expenditures Never invest in telephone companies because of big capital outlays Important: company with durable competitive advantage uses a smaller portion of earnings for capital expenditure for continuing operations than those without. To compare capex to net earnings, add up total capex for ten-yr period and compare with total net earnings over the same

http://www.gurufocus.com/forum/read.php?1,177493

5/23/2012

How Buffett Interprets Financial Statements - GuruFocus.com

Page 4 of 6

7-Day New CreateFree Portfolio All Insiders Trial My Features Articles Market ($/Year) Guru Stocks KeyPortfolios SubscribeValuation My Portfolios CEO Buys/Sales

Home Screeners Gurus Insiders Market Try Our My Space Submit New Screener Premium Membership By Country Aggregated Picks Home Articles My Account

Articles

Portfolio

SUBSCRIBE

-- Browse Gurus --

oscar

(Personalize)

DIA SPY QQQ GLD (My Stocks) PremiumTicker, Guru, Latest User Portfolios Company, etc. Search CFO Buys/Sales vs. Free -0.05% -0.05% -0.35% -1.66% 7-Day My Articles Create New WritersGuru USA Free Portfolio Market-Cap/GDP Aggregated Portfolio ListModel Membership All EnterWanted Performances Premium Portfolios Homepage Trial Latest GurusPicks Space of Guru Stocks Value Screens Model Portfolios Contact Us Insider Cluster Valuation Picks ($/Year) ($/Year) Upgrade My Blogs GuruFocus Australia Consensus Picks Latest GuruResearch Buffett-Munger (+78.2%) BenPortfolios Net-Net RealGrahamPicks ForumContest Winners Value Strategies Time period Guru+Insider Double Log PM Latest Contest Editor'sMarket BrazilBargains Global User Portfolios Guru Time Picks Undervalued Valuation Gurus Portfolios Monthly Newsletters: TutorialsAnnouncement RealOut PicksPredictable Buys Change (Win $1000) Guru Calculator Canada Email Shiller P/E Hot Important: Gurus Portfolios historically (+76.25%) Buffett-MungerFounder Aggregated ifScreener Ben Picks Portfolio Message from Address using less than 50%, then good place to look for durable competitive advantage. If less than 25%, DCFGraham Net-Net News probably has a competitive advantage. Triple Buys/Sales Change Foreign Submit Grid Value China Companies Market in(+22.47%) S&P Ideas Scoreboard Low 500Password Consensus Picks Buffett-Munger Bargains FAQ P/SArticles Online The All-In-One Screener Insider Trends of What to Look for Summary Dividend Companies France Trends Currencies Sector Picks Low GuruFocus GuruP/B (+19.99%) Micro-Cap Charts AboutBargains Interactive Magic Stocks Download Income (DCA = Durable Competitive Interviews Germany Geographic International Picks Broadest Trend DCF Financials S&P Feed with Formula Owned RSS Screener 10-Y 500 Grid Gurus Statement Advantage) Comments

Top IndiaRanked Guru Screener Download (+8.26%) 52-Wk Lows (Old) Dividend Portfolio Contact Stocks Model Portfolios Value Japan Most Highs 52-WkIdea Contest ETFs Weighted (+-7.41%) Videos UK Predictables Companies Options More... Preferred Stocks

Gross Profit Margin SG&A(SGA as % of gross profit) Depreciation (depreciation costs as a % of gross profit)

>40% = D.C.A.<40% = competition eroding margins<20% = no sustainable competitive advantage < 30% is fantasticNearing 100% is in highly competitive industry

Consistency is Key

Consistency is Key

Company with moat tend to have lower % Company with lowest ratio of interest to Operating Income = competitive advantage.Varies widely between industries.

