Académique Documents

Professionnel Documents

Culture Documents

Alignment - Using The Balanced Scorecard

Transféré par

le_kien_31Description originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Alignment - Using The Balanced Scorecard

Transféré par

le_kien_31Droits d'auteur :

Formats disponibles

Alignment - Using the Balanced Score-card to create Corporate Synergies

By Robert S Kaplan & David P Norton, Harvard Business School Press, 2006

Introduction

Most large organizations are divided into business units. The challenge is to coordinate the activities of these units and leverage their skills for the benefit of the organization as a whole. Too often, these units are out of synch and work at cross purposes. This book explains how the Balanced Score Card can be used to align business units with corporate strategy. Alignment poses a strategic challenge for most organizations. Alignment is multidimensional in scope, involving financial synergies, cross selling of products and services to deliver unique solutions to customers and sharing of knowledge and expertise across the organisation. Alignment needs to be planned and executed carefully to maximize shareholder value.

Generating Synergy

When an organization aligns the activities of its various business and support units, it creates additional sources of value. The authors call this Enterprise derived value. Value can be created in various ways. Corporate financial synergy revolves around issues such as where to invest, where to harvest, how to balance risk and how to create an investor brand. Customer synergy means enhancing customer relationships by offering a range of complementary products and services from different business units. Internal process synergies can be created by generating economies of scale in activities such as procurement, logistics and infrastructure. Learning and growth synergies can be generated by developing and sharing critical intangible assets including people, technology, culture and leadership. Despite various innovations in organization design, there is nothing like the best structure to balance the tension between specialization and integration. The authors suggest that instead of looking for the best structure, companies must choose an optimal structure and put in place the necessary systems to align the structure with the corporate strategy.

Financial Synergies

Enterprises can generate financial synergies by using centralized resource allocation and financial management. The enterprise value proposition for a large multi unit company lies in its ability to allocate capital and manage risks in its diverse businesses. This is facilitated by the use of high level metrics such as Economic Value Added and Return on Capital. Different metrics can be used across businesses depending on the state of their lifecycle. Value can also be created if corporate headquarters can operate internal capital markets

2 better than external market mechanisms and share information/common themes across business units, in a manner that would be difficult if the different units were independent entities.

Customer Synergies

Corporations whose operating companies sell to common customers have the opportunity to leverage their multiple products and services to create unique integrated solutions, resulting in customer satisfaction and loyalty that less diversified and more focused organizations cannot match. Companies can also generate value by constantly delivering a common value proposition throughout their decentralized units. Cross selling to specific customers can also generate value.

Internal Process Synergies

Sharing processes across units generates value in two ways. One is economies of scale in activities such as procurement, logistics and information technology. By doing things on a large scale, there is considerable scope to cut costs in these areas.The second comes from leveraging the benefits of centralized resources having specialized expertise and knowledge in how to operate a key process or service. The sharing of common philosophies, programs and competencies across business units can also generate significant benefits. Expertise sharing can reduce the time to respond to customer needs and make the company better equipped to exploit the emerging opportunities in the business environment. Customers typically combine the products and services of different vendors to achieve some higher value proposition. Many industries present opportunities for enterprises to expand their scope into related areas in the customer value chain. An active headquarters role is essential for the success of such value chain integration by integrating various processes.

Learning & Growth Synergies

Growing leaders faster than competition can be a significant source of competitive advantage. Value can be created by proactively managing leadership and human capital development. Corporate Headquarters can put in place effective processes for developing intangible assets. Headquarters can also promote the sharing of knowledge and best practices throughout all its business and support units. That would enable new ideas to be rapidly spread across the enterprise and assimilated by the business units in a manner that would be difficult, were they independent entities.

