Académique Documents

Professionnel Documents

Culture Documents

3.recent Ammendments in Indirect Tax

Transféré par

mercatuzDescription originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

3.recent Ammendments in Indirect Tax

Transféré par

mercatuzDroits d'auteur :

Formats disponibles

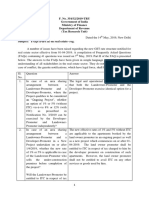

RECENT AMENDMENTS IN INDIRECT TAX LAWS

The amendments to the Indirect tax laws as per the Finance Act 2011 which has received assent of President on 8-4-2011 and statutory changes have become effective on 8-4-2011. Service tax on new services and expansion in definitions of taxable services has become effective from 1-5-2011. 1. Changes in Central Excise Excise duty @ 1% or 5% on 130 items As a step towards moving to GST, exemption in respect of 130 items has been withdrawn and excise duty of 5% has been imposed (total duty 5.15%) vide Notification No. 2/2011-CE dated 1-3-2011. If assessee does not avail CENVAT credit on his inputs, excise duty payable on these goods will be 1% vide Notification No. 1/2011CE dated 1-3-2011. It is also clarified that if excise duty @ 1% is paid, buyer cannot avail CENVAT credit. Excise duty on branded readymade garments and made up articles - Excise duty @ 10.30% has been imposed on branded readymade garments and made up articles, w.e.f. 1-32011. Provision has been made that brand name owner can pay excise duty, if he gets the goods manufactured from job workers. Increase in interest rate Interest payable on delayed payment of excise duty or wrong availment of CENVAT credit has been increased from 13% to 18% w.e.f. 1-4-2011. Change in penalty provisions Penalty provisions as contained in sections 11A and 11AC have been revamped. A separate category of penal provisions has been created in cases where there has been suppression of facts or wilful mis-statement or fraud but transactions were duly recorded by the assessee in the specified records. In such cases, penalty will be upto 50% of duty (against normal penalty of 100% of duty). 2. Changes in Cenvat Credit Rules Substantial changes have been made in CENVAT Credit Rules, 2004 w.e.f. 1-4-2011. The summary is as follows Inputs - Definition of input [rule 2(k)] has been amended. Construction material, goods for personal consumption of employees and goods which have no relation with manufacture will not be eligible for CENVAT credit. Expenses beyond place of removal will not be entitled to CENVAT credit. Inputs relating to construction of factory or office, motor vehicles and personal use or consumption of employee will not be eligible for CENVAT credit. Input Services - Definition of input services [rule 2(l)] have been completely revamped. Many input service which were hitherto eligible will not be eligible after 1-4-2011. Services relating to construction of factory or office, motor vehicles and personal use or consumption of employee will not be eligible for CENVAT credit. Capital goods - Capital goods used outside the factory for generation of electricity for captive use within the factory will be eligible for CENVAT credit. Services in relation to generation of electricity for captive use within the factory are also eligible for CENVAT credit.

