Académique Documents

Professionnel Documents

Culture Documents

Cityam 2012-06-29

Transféré par

City A.M.Description originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Cityam 2012-06-29

Transféré par

City A.M.Droits d'auteur :

Formats disponibles

FTSE 100 5,493.06 -30.86 DOW 12,602.26 -24.75 NASDAQ2,849.49 -25.83 /$ 1.56 unc / 1.25 unc /$ 1.24 -0.

01

BUSINESS WITH PERSONALITY

LONDON2012

days to go

WORLD NO2 CRASHES OUT OF WIMBLEDON

See Sport

Page 38-39

WE REVIEW THE NEW INTROSPECTIVE SPIDERMAN

See Page 35

28

www.cityam.com FREE ISSUE 1,663 FRIDAY 29 JUNE 2012

Certified Distribution

30/04/12 till 27/05/12 is 132,076

BANKSHARES PLUNGE

AS SCANDALS SPREAD

BY PETER EDWARDS

MORE: ALLISTER HEATH, Page 2 and 8

L L

FORUM: Page 18

L L

AROUND 3.7bn was wiped off the

value of Barclays shares yesterday as

anti-fraud investigators looked into

the interest rates scandal and

George Osborne said the banks exec-

utives should pay the price.

Barclays shares fell up to 18 per

cent as chief executive Bob Diamond

and chairman Marcus Agius were

left clinging on to their jobs.

After a day of intense speculation

over his future, Diamond published

a letter in which he attempted to

explain the banks actions in manip-

ulating the interest rate known as

Libor. He said that the banks prime

motivation in acting as it did was to

protect itself from suggestions that

it was in financial difficulties. He hit

out at other banks too, saying that

their actions forced Barclays to act in

the way it did.

Although he said the decision to

do what the bank did was wrong, he

did not adopt the tone of a man con-

templating resignation.

Barclays shares closed down 15.53

per cent and dragged down the rest

of the sector with Royal Bank of

Scotland sinking 11.45 per cent and

Lloyds and HSBC dropping 3.9 per

cent 2.58 respectively.

Prime Minister David Cameron

joined the political backlash against

Barclays and said management had

serious questions to answer. His

spokesman said there had been a

discussion of the possible criminal

aspects of the long-running bid to

rig the rate at which banks lend to

each other. It came as Osborne

described the banks behaviour as

an epitaph to an age of irresponsi-

bility. He later said that HSBC, RBS,

Citigroup and UBS are also under

investigation. Labour leader Ed

Miliband called for criminal prosecu-

tions against Barclays.

Barclays and the other major banks

will face further embarrassment

today when the FSA is expected to

reveal evidence of the improper sale

of interest rate swap products to

small businesses. The regulator has

completed an initial review after

claims Barclays, HSBC, Lloyds and

RBS pushed firms to take out interest

rate swap products. Analysts warn

that potential claims from swaps mis-

selling could reach hundreds of thou-

sands of pounds, or even millions.

Barclays boss tries to explain actions FSA to confirm fresh mis-selling shame

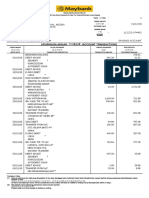

HSBC Holdings PLC

27Jun 28Jun 22Jun 25Jun 26Jun

575

570

565

560

555

550

p

558.20

28Jun

Lloyds Banking Group PLC

27Jun 28Jun 22Jun 25Jun 26Jun

32.00

31.00

31.50

30.50

30.00

29.50

29.00

p

29.94

28Jun

Barclays PLC

27Jun 28Jun 22Jun 25Jun 26Jun

210

200

190

180

170

p

165.60

28Jun

Royal Bank of Scotland Group PLC

27Jun 28Jun 22Jun 25Jun 26Jun

250

240

230

220

210

p

206.40

28Jun

Bob Diamond is determined to stay in post despite a wave of political criticismis.

NADAL STUNNED

allister.heath@cityam.com

Follow me on Twitter: @allisterheath

BLACKBERRY manufacturer

Research in Motion (RIM) last night

announced worse-than-expected

quarterly losses and said it has been

forced to delay the launch of its new

operating system until early next

year, a potentially devastating

setback for the struggling firm.

RIM said consumers would have

to wait for devices running its next-

generation BlackBerry 10 software

because the integration of a huge

volume of code into the platform

had proven to be more time

consuming than anticipated.

Until recently it had maintained

that the long-awaited new phones

would be available to purchase in

late 2012, in time for the crucial

Christmas buying period.

Last night RIM said losses for the

three months to June were $192m

(123m) as revenues plummeted by

33 per cent to $2.8bn.

The firm also said its plans to cut

5,000 jobs about 30 per cent of its

workforce as it looks

to reduce costs in the

face of falling sales.

Shares in RIM

dropped 15 per cent

to $7.75 in after-hours

trading on New

Yorks Nasdaq.

RIMs massive

losses delay

new BlackBerry

BY JAMES WATERSON

G

E

T

T

Y

Obamacare given green

light by Supreme Court

THE FUTURE of American healthcare

will be a key battleground in the run

up to this years presidential elec-

tion, after the US Supreme Court

waved through the controversial

Affordable Care Act yesterday.

Republicans had hoped the court

would deem part of the bill, which is

dubbed Obamacare, to be unconsti-

tutional a decision that would have

thrown its progress into turmoil.

Yet by a narrow vote of 5-4 the

court said that the legislations indi-

vidual mandate, intended to force

Americans to buy health insurance,

was constitutionally valid because

penalising people without insurance

would count as a tax.

Following the announcement,

Republican presidential candidate

Mitt Romney said: What the court

did not do on its last day in session, I

will do on my first day if elected

President that is to act to repeal

Obamacare.

Attacking the policy as being set to

add trillions of dollars to the US gov-

ernments mammoth debt, Romney

concluded: If we want to get rid of

Obamacare, were going to have to

replace President Obama.

Yet observers said that even if they

lost the White House, Democrats

would still be likely to have enough

votes in the Senate to prevent the leg-

Bostock poised to leave M&S

Kate Bostock, the head of all of Marks and

Spencers non-food business, including

clothing, is poised to leave the high street

retailer. Ms Bostocks departure could be

announced at M&Ss annual meeting on

July 10, or possibly sooner. The expected

departure of Ms Bostock, who has been

with M&S for eight years, is the latest

blow to Marc Bolland, chief executive.

Dearth of deals weighs on bank fees

Global investment banks are bracing

themselves for a dismal second half, with

further cuts in costs and staff, after a

sharp drop in dealmaking pushed down

fees in the second quarter to their worst

level in three years. The dearth of

transactions drove down advisory fees

from M&A as well as debt and equity

issuance to $32bn in the first half, a fall of

a quarter on the first six months of 2011.

Batista no longer Brazils richest

Brazilian billionaire Eike Batista is

set to lose his title as Brazils richest man

after shares in his flagship oil company

plummeted 40 per cent in just two days.

OGXs stock dropped 25 per cent on

Wednesday and 19 per cent yesterday.

Lawyer: Kerviel was made scapegoat

Socit Gnrale spent millions in an

attempt to sully the junior employee

accused of dragging the bank into

Frances biggest rogue-trading scandal, a

court was told yesterday. Lawyers for

Jrme Kerviel who lost 4.9bn

(3.9bn) painted him as the scapegoat

in a scandal caused by the bank itself.

Fiat targets US and China

Fiat is hoping to revive the glory of the

102-year-old Italian marque by returning

to the United States and entering China,

now the worlds biggest car market.

Glencore executive moves shares

Glencores finance director has moved

shares worth 200m into trusts, at least

one of which is based in Cayman Islands,

as the commodity giant's merger with

Xstrata stands on the verge of unravelling.