Achieving Alignment

There are different ways of achieving alignment. One way is to start at the top and then cascade down. Another way is to start in the middle, at the business unit level, before building a corporate scorecard and map. Some companies launch an enterprise wide initiative right at the start. Others conduct a pilot test at one or two business units before extending the scope to other enterprise units. The authors suggest that the initial score card should be built where the leadership and enthusiasm exist. Often, this is at a local unit, not at the headquarters. But this approach

3 may lead to a sub optimal local strategy. The unit may be thinking too independently and ignore links and opportunities for integration with other units in the organization. The trick lies in involving corporate headquarters once the scorecard is ready and work out how it should be aligned with corporate priorities. Flexibility is the key ingredient during the early stage of cascading. Once an organization is using the tool, imposing corporate priorities from the top down becomes more acceptable.

Aligning Support Units

Support units offer specialized knowledge and expertise that can be productively deployed across the organization for tasks like human resources management, deployment of information technology, managing legal affairs and so on. Support units must understand corporate and business unit strategies and accordingly align themselves. These units must develop plans to acquire, develop and deliver their strategic services to operating units. Support units must also evaluate their performance using techniques such as service-level agreements, internal customer feedback, customer ratings and internal audits. Support units are different from business units in two ways. Their main goal is not to make a profit. They serve primarily internal customers. The performance of a support unit can be assessed along two dimensions efficiency and effectiveness. Efficiency deals with the cost of services delivered and adherence to the budget. Effectiveness describes the impact the support unit has on the enterprise strategy. For example, the IT department may introduce transformational applications that change the prevailing business model of the enterprise. At the lowest level, support units can achieve operational excellence. At the next level, they can create and support business unit partnerships. Finally, they can provide strategic support that helps business units position themselves for competitive advantage.

Aligning Boards and Investors

If shareholder value is to be maximized, capital must be directed to the most productive opportunities. Managers need to be monitored carefully so that they act in the best interests of shareholders. Managers often have more information than investors. Managers can spend money on themselves, and distort financial statements. This is where the board of directors comes in. The board checks the integrity of financial statements, approves and monitors strategy, whets major financial decisions, selects the CEO and monitors the CEOs performance and provides counsel & support to the CEO. Boards often fail to discharge their responsibilities effectively because they have limited time and inadequate information. In the trend towards independent directors, what has effectively happened is that the depth of knowledge needed to monitor the actions of managers is missing. A governance system built around the Balance Scorecard makes the boards better equipped to discharge their responsibilities. At the first level is the Enterprise Scorecard consisting of performance measures, targets and initiatives. This scorecard can become the basis for discussions between the CEO and

4 the board. Then come executive scorecards that the board and the compensation committee can use to select, evaluate and reward senior executives. Executive scorecards describe the strategic contributions of key executives. The board itself can use a scorecard that defines its strategic contributions, provide a tool to manage the composition and performance of the board and its committees and clarify the strategic information required by the board. Instead of the traditional customer perspective, the board scorecard can use the stakeholder perspective. Alignment vis--vis analysts is also important. Increasingly, earnings seem to be less important in predicting stock price. Analysts are paying greater attention to non-financial measures, especially the companys ability to execute its strategy. Reporting of nonfinancial measures is still adhoc. Companies can benefit by using the Balanced Scorecard to structure their external communications.

Aligning External Partners

Strategic external partners include key suppliers, customers and alliances. A balanced score card approach helps in reaching a consensus about the objectives for the relationship. The process creates understanding and trust across organizational boundaries, reduces transaction costs and minimizes misalignment between the two parties. This way, companies can forge deeper and more effective relationships with their external partners through an intense process of collaboration. The objectives and strategy of the inter organizational relationship can be better captured and tracked. The jointly developed scorecard serves as the basis for accountability of the partners.

Managing the Alignment Process

A comprehensive alignment process helps the enterprise achieve synergies through integration. There are eight alignment checkpoints: Enterprise value proposition Guidelines for strategy formulation Board and shareholder alignment Board approval of corporate strategy Corporate office to corporate support unit Translate corporate strategy into corporate policies that will be administered by corporate support units. Corporate office to business units Corporate priorities are cascaded into business unit strategies. Business units to support units Alignment of strategies of support units with those of the business units Business units to customers Business units to suppliers and alliance partners Business support units to corporate support

Any interface where two disparate organizations come together, represents a potential source of value creation through alignment. The alignment process must be managed proactively to create value.

