Académique Documents

Professionnel Documents

Culture Documents

The Underground Economy and Tax Evasion in Pakistan

Transféré par

Ali ShehzadDescription originale:

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

The Underground Economy and Tax Evasion in Pakistan

Transféré par

Ali ShehzadDroits d'auteur :

Formats disponibles

The underground economy and tax evasion in Pakistan: annual estimates and the impact of dollarisation of the economy

Several studies have been done to estimate the size of the underground economy in Pakistan. This study attempts to improve on previous work by taking a large sample sizeand adding a new dimension to the approaches being used by evaluating the effect of dollarisation of the economy with the help of a slightly modified version of Tanzi methodology. The results of the study confirm presence of a large underground economy and rampant tax evasion between 1960 and 1998. Moreover, dollarisation of the economy has become a problem because of a significant involvement of underground foreign exchange in the economy. I. INTRODUCTION The underground economy (UE) and tax evasion have been a focus of research in Pakistan for many years now. The growing interest in these areas is because of persistent budget deficits resulting from inadequate tax revenues. It is not the presence but the size of the underground economy and the extent of tax evasion that is a major cause of concern. The growth rate of the underground economy is crucial to policy making. Lack of information in this regard is often held responsible for distortions in major macroeconomic indicators. In effect, the socio-economic policies based on these indicators are made ineffectual. Thus up-to-date estimates of the size and growth of the underground economy are very important. Social and economic policies directly affect the size and growth of the underground economy. Major policy changes like structural reforms in the financial and banking sectors make a significant impact on both economies. In this respect, it is crucial to gauge the impact of structural changes like dollarisation of the economy on underground activities. Several studies have been done to estimate the size of the underground economy in Pakistan. This study attempts to improve on previous work by taking a large sample sizeand adding a new dimension to the approaches being used by evaluating the effect of dollarisation of the economy with the help of a slightly modified version of Tanzi methodology. The results of the study confirm presence of a large underground economy and rampant tax evasion between 1960 and 1998. Moreover, dollarisation of the economy has become a problem because of a significant involvement of underground foreign exchange in the economy. The term underground economy encompasses a vast variety of activities that are not deemed legal by law and one cannot be sure of the exact meaning of the phrase. There are

several synonyms of the term underground; for example Secondary, Hidden, Irregular, Parallel, Unofficial, Black etc. However, there are four different categories under which the underground economy can be classified. The illegal economy consists of income produced by economic activities that are anti-social in nature. This category would comprise smuggling, gambling, prostitution, drug trafficking, and so on. The unreported economy refers to those economic activities that operate by evading the payment of taxes by not reporting income to the fiscal authorities. The unrecorded economy, similar to the unreported economy, consists of income that should be recorded in the national accounts but which are not. And lastly, the informal economy includes those activities that entail a cost but which are excluded from the rights and benefits of the formal economy. Thus the definition of the term differs with the objective and the approach of the study. Consequently, every study presents different results based on its objective and approach. This study defines underground economy as consisting of income generated from activities that are hidden from tax authorities in an attempt to evade taxes. Therefore it does not measure illegal or informal economies. The underground economy of Pakistan, based on the mentioned definition has been estimated previously. It is important to state here, that no previous estimate has been termed entirely accurate and neither can this one be termed so. However, this paper attempts to improve upon previous estimates, by taking a large sample size, and adding a new dimension to the approaches being used by evaluating the effect of dollarisation of the economy. It presents qualitative and quantitative consequences of a sizeable underground economy and its policy implications. The paper is divided into six sections. After the introduction, Section II presents a brief literature review of the monetary approach. Section III provides the methodology of the estimation. This paper makes some modifications to the Tanzi methodology to make it suitable for the economy of Pakistan. The regression results and the estimates for the underground economy and tax evasion are tabulated in Section IV. Section V includes the important consequences followed by conclusion and policy implications in Section VI. II. LITERATURE REVIEW In most of the studies the measurement of the underground economy is restricted purely to attempts at estimating the level of underground income earned, as opposed to the level of underground wealth. This is because of the difficulty in measuring hidden wealth as well as because of conceptual difficulties that will necessarily be encountered. For example, a man who earns money through both legitimate and illegitimate means may keep the sum of his earnings in a single account. Measuring his level of underground wealth would therefore entail measuring the level of his savings. Complications arise when withdrawals are made from this account: should the remaining balance be treated as legal, illegal, or a combination of both? And if it is to be treated as a combination, in which proportions