Shareholder spring hits Stobart

The shareholder spring claimed its latest

scalp as a third of investors at Stobart

failed to back the transport groups pay

report. Shareholders are angered by a plan

that could see directors given shares worth

10 per cent of its market capitalisation.

Beijing and EU tangle over telcoms

Beijing is pressing the EU not to start a

trade investigation into Chinas

telecommunications-equipment makers

that could spark a trade war. European

officials are in China to discuss allegations

that China gives subsidies to the firms

that are forbidden by trade rules.

HSBC sells stake in Indian banks

A unit of HSBC has sold stakes in two

Indian banks for around $425m. HSBC

described these sales as the disposal of

"non-core investments and said India

remains a priority market.

WHAT THE OTHER PAPERS SAY THIS MORNING

CITY law firm Herbert Smith

announced yesterday that it is to

merge with Australias Freehills, in

a tie-up that will create one of the

worlds top 10 law firms by

headcount.

Herbies, which employs more

than 700 lawyers in its London

offices, will combine with the

Australian firm to create a business

with historic joint revenues of

more than $1.3bn in the biggest

legal merger for 12 years. The

combined firm will be known as

Herbert Smith Freehills, and

operate across 20 global offices.

It will be lead by Herbert Smiths

managing partner David Willis and

his equivalent at Freehills, Gavin

Bell, who will be co-chief executives

of the 2,800-strong lawyer firm.

Yesterday Willis told City A.M. that

a vote among partners had shown

overwhelming support for the

merger, which will see the two

firms share a single profit pool.

Willis also said Freehills

Australian experience would allow

the firm to increase its capacity to

take on large cross-border deals,

particularly in the lucrative Asia

Pacific market. There are also plans

to open a New York office in the

autumn, and an application for a

South Korean licence is underway.

The merger is expected to be

completed by 1 October this year.

Herbert Smith

merger to form

top 10 law firm

President Barack Obama said the decision was a victory for people across the US

2

NEWS

BY ELIZABETH FOURNIER

BY JULIAN HARRIS

To contact the newsdesk email news@cityam.com

C

AN it get any worse for Britains

banks? Well, yes. Much, much

worse. Not only is Barclays

merely the first firm to settle

when it comes to the despicable Libor

scandal others are also being

investigated but the FSA is about to

announce that it will penalise a

number of banks for a separate

scandal which involved misselling

swaps to small businesses. In at least

some cases, retail bankers talked

absolute nonsense to their customers,

telling them they couldnt lose out

when they obviously could and did.

This is a perfect storm for the bank-

ing industry, and one from which it

will take years to recover. Just when it

seemed the industry was on the

mend, this latest blow could set it

back years. And this time those insti-

tutions being targeted actually

deserve the opprobrium they are get-

EDITORS

LETTER

ALLISTER HEATH

From boom to bezzle: this banking scandal will run and run

FRIDAY 29 JUNE 2012

ting. The behaviour of a small minor-

ity of staff was disgusting, and should

have been checked by senior manage-

ment. Those of us who believe that we

need a strong, healthy and honest

City, for the sake of hundreds of thou-

sands of jobs and of the UK economy,

have the right to be very angry at the

idiocy of many individuals and insti-

tutions. Ordinary City workers in

banks, fund managers, law firms and

other related industries are especially

entitled to be furious.

It is vital that all banks deal with

their problems, and that heads roll. It

beggars belief that Bob Diamond

thought all those months ago that

the time for contrition was over for

his industry. He must have known he

was sitting on the Libor scandal.

But it is important to understand

what is really going on. Im no fan of

John Kenneth Galbraith, the US econ-

omist. But he was right about one

thing: at the height of a bubble, a

punch drunk world becomes so

wealthy that it turns a blind eye to

financial crime (embezzlement, or

the bezzle). But when the music

stops, and the crash comes, everybody

suddenly uncovers past scandals. It is

worth quoting him at length: the bez-

zle, he said, varies in size with the

business cycle. In good times people

are relaxed, trusting, and money is

plentiful. But even though money is

recession had everybody behaved

legally: it was US government policy

to subsidise mortgages for those who

couldnt afford them. It would have

ended in tears regardless of whether

everybody had been honest or not.

Greece would still be bust even it had-

nt lied about its deficit in the run-up

to euro membership. Others made

honest but terrible mistakes. And so

on. It is vitally important to crack

down and punish wrongdoing but

doing so wont prevent another eco-

nomic crisis. The two problems need

to be tackled in parallel.

The biggest issue is this: this latest

outburst of self-harm from the City is

bound to hinder the recovery. It will

make all of us poorer. It will prolong

the crisis. It is very, very bad news.

plentiful, there are always many peo-

ple who need more. Under these cir-

cumstances the rate of embezzlement

grows, the rate of discovery falls off,

and the bezzle increases rapidly. In

depression all this is reversed. Money

is watched with a narrow, suspicious

eye. The man who handles it is

assumed to be dishonest until he

proves himself otherwise. Audits are

penetrating and meticulous.

Commercial morality is enormously

improved. The bezzle shrinks. We

are now at this stage of the cycle.

Yet while the discovery of lies is

shocking, it will inevitably confuse

our understanding of the boom and

bust. The wrongdoings were over-

whelmingly the product, not the

cause, of the bubble. Of course, they

contributed to the subsequent pain

but only marginally. There would still

have been a sub-prime crisis and a

islation being quashed.

In such an event, Republicans could

seek to delay and erode Obamacare by

targeting smaller elements of the bill.

Fiscal sections involving tax and

spend decisions could be outvoted,

the Cato Institute in Washington DC

told City A.M.

In the event of a Barack Obama victo-

ry in this Novembers elections, the bill

will progress in 2013, yet much of its

components remain unpopular and

will provoke more debate.

Todays decision was a victory for

people all over this country whose lives

will be more secure because of this

law, President Obama said yesterday.

The highest court in the land has

now spoken. We will continue to

implement this law and well work

together to improve on it where we

can, Obama added.

Stocks in US hospital firms shot up

after the Supreme Courts verdict.

HCA Holdings closed up more than 10

per cent and Community Health

Systems was up more than eight per

cent. Yet some insurers sank, with

Aetna ending down 2.7 per cent at

$39.85 last night.

RIM has delayed its

BlackBerry update.

The new jobs website for London professionals

CITYAMCAREERS.com

G

E

T

T

Y

RUPERT Murdoch delivered a stinging

blow to the UK yesterday as he out-

lined plans to split his businesses in

two.

Asked about the ongoing investiga-

tions into several of News Corps

British subsidiaries, including News

International and BSkyB, Murdoch

implied his UK-based assets are not

crucial to the success of his company.

The News Corp boss said, There are

billions and billions of dollars, and if

Britain didnt want them, there are

plenty of good places to put them

here [in the US].

But Murdoch averted fears that a UK

exit might be on the cards, saying,

Weve got things to be very bullish

about in this country.

After days of speculation, which

drove up News Corps share price by

almost 11 per cent, News Corp yester-

day confirmed it will split its opera-

tions into two companies a

publishing division and a media and

entertainment arm.

Rupert Murdoch, who will be chair-

man of both companies, said he will

serve as chief executive of the media

Slap in the face

for UK as News

Corp plans split

BY LAUREN DAVIDSON

and entertainment arm. While a sur-

prising announcement, as Murdochs

heart is known to be in newspapers,

the media and entertainment division

will be the larger and more lucrative

company.

The tycoon said the hunt is on for

the publishing companys chief execu-

tive, who is likely to be an internal

applicant. Murdoch said it was highly

unlikely that his son Lachlan would

be put in charge of the division.

Other details of the plan were also

vague, including how investors will be

affected. News Corp said each current

share will translate into one share of

the new company, but declined to

comment further.