Total Strategic Alignment

5 Alignment has four components: strategic fit, organization alignment, human capital alignment and alignment of planning and control systems. Strategic fit refers to the internal consistency of the activities that implement the differentiating components of the strategy. Strategic fit exists when the network of internal performance drivers is consistent and aligned with the desired customer and financial outcomes. Organization alignment explores how the various parts of an organization synchronise their activities to generate synergy. Human capital alignment is achieved when employees goals, training and incentives become aligned with business strategy. Planning and control systems alignment exists when management systems for planning, operations and control are linked to the strategy.

Conclusion

Successful execution of strategy requires the successful alignment of four components: the strategy, the organization, the employees and the management systems. As Kaplan and Norton put it, Strategy execution is not a matter of luck. It is the result of conscious attention, combining both leadership and management processes to describe and measure the strategy, to align internal and external organizational units with the strategy, to align employees with the strategy through intrinsic and extrinsic motivation and targeted competency development programs and finally, to align existing management processes, reports and review meetings, with the execution, monitoring and adapting of the strategy.

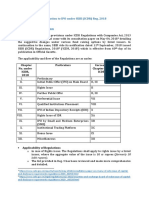

Exhibit: I

Achieving Alignment

Mobilise change through executive leadership Translate the strategy into operational terms Align the organization with the strategy Motivate to make strategy everyones job Govern to make strategy a continual process.

Exhibit: II

Enterprise Scorecard (Enterprise derived value)

Financial How can we increase the shareholder value of our SBU portfolio? Internal capital management Corporate brand How can we share the customer interface to increase total customer value? Cross selling Common value proposition How can we manage SBU processes to achieve economies of scale or value chain integration? Shared services Value chain integration How can we develop and share our intangible assets? Intangible assets development

Customer

Internal Process

Learning & Growth

SBU Scorecard (Customer derived value)

Financial Customer Internal Process Learning & Growth What are our shareholder expectations for financial performance? To reach our financial objectives, how do we create value for our customers? What processes must we excel at to satisfy our customers and our shareholders? How do we align our intangible assets, people, systems and culture to improve the critical processes?

Vous aimerez peut-être aussi

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (120)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (399)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (73)

- Strategic Analysis & Choice Topic 5Document48 pagesStrategic Analysis & Choice Topic 5venu100% (1)

- Bain - Report - Global Private Equity Report 2022Document84 pagesBain - Report - Global Private Equity Report 2022rrPas encore d'évaluation

- Chapter 15-Reasons For Busines Failure: Quote: 'Document26 pagesChapter 15-Reasons For Busines Failure: Quote: 'sk001100% (2)

- Legal Aspects of Crowdfunding by Natalia Thurston, Social Venture LawDocument17 pagesLegal Aspects of Crowdfunding by Natalia Thurston, Social Venture Lawinnov8socialPas encore d'évaluation

- Assignment-I (Interpretation of Financial Statements) On Global IME BankDocument8 pagesAssignment-I (Interpretation of Financial Statements) On Global IME BankPrena TmgPas encore d'évaluation

- What Is Organizational Behavior?: Chapter 1-OutlineDocument13 pagesWhat Is Organizational Behavior?: Chapter 1-Outlinele_kien_31Pas encore d'évaluation

- Fin Statement FormulaDocument2 pagesFin Statement Formulale_kien_31Pas encore d'évaluation

- Chapter OutlineDocument7 pagesChapter Outlinele_kien_31Pas encore d'évaluation

- Pre WritingDocument2 pagesPre Writingle_kien_31Pas encore d'évaluation

- Global Food PriceDocument2 pagesGlobal Food Pricele_kien_31Pas encore d'évaluation