should the legally earned and illegally earned money be split? There are essentially five methods of estimating the size and extent of the underground economy, all of which focus on trying to gauge the level of underground income earned. They are: the monetary approach, the fiscal approach, the national account approach, the labour market approach, and the physical input approach. Acharya (1986) and Pyles (1989) present a comprehensive critique of these approaches. This paper incorporates the monetary approach to estimate the level of underground economy. The monetary approach assumes there to be an implicit and, more importantly, stable relationship between various monetary stocks. It suggests that underground economy translates into changes in the 'norm' value of certain monetary stocks. Essentially it attempts to determine the demand for currency holding equation, and estimate the effect of tax rate on the total demand. Various versions of this approach are available in the literature depending on the assumptions used to determine the currency demand. Guttman (1977) estimated the impact of tax rate on currency to demand deposits ratio. He argued that a rise in this ratio indicates an increase in the underground economy. He assumed that income velocity of money is the same for both the underground and the observed economies. Fiege (1979) used Irving Fisher's quantity theory of money to come up with his estimates. He estimated the nominal GNP by using the transaction velocity of money and money supply defined as currency in circulation plus demand deposits. The difference between this GNP and the GNP measured by national accounts is assumed to estimate the underground economy. Finally, the Tanzi analysis (1980, 1982, t983) used by this study, estimates demand for money (currency/M2) as a function of tax rate, share of salaries and wages to national income and interest rate on time deposit. This approach is based on two main assumptions: The underground economy is due to tax evasion and currency alone is used as a medium to carry out transactions in the underground economy. Tanzi estimated the GNP of the underground economy assuming that the underground velocity of money is the same as the observed economy. Several other studies; Ahmad and Qazi (1992); Shabsigh (1995); Iqbal, Qureshi and Mahmood (1996), modify this methodology to suit Pakistan's case. Ahmad and Qazi (1992) redefined the currency to money supply ratio to add the effect of bearer bonds. Shabsigh (1995) and Iqbal, Qureshi and Mahmood (1996) estimate the sectoral composition of the underground economy. III. METHODOLOGY This paper uses the Tanzi methodology with minor changes made to the specification of the demand for currency model to incorporate the effect of dollarisation of the economy. It includes more relevant variables and it measures the underground economy over the period 1960-98 to increase the accuracy of the estimates. However, due to large sample size, the sectoral composition is not included in this paper since there are inconsistencies between the data for the

periods 1960-71 and 1971-98. Finally velocity is defined in a different manner to facilitate the modified model.

Vous aimerez peut-être aussi

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (399)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (587)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- Blades in The Dark - Doskvol Maps PDFDocument3 pagesBlades in The Dark - Doskvol Maps PDFRobert Rome20% (5)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (890)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (73)

- The Optimum Quantity of Money Milton FriedmanDocument305 pagesThe Optimum Quantity of Money Milton Friedmantrafalgar111100% (4)

- Joint Venture Report on Successful Business PartnershipsDocument26 pagesJoint Venture Report on Successful Business PartnershipsKuldeep Kaur SindhavPas encore d'évaluation

- Ba 655Document2 pagesBa 655Ali ShehzadPas encore d'évaluation

- Project InvestmentDocument2 pagesProject InvestmentAli ShehzadPas encore d'évaluation

- When Performance Appraisals Are ConductedDocument1 pageWhen Performance Appraisals Are ConductedAli ShehzadPas encore d'évaluation

- Adnan Best File in The World Me John CenaDocument1 351 pagesAdnan Best File in The World Me John CenaAli ShehzadPas encore d'évaluation

- When Performance Appraisals Are ConductedDocument1 pageWhen Performance Appraisals Are ConductedAli ShehzadPas encore d'évaluation

- Ashmore Dana Obligasi Nusantara: Fund Update Jul 2019Document2 pagesAshmore Dana Obligasi Nusantara: Fund Update Jul 2019Power RangerPas encore d'évaluation

- Aqa Econ2 QP Jan13Document16 pagesAqa Econ2 QP Jan13api-247036342Pas encore d'évaluation

- Iraqi Dinar - US and Iraq Reached On Agreement To IQD RV - Iraqi Dinar News Today 2024Document2 pagesIraqi Dinar - US and Iraq Reached On Agreement To IQD RV - Iraqi Dinar News Today 2024Muhammad ZikriPas encore d'évaluation

