Académique Documents

Professionnel Documents

Culture Documents

4 SFM Dividend Policy 21.08.2010

Transféré par

Revathi GaneshDescription originale:

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

4 SFM Dividend Policy 21.08.2010

Transféré par

Revathi GaneshDroits d'auteur :

Formats disponibles

Downloaded from www.ashishlalaji.

net

Pinnacle Academy

Chapter Tests [CT] Series June 2010 Batch

201-202, Silver Coin, Nr. Shrenik Park Cross Road, Off. Productivity Rd., Akota, Vadodara-20. ph: (0265) 30 83 82 4 / 98258 561 55

Solution of Test of Dividend Policy

[SFM CA Final]

Conducted on 21st August 2010

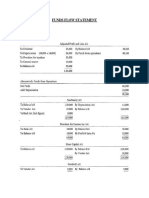

Q1 For a firm current earnings per share is Rs.2 and last dividend paid is Re.0.4. For the next five years the firm is expected to grow at a high rate of 24% during which its retention ratio shall be 80% and its equity beta shall be 1.5. Thereafter, there shall be an intermediate transition period of five years during which the dividend payout ratio shall increase from 20% at the end of 5th year to 70% at the end of 10th year by way of linear increments each year. There shall be no change in the cost of equity and the growth rate of the firm shall be 20% in year 6, 16% in year 7, 12% in year 8, 8% in year 9 and 6% in year 10. From the end of 10th year till perpetuity the firm shall grow at the rate of 4%, its dividend payout ratio shall be 70% and its equity beta shall settle at 1. The risk free rate of return is 7.5% and the market risk premium is 5.5%. Applying Capital Asset Pricing Model (CAPM), find the price of share as on today as per the Gordons Dividend Model. A client of yours is interested in buying this share which currently trades at Rs.35. What shall be your advice? (10 Marks) Solution: Valuation of Shares as per Gordons Dividend Model: Year EPS 1 2.48 2 3.08 3 3.81 4 4.73 5 5.86 6 7.04 7 8.16 8 9.14 9 9.87 10 10.47 10 D / P Ratio 20 % 20 % 20 % 20 % 20 % 30 % 40 % 50 % 60 % 70 % DPS 0.496 0.616 0.762 0.946 1.172 2.112 3.264 4.570 5.922 7.329 84.609* PVF (15.75%) .864 .746 .645 .557 .481 .416 .359 .310 .268 .232 .232 PV 0.4285 0.4595 0.4915 0.5269 0.5637 0.8786 1.1718 1.4167 1.5871 1.7003 9.2246 19.6482 28.8728

Downloaded from www.ashishlalaji.net

Cost of equity for high growth and transition period: ke = 7.5 + 1.5 [5.5] = 15.75 % Cost of equity for stable period: ke = 7.5 + 1 [5.5] = 13 % *Continuing Value of Dividend: Continuing value = 7.329 + 4 % / 13 % 4 % = 84.6907 Recommendation: The current MPS (Rs.35) is higher than fundamental value of share (Rs.28.87). Thus, the share is overpriced and hence not worth purchasing.

Solution prepared by Q2

CA. Ashish Lalaji

A Ltd. has surplus cash of Rs.80 lakhs and wants to distribute 30 % of it to the shareholders. The company has decided to buyback shares. The finance manager of the company has estimated that the share price after buyback shall be 10 % higher than the buyback price, if the buyback route is taken. Currently the number of shares is 10 lakhs and the EPS is Rs.3. You are required to determine:

i. The price at which the shares can be repurchas ed if the market capitalisation of the company should be Rs.180 lakhs after buyback ii. The number of shares that can be repurchased iii. The impact of share repurchase on the EPS assuming same level of total earnings (10 Marks) Solution: (i) Let P be the buyback price. Thus, price after buyback shall be 1.1P. Now, market capitalisation after buyback shall be: 1.1P (Original Shares Shares Repurchased), which has to be Rs.180 lakhs. Further, 30 % of Rs.80 lakhs is to be distributed i.e. Rs.24 lakhs. Hence, no. of shares repurchased shall be: 24 / P. Based on above, following equation has been developed and solved: 1.1P (Original Shares Shares Repurchased) = 180 i.e. 1.1P (10 24/P) = 180 i.e. 11P 26.4 = 180 i.e. P = Rs.18.76 (ii) (iii) No. of shares repurchased = 24 / 18.76 = 1.2793 ~ 1.28 lakh shares. New EPS = (3 X 10) / [10 1.28] = Rs.3.44 Solution prepared by

