Académique Documents

Professionnel Documents

Culture Documents

Mode of Operations

Transféré par

Archana SinhaDescription originale:

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Mode of Operations

Transféré par

Archana SinhaDroits d'auteur :

Formats disponibles

Insight Either or Survivor

http://insight.banyanfa.com/?tag=either-or-survivor

Insight Official blog of Banyan Financial Advisors.A place where we share out views with public.

Home About Us Contact Us Terms & Conditions

Posts Tagged Either or Survivor

Modes of Operating Bank account

Monday, January 23rd, 2012 Number of View: 34 Operating a bank account may sound very simple to you and possibly you may be wondering why I am trying to write a blog on modes of operating bank account. Well the motive is to reflect upon different ways you can open your bank account in order to control who can operate your account and when can a person operate the account. It is very handy to know these details as it may be of help while trying to open a bank account. My experience while dealing with bankers has not been very positive as most of them didnt know the subtle differences between different modes of operating a bank account. Broadly, the following options are available when opening up a bank account: 1. 2. 3. 4. 5. 6. 7. 8. 9. Single Joint Jointly or Survivor Either or Survivor Any or Survivor Former or Survivor Joint accounts with Special Instructions Via Letter of Authority / Power of Attorney holder Minor account

Single Mode of Operations This mode of operating a bank account is very simple and applies when you open a bank account in only one name. Hence the instruction given to the bank is Single, i.e. only the account holder shall operate the account. In case of death of the account holder, the proceeds shall be paid to the nominee or the legal representative of the deceased person.

Joint Holders When you have more than one account holders of a bank, the type of bank account is called a Joint Bank account. In case of a simple Joint mode of operation, both / all the account holders would have to sign a cheque in order to allow the cheque to clear. If for example, Mr. A & Mr B open a joint account with mode of operation Joint, then both Mr. A & Mr. B would have to sign together on the cheque. If only Mr. A or Mr. B signed the cheque, the respective bank wont honour the cheque. In case any of joint account holder dies, the account can not be further operated and the proceeds shall be payable to the

1 of 5

10-03-2012 19:12

Insight Either or Survivor

http://insight.banyanfa.com/?tag=either-or-survivor

surviving account holder along with the nominee / legal representative of the deceased account holder.

Jointly or Survivor Under this mode of operation of a Joint account, during the life time of the joint account holders, the cheque would have to be signed by both the Joint account holders (just like a normal Joint mode of operating a bank account). However, in a an event whereby any of the joint holder dies, the surviving account holder can continue to operate the account as if he was the single account holder. Alternatively, the proceeds of the account can be credited to the account of the surviving account holder. For example, if Mr. A & Mr. B operate their bank account in the mode of Joint or Survivor and Mr. A dies, then Mr. B can individually operate the account or transfer the proceeds to his own other bank account.

Either or Survivor (E o S) This mode of bank account is opened when the number of bank account holders are more than 1. The account opened as Either or Survivor can be operated by any of the account holders and do not require joint signature of all account holders in order to operate the account. In case of our above example, if the account was opened under EoS mode, either Mr. A or Mr. B could individually operate the account as if they are the sole owner of the account. However, in case of death of any of the account holders, the surviving account holder can either continue to operate the account or take the proceeds into his own bank account.

Any or Survivor ( A o S) This mode of operation is very similar to the EoS category. Infact people often speak upon EoS or AoS interchangeably. However there is a slight difference between Either or Survivor versus Any or survivor mode. Just like EoS, an account opened under AOS mode can be operated by any of the account holders without requiring the other account holder(s) to sign. However the difference is after any of the account holder dies, the right to operate lies with the surviving account holders (but jointly). They have to decide if they would like to continue with the account as Either or Survivor or take the proceeds out of the account. In case where all but one account holder remains alive, the balance is paid to the surviving account holders.

Former or Survivor This account is opened jointly between more than one account holders. However, till the primary account holder is alive, the right to operate the account vests with him / her. After the death of the primary account holder, the right to operate vests with the surviving account holders after submission of necessary documents such as death certificates. It is necessary to clarify that while the primary account holder is alive, the other account holders can not operate the account. A slight different account operation mode is Latter or Survivor where by the second account holder shall operate the bank account till his / her death and only after that the surviving account holders shall be allowed to operate the bank account.