- Jagath Nissanka,: Experience Key Roles and ResponsibilitiesDocument2 pagesJagath Nissanka,: Experience Key Roles and ResponsibilitiesJagath NissankaPas encore d'évaluation

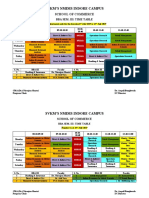

- Time-Table - BBA 3rd SemesterDocument2 pagesTime-Table - BBA 3rd SemesterSunny GoyalPas encore d'évaluation

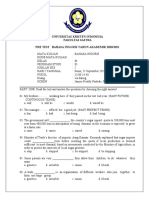

- Pre Test of Bahasa Inggris 21 - 9 - 2020Document5 pagesPre Test of Bahasa Inggris 21 - 9 - 2020magdalena sriPas encore d'évaluation

- Lesson 1 Business EthicsDocument21 pagesLesson 1 Business EthicsRiel Marc AliñaboPas encore d'évaluation

- 4 93-F Y B A - Micro-EconomicsDocument3 pages4 93-F Y B A - Micro-EconomicsSanjdsgPas encore d'évaluation

- A Mutual Fund Is A Trust That Pools The Savings of A Number of Investors Who Share A Common Financial GoalDocument10 pagesA Mutual Fund Is A Trust That Pools The Savings of A Number of Investors Who Share A Common Financial GoalMonika MonaPas encore d'évaluation

- Signature Global Park 5 Apartment Details and Payment PlansDocument2 pagesSignature Global Park 5 Apartment Details and Payment Planssanyam ralliPas encore d'évaluation

- Resume NaveenDocument2 pagesResume NaveenVinaySinghPas encore d'évaluation

- Group A Hyderabad Settlement StudyDocument12 pagesGroup A Hyderabad Settlement StudyRIYA AhujaPas encore d'évaluation

- Energia Solar en EspañaDocument1 pageEnergia Solar en EspañaCatalin LeusteanPas encore d'évaluation

- Radical Culture Research Collective - Nicolas BourriaudDocument3 pagesRadical Culture Research Collective - Nicolas BourriaudGwyddion FlintPas encore d'évaluation

- Ex 6 Duo - 2021 Open-Macroeconomics Basic Concepts: Part 1: Multple ChoicesDocument6 pagesEx 6 Duo - 2021 Open-Macroeconomics Basic Concepts: Part 1: Multple ChoicesTuyền Lý Thị LamPas encore d'évaluation

- Analisa Investasi AlatDocument15 pagesAnalisa Investasi AlatPaula Olivia SaiyaPas encore d'évaluation

- Second Reading of Ordinance State Housing Law 01-05-16Document16 pagesSecond Reading of Ordinance State Housing Law 01-05-16L. A. PatersonPas encore d'évaluation

- INTERNATIONAL BUSINESS About Mercantilizm and Absolute AdvanceDocument13 pagesINTERNATIONAL BUSINESS About Mercantilizm and Absolute AdvanceKhang Ninh HồngPas encore d'évaluation

- Measuring Elasticity of SupplyDocument16 pagesMeasuring Elasticity of SupplyPetronilo De Leon Jr.Pas encore d'évaluation

- Critique Paper BA211 12 NN HRM - DacumosDocument2 pagesCritique Paper BA211 12 NN HRM - DacumosCherBear A. DacumosPas encore d'évaluation

- Form 32 A Central: Treasury or Sub TreasuryDocument1 pageForm 32 A Central: Treasury or Sub TreasuryMuhammad AsifPas encore d'évaluation

- Reading: Time Allowed: 90 Minutes Maximum Marks: 40 General InstructionsDocument5 pagesReading: Time Allowed: 90 Minutes Maximum Marks: 40 General InstructionssayedPas encore d'évaluation

- Airborne Express CaseDocument3 pagesAirborne Express Casehowlnmadmurphy2Pas encore d'évaluation

- Akpk SlideDocument13 pagesAkpk SlideizzatiPas encore d'évaluation

- Topic 6 Stances On Economic Global IntegrationDocument43 pagesTopic 6 Stances On Economic Global IntegrationLady Edzelle Aliado100% (1)

- AG R2 E PrintDocument308 pagesAG R2 E PrintPrem KumarPas encore d'évaluation

- Day Balance Daily % Growth Daily Profit Goal TP: Necessary Lot Size Based On ONE Trade Per DayDocument8 pagesDay Balance Daily % Growth Daily Profit Goal TP: Necessary Lot Size Based On ONE Trade Per DaymudeyPas encore d'évaluation