Interest Expenses Durable competitive (interest advantage carry little or no expenses relative interest expense.Buffett's to operating favorite consumer products income) have<15% Net Earnings(% net earnings to total revenues)

Net earnings history >20% = Long Term moat< 10% = in highly competitive consistency and upward LT business trend 10-year period showing Consistency = sign products consistency and upward dont need to trend.Avoid erratic earnings change.Upward trend = pictures. strong Test to see what is creating lots of cash and marketable cash by looking at past 7 yrs securities + little debt of balance sheets Look for an inventory and net earnings that are on a corresponding rise consistently shows lower % net receivables to gross sales than competitors increase in goodwill over number of years assume because company out buying companies >BV can have valuable assets on books at valuation< market price (booked at lowest price) Internally developed brands not reflected on BS Higher return the better (but: really high ROA may indicate vulnerability in durability of c.a.) financial institutions. Buffett shies from those who are bigger borrowers of ST than LT debt d.c.a. need little or no LT debt to maintain operations higher the ratio, the more liquid, the greater its ability to pay CL d.c.a.s dont need liquidity cushion so may have<1 inventories that spike up/down are indicative of competitive industries prone to (boom/bust) d.c.a. no need to offer generous credit

EPS Balance Sheet Cash and Equivalents

Inventory

Net Receivables

Goodwill

d.c.a.s never sell for less than BV tells us about investment mindset of management (Looking for d.c.a.?)

LT Investments Intangible Assets Total Assets + ROA(Measure efficiency using ROA)

Capital = barrier to entry

ST Debt LT Debt Due Total CL + Current Ratio

LT Debt Total Liabilities + Treasury ShareAdjusted debt to Shareholder Eq Ratio Preferred + Common Stock Retained Earnings

LT debt load for last ten yrs. earning power to pay their ten yrs w/ little LT debt = LT debt in<3/4 yrs = good d.c.a. candidates

If<.80, Good chance company has d.c.a. in search for d.c.a. we look for absence of preferred stock Rate of growth of RE is good indicator convert ve value of treasury shares into +ve and add shareholder eq.Divide net earnings by new shareholders eq. give us return on equity minus dressing. If company shows history of strong net earnings, but

Treasury Stock

presence of treasury shares and a history of buyback are good indicators that company has d.c.a.

http://www.gurufocus.com/forum/read.php?1,177493

5/23/2012

How Buffett Interprets Financial Statements - GuruFocus.com

Page 5 of 6

7-Day New CreateFree Portfolio All Insiders Trial My Features Articles Market ($/Year) Guru Stocks KeyPortfolios SubscribeValuation My Portfolios CEO Buys/Sales

Home Screeners Gurus Insiders Market Try Our My Space Submit New Screener Premium Membership By Country Aggregated Picks Home Articles My Account

Articles

Portfolio

SUBSCRIBE

-- Browse Gurus --

oscar

(Personalize)

DIA SPY QQQ GLD (My Stocks) PremiumTicker, Guru, Latest User Portfolios Company, etc. Search CFO Buys/Sales vs. Free -0.05% -0.05% -0.35% -1.66% 7-Day My Articles Create New WritersGuru USA Free Portfolio Market-Cap/GDP Aggregated Portfolio ListModel Membership All EnterWanted Performances Premium Portfolios Homepage Trial Latest GurusPicks Space of Guru Stocks Value Screens Model Portfolios Contact Us Insider Cluster Valuation Picks ($/Year) ($/Year) Upgrade My Blogs GuruFocus Australia Consensus Picks Latest GuruResearch Buffett-Munger (+78.2%) BenPortfolios Net-Net RealGrahamPicks ForumContest Winners Value Strategies Time Guru+Insider Double shows ve sholder equity, Log PM Latest Contest Editor'sMarket BrazilBargains Global User Portfolios Guru Time Picks Undervalued Valuation Gurus Portfolios Monthly Newsletters: TutorialsAnnouncement RealOut PicksPredictable Return on d.c.a. show higher than probably d.c.a. because Buys Shareholder average returns on strong companies dont Change (Win News Guru $1000) Canada Email Shiller P/E Hot Calculator Gurus Portfolios (+76.25%) Buffett-Munger Screener Aggregated Founder Ben Picks Portfolio Message from Address DCFGraham Net-Net equity shareholders equity need to retain Triple Buys/Sales Change Foreign Submit Grid Value China Companies Market in(+22.47%) S&P Ideas Scoreboard Low 500Password Consensus Picks Buffett-Munger Bargains FAQ P/SArticles Online The All-In-One Screener Cash Flow Statement Insider Trends Dividend Companies France Trends Currencies Sector Picks Low GuruFocus GuruP/B (+19.99%) Micro-Cap Charts AboutBargains Interactive Magic Stocks historically using<50% then Add up total cap exp for Download good place to look for ten-yr period and compare Interviews Germany Geographic International Picks Broadest Trend DCF Financials S&P Feed with Formula Owned RSS Screener 10-Y 500 Grid Gurus

