Académique Documents

Professionnel Documents

Culture Documents

Rule-Comments@sec - Gov: Institute of International Bankers

Transféré par

MarketsWikiDescription originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Rule-Comments@sec - Gov: Institute of International Bankers

Transféré par

MarketsWikiDroits d'auteur :

Formats disponibles

INSTITUTE OF INTERNATIONAL BANKERS

299 Park Avenue, 17th Floor New York, N.Y. 10171 Direct: (646) 213-1147 Facsimile: (212) 421-1119 Main: (212) 421-1611 www.iib.org

Sarah A. Miller Chief Executive Officer E-mail: smiller@iib.org

June 8, 2012 Via rule-comments@sec.gov Elizabeth M. Murphy Secretary Securities and Exchange Commission 100 F Street, NE Washington, DC 20549 Re: Proposed Amendments to Financial Responsibility Rules for Broker-Dealers (Release Nos. 34-66910, 34-55431; File No. S7-08-07) Ladies and Gentlemen: The Institute of International Bankers (the IIB) appreciates this opportunity to provide the Securities and Exchange Commission (the Commission) with comments on the Commissions proposed amendments (the Proposed Amendments) to its financial responsibility rules for broker-dealers under the Securities Exchange Act of 1934 (the Exchange Act), as set out in Release No. 34-55431 (the Proposing Release). 1 The IIB, which represents internationally headquartered financial institutions from over thirty-five countries from around the world, 2 would like to comment on one element of the proposed amendments that would directly impact U.S. branches of non-U.S. banks. Exchange Act Rule 15c3-3, 3 among other things, requires broker-dealers to maintain cash or qualified securities in a Special Reserve Bank Account for the Exclusive Benefit of Customers (a Reserve Account) in an amount determined by a formula set forth in Exhibit A

1 2

72 Fed. Reg. 12862 (Mar. 19, 2007).

Collectively, the U.S. branches, agencies, banking subsidiaries, securities affiliates and other nonbank operations of the IIB's member institutions are an important source of credit for U.S. borrowers and enhance the depth and liquidity of U.S. financial markets. IIB members also inject billions of dollars each year into the economies of major cities across the country in the form of employee compensation and other operating and capital expenditures.

___________________________________________________________________

The Institutes mission is to help resolve the many special legislative, regulatory and tax issues confronting internationally headquartered financial institutions that engage in banking, securities and/or insurance activities in the United States.

17 C.F.R. 240.15c3-3.

___________________________________________________________________

INSTITUTE OF INTERNATIONAL BANKERS

to Rule 15c3-3. 4 Reserve Accounts must be maintained at banks as defined in Rule 15c3-3, and a significant number of Reserve Accounts are maintained at U.S. branches of non-U.S. banks that qualify as banks under that definition. 5 To mitigate the risk that the impairment of the reserve deposit at a single bank would have a material negative impact on the broker-dealers ability to meet its obligations, the Commission has proposed to prevent broker-dealers from depositing cash into a Reserve Account with a bank that is out of proportion to the banks capital base by limiting a brokerdealers cash deposits in Reserve Accounts at any one bank to 10% of the banks equity capital. 6 Under the Proposed Amendments, a banks equity capital for purposes of this limit is as reported by the bank in its most recent Call Report or Thrift Financial Report, which, as the Commission notes, includes a line item for equity capital. 7 However, it is not universally true that a banks equity capital is reported in a Call Report or a Thrift Financial Report. The Call Reports for U.S. branches of non-U.S. banks do not have a line item for equity capital. This is due to the fact that a branch of a bank (whether U.S. or non-U.S) is not a separately incorporated legal entity from the bank itself a branchs capital is the capital of the bank. The equity capital of the non-U.S. bank (or a more conservative capital measure) can be obtained from a variety of sources, for example: (i) the Form FR Y-7 (Annual Report of Foreign Banking Organizations) filed annually with a Federal Reserve Bank with respect to all non-U.S. banks with

