Académique Documents

Professionnel Documents

Culture Documents

Market Efficiency Notes

Transféré par

hayisco_fc456Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Market Efficiency Notes

Transféré par

hayisco_fc456Droits d'auteur :

Formats disponibles

STOCK MARKET EFFICIENCY Short Notes Prepared by Hayford Kumah

OBJECTIVES 1. Concept of efficiency 2. Importance of market efficiency 3. Three levels of efficiency 4. Implication of market efficiency for investors and companies

Efficiency In an efficient capital market, security prices rationally reflect available information The Efficient Market Hypothesis implies that, if new information is revealed about a firm, it will be incorporated into the share price rapidly and rationally, with respect to the direction of the share price movement and the size of that movement.

Importance of Market Efficiency To encourage share buying To give correct signals to company managers (appreciation in prices) To help allocate resources

Three Levels of Efficiency Weak form: prices reflect past price information Semi-strong form: prices reflect relevant publicly available information (past and present like dividend announcements, right issues, technological breakthroughs, resignations etc) Strong form: prices reflect all information including those privately held (information available to insiders)

1

Implications of EMH for Investors Investors will be well informed and can make own decisions instead of paying premium to fund managers for their expert knowledge to act on their behalf Companies will be pressured to provide adequate and timely information for investor consumption Insiders will not have undue advantage

Implications of EMH for Companies Usage of creative accounting to boost profits will be discovered by investors Share issues will not be delayed to when prices are favorable (current price is the correct price) Large issues will not depress the market price Signals from price movement inform management about investor perception of their stewardship role

Corporate Finance - Introduction OBJECTIVES Overview of corporate finance Objectives of the firm Ownership and control Role of financial manager Financial intermediation Focus of indicative content

Overview Investment decisions (project appraisal) Risk and return 1. Risk and project appraisal

2

2. Portfolio theory 3. Capital asset pricing models Sources of finance 1. Stock markets 2. Long and short term debt finance 3. Treasury and working capital management Corporate value 1. Capital structure 2. Valuing shares 3. Dividend policy 4. Mergers Managing risk 1. Derivatives 2. Exchange rate risk

Introduction Objectives of the business Ownership and control Role of financial manager Role of financial institutions and markets

Objectives of the firm Target market share Maximizing profits Maximizing long term shareholder wealth Minimizing employee agitation Creating an ever-expanding empire

3

Discuss other objectives

Ownership and control Challenges posed by separating ownership and control Managing dysfunctional effects of the separation 1. Link managerial rewards to shareholder wealth improvement 2. Sackings 3. Selling shares and takeover threat 4. Corporate governance 5. Information flow

Role of financial manager Interaction with financial markets Investment Treasury management Risk management Strategy formulation and implementation

Financial intermediation Concept of financial intermediation Participants 1. Brokers 2. Financial institutions Activities involved 1. Risk transformation 2. Maturity transformation 3. Volume transformation

4

Intermediaries Economies of Scale Efficiency in gathering information about participants Risk spreading Transaction costs

Financial Markets Primary market Secondary markets

Institutions in Financial System The banking sector 1. Retail banks 2. Wholesale banks 3. International banks 4. Building societies 5. Other finance houses Long term Savings institutions 1. Pension funds 2. Insurance funds Risk Spreaders 1. Unit trusts 2. Mutual funds

The Markets Bond markets Forex markets

5

Share markets Derivative markets

Indicative Content of Course

Efficient Market Hypothesis and implications to investors and financial

managers.

Investment Appraisal Dividend Policy Capital Structure Decision Alternative financing methods Company valuation methods Merger and Acquisition Financial distress

THANK YOU

CAPITAL INVESTMENT APPRAISAL

OBJECTIVES Understand the relationship of long and short-term decision making Know the importance of the time value of money Use the traditional techniques of ARR and Payback Understand the principles of Discounted Cash flow Calculate NPV and IRR Long-run & Short-run Decision Making Similarities 1. Choice between alternatives 2. Consideration of future costs and revenue

6

3. Importance of incremental and relevant costs and revenue Differences 1. Requirement for investment decision 2. Time scale and quantum of money needed 3. Treatment of uncertainty and inflation