Top IndiaRanked Guru Screener Download (+8.26%) 52-Wk Lows (Old) Dividend Portfolio Contact Stocks Model Portfolios Value Japan Most Highs 52-WkIdea Contest ETFs Weighted (+-7.41%)

Capital Expenditures

d.c.a.<25% probably has d.c.a. indicator of d.c.a. is a history of repurchasing/retiring its shares

w/ total net earnings over period.

Videos UK Predictables Companies Stock Buybacks Options More... Preferred Stocks

Look at cash from investment activities. Issuance (Retirement) of Stock, Net

Guru Discussed: Warren Buffett: Current Portfolio, Stock Picks Stocks Discussed: SPY, QQQ, DJI, Rate this post: Rating: 4.0/5 (27 votes)

Options: Reply To This Message Quote This Message Follow This Thread Report This Message Re How Buffett Interprets Financial Statements Posted by: DurableCompetitiveAdvantage (IP Logged) [Ignore this user] Date: May 21, 2012 07:22PM Thanks for taking the time to put this article together

Guru Discussed: Warren Buffett: Current Portfolio, Stock Picks Stocks Discussed: SPY, QQQ, DJI, Rate this post: Rating: 0.0/5 (0 votes)

Options: Reply To This Message Quote This Message Follow This Thread Report This Message Re How Buffett Interprets Financial Statements Posted by: pirot Date: May 22, 2012 09:46AM (IP Logged) [Ignore this user]

Awesome article!! Should be rated higher than 3.8/5 for sure.

Guru Discussed: Warren Buffett: Current Portfolio, Stock Picks Stocks Discussed: SPY, QQQ, DJI, Rate this post: Rating: 0.0/5 (0 votes)

Options: Reply To This Message Quote This Message Follow This Thread Report This Message

Your Name: Subject (Title): Stocks Discussed: Tags:

oscar Re: How Buffett Interprets Financial Statements (e.g. BRK.A,WMT,PFE) (e.g. Long, Energy,Gold)

Send replies to this thread to me via email Add my signature to this post. Text Editing Tools

Font Name and Size Font Style Undo/Redo

Arial

Alignment

13

Paragraph Style Indenting and Lists Insert Item

Normal

http://www.gurufocus.com/forum/read.php?1,177493

5/23/2012

How Buffett Interprets Financial Statements - GuruFocus.com

Page 6 of 6

7-Day New CreateFree Portfolio All Insiders Trial My Features Articles Market ($/Year) Guru Stocks KeyPortfolios SubscribeValuation My Portfolios CEO Buys/Sales

Home Screeners Gurus Insiders Market Try Our My Space Submit New Screener Premium Membership By Country Aggregated Picks Home Articles My Account

DIA

-0.05%

Articles

Portfolio

SUBSCRIBE

-- Browse Gurus --

oscar

(Personalize)