Rule 15c3-3(e), 17 C.F.R. 240.15c3-3(e). The Proposed Amendments would also require reserve deposits in respect of PAB accounts, computed in accordance with a similar formula. Proposing Release, 72 Fed. Reg. at 12863-64. As defined in Rule 15c3-3, bank includes any bank as defined in Exchange Act section 3(a)(6). In addition to national banks, federal savings associations and member banks of the Federal Reserve System, section 3(a)(6) defines as a bank: any other banking institution , whether incorporated or not, doing business under the laws of any State or of the United States, a substantial portion of the business of which consists of receiving deposits or exercising fiduciary powers similar to those permitted to national banks under the authority of the Comptroller of the Currency pursuant to section 92a of title 12, and which is supervised and examined by State or Federal authority having supervision over banks or savings associations, and which is not operated for the purpose of evading the provisions of [the Exchange Act].

Exchange Act Section 3(a)(6)(C), 15 U.S.C. 78c(a)(6)(C). The Commission has recognized that a U.S. branch of a non-U.S. bank that is supervised and examined by a federal or state banking authority can be a bank within the meaning of section 3(a)(6), although the determination of whether any particular financial institution meets the requirements of Section 3(a)(6) is the responsibility of the institution and its counsel. SEC Rel. No. 34-27017 (July 11, 1989), 54 Fed. Reg. 30013, 30015 n.16 (July 18, 1989).

6 7

Proposing Release, 72 Fed. Reg. at 12864. Proposed Rule 15c3-3(e)(5)(ii), Proposing Release, 72 Fed. Reg. at 12895.

INSTITUTE OF INTERNATIONAL BANKERS

U.S. branches includes the banks financial statements, with balance sheets that generally have a line item for equity capital (or shareholders equity, or the equivalent); (ii) the Form FR Y-7Q (Capital and Asset Report for Foreign Banking Organizations) filed quarterly with a Federal Reserve Bank with respect to virtually all relevant non-U.S. banks with U.S. branches includes a line item for the banks Tier 1 capital, which is always less than or equal to its equity capital; 8 the Form 6-K (Report of Foreign Private Issuer Pursuant to Rule 13a-16 or 15d16 under the Exchange Act) filed with the Commission by non-U.S. banks that are foreign private issuers reports financial statements the bank periodically (generally semiannually) makes public in its home country or distributes to its security holders; or other financial statements filed by the bank with a banking or securities regulator in the United States (e.g., a Form F-20 filed by a bank with American depositary shares) or in the banks home country should include a line item for the banks equity capital or other, more conservative, capital measures.

(iii)

(iv)

Not all of these documents are filed with respect to every non-U.S. bank with a U.S. branch, and, in some cases, the documents are filed on a confidential basis. Accordingly, we believe that a broker-dealer that maintains a Reserve Account at a U.S. branch of a non-U.S. bank should have flexibility in how it determines the non-U.S. banks equity capital for purposes of applying the 10% limitation. We recommend that a broker-dealer be permitted to determine a banks equity capital from any one of the foregoing documents, or determine the banks equity capital by (for example) periodically obtaining a certificate from the U.S. branch of the non-U.S. bank specifying the equity capital of the bank (or, if the exact equity capital is confidential, certifying that the banks equity capital is in excess of a specified amount). Our recommendation could be easily implemented by the following revision to proposed Rule 15c3-3(e)(5)(ii): (ii) The amount of the deposit exceeds 10% of the banks equity capital (as reported by the bank in its most recent Call Report or Thrift Financial Report if such report includes a line item for equity capital). The explanation of this revision in the adopting release should make it clear that, if the bank at which a Reserve Account is maintained does not file a Call Report or Thrift Financial Report that includes a line item for equity capital, then the broker-dealer would be responsible for

Since Tier 1 capital cannot exceed equity capital, a broker-dealer which limits its Reserve Account deposits to 10% of the banks Tier 1 capital can be confident that the deposit does not exceed 10% of the banks equity capital.