- Case Game TechDocument1 pageCase Game Techle_kien_31Pas encore d'évaluation

- Sahrudaya SolutionDocument2 pagesSahrudaya SolutionSankalp MishraPas encore d'évaluation

- Firm Investment DecisionsDocument20 pagesFirm Investment DecisionsMaaz WahidPas encore d'évaluation

- Monetary and Financial SystemDocument9 pagesMonetary and Financial SystemChristopher MungutiPas encore d'évaluation

- 1 Should Portfolio Effects Impact The Way Investors Think AbouDocument1 page1 Should Portfolio Effects Impact The Way Investors Think AbouAmit PandeyPas encore d'évaluation

- Key Amendments in Relation To IPO Under SEBI (ICDR) Reg. 2018Document5 pagesKey Amendments in Relation To IPO Under SEBI (ICDR) Reg. 2018jayaram gPas encore d'évaluation

- MBFS - 3Document30 pagesMBFS - 3Kaviya KaviPas encore d'évaluation

- Nurfatin Najiha Fazal MohamedDocument9 pagesNurfatin Najiha Fazal MohamedFatin Najiha FazalPas encore d'évaluation

- Balance SheetDocument2 pagesBalance SheetSachin SinghPas encore d'évaluation

- Mcdonal's Finanical RatiosDocument11 pagesMcdonal's Finanical RatiosFahad Khan TareenPas encore d'évaluation

- Capital BudgettingDocument12 pagesCapital BudgettingElla Montefalco100% (1)

- Ishares Msci Emerging Markets Etf: Fact Sheet As of 03/31/2021Document3 pagesIshares Msci Emerging Markets Etf: Fact Sheet As of 03/31/2021hkm_gmat4849Pas encore d'évaluation

- Mohd Azzarain Bin Abdul Aziz: Injection WithdrawalDocument2 pagesMohd Azzarain Bin Abdul Aziz: Injection WithdrawalAffeif AzzarainPas encore d'évaluation

- About 5paisa PDFDocument2 pagesAbout 5paisa PDFShashwat ShrivastavaPas encore d'évaluation

- FA 3 Sem 5Document13 pagesFA 3 Sem 5Vasant SriudomPas encore d'évaluation

- 304FIN AFM Unit 3.3 Capital Rationing and Project Selection.Document21 pages304FIN AFM Unit 3.3 Capital Rationing and Project Selection.Karan KachePas encore d'évaluation

- KSDL 1 Repaired)Document76 pagesKSDL 1 Repaired)Arshad Ali100% (1)

- VC Detailed LinkedinDocument45 pagesVC Detailed LinkedinMichael BuryPas encore d'évaluation

- Cherat Packaging Annual Report 2015Document130 pagesCherat Packaging Annual Report 2015Mahmood ChaudhryPas encore d'évaluation

- How To Invest in Stocks: A Beginner's Guide For Getting StartedDocument4 pagesHow To Invest in Stocks: A Beginner's Guide For Getting StartedMarko Zero FourPas encore d'évaluation

- A. Reading Comprehension Unit 2. Financial AnalysisDocument4 pagesA. Reading Comprehension Unit 2. Financial AnalysisAeynah ChintiaPas encore d'évaluation

- CFA Program Curriculum Changes Level 1Document3 pagesCFA Program Curriculum Changes Level 1Zain RehmanPas encore d'évaluation

- Multinational Capital BudgetingDocument9 pagesMultinational Capital BudgetingRem Suarez100% (3)

- UTI Mastershare Unit Scheme-Growth: Objective of The SchemeDocument1 pageUTI Mastershare Unit Scheme-Growth: Objective of The SchemeGurvansh SinghPas encore d'évaluation

- Blue and White Illustrative Technology Startup Pitch Deck Responsive PresentationDocument12 pagesBlue and White Illustrative Technology Startup Pitch Deck Responsive PresentationRajesh KumarPas encore d'évaluation

- SFM Lecture 4 Part 1Document35 pagesSFM Lecture 4 Part 1Karthina RishiPas encore d'évaluation