Decision to Invest Confidence in the future Alternatives available Investors attitude to risk (risk v return)

Accounting Rate of Return This is the ratio of average profits (after depreciation) to the capital invested Profits may be before or after tax Capital invested may be initial capital invested or the average capital invested over the life of the project

Advantages and Disadvantages Advantage 1. Simple Disadvantage 1. Ignores the timings of cash flows 2. Accounting profit used may be subjective (different conventions used) 3. No universally accepted method of calculating ARR Payback This is the time required for the cash inflows from a capital investment project to equal the cash outflows Decision rule:

7

Accept the project with the shortest payback period Advantages

1. Simple to understand and calculate 2. More objective because it uses cash flows rather than profits 3. Favors quick return projects which may produce faster growth and enhance liquidity 4. Minimizes time related risks because projects with faster payback are selected

Disadvantages May not consider cash flows after payback period. It is a rough measure of liquidity and not overall project worth Provides a crude measure of the timing of cashflows

Discounted Cash Flow (DCF) Measures These use cash flows and make allowance for the time value of money 1. Net Present Value (NPV) 2. Internal Rate of Return (IRR) NPV

1. NPV = Ci

(1+r)i Where Ci = is the cash flow (+ or -) at period i i = is the period number r = is the cost of capital The discount factor 1 (1+r)i NB: DF at time zero is 1 (This is the present time)

Internal Rate of Return (IRR) IRR is the discount rate which gives a zero NPV

8

Cost of capital is the discount rate used in NPV and IRR calculations

Expected Value Used to even out the effects of uncertainty It is the average value of an event which has several possible outcomes. It is the product of the value of each outcome multiplied by its probability

Profitability Index PV of future cash flows Initial investment Decision rule If PI > 1 then accept the project If PI < 1 then reject the project

Post audit of investment decisions Comparison of forecast and actual results for each of the project elements Review forecasting methods used to assess accuracy and appropriateness Review sources of information used for the appraisal Review appraisal and analysis carried out Review unforeseen factors which arose Review the decision process. Was it reasonable based on evidence available

Vous aimerez peut-être aussi

- Engineering Economics & Accountancy :Managerial EconomicsD'EverandEngineering Economics & Accountancy :Managerial EconomicsPas encore d'évaluation

- Survey Questionnaire of InvestorsDocument3 pagesSurvey Questionnaire of InvestorsGowtham JayaramPas encore d'évaluation

- Risk, Return and Cost of Capital ExplainedDocument97 pagesRisk, Return and Cost of Capital ExplainedIvecy ChilalaPas encore d'évaluation

- T1 Introduction (Answer)Document5 pagesT1 Introduction (Answer)Wen Kai YeamPas encore d'évaluation

- Ch18 of Reilly & BrownDocument52 pagesCh18 of Reilly & Brownsubodhagarwal22Pas encore d'évaluation

- Chapter 8 An Economic Alaysis of Financiaal StructureDocument14 pagesChapter 8 An Economic Alaysis of Financiaal StructureSamanthaHandPas encore d'évaluation

- Analyzing Developing Country Debt Using the Basic Transfer MechanismDocument5 pagesAnalyzing Developing Country Debt Using the Basic Transfer MechanismJade Marie FerrolinoPas encore d'évaluation

- International Financial Risk AnalysisDocument33 pagesInternational Financial Risk AnalysisAkshay SinghPas encore d'évaluation

- Maximize Returns with Minimal RiskDocument33 pagesMaximize Returns with Minimal RiskUqaila Mirza0% (1)

- Introduction To Financial InstrumentsDocument2 pagesIntroduction To Financial InstrumentsStacy Smith100% (1)

- Course Outline - International Business FinanceDocument4 pagesCourse Outline - International Business FinanceSnn News TubePas encore d'évaluation

- Investment Analysis and Portfolio Management: Lecture Presentation SoftwareDocument77 pagesInvestment Analysis and Portfolio Management: Lecture Presentation SoftwarekhandakeralihossainPas encore d'évaluation

- Notes On Efficient Market HypothesisDocument4 pagesNotes On Efficient Market HypothesiskokkokkokokkPas encore d'évaluation