The process is expected to take a year.

Murdoch defended the decision

against allegations that the split is a

result of the hacking scandal plaguing

News Corps UK newspapers.

Its nothing to do with it at all. This

is not any reaction. This is looking for-

ward to whats best for the company

and for our shareholders, he said.

Goldman Sachs, JP Morgan and

Centerview Partners are said to be

advising News Corp on its restructur-

ing.

Rupert Murdoch will serve as chief executive of the media and entertainment arm

MEDIA & ENTERTAINMENT

FRIDAY 29 JUNE 2012

3

NEWS

cityam.com

PUBLISHING

BSkyB

Sky Italia

Sky Deutschland

Twentieth Century Fox

Fox Broadcasting

Fox Sports

Fox News

National Geographic

Channels

Shine Group

The Times

The Sunday Times

The Sun

Dow Jones

The New York Post

The Australian

The Herald Sun

HarperCollins

The Wall Street

Journal

Dear Colleagues,

It is with much enthusiasm and

personal pride that I share with you

today's news regarding our plan to

drive towards the next,

transformative phase of this

organisation you and I have built

together into one of the largest,

most innovative media companies

of our time..

We will separate News Corporation

into two global leaders in their own

right we will wow the world as

two, as opposed to merely one...

Our publishing businesses are

greatly undervalued by the skeptics.

Through this transformation we will

unleash their real potential... Our

aim is to create the most ambitious,

well-capitalised and highly

motivated publishing company in

the world... I believe our leadership

is born out of a spirit of innovation.

We have never accepted the status

quo... Over the years, I have become

accustomed to the noise of critics

and naysayers... and pretty thick-

skinned! Remember what they said

when we started the Fox Network,

Sky, Fox News and The Sun? These

experiences have made me more

resilient. And they should you, as

well.

All the best,

ACCOUNTANCY giant PwC will today

announce the names of the 39

employees it will promote to its

partnership next month, bringing

the firms total new partners over

the last year to 61.

The other 22 partners have joined

PwC in the last 12 months from

other companies.

Spread across the firms advisory,

tax and assurance practices, the new

partners will take up their roles

from 1 July.

I am very pleased to welcome our

new partners, PwC senior partner

Ian Powell said yesterday.

As the UKs leading professional

services firm, we continue to invest

heavily in the future as we grow our

business, and as part of this, we draw

our partners from a wide base of

skills to reflect the needs of our

clients in all areas of their business.

The firm also said it planned to

recruit up to 2,200 new staff this

year, at student, intern, graduate

and experienced levels.

In the latest rankings of

professional services firm released by

Morningstar, PwC ranked top of the

list of FTSE 100 auditors, counting 41

of the UKs top companies among its

clients. It also works for 67 firms

listed in the FTSE 250, and 107 on

the Alternative Investment Market.

PwC adds 61

partners across

its UK offices

BY ELIZABETH FOURNIER

G

E

T

T

Y

G

E

T

T

Y

THE UK recession was deeper than

previously thought, showed revised

estimates released by the Office for

National Statistics yesterday.

The growth estimates for the fourth

quarter 2011 were revised down to -

0.4 per cent, rather than the 0.3 per

cent shrinkage previously estimated.

On the other hand, the new data

estimates a 6.3 per cent contraction

from peak to trough in the recession

of 2008 and 2009, comparing to an

original estimate of 7.1 per cent. The

new estimates have current GDP as

just 3.9 per cent lower than peak out-

put, whereas output was previously

believed to remain 4.4 per cent down.

The GDP data this morning show

further signs of economic weakness,

said Michael Saunders at Citi

European economics, The economy

has been roughly flat for about two

years andis likely to remain

depressed given headwinds from

high private debts, poor credit avail-

ability, tight fiscal policy and the

UK GDP deeper

in recession on

newest figures

BY BEN SOUTHWOOD

EMU crisis.

With weak nominal growth and

falling inflation, there is a clear need

to add sizeable stimulus urgently.

The newest estimates confirm that

GDP inched down 0.3 per cent in the

first quarter, while manufacturing

also fell 0.3 per cent and services crept

up 0.2 per cent. Household consump-

tion was flat, decreasing 0.1 per cent,

while nominal wages rose 1.1 per cent

well below inflation.

The release also included data on

trade, showing the current account

deficit widening to 11.2bn in the first

quarter of the year.

Analysts at Investec said it was a con-

cern that the largest positive growth

contribution came through from gov-

ernment consumption.

As the government presses on with

this plan through the year ahead, we

would expect the demand support

provided by government spending to

be squeezed with this therefore poten-

tially weighing on quarterly growth

outturns, Investec analysts warned in

a note.

Auditors blame overwork for

HMRCs 5.2bn tax write-offs

THE BRITISH taxman wrote off

5.2bn last year and made billions

more in errors as it was

overwhelmed by its growing

workload, the National Audit Office

said yesterday.

The audit unearthed a large

increase in the amount of tax liabili-

ties that HM Revenue and Customs

decided not to pursue over the last

two years.

Around 503m of the write-offs in

the last year were for corporate tax,

while the department also gave up

1.9bn of VAT payments and 1.5bn

in income tax.

BY MARION DAKERS HMRC overpaid between 2.08bn

and 2.46bn to claimants as a result

of error and fraud in 2011-12, while it

underpaid between 170m and

290m, the NAO said.

And while the Revenue claimed to

meet targets to reduce tax credit

debt to 4bn and crack down on

mistakes, the NAO said the

department only did so by writing

off 1.7bn of old debts and

overstating its error detection rate.

It warned that ongoing work to

overhaul the pay-as-you-earn system

contributed to the jump in rebates.

This year has seen a litany of tax

errors and scandals come to light

with mistakes made at the most

senior level from the Permanent

Secretary for Tax downwards, said

Labours Margaret Hodge, chair of

the Commons public accounts

committee. The sheer scale of waste

and mismanagement at HMRC never

ceases to shock me.

Overall tax revenue rose by 4.5bn

or 0.96 per cent to 474.2bn, as the

VAT hike in January 2011 offset a fall

in corporation tax.

The audit concluded that HMRC

should look again at the cost and

benefits of its collection strategies,

and set out clearly how it would

handle structural changes, such as

the introduction of a universal tax

credit.

Ian Powell recently won a second term as senior partner at PwC

OLYMPICS CABLE CAR LIFTS OFF IN EAST LONDON

LONDONS first

cable car service

opened its doors to

the public

yesterday, a

spectacular ride

high across the

River Thames near

the Olympic Park

which will help

visitors to the

Games avoid any

jams on the

ground. Called the

Emirates Air Line, it

soars almost 300ft

above the river,

offering 360-

degree views of

the east of the

capital including

the O2 Arena and

Canary Wharf.

EUROPEAN regulators published

draft rules yesterday to crack down

on excessive bonuses for managers

of hedge funds.

The European Securities and

Markets Authority (ESMA) said

yesterday the curbs bankers face

must be extended to managers of

alternative investment funds,

including hedge funds and private

equity and real estate funds.

The rules could have a huge effect

on hedge fund managers the bulk

of whose pay is from performance

fees. Open for consultation until

September, the rules bolster a law

the EU has approved to force all

alternative investment fund

managers to undergo supervision.

EU cracks down

on hedge funds

BY CITY A.M. REPORTER

BUSINESS secretary Vince Cable

yesterday threatened HBOS with a

regulatory probe relating to the

banks role in the collapse of

Christmas savings firm Farepak.

Cable said he would refer HBOS to

the Financial Services Authority

(FSA) after a high court judge said it

was the banks decision to extract

around 10m from Farepak that

pushed the firm into

administration.