CA. Ashish Lalaji

2

Downloaded from www.ashishlalaji.net

Q3 The managing directors of three profitable companies were discussing their companies dividend policies over lunch. Each managing director is certain that his or her companys policy is maximizing shareholder wealth. Company A has deliberately not paid any dividends over the last five years Company B pays dividend of 50% of earnings after taxation Company C maintains a constant dividend rate of 15% coupled with extra dividends in years of high profits Discuss the circumstances in which the dividend policies may be maximizing shareholders wealth. What are the advantages and disadvantages of each dividend policy? (10 Marks) Solution: Circumstances under which different dividend policies shall maximize shareholders wealth: Company A: Company A is deliberately not paying dividend. This may be on account of the fact that it is a newly formed company. Such companies need to conserve cash to finance their expansion activities. Even if the company is a fast growing firm it may not pay dividend mainly to exploit attractive internal investment opportunities. In such a scenario, the share prices shall still rise in expectations of higher profits. Later on such companies may declare bonus shares and capitalize their reserves. Advantage: The major advantage of not paying dividend is that company need not resort to borrowings to arrange for funds to finance its growth. Thus, internal cash generated shall be deployed in the fast growing or the newly formed business of the company itself. Disadvantage: This policy shall fail to attract investors in need of regular income in form of dividend. Company B: Company Bs policy shall work if its earnings are inconsistent. If the business of company B is cyclic in nature or giving rise to sporadic returns linking dividend to earnings makes sense. Advantage: There is no burden to maintain dividend rate. Hence, in years in which profits are on the lower side the company needs to pay only a fixed proportion of income by way of dividend. Disadvantage: This policy shall fail to attract investors in need of regular income in form of dividend. Company C: Shareholders invest in companies in anticipation of handsome returns. If a company pays regular dividend and extra dividends at time of additional profits the policy satisfies each and every type of investor. This helps the firm in improving its reputation amongst the investors thereby increasing its prices.

Downloaded from www.ashishlalaji.net

Advantage: As stated above, this policy attracts all types of investors. Even senior citizens and pensioners shall not mind investing in shares of such companies, as there is certainty as to dividends. Disadvantage: The firm shall be under immense pressure to maintain dividend rate even in years in which its performance is not satisfactory. If on account of reduced profits or no profits if dividend rate is reduced or dividend is not declared at all, it shall not be well accepted by its investors. It shall bring down investor sentiments and thereby its share prices. Solution prepared by

CA. Ashish Lalaji

Vous aimerez peut-être aussi

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (399)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (587)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (890)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (73)

- Final FIN 200 (All Chapters) FIXEDDocument65 pagesFinal FIN 200 (All Chapters) FIXEDMunPas encore d'évaluation

- Advance Accounting 2 by GuerreroDocument13 pagesAdvance Accounting 2 by Guerreromarycayton100% (7)

- Functions of Business FinanceDocument6 pagesFunctions of Business FinancePrincess AudreyPas encore d'évaluation

- Tax Laws in Tanzania: Taxation Questions & AnswersDocument11 pagesTax Laws in Tanzania: Taxation Questions & AnswersKessy Juma90% (119)

- Financial Management & Policy by James C. Van Horne 12th EditionDocument832 pagesFinancial Management & Policy by James C. Van Horne 12th EditionKashif Mirza82% (34)

- Question and Answer - 49Document30 pagesQuestion and Answer - 49acc-expertPas encore d'évaluation