Joint Account Holders with Special Instructions These types of bank accounts are more prevalent for corporate bank accounts where by the management wants to enforce internal controls based upon the materiality of the amount. In these accounts, the

2 of 5

10-03-2012 19:12

Insight Either or Survivor

http://insight.banyanfa.com/?tag=either-or-survivor

management specifies the limits upto which a single named account holder can sign a cheque and beyond which dual or even more than two account holders would be required to sign. For very high value transactions, it can also be mentioned that signature would be required from a specific named individual in addition to other named account holders. For example, for cheques upto Rs. 100,000 Mr. X can sign. Between Rs. 100,000 & 10,00,000 Mr. X & Mr. Y both need to sign. Any cheque beyond Rs. 10 lacs, signature of Mr. Z is required.

Via Letter of Authority / Power of Attorney Holder In some accounts you can authorise a third party to operate your bank account in your name. In such cases, though the third party can sign the cheques, but can not deposit any cheques of their own into your account. Simply speaking only an authority to sign cheques or perform other functions such as create demand drafts, and other banking functions can be performed by the authority holder. Such accounts are more common in case of Non Resident Bank accounts (NRE / NRO) or current accounts. All the joint account holders needs to agree before creating an authority holder to the respective bank account.

Minor Bank account According to Indian Majority Act, any one who is less than 18 years of age is classified as a minor. A minor above 14 years of age can open and operate saving bank account. However, a minor who is a student (literate) can generally open and operate bank accounts above 12 years of age. However any account operated by Minor themself would not be issued a cheque book probably the reason behind that is any contract with a Minor is not valid (as per Contract Act) and hence collection of cheques are not generally allowed in Minor operated bank accounts. A guardian can also open an account in the name of the minor and can operate it. Once the minor attains majority or dies, the guardian should not operate the account.

The author of this article is Banyan Financial Advisors. You can contact us on www.banyanfa.com . Tags: Any or Survivor, Banyan Financial Advisors, Different Types of Bank account, Either or Survivor, Former or Survivor, Joint account with Special Instructions, Joint bank account, Jointly or Survivor, Latter or Survivor, Letter of Authority Holder, Minor bank account, Minor no chequebook, Mode of Operating Bank account, Power of Attorney Holder, Singe mode, www.banyanfa.com Posted in Financial Infrastructure, Regulatory Updates 1 Comment

Subscribe to Insight via Email

Enter your email address to subscribe to this blog and receive notifications of new posts by email.

Popular post by view

Term Insurance - First Step Towards Financial Planning - 138 hits Your House - A drain on your Finances - 132 hits

3 of 5 10-03-2012 19:12

Insight Either or Survivor

http://insight.banyanfa.com/?tag=either-or-survivor

Fixed Deposits - How to Benefit the Most Out of them. - 132 hits NRE Fixed Deposit - Should you invest in it ? - 131 hits Provident Fund (PF) - Best Investment Option Available for Salaried Employee ! - 102 hits

Recent Comments

vignesh on How SIPs Work ankur on Can You Design Your Own Customised Child Investment Plan ? Banyan Financial Advisors on Improve your Credit History Timeline of Your Current & Future Financial Image ! Vivek K on Improve your Credit History Timeline of Your Current & Future Financial Image ! Banyan Financial Advisors on Can You Design Your Own Customised Child Investment Plan ?

Archives

March 2012 (2) February 2012 (4) January 2012 (9) December 2011 (4) November 2011 (4) October 2011 (8)

Categories

Financial Infrastructure (2) Financial Planning (4) Insurance (3) Investment Ideas (19) NRI Land (3) Regulatory Updates (9) Taxation (2) Uncategorized (1)

Blogroll

Banyan Financial Advisors Part -1 Bachat Nivesh Badhat OR Save Invest & Grow Must Watch video for investors Part -2 Bachat Nivesh Badhat OR Save Invest & Grow Must Watch video for investors

Updates from our Facebook Page

An article on something which is very important financially and plays a vital ro... March 9, 2012 http://insight.banyanfa.com/?p=348 March 2, 2012 http://insight.banyanfa.com/?p=346 February 24, 2012 http://insight.banyanfa.com/?p=288 February 20, 2012

4 of 5

10-03-2012 19:12

Insight Either or Survivor

http://insight.banyanfa.com/?tag=either-or-survivor

http://insight.banyanfa.com/?p=298 February 11, 2012 Subscribe to Insight Svelt Theme for WordPress

5 of 5

10-03-2012 19:12

Vous aimerez peut-être aussi

- T R A N S F O R M A T I O N: THREE DECADES OF INDIA’S FINANCIAL AND BANKING SECTOR REFORMS (1991–2021)D'EverandT R A N S F O R M A T I O N: THREE DECADES OF INDIA’S FINANCIAL AND BANKING SECTOR REFORMS (1991–2021)Pas encore d'évaluation