In an usual move, Mr Justice

Smith last week said that although

HBOS now part of Lloyds Banking

Group acted legally, the bank

should seriously consider the

moral case for providing additional

compensation to victims.

Cable refers

HBOS to FSA

BY JAMES WATERSON

TAX

Fiona Camenzuli

Dean Farthing

Ben Flockton

Janette Jones

Scott Lindsay

Philip Martinos

Tim McCann

Darrel Poletyllo

Lucy Redding

Lachlan Roos

Ben Wilkins

Paul Wolstenholme

ADVISORY

Mark Anderson

Antony Cook

Jeff Ford

Celine Herweijer

John Lyons

Edward Macnamara

Richard Major

David Morris

Brendan ODriscoll

Neil OKeeffe

Will Richardson

Dan Stott

Jeremy Webb

ASSURANCE

Lee Clarke

Jill Emney

Ben Higgin

Martin Hislop

Nick Morrison

Paul Pannell

Reeken Patel

Darryl Phillips

James Quin

Sarah Quinn

Clare Reid

Jessica Taurae

Sam Taylor

Andy Ward

PWCS PARTNERSHIP: THE NEW RECRUITS

FRIDAY 29 JUNE 2012

6

NEWS

cityam.com

THE reign of Vivendi chief

executive Jean-Bernard Levy ended

yesterday in a strategy dispute with

the French telecoms and media

conglomerates supervisory board,

paving the way for possible

disposals to shake up its flagging

share price.

Vivendi, whose shares are at

nine-year lows, has been reviewing

its conglomerate structure and

seeking ideas on how to reverse the

stock slump, while its SFR telecom

business has been hammered by

fresh competition in the French

mobile market since January.

Investors are pushing for a break-

up of the firm in order to release

Vivendi break-up eyed as Levy

steps down over strategy row

BY CITY A.M. REPORTER

the full value of its various

divisions.

Vivendi has mature telecoms

businesses in France and Morocco

generating nearly 60 per cent of

operating profits, while growth is

coming from Brazilian telecom

GVT and video games maker

Activision Blizzard plus smaller

pay-TV and music units including

Universal Music.

Jean-Bernard Levys departure

clearly makes the divestiture

scenario more probable, said

Gilles Guibout, a fund manager at

AXA Investment Management in

Paris.

The question is whether he

couldnt have taken tougher steps

earlier.

INTERNAL auditors at leading banks

must now report directly to an

organisations board in an attempt

to stop bad news being blocked by

senior management, regulators

announced yesterday.

The decision taken by the Basel

Committee on Banking

Supervision helps plug a gap

highlighted by the 290m of fines

levied on Barclays after the bank

was found to have manipulated the

Libor interest rate.

Changing the rules should also

make it more difficult for board

members to ignore what internal

auditors say or claim they were not

told about key developments.

An internal audit function,

independent from management

and composed of competent

auditors, is a key component of a

banks sound governance

framework, said Stefan Ingves,

chairman of the committee.

Setting out 20 principles of

internal auditing, the new

document places additional

pressure on directors.

The banks board of directors has

the ultimate responsibility for

ensuring that senior management

establishes and maintains an

adequate, effective and efficient

internal control system, it states.

Audit reform

makes rate

fixing harder

BY JAMES WATERSON

G

E

T

T

Y

BARCLAYS could face legal claims

running into billions of pounds after

it admitted trying to rig the Libor rate,

analysts have warned.

The bank, which will pay 290m in

fines to regulators in Britain and the

US, is expected to face legal action

around the world and still faces pun-

ishments from authorities in other

jurisdictions, such as Japans

Financial Services Authority.

We view the final litigation out-

come in relation to Barclays interbank

offered rate settlement as highly

uncertain. However... any litigation

has the potential to be material given

the size of the inter-bank market,

Goldman Sachs said in a note.

Sandy Chen, an analyst at Cenkos

Securities, said the cost of law suits

related to Libor would dwarf the

cost of the fines issued on Wednesday.

Since RBS, HSBC and Lloyds have

also been named in lawsuits, we

expect they will also face significant

fines and damages. We are pencilling

Legal cost over

Libor could run

into the billions

BY PETER EDWARDS

in multi-year provisions that could

run into the billions.

Former SFO prosecutor, Andrew

Oldland QC, now a partner at law firm

Michelmores, said: Barclays decision

to settle with the FSA could just be the

tip of the iceberg.

Separately the British Bankers

Association, which has co-ordinated

Libor since the 1980s in a process

which is not officially regulated, said

it was shocked by the scandal and

called for an official review of the way

the rate is regulated.

The banks which contribute to the

Libor rate must meet the necessary

obligations to their regulators...

It launched a review of Libor in

March after concerns spiralled during

the credit crisis that banks were low-

balling quotes for benchmarks used to

price around $350 trillion in contracts

ranging from corporate loans to home

mortgages.

As part of this review we will now be

asking the authorities to consider in

what manner the Libor setting mecha-

nism should be regulated in the

future, the BBA added.

A DEFIANT but apologetic Bob

Diamond insisted last night that the

bank was acting to protect itself

when it manipulated the key

interest rate known as Libor.

Amid calls for his resignation,

Diamond in an open letter to

Treasury Select Committee chief

Andrew Tyrie, said the actions were

made essentially to protect the

interests of shareholders.

Diamond revealed that both

traders and the bank itself tried to

influence the rate, but with

different motivations.

The traders sought to influence

short one and three-month rates,

BY KATIE HOPE

purely for their own benefit,

Diamond said, in actions he

acknowledged were wholly

inappropriate.

However, the bank was acting to

protect itself following what he said

was unwarranted speculation

regarding Barclays liquidity.

The inaccurate speculation about

potential liquidity problemscreated

a real and material risk that the

bank and its shareholders would

suffer damage, he wrote.

Nonetheless, despite the banks

motivation being to protect itself

from undue speculation, Diamond

apologised for the actions saying; I

accept that the decision to lower

submissions was wrong.

*extracts from Diamond's letter

Chief executive Jamie Dimon has said the bank will be profitable this quarter

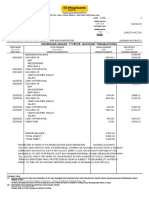

JPMorgan Chase & Co

27Jun 28Jun 22Jun 25Jun 26Jun

36.50

36.00

35.50

35.00

$

35.88

28Jun

3

2

SHARES in JP Morgan plunged

2.45 per cent yesterday on reports

that its London Whale derivatives

trading loss could end up costing

the bank much more than first

thought.

JP Morgan, which declined to

comment, said it expected to lose

at least $2bn on a bungled credit

derivatives trade when it disclosed

the position in May.

But reports yesterday in the US

media suggested that the total

JP Morgan stock plummets after

reports of bigger trade losses

BY MARION DAKERS loss could balloon to more than

twice initial estimates to around

$5bn.

Chief executive Jamie Dimon

told Congress last week that JP

Morgan would be solidly

profitable in the third quarter in

spite of the trade, which the bank

is working to unwind.

The bank boss has pledged to

give a fuller picture of the

situation on 13 July, alongside the

firms second-quarter results.

Shares in the bank closed at

$35.88 yesterday.

FRIDAY 29 JUNE 2012

8

BANKS IN CRISIS

cityam.com

Bank shares get bashed but arent necessarily mis-sold

B

UY when theres blood in the

streets, goes the old saying. So

was yesterday a good day to be

buying UK bank shares? The

growing outrage over the Libor

scandal saw Barclays plunge 18 per

cent before pulling back slightly,

and RBS was also down more than

11 per cent, although HSBC and

Lloyds Banking group were both

down far less. So does that make

Barclays and RBS better buys? That

depends on how you see the new

round of bank scandals playing out.