Restriction on Cenvat credit in case of ships brought for ship breaking - CENVAT credit of CVD paid on ship breaking will be restricted to 85% Manufacturers of exempted goods and taxable goods and exempted service and taxable services - Rule 6 applies where both exempted goods and taxable goods are manufactured or exempted and taxable services provided. In case of exempted services, amount payment reduced to 5% w.e.f. 1-4-2011. Payment of amount means CENVAT credit not taken - Rule 6(3D) (inserted w.e.f. 1-42011) states that payment of amount under rule 6(3) means CENVAT credit is not taken for purpose of an exemption notification where exemption is granted on condition that no CENVAT on input and input services is availed. Overriding provisions - In respect of banking service [section 65(105)(zm)], the Bank or NBFC is required to pay amount equal to 50% of CENVAT Credit availed on inputs and input services [Rule 6(3B) of CENVAT Credit Rules as inserted w.e.f. 1-4-2011]. In respect of general insurance services [section 65(105)(zx)] and life insurance service [section 65(105)(zzzza)], amount payable is equal to 20% of CENVAT credit availed on inputs and input services in the month [Rule 6(3C) of CENVAT Credit Rules as inserted w.e.f. 1-4-2011]. No reversal of CENVAT if service provided to SEZ unit or developer - No reversal or payment of amount if services provided to SEZ unit or developer [Rule 6(6A) inserted w.e.f. 1-42011] 3. Change in Customs Law Introduction of self assessment One major change is that self assessment has been introduced in customs w.e.f. 8-4-2011. It is trust based compliance management. Provision has been made for provisional assessment. Customs officer will verify assessment and examine goods on selective basis. Subsequently, audit can be conducted either at customs office or at premises of importer or exporter Section 17 of Customs Act. Time limit for filing refund claim Time limit for filing refund claim has been uniformly increased to one year from present limit of 6 months section 27 of Customs Act. Penalty provisions revamped Penalty provisions have been revamped. Lower penalty has been provided where assessee pays customs duty short paid with interest on his own section 28 of Customs Act. Electronic submission of documents Electronic submission of Bill of Entry and Shipping Bill has been made mandatory. Permission of Commissioner of Customs would be required to file these documents manually Sections 46 and 50 of Customs Act. Customs dues to be first charge on property of assessee Customs duty, interest, penalty and any other sum payable will have first charge on property of assessee section 142A of Customs Act.

Goods cleared by SEZ to DTA exempt from Special CVD Goods cleared from SEZ to DTA will be exempt from special CVD of 4% if Vat/sales tax is payable on them (Till 1-3-2011, the exemption was only to goods manufactured or produced within SEZ). Increase in interest rate Interest payable on delayed payment of customs duty has been increased from 13% to 18% w.e.f. 1-4-2011. Export duty on iron ore lumps and fines The export duty has been increased to 20%. Simplification is project imports Requirement of security deposit has been replaced by a bank guarantee of maximum one crore.

4. Service tax Major changes have been made in service tax. New services Service tax on these new services is effective from 1-5-2011. Hotels, clubs, guest houses having declared tariff rate more than Rs 1,000 per day even if actual charge was less service tax @ 5% Services in air-conditioned restaurant having license to service liquor abatement 70% i.e. service tax payable on 30% Expansion of existing services Changes are effective from 1-5-2011. Providing any operational or administrative assistance will be Business Support Service. Legal services arbitration services covered. Representational services provided by any person to a business entity now taxable. However, no daring to touch individual advocates. Commercial coaching now covers all courses which are not recognized by law, even if conducted by recognized Institutes. All vehicle repair services except goods transport vehicles and auto-rickshaws will be taxable (so far only authorised service stations were covered). Services provided by clubs to non-members are now taxable. Point of taxation Rules Major change is that service tax would be payable on billing basis, and not on receipt basis, w.e.f. 1-4-2011. Basic principle in Point of Taxation Rules is that service tax is payable when service is provided, bill is made or advance is received, whichever is earlier, w.e.f. 1-4-2011. Change in service tax rate - Receipt of advance or issue of bill, whichever is earlier is relevant. Hence, if advance was received and service tax rate changes later, differential tax is neither payable nor refundable.

Imposition of tax on new services - No service tax will be payable on new services if these were provided before imposition tax, if invoice is raised within 14 days.