- Note 08Document6 pagesNote 08Tharaka IndunilPas encore d'évaluation

- Digital Transformation and Its Impact On PDFDocument30 pagesDigital Transformation and Its Impact On PDFKashif ManzoorPas encore d'évaluation

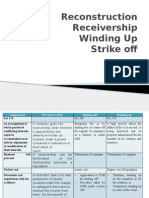

- Reconstruction Receivership Winding Up Strike OffDocument71 pagesReconstruction Receivership Winding Up Strike OffMohammad Hasrul AkmalPas encore d'évaluation

- Short Essay 1: UnrestrictedDocument8 pagesShort Essay 1: UnrestrictedSatesh KalimuthuPas encore d'évaluation

- Interest Rate ParityDocument5 pagesInterest Rate Parityrosario correiaPas encore d'évaluation

- MBA 113 Financial Management and Corporate Finance Full RetakeDocument27 pagesMBA 113 Financial Management and Corporate Finance Full RetakeJitendra PatidarPas encore d'évaluation

- Empirical FinanceDocument563 pagesEmpirical FinanceJackTaPas encore d'évaluation

- Key Mechanics of Corporate Bonds ExplainedDocument54 pagesKey Mechanics of Corporate Bonds ExplainedAnna LinPas encore d'évaluation

- BTR Functions Draft 6-1-15Document16 pagesBTR Functions Draft 6-1-15Hanna PentiñoPas encore d'évaluation

- 6 Money and Banking in Philippine SettingDocument16 pages6 Money and Banking in Philippine SettingJay MarkPas encore d'évaluation

- Industry Life-cycle Analysis StrategiesDocument7 pagesIndustry Life-cycle Analysis StrategiesUmar ButtPas encore d'évaluation

- Euro Bond Market & TypesDocument2 pagesEuro Bond Market & TypesVikram Kaintura100% (1)

- Investment and Portfolio Management 5Document51 pagesInvestment and Portfolio Management 5madihashkh100% (1)

- Amoun Company Analysis and Credit RatingDocument9 pagesAmoun Company Analysis and Credit RatingHesham TabarPas encore d'évaluation

- 1 Markerting MixDocument16 pages1 Markerting MixAna Kristelle Grace SyPas encore d'évaluation

- BFW 3331 T6 AnswersDocument6 pagesBFW 3331 T6 AnswersDylanchong91Pas encore d'évaluation

- CONVERTIBLE BONDS EXPLAINEDDocument3 pagesCONVERTIBLE BONDS EXPLAINEDRocking LadPas encore d'évaluation

- 1.2 Doc-20180120-Wa0002Document23 pages1.2 Doc-20180120-Wa0002Prachet KulkarniPas encore d'évaluation

- Pecking Order TheoryDocument2 pagesPecking Order TheorymavimalikPas encore d'évaluation

- Portfolio ManagementDocument35 pagesPortfolio ManagementmohikumarPas encore d'évaluation

- Risk and ReturnDocument70 pagesRisk and Returnmiss_hazel85Pas encore d'évaluation

- Mutual Fund......Document113 pagesMutual Fund......Amrin ChaudharyPas encore d'évaluation

- Principles of FinanceDocument1 pagePrinciples of FinanceSaiful Islam100% (1)

- Finman Chapter 7 SummaryDocument2 pagesFinman Chapter 7 SummaryJoyce Anne Gevero CarreraPas encore d'évaluation

- Risk Management Options and DerivativesDocument13 pagesRisk Management Options and DerivativesAbdu0% (1)

- Financial IntermediationDocument45 pagesFinancial IntermediationVanessa DavisPas encore d'évaluation

- TRUE/FALSE AND MULTIPLE CHOICE FINANCE QUESTIONSDocument6 pagesTRUE/FALSE AND MULTIPLE CHOICE FINANCE QUESTIONSf100% (1)

- Financial ManagementDocument103 pagesFinancial ManagementMehwishPas encore d'évaluation

- International DiversificationDocument43 pagesInternational Diversificationapi-3718600Pas encore d'évaluation

- Reference LetterDocument2 pagesReference Letterapi-301772218Pas encore d'évaluation