INSTITUTE OF INTERNATIONAL BANKERS

determining the banks equity capital for purposes of applying the limit and that any of the sources described above could be used to satisfy that responsibility. If the Commission does not make such a technical revision to proposed Rule 15c33(e)(5)(ii), the rule as proposed could have the unintended consequence of barring broker-dealers from making cash reserve account deposits with a U.S. branch of a non-U.S. bank (because their Call Reports do not report equity capital), notwithstanding the fact that they are banks as defined in Rule 15c3-3(a)(7). 9 We understand that significant reserve account deposits are currently maintained with U.S. branches of non-U.S. banks. Removing significant participants from the business of accepting these deposits could have a materially adverse effect on competition for such deposits and potentially reduce the return on such deposits received by the broker-dealers. We respectfully suggest that, prior to finalizing the proposed rule, the Commission consider the possible impact the Proposed Amendment may have on broker-dealers who maintain Reserve Accounts at U.S. branches of non-U.S. banks and on competition for reserve account deposits. 10

Every indication in the Proposing Release is that Call Reports and Thrift Financial Reports were referenced because of the Commissions belief that these reports contained a line item for equity capital and therefore would provide a convenient way to apply the proposed 10% limit, not because there was any intent by the Commission to bar cash reserve account deposits at U.S. branches of non-U.S. banks. Indeed, there was no discussion of the use of these sources other than a footnote listing the entities required to file the Call Report or Thrift Financial Report and noting that the reports include a line item for equity capital and can be obtained from a FDIC website. We note that Exchange Act Sections 3(f) and 23(a)(2) require the Commission to consider the effect of the proposed rule on competition and not to adopt any rule that would impose a burden on competition not necessary or appropriate in furtherance of the purposes of the Exchange Act.

10

INSTITUTE OF INTERNATIONAL BANKERS

We thank the Commission for the opportunity to submit this comment letter. We would be happy to discuss any of the comments above or any other matters that would be helpful in the evaluation of the Proposed Amendments. If you have any questions regarding our comments, or would like to discuss them further, please do not hesitate to contact the undersigned or the IIBs General Counsel, Richard Coffman (646-213-1149; rcoffman@iib.org).

Sincerely,

Sarah A. Miller Chief Executive Officer cc: Mary L. Schapiro, Chairman Luis A. Aguilar, Commissioner Daniel M. Gallagher, Commissioner Troy A. Paredes, Commissioner Elisse B. Walter, Commissioner Robert W. Cook, Director, Division of Trading and Markets Michael A. Macchiaroli, Associate Director, Division of Trading and Markets Thomas K. McGowan, Deputy Associate Director, Division of Trading and Markets Randall W. Roy, Assistant Director, Division of Trading and Markets Raymond A. Lombardo, Branch Chief, Division of Trading and Markets Sheila Dombal Swartz, Special Counsel, Division of Trading and Markets

Vous aimerez peut-être aussi

- Pickard An D Inis LLP: Attorneys at Law 1990 M Street, N.W., Suite 660 WASHINGTON, D.C. 20036Document15 pagesPickard An D Inis LLP: Attorneys at Law 1990 M Street, N.W., Suite 660 WASHINGTON, D.C. 20036MarketsWikiPas encore d'évaluation

- Federal Register / Vol. 72, No. 52 / Monday, March 19, 2007 / Proposed RulesDocument38 pagesFederal Register / Vol. 72, No. 52 / Monday, March 19, 2007 / Proposed RulesMarketsWikiPas encore d'évaluation

- Institute of International Bankers: Sarah A. Miller Chief Executive OfficerDocument20 pagesInstitute of International Bankers: Sarah A. Miller Chief Executive OfficerMarketsWikiPas encore d'évaluation

- Federal Register / Vol. 76, No. 221 / Wednesday, November 16, 2011 / Rules and RegulationsDocument112 pagesFederal Register / Vol. 76, No. 221 / Wednesday, November 16, 2011 / Rules and RegulationsMarketsWikiPas encore d'évaluation

- FFIEC009 201103 IDocument30 pagesFFIEC009 201103 IaruncePas encore d'évaluation

- Filed Electronically: Re: Credit Risk RetentionDocument3 pagesFiled Electronically: Re: Credit Risk RetentionMarketsWikiPas encore d'évaluation

- Washington - : New York 1101 New York Avenue, 8th Floor Washington, DC 20005-4269 P: 202.962.7300 F: 202.962.7305Document18 pagesWashington - : New York 1101 New York Avenue, 8th Floor Washington, DC 20005-4269 P: 202.962.7300 F: 202.962.7305MarketsWikiPas encore d'évaluation