Continuous supply of service - Continuous supply of services means provided for continuous period of three months e.g. telephone, construction, insurance, AMC. In case of continuous service, due dates of payment as per contract will be point of taxation, except when payment was received or bill was raised before due date Adjustment of service tax on basis of credit note issued Service tax is payable on billing basis. The service provider may not receive full payment. In such cases, he can issue credit note in following situations (a) if service is not provided partly or fully or (b) amount of invoice is re-negotiated due to deficient provision of service or any terms contained in the contract. After credit note, assessee can take self credit of excess service tax paid by him when he had issued the invoice/Bill/Challan. Service tax when goods are imported by air W.e.f. 1-4-2011, goods transport by air service is classifiable under rule 3(iii) of Import of Service. Hence, it will be import of service if service is received in India. However, if goods are imported by air, service tax on transport of goods has been partially exempted w.e.f. 1-4-2011. The exemption is available to the extent of air freight included in assessable value under section 14 of Customs Act [Notification No. 9/2011-ST dated 1-3-2011] In case of air freight, fright to the extent of 20% of FOB value is includible in assessable value for customs duty. Thus, balance air freight will be subject to service tax. Other changes in service tax Increase in interest rate Interest payable on delayed payment of service tax or wrong availment of Cenvat credit has been increased from 13% to 18% Change in penalty provisions Penalty provisions as contained in sections 76 to 80 of Finance Act, 1994 have been revamped. It is provided that even if service tax and interest is paid before issue of show cause notice, penalty @ 1% per month (maximum 25%) is imposable if the short payment was on account of suppression of facts, wilful misstatement or fraud. Benefits to small service providers There will be no audit if turnover is upto Rs 60 lakhs per annum. Interest rate applicable to them would be 15% instead of normal 18%. Provision for prosecution Provision has been made for prosecution of offenses under service tax provisions. However, there is no power of arrest under service tax provisions. Questions : 1.What are the new services introduced by Finance Act, 2011? 2.What are the amendments to The Central Excise Act,1944 ? 3.Explain the concept of Self assessment which is introduced in the Customs Act, as per the Finance Act,2011? Source : www.dateyvs.com Compiled By :

Christina Samuel

Vous aimerez peut-être aussi

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- 17.role of Tax ConsultantsDocument4 pages17.role of Tax Consultantsmercatuz100% (1)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- 33.tax Planning Under Indirect TaxationsDocument3 pages33.tax Planning Under Indirect TaxationsmercatuzPas encore d'évaluation

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- 67.ifrs ConvergenceDocument2 pages67.ifrs ConvergencemercatuzPas encore d'évaluation

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- 8.global WarmingDocument3 pages8.global WarmingmercatuzPas encore d'évaluation

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- Certificate of Deposit: Add-On CdsDocument4 pagesCertificate of Deposit: Add-On CdsmercatuzPas encore d'évaluation

- 63 KaizenDocument4 pages63 KaizenmercatuzPas encore d'évaluation

- 7.stpi & SezDocument3 pages7.stpi & SezmercatuzPas encore d'évaluation

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (400)

- 6.standards On Quality ControlDocument2 pages6.standards On Quality ControlmercatuzPas encore d'évaluation

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- 62.insider TradingDocument5 pages62.insider TradingmercatuzPas encore d'évaluation

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- 9.corporate GovernanceDocument3 pages9.corporate GovernancemercatuzPas encore d'évaluation

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- 65.role of A ConsultantDocument2 pages65.role of A ConsultantmercatuzPas encore d'évaluation

- 61.forensic AccountingDocument3 pages61.forensic Accountingmercatuz0% (1)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- 49.transfer PricingDocument4 pages49.transfer PricingmercatuzPas encore d'évaluation

- 53.income Tax Compliance Check ListDocument5 pages53.income Tax Compliance Check ListmercatuzPas encore d'évaluation

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- 58.process CostingDocument3 pages58.process CostingmercatuzPas encore d'évaluation

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (345)

- System Audit: Foundations of Information System AuditingDocument4 pagesSystem Audit: Foundations of Information System AuditingmercatuzPas encore d'évaluation

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (74)

- 57.pricing DecisionsDocument3 pages57.pricing DecisionsmercatuzPas encore d'évaluation

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- 55.profesional EthicsDocument5 pages55.profesional EthicsmercatuzPas encore d'évaluation

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- 56.IFRS Vs IASDocument3 pages56.IFRS Vs IASmercatuzPas encore d'évaluation

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- 54.banking Regulation ActDocument5 pages54.banking Regulation ActmercatuzPas encore d'évaluation

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- 52.analysis For Decision MakingDocument4 pages52.analysis For Decision MakingmercatuzPas encore d'évaluation