- FIMSDocument264 pagesFIMSPrakash ReddyPas encore d'évaluation

- Understanding Capital MarketsDocument15 pagesUnderstanding Capital MarketsSakthirama VadiveluPas encore d'évaluation

- Portfolio Management Meaning and Important Concepts: What Is A Portfolio ?Document17 pagesPortfolio Management Meaning and Important Concepts: What Is A Portfolio ?Calvince OumaPas encore d'évaluation

- PSE Guide: Investing in Philippine StocksDocument6 pagesPSE Guide: Investing in Philippine StocksDennisOlayresNocomoraPas encore d'évaluation

- QBE Corporate BrochureDocument13 pagesQBE Corporate BrochureQBE European Operations Risk ManagementPas encore d'évaluation

- Solution Manual For Introduction To Finance Markets Investments and Financial Management 14th Edition by MelicherDocument13 pagesSolution Manual For Introduction To Finance Markets Investments and Financial Management 14th Edition by Melichera447816203Pas encore d'évaluation

- Global Credit Exposure Management Policy - 2019 - PDF - Credit Risk - CreditDocument86 pagesGlobal Credit Exposure Management Policy - 2019 - PDF - Credit Risk - CreditRavi PrajapatiPas encore d'évaluation

- Predatory Pricing Analysis Group ProjectDocument27 pagesPredatory Pricing Analysis Group ProjectEsheeta GhoshPas encore d'évaluation

- PWC Mutual Fund Regulatory Services Brochure PDFDocument31 pagesPWC Mutual Fund Regulatory Services Brochure PDFramaraajunPas encore d'évaluation

- Enterprise Risk Management Methods in 40 CharactersDocument12 pagesEnterprise Risk Management Methods in 40 CharactersRao ArsalanPas encore d'évaluation

- Continuous Distributions and The Normal Distribution: Notation: Probability Density Function PDFDocument5 pagesContinuous Distributions and The Normal Distribution: Notation: Probability Density Function PDFPal AjayPas encore d'évaluation

- Valuation of BusinessDocument44 pagesValuation of Businessnaren75Pas encore d'évaluation

- Types Financial RatiosDocument8 pagesTypes Financial RatiosRohit Chaudhari100% (1)

- Securities Analysis & Portfolio Management GuideDocument52 pagesSecurities Analysis & Portfolio Management GuideruchisinghnovPas encore d'évaluation

- Investment & Risk ManagementDocument5 pagesInvestment & Risk ManagementE-sabat RizviPas encore d'évaluation

- Investment Valuatio1Document9 pagesInvestment Valuatio1Nguyen Thi HangPas encore d'évaluation

- Securities Analysis & Portfolio Management IntroDocument50 pagesSecurities Analysis & Portfolio Management IntrogirishPas encore d'évaluation

- Answers, Solutions and ClarificationsDocument4 pagesAnswers, Solutions and ClarificationsAnnie Lind100% (1)

- Land Module Handbook - Single HonoursDocument42 pagesLand Module Handbook - Single HonoursEdwin OlooPas encore d'évaluation

- F Business Taxation 671079211Document4 pagesF Business Taxation 671079211anand0% (1)

- Reliability Strategy and PlansDocument59 pagesReliability Strategy and Planszona amrulloh100% (1)

- Ch-29 Monetary SystemDocument13 pagesCh-29 Monetary SystemSnehal BhattPas encore d'évaluation

- SACCO Budgeting and Business Planning ManualDocument54 pagesSACCO Budgeting and Business Planning ManualFred IlomoPas encore d'évaluation

- Test Booklet: General Studies Paper-IDocument11 pagesTest Booklet: General Studies Paper-IMukesh KumarPas encore d'évaluation

- National Roads Authority: Project Appraisal GuidelinesDocument44 pagesNational Roads Authority: Project Appraisal GuidelinesPratish BalaPas encore d'évaluation

- Learning OutcomesDocument48 pagesLearning OutcomesPom Jung0% (1)

- Assignment Financial Economics Sem5 (2021)Document2 pagesAssignment Financial Economics Sem5 (2021)shamsuzPas encore d'évaluation