Lets start with Libor. While the

record 290m payments that

Barclays will make for its attempts

to manipulate the interbank

lending rate are not enough to

make much of a dent in its 43bn

core tier one capital, it could only

be the beginning. Civil lawsuits for

manipulating the rate could be

vast, with trillions of pounds in

loans affected, and hundreds of

trillions of pounds in derivatives.

And if so, its unlikely to just be

Barclays that gets dragged down.

The FSA is also investigating HSBC

and RBS, among others, and Lloyds

has been named in a private lawsuit

in the US. The problem is that Libor

is set by looking at rates submitted

by a large number of banks, and

outlying values are excluded. That

helps to explain why investigators

are looking for a wider scandal it

wouldnt be easy for one bank to

have played the system alone.

You can see where all this could

be going in the lawsuit filed by US

investment firm Charles Schwab

against all the banks involved in

setting Libor. The documents claim

that these banks collectively

earned billions in net interest

revenues during the relevant

period. It goes on to seek redress

under US racketeering laws,

claiming every member of the

enterprise participated in the

process of misrepresenting their

costs of borrowing to the BBA. Of

course, these claims still have to be

proved, but with an awful lot of

investigations still ongoing.

Barclays could end up looking

shrewd for having come to terms

early. Now isnt a great time to bet

on any of the banks potentially

involved.

Meanwhile, the new mis-selling

scandal involving interest rate

swaps looks set to be seriously

damaging for the sector as a whole.

While theres nothing wrong in

principle with complex hedging

products of this kind, the

suggestion that their potential

downsides were glossed over is a

serious one. Ironically, it has meant

that for some small businesses in

the UK, the costs of lower than

anticipated interest rates have run

into millions. Some estimates put

the overall cost in the billions.

As ever though, its important to

draw the right lessons. Guto Bebb

MP, who moved the 21 June

Commons debate on this scandal,

also made a plea that in finding a

solution, we do not end up going

down the same route as for

payment protection insurance (PPI),

which he described as an

ambulance-chasing gift for

solicitors of disreputable means.

Real scandals need serious answers.

Marc Sidwell is City A.M.s managing

editor.

BOTTOM

LINE

MARC SIDWELL

Dear Andrew

I welcome the opportunity to provide answers....for the

Treasury Committee. Our settlements yesterday represent

only a part of a complex, industry-wide investigation by

authorities that include the U.S. Department of Justice,

Fraud Section, U.S. Department of Justice, Antitrust Division,

the U.S. Commodities Futures Trading Commission and the

Financial Services Authority. Barclays is the first bank to

settle with those authorities. Even taking account of the

abnormal market conditions at the height of the financial

crisis, and that the motivation was to protect the bank, not

to influence the ultimate rate, I accept that the decision to

lower submissions was wrong.

We need to work every day to rebuild the trust that has

been damaged by these actions and others that have come

before them.

Yours sincerely,

Bob Diamond

Diamond in defiant mood as he

attempts to justify Barclays acts

The revelation from Diamond,

who was not chief executive at the

time of the scandal, will put

pressure on him to reveal whether

the decision to manipulate the key

interest rate, used to set the prices of

thousands of retail products as well

as wholesale pricing, was taken at

board level.

Diamond also pointed out that

other rival banks were also under

investigation for libor manipulation.

However, Diamond, who saw a

staggering 3.7bn wiped off Barclays

share price yesterday, conceded

yesterday that the bank now needed

to work every day to rebuild the

trust that has been damaged by

these actions.

Credit subject to acceptance. Credit is provided by external nance companies as determined by DFS. 4 years interest free credit from date of order. Delivery charges apply. After event prices apply from 02.07.12 - see instore or online for details. Mobile charges may apply

when calling 0800 110 5000. DFS is a division of DFS Trading Ltd. Registered in England and Wales No 01735950. Redhouse Interchange, Doncaster, DN6 7NA.

Visit your nearest store, order direct at www.dfs.co.uk or call free on 0800 110 5000 24 hours a day, 7 days a week

4 years interest free credit on everything

Or pay nothing until January 2013 then take 3 years

interest free credit

0

%

REPRESENTATIVE

APR

50%

OFF

MODA COLLECTION

SOFAS

LUSH

CORNER SOFA

HALF PRICE

899

AFTER EVENT PRICE

1798

18.72

A MONTH

NO DEPOSIT

NO INTEREST

EVER

No deposit with 4 years interest free credit. 48 equal monthly payments of 18.72. Or pay nothing until January 2013 then 36 equal monthly payments of 24.97. 0% APR. Total 899.

half price

ends Sunday

G

E

T

T

Y

SPAIN and Italy faced mounting pres-

sure yesterday as their borrowing

costs continued to spiral.

Spain saw its 10-year bond levels

surge briefly above the dangerous

seven per cent level yesterday, while

Italy was forced to pay its highest

interest rate in over six months at an

auction of ten and five-year debt.

The endebted nations have been

pleading for emergency action in a

bid to reduce their borrowing costs

before they are forced out of the bond

market.

Italy yesterday managed to sell

5.42bn in five and 10-year bonds,

near the top of its lower-than-average

BY KATIE HOPE

target range, helped by domestic

demand.

But 10-year yields rose to 6.19 per

cent from 6.03 per cent a month ago,

fuelling concern on markets.

Meanwhile, Italys five-year bonds

priced at a rate of 5.84 per cent, com-

pared with 5.66 per cent last month

the highest since a euro-lifetime peak

of 6.5 per cent in December.

The possibility of the Eurozones

bailout funds buying Spanish and

Italian bonds to help ease funding

costs for Rome and Madrid, was dis-

cussed at yesterdays summit.

Both the EFSF and the ESM, once it

is active, have the capacity to buy

bonds in the primary market, one EU

official said.

IN BRIEF

German unemployment rises

n German joblessness rose for the third

month in a row in June, data showed,

signalling that Europes largest

economy is not immune to the euro

debt crisis and cannot be relied on to

prop up growth. The Labour Office said

yesterday the number of people out of a

job rose by a seasonally-adjusted 7,000

to 2.882m in June from 2.875m in May.

Mood across Europe remains low

n Eurozone economic sentiment fell by

more than expected in June, the

European Commission said yesterday.

Its economic sentiment index slipped by

0.6 points in the 17-nation Eurozone to

89.9, compared to the 89.5 point

average forecast. It was the indexs

third consecutive monthly decline.

New chief for Greek National Bank

n National Bank of Greece named

deputy chief executive Alexandros

Tourkolias as chief of Greeces largest

lender yesterday, as part of a

management reshuffle. Tourkolias, in

charge of NBGs shipping portfolio, has

been an executive member of the board

since 2010. Apostolos Tamvakis resigned

as chief executive on Wednesday.

Inflation in Spain eases

n Spains annual inflation slowed

slightly in June, a flash estimate

released by the statistical office INE

revealed yesterday. EU harmonised

inflation unexpectedly fell to 1.8 per

cent in June from 1.9 per cent a month

ago. The rate was expected to remain at

1.9 per cent.

JUNCKER TO STAY ON AS EUROGROUP PRESIDENT

LUXEMBOURG

Prime Minister

Jean-Claude

Juncker (pictured

right) is likely to

stay on as the

president of the

Eurogroup, while

the head of the

temporary

Eurozone bailout

fund Klaus Regling

(pictured left) is

likely to become

the head of the

permanent fund,

Eurozone officials

said yesterday. The

appointments are

expected to be

formally

announced today.

Spains 10-year bond yield

Jun1 May1

8.00

7.00

6.00

5.00

6.94%

%

FRIDAY 29 JUNE 2012

10

EUROZONE CRISIS

cityam.com

Italys 10-year bond yield

Jun28 May31

7.00

6.00

5.00

6.19%

%

Spain and Italy

under pressure

11

EUROZONE CRISIS

FRIDAY 29 JUNE 2012

ECBs Coeure demands power

to inject capital into banks

EUROPEAN Central Bank

policymaker Benoit Coeure called

yesterday for the Eurozones

permanent bailout fund to have the

power to inject capital directly into

banks as part of a package of steps

to tackle the blocs debt crisis.