- 51.limited Liability PartnershipDocument8 pages51.limited Liability PartnershipmercatuzPas encore d'évaluation

- 50.cost Control & Cost ReductionDocument6 pages50.cost Control & Cost ReductionmercatuzPas encore d'évaluation

- 41.international Standards On Related ServicesDocument4 pages41.international Standards On Related ServicesmercatuzPas encore d'évaluation

- 5.money LaunderingDocument3 pages5.money LaunderingmercatuzPas encore d'évaluation

- 45.working Capital ManagementDocument5 pages45.working Capital ManagementmercatuzPas encore d'évaluation

- Due Diligence Review: Purpose of Due-Diligence Review-The Purpose of Due Diligence Review Is To Assist TheDocument4 pagesDue Diligence Review: Purpose of Due-Diligence Review-The Purpose of Due Diligence Review Is To Assist ThemercatuzPas encore d'évaluation

- 40.schedule XIII Compliance With Sec 209Document5 pages40.schedule XIII Compliance With Sec 209mercatuzPas encore d'évaluation

- 43.enterprise Resource PlanningDocument5 pages43.enterprise Resource PlanningmercatuzPas encore d'évaluation

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- 44 LokpalDocument3 pages44 LokpalmercatuzPas encore d'évaluation

- Top 30 Tally Interview Questions & Answers: 1) Explain What Is Tally and Where It Can Be Used?Document7 pagesTop 30 Tally Interview Questions & Answers: 1) Explain What Is Tally and Where It Can Be Used?saboxaPas encore d'évaluation

- This Is Not A Legal InvoiceDocument2 pagesThis Is Not A Legal InvoiceMerliza JusayanPas encore d'évaluation

- Tally 9.0 Multiple Choice QuestionsDocument15 pagesTally 9.0 Multiple Choice QuestionsShubham VermaPas encore d'évaluation

- Fails To Make Payment To The Supplier Within 180 Days From The Date of Issue of InvoiceDocument54 pagesFails To Make Payment To The Supplier Within 180 Days From The Date of Issue of InvoiceKrishna Chaitanya DammalapatiPas encore d'évaluation

- Film Financing and TelevisionDocument21 pagesFilm Financing and TelevisionTsn DavidPas encore d'évaluation

- Submit VAT Return Mushak-9.1Document107 pagesSubmit VAT Return Mushak-9.1Tapu BassPas encore d'évaluation

- CPAR Preweek LectureDocument31 pagesCPAR Preweek LectureNoroPas encore d'évaluation

- 04.1 S4 VAT PPT AquinoDocument112 pages04.1 S4 VAT PPT Aquinosaeloun hrdPas encore d'évaluation

- GST RevisionDocument10 pagesGST RevisionSumit rautelaPas encore d'évaluation

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- YW VAT Guide 2020 P21 22 ICE 70Document2 pagesYW VAT Guide 2020 P21 22 ICE 70Mansueto MarinePas encore d'évaluation

- Atlas Consolidated Mining Development Corp. v. CIRDocument1 pageAtlas Consolidated Mining Development Corp. v. CIRIshPas encore d'évaluation

- Business & Transfer Taxation: Rex B. Banggawan, Cpa, MbaDocument38 pagesBusiness & Transfer Taxation: Rex B. Banggawan, Cpa, Mbajustine reine cornicoPas encore d'évaluation

- G.R. No. 153205 January 22, 2007 Commissioner of Internal Revenue, Petitioner, Burmeister and Wain Scandinavian Contractor Mindanao, Inc., RespondentDocument11 pagesG.R. No. 153205 January 22, 2007 Commissioner of Internal Revenue, Petitioner, Burmeister and Wain Scandinavian Contractor Mindanao, Inc., RespondentRomeo Boy-ag Jr.Pas encore d'évaluation

- Taxation May Board ExamDocument20 pagesTaxation May Board ExamjaysonPas encore d'évaluation