- PW, FW, Aw: Shreyam PokharelDocument14 pagesPW, FW, Aw: Shreyam PokharelLuna Insorita100% (1)

- Sequoia's Investment Memo - The Infovore's DilemmaDocument8 pagesSequoia's Investment Memo - The Infovore's Dilemmamaanas50% (2)

- Intership ReportqerqrDocument22 pagesIntership ReportqerqrNgo TramPas encore d'évaluation

- Transfer Pricing Impact on Divisional and Company ProfitsDocument8 pagesTransfer Pricing Impact on Divisional and Company ProfitsSoham SahaPas encore d'évaluation

- AssesmentDocument31 pagesAssesmentLoudie ann MarcosPas encore d'évaluation

- Curriculum Vitae Summary for Construction and HSE ProfessionalDocument20 pagesCurriculum Vitae Summary for Construction and HSE ProfessionaldeniPas encore d'évaluation

- Kotler POM13e Instructor 10Document35 pagesKotler POM13e Instructor 10Ahsan ButtPas encore d'évaluation

- Sexton7e Chapter 03 MacroeconomicsDocument49 pagesSexton7e Chapter 03 MacroeconomicscourtneyPas encore d'évaluation

- Negotiation Review-Clock FaceDocument7 pagesNegotiation Review-Clock Faceinitiative1972Pas encore d'évaluation

- Water Infrastructure Indonesia 2012Document6 pagesWater Infrastructure Indonesia 2012iqsgPas encore d'évaluation

- ACTBAS1 - Lecture 9 (Adjusting Entries) RevisedDocument44 pagesACTBAS1 - Lecture 9 (Adjusting Entries) RevisedAlejandra MigallosPas encore d'évaluation

- IES OBJ Mechanical Engineering 2007 Paper IIDocument14 pagesIES OBJ Mechanical Engineering 2007 Paper IIGopal KrishanPas encore d'évaluation

- Best Buy Strategic Initiatives Changing MarketsDocument13 pagesBest Buy Strategic Initiatives Changing Marketsdavid_leverePas encore d'évaluation

- Source All Overview enDocument28 pagesSource All Overview enFaridPas encore d'évaluation

- Business ValuationDocument5 pagesBusiness ValuationAppraiser PhilippinesPas encore d'évaluation

- PWC Clarifying The RulesDocument196 pagesPWC Clarifying The RulesCA Sagar WaghPas encore d'évaluation

- Exchange Rate Report - V2Document82 pagesExchange Rate Report - V2VANNGUYEN84Pas encore d'évaluation

- Determine equilibrium price and output under demand and supplyDocument10 pagesDetermine equilibrium price and output under demand and supplyBisweswar DashPas encore d'évaluation

- World Bank Briefing BookDocument4 pagesWorld Bank Briefing Bookapi-554844732Pas encore d'évaluation

- SA LII 45 111117 Indira Chakravarthi With Annexure 1-6 PDFDocument11 pagesSA LII 45 111117 Indira Chakravarthi With Annexure 1-6 PDFDebashish BhattacharyaPas encore d'évaluation

- Value: The Four Cornerstones of Corporate FinanceD'EverandValue: The Four Cornerstones of Corporate FinanceÉvaluation : 4.5 sur 5 étoiles4.5/5 (18)

- 7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelD'Everand7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelPas encore d'évaluation

- Joy of Agility: How to Solve Problems and Succeed SoonerD'EverandJoy of Agility: How to Solve Problems and Succeed SoonerÉvaluation : 4 sur 5 étoiles4/5 (1)

- Angel: How to Invest in Technology Startups-Timeless Advice from an Angel Investor Who Turned $100,000 into $100,000,000D'EverandAngel: How to Invest in Technology Startups-Timeless Advice from an Angel Investor Who Turned $100,000 into $100,000,000Évaluation : 4.5 sur 5 étoiles4.5/5 (86)

- Finance Basics (HBR 20-Minute Manager Series)D'EverandFinance Basics (HBR 20-Minute Manager Series)Évaluation : 4.5 sur 5 étoiles4.5/5 (32)