The adverse feedback loop

between banks and sovereigns ...

can be broken by establishing a

true financial union, Coeure said

at a sovereign risk forum in Rio de

Janerio.

In my view this includes the

BY CITY A.M. REPORTER

creation of a pan-euro area deposit

insurance fund and a pan-euro area

bank resolution framework,

supported by a single supervisory

system with centralised decision-

making, he added.

Spain and Cyprus have both had

to seek bailouts to prop up their

banking sectors.

Giving the European Stability

Mechanism (ESM), the Eurozones

permanent bailout fund, the ability

to inject capital directly into banks

would also help to break the bank-

sovereign loop, Coeure said.

Coeure said a path towards fiscal

union would provide a sound

fiscal pillar on which the single

currency could safely rest but

added that national governments

could not avoid putting their own

houses in order.

A fiscal union can only come

about once the participating

countries have successfully restored

domestic fiscal sustainability and

solidified the conditions for long-

term growth, he said. Joint debt

issuance cannot be a substitute for

putting national fiscal houses in

order and restoring

competitiveness.

ITALY and Spain last night blocked

final agreement on a stimulus pack-

age, saying that they would hold out

until they won promises of immedi-

ate help in reducing their borrowing

costs.

European Council President

Herman Van Rompuy said that

European leaders had agreed to

devote 120bn for immediate

growth measures to try and dig

the Eurozone out of the crisis.

Van Rompuy said half the money

in the new growth pact would

come from increasing the lending

capacity of the European

Investment Bank (EIB) by 60bn,

adding that this money must flow

across Europe, and at least to the

most vulnerable countries to help

them grow out of the crisis.

That includes 50bn in already

existing EIB money, plus 10bn in

new capital, as it loans alongside

private investors.

But the EIBs board has

cautioned that it may have

difficulty in finding projects that

meet its standards.

BY HARRY BANKS Then there are 55bn in funds

that were already earmarked in the

EUs 2013 budget for growth

projects in poorer regions around

Europe.

Finally, the pact will make

another 5bn in project bonds

available to invest in transport,

sustainable energy and digital

infrastructure. While the EU budget

will provide some risk cushion for

the EIB to finance the underlying

projects, the EIB would have to

cover the remaining risk.

But Italy, Spain and some other

countries said that they wanted the

Eurozone to agree steps to help

bring down their high borrowing

costs first, including steps to buy

their government bonds in order to

bring down yields.

Were in favour of the growth

pact and there is a deal on the

content, but before we sign it we

want a comprehensive deal

including short-term measures a

Spanish government official said.

An Italian offical said it also

wanted immediate measures to

relieve Italys borrowing costs. We

see it as a package, he said.

Growth deal of

120bn hangs

in the balance

EU Council President Herman Van Rompuy said there would be project bonds for infrastructure

SHARES of energy giant

International Power (IPR) were

suspended from trading on the

London Stock Exchange yesterday

after its takeover by parent company

GDF SUEZ was hit by delays.

A court needs to sanction the deal

but that process has been held up.

The deal is now not expected to be

completed until at least 2 July.

French utility GDF Suez agreed to

buy the 30 per cent of IPR it does

not already own for 6.4bn in April.

Suspension of

shares at IPR

over GDF deal

BY JOHN DUNNE

BRITISH packaging company DS

Smith yesterday said its full-year

profit rose 44 per cent on strong

sales of corrugated paper in Europe.

The company, which makes

packaging boxes for Procter &

Gamble and Nestle, said pre-tax

profit for the company rose to

110.2m for the year ended 30 April

from 76.7m a year ago.

Revenue rose 12 per cent to about

2bn. DS Smith raised its dividend

by 31 per cent to 5.9p per share.

DS Smith sees

profit increase

by 44 per cent

BY CITY A.M. REPORTER

G

E

T

T

Y

FRENCH utility Veolia Environnement

has sold a majority stake in its regulated

UK water business for 1.24bn including

debt, notching a milestone in its overhaul

aimed at returning to profitability and

cutting debt.

It is the first significant divestment

since chairman and chief executive

Antoine Frerot announced a reorganisa-

tion in December to cut debt that had

piled up under an acquisition spree by

Veolias founder and head Henri Proglio.

The sale will shave 1.45bn off the

14.7bn debt Veolia had at the end of last

year and help it to meet its goal to cut

debt to below 12bn by the end of 2013 by

selling assets worth 5bn. Analysts said

that the price Veolia will receive for the

unit, which is widely seen as the most

attractive it has put up for sale, beat

expectations and the strength of the

pound against the euro had helped prop

up the deals value in euros.

In the current context, regulated assets

are very coveted, they are very defensive

and not exposed to economic growth,

said Exane BNP Paribas analyst Yohann

Terry. Shares in the waste, water and

energy group have lost 46 per cent of

their value in the last 12 months.

The timing and the exit price exceeded

our expectations by a couple of months

and by about 150m respectively,

Citibanks head of utilities research Sofia

Savvantidou wrote in a research note.

Under the agreement with the assets

buyer, Rift Acquisitions, Veolia will keep a

10 per cent stake in the regulated water

business for at least five years.

It will also keep its non-regulated water

business, Veolia said in a statement. Rift

is a joint venture of a Prudential man-

aged infrastructure investment fund and

Morgan Stanley Infrastructure partners.

Veolia sells UK

water unit to

Rift for 1.2bn

BY HARRY BANKS

ADVISERS DEUTCHE BANK

Shell again extends its offer

deadline in bid to buy Cove

OIL major Shell again extended a

deadline for Cove Energy

shareholders to accept its $1.8bn

(1.1bn) takeover offer, leaving the

way open to trump a higher bid

from rival Thai group PTT

Exploration and Production.

The two suitors have been

battling to buy Cove since

February, attracted by the

companys position in huge gas

fields discovered off the coast of

Mozambique which look set to

transform the East African

country into a major supplier of

energy to Asia.

Shell said yesterday that it was

extending the deadline for Cove

shareholders to accept its bid for

a third time to 11 July, following

PTTs move on Monday to extend

to 6 July the cut-off date for

investors to accept its $1.9bn

offer. Investors are still betting

that Shell, keen to establish a

presence in the worlds next

biggest gas frontier in East Africa,

will raise its offer for Cove.

Under British takeover rules,

Shell has until 17 July to launch a

higher offer. Investec analyst

Stuart Joyner said Shell was likely

to raise its offer. The further

extension of the offer was

expected, given the timetable.

Why fold and why raise when

youve got another three weeks?

Id have been very surprised at

any other outcome. As with all

these things, why not wait until

as late as possible? The reason

being, is that gives your

opponent the least ability to

respond, he said. Up to 100

trillion cubic feet of gas enough

to supply Germany, Britain,

France and Italy for a decade

have been discovered off the

coast of Mozambique in the last

two years with forecasts that

$50bn could flow into the

country to help develop the

resources to turn the country

into a gas exporter to energy-

hungry Asia.

BY HARRY BANKS

IN BRIEF

Costain links with Severn Trent

nEngineering group Costain said

yesterday it had a strong order book

and was trading in line for the full

year while securing a joint venture

with Severn Trent. The company said

its forward order book currently

stands at 2.4bn compared to 2.3bn

the same time a year earlier. The

joint venture with Severn Trent will

provide business water and waste

water management services to

commercial and industrial water

users.