- Financial Statement Analysis (Fsa)Document32 pagesFinancial Statement Analysis (Fsa)Shashank100% (1)

- Funds Flow Statement: Numerical 1Document4 pagesFunds Flow Statement: Numerical 1Neelu AhluwaliaPas encore d'évaluation

- FM Assignment 1Document8 pagesFM Assignment 1SAKSHAM ARJANIPas encore d'évaluation

- Why I Increase My HDMF - Pag-IBIG Contribution - Cebu AccountantDocument4 pagesWhy I Increase My HDMF - Pag-IBIG Contribution - Cebu Accountantmarkanthony_alvario2946Pas encore d'évaluation

- Blackstone 2 Q 22 Earnings Press ReleaseDocument41 pagesBlackstone 2 Q 22 Earnings Press ReleaseLinh Linh NguyenPas encore d'évaluation

- The Product Life Cycle: Understanding Financials Through PhasesDocument9 pagesThe Product Life Cycle: Understanding Financials Through PhasesYuka Tarantoro100% (1)

- Apple Q3 FY19 Consolidated Financial StatementsDocument3 pagesApple Q3 FY19 Consolidated Financial StatementsJack PurcherPas encore d'évaluation

- UMEME 2021 financial results reflect recovery from Covid impactsDocument2 pagesUMEME 2021 financial results reflect recovery from Covid impactsTrial MeisterPas encore d'évaluation

- Project Company Law Ii Sem 6Document13 pagesProject Company Law Ii Sem 6gauravPas encore d'évaluation

- FM 101 Chapter 2 (Cabrera)Document17 pagesFM 101 Chapter 2 (Cabrera)Chelsea PagcaliwaganPas encore d'évaluation

- Measuring Bank Performance & Risk with Key RatiosDocument45 pagesMeasuring Bank Performance & Risk with Key RatiospavithragowthamnsPas encore d'évaluation

- Dokumen - Tips - Laporan Keuangan 5671d4081a509 PDFDocument187 pagesDokumen - Tips - Laporan Keuangan 5671d4081a509 PDFAgustinus Dwichandra12Pas encore d'évaluation

- Intermediate Accountig AkuntansiDocument46 pagesIntermediate Accountig AkuntansiRika LerianiPas encore d'évaluation

- Carlos F Lucero Financial Disclosure Report For 2010Document8 pagesCarlos F Lucero Financial Disclosure Report For 2010Judicial Watch, Inc.Pas encore d'évaluation

- Ratio Analysis of Infowiz Pvt LtdDocument39 pagesRatio Analysis of Infowiz Pvt LtdRahul Mehta0% (1)

- Fy 2016 AuditedDocument222 pagesFy 2016 AuditedError 707Pas encore d'évaluation

- Dividend Theories and LimitationsDocument11 pagesDividend Theories and LimitationsPerah MemonPas encore d'évaluation

- Answer KeyDocument5 pagesAnswer KeyYhancie Mae TorresPas encore d'évaluation

- Module 5 - Profit and Loss Trainer HandoutDocument7 pagesModule 5 - Profit and Loss Trainer Handoutapplefox2022Pas encore d'évaluation

- What Amount Should Be Reported As Diluted Earnings Per Share?Document6 pagesWhat Amount Should Be Reported As Diluted Earnings Per Share?carinaPas encore d'évaluation

- IGCSE-OL - Bus - CH - 5 - Answers To CB ActivitiesDocument3 pagesIGCSE-OL - Bus - CH - 5 - Answers To CB ActivitiesAdrián CastilloPas encore d'évaluation

- 19 Answer Key PDFDocument23 pages19 Answer Key PDFBianca BazanPas encore d'évaluation

- Final Project Report in 1Document91 pagesFinal Project Report in 1MKamranDanish100% (1)

- Business Tax Laws in The PhilippinesDocument12 pagesBusiness Tax Laws in The PhilippinesEthel Joi Manalac MendozaPas encore d'évaluation