- These are the Plunderers: How Private Equity Runs—and Wrecks—AmericaD'EverandThese are the Plunderers: How Private Equity Runs—and Wrecks—AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (14)

- Venture Deals, 4th Edition: Be Smarter than Your Lawyer and Venture CapitalistD'EverandVenture Deals, 4th Edition: Be Smarter than Your Lawyer and Venture CapitalistÉvaluation : 4.5 sur 5 étoiles4.5/5 (73)

- Product-Led Growth: How to Build a Product That Sells ItselfD'EverandProduct-Led Growth: How to Build a Product That Sells ItselfÉvaluation : 5 sur 5 étoiles5/5 (1)

- Financial Intelligence: A Manager's Guide to Knowing What the Numbers Really MeanD'EverandFinancial Intelligence: A Manager's Guide to Knowing What the Numbers Really MeanÉvaluation : 4.5 sur 5 étoiles4.5/5 (79)

- Mastering Private Equity: Transformation via Venture Capital, Minority Investments and BuyoutsD'EverandMastering Private Equity: Transformation via Venture Capital, Minority Investments and BuyoutsPas encore d'évaluation

- Summary of The Black Swan: by Nassim Nicholas Taleb | Includes AnalysisD'EverandSummary of The Black Swan: by Nassim Nicholas Taleb | Includes AnalysisÉvaluation : 5 sur 5 étoiles5/5 (6)

- Startup CEO: A Field Guide to Scaling Up Your Business (Techstars)D'EverandStartup CEO: A Field Guide to Scaling Up Your Business (Techstars)Évaluation : 4.5 sur 5 étoiles4.5/5 (4)

- Burn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialD'EverandBurn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialPas encore d'évaluation

- Financial Modeling and Valuation: A Practical Guide to Investment Banking and Private EquityD'EverandFinancial Modeling and Valuation: A Practical Guide to Investment Banking and Private EquityÉvaluation : 4.5 sur 5 étoiles4.5/5 (4)

- Note Brokering for Profit: Your Complete Work At Home Success ManualD'EverandNote Brokering for Profit: Your Complete Work At Home Success ManualPas encore d'évaluation

- The Six Secrets of Raising Capital: An Insider's Guide for EntrepreneursD'EverandThe Six Secrets of Raising Capital: An Insider's Guide for EntrepreneursÉvaluation : 4.5 sur 5 étoiles4.5/5 (34)

- Financial Risk Management: A Simple IntroductionD'EverandFinancial Risk Management: A Simple IntroductionÉvaluation : 4.5 sur 5 étoiles4.5/5 (7)

- 2019 Business Credit with no Personal Guarantee: Get over 200K in Business Credit without using your SSND'Everand2019 Business Credit with no Personal Guarantee: Get over 200K in Business Credit without using your SSNÉvaluation : 4.5 sur 5 étoiles4.5/5 (3)

- These Are the Plunderers: How Private Equity Runs—and Wrecks—AmericaD'EverandThese Are the Plunderers: How Private Equity Runs—and Wrecks—AmericaÉvaluation : 3.5 sur 5 étoiles3.5/5 (8)

- Add Then Multiply: How small businesses can think like big businesses and achieve exponential growthD'EverandAdd Then Multiply: How small businesses can think like big businesses and achieve exponential growthPas encore d'évaluation

- Warren Buffett Book of Investing Wisdom: 350 Quotes from the World's Most Successful InvestorD'EverandWarren Buffett Book of Investing Wisdom: 350 Quotes from the World's Most Successful InvestorPas encore d'évaluation

- The Masters of Private Equity and Venture Capital: Management Lessons from the Pioneers of Private InvestingD'EverandThe Masters of Private Equity and Venture Capital: Management Lessons from the Pioneers of Private InvestingÉvaluation : 4.5 sur 5 étoiles4.5/5 (17)

- Investment Valuation: Tools and Techniques for Determining the Value of any Asset, University EditionD'EverandInvestment Valuation: Tools and Techniques for Determining the Value of any Asset, University EditionÉvaluation : 5 sur 5 étoiles5/5 (1)

- Burn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialD'EverandBurn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialÉvaluation : 4.5 sur 5 étoiles4.5/5 (32)