PremiumTicker, Guru, Latest User Portfolios Company, etc. Search CFO Buys/Sales vs. Free 7-Day My Articles Create New WritersGuru USA Free Portfolio Market-Cap/GDP Aggregated Portfolio ListModel Membership All EnterWanted Performances Premium Portfolios Homepage Trial Latest GurusPicks Space of Guru Stocks Value Screens Contact Us Insider Cluster Valuation Picks ($/Year) ($/Year) Upgrade My Blogs GuruFocus Australia Consensus Picks Latest GuruResearch Buffett-Munger (+78.2%) BenPortfolios Net-Net RealGrahamPicks ForumContest Winners Value Strategies Time Guru+Insider Double Log PM Latest Contest Editor'sMarket BrazilBargains Global User Portfolios Guru Time Picks Undervalued Valuation Gurus Portfolios Monthly Newsletters: TutorialsAnnouncement RealOut PicksPredictable Buys Change (Win News Guru $1000) Canada Email Shiller P/E Hot Calculator Gurus Portfolios (+76.25%) Buffett-Munger Screener Aggregated Founder Ben Picks Portfolio Message from Address DCFGraham Net-Net Triple Buys/Sales Change Foreign Submit Grid Value China Companies Market in(+22.47%) S&P Ideas Scoreboard Low 500Password Consensus Picks Buffett-Munger Bargains FAQ P/SArticles Online The All-In-One Screener Insider Trends Dividend Companies France Trends Currencies Sector Picks Low GuruFocus GuruP/B (+19.99%) Micro-Cap Charts AboutBargains Interactive Magic Stocks Download Interviews Germany Geographic International Picks Broadest Trend DCF Financials S&P Feed with Formula Owned RSS Screener 10-Y 500 Grid Gurus Top IndiaRanked Guru Screener Download (+8.26%) 52-Wk Lows (Old) Dividend Portfolio Contact Stocks Model Portfolios Value Japan Most Highs 52-WkIdea Contest ETFs Weighted (+-7.41%) Videos UK Predictables Companies Options More... Preferred Stocks

body

SPY

-0.05%

QQQ

-0.35%

GLD

-1.66%

(My Stocks)

Model Portfolios

Send replies to this thread to me via email

Post

GuruFocus Affiliate Program: Earn up to $140.4 per referral. Learn More FAQ Join the affiliate program

Links

personalcashadvance.com loans Payday Loan Online Business Checks loan fast penny stocks forex india Steve J Heyer Use printed envelopes for mailings.

Home About Advertise

Site Map

Term of Use

Privacy Policy

RSS

Email Alerts

Become an Affiliate

FAQ

Contact Us

Sign Out

2004-2012 GuruFocus.com, LLC. All Rights Reserved.

Disclaimers: GuruFocus.com is not operated by a broker, a dealer, or a registered investment adviser. Under no circumstances does any information posted on GuruFocus.com represent a recommendation to buy or sell a security. The information on this site, and in its related newsletters, is not intended to be, nor does it constitute, investment advice or recommendations. The gurus may buy and sell securities before and after any particular article and report and information herein is published, with respect to the securities discussed in any article and report posted herein. In no event shall GuruFocus.com be liable to any member, guest or third party for any damages of any kind arising out of the use of any content or other material published or available on GuruFocus.com, or relating to the use of, or inability to use, GuruFocus.com or any content, including, without limitation, any investment losses, lost profits, lost opportunity, special, incidental, indirect, consequential or punitive damages. Past performance is a poor indicator of future performance. The information on this site, and in its related newsletters, is not intended to be, nor does it constitute, investment advice or recommendations. The information on this site is in no way guaranteed for completeness, accuracy or in any other way. The gurus listed in this website are not affiliated with GuruFocus.com, LLC. Daily updates provided by QuoteMedia, Inc. (CSI). Fundamental company data provided by Zacks, Inc. Credit card offers: Please note that GuruFocus.com has financial relationships with some of the merchants mentioned here. GuruFocus.com may be compensated if consumers choose to utilize the links located throughout the content on this site and generate sales for the said merchant.

http://www.gurufocus.com/forum/read.php?1,177493

5/23/2012

Vous aimerez peut-être aussi

- Fin 630 Mid Term Papers Mega File by Afaaq & Shani BhaiDocument79 pagesFin 630 Mid Term Papers Mega File by Afaaq & Shani BhaiSayed AssadullahPas encore d'évaluation