- United States v. Philadelphia Nat. Bank, 374 U.S. 321 (1963)Document58 pagesUnited States v. Philadelphia Nat. Bank, 374 U.S. 321 (1963)Scribd Government DocsPas encore d'évaluation

- 2023 Regulatory Capital Rule Large Banking Organizations 3064 Af29 C 278Document29 pages2023 Regulatory Capital Rule Large Banking Organizations 3064 Af29 C 278Chi Trịnh Dương KimPas encore d'évaluation

- Chapter Twenty Three Geographic Diversification: InternationalDocument5 pagesChapter Twenty Three Geographic Diversification: InternationaliuPas encore d'évaluation

- Via Electronic MailDocument3 pagesVia Electronic MailMarketsWikiPas encore d'évaluation

- Proposed Rules: I. BackgroundDocument18 pagesProposed Rules: I. BackgroundMarketsWikiPas encore d'évaluation

- General Banking Law of 2000 ReviewerDocument10 pagesGeneral Banking Law of 2000 ReviewerBryan AriasPas encore d'évaluation

- Stuart KaswellDocument12 pagesStuart KaswellMarketsWikiPas encore d'évaluation

- Re: Docket No. OCC-2011-0008/RIN 1557-AD43 Docket No. R-1415 /RIN 7100 AD74 RIN 3064-AD79 RIN 3052-AC69 RIN 2590-AA45Document42 pagesRe: Docket No. OCC-2011-0008/RIN 1557-AD43 Docket No. R-1415 /RIN 7100 AD74 RIN 3064-AD79 RIN 3052-AC69 RIN 2590-AA45MarketsWikiPas encore d'évaluation

- CR FactsheetDocument2 pagesCR FactsheetMarketsWikiPas encore d'évaluation

- International Swaps and Derivatives Association, IncDocument24 pagesInternational Swaps and Derivatives Association, IncMarketsWikiPas encore d'évaluation

- Research Paper - Student #101Document13 pagesResearch Paper - Student #101fundacion.donca.rdPas encore d'évaluation

- Diana PrestonDocument9 pagesDiana PrestonMarketsWikiPas encore d'évaluation

- Transcript SEC Fundamentals Part 1Document10 pagesTranscript SEC Fundamentals Part 1archanaanuPas encore d'évaluation

- Federal Register / Vol. 77, No. 195 / Tuesday, October 9, 2012 / Rules and RegulationsDocument11 pagesFederal Register / Vol. 77, No. 195 / Tuesday, October 9, 2012 / Rules and RegulationsMarketsWikiPas encore d'évaluation

- Federalregister 042711 CDocument147 pagesFederalregister 042711 CMarketsWikiPas encore d'évaluation

- Tara HairstonDocument6 pagesTara HairstonMarketsWikiPas encore d'évaluation

- Calendar Oct-2011 M T W T F S S 08 Economic Events China HSBC Services PMIDocument46 pagesCalendar Oct-2011 M T W T F S S 08 Economic Events China HSBC Services PMImeenakshi56Pas encore d'évaluation

- Capital, Margin, and Segregation Requirements For Security-Based Swap Dealers and Major Security-Based Swap Participants and Capital Requirements For Broker-Dealers (File No. S7-08 12)Document12 pagesCapital, Margin, and Segregation Requirements For Security-Based Swap Dealers and Major Security-Based Swap Participants and Capital Requirements For Broker-Dealers (File No. S7-08 12)MarketsWikiPas encore d'évaluation

- Being Conducted by TheDocument11 pagesBeing Conducted by TheMarketsWikiPas encore d'évaluation

- UntitledDocument2 pagesUntitledapi-249785899Pas encore d'évaluation

- Dodd-Frank ACT: 1. Oversees Wall StreetDocument12 pagesDodd-Frank ACT: 1. Oversees Wall StreetTanishaq bindalPas encore d'évaluation

- Chapter 13Document3 pagesChapter 13magnatecyPas encore d'évaluation

- ECB Gudelines 1.1.16Document40 pagesECB Gudelines 1.1.16Saloni DewanPas encore d'évaluation