- 01 07-VpisDocument19 pages01 07-Vpishell_hello11Pas encore d'évaluation

- 0 - Retail Banking Doc2Document8 pages0 - Retail Banking Doc2Niyati BagwePas encore d'évaluation

- Minor AccountDocument12 pagesMinor AccountAshwini Venugopal100% (1)

- General Ledger User ManualDocument225 pagesGeneral Ledger User ManualVenkatesanSelvarajanPas encore d'évaluation

- Presentation On Export CreditDocument21 pagesPresentation On Export CreditArpit KhandelwalPas encore d'évaluation

- What Is An Account Aggregator?Document7 pagesWhat Is An Account Aggregator?Francis NeyyanPas encore d'évaluation

- 8 To 8 Functionality: Section Section DescriptionDocument7 pages8 To 8 Functionality: Section Section Descriptionmevrick_guyPas encore d'évaluation

- 01.01 IntroductionDocument16 pages01.01 Introductionmevrick_guyPas encore d'évaluation

- 01.09-User System ManagementDocument12 pages01.09-User System Managementmevrick_guyPas encore d'évaluation

- IRAC Norms & NPA ManagementDocument29 pagesIRAC Norms & NPA ManagementSarvar PathanPas encore d'évaluation

- NPA & Income RecognitionDocument56 pagesNPA & Income RecognitionDrashti Raichura100% (1)

- Hamim Al Mukit - General Banking of Pubali Bank LTDDocument42 pagesHamim Al Mukit - General Banking of Pubali Bank LTDHamim Al MukitPas encore d'évaluation

- Banking Regulations Basel Norms1590249674403 PDFDocument10 pagesBanking Regulations Basel Norms1590249674403 PDFAadeesh JainPas encore d'évaluation

- Punjab & Sind Bank: For Official Use OnlyDocument22 pagesPunjab & Sind Bank: For Official Use OnlySurender RanaPas encore d'évaluation

- The Electronic Clearing Service in IndiaDocument3 pagesThe Electronic Clearing Service in Indiamax_dcostaPas encore d'évaluation

- E BankingDocument41 pagesE Bankingchandni babunuPas encore d'évaluation

- Itl - Letter of CreditDocument18 pagesItl - Letter of CreditSonal SahayPas encore d'évaluation

- 7 - SBI BC ManualDocument24 pages7 - SBI BC ManualVisas SivaPas encore d'évaluation

- Chapter - 11: Npa DateDocument9 pagesChapter - 11: Npa DateBaideheePas encore d'évaluation

- 01.12 Posting RestrictionsDocument14 pages01.12 Posting Restrictionsmevrick_guyPas encore d'évaluation

- Annexure: 1.0 PreambleDocument6 pagesAnnexure: 1.0 PreambleBala CoolPas encore d'évaluation

- Customer Information File User Manual PDFDocument314 pagesCustomer Information File User Manual PDFFahim KaziPas encore d'évaluation

- Final-General Banking .Document27 pagesFinal-General Banking .Salman AhmedPas encore d'évaluation

- IbcDocument62 pagesIbcpankaj vermaPas encore d'évaluation

- Consumer Financing in PakistanDocument63 pagesConsumer Financing in Pakistansheharyar696Pas encore d'évaluation

- Credit Information Bureaue (India) LTDDocument14 pagesCredit Information Bureaue (India) LTDMayank JainPas encore d'évaluation

- L052-Cheque Truncation SystemDocument21 pagesL052-Cheque Truncation SystemRISHI KESHPas encore d'évaluation

- Banking Is Described As The Business of Taking and Securing Money Held by Other People and CompaniesDocument8 pagesBanking Is Described As The Business of Taking and Securing Money Held by Other People and CompaniesTasnim ZaraPas encore d'évaluation

- 01.04-DepositAccounts Other FunctionalitiesDocument30 pages01.04-DepositAccounts Other Functionalitiesmevrick_guyPas encore d'évaluation

- Finacle Command - TM For Transaction Maintainance Part - I - Finacle Commands - Finacle Wiki, Finacle Tutorial & Finacle Training For BankersDocument4 pagesFinacle Command - TM For Transaction Maintainance Part - I - Finacle Commands - Finacle Wiki, Finacle Tutorial & Finacle Training For BankersShubham PathakPas encore d'évaluation

- Defining Provisioning Coverage Ratio-VRK100-05Oct2011Document2 pagesDefining Provisioning Coverage Ratio-VRK100-05Oct2011RamaKrishna Vadlamudi, CFAPas encore d'évaluation