- Win / Loss Reviews: A New Knowledge Model for Competitive IntelligenceD'EverandWin / Loss Reviews: A New Knowledge Model for Competitive IntelligencePas encore d'évaluation

- How To Create A Research ReportDocument24 pagesHow To Create A Research ReportJayden JiangPas encore d'évaluation

- Business Portfolio AnalysisDocument66 pagesBusiness Portfolio AnalysisPrashant Kalaskar100% (1)

- Discount Business Strategy: How the New Market Leaders are Redefining Business StrategyD'EverandDiscount Business Strategy: How the New Market Leaders are Redefining Business StrategyPas encore d'évaluation

- Product Portfolio PlanningDocument35 pagesProduct Portfolio PlanningPunit BadalPas encore d'évaluation

- Ch14 Company Analysis 0Document39 pagesCh14 Company Analysis 0Joan marie SupsupPas encore d'évaluation

- How to Make Money in Stocks and Become a Successful Investor (TABLET--EBOOK)D'EverandHow to Make Money in Stocks and Become a Successful Investor (TABLET--EBOOK)Pas encore d'évaluation

- 10 Highest Rated Stocks - ToolsDocument15 pages10 Highest Rated Stocks - Toolsanon-469745100% (4)

- Chris Christina Elissa KlueverDocument22 pagesChris Christina Elissa Kluevervisa_kpPas encore d'évaluation

- Keys For An Effective Business Plan: Business Planning Workshop September 27, 2006Document61 pagesKeys For An Effective Business Plan: Business Planning Workshop September 27, 2006Tan Tok HoiPas encore d'évaluation

- Managed Futures for Institutional Investors: Analysis and Portfolio ConstructionD'EverandManaged Futures for Institutional Investors: Analysis and Portfolio ConstructionPas encore d'évaluation

- Ge Matrix NotesDocument13 pagesGe Matrix Notes51095BRizwana KhojaPas encore d'évaluation

- Mining Investment NotesDocument5 pagesMining Investment NotesTrade2 WinPas encore d'évaluation

- Company Analysis and Stock ValuationDocument37 pagesCompany Analysis and Stock ValuationHãmèéž MughalPas encore d'évaluation

- Strategy and Capital AllocationDocument32 pagesStrategy and Capital AllocationsonalPas encore d'évaluation

- Entrepreneurship: Unternehmensgründung Im InformationszeitalterDocument37 pagesEntrepreneurship: Unternehmensgründung Im InformationszeitalterChintan JoshiPas encore d'évaluation

- TPG PE PresentationDocument37 pagesTPG PE Presentationnicolee593100% (1)

- 2 - 16th April 2008 (160408)Document5 pages2 - 16th April 2008 (160408)Chaanakya_cuimPas encore d'évaluation

- The Well-Timed Strategy (Review and Analysis of Navarro's Book)D'EverandThe Well-Timed Strategy (Review and Analysis of Navarro's Book)Pas encore d'évaluation

- MGT 502. Business Strategy, Social Resposibility and SustainabilityDocument22 pagesMGT 502. Business Strategy, Social Resposibility and SustainabilityBaken D DhungyelPas encore d'évaluation

- Solved by Vuzs Team: Midterm Examination Spring 2009 Fin630-Investment Analysis & Portfolio Management (Session - 2)Document16 pagesSolved by Vuzs Team: Midterm Examination Spring 2009 Fin630-Investment Analysis & Portfolio Management (Session - 2)altamashrathorePas encore d'évaluation

- Growth Strategy BainDocument12 pagesGrowth Strategy BainAldo CalderaPas encore d'évaluation

- The Manual of Ideas: The "Magic Formula" Issue, Feat. Exclusive Q&A With Joel Greenblatt (Excerpt)Document19 pagesThe Manual of Ideas: The "Magic Formula" Issue, Feat. Exclusive Q&A With Joel Greenblatt (Excerpt)The Manual of Ideas100% (3)

- 2014 MarDocument64 pages2014 Marehlaban100% (3)