- Commodity Futures Trading Commission: Vol. 79 Friday, No. 192 October 3, 2014Document40 pagesCommodity Futures Trading Commission: Vol. 79 Friday, No. 192 October 3, 2014MarketsWikiPas encore d'évaluation

- First National Bank of Council Bluffs, Iowa v. Office of The Comptroller of The Currency, 956 F.2d 1456, 1st Cir. (1992)Document12 pagesFirst National Bank of Council Bluffs, Iowa v. Office of The Comptroller of The Currency, 956 F.2d 1456, 1st Cir. (1992)Scribd Government DocsPas encore d'évaluation

- Karrie McmillanDocument9 pagesKarrie McmillanMarketsWikiPas encore d'évaluation

- Via Electronic SubmissionDocument15 pagesVia Electronic SubmissionMarketsWikiPas encore d'évaluation

- U.S.basel .III .Final .Rule .Visual - MemoDocument79 pagesU.S.basel .III .Final .Rule .Visual - Memoswapnit9995Pas encore d'évaluation

- Capital Reserves and Bank ProfitabilityDocument49 pagesCapital Reserves and Bank Profitabilityjen18612Pas encore d'évaluation

- Objectives of Bank RegulationDocument15 pagesObjectives of Bank RegulationParul RamaniPas encore d'évaluation

- Unit 2 PPT 2Document26 pagesUnit 2 PPT 2Shristi SinhaPas encore d'évaluation

- SIFMADocument19 pagesSIFMAMarketsWikiPas encore d'évaluation

- With Tail: Retail Exchange Docket 2011 0007Document9 pagesWith Tail: Retail Exchange Docket 2011 0007MarketsWikiPas encore d'évaluation

- International Banking Law: Unit-02, PPT-02Document26 pagesInternational Banking Law: Unit-02, PPT-02Adarsh MeherPas encore d'évaluation

- By Electronic Submission To WWW - Cftc.gov by Electronic Submission To WWW - Sec.govDocument6 pagesBy Electronic Submission To WWW - Cftc.gov by Electronic Submission To WWW - Sec.govMarketsWikiPas encore d'évaluation

- Chapter04 ProblemsDocument2 pagesChapter04 Problemshoholalahoop50% (2)

- Bank") Appreciates The Opportunity To Provide Comments To The Board of GovernorsDocument9 pagesBank") Appreciates The Opportunity To Provide Comments To The Board of GovernorsMarketsWikiPas encore d'évaluation

- Preliminary Staff Report: T R F R B S RDocument24 pagesPreliminary Staff Report: T R F R B S Raslater00Pas encore d'évaluation

- CAIIB Elective Paper - International Banking Updates No. No. UpdateDocument7 pagesCAIIB Elective Paper - International Banking Updates No. No. UpdateSelvaraj VillyPas encore d'évaluation

- By Electronic Submission: Re: Notice of Proposed Rulemaking, Credit Risk RetentionDocument20 pagesBy Electronic Submission: Re: Notice of Proposed Rulemaking, Credit Risk RetentionMarketsWikiPas encore d'évaluation

- 2007-2010 Banking Bar QuestionsDocument4 pages2007-2010 Banking Bar QuestionsNorhalisa Naga SalicPas encore d'évaluation

- Capital Adequacy UCBsDocument32 pagesCapital Adequacy UCBsabhishekchauhan0096429Pas encore d'évaluation

- Chap 020Document11 pagesChap 020Mitra MallahiPas encore d'évaluation

- Via Electronic Mail: Federal Register 62718, October 13, 2010Document4 pagesVia Electronic Mail: Federal Register 62718, October 13, 2010MarketsWikiPas encore d'évaluation

- Arranger Fees in Syndicated Loans - A Duty To Account To Particip PDFDocument57 pagesArranger Fees in Syndicated Loans - A Duty To Account To Particip PDFLuka AjvarPas encore d'évaluation

- Black RockDocument16 pagesBlack RockMarketsWikiPas encore d'évaluation

- The General Banking Law of 2000Document25 pagesThe General Banking Law of 2000Princess ViePas encore d'évaluation

- GBLDocument13 pagesGBLCeejust DelalunaPas encore d'évaluation

- Banking and Allied LawsDocument5 pagesBanking and Allied LawsFatima FatemehPas encore d'évaluation