- Annexure-I Self Help Group (SHG) Profile SHG Related QuestionsDocument5 pagesAnnexure-I Self Help Group (SHG) Profile SHG Related QuestionsRavi ShankarPas encore d'évaluation

- Sources of Banks FundDocument21 pagesSources of Banks FundSatendra DubeyPas encore d'évaluation

- Banking AccountsDocument16 pagesBanking Accountssanju kumarPas encore d'évaluation

- Credit Apprisal Method-FDocument16 pagesCredit Apprisal Method-FRishabh JainPas encore d'évaluation

- KYC New ProjectDocument42 pagesKYC New ProjectNisha RathorePas encore d'évaluation

- Truncated Cheque Clearance ProceduresDocument31 pagesTruncated Cheque Clearance Proceduresjhanvi75% (4)

- Accounting Concept of Currency Chest TransactionDocument1 pageAccounting Concept of Currency Chest TransactionAjoydeep DasPas encore d'évaluation

- Corporate Banking: 11/04/21 Om All Rights Reserved. 1Document180 pagesCorporate Banking: 11/04/21 Om All Rights Reserved. 1Pravah ShuklaPas encore d'évaluation

- Loans &advances (Mantu) - Project - 1-2Document48 pagesLoans &advances (Mantu) - Project - 1-2Shivu BaligeriPas encore d'évaluation

- LogicDocument712 pagesLogicsuresh vedpathiPas encore d'évaluation

- Department of Management Studies: Serial No. Name ID No. Assignment Marks Presentation MarksDocument14 pagesDepartment of Management Studies: Serial No. Name ID No. Assignment Marks Presentation MarksKawsar Ahmed BadhonPas encore d'évaluation

- Institute of Managment Studies, Davv, Indore Finance and Administration - Semester Iv Credit Management and Retail BankingDocument3 pagesInstitute of Managment Studies, Davv, Indore Finance and Administration - Semester Iv Credit Management and Retail BankingS100% (2)

- SBI MiniBank User Manual PPT PresentationDocument75 pagesSBI MiniBank User Manual PPT PresentationMayur KhichiPas encore d'évaluation

- Mortgage Loans in IndiaDocument11 pagesMortgage Loans in IndiaDebobrata MajumdarPas encore d'évaluation

- PNB Roi New Supplementry Agreement-WordDocument2 pagesPNB Roi New Supplementry Agreement-WordAnonymous XsYDXMVPas encore d'évaluation

- GLIFDocument38 pagesGLIFTigmarashmi MahantaPas encore d'évaluation

- Manual On Banking Financial Statistics by RBIDocument312 pagesManual On Banking Financial Statistics by RBIJohn AndrewsPas encore d'évaluation

- Npa Status Through Short Enquiry: Menu Navigation For Npa inDocument11 pagesNpa Status Through Short Enquiry: Menu Navigation For Npa inBaidehee0% (3)

- Credit MonitoringDocument15 pagesCredit MonitoringTushar JoshiPas encore d'évaluation

- Comparison Between Retail and CorporateDocument10 pagesComparison Between Retail and CorporateAkshay RathiPas encore d'évaluation

- e-KYC and New Investor Process FlowDocument32 pagese-KYC and New Investor Process FlowSneha Abhash SinghPas encore d'évaluation

- Bank Portfolio ManagementDocument6 pagesBank Portfolio ManagementAbhay VelayudhanPas encore d'évaluation

- Internship Report On Generel Banking Activities of Exim BankDocument57 pagesInternship Report On Generel Banking Activities of Exim BankMorshedul Hasan100% (2)

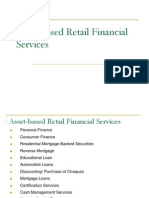

- Asset Based Retail Financial ServicesDocument37 pagesAsset Based Retail Financial Servicesjimi02100% (1)

- ChequeDocument31 pagesChequeKowshik ChakrabortyPas encore d'évaluation

- Account Closure/ Fixed Deposit Premature Withdrawal FormDocument1 pageAccount Closure/ Fixed Deposit Premature Withdrawal Formrony1346100% (1)

- Procedural Guidelines1Document69 pagesProcedural Guidelines1sburugulaPas encore d'évaluation

- Problem Set 2Document2 pagesProblem Set 2nskabra0% (1)

- Public Perceptionon Print MediaDocument8 pagesPublic Perceptionon Print MediaSeyram MayvisPas encore d'évaluation

- Patrick Svitek - Resume 2012Document1 pagePatrick Svitek - Resume 2012Patrick SvitekPas encore d'évaluation