- The Black Book of Outsourcing: How to Manage the Changes, Challenges, and OpportunitiesD'EverandThe Black Book of Outsourcing: How to Manage the Changes, Challenges, and OpportunitiesÉvaluation : 4 sur 5 étoiles4/5 (1)

- Market-Penetration Strategy 3. Product - Development StrategyDocument28 pagesMarket-Penetration Strategy 3. Product - Development Strategyaanu1234Pas encore d'évaluation

- Class Notes #4 Investor Buying Distressed Tech CompanyDocument30 pagesClass Notes #4 Investor Buying Distressed Tech CompanyJohn Aldridge Chew100% (2)

- Best Stock Picks of Best Hedge FundsDocument141 pagesBest Stock Picks of Best Hedge FundsstockholmesPas encore d'évaluation

- Pom PlanningDocument50 pagesPom PlanningBhaumik Gandhi100% (1)

- Stock Screener PDFDocument9 pagesStock Screener PDFClaude Bernard100% (2)

- Amba Canslim1Document9 pagesAmba Canslim1api-266993521Pas encore d'évaluation

- Mining Finance Interview QuestionsDocument17 pagesMining Finance Interview QuestionsIshanSanePas encore d'évaluation

- Proposal To Launch An An Asset Management Business: George Parkanyi Sset Anagement Mpany ( (Placeholder Name)Document41 pagesProposal To Launch An An Asset Management Business: George Parkanyi Sset Anagement Mpany ( (Placeholder Name)Arifur RahmanPas encore d'évaluation

- MGT603 Final Term Solved Papers 08 Papers SolvedDocument83 pagesMGT603 Final Term Solved Papers 08 Papers SolvedMurad Khan100% (1)

- Discussion On Equity Capital Markets: Tuesday, December 12, 2006Document22 pagesDiscussion On Equity Capital Markets: Tuesday, December 12, 2006Ankit ChoudharyPas encore d'évaluation

- Strategic Capital Group Workshop #1: Stock Pitch CompositionDocument28 pagesStrategic Capital Group Workshop #1: Stock Pitch CompositionUniversity Securities Investment TeamPas encore d'évaluation

- Outthink the Competition (Review and Analysis of Krippendorff's Book)D'EverandOutthink the Competition (Review and Analysis of Krippendorff's Book)Pas encore d'évaluation

- Applying Fundamental Analysis For Growth Stocks: Partha MohanramDocument23 pagesApplying Fundamental Analysis For Growth Stocks: Partha MohanramErica HartPas encore d'évaluation

- Quantitative Strategies for Achieving Alpha: The Standard and Poor's Approach to Testing Your Investment ChoicesD'EverandQuantitative Strategies for Achieving Alpha: The Standard and Poor's Approach to Testing Your Investment ChoicesÉvaluation : 4 sur 5 étoiles4/5 (1)

- Break Up or Shake UpDocument5 pagesBreak Up or Shake UpMaxMolinariPas encore d'évaluation

- Assignment Human Resource Planning 086Document4 pagesAssignment Human Resource Planning 086Mani RayPas encore d'évaluation

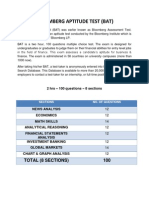

- Bloomberg Aptitude Test (BAT)Document10 pagesBloomberg Aptitude Test (BAT)Shivgan Joshi100% (1)

- Exitround Tech M&a Report From 0-100 Million, The Exit CurveDocument15 pagesExitround Tech M&a Report From 0-100 Million, The Exit Curvebragster2201Pas encore d'évaluation

- Lessons from Private Equity Any Company Can UseD'EverandLessons from Private Equity Any Company Can UseÉvaluation : 4.5 sur 5 étoiles4.5/5 (12)

- BCG Matrix Apple IncDocument5 pagesBCG Matrix Apple IncManish SehrawatPas encore d'évaluation

- BCG Matrix Apple IncDocument5 pagesBCG Matrix Apple Incahsan1379100% (4)