- Bank License - 2Document10 pagesBank License - 2Foram ShahPas encore d'évaluation

- Ch29 Chapter Answers AidDocument9 pagesCh29 Chapter Answers AidAshura ShaibPas encore d'évaluation

- InvescoDocument6 pagesInvescoMarketsWikiPas encore d'évaluation

- Minute Entry 336Document1 pageMinute Entry 336MarketsWikiPas encore d'évaluation

- Federal Register / Vol. 81, No. 88 / Friday, May 6, 2016 / Rules and RegulationsDocument6 pagesFederal Register / Vol. 81, No. 88 / Friday, May 6, 2016 / Rules and RegulationsMarketsWikiPas encore d'évaluation

- 34 77617 PDFDocument783 pages34 77617 PDFMarketsWikiPas encore d'évaluation

- CFTC Final RuleDocument52 pagesCFTC Final RuleMarketsWikiPas encore d'évaluation

- Federal Register / Vol. 81, No. 55 / Tuesday, March 22, 2016 / NoticesDocument13 pagesFederal Register / Vol. 81, No. 55 / Tuesday, March 22, 2016 / NoticesMarketsWikiPas encore d'évaluation

- Eemac022516 EemacreportDocument14 pagesEemac022516 EemacreportMarketsWikiPas encore d'évaluation

- Commodity Futures Trading Commission: Office of Public AffairsDocument2 pagesCommodity Futures Trading Commission: Office of Public AffairsMarketsWikiPas encore d'évaluation

- Commodity Futures Trading Commission: Vol. 80 Wednesday, No. 246 December 23, 2015Document26 pagesCommodity Futures Trading Commission: Vol. 80 Wednesday, No. 246 December 23, 2015MarketsWikiPas encore d'évaluation

- Douglas C I FuDocument4 pagesDouglas C I FuMarketsWikiPas encore d'évaluation

- 34 76474 PDFDocument584 pages34 76474 PDFMarketsWikiPas encore d'évaluation

- Via Electronic Submission: Modern Markets Initiative 545 Madison Avenue New York, NY 10022 (646) 536-7400Document7 pagesVia Electronic Submission: Modern Markets Initiative 545 Madison Avenue New York, NY 10022 (646) 536-7400MarketsWikiPas encore d'évaluation

- Commodity Futures Trading Commission: Office of Public AffairsDocument3 pagesCommodity Futures Trading Commission: Office of Public AffairsMarketsWikiPas encore d'évaluation

- Commodity Futures Trading Commission: Office of Public AffairsDocument2 pagesCommodity Futures Trading Commission: Office of Public AffairsMarketsWikiPas encore d'évaluation

- 2015-10-22 Notice Dis A FR Final-RuleDocument281 pages2015-10-22 Notice Dis A FR Final-RuleMarketsWikiPas encore d'évaluation

- Commodity Futures Trading Commission: Office of Public AffairsDocument5 pagesCommodity Futures Trading Commission: Office of Public AffairsMarketsWikiPas encore d'évaluation

- Daniel Deli, Paul Hanouna, Christof W. Stahel, Yue Tang and William YostDocument97 pagesDaniel Deli, Paul Hanouna, Christof W. Stahel, Yue Tang and William YostMarketsWikiPas encore d'évaluation

- Odrgreportg20 1115Document10 pagesOdrgreportg20 1115MarketsWikiPas encore d'évaluation

- Muhammad Arif Vs Faisal Bank 2Document9 pagesMuhammad Arif Vs Faisal Bank 2Khan Elie Gohar DurraniPas encore d'évaluation

- RTI AccountingManual PDFDocument459 pagesRTI AccountingManual PDFVanita ValluvanPas encore d'évaluation

- DSP Sip FormDocument3 pagesDSP Sip Formvipin sharmaPas encore d'évaluation

- Required Documents Mera GharDocument2 pagesRequired Documents Mera GharEngr Fahimuddin QureshiPas encore d'évaluation

- The Singapore Property Beginner S GuideDocument39 pagesThe Singapore Property Beginner S GuideCaleb LeePas encore d'évaluation