OFT says Mercedes broke rules

n The UKs consumer watchdog said

that German automaker Mercedes-

Benz and five UK dealers of its trucks

and vans may have broken

competition law by co-operating

illegally. The Office of Fair Trading

(OFT) issued a provisional finding

alleging that the Mercedes-Benz unit

of German automotive group

Daimler AG and five UK auto dealers

were involved in price-fixing and the

sharing of commercially sensitive

information between 2007 and 2010.

Pursuit dives after update

n Shares in fluid technology firm

Pursuit Dynamics suffered losses

yesterday after it said current year

revenues are expected to be around

1m disappointing investors who

had hoped that the company would

win more exclusive contracts. The

firm also said it plans to reduce its

head-count to 40 from the current

level of 61. As part of the changes

finance chief Richard Webster will be

stepping down from the board on 30

September 2012.

Cove Energy PLC

27Jun 28Jun 22Jun 25Jun 26Jun

269

268

267

266

265

264

263

p

267.00

28Jun

FRIDAY 29 JUNE 2012

12

NEWS

cityam.com

Veolia chairman Antoine Frerot announced a reorganisation in December

Nigel Robinson was one of the

advisers from Deutsche Bank who

advised Veolia.

Robinson is no stranger to big deals

and is currently also working on the

mega merger between

commodities giant Glencore and

FTSE 100 miner Xstrata.

Robinson joined the bank in 2007

as managing director and head of

M&A for natural resources Europe.

Robinson initially trained as a lawyer

and spent eight years at Slaughter

and May in London.

He joined Deutsche from Goldman

Sachs where he has was managing

director of the UK Advisory Team.

During his career at Goldman

Sachs, Robinson played a leading

role on a number of major, cross-

border M&A transactions, including

the sale of Thames Water by RWE.

He also steered through the sale of

Serono to Merck, the acquisition of

Associated British Ports by Admiral

Acquisitions, the sale of

PetroKazakhstan to CNPC, the sale

of Innovene to Ineos and the

successful defence by Goldfields

against the hostile bid by Harmony.

Working with him on the Veolia

deal for Deutsche was Martyn

Nicholas.

Meanwhile JP Morgan was joint

adviser with Murray Orr, managing

director, mergers & acquisitions,

and Alex Garner representing the

bank. Macquarie advised Rift on

the deal.

NIGEL

ROBINSON

GLOBAL HEAD

NATURAL

RESOURCES

M&A

DEBENHAMS posted better-than-

expected sales yesterday after events

such as the Diamond Jubilee and the

Easter bank holiday helped lure shop-

pers through its doors despite the wet

spring weather.

Britains second-largest department

store group after John Lewis said that

sales at stores open more than a year

rose 3.1 per cent, excluding VAT, in

the 16 weeks to 23 June.

That compares with a rise of 0.3 per

cent in its first half and analysts fore-

casts that ranged from a three per

cent fall to a one per cent rise.

Chief executive Michael Sharp said

key calendar events such as the

Jubilee and Mothers Day were becom-

ing increasingly important as cus-

tomers focus their spending around

those occasions.

I have seen more of a shift towards

that in the past six months than I

have seen previously. Some of that is

to do with tightening budgets at

home and obviously consumer senti-

ment, he told City A.M.

The retailer, which has 165 stores in

the UK and Ireland, said sales of beau-

ty and homeware products helped off-

set the impact of the cold, wet spring

on demand for seasonal clothing.

But smaller margins on these goods

has prompted Debenhams to lower its

Holidays help

bring sales joy

to Debenhams

BY KASMIRA JEFFORD

gross margin guidance for the full

year by 30 basis points, which Sharp

said yesterday was not a drama.

It would be a concern if the margin

deterioration had been driven by an

increase in discounting or mark

downs but it hasnt. It has been driven

through a mix change and our desire

to grow our non-clothing categories.

Online sales grew by 34.9 per cent,

driven in part by its so-called endless

aisle technology launched in October

that allows shoppers to buy stock from

an online stockroom as well as in

stores. Sharp said 60 per cent of sales

made online were incremental and

not cannibalising its bricks-and-mor-

tar business.

We know that people who shop

multi-channel spend three times more

than those who just shop online...the

key is to get people to shop across

more channels, he said.

Rooney Anand says the industry is resilient

Debenhams PLC

27Jun 28Jun 22Jun 25Jun 26Jun

85

84

83

82

81

p

84.95

28Jun

FRIDAY 29 JUNE 2012

13

NEWS

cityam.com

We turned buyers of Debenhams last week, given the transformation that

the company has undergone, increasing cash returns to shareholders and

signicant growth avenues...This potential is not reected in the share price.

ANALYST VIEWS

HAS DEBENHAMS

WEATHERED THE RETAIL

STORM? Interviews by Kasmira Jefford

BETHANY HOCKING INVESTEC

DO YOU STILL GO OUT TO EAT IN PUBS

AND RESTAURANTS? Interviews by Polly Young

I still go to restaurants and pubs as much as I used

to, in fact probably more, as I want to take my mind

off everything that is going on economically. People are more

picky about where they go and pubs are considered cheaper.

These views are those of the individuals above andnot necessarily those of their company

MARTIN JACKS

SKANSEN INTERIORS

Of course I eat at restaurants and pubs as much as I

used to. In my experience people drink more and

smoke more in recessions. More people are going out as they need

something to do with their time with so many unemployed.

STEPHEN ALLEN

RFC AMBRIAN

I go to pubs andrestaurants about the same amount

as I usedto. Imusinga Taste cardat the moment and

that gives you 50per cent off so I use that for when I go out. But I

still dine out as often as I have in the past, despite the recession.

TOM KIELY

KELWAY

CITYVIEWS

Debenhams has announced a strong third quarter interim statement.

Forecasts remain unchanged for now as sales outperformance is offset by

lower gross margins at this stage...we reiterate our buy stance.

JOHN STEVENSON PEEL HUNT

Although a solid rather than exciting update, managements reputation for

generating steady growth is further enhanced... The contrast with larger

rival M&S is notable, with analysts rewarding shares with a buy rating.

KEITH BOWMAN HARGREAVES LANSDOWN

Pubbers in need of an everyday treat boost Greene King

GREENE Kings full year results

suggest that the pub industry, if

anything, is recession resilient.

The pub operator and brewer

posted record pre-tax profits of

152m, up 8.6 per cent on the year

before, as revenues jumped 9.4 per

cent to 1.14bn.

Chief executive Rooney Anand

told City A.M., After reaching the

1bn turnover landmark last

summer, this is another real

milestone for us.

The business has proven itself in

really tough conditions. Going to

the pub is one of lifes little

luxuries, an everyday treat, which

will be reserved and cherished.

Greene King, which operates

2,334 pubs, restaurants and hotels

BY LAUREN DAVIDSON

across the UK, reported a like-for-

like sales growth of four per cent,

while food sales charged ahead

with a 17 per cent rise.

Brewing revenue, which includes

Old Speckled Hen and IPA, grew

five per cent.

Greene Kings shares added one

per cent to 536p.

Greene King PLC

27Jun 28Jun 22Jun 25Jun 26Jun

540

535

530

525

520

p

536.00

28Jun

P

OLO stars have raised more than

100,000 for the Laureus Sport

for Good Foundation Argentina

following a weekend event at

the Guards Polo Club in Windsor.

The players were enthusiastic as was

the support from the celebrity-filled

stands, with the likes of rugbys Sean

Fitzpatrick and Boris Becker in atten-

dance. And the victory seemed to lie

not just with the winning team but

with everyone that contributed to rais-

ing money for disadvantaged children

all over Argentina.

Rugby legend Hugo Porta, the

President of Laureus Fundacion

Argentina, said: You just cannot exag-

gerate what good the money that has

been raised here today will do for the

youngsters we are trying to help in my

country.

The fundraising went beyond the

Polo stars turn

out in force for

deprived kids

match as renowned Swiss watch-maker

IWC Schaffhausen donated a special

Laureus edition watch in stainless steel,

only 1,000 of which are being manufac-

tured, which was auctioned to raise

additional funds.

Edwin Moses, chairman of the

Laureus Sport for Good Foundation,

said: This great day out at Windsor has

become one of the highlights of the

Laureus year.

It seems the event was inspiring for

everyone involved, combining great

sport with the opportunity to raise

funds for a very worthy cause.

The next fundraising event is the

London to Champagne bike ride from

4-8 July. This involves travelling across

the English Landscape to the white

cliffs of Dover, ending in the historic

Champagne region, where the reward

of a glass of bubbly awaits.

L

A

U

R

A

L

E

A

N

/

C

I

T

Y

A

.

M

.

The participants of the Laureus Sports polo event at Windsor line up for the camera

FRIDAY 29 JUNE 2012

14

cityam.com

Got A Story? Email

thecapitalist@cityam.com

cityam.com/the-capitalist

In the golden age of business, networking was an unspoken phenomenon, which

occurred as if unplanned in City bars and restaurants. But in these times of

austerity, the cash-strapped and the wealthy have no time for flirting, instead heading to

designated networking centres to get the job done. With great pride Hackney Borough

Council yesterday announced the opening of Hackney House, a pop-up centre designed

to offer a state of the art networking venue for business, investors and media during the

Olympic games. While this is another nail in the coffin for old-school networking, The

Capitalist applauds any effort to promote business, innovation and entrepreneurship.

THECAPITALIST

LONDON 2012 IMAGE OF THE WEEK

ON WEDNESDAY, giant Olympic rings were lowered

into place beneath Tower Bridges walkways,

signalling one month to go until the Games begin.

Measuring 25 metres wide and 11.5 metres tall, the

rings will remain in place throughout London 2012.

They will also form the centrepiece of a lightshow,

using the bridges newly-installed lighting system,

which will take place every evening of the Games.

Between now and the start of

the Olympics, City A.M. is

publishing its Olympic Image

of the Week. If you have a

shot you think our readers

will like, please email

pictures@cityam.com with

IOW2012 in the subject line.

CELEBRATING its fifth birthday

today, the worlds most iconic

smartphone continues to dominate

its rivals according to data from

Ipsos MORI.

Revealed to the world by Steve Jobs

in January 2007, the first iPhone was

scanned through the till on 29 June

of the same year.

British fans of Apple will be able to

celebrate the smartphones fifth

birthday again in November, the

month in 2007 when the iPhone was

released in the UK.

Ipsos MORI data, which examines

smartphone dominance in the UK,

shows that 19 per cent of people own

an iPhone. By comparison, 15 per

cent use an Android-based phone

which includes Samsung and HTC

and 11 per cent have a BlackBerry.

The last five years have produced a

wealth of milestones for Apple,

including record sales and becoming

the worlds most valuable company.

Earlier this year research firm

Gartner crowned Apple the worlds

top smartphone vendor, pipping

archrival Samsung to the top spot,

although the International Data

Corporation said last month that

Samsung was back on top.

Five years old:

iPhone hits the

grand old age

BY LAUREN DAVIDSON

NATIONAL Express reassured share-

holders that its Spanish bus business

is still growing yesterday, but added

that its UK coach division has been

dented by the cut in subsidies for OAP

passengers.

Just a week after the firm took

investors on a trip to Madrid to

demonstrate its resilience in the

Eurozone nation, National Express

said revenues at its Spanish Alsa unit

are set to rise two per cent in the first

half of the year.

The group added that Spanish state

bodies are paying their bills promptly,

with state receivables falling to 12m

(9.6m) in May compared to 45m at

the end of 2011.

But the firm admitted that its UK

coaches had lost 40 per cent of their

income from concessionary fares

after the government withdrew 15m

of funding for senior citizen ticket

subsidies in November.

Spanish buses

boost National

Express sales

BY MARION DAKERS Analysts at Shore Capital estimate

that profits from UK coach will drop

3m this year, though they are opti-

mistic that the firm can offset this

with growth elsewhere.

Chief executive Dean Finch said the

group is already making progress on

replacing the lost revenues, with its

event-day services to festivals and foot-

ball matches proving increasingly pop-

ular. Revenues are rising in all

divisions apart from UK coach, the

firm added in its pre-close update.

IN BRIEF

Ladbrokes online profits fall

n Britain's second-biggest bookmaker

Ladbrokes issued a profit warning

yesterday after saying income from its

digital division would fall more than

expected in the first half due to a delay

in technology upgrades and a poor

sportsbook margin. Ladbrokes, which

has been pushing its investment in its

internet business, said it now expected

digital profits in the first half to be down

further than expected, at around half

that delivered in the first half of last

year. However, due to a stronger

performance in other parts of the

business including the retail division,

Ladbrokes expects to meet overall

market expectations and believes it will

grow digital profits in 2013 and beyond.

Shares in the company closed down 12

per cent at 152.7p.

Morgan Sindall says it is on track

n Morgan Sindall said yesterday it

remained on track to meet its full-year

expectations but warned that tough

market conditions had continued to

squeeze its margins as companies

compete for a shrinking pile of

construction work. In a trading update

for the first half of the year, the

construction group said its financial

position remains sound with the

forward order book of 3.2bn, broadly

in line with the start of the year.

However Morgan Sindall said its fit-out

unit continued to be impacted by the

lack of major project opportunities while

its affordable housing arm had been

weighed down by the lack of grant

funding for social housing schemes.

Overall, the group said it had a

satisfactory first half.

Olympus insists brand will remain

n An Olympus executive said yesterday

at the firms annual meeting that

despite ongoing talks for a capital tie-up

with several firms, it would maintain an

independent brand. We understand we

need to consider an increase in capital

as one of our key management issues.

The main premise is to fully preserve our

Olympus brand, Yasuo Takeuchi,

Olympus senior executive managing

officer said. Olympus is in final talks

with a firm, believed to be Sony, to get a

roughly 50bn yen (399.7m) capital

injection in return for a stake, as the

Japanese camera and medical

equipment maker looks to rebuild from

a huge accounting scandal. After the

deal, Sony is expected to become

Olympus top shareholder with a more

than 10 per cent stake.

National Express Group PLC

27Jun 28Jun 22Jun 25Jun 26Jun

207

206

205

204

203

202

201

p

204.80

28Jun

PHILIPP Humm, who quit the top

job at T-Mobile USA on Wednesday,

said yesterday he would become

chief executive of northern and

central Europe for Vodafone from 1

October.

Humm joins Vodafone from his

role as president and chief

executive of Deutsche Telekoms T-

Mobile USA to oversee the British

firms presence in such markets as

Germany, Britain, Turkey and the

Czech Republic.

Vodafones operations in

northern Europe have held up well

in recent years despite the pressures

on consumer spending, which has

Vodafone snaps up new Europe

boss from rival group T-Mobile

BY CITY A.M. REPORTER

helped to offset the slump in

spending in southern Europe.

Vodafone said yesterday it would

split its European region into two

between northern and central

Europe, and southern Europe, with

the chief executive of Vodafone Italy

Paolo Bertoluzzo taking the top job

over the latter.

He will oversee such markets as

Italy, Spain, Portugal and Greece.

T-Mobile USA said on Wednesday

that Humm was leaving for

personal reasons to spend more

time with his family, but in a letter

to employees Deutsche Telekom

chief executive Rene Obermann said

Humm was leaving to join a

competitor.

15

cityam.com

FRIDAY 29 JUNE 2012

GLOBAL BUSINESSES

RECRUITING LONDONS