- Competition Demystified (Review and Analysis of Greenwald and Kahn's Book)D'EverandCompetition Demystified (Review and Analysis of Greenwald and Kahn's Book)Pas encore d'évaluation

- Stock Screening For Tiny TitansDocument9 pagesStock Screening For Tiny Titansthiend100% (1)

- Option Volatility and Pricing: Advanced Trading Strategies and Techniques, 2nd EditionD'EverandOption Volatility and Pricing: Advanced Trading Strategies and Techniques, 2nd EditionPas encore d'évaluation

- The Profit Zone (Review and Analysis of Slywotzky and Morrison's Book)D'EverandThe Profit Zone (Review and Analysis of Slywotzky and Morrison's Book)Pas encore d'évaluation

- BCGDocument31 pagesBCGNilesh MandlikPas encore d'évaluation

- BCG Matrix: Question Marks???Document6 pagesBCG Matrix: Question Marks???jagdish92Pas encore d'évaluation

- Chapter2 (2 1 1)Document50 pagesChapter2 (2 1 1)Xander MaxPas encore d'évaluation

- Financial Statement AnalysisDocument80 pagesFinancial Statement AnalysisSujatha SusannaPas encore d'évaluation

- Biotech 3Document38 pagesBiotech 3dovnadlerPas encore d'évaluation

- Commentaries Edmp 209112.PhpDocument7 pagesCommentaries Edmp 209112.PhpdovnadlerPas encore d'évaluation

- Handbook of Modern Finance - Bond AnalysisDocument21 pagesHandbook of Modern Finance - Bond AnalysisAmis NomerPas encore d'évaluation

- 22RATIOANALYSISDocument23 pages22RATIOANALYSISdovnadlerPas encore d'évaluation

- Introduction To Islamic InvestingDocument8 pagesIntroduction To Islamic InvestingdovnadlerPas encore d'évaluation

- TP 75Document12 pagesTP 75dovnadlerPas encore d'évaluation

- State Report:: of TechDocument9 pagesState Report:: of TechdovnadlerPas encore d'évaluation

- 7 - Integrated Microsystems For Controlled Drug DeliveryDocument14 pages7 - Integrated Microsystems For Controlled Drug DeliverydovnadlerPas encore d'évaluation

- Hasset Pcicing ModelDocument25 pagesHasset Pcicing ModeldovnadlerPas encore d'évaluation

- Mind of An AnalystDocument82 pagesMind of An Analystapi-3826223100% (1)

- Too Far, Too Fast: Arron S OverDocument17 pagesToo Far, Too Fast: Arron S OverdovnadlerPas encore d'évaluation

- Why Individual Investors Want Dividends - 2005 - Journal of Corporate Finance PDFDocument38 pagesWhy Individual Investors Want Dividends - 2005 - Journal of Corporate Finance PDFYoussef AlyPas encore d'évaluation

- Fatemi 2002 Global Finance JournalDocument10 pagesFatemi 2002 Global Finance JournaldovnadlerPas encore d'évaluation

- ElliotDocument3 pagesElliotdovnadlerPas encore d'évaluation

- 5 PlayDocument3 pages5 PlaydovnadlerPas encore d'évaluation

- Pimco HedgingDocument4 pagesPimco HedgingdovnadlerPas encore d'évaluation

- Chicken Wings With Sweet... RecipeDocument9 pagesChicken Wings With Sweet... RecipeAngshuman DuttaPas encore d'évaluation

- Pangasinan Coop Masterlist 2013 PDFDocument43 pagesPangasinan Coop Masterlist 2013 PDFeslima5100% (2)

- QPMC Rate CardsDocument9 pagesQPMC Rate CardsTarek TarekPas encore d'évaluation

- Bus Ticket Invoice 1673864116Document2 pagesBus Ticket Invoice 1673864116SP JamkarPas encore d'évaluation

- Classwork10 06-Chasekinnel 15Document4 pagesClasswork10 06-Chasekinnel 15api-310965037Pas encore d'évaluation