- Full Cases in Nego (Exam Coverage)Document276 pagesFull Cases in Nego (Exam Coverage)Russel SirotPas encore d'évaluation

- Dictionary of EconomicsDocument225 pagesDictionary of EconomicsMushtak Shaikh100% (1)

- Letter of From Class-XI (VIKAAS-JA) To Class-XII (VIJETA-JP)Document4 pagesLetter of From Class-XI (VIKAAS-JA) To Class-XII (VIJETA-JP)Manjushri SoniPas encore d'évaluation

- HR Process Manual: Human Resource at Montex Glass Fibre Industries PVT LTDDocument54 pagesHR Process Manual: Human Resource at Montex Glass Fibre Industries PVT LTDPRASHANT CHAUDHARIPas encore d'évaluation

- Glosario Español-Ingles de Palabras y Expresiones - 04 05 2014Document220 pagesGlosario Español-Ingles de Palabras y Expresiones - 04 05 2014Melo2008100% (1)

- Signed MOUDocument3 pagesSigned MOUSheila MaPas encore d'évaluation

- Debt Vs EquityDocument27 pagesDebt Vs EquitynisakardryPas encore d'évaluation

- Profile S.Banerjee FDocument4 pagesProfile S.Banerjee FabhishekatupesPas encore d'évaluation

- Capital FormationDocument76 pagesCapital FormationAnonymous 45z6m4eE7pPas encore d'évaluation

- Financial InclusionDocument28 pagesFinancial InclusionrajjinonuPas encore d'évaluation

- CAPE U1 Partnership Revaluation QuestionsDocument6 pagesCAPE U1 Partnership Revaluation QuestionsNadine DavidsonPas encore d'évaluation

- Hatem Hassan Zakaria - Juhayna Co. Credit AnalysisDocument49 pagesHatem Hassan Zakaria - Juhayna Co. Credit AnalysisHatem Hassan100% (3)

- PBRM QuestionnaireDocument3 pagesPBRM QuestionnaireAzraPas encore d'évaluation

- Supply of Clinker To Alangulam Cement Works, Virudhunagar DistrictDocument29 pagesSupply of Clinker To Alangulam Cement Works, Virudhunagar DistrictTHANGAVEL S PPas encore d'évaluation

- Ethiopia Permits Mobile Banking and Money ServicesDocument1 pageEthiopia Permits Mobile Banking and Money ServicesWellik SouzaPas encore d'évaluation

- TAPMI Brochure 2018-20Document40 pagesTAPMI Brochure 2018-20sakshi raiPas encore d'évaluation

- Banking Management SystemDocument78 pagesBanking Management SystemHarshil Sanghavi100% (1)

- SATYA RINALDI Disruptive Tech. Opportunity Challenges TSR v1.3 1 1Document33 pagesSATYA RINALDI Disruptive Tech. Opportunity Challenges TSR v1.3 1 1Agus WijayaPas encore d'évaluation

- (VIII) Chapter 3 (Financial Analysis and SWOT Analysis)Document14 pages(VIII) Chapter 3 (Financial Analysis and SWOT Analysis)Swami Yog BirendraPas encore d'évaluation

- MBA Finance Project Report On Micro FinancingDocument65 pagesMBA Finance Project Report On Micro FinancingNisha Patel100% (2)

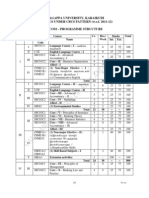

- Alagappa University, Karaikudi SYLLABUS UNDER CBCS PATTERN (W.e.f. 2011-12)Document26 pagesAlagappa University, Karaikudi SYLLABUS UNDER CBCS PATTERN (W.e.f. 2011-12)Mathan NaganPas encore d'évaluation

- Accounting Textbook Solutions - 48Document19 pagesAccounting Textbook Solutions - 48acc-expertPas encore d'évaluation

- FAR Pre-Week Part 1Document24 pagesFAR Pre-Week Part 1John DoePas encore d'évaluation

- Stock Market Cycles A Practical ExplanationDocument184 pagesStock Market Cycles A Practical ExplanationNur Zhen67% (3)

- Functions of Central BankDocument22 pagesFunctions of Central BankMd Rabbi KhanPas encore d'évaluation