Académique Documents

Professionnel Documents

Culture Documents

Notice On Lodgement of Import - Export Declaration

Transféré par

Mr YiDescription originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Notice On Lodgement of Import - Export Declaration

Transféré par

Mr YiDroits d'auteur :

Formats disponibles

Census & Statistics Department Trade Statistics Branch (2)

Notice Reference No.:

Tel No.: 2877 1818 (press 2 and 1 after selection of language) Date:

Dear Sir/Madam,

Notice on Lodgement of Import/Export Declaration

As shown on the relevant manifest, you have imported the following article(s):

Goods Description: Carrier Name: Forwarder Name: Date of Arrival: Flight No.:

Master Air Waybill No.: House Air Waybill No.: Name of Port of Loading: Total Number of Packages: Gross Weight (Weight Unit):

In accordance with the Import and Export (Registration) Regulations, Chapter 60 and/or the Industrial Training (Clothing Industry) Ordinance, Chapter 318, Laws of Hong Kong, every person who imports or exports any article other than an exempted article* is required to lodge with the Commissioner of Customs and Excise an accurate and complete import/export declaration within 14 days after the importation/exportation of the article and pay the required declaration charges. Any late lodgement of declaration will result in penalty* being imposed on the importer/exporter. It is therefore in your own interest to lodge the declaration as soon as possible. If you have not yet lodged the required declaration, you have to lodge* the declaration without further delay. Please quote the 8-digit Notice Ref. No. (which appears at the top right corner of this notice) on the declaration. It is an offence for any person failing to lodge the required declaration within the specified period, or knowingly or recklessly lodging a declaration that is inaccurate in any material particular. For other cases, you are requested to complete this notice by putting a 'X' in the appropriate box and filling in the required information below, and return* it to this department together with the necessary supporting document, if applicable.

a.

The declaration for the article(s) in question has been already lodged. Details are as follows: Unique Declaration Reference: Lodgement Date:

Day Month Year

b. The article(s) in question is/are exempted under regulation 3 of the Import and Export (Registration) Regulations.

Reason for exemption : ____________________________________________________________________________________________ Documentary proof attached (Please specify) : ________________________________________________________________________

c. Your company is not the actual importer/exporter and act as a forwarding agent in respect of the above article(s) only.

(Please arrange to submit the name(s) and address(es) of the actual consignor(s) / consignee(s) and the shipment details to the government. Your company is strongly advised to provide these details to the carrier in future for one go submission.)

d. The importation/exportation of the article(s) in question has (have) been cancelled.

Documentary proof attached (Please specify) : ________________________________________________________________________

e. Your company has not imported/exported the article(s) in question. f. Others (Please specify) : _________________________________________________________________________________________

*For enquiry and details, please refer to the Explanatory Notes. The powers and duties exercised by the undersigned under the Import and Export (Registration) Regulations and the Industrial Training (Clothing Industry) Ordinance (Cap. 318) are authorised by the Commissioner of Customs and Excise in accordance with Section 4 of the Import and Export Ordinance (Cap. 60) and Section 43(1) of the Interpretation and General Clauses Ordinance (Cap. 1).

DqCqeiqF-pB (}: http://www.censtatd.gov.hk/co rner_on_trade_matters/index.jsp) iX ] qXG2877 1818 y ffdu su2vu1vCpBzoqxA-Pq 2877 1818 ^ u 2877 539 dC

Yours faithfully,

Statistics Supervisor, Census Statistics Department, and on behalf of Commissioner of Customs and Excise

EXPLANATORY NOTES A. Common Categories of Exempted Articles

The following classes of goods are commonly classified as exempted articles. For full details, please refer to Regulation 3 of the Import and Export (Registration) Regulations, Chapter 60, Laws of Hong Kong. (1) Any article valued at less than $1,000, which is a sample of any product OR any article which is marked clearly as a sample of any product and is to be distributed free of charge; (2) Transhipment cargo consigned on a through bill of lading or a through air waybill; (3) Any article which is marked clearly as advertising material and is supplied free of charge; (4) Personal baggage including any article imported or exported otherwise than for trade or business; (5) Any article which is imported or exported solely for the purpose of exhibition and which is to be exported or imported after exhibition; (6) Gifts of a personal nature where no payment is or is to be made by the consignee thereof; (7) Any article which is imported or exported solely for the purpose of being used in a sports competition and which is to be exported or imported after the competition.

B.