- Sworn Statement of Assets, Liabilities and Net WorthDocument4 pagesSworn Statement of Assets, Liabilities and Net WorthSugar Fructose GalactosePas encore d'évaluation

- The Qmentary (더큐멘터리) - Seventeen (세븐틴) - Mansae (만세) (Eng-jpn-chn Sub) .SrtDocument16 pagesThe Qmentary (더큐멘터리) - Seventeen (세븐틴) - Mansae (만세) (Eng-jpn-chn Sub) .SrtArancha LucianaPas encore d'évaluation

- Hotel Housekeeping - GuidelinesDocument2 pagesHotel Housekeeping - GuidelinesNakhayo Juma100% (1)

- Short-Term AnalysisDocument24 pagesShort-Term AnalysisJhaycob Lance Del RosarioPas encore d'évaluation

- Nota TransistorDocument13 pagesNota TransistorLokman HakimPas encore d'évaluation

- Activity Sheet - Module 4Document4 pagesActivity Sheet - Module 4Chris JacksonPas encore d'évaluation

- Chapter 9 Making Capital Investment DecisionsDocument32 pagesChapter 9 Making Capital Investment Decisionsiyun KNPas encore d'évaluation

- Sample UploadDocument14 pagesSample Uploadparsley_ly100% (6)

- Future Worth Analysis + Capitalized CostDocument19 pagesFuture Worth Analysis + Capitalized CostjefftboiPas encore d'évaluation

- Process Costing LafargeDocument23 pagesProcess Costing LafargeGbrnr Ia AndrntPas encore d'évaluation

- GoibiboDocument4 pagesGoibiboAshok BansalPas encore d'évaluation

- UK Hotel Industry ReportDocument10 pagesUK Hotel Industry Reportagrawalnakul100% (1)

- Airline TermsDocument8 pagesAirline TermsVenus HatéPas encore d'évaluation

- DemonetisationDocument3 pagesDemonetisationKashreya JayakumarPas encore d'évaluation

- Business Environment PPT 2020 PDFDocument50 pagesBusiness Environment PPT 2020 PDFSatyam AgarwallaPas encore d'évaluation

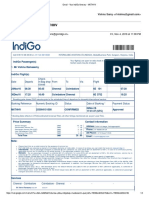

- Gmail - Your IndiGo Itinerary - M6THHV - Chennai CoimbatoreDocument3 pagesGmail - Your IndiGo Itinerary - M6THHV - Chennai CoimbatoreVishnu SamyPas encore d'évaluation

- Define A Class AssignmentDocument5 pagesDefine A Class AssignmentRam AdityaPas encore d'évaluation

- Saphelp Nw73ehp1 en 0c Ea5e52e35b627fe10000000a44538d FramesetDocument24 pagesSaphelp Nw73ehp1 en 0c Ea5e52e35b627fe10000000a44538d Framesety2kmvrPas encore d'évaluation

- Assignment On Ratio Analysis: Presented byDocument5 pagesAssignment On Ratio Analysis: Presented bybhaskkarPas encore d'évaluation

- VL Mock ExamDocument11 pagesVL Mock ExamJohnelle Ashley Baldoza TorresPas encore d'évaluation

- 3 How To Create The PartsDocument47 pages3 How To Create The PartsArief Noor RahmanPas encore d'évaluation

- Project Proposal IN Broiler Production: Maria Sofia B. Lopez Viii-Emerald Mrs. HongeriaDocument3 pagesProject Proposal IN Broiler Production: Maria Sofia B. Lopez Viii-Emerald Mrs. HongeriaSofiaLopezPas encore d'évaluation

- Characteristics of Intermittent and Continuous ManufacturingDocument3 pagesCharacteristics of Intermittent and Continuous ManufacturingSa RiTa100% (1)

- Magnit ValuationDocument50 pagesMagnit ValuationNikolay MalakhovPas encore d'évaluation

- Milken Institute - Mortgage Crisis OverviewDocument84 pagesMilken Institute - Mortgage Crisis Overviewpemmott100% (3)