- (Ontario) 120 - Amendment To Agreement of Purchase and SaleDocument2 pages(Ontario) 120 - Amendment To Agreement of Purchase and Salealvinliu725Pas encore d'évaluation

- S.No. Deo Ack. No Appl - No Emp Name Empcode: School Assistant Telugu Physical SciencesDocument8 pagesS.No. Deo Ack. No Appl - No Emp Name Empcode: School Assistant Telugu Physical SciencesNarasimha SastryPas encore d'évaluation

- 6 Habits of True Strategic ThinkersDocument64 pages6 Habits of True Strategic ThinkersPraveen Kumar JhaPas encore d'évaluation

- Nature of Vat RefundDocument7 pagesNature of Vat RefundRoselyn NaronPas encore d'évaluation

- LGGM Magallanes Floor PlanDocument1 pageLGGM Magallanes Floor PlanSheena Mae FullerosPas encore d'évaluation

- Case Studies in Entrepreneurship-3MDocument3 pagesCase Studies in Entrepreneurship-3MAshish ThakurPas encore d'évaluation

- Emerging and Reemerginginfectious Diseases PDFDocument98 pagesEmerging and Reemerginginfectious Diseases PDFRakesh100% (1)

- Big Enabler Solutions ProfileDocument6 pagesBig Enabler Solutions ProfileTecbind UniversityPas encore d'évaluation

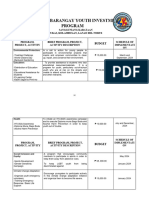

- Annual Barangay Youth Investment ProgramDocument4 pagesAnnual Barangay Youth Investment ProgramBarangay MukasPas encore d'évaluation

- Little White Book of Hilmy Cader's Wisdom Strategic Reflections at One's Fingertip!Document8 pagesLittle White Book of Hilmy Cader's Wisdom Strategic Reflections at One's Fingertip!Thavam RatnaPas encore d'évaluation

- Research Paper On RapunzelDocument8 pagesResearch Paper On RapunzelfvgcaatdPas encore d'évaluation

- Retrato Alvin YapanDocument8 pagesRetrato Alvin YapanAngel Jan AgpalzaPas encore d'évaluation

- Isa 75.03 1992 PDFDocument14 pagesIsa 75.03 1992 PDFQuang Duan NguyenPas encore d'évaluation

- COWASH Federal Admin Manual v11 PDFDocument26 pagesCOWASH Federal Admin Manual v11 PDFmaleriPas encore d'évaluation

- The Peace Report: Walking Together For Peace (Issue No. 2)Document26 pagesThe Peace Report: Walking Together For Peace (Issue No. 2)Our MovePas encore d'évaluation

- Outpatient ClaimDocument1 pageOutpatient Claimtajuddin8Pas encore d'évaluation

- Price Controls and Quotas: Meddling With MarketsDocument53 pagesPrice Controls and Quotas: Meddling With MarketsMarie-Anne RabetafikaPas encore d'évaluation

- Seryu Cargo Coret CoreDocument30 pagesSeryu Cargo Coret CoreMusicer EditingPas encore d'évaluation

- Meb Ydt 16Document21 pagesMeb Ydt 16Guney BeyPas encore d'évaluation

- Elvis CV Dec 2017Document3 pagesElvis CV Dec 2017api-385945907Pas encore d'évaluation

- Item 10 McDonalds Sign PlanDocument27 pagesItem 10 McDonalds Sign PlanCahanap NicolePas encore d'évaluation

- Security System Owner's Manual: Interactive Technologies Inc. 2266 North 2nd Street North St. Paul, MN 55109Document61 pagesSecurity System Owner's Manual: Interactive Technologies Inc. 2266 North 2nd Street North St. Paul, MN 55109Carlos Enrique Huertas FigueroaPas encore d'évaluation

- Neste Annual Report 2019Document213 pagesNeste Annual Report 2019Xianchi ZhangPas encore d'évaluation

- 2015 BT Annual ReportDocument236 pages2015 BT Annual ReportkernelexploitPas encore d'évaluation

- 2016 VTN Issue 026Document24 pages2016 VTN Issue 026Bounna PhoumalavongPas encore d'évaluation

- Altered Ego Todd HermanDocument11 pagesAltered Ego Todd HermanCatherine Guimard-Payen75% (4)

- G.R. No. L-15363: Bruno, Rufa Mae RDocument2 pagesG.R. No. L-15363: Bruno, Rufa Mae Rglaide lojeroPas encore d'évaluation