- Part I - PSALM v. CIRDocument3 pagesPart I - PSALM v. CIRCyruz TuppalPas encore d'évaluation

- Reviewer Taxation Modules 1 - 3Document11 pagesReviewer Taxation Modules 1 - 3afeiahnaniPas encore d'évaluation

- Txbwa 2018 Dec Q PDFDocument19 pagesTxbwa 2018 Dec Q PDFgajendra.naiduPas encore d'évaluation

- Sage X3 Solution CapabilitiesDocument62 pagesSage X3 Solution CapabilitiestouxiePas encore d'évaluation

- Recovery of Tax: (Goods and Services Tax)Document3 pagesRecovery of Tax: (Goods and Services Tax)11priyagargPas encore d'évaluation

- Module23 Version 2013Document80 pagesModule23 Version 2013Jed DíazPas encore d'évaluation

- RESA 41 - Tax First Preboard (May 2021) (Key Answer)Document17 pagesRESA 41 - Tax First Preboard (May 2021) (Key Answer)Aldrine CasilangPas encore d'évaluation

- Vocabulary - Money, Finance, Bank Accounts, Public FinanceDocument2 pagesVocabulary - Money, Finance, Bank Accounts, Public FinanceNachø MV0% (1)

- CIR Vs Aichi Forging Company of Asia, Inc. GR No. 184823Document11 pagesCIR Vs Aichi Forging Company of Asia, Inc. GR No. 184823johnnayelPas encore d'évaluation

- Accounting QuestionsDocument10 pagesAccounting QuestionsGioPas encore d'évaluation

- Legal Aspect Legal Requirements: Fruity FloralDocument14 pagesLegal Aspect Legal Requirements: Fruity FloralJesse CorpuzPas encore d'évaluation

- Aert EgyDocument90 pagesAert Egy65486sfasdkfhoPas encore d'évaluation

- Boq 50235Document30 pagesBoq 50235sidhuaraviiPas encore d'évaluation

- FAQ (II) Real Estate Sector 1405Document9 pagesFAQ (II) Real Estate Sector 1405raj pandeyPas encore d'évaluation

- TAXATION 2 Chapter 14 VAT Payable and Compliance RequirementsDocument4 pagesTAXATION 2 Chapter 14 VAT Payable and Compliance RequirementsKim Cristian MaañoPas encore d'évaluation

- 2016 Syllabus Cpa ExamDocument18 pages2016 Syllabus Cpa ExamJudy Angel Villanueva CalvarioPas encore d'évaluation

- Tax Strategies: The Essential Guide to All Things Taxes, Learn the Secrets and Expert Tips to Understanding and Filing Your Taxes Like a ProD'EverandTax Strategies: The Essential Guide to All Things Taxes, Learn the Secrets and Expert Tips to Understanding and Filing Your Taxes Like a ProÉvaluation : 4.5 sur 5 étoiles4.5/5 (43)

- Small Business Taxes: The Most Complete and Updated Guide with Tips and Tax Loopholes You Need to Know to Avoid IRS Penalties and Save MoneyD'EverandSmall Business Taxes: The Most Complete and Updated Guide with Tips and Tax Loopholes You Need to Know to Avoid IRS Penalties and Save MoneyPas encore d'évaluation

- How to get US Bank Account for Non US ResidentD'EverandHow to get US Bank Account for Non US ResidentÉvaluation : 5 sur 5 étoiles5/5 (1)

- The Panama Papers: Breaking the Story of How the Rich and Powerful Hide Their MoneyD'EverandThe Panama Papers: Breaking the Story of How the Rich and Powerful Hide Their MoneyÉvaluation : 4 sur 5 étoiles4/5 (52)

- Bookkeeping: Step by Step Guide to Bookkeeping Principles & Basic Bookkeeping for Small BusinessD'EverandBookkeeping: Step by Step Guide to Bookkeeping Principles & Basic Bookkeeping for Small BusinessÉvaluation : 5 sur 5 étoiles5/5 (5)