Method for Lodging Declarations

Import/export declarations are to be lodged electronically through the services provided by the service providers appointed by Government. Paper-to-electronic conversion service for declaration is also provided by the service providers through a network of service agents in Hong Kong. The service agents will send the converted electronic messages to the respective service provider for onward transmission to the Government. Further information can be obtained from the two service providers through their websites, e-mail addresses and enquiry hotlines listed in Section E below.

C.

Forms, Imports and Exports Declaration Charge, Clothing Industry Training Levy and Penalty Charge

At the time of lodging declaration, importer/exporter is required to use the prescribed form, pay Imports and Exports Declaration Charge and/or Clothing Industry Training Levy to the Government as shown in the following table: Prescribed form type Importation of non-food items Importation of food items (1) Importation of articles exempted from declaration charge (3) Exportation of Hong Kong made non-clothing and non-footwear items and Re-exportation Exportation of Hong Kong made clothing and footwear items (2) Exportation of articles exempted from declaration charge (3) Notes: (1) (2) (3) Import Declaration Form 1 Import Declaration Form 1A Import Declaration Form 1B Export/Re-export Declaration Form 2 Export Declaration Form 2A Export/Re-export Declaration Form 2B Charges 50 cents in respect of the first $46,000 of the value of the goods and 25 cents in respect of each additional $1,000 or part thereof and rounded up to the nearest 10 cents. 50 cents per declaration irrespective of the value. Exempted from declaration charge irrespective of the value. 50 cents in respect of the first $46,000 of the value of the goods and 25 cents in respect of each additional $1,000 or part thereof and rounded up to the nearest 10 cents. Clothing Industry Training Levy of 30 cents in respect of each $1,000 value or part thereof in addition to the Imports and Exports Declaration Charge. Exempted from declaration charge irrespective of the value.

Details specified in Appendix I of the current Hong Kong Imports and Exports Classification List (Harmonized System) Details specified in Appendix II of the current Hong Kong Imports and Exports Classification List (Harmonized System) Details specified in Regulations 8(3) & 8(4) of the Import and Export (Registration) Regulation, Chapter 60E, Laws of Hong Kong

A penalty charge calculated according to the following table is required to be paid in respect of each declaration not lodged within 14 days after the importation/exportation: Penalty payable where a declaration is lodged Total value of articles specified in a declaration Not exceeding $20,000 Exceeding $20,000 D. within one month and 14 days after the importation/exportation $20 $40 within two months and 14 days after the importation/exportation $40 $80 after two months and 14 days after the importation/exportation $100 $200

Making Reply to Declaration Notice calling the Declaration Notice Reply Hotline at 2828 3476 (A fax of the instruction on using the system can be obtained from the system by pressing 2 after selection of language.); sending a completed electronic form TSP101 (which is available in the website of the Census and Statistics Department (C&SD) at http://www.censtatd.gov.hk) to the e-mail address trade-declaration@censtatd.gov.hk; fax to 2877 5399; or mailing the reply to Trade Statistics Processing Section, 18/F, Wanchai Tower, Hong Kong.

E. Reference and Enquiry A booklet entitled "How to Complete and Lodge Import/Export Declarations", which outlines the main points to note in completing import/export declarations, is available free of charge at C&SD and the Customs and Excise Department. Besides, this booklet can be viewed or downloaded from C&SDs website at http://www.censtatd.gov.hk. If you have further question or difficulty in completing your import/export declarations, you may telephone the Census and Statistics Department Import/Export Declaration and Cargo Manifest Enquiry Hotline at 2877 1818 (for specific enquiry on Declaration Notice matters, you can press 2 and 1 after selection of language), send an e-mail to trade-declaration@censtatd.gov.hk or fax it to 2877 5399. Websites, enquiry e-mail addresses and telephone hotlines of some services relevant to lodgement of import/export declarations are listed below for reference: Organization Service Websites / E-mail Address Enquiry Hotline Customs and Excise Verification and assessment on import/export declarations, permits for http://www.customs.gov.hk 2815 7711 dutiable commodities, licences for dutiable commodities customsenquiry@customs.gov.hk Department Trade and Industry Department Brio Electronic Commerce Limited Global e-Trading Services Limited Tradelink Electronic Commerce Limited Import/export licences for textiles and non-textiles goods, certificates of origin, information on tariff and import regulations of other countries Electronic Declaration Service Electronic Declaration Service Electronic Declaration Service http://www.tid.gov.hk enquiry@tid.gov.hk 2392 2922 2111 1611 8201 0082 2599 1700

http://www.brio.com.hk helpdesk@brio.com.hk

http://vip.ge-ts.com.hk enquiry@ge-ts.com.hk http://www.tradelink.com.hk mktsales@tradelink.com.hk

Vous aimerez peut-être aussi

- Print Reading For Constn (2013) D. DorfmuellerDocument51 pagesPrint Reading For Constn (2013) D. DorfmuellerBogasi Q.Pas encore d'évaluation

- FSCJ Unofficial TranscriptsDocument2 pagesFSCJ Unofficial TranscriptsMegan AllenPas encore d'évaluation

- Beware 23122019-1enDocument3 pagesBeware 23122019-1enmarcell ribeiroPas encore d'évaluation

- SGS EN455 Test Report SDocument4 pagesSGS EN455 Test Report SAhmad Yani S NoorPas encore d'évaluation

- Public Policymaking Processes: Unit 5Document80 pagesPublic Policymaking Processes: Unit 5henokPas encore d'évaluation

- 8 Lim 026708Document3 pages8 Lim 026708mapiforeverPas encore d'évaluation

- U.S. Customs and Border Protection Entry Summary: Department of Homeland SecurityDocument2 pagesU.S. Customs and Border Protection Entry Summary: Department of Homeland SecurityGabriel ColomboPas encore d'évaluation

- Applied Economics: Business Environment 666Document12 pagesApplied Economics: Business Environment 666RUBEN LEYBA100% (2)

- Commercial Invoive & Ppop UptimeDocument9 pagesCommercial Invoive & Ppop Uptimeyjmfvffqx9Pas encore d'évaluation

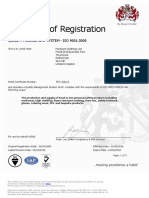

- Certificate of Registration: Quality Management System - Iso 9001:2008Document2 pagesCertificate of Registration: Quality Management System - Iso 9001:2008Adriana FranciscaPas encore d'évaluation

- Virtual School ABSUDocument2 pagesVirtual School ABSUTristan ReedPas encore d'évaluation

- PIL SamplexDocument8 pagesPIL SamplexJMXPas encore d'évaluation

- Seller's Mandate Ncnda-Imfpa For Euro-4Document6 pagesSeller's Mandate Ncnda-Imfpa For Euro-4john simonPas encore d'évaluation

- ACR SLAC On Mental Health Awareness Month CelebrationDocument2 pagesACR SLAC On Mental Health Awareness Month CelebrationKenneth Tuazon Tingzon50% (2)

- Awb - 176-3616 9700 PDFDocument1 pageAwb - 176-3616 9700 PDFWilfredo Amr RuizPas encore d'évaluation

- Import and Export LicensesDocument3 pagesImport and Export LicensesAngie PhaTchananPas encore d'évaluation

- Application For A Bank Guarantee: Please SelectDocument6 pagesApplication For A Bank Guarantee: Please SelectGulrana AlamPas encore d'évaluation

- Booking Form DHLDocument2 pagesBooking Form DHLSơn Lê ThếPas encore d'évaluation

- Import LicenseDocument3 pagesImport LicensejagdishPas encore d'évaluation

- Pro Forma Vietnam DPDocument4 pagesPro Forma Vietnam DPAfanPas encore d'évaluation

- 0325 Jet Fuel Aand A1Document10 pages0325 Jet Fuel Aand A1VidyasenPas encore d'évaluation

- Letter of Intent BG Fresh Cut HSBC Holdings PLC: Loi/Rwa PackageDocument32 pagesLetter of Intent BG Fresh Cut HSBC Holdings PLC: Loi/Rwa PackageCarlo ValenciaPas encore d'évaluation

- Sample 27001 QRODocument1 pageSample 27001 QROYogesh PrajapatiPas encore d'évaluation

- Whose Shoes? Identity in Works of ArtDocument15 pagesWhose Shoes? Identity in Works of ArtpolklePas encore d'évaluation

- Expenses Claim Form: QF/FIN/005/01/00Document2 pagesExpenses Claim Form: QF/FIN/005/01/00rahmanPas encore d'évaluation

- British Petroleum Terms and ConditionDocument4 pagesBritish Petroleum Terms and Conditionkarthikeyan mpPas encore d'évaluation

- Pro Fora - Invoice: Your Number One Partner in Transport SolutionsDocument1 pagePro Fora - Invoice: Your Number One Partner in Transport SolutionsMichelPas encore d'évaluation

- MSDS Acetate TowDocument5 pagesMSDS Acetate TowTegar Bagaskara100% (1)

- BRC - 2019-Shuaiba Industrial Company (Jafza)Document1 pageBRC - 2019-Shuaiba Industrial Company (Jafza)VincentPas encore d'évaluation

- 007Document1 page007Bacana das NuvensPas encore d'évaluation

- Quality Certificate Jet FuelDocument2 pagesQuality Certificate Jet FuelLeather BredBoi100% (1)

- Preferred Manufacturers List (PML) Registration Form: Registration Reference No: Date: Manufacturing Plant DetailsDocument2 pagesPreferred Manufacturers List (PML) Registration Form: Registration Reference No: Date: Manufacturing Plant DetailsRoshanPas encore d'évaluation

- Kuwait Export Crude Oil PDFDocument14 pagesKuwait Export Crude Oil PDFShiva KrishnaPas encore d'évaluation

- Cargo Manifest AnnabaDocument8 pagesCargo Manifest AnnabaMohamed ChelfatPas encore d'évaluation

- Cargo Documents09022020052651Document23 pagesCargo Documents09022020052651ROMULO ESCALANTE100% (1)

- NEXT TFD Elder (1) 1Document13 pagesNEXT TFD Elder (1) 1Ruffabbey06Pas encore d'évaluation

- Customs DocumentationDocument2 pagesCustoms DocumentationDHL Express UKPas encore d'évaluation

- 711 申請書Document2 pages711 申請書Stefanie SusantiPas encore d'évaluation

- Web Eticket: Page 1 of 2Document2 pagesWeb Eticket: Page 1 of 2Anindita Biswas RoyPas encore d'évaluation

- Qq88 Gosyen Haromain IntergrationDocument9 pagesQq88 Gosyen Haromain IntergrationFebri GunawanPas encore d'évaluation

- Sitindustrie Marine Bureau Veritas CertificateDocument2 pagesSitindustrie Marine Bureau Veritas CertificateomarPas encore d'évaluation

- Department of Marketing Management Assignment On Import and ExportDocument13 pagesDepartment of Marketing Management Assignment On Import and ExportTekletsadik TeketelPas encore d'évaluation

- Intertek Code of EthicsDocument2 pagesIntertek Code of EthicsAlishan ZaidiPas encore d'évaluation

- Caution Credit IrrevocableDocument2 pagesCaution Credit Irrevocabledavid0775Pas encore d'évaluation

- Import RegulationsDocument8 pagesImport RegulationsAfaa NkamaPas encore d'évaluation

- U.S. Customs Form: CBP Form 19 - ProtestDocument3 pagesU.S. Customs Form: CBP Form 19 - ProtestCustoms FormsPas encore d'évaluation

- MTD 2Document2 pagesMTD 2tomasagustingraneroPas encore d'évaluation

- Jet Fuel A1 Fob HoustonDocument2 pagesJet Fuel A1 Fob HoustonLTPN (Jet Fuel A1)Pas encore d'évaluation

- Bureau Veritas 2011 HighlightsDocument17 pagesBureau Veritas 2011 HighlightsvictoriaroomPas encore d'évaluation

- Marine Certificate of Insurance: (Schedule)Document2 pagesMarine Certificate of Insurance: (Schedule)Mufti Ali100% (1)

- DHL Express Account Open Form HK enDocument7 pagesDHL Express Account Open Form HK enAnna Võ0% (1)

- Agency Approvals Spiral GH200 - BVDocument3 pagesAgency Approvals Spiral GH200 - BVMohamed ElmakkyPas encore d'évaluation

- On Board Confirmation Letter To CustomerDocument1 pageOn Board Confirmation Letter To CustomerPandit Aashish BhardwajPas encore d'évaluation

- ΝΑΥΛΟΣΥΜΦΩΝΟDocument4 pagesΝΑΥΛΟΣΥΜΦΩΝΟYannis DoulisPas encore d'évaluation

- 1) ICPO-THMC-A&H GLOBAL - (Chicken Paws)Document8 pages1) ICPO-THMC-A&H GLOBAL - (Chicken Paws)Seara FerminoPas encore d'évaluation

- Crude OilDocument12 pagesCrude OilRanjithPas encore d'évaluation

- Sub Agency AgreementDocument3 pagesSub Agency AgreementDuong Truong0% (1)

- PL 1018 203008 M05 003014 PDFDocument2 pagesPL 1018 203008 M05 003014 PDFAnonymous 1YmFJf7A7Pas encore d'évaluation

- Rosneft Oil Company ProfileDocument37 pagesRosneft Oil Company ProfileVo Ngoc HoangPas encore d'évaluation

- Contract Award NoticeDocument11 pagesContract Award NoticeJosé ConstantePas encore d'évaluation

- Ocean Freight USA - Glossary of Shipping Terms PDFDocument9 pagesOcean Freight USA - Glossary of Shipping Terms PDFshivam_dubey4004Pas encore d'évaluation

- Coo1047880 AcetonaDocument1 pageCoo1047880 AcetonaDaniel Escalante GuzmanPas encore d'évaluation

- 24 Proforma InvoiceDocument2 pages24 Proforma Invoicekevin_rumbelowPas encore d'évaluation

- (Original) : Freight Invoice / Tax InvoiceDocument8 pages(Original) : Freight Invoice / Tax InvoiceEdith Olivera NozupPas encore d'évaluation

- Khulna Shipyard Limited: Invitation For QuotationDocument3 pagesKhulna Shipyard Limited: Invitation For QuotationSafiqHasanPas encore d'évaluation

- Policy Cancellation Form NewDocument2 pagesPolicy Cancellation Form Newteja_praveenPas encore d'évaluation

- Trade Import Export DeclarationDocument7 pagesTrade Import Export DeclarationErik TreasuryvalaPas encore d'évaluation

- Converting Leads Into SalesDocument3 pagesConverting Leads Into SalesFrank Finn100% (2)

- Zeeshan Sarwar Khan: Professional ExperienceDocument3 pagesZeeshan Sarwar Khan: Professional Experiencezeekhan898Pas encore d'évaluation

- Intro 2 Customer ServiceDocument3 pagesIntro 2 Customer ServiceFriti FritiPas encore d'évaluation

- Employee Motivation and Retention Strategies at MicrosoftDocument14 pagesEmployee Motivation and Retention Strategies at MicrosoftJay DixitPas encore d'évaluation

- CIA Wants To Convert India To ChristianityDocument1 pageCIA Wants To Convert India To Christianityripest100% (1)

- MCC Codes 2007Document18 pagesMCC Codes 2007xinh nguyễnPas encore d'évaluation

- Mobile: 01769011228: Mirzapur Cadet College P.O: Cadet College Dist. TangailDocument2 pagesMobile: 01769011228: Mirzapur Cadet College P.O: Cadet College Dist. TangailAbdullah Al-MahmudPas encore d'évaluation

- Tesla TV 32T320BH 32T320SH User ManualDocument42 pagesTesla TV 32T320BH 32T320SH User ManualSaso MangePas encore d'évaluation

- RCB Dealers PHDocument3 pagesRCB Dealers PHJing AbionPas encore d'évaluation

- Beginner BooksDocument45 pagesBeginner BooksAlina MihulPas encore d'évaluation

- Updated - Zoom Case StudyDocument2 pagesUpdated - Zoom Case StudyShazaib SarwarPas encore d'évaluation

- On H L A Harts Rule of RecognitionDocument10 pagesOn H L A Harts Rule of Recognitionuzowuru princewillPas encore d'évaluation

- G11-Module 1Document23 pagesG11-Module 1Mindanao Community SchoolPas encore d'évaluation

- Behavior Modification PlanDocument20 pagesBehavior Modification PlanAryaPas encore d'évaluation

- Sebi2 PDFDocument5 pagesSebi2 PDFNAGARAJU MOTUPALLIPas encore d'évaluation

- Answer Scheme. F2.SetB.2016Document5 pagesAnswer Scheme. F2.SetB.2016Miera MijiPas encore d'évaluation

- Role of A Reporting OfficerDocument8 pagesRole of A Reporting OfficerAla DanPas encore d'évaluation

- 5 Families - Teaching StrategiesDocument1 page5 Families - Teaching StrategiesZiyan SheriffPas encore d'évaluation

- Children in Sport: Module Number: SP-017Document5 pagesChildren in Sport: Module Number: SP-017Mohd Haffiz ZainiPas encore d'évaluation

- Business - Case Template 4Document30 pagesBusiness - Case Template 4ing_manceraPas encore d'évaluation

- Obtl Understanding Culture, Society and Politics JeffDocument7 pagesObtl Understanding Culture, Society and Politics JeffJeffrey MasicapPas encore d'évaluation

- Certificate of Moral Fitness ANITA MC KIGENDocument9 pagesCertificate of Moral Fitness ANITA MC KIGENWalter Ochieng100% (4)

- EC - Culturally Responsive Observation ChecklistDocument2 pagesEC - Culturally Responsive Observation ChecklistLesti Kaslati SiregarPas